deposit:

- 1000$

Trading platform:

- MT4

- FCA

- FSA

- ASIC

- CGSE

- JSC

- FSC

- FSCS

- 0%

Hantec Markets Review 2024

deposit:

- 1000$

Trading platform:

- MT4

- FCA

- FSA

- ASIC

- CGSE

- JSC

- FSC

- FSCS

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

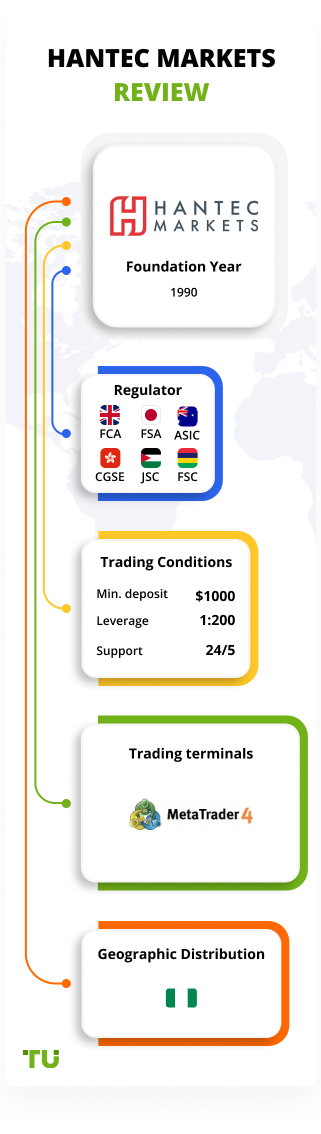

Summary of Hantec Markets Trading Company

Hantec Markets is a moderate-risk broker with the TU Overall Score of 5.1 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Hantec Markets clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. Hantec Markets ranks 108 among 414 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Hantec Markets is a professional manual and algorithmic trading broker that focuses on the European and Asian markets.

The Hantec Markets (also, Hantec) broker was founded in Hong Kong in 1990. Initially, the company focused only on the Chinese and Taiwan markets, providing classic services on OTC financial markets. In 2008, the broker was rebranded and offices were opened in Australia, Great Britain, Japan, and other countries during the next two years. Today, Hantec is a multinational company with 18 offices in the European and Asian regions and is licensed by six regulators.

| 💰 Account currency: | USD, EUR, GBP, CHF, CAD, AUD, PLN, and AED |

|---|---|

| 🚀 Minimum deposit: | $1,000 |

| ⚖️ Leverage: | Up to 1:200 for currencies |

| 💱 Spread: | From 0.2 pips |

| 🔧 Instruments: | Currency, stock, commodity assets, cryptocurrencies |

| 💹 Margin Call / Stop Out: | No/40% |

👍 Advantages of trading with Hantec Markets:

- Large range and reliability. Its regulators include FCA (UK), ASIC (Australia), and FSA (Japan), which are considered some of the strictest regulators in the world.

- Segregated accounts and partner banks are Barclays and Lloyds.

- Deposits of traders are insured by the Financial Services Compensation Scheme for £85,000.

- A relatively small entry threshold for trading stock and commodity assets is just $0-$100.

- Relatively small floating spread — from 0.2-0.5 pips.

👎 Disadvantages of Hantec Markets:

- The high minimum deposit for trading currency pairs is $1,000.

- Lack of reversal competitive advantages. There are no proprietary technological developments, copyright applications, or passive investment services.

- Lack of comprehensive presentation of information on trading terms.

Evaluation of the most influential parameters of Hantec Markets

Trade with this broker, if:

- You prioritize trading with brokers regulated by reputable authorities such as the Financial Conduct Authority (FCA), Financial Services Authority (FSA), Australian Securities and Investments Commission (ASIC), China Securities Regulatory Commission (CGSE), Japan Securities Clearing Corporation (JSC), Financial Services Commission (FSC), or Financial Services Compensation Scheme (FSCS). Regulation provides a level of protection and oversight that can be important for traders.

- You value the security of your deposits and seek protection against unforeseen events, as this broker provides deposit insurance through the Financial Services Compensation Scheme (FSCS) for amounts up to £85,000.

