deposit:

- $100

Trading platform:

- MT4

- MT5

- WebTrader

- SVG FSA

- 35%

deposit:

- $100

Trading platform:

- MT4

- MT5

- WebTrader

- SVG FSA

- 35%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

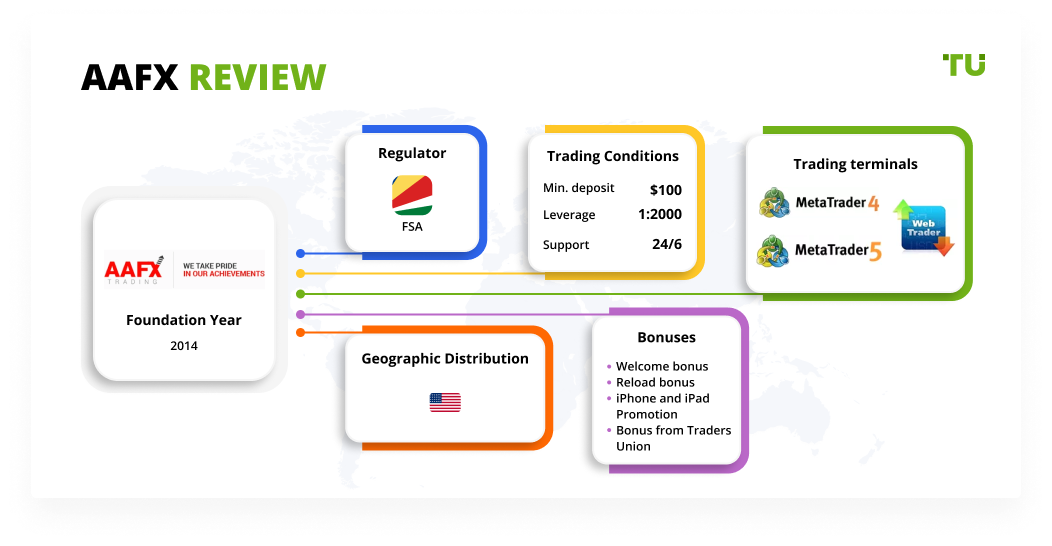

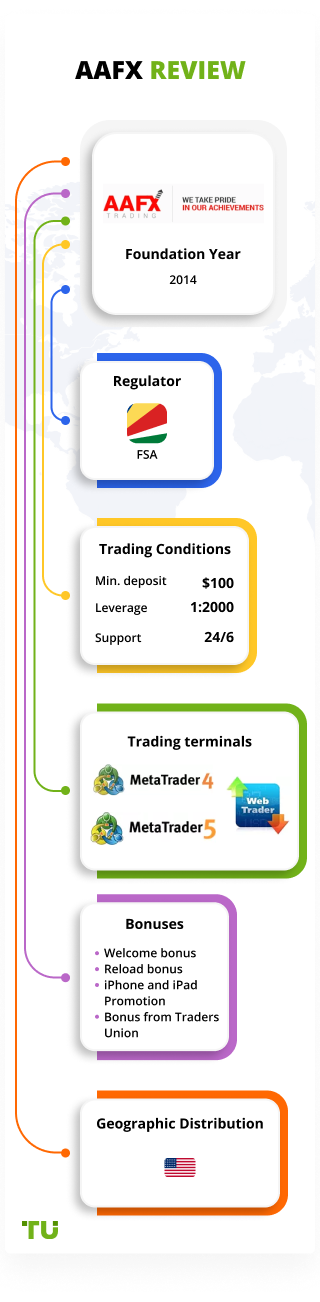

Summary of AAFX Trading Company

AAFX is a moderate-risk broker with the TU Overall Score of 6.93 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by AAFX clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. AAFX ranks 41 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

AAFXTRADING is a broker offering services in over 150 countries. It is suitable for the traders who prefer to work using STP and ECN technologies.

