How Micro Account Can Help Forex Beginners

A micro Forex trading account allows beginners to enter the currency exchange market with lower capital requirements, typically 1,000 units of the base currency, or a "micro lot." This is compared to the standard lot size of 100,000 units in Forex trading.

-

Pros: Lower Risk, Lower Capital Requirement

-

Cons: Limited Profits, Spread costs can be higher, Overtrading Temptation

-

Use cases: A practical way to learn Forex trading. Useful for testing trading strategies

Trading currencies on the global foreign exchange (Forex) market can be exciting yet challenging for newcomers. The Forex market's immense trading volume of over $7.6 trillion daily offers tremendous profit potential. However, the volatility and use of leverage also make it risky for beginners who lack experience. A rookie mistake can easily result in hundreds or thousands dollars of capital lost. This necessitates beginning with smaller position sizes to minimize risk. In this scenario, micro Forex trading accounts can provide the ideal solution. This comprehensive guide will outline everything you need to know about micro-accounts.

-

What is a Forex account?

A Forex trading account is a transactional account with a regulated broker to trade on the foreign currency exchange (Forex) market. The account provides access to a trading platform through which you can buy and sell currency pairs (and/or other assets like CFDs).

-

What is account type in Forex trading?

The primary account types are: Standard, Micro, ECN, Demo, Islamic, and others. Each of the account types serves a specific purpose. See the specialized article for more details: Forex accounts types explained.

-

What are lots in Forex trading?

Lots represent the size of a trading position or contract in the Forex market. The standard lot size is 100,000 currency units, while a micro lot is only 1,000. Trading using different position sizes provides flexibility for retail Forex traders.

-

Do Forex micro accounts have a minimum deposit?

Yes, brokers still require a minimum deposit to open a micro account, but this is much lower than standard accounts. Typical micro account minimum deposits range from as low as $1.$5 to $100. This allows opening an account with minimal starting capital.

What is a Micro Trading Account?

A micro account is an accessible starting point for aspiring Forex traders to dip their toes into the vast ocean of currency exchange without risking much capital upfront. Also referred to as a cent account, it enables conducting transactions in micro lots or units of 1,000 of the base currency. This fraction of the standard 100,000-unit lot provides the ideal playground for new traders to practice strategies and gain market experience while limiting overall risk exposure due to the small trade sizes.

Key Features of a Micro Trading Account:

-

Lower Minimum Deposit: Brokers require much lower upfront capital to open a micro account than standard or ECN accounts. Many brokers offer micro accounts with deposits between $5 to $100. This makes it accessible to traders with limited starting capital

-

Risk Management: Smaller contract sizes and position values in micro lots allow you to manage and limit risk effectively. You can implement wider stop losses without tying up too much capital

-

Leverage Usage: Micro accounts provide the opportunity to utilize higher leverage ratios, which amplifies both profits and losses. However, due to the lower position sizes, the risk with leverage remains contained compared to a standard account

-

Practice Arena: The micro account serves as a practice arena to experiment with different trading strategies and chart patterns without worrying about significant dollar losses associated with larger lot trades

-

Psychology Training: Trading micro lots allows the trader to experience real market emotions, like fear and greed, on smaller positions. This provides a certain psychological training to prepare for standard lot trading

You can open a Forex trading account using platforms like RoboForex, Exness, InstaForex and many others.

Opening a micro account is usually a simple procedure inside your private cabinet

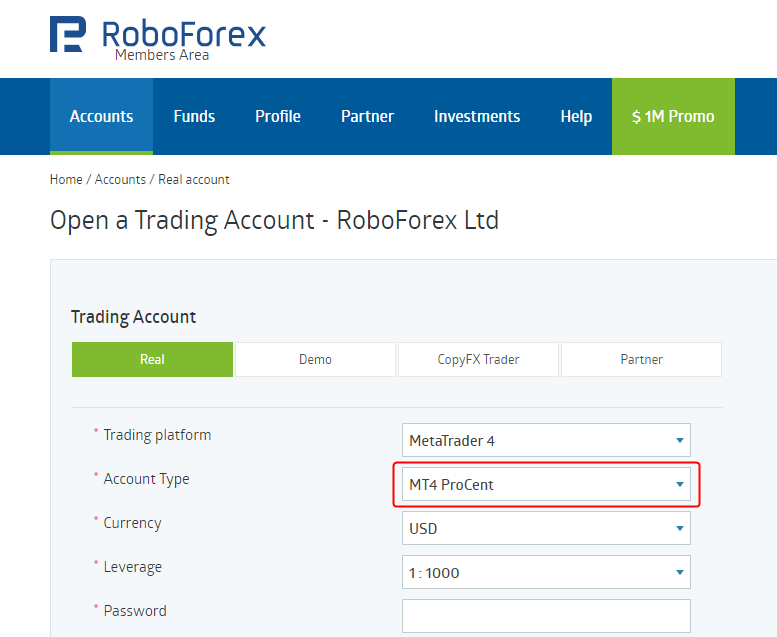

For example, the image shows the process of starting a small-scale Forex trading account:

-

Account Type Selection: You can see two options, “Real” and “Demo.” The “Real” option is highlighted, meaning you'll set up a live account to trade with actual money if you proceed

-

Trading Platform: The dropdown menu is set to “MetaTrader 4”, a popular platform traders use to buy and sell currencies in the Forex market

-

Account Type Details: Within MetaTrader 4, you can choose different types of accounts. The one selected, “MT4 ProCent”, is designed for smaller balances and trades. It's like a mini-version of a regular trading account, perfect for beginners or those wanting to trade with smaller amounts

-

Currency: This is set to “USD,” indicating that the account will use US dollars for transactions

-

Leverage: The option shown, “1:1000”, represents how much more you can trade compared to what you have in your account. For example, if you have $1, the leverage allows you to trade as if you have $1000

-

Password: This is where you would enter a password to secure your account

When you complete the process of creating a micro Forex account, the data for its access is usually sent to your e-mail specified during the registration process.

It is recommended that you save this information in a secure vault in case you have to transfer your account to another trading platform or simply forget your access password.

How Micro Accounts Work

Micro accounts function through trading contracts in micro lots, representing small position sizes in increments of 1,000 currency units. For example, a micro lot for EUR/USD equals 1,000 euros. This compares to the standard lot size of 100,000 units.

| Account Type | Lot Size | Units |

|---|---|---|

Standard |

1 lot |

1,00,000 |

Mini |

0.1 lot |

10,000 |

Micro |

0.01 lot |

1,000 |

The smaller position sizes in micro accounts allow for exposure to the currency markets while placing a much smaller amount of capital at risk. For instance, trading a 1 micro lot position on EUR/USD with $1 per pip would risk $10 per pip movement. Contrast this to a 1 standard lot position, which would risk $100 per pip.

Micro accounts also utilize high leverage ratios, often starting from 1:500 up to 1:2000 in some cases. This further amplifies the gains and losses on a trade. You must exercise caution and proper risk management when using leverage with micro or other account types.

These factors of smaller contract size and high leverage make the micro account ideal for new traders to avoid large losses as they learn the ins and outs of Forex trading.

The value of a pip in a micro account depends on the currency pair traded and the exchange rate and lot size. Typically, with a micro lot of 1,000 units, a pip would be worth about $0.10 on most major pairs. Here are some examples:

-

EUR/USD: 0.0001 x 1,000 = $0.10 per pip

-

GBP/USD: 0.0001 x 1,000 = $0.10 per pip

-

USD/JPY: 0.01 x 1,000 = $10 per pip

These values can fluctuate slightly based on the exchange rate. The amount per pip also increases as you trade larger lot sizes in a micro account. For instance, 5 micro-lots on EUR/USD would be 0.0001 x 5,000 units = $0.50 per pip.

Most brokers enable micro account holders to trade standard lot sizes if their account balance permits it. However, trading full standard lots defeats the micro account's risk protection purpose. It is best to use the lower micro lot sizes when starting.

Consider transitioning to a standard account once you generate consistent profits with micro lots. Even in a standard account, you can trade micro-lots to keep risk in check. The account type determines the minimum lot size, not the maximum.

👍 What are the advantages of micro accounts in Forex?

Here are some of the major advantages of micro accounts for beginners:

• Low Initial Deposit Requirement

One of the biggest advantages of a micro account is the low deposit requirement. Most brokers only require an initial deposit of $5 to $100 to open a micro account. This allows anyone serious about trading to open an account and get started

• Effective Risk Management

Combining low capital requirements and tiny micro lot positions provides effective risk management. Firstly, you can deposit a little money to begin with. Secondly, potential losses on open positions remain small due to the tiny contract sizes

• Learning Opportunities for Beginner Traders

The micro account provides a practice arena for novice traders to gain real-time market experience. In a lower-risk environment, you can learn technical and fundamental analysis, risk management, and trading psychology skills

• This hands-on experience and education cannot be replicated through demo accounts and backtesting alone. Those tools, while useful, do not capture the real emotions and pressures felt when actual money is on the line. The micro account bridges the gap between demo and live accounts

👎 Disadvantages of Micro Accounts

While beneficial for many new traders, micro accounts also come with some disadvantages to consider:

• Lower Profit Potential

You cannot expect to bank huge profits by trading such small position sizes. Consider how trading 1 standard lot on EUR/USD earns/loses about $10 per pip of movement. The same 1 pip move on a micro lot earns/loses just $0.10

• Challenges Scaling Up

One myth about micro accounts relates to strategies seamlessly scaling up to standard lots. While the principles remain the same, tactics that work for micro lots do not always directly translate to larger position sizes

• Relative Costs

When trading micro lots, transaction costs like spreads take a larger bite out of profits relative to the position size. For example, if the spread on EUR/USD is 1.2 pips, that represents $0.12 per round turn trade for 1 micro lot. This accounts for over 1% of the $10 risk per pip

Is it useful to trade Forex with a micro-account?

Here are some typical profiles of traders who tend to benefit the most from starting with a micro account:

-

Complete beginners who want to get live market experience with minimal initial capital. The micro account allows this while limiting risk

-

Traders focused on practice and education in real market conditions and were less concerned with high profitability initially

-

Part-time traders who want to maintain their regular jobs while trying out trading with low risk

-

Traders who want to test drive new strategies and technical indicators before applying them to larger positions

-

Traders specifically use techniques like martingale that require many small incremental positions. For example, martingale strategies rely on doubling down with small positions to recoup losses. The micro lot sizes allow for implementing this high-risk approach more safely

Micro accounts cater well to traders' needs, prioritizing practice, education, and risk management over maximizing profits in the short term.

Best Forex Brokers For Beginners in 2024

Comparing Forex Account Types

The following tables are provided for comparative purposes only and may not reflect the actual values or conditions offered by any specific broker. It is intended to help the reader understand the differences between a micro Forex account and other common types of accounts through comparison. Always verify the specifics with your chosen broker before making any trading decisions.

| Feature | Micro Account | Mini Account | Standard Account |

|---|---|---|---|

Minimum Deposit |

$5 - $100 |

$100 - $500 |

$1,000 - $5,000 |

Lot Size |

0.01 (1,000 units) |

0.1 (10,000 units) |

1 (100,000 units) |

Leverage Offered |

Up to 1:2000 |

Up to 1:500 |

Up to 1:100 |

Typical User Profile |

Beginner Low starting capital Focus on practice |

Transitioning from micro Moderate capital |

Experienced Higher capital Focus on profits |

How to open a micro Forex trading account?

The following table summarizes the best brokers that offer micro account service.

| Feature | RoboForex | Exness | IC Markets | Pocket Option | AAFX Trading |

|---|---|---|---|---|---|

Platform |

cTrader, MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader |

Exness Trade Terminal, MobileTrading, MT4, MT5, WebTrader |

MT4, cTrader, MT5 |

Pocket Option, MT5 |

MT4, MT5, Web platform |

Min deposit |

$10 |

$1 |

$200 |

$50 |

$100 |

Leverage |

1:1 - 1:2000 |

1:1 - 1:2000 |

1:1 - 1:500 |

1:1 - 1:500 |

1:1 - 1:2000 |

Trust management |

No |

No |

No |

No |

No |

Accrual of % on balance |

No |

No |

No |

No |

No |

Spread (from) |

0 points |

0 points |

0 points |

0 points |

0.7 points |

Margin call / stop out |

60% / 40% |

30% / 0% |

100% / 50% |

No |

50% / 20% |

Order execution |

Market, Instant |

Market, Instant |

Market |

Market |

Market |

No deposit bonus |

No |

No |

No |

No |

No |

Here is the step-by-step process to open a Forex micro trading account:

-

Research brokers that offer micro accounts: Compare minimum deposits, commissions, leverage, and spreads across brokers

-

Complete account applicatio: Fill in the new form with your details and submit verification documents like ID and address proof. Regulators require this for KYC and anti-money laundering laws

-

Fund your account: Deposit the minimum capital through online transfer or other methods to activate your account. Some brokers may offer free signup bonuses

-

Download trading platform: Gain access to the broker's proprietary platform or supported third-party platform like MetaTrader 4 or cTrader. Install the platform on your desktop or mobile device

-

Practice with demo: Use the demo account mode on the platform to test out making trades and orders. Paper trade until you become comfortable

-

Go live: When ready, switch the account mode to live trading and start trading micro lots to gain real market experience

Conclusion

For new traders seeking to gain experience in the live markets with minimal starting capital, a Forex micro account can be the ideal gateway into the world of currency trading. However, such small position sizes also reduce the potential for profits. Use the micro account to learn essential trading principles, test strategies, and acclimate to real money psychology to form the foundation to transition to larger position sizes eventually.

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).