Do not trade with this broker, if:

- You're looking for brokers with lower minimum deposit requirements, as they require a high minimum deposit of $1000. High minimum deposits can be prohibitive for traders with limited capital or those who prefer to start with smaller initial investments.

Table of Contents

- Geographic Distribution

- Video Review

- Latest Comments

- Expert Review

- Latest Hantec Markets News

- Analysis of Hantec Markets

- Dynamics of the Popularity

- Investment Programs

- Trading Conditions

- Commissions & Fees

- Detailed Review

- Client Area of Hantec Markets

- User Reviews of Hantec Markets

- FAQs

- TU Recommends

Geographic Distribution of Hantec Markets Traders

Popularity in

Video Review of Hantec Markets i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Hantec Markets

Hantec Markets is a broker with ambitious goals. Over the past 12 years, the company has obtained the support of six regulators in the European and Asian regions. The company is completely transparent and it doesn’t hide its partners. Also, its legal documentation is in the public domain, and you can request extra information from support at any time.

This broker focuses on creating a technological model of communication between all market participants. The implemented MT4 ECN Bridge system, a liquidity bridge, allows you to instantly process orders and transfer information worldwide without the participation of a broker. And although the broker doesn’t have investment programs or original trading developments, its order processing speed and constant liquidity support are considered a competitive advantage.

As for its disadvantages, there are many questions for this crude website regarding the types of trading accounts and trading terms. But the support is always ready to answer the questions instantly. In general, the broker leaves a positive impression and can be recommended as a reliable partner for traders with any level of trading experience.

Latest Hantec Markets News

Dynamics of Hantec Markets’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

The broker doesn’t have proprietary investment programs. But Hantec Markets has no trading restrictions, so traders can take advantage of the MetaQuotes investment offers. The MT4 platform allows users to connect accounts to a trader and copy his signals after registration on the MQL5 website. Accounts can only be linked to one trader. The subscription price is set by the managing trader. Each Hantec Markets client can be both a trader and an investor.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Hantec Markets’ affiliate program

-

Introducing Broker (IB) is a program for retail clients who are ready to create their own multi-level partner network. The partner gets a reward for each referral attracted. In return, the broker guarantees full back-office support.

-

White Label is a program for legal entities developing their own brokerage business. Hantec Markets transfers trading technology on individual terms which include back and front office setup, access to liquidity providers, a customizable platform, account management, etc.

Learn more about the terms of partnership offers from the broker's support service.

Trading Conditions for Hantec Markets Users

The broker has over 150 trading instruments, including cryptocurrencies. Leverage depends on the type of asset; for currencies, the maximum leverage is 1:200 following the requirements of regulators. The deposit depends on the type of asset.

1000$

Minimum

deposit

1:200

Leverage

24/5

Support

| 💻 Trading platform: | MT4, including mobile version |

|---|---|

| 📊 Accounts: | For retail and professional clients |

| 💰 Account currency: | USD, EUR, GBP, CHF, CAD, AUD, PLN, and AED |

| 💵 Replenishment / Withdrawal: | Wire transfer, Visa, Skrill, and Neteller |

| 🚀 Minimum deposit: | $1,000 |

| ⚖️ Leverage: | Up to 1:200 for currencies |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0.2 pips |

| 🔧 Instruments: | Currency, stock, commodity assets, cryptocurrencies |

| 💹 Margin Call / Stop Out: | No/40% |

| 🏛 Liquidity provider: | Barclays, Lloyds |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | Special terms for qualified traders |

| 🎁 Contests and bonuses: | No |

Comparison of Hantec Markets with other Brokers

| Hantec Markets | RoboForex | Pocket Option | Exness | AMarkets | Tickmill | |

| Trading platform |

MT4 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5, AMarkets App | MT4, MT5, Tickmill Mobile App |

| Min deposit | $100 | $10 | $5 | $10 | $100 | $100 |

| Leverage |

From 1:1 to 1:200 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:3000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.2 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0 points |

| Level of margin call / stop out |

No / 40% | 60% / 40% | 30% / 50% | No / 60% | 50% / 20% | 100% / 30% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | $30 |

| Cent accounts | No | Yes | No | No | No | No |

Broker comparison table of trading instruments

| Hantec Markets | RoboForex | Pocket Option | Exness | AMarkets | Tickmill | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes |

| ETF | No | Yes | No | No | No | No |

| Options | No | No | No | No | No | No |

Hantec Markets Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Retail account | from $2 | No |

| Professional trading account | from $18 | No |

There is a swap commission (for shifting transactions to the next day). Analysts at Traders Union also compared Hantec Markets' commissions with the spread of its major competitors. The spread was taken as a basis for the EUR/USD currency pair and averaged over all types of accounts.