AAFXTRADING is an STP and ECN broker, which was founded in 2014. The broker is headquartered in Hong Kong and has offices in Australia and in Saint Vincent and the Grenadines. The company offers its clients access to trading 7 classes of trading instruments, including currency pairs and contracts for difference (CFDs) on stocks, equity indices, precious metals, energies, commodities and cryptocurrencies. AAFX Trading Company Ltd is a registered online trading broker with the company number 22916 IBC , based in Saint Vincent and the Grenadines. Read more about AAFX Available Countries.

| 💰 Account currency: | USD, EUR, GBP |

|---|---|

| 🚀 Minimum deposit: | USD 100 |

| ⚖️ Leverage: | Up to 1:2000 |

| 💱 Spread: | from 2 pips (Fixed), from 0.8 pips (ECN), from 0.7 pips (VIP) |

| 🔧 Instruments: | Currency pairs (62), CFDs on stocks (64), indices (11), metals (2), energies (3), commodities (8) cryptocurrencies (2) |

| 💹 Margin Call / Stop Out: | 50%/20% |

👍 Advantages of trading with AAFX:

- Tight spreads (from 0.8 pips on ECN accounts and 0.7 pips on VIP accounts).

- 150+ trading instruments.

- 3 types of partnership programs.

- Support of STP and ECN technologies.

- 0% withdrawal fee.

👎 Disadvantages of AAFX:

- No investment programs.

- Customer support operates 24/6.

Evaluation of the most influential parameters of AAFX

Trade with this broker, if:

- You want to pay only for the spread. AAFX’s spreads differ subject to the account type, with a minimum of 0.4 pips. Yet, there are no trading fees on all account types.

- You need a profitable partnership program. The broker’s partners receive payments not for referral’s trading, but for their deposits. The bonus is 10% regardless of the deposited amount.

Do not trade with this broker, if:

- You don’t want to pay for withdrawals. AAFX’s clients get zero withdrawal fees and instant execution only for amounts over $10,000.

Geographic Distribution of AAFX Traders

Popularity in

Video Review of AAFX i

Traders’ opinions on AAFX Trading stretch from one end of the spectrum to the other – all the way from “best broker ever” to “total scam broker”. In this review, I’m simply going to lay out some of the primary indisputable facts about AAFX. You can then check out this broker for yourself and make your own decision about whether or not to use its services for trading.

Here are four of the primary “pluses” and “minuses” that are most often noted about AAFX Trading:

- Plus: AAFX offers multi-market exposure through CFD trading of Forex, stocks, indexes, commodities, and cryptocurrency.

- Minus: AAFX is an “offshore” broker (headquartered in Kazakhstan, and registered in St. Vincent and the Grenadines), not regulated by any Tier 1 regulatory authorities such as the Financial Conduct Authority (FCA) in the UK.

- Minus: Even though traders can trade various financial markets, the total number of financial assets available to trade at AAFX is only a little over 100 – and the bulk of that is comprised of currency pairs. Crypto trading is limited to Bitcoin. However, AAFX does offer some commodity exposure not found at other Forex brokers, such as access to trade wheat and cocoa.

- Plus: Traders can access leverage as high as 2000:1.

I found the choice of trading platforms (only MT4 or MT5) somewhat limited. One distinguishing feature at AAFX that I like is the option to make deposits with cryptocurrency. That’s an option that has become increasingly popular with investors.

Founded in 2014 on the island of Saint Vincent and the Grenadines, AAFX Trading is well known for its competitive trading conditions, offering traders the best possible experience with minimal costs. Its diverse range of trading instruments, including forex, stocks, indices, commodities, and cryptocurrencies, makes AAFX highly suitable for traders looking to build a diversified trading portfolio.

AAFX offers multiple account types to accommodate different trading needs, styles, and preferences, with minimum deposits ranging from $100 (Fixed Spread account) to $20,000 (VIP account). Beginners can choose the low-cost Standard account, while high-volume traders might prefer the ECN account with tight spreads and low commissions.

AAFX employs the ever popular and user-friendly MetaTrader 4 and 5 trading platforms loaded with advanced charting tools, trading features, and customization options. These work alongside AAFX's WebTrader platform—a browser-based platform for traders who want to access their accounts via internet-connected devices. Through WebTrader, traders can access a range of tradable assets, real-time market data, and advanced charting tools.

One standout feature is AAFX's competitive affiliate program that offers traders the opportunity to earn an additional income stream in the form of commissions by referring new clients.

Despite its solid 4.2-star rating with Trustpilot, AAFX continuously strives to improve its 24/5 customer support accessed through email, phone, or live chat, with multilingual support available.

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of AAFX

AAFX offers competitive trading conditions for both retail and professional clients. Regulation is adequate with licensing from St. Vincent and Grenadines, while segregated accounts enhance security. Leverage up to 1:2000 and low minimum deposit of $100 are appealing. Commission fees are transparently disclosed with no hidden costs, giving traders clear pricing. A variety of over 150 instruments caters to different trading strategies. MT4 and MT5 platforms via multi-device apps provide a familiar experience. Educational resources and market commentary help both new and experienced traders. While client support could be improved, overall communication channels seem sufficient.

