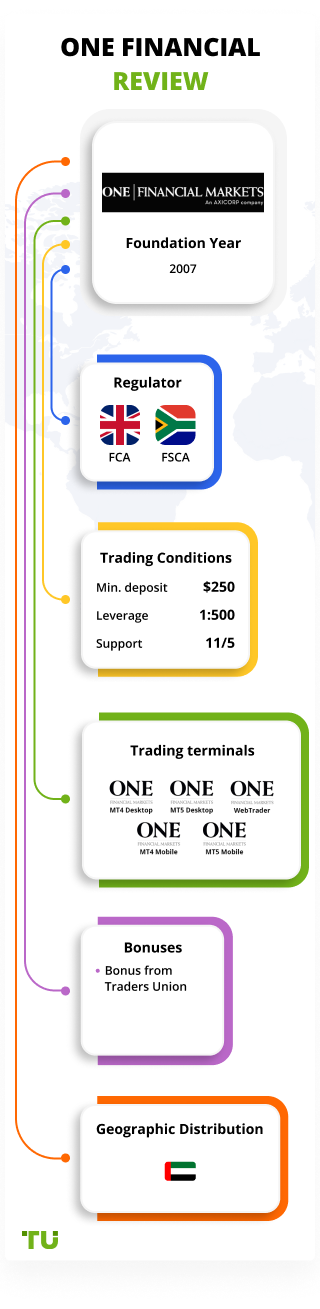

deposit:

- $250

Trading platform:

- ONE|MT4 Desktop

- ONE|MT4 Mobile

- ONE|MT5 Desktop

- ONE|MT5 Mobile

- ONE|WebTrader

- FCA

- FSCA

- 0%

One Financial Markets Review 2024

deposit:

- $250

Trading platform:

- ONE|MT4 Desktop

- ONE|MT4 Mobile

- ONE|MT5 Desktop

- ONE|MT5 Mobile

- ONE|WebTrader

- FCA

- FSCA

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of One Financial Markets Trading Company

One Financial Markets is a broker with higher-than-average risk and the TU Overall Score of 4.91 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by One Financial Markets clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. One Financial Markets ranks 125 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

The One Financial Markets broker offers a wide range of currency pairs and CFDs, but its conditions are more suitable for experienced and professional traders who are ready to invest from $250-$1,000 upon opening an account.

One Financial Markets is a group of brokerage companies. The first one started operating in 2007 in London. Today, the financial holding company has offices not only in the UK but also in the United Arab Emirates and several countries of Central and Southeast Asia. One Financial Markets Group is regulated by financial services around the world, including the UK Financial Conduct Authority (FCA, 466201) and the Financial Services Authority in South Africa (FSA, 45784).

| 💰 Account currency: | USD, EUR, GBP |

|---|---|

| 🚀 Minimum deposit: | From 250 USD |

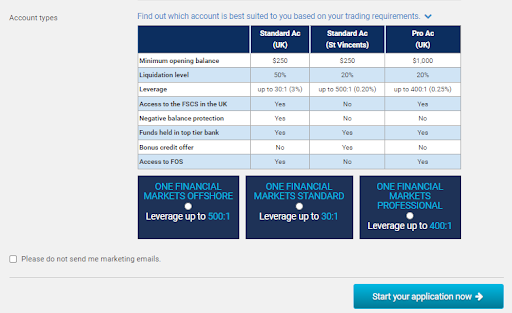

| ⚖️ Leverage: | Up to 1:30 on Standard Account (UK), up to 1:400 on Professional Account (UK), up to 1:500 on Standard Account (St Vincent) |

| 💱 Spread: | From 1 pip |

| 🔧 Instruments: | Currency pairs (67), CFD on indices (15), commodities (5), energy resources (6), gold (7), cryptocurrencies (6), stocks (458) |

| 💹 Margin Call / Stop Out: | 100%/20-50% |

👍 Advantages of trading with One Financial Markets:

- Regulated by the FCA and other reputable international supervisory bodies.

- Cooperation with both professional market participants and institutional clients and private traders.

- Wide range of Forex and CFD trading instruments including American, British, and European stocks.

- Desktop and mobile terminals including MetaTrader 4/5 and well as WebTrader, which is based on MT4.

- An opportunity to test trading conditions on demo MT4 and MT5 accounts.

- No prohibition on automated trading with Expert Advisors (EAs).

- Free-of-charge analytics such as economic calendar, technical analysis from Trading Central, and news from Bloomberg and CNBC.

👎 Disadvantages of One Financial Markets:

- Cent (micro) accounts are not available to clients.

- The high minimum deposit on Standard accounts is $250.

- There is no referral program for retail traders which does not allow them to earn additional passive income for attracting new clients to the company.