| Broker | Average commission | Level |

| Hantec Markets | $10 | High |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | Medium |

Detailed Review of Hantec Markets

Hantec Markets' mission is to maximize transparency and improve data processing technology. The company’s strategy is based on the trust and maximum support of its traders. Therefore, it has one of the best theoretical training bases, transparent pricing, and high order processing speed. The broker operates following the requirements of the regulators. Therefore, there is relatively small leverage here, and special terms for qualified traders.

Hantec Markets by the numbers:

-

Over 15 offices in Europe and Asia.

-

Over 10 years delivering brokerage services.

-

7 licenses of European and Asian regulators.

Hantec Markets is a professional trading broker

Data transmission technology - MT Bridge ECN includes a liquidity bridge that connects directly to suppliers and ECN systems with complete security of information while it’s processing. The FIX API protocol provides direct access to interbank quotes, which increases the speed of transactions.

Trading platform - МТ4. An additional application is a mechanism for managing multiple accounts such as MAM technology. The offer may be of interest to those who work with different client accounts or are experimenting with several types of strategies in which different levels of deposit are required for risk management.

Hantec’s useful services:

-

The Training section contains everything including risk management policy and fundamental theory.

-

There is an economic calendar and professional market analysis.

Advantages:

Segregated accounts and availability of an insurance fund.

Licenses from European and Asian regulators. Ongoing external cross-audit.

Technological improvement of the transmission of data and the information processing model.

Narrow spreads.

Loyal trading terms for several assets.

It has an Islamic account and demo accounts for practicing trading skills.

How to Start Making Profits — Guide for Traders

There is no clear division into account types on the Hantec website, but information may change as the website is updated. The broker has a clear separation between retail and professional investor accounts, however. Moreover, trading terms are less favorable for those who qualify as professional traders. More precisely, the broker does not indicate the competitive advantages of such accounts. Perhaps this is due to the requirements of regulators. For both types of accounts for foreign currency assets the deposit is from $1,000, and for commodity assets, it’s from $100, There are no requirements for stock assets and cryptocurrencies.

Types of accounts:

Bonuses Paid by the Broker

Hantec has no active bonus offers at the moment. The company attracts customers by improving the quality of services provided. But bonuses may appear in the future.

Investment Education Online

Hantec Markets' theoretical knowledge base is considered one of the best among European and Asian brokers. There is a separate section for training on the broker's website. All the information is structured following each trader's skill level.

A demo account is provided for practicing trading skills and testing strategies.

Security (Protection for Investors)

Hantec Markets has 18 offices in Europe and Asia and is licensed by the following regulators: FCA 502635 (UK), FSA 102 (Japan), ASIC 326907 (Australia), CGSE 163 (Hong Kong), JSC (Jordan), and FSC C114013940 (Mauritius). It is part of the FSCS, an organization that has an insurance fund of up to £85,000 for each deposit.

Client accounts are separated from the broker's operating accounts and are stored in Barclays and Lloyds banks. Compliance with the segregation policy is regularly audited.

👍 Advantages

- Cross-audit of multiple regulators

- Segregation of customer accounts

👎 Disadvantages

- The difficulty of filing a private claim with a regulator if it is needed

Withdrawal Options and Fees

-

Hantec Markets does not set limits on the number of withdrawal requests.

-

Funds can be withdrawn via wire transfer, Visa, Skrill, and Neteller.

-

There is no information on the speed of accruals, withdrawal of money, or related commissions on the broker's website.

Customer Support Service

The support service is ready to answer trade-related questions 24 hours a day, except on weekends and holidays.