AAFX is a good option, especially for traders prioritizing conditions over top-tier oversight. Continuous improvements may help strengthen its value in the competitive online brokerage sphere.

Dynamics of AAFX’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

AAFX specializes in services for traders. The platform does not feature investment programs. Therefore, it is possible to earn a profit here only through active trading. However, AAFXTRADING is actively promoting its partnership programs. There are offers for all types of partners.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

AAFX’s affiliate programm

-

Introducing Broker. AAFXTRADING offers a partnership program for account, hedge funds managers and other organizations involved in increasing the capital of their clients.

According to this partnership program, the clients can fully use AAFX Trading software, including all trading platforms, trade all types of assets, etc. The reward under the partnership program is credited per lot and depends on the number of clients. The maximum commission is provided for the partners who have 100+ clients; they are rewarded up to USD 20 per trading lot.

-

White Label. This program is designed for large investment companies, brokers, banks, etc. Under this partnership program, the clients can also use the software and promote the services under their own label.

The broker provides trading platforms, back office, services, etc. The clients have support 24/6.

-

Affiliate Program. This partnership program is for private traders, who can refer new users and receive a reward from AAFXTRADING for that. The broker provides traders with the promotion materials -–banners, landing pages, etc.

Under the Affiliate Program, traders can receive a bonus for each referred trader, who registered and funded his/her account. The bonus amount ranges from 5% to 10% depending on the deposit amount.

Trading Conditions for AAFX Users

AAFXTRADING offers its clients access to working with 150+ trading instruments. Marginal trading is available; leverage is up to 1:2000. Traders can work on Metatrader 4 and Metatrader 5 trading platforms. Potential clients can test broker’s conditions using a demo account. Swap free trading is available for Muslim traders (Islamic accounts).

$100

Minimum

deposit

1:2000

Leverage

24/6

Support

| 💻 Trading platform: | МТ4 (Desktop, Mobile, Web), МТ5 (Desktop, Mobile), WebTrader |

|---|---|

| 📊 Accounts: | Demo, Fixed, ECN, VIP |

| 💰 Account currency: | USD, EUR, GBP |

| 💵 Replenishment / Withdrawal: | Debit/credit cards, bank cards, Neteller, Skrill, FasaPay, Bitcoin |

| 🚀 Minimum deposit: | USD 100 |

| ⚖️ Leverage: | Up to 1:2000 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | from 2 pips (Fixed), from 0.8 pips (ECN), from 0.7 pips (VIP) |

| 🔧 Instruments: | Currency pairs (62), CFDs on stocks (64), indices (11), metals (2), energies (3), commodities (8) cryptocurrencies (2) |

| 💹 Margin Call / Stop Out: | 50%/20% |

| 🏛 Liquidity provider: | More than 20 large banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market Execution |

| ⭐ Trading features: | No inactivity fee |

| 🎁 Contests and bonuses: | Yes |

Comparison of AAFX with other Brokers

| AAFX | RoboForex | Eightcap | Exness | Octa | XM Group | |

| Trading platform |

MT4, MT5, Web platform | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MetaTrader4, MetaTrader5 | MT4, MT5, MobileTrading, XM App |

| Min deposit | $100 | $10 | $100 | $10 | $25 | $5 |

| Leverage |

From 1:1 to 1:2000 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:30 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.7 points | From 0 points | From 0 points | From 1 point | From 0.6 points | From 0.6 points |

| Level of margin call / stop out |

50% / 20% | 60% / 40% | 80% / 50% | No / 60% | 25% / 15% | 100% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | Yes |

Broker comparison table of trading instruments

| AAFX | RoboForex | Eightcap | Exness | Octa | XM Group | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes |

| ETF | No | Yes | No | No | No | No |

| Options | No | No | No | No | No | No |

AAFX Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Fixed | from $20 | No |

| ECN | from $8 | No |

| VIP | from $4 | No |

Swaps are charged (commission for position rollover to the following day).

Traders Union analysts also compared average trading commission on AAFXTRADING, RoboForex and FxPro. You can see the results of comparison in the table below.

| Broker | Average commission | Level |

| AAFX | $10.6 | High |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | Medium |

Detailed Review of AAFX

AAFXTRADING is targeted at the traders who prefer to work directly with the liquidity providers. Clients of the company have access to 150+ trading instruments. The users can work with Market Execution type of order execution. AAFX provides clients an opportunity to use automated trading and work with trading advisors.