Evaluation of the most influential parameters of One Financial Markets

Table of Contents

- Geographic Distribution

- Video Review

- Latest Comments

- Expert Review

- Latest One Financial Markets News

- Analysis of One Financial Markets

- Dynamics of the Popularity

- Investment Programs

- Trading Conditions

- Commissions & Fees

- Detailed Review

- Client Area of One Financial Markets

- User Reviews of One Financial Markets

- FAQs

- TU Recommends

Geographic Distribution of One Financial Markets Traders

Popularity in

Video Review of One Financial Markets i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of One Financial Markets

One Financial Markets is a large company with multiple offices that has been operating since 2007. It is well-capitalized and its financial resources exceed the minimum requirements set by the FCA. The UK division participates in the FSCS compensation scheme, which greatly enhances the safety of clients’ funds and investments.

The One Financial Markets broker offers two types of accounts: standard and professional. Standard accounts are designed for retail clients, but their terms are not suitable for novice traders. The minimum deposit is $250 and spreads do not fall below 1 point. Customers living outside the UK and EEA cannot make deposits or withdrawals using e-wallets, including Neteller and Skrill.

One Financial Markets UK is regulated by the FCA, which prohibits regulated brokers from providing high leverage to retail clients. For this reason, traders who have opened a Standard account are allowed maximum leverage of 1:30. Non-professional clients can increase their leverage to 1:500, but to do so they must open an account with a broker registered in St. Vincent and the Grenadines that is not regulated by the FCA and is not subject to the FSCS scheme.

Dynamics of One Financial Markets’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

One Financial Markets focuses on active market participants, but also offers solutions for investors who prefer passive income in the Forex market. The broker allows the use of expert advisors for automated trading, provides an opportunity to invest funds in trust management accounts, and offers several types of affiliate programs.

Passive income solutions using expert advisors and the Managed Account Program

Each One Financial Markets client trading via the MetaTrader 4 terminal can become a passive investor. The broker offers two options for passive income:

-

Managed Account Program. The investor entrusts the funds to an experienced account manager, who trades in MT4 on behalf of the clients connected to it. If the manager makes a profitable trade, the investor gives him a part of the profit. Calculation of commissions for performance and management is fully automated. All trading statistics are displayed in the personal account.

-

Trading using Expert Advisors. Each client of One Financial Markets can connect advisors that work using different algorithms. The broker does not forbid the use of completely automated systems that make transactions for the trader, and advisors for semi-automatic trading when the decision to place the order is made by the investor.

A client of One Financial Markets can become not only an investor but also a manager. To register as an asset manager, it is necessary to obtain the Professional client qualification and then fill in a special form on the company's website.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

One Financial Markets’ affiliate program:

-

Introducing Partners is a program for representatives who want to work under the One Financial Markets brand. Partners are provided with a personal manager and a personalized web page with embedded links for tracking new client activity.

-

White Label Partners is an offer for financial companies and institutions who want to operate under their own brand and develop their business model, using the resources of One Financial Markets.

-

Counterparty Relationships is a program for institutional clients who need liquidity streaming to their trading platform and wealth management services.

One Financial Markets offers partners a comprehensive compensation scheme combined with competitive low spreads and margins. However, all programs offered by the company are aimed at institutional clients (financial institutions, money managers, corporations, and private brokerage firms) rather than retail traders.

Trading Conditions for One Financial Markets Users

The One Financial Markets broker offers standard and professional accounts with tight floating spreads from 1 pip. Leverage varies from 1:30 to 1:500, depending on the client's category and the chosen regulator. Traders can trade currency pairs and CFDs through MT4, MT5, and WebTrader. Accounts can be opened in GBP, EUR, or USD, but the broker allows deposits in other currencies as well including AED, HKD, JOD, KWD, SGD, and ZAR.

$250

Minimum

deposit

1:500

Leverage

11/5

Support

| 💻 Trading platform: | ONE|MT4 Desktop, ONE|MT4 Mobile, ONE|MT5 Desktop, ONE|MT5 Mobile, ONE|WebTrader |

|---|---|

| 📊 Accounts: | Demo МТ4, Demo МТ5, Standard Account, Professional Account, Black Account |

| 💰 Account currency: | USD, EUR, GBP |

| 💵 Replenishment / Withdrawal: | UK bank transfers, SWIFT international wire transfers, credit/debit cards, Neteller and Skrill (UK & EEA only) |

| 🚀 Minimum deposit: | From 250 USD |

| ⚖️ Leverage: | Up to 1:30 on Standard Account (UK), up to 1:400 on Professional Account (UK), up to 1:500 on Standard Account (St Vincent) |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 1 pip |

| 🔧 Instruments: | Currency pairs (67), CFD on indices (15), commodities (5), energy resources (6), gold (7), cryptocurrencies (6), stocks (458) |

| 💹 Margin Call / Stop Out: | 100%/20-50% |

| 🏛 Liquidity provider: | Proprietary aggregator |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | The terms and conditions of the standard accounts vary according to the choice of the regulator |