👍 Advantages

- Responds quickly

- Professional answers

👎 Disadvantages

- None found

The broker provides the following communication channels:

-

Chat on the broker’s website.

-

Contact form;

-

London office phone number.

You can contact individual offices in other regions.

Contacts

| Foundation date | 1997 |

| Registration address | 5-6 Newbury St, Barbican, London EC1A 7HU |

| Regulation |

FCA, FSA, ASIC, CGSE, JSC, FSC, FSCS |

| Official site | https://hmarkets.com/ |

| Contacts |

Phone:

London Office: +442070360850

|

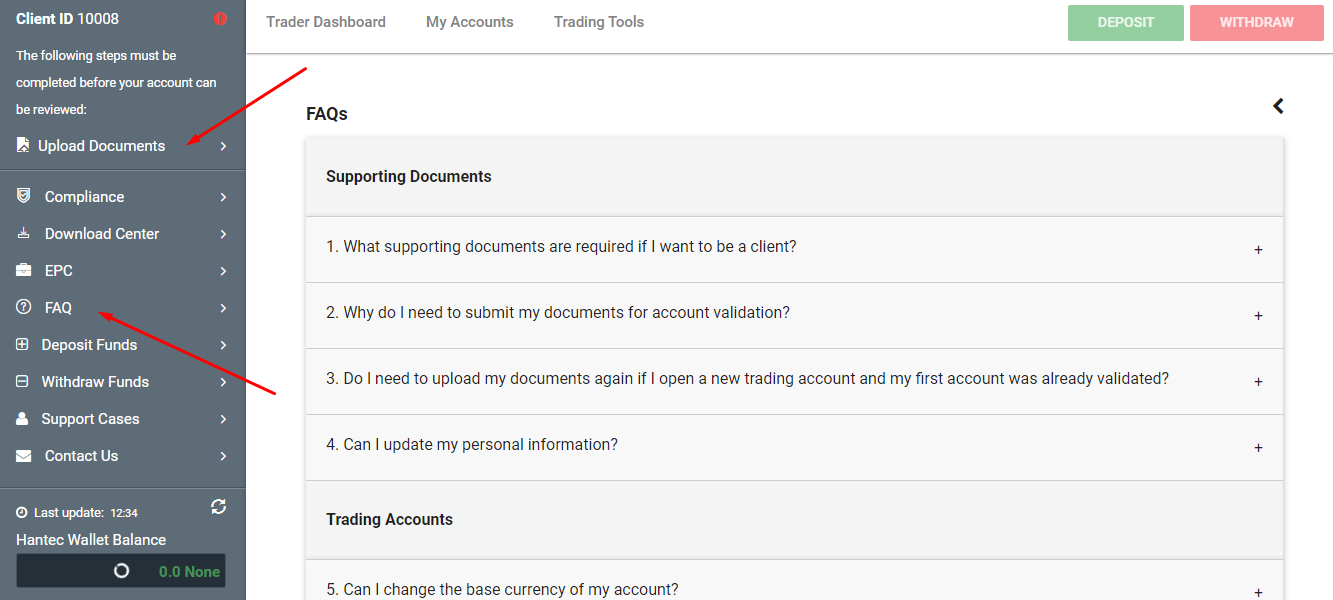

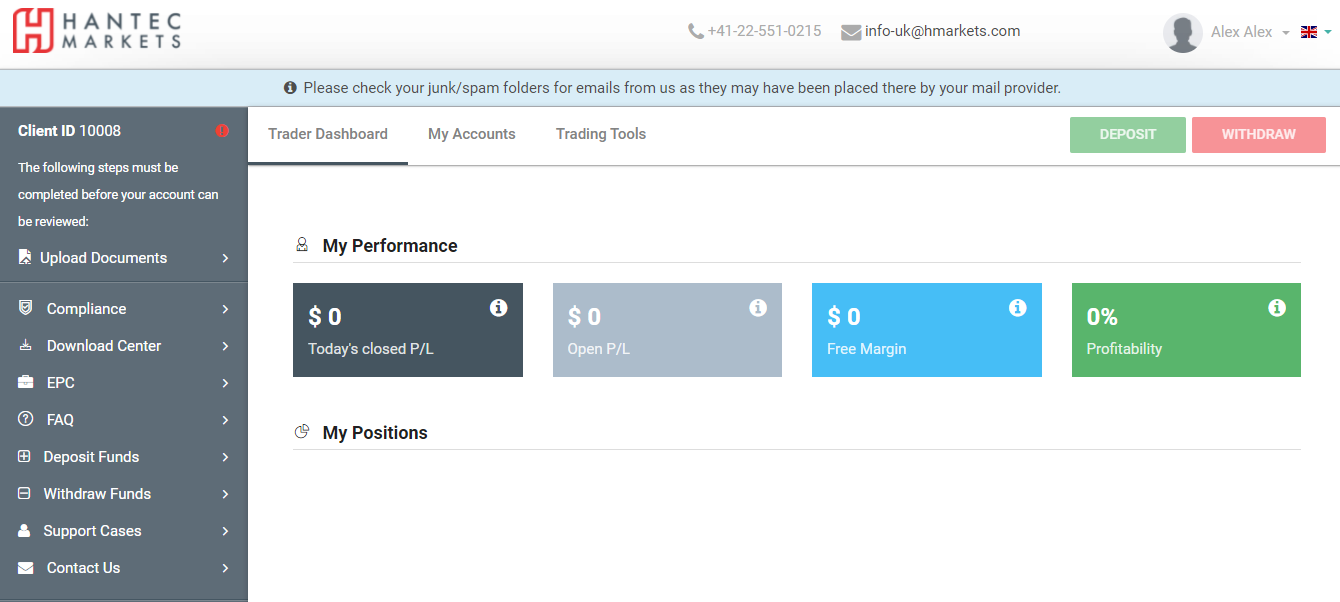

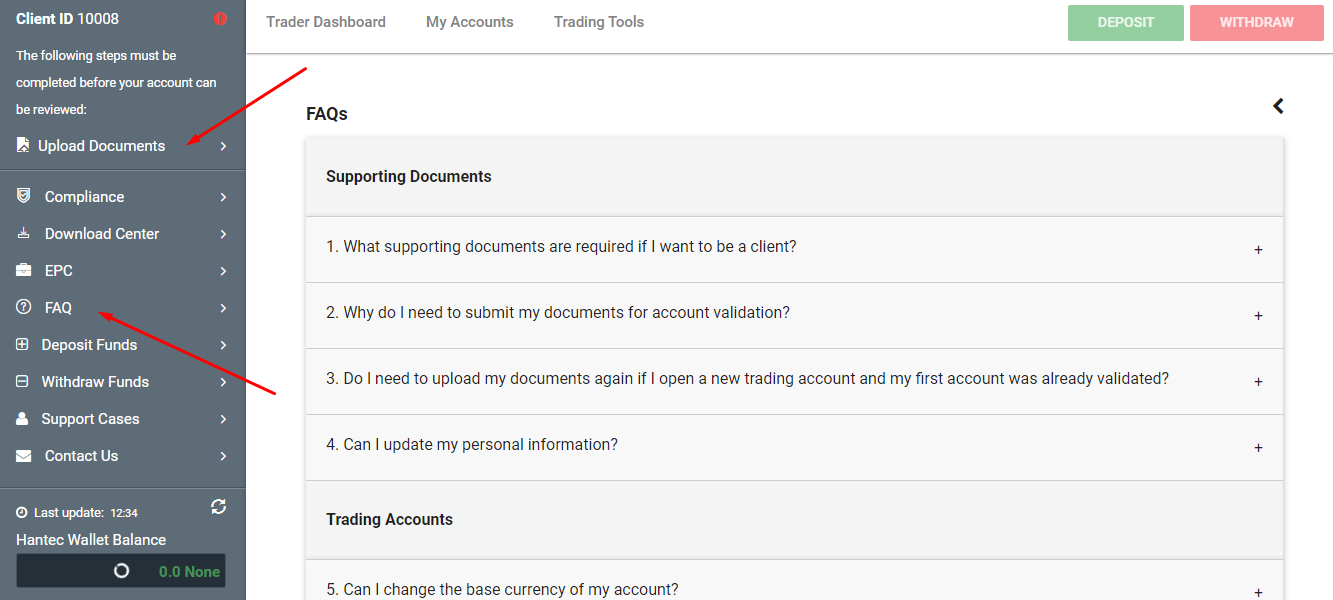

Review of the Personal Cabinet of Hantec Markets

Register on the Traders Union website before opening an account with Hantec Markets. Use a referral link and get spread compensation in the form of bonuses in the future.