AAFX in figures:

-

Over 7 years in the market.

-

150+ trading instruments.

-

Spreads from 0.7 pips.

AAFX is a broker for active trading

AAFXTRADING uses ECN and STP technologies. This means that the traders receive direct access to the broker’s liquidity providers. AAFX is not involved in dealing; all quotations come directly from the market, which guarantees fair prices, tight spreads and maximum quick execution. AAFXTRADING does not provide opportunities for passive investing, but the conditions for the traders are attractive. The clients of the company can work with currency pairs and CFDs on stocks, equity indices, energies, precious metals, commodities and cryptocurrencies.

Trading with AAFX is performed through classic trading platforms MetaTrader 4 and MetaTrader 5. Web, desktop and mobile versions of the platforms are available. The broker does not set limitations to the use of any trading strategies.

Useful services by AAFX:

-

Economic calendar. AAFXTRADING clients are always up to date on the coming economic events. A trader can select the events that interest him/her using filters. You can set up filters by the class and type of assets, on which an event may have an impact, date and time, expected volatility, etc.

-

Blog. Broker’s experts regularly publish market reviews. The company’s blog features the events that happened in the financial markets the previous day or previous week and also their impact on specific assets.

-

Video analysis. AAFT Trading analysts publish video reviews of economic events. The videos are published on the broker’s website and Youtube channel. The broker publishes video reviews daily.

Advantages:

7 classes of assets are available for trading.

The company keeps clients’ funds on segregated accounts to ensure their safety.

Negative balance protection.

Tight spreads (from 0.7 pips) on VIP accounts.

The broker provides free analytics and online instruments for improving the quality of trading.

35% Welcome Bonus.

1:2000 Leverage.

US clients accepted.

All clients, regardless of the amount of their deposit, have access to the broker’s analytics, economic calendar, demo accounts, Islamic account, etc.

How to Start Making Profits — Guide for Traders

AAFX offers 3 account types. They differ by the amount of minimum deposit, types and size of spreads, etc. Marginal trading with leverage up to 1:2000 is available to traders. Minimum deposit on the platform is USD 100.

Account types:

Demo accounts are available for all types of trading platforms.

AAFXTRADING is a broker that provides traders with direct access to liquidity provides, free choice of suitable type of spreads and an opportunity to open a trading account that meets their financial possibilities. If you want to learn how to make money on AAFX, read the Traders Union article.

AAFX Trading - How to open, deposit and verify a trading account | Firsthand experience of TU

Bonuses Paid by the Broker

Bonus policy is one of the ways to attract new traders for AAFXTRADING. The company offers its clients 4 types of bonuses.

Welcome bonus

The broker awards clients a bonus for the first deposit made to the account. The bonus amount is 35% of the deposit amount. In order to receive the bonus, a trader needs to deposit USD 500 or an equivalent amount.

Reload bonus

This is a special offer for the clients for redeposits. The bonus amount is calculated as a percentage of the deposit amount. It can be 25% for the deposits in the amount from USD 500 to USD 1,000 or 30% for deposits over USD 1,000.

iPhone and iPad Promotion

The broker offers its clients to win an iPhone or iPad if they meet specific criteria. All traders with deposits USD 10,000 and more and those who traded the required number of lots on the platforms are eligible for this bonus. The minimum number of trading lots for traders with deposits in the amount of USD 10,000 is 250.

Investment Education Online

AAFX has a separate section titled Education. The company offers a course of educational videos and also electronic books. The video course is published on the broker’s official website and also on AAFXTRADING channel on Youtube.

The broker does not have cent accounts, so the training on the demo account is the only way to test the knowledge you obtained.

Security (Protection for Investors)

AAFX has three offices. The company’s headquarters are located in Hong Kong. Also, AAFXTRADING has offices in Australia and in Saint Vincent and the Grenadines. The funds of the clients are kept in separate, segregated accounts. For data transfer AAFX uses a secure socket layer (SSL), which reduces the risk of user information leakage.

👍 Advantages

- The funds of the clients are separated from AAFXTRADING equity and kept on segregated bank accounts

- Negative balance protection

- If the broker violates its obligations written in the public offer, the client can file a complaint with the regulator

👎 Disadvantages

- Deposit and withdrawal of funds using debit/credit bank cards Visa, Mastercard or Wire transfer is available only after a client account is duly verified

Withdrawal Options and Fees

-

AAFX processes a request for money withdrawal within 24 hours.