| 🎁 Contests and bonuses: | Yes |

Comparison of One Financial Markets with other Brokers

| One Financial Markets | RoboForex | Eightcap | Exness | TeleTrade | AMarkets | |

| Trading platform |

ONE|MT4 Desktop, ONE|MT4 Mobile, ONE|MT5 Desktop, ONE|MT5 Mobile, ONE|WebTrader | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5 | MT4, MT5, AMarkets App |

| Min deposit | $250 | $10 | $100 | $10 | $1 | $100 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:10 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 1 point | From 0 points | From 0 points | From 1 point | From 0.8 points | From 0 points |

| Level of margin call / stop out |

100% / 50% | 60% / 40% | 80% / 50% | No / 60% | 70% / 20% | 50% / 20% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Broker comparison table of trading instruments

| One Financial Markets | RoboForex | Eightcap | Exness | TeleTrade | AMarkets | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes |

| ETF | No | Yes | No | No | Yes | No |

| Options | No | No | No | No | No | No |

One Financial Markets Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard Account | From $10 | Yes, there is a withdrawal by wire transfer |

| Professional Account | From $10 | Yes, there is a withdrawal by wire transfer |

There are fees for swaps (commission for transferring a position to the next day).

The experts at the Traders Union also calculated the average commission rate of One Financial Markets and compared it with the rates of other similarly situated Forex brokers, such as RoboForex and FxPro. The results are presented in the below table.

| Broker | Average commission | Level |

| One Financial Markets | $10 | High |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | Medium |

Detailed Review of One Financial Markets

One Financial Markets is an award-winning online broker registered in the UK, which also has affiliated offices in Europe, the Middle East, South and Central America, and Southeast Asia. It offers clients a vast array of financial instruments, multilingual support, and the most popular trading platforms among Forex traders. One Financial Markets is regulated in several jurisdictions, is a member of the FSCS, and supplies analytics from reputable exchange data resources.

One Financial Markets by the numbers:

-

More than 14 years in the Forex market.

-

The company's clients are from more than 100 countries.

-

There are 7 asset classes available for trading.

One Financial Markets is a broker for foreign exchange and CFD trading

The One Financial Markets broker allows its clients to trade currency pairs, as well as CFDs on indices, commodities, energy resources, metals, and cryptocurrencies. The selection of stock CFDs is particularly broad. In addition to 141 British securities, traders can trade 271 American and 46 European shares. Stocks can be traded not only from standard and professional accounts but also from a special Black Account, which opens wider possibilities for research and analysis.

Clients of One Financial Markets can use the most popular Forex terminals such as MetaTrader 4 and MetaTrader 5. Moreover, you can use not only their desktop versions but also mobile applications that are compatible with iOS like iPhone, iPod Touch, and iPad; and with Android 2.1 and higher like smartphones and tablets. The broker also provides a WebTrader platform based on MT4. It works in all web browsers such as Internet Explorer, Microsoft Edge, Mozilla Firefox, Google Chrome, and Safari.

Useful services of One Financial Markets:

-

Technical analysis from Trading Central. Daily reports and newsletters with the data you need to make informed trading decisions. The tool is available in MT4.

-

Economic Calendar. A section of the site with current information about upcoming financial events, which helps traders to thoroughly study the situation on the Forex market and further use this information in their trading strategies.

-

Newsroom. News from Bloomberg, CNBC, and leading providers of news and reviews for financial market participants.

-

Built-in tools on the site. Trading hours calendar and dividend forecast charts.

Advantages:

Clients of the company can make transactions with 7 asset classes.

High security of client's funds due to holding them in segregated accounts in large global banks.

Retail traders are protected from negative balances.

The broker offers mid-market typical spreads from 1 pip in a quiet market.

High leverage on Professional Accounts.

Clients can not only trade for themselves but may also use expert advisors or entrust their capital to a professional asset manager.

How to Start Making Profits — Guide for Traders

The One Financial Markets broker offers two types of accounts for trading on the Forex market – standard and professional. They differ in the size of the minimum deposit, maximum leverage, and stop-outs. The conditions of the standard accounts also vary depending on the jurisdiction selected during registration.

Account Types:

The broker offers demo accounts with conditions identical to those for standard accounts. They can be opened in any version of MT4 and MT5 terminals.

One Financial Markets is a broker that offers trading accounts for retail and professional traders, as well as a separate premium account for equity trades.

Bonuses Paid by the Broker

The One Financial Markets broker regularly runs promotions and updates bonus offers. The list of bonuses available varies depending on the client's country of jurisdiction and is displayed in the client’s personal account.

Investment Education Online

A detailed description of Forex financial instruments can be found in the Markets section of the site. However, the main educational information is in the Academy block. It also gives access to registration in free seminars and webinars which are conducted by specialists for One Financial Markets.