How to open an account with Hantec Markets:

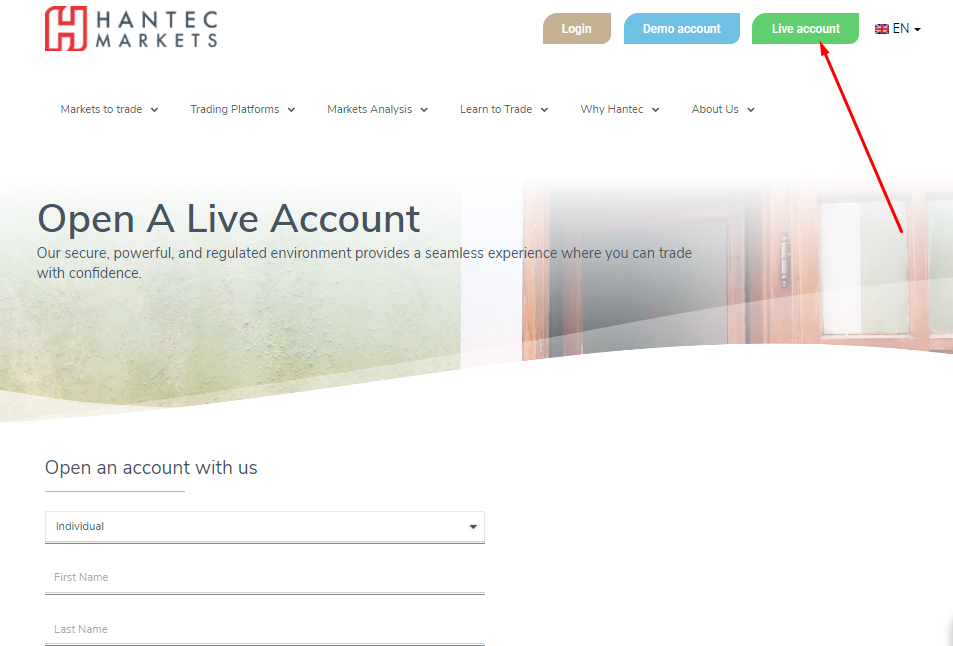

Opening an account. On the Hantec Markets website, you can open a real or demo account from any tab:

Important notice! After opening a demo account, you will get access to the MT4 trading platform and to the broker's server. Registration allows you to study only the functionality of the platform. To gain access to your personal account, opening a real account is required. When opening a real account, provide only reliable information to avoid problems with verification in the future.