-

The money can be withdrawn to Visa and Mastercard debit/credit cards, via a wire transfer, electronic payment systems Neteller, Skrill, FasaPay. It is also possible to use Bitcoin.

-

Wire transfer takes 1-2 working days. In case of withdrawal via an EPS, the money is credited within several minutes after the broker approves the withdrawal request.

-

AAFXTRADING does not charge deposit and withdrawal fees. Payment systems, however, may charge their commissions.

-

In order to make a deposit, a user needs to pass verification.

Customer Support Service

The operators of the customer support team are online 24 hours a day. Customer support operates 6 days a week with Sunday off.

👍 Advantages

- A person can ask a question in the online chat without being the broker’s client

- Support is available in 30 languages

👎 Disadvantages

- Operates 24/6

The broker provides the following methods of contacting customer support:

-

Phone number (specified in the Contact section);

-

email;

-

online chat on the website and in the Personal Account;

-

callback;

-

Skype.

Not only a registered client, but also a trader without an active account can contact the broker’s representative to ask a question.

Contacts

| Foundation date | 2007 |

| Registration address | Two Exchange Square 8 Connaught Place Central, Hong Kong. |

| Regulation |

SVG FSA |

| Official site | https://www.aafxtrading.com/ |

| Contacts |

Email:

support@aafxtrading.com,

Phone: +85281981079 |

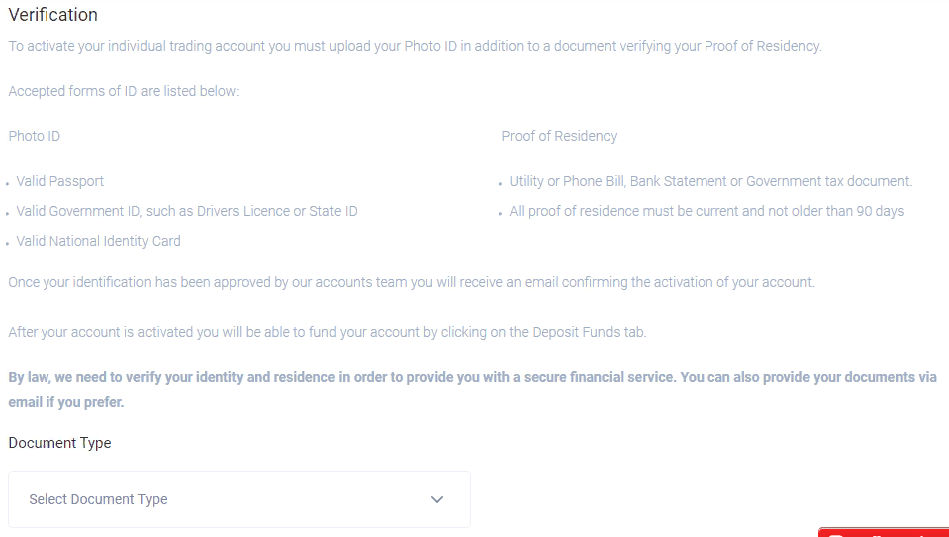

Review of the Personal Cabinet of AAFX

In order to start trading on AAFX Trader, you need to become a broker’s client by opening a trading account. Here is a short guide:

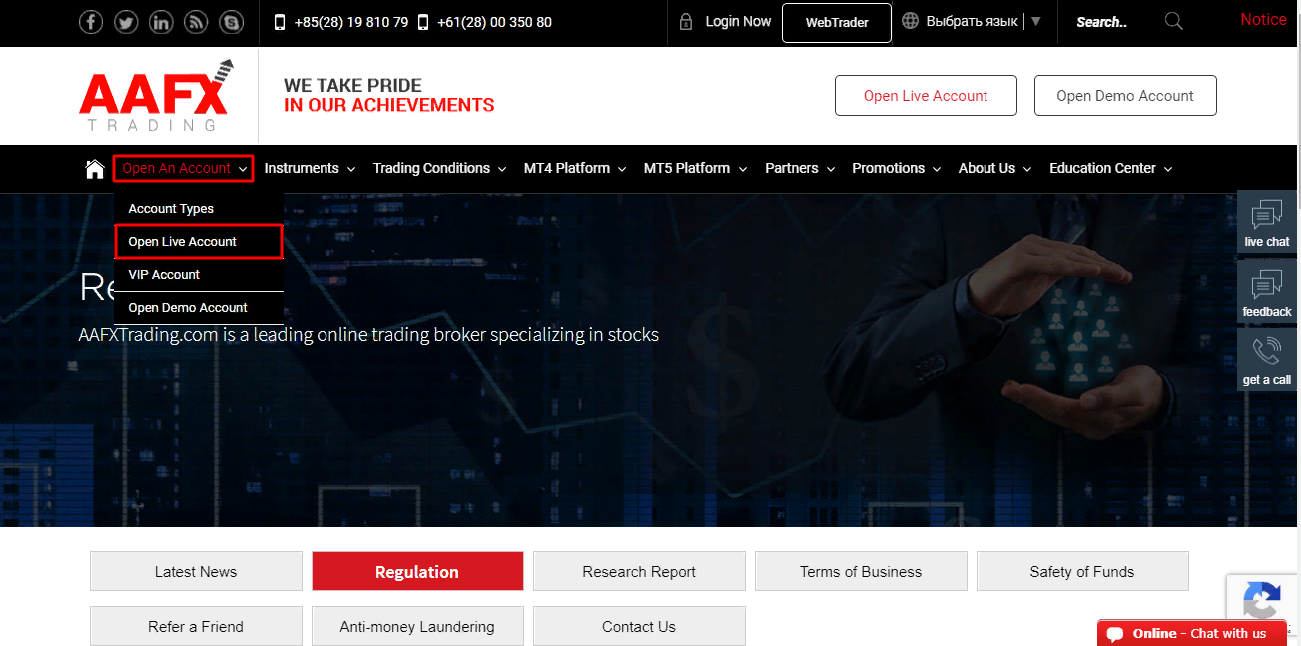

In the top menu on the main page of the website, select Open An Account and click on Open Live Account.

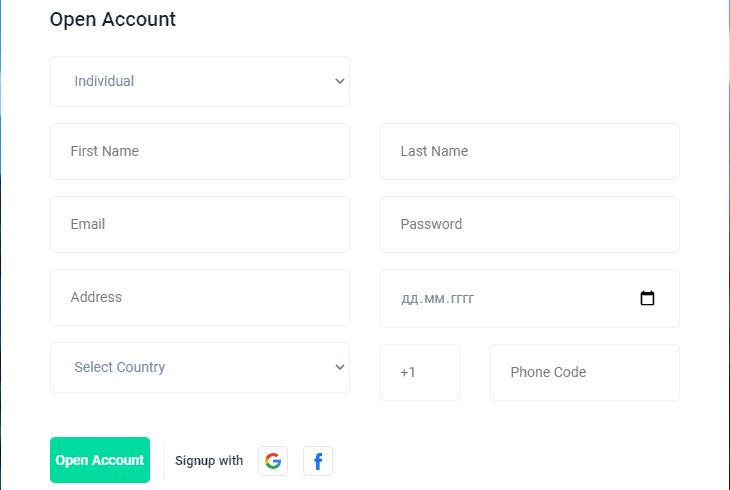

Next, fill out the registration form. In order to register with the company, you need to provide your first name and last name, your address, date of birth, email, password, country and phone number.

Next is verification. For this you need to upload your ID document.

The following features are also available in the Personal Account:

-

Reviews of quotations of trading instruments. The quotations are updated in real time mode, and therefore the traders always get the latest information.

-

Daily News. The clients of the company can monitor relevant news. The company publishes news both in text format and as video reviews.

-

Trading statistics. Traders can monitor statistics on open and closed trades. The clients can check their profit or loss from the trades, opening and closing price, statistics on trading different instruments, etc.

Find out how AAFX stacks up against other brokers.

Articles that may help you

FAQs

Is AAFX trading regulated?

The broker is officially registered in two jurisdictions: Saint Vincent and the Grenadines, and Malaysia. The company has an office in Hong Kong. However, registration does not imply a license to provide brokerage services in any specific jurisdiction. Therefore, before opening a real account, ask the broker's support team whether they operate in your country.

How long does it take to withdraw money from AAFX?

Withdrawals to electronic wallets and cryptocurrency wallets are processed within 24 hours. Withdrawal requests to a bank account may take 1-3 days to process, and the crediting time is up to 10 business days.

What is the maximum leverage at AAFX?

The trading conditions specify leverage up to 1:2000, but in certain cases, the leverage may be reduced to 1:500. Also, check the leverage separately for each asset in the contract specification. You can find the specifications on the MT4/MT5 trading platforms.

Does AAFX accept U.S. clients?

No, the broker does not operate in this jurisdiction.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.