Trading with a demo account is a safe way to consolidate theoretical knowledge during practice.

Security (Protection for Investors)

One Financial Markets is a trading name of CB Financial Services Ltd. It is authorized and regulated by the Financial Conduct Authority (FCA), the central market oversight body for financial services in the United Kingdom. The South African unit is regulated by the Financial Sector Conduct Authority of South Africa (FSCA) with registration number FSP 45784.

Accounts of clients who choose to be regulated by the FCA are protected by the Financial Services Compensation Scheme (FSCS). In the event of insolvency and liquidation of One Financial Markets, clients may be eligible for compensation under the FSCS. It is limited to £85,000 per investor.

👍 Advantages

- Customers’ funds are kept in accounts separate from the company's own money

- Retail clients are protected from negative balances

- The broker strictly follows the rules prescribed in the agreement on providing financial services

👎 Disadvantages

- Under FCA requirements, customers residing in the UK cannot make payments using electronic payment systems

- Deposits to the trading account are possible only after verification

- Professional clients are not protected from negative balance

- Compensation under the FSCS scheme is only available to clients who have opened an account with an FCA-controlled unit

Withdrawal Options and Fees

-

Withdrawal requests are processed till 13:00 (UK time).

-

The broker will transfer funds to UK bank accounts and overseas through SWIFT. Clients may also withdraw to cards (credit and debit), and for traders outside the UK and EEA also to e-wallets, including Neteller and Skrill.

-

Minimum withdrawal amount: £30 for bank transfers within the UK, $50 (or equivalent) for SWIFT, Neteller, and Skrill, $50/€35/£30 for cards.

-

Withdrawal fees: UK bank transfer fee is £1 for next-day withdrawal or £20 for same-day withdrawal; SWIFT is $25; cards, Skrill, and Neteller fees are 0%.

-

Timeframe for depositing: 1-2 days to UK bank account, 2-5 days to international bank account, 3-10 days to cards, same day to e-wallets.

Customer Support Service

Support technicians are available Monday through Friday from 7:00 a.m. to 6:00 p.m. (GMT+1).

👍 Advantages

- Online chat operators respond within 2-3 minutes after pressing the contact button

- You can quickly get answers via messengers

👎 Disadvantages

- There is no round-the-clock support

- The answer by email comes within 24 hours after making a request

Customers (current and potential) may contact the company's representatives by:

-

telephone;

-

fax;

-

online chat at the site and in the personal account;

-

email feedback form;

-

email inquiry form via info@ofmarkets.com;

-

Yasmeen forum (women only);

-

WhatsApp;

-

Twitter;

-

Facebook.

Note: Chat operators do not answer questions about One Financial Markets' services, but only relay the user's contact details to company representatives for further communication by phone or email.

Contacts

| Foundation date | 2005 |

| Registration address | Level 2, 36-38 Leadenhall Street, London EC3A 1AT, United Kingdom |

| Regulation |

FCA, FSCA |

| Official site | https://www.onefinancialmarkets.com/ |

| Contacts |

Email:

info@ofmarkets.com,

Phone: +61448088246 |

Review of the Personal Cabinet of One Financial Markets

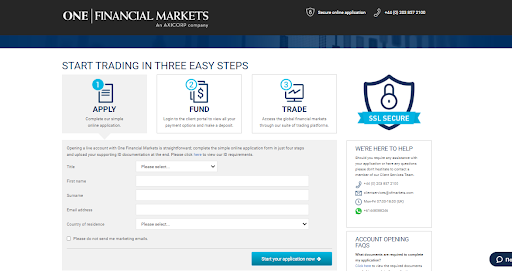

To begin trading with One Financial Markets, you need to register on its website, open an account and create a personal account. The procedure is as follows:

On the official website of One Financial Markets and click Live Account.

In the form that opens, enter your name, last name, email address, and country of residence.

Choose your trading account type and then enter your personal and financial information requested by the company. It takes up to 48 hours to review your application to open an account.

After receiving an email about opening an account, log into your personal account. To do this, click on Client Portal on the main page, select the regulator, enter your email and password indicated during registration.

Functions permitted in the personal account within One Financial Markets:

-

Uploading of documents required for verification.

-

Making a deposit, transferring funds between accounts, and withdrawing money.

-

Viewing the list of recent transactions.

-

Managing real and demo accounts.

-

Modification of personal information and security data.

-

Access to technical support.

-

Request to change leverage.

Articles that may help you

FAQs

Do reviews by traders influence the One Financial Markets rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about One Financial Markets you need to go to the broker's profile.

How to leave a review about One Financial Markets on the Traders Union website?

To leave a review about One Financial Markets, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about One Financial Markets on a non-Traders Union client?

Anyone can leave feedback about One Financial Markets on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.