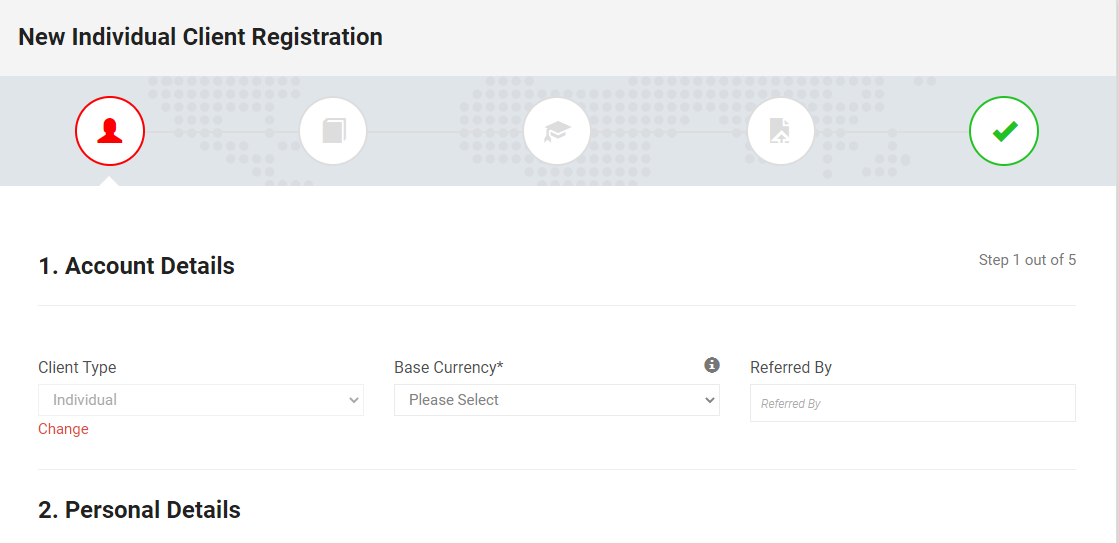

Filling out the application. It consists of 5 steps, including uploading documents for verification. It can be skipped temporarily.

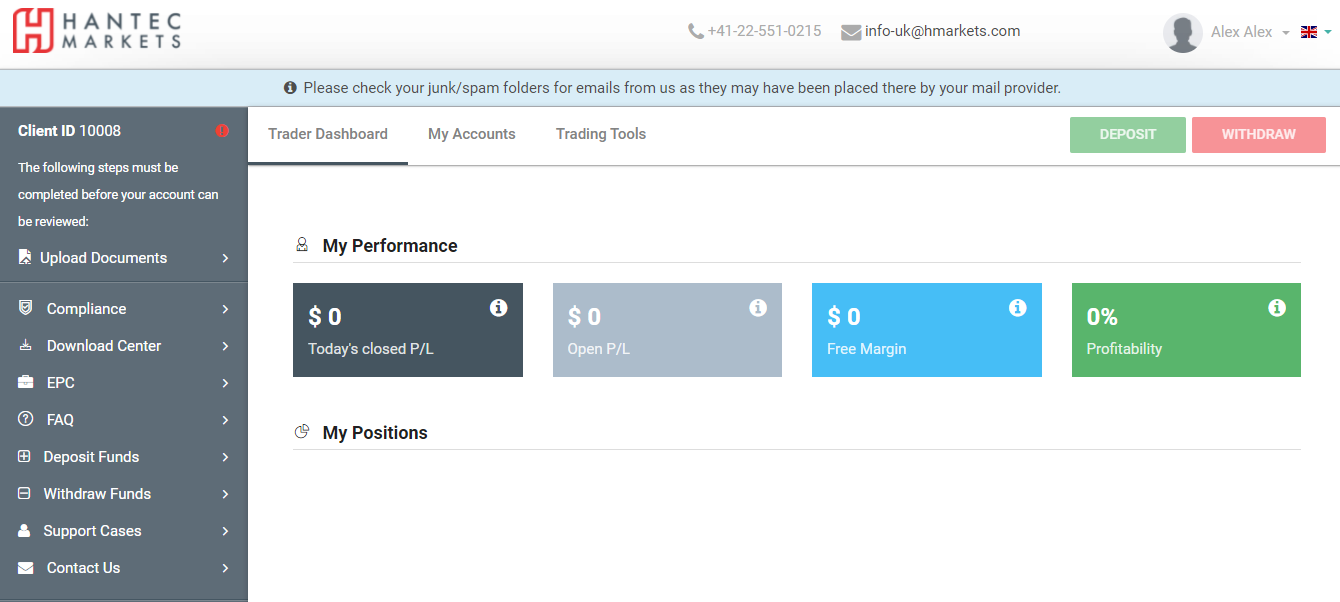

The functionalities of the personal account:

1. Account management and trading panel:

2. Answers to basic questions:

1. Account management and trading panel:

2. Answers to basic questions:

Also in the personal account, you will have access to:

-

Replenishment and withdrawals. Tabs become active only after verification.

-

Proceeding to the status of a professional client.

-

Access to the platform.

-

Compliance.

Articles that may help you

FAQs

Do reviews by traders influence the Hantec Markets rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Hantec Markets you need to go to the broker's profile.

How to leave a review about Hantec Markets on the Traders Union website?

To leave a review about Hantec Markets, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Hantec Markets on a non-Traders Union client?

Anyone can leave feedback about Hantec Markets on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.