79.79% of retail investors accounts lose money when trading CFDs with this provider.

Colmex Pro Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $500

- MT4

- Colmex Pro 2.0

- CySEC

- 2010

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $500

- MT4

- Colmex Pro 2.0

- CySEC

- 2010

Our Evaluation of Colmex Pro

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Colmex Pro is a broker with higher-than-average risk and the TU Overall Score of 4.23 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Colmex Pro clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

Colmex is a broker for professional traders who are ready to invest over $1,000 in the stock markets.

Brief Look at Colmex Pro

Colmex is a professional broker founded in 2009 for Forex and OTC markets. The company allows trading CFDs on all types of standard assets, except for cryptocurrencies. It also offers to invest in over 9,000 stock assets of OTC and exchange markets, including IPOs and ETFs. The broker is headquartered in Cyprus and licensed by the regulators of Cyprus and South Africa.

- Over 11,000 trading asset types are available including Blue chips, OTC markets, IPOs, and depositary receipts; also classic CFD assets.

- Availability of an insurance fund with payment of up to €20 thousand for each trader's account.

- Segregation of customer accounts.

- Flexible approach to the formation of tariff policy.

- A proprietary platform for professional trading that surpasses MT4 in many respects.

- High initial deposit. For most accounts, the minimum entry threshold is from 2-3,000 USD.

- Offshore regulation.

- Withdrawal commission.

TU Expert Advice

Financial expert and analyst at Traders Union

Colmex Pro can hardly be considered a broker for private traders since its minimum deposit for OTC market assets starts at US$2,000. There is only one account on stock instruments with a deposit of $500 or more, but the company honestly warns: effective trading is out of the question with such a deposit since your monthly income will be less than the average salary. Therefore, Colmex is primarily a broker for large investment funds, asset managers, and institutional investors.

Overall flexibility is the broker’s advantage. The company has over 10 accounts, which are designed for each type of asset. There are even differences between stocks and CFDs. The owners of Colmex tried to take into account the nuances of each asset: types of commissions, large volumes, and volatility. They also offer unique accounts with optimal terms, taking into account the distinguishing nuances.

Colmex is technologically superior to many of its competitors. The execution speed of over 95% of its orders is 30-40ms. The proprietary trading platform is a more advanced analog of MT5, which in terms of functionality and technical capabilities can be compared with Rumus and QUIK. The disadvantages include offshore regulation. But that’s not necessarily disqualifying.

- You're an experienced trader seeking advanced features. Colmex Pro offers a powerful trading platform with advanced charting tools, market depth data, and various order types, providing in-depth analysis and precise control over your positions.

- You want access to IPOs. Colmex Pro allows retail investors to participate in IPOs at the issue price before public trading begins, providing an opportunity for early access to potentially high-growth companies.

- You prefer a mobile-first approach. Colmex Pro's mobile app offers full functionality, allowing you to manage your account and trade anywhere, anytime. This flexibility is beneficial for active traders who need constant market access.

- You prioritize negative balance protection. Colmex Pro does not offer this feature, meaning you could potentially lose more than your deposited funds if your trades go against you. This poses a significant risk, especially for those with limited capital or risk tolerance

Colmex Pro Summary

Your capital is at risk. 79.79% of retail investors accounts lose money when trading CFDs with this provider. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | МТ4 (desktop, mobile), Colmex Pro 2.0 (desktop, web, and mobile) |

|---|---|

| 📊 Accounts: | Groups of accounts: CFDs on stocks, stocks, Forex, etc. |

| 💰 Account currency: | USD, EUR, and GBP |

| 💵 Replenishment / Withdrawal: | Visa, MasterCard, PayPal |

| 🚀 Minimum deposit: | From USD 500-2,000. |

| ⚖️ Leverage: | from 1:200 up to 1:400 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | By Forex assets: from 1.4 pips for a Basic account |

| 🔧 Instruments: | Over 11,000 instruments, 8,000+ of which are stocks |

| 💹 Margin Call / Stop Out: | 50%. There is no stop-out for traders with the "Professional/Qualified" status |

| 🏛 Liquidity provider: | n/a |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | Stockbrokers focused on unique structured products |

| 🎁 Contests and bonuses: | No |

Colmex offers services in three directions: CFD trading in Forex with all types of assets, except for cryptocurrencies; trading in shares on the OTC market; CFD trading on different types of shares. There are several sub-type of accounts in each direction, which differ in the minimum deposit and the amount of commission. There may be a withdrawal fee depending on the withdrawal amount and frequency.

Colmex Pro Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

Don’t forget to register on the Traders Union website before opening an account with Colmex. If you follow the account opening form using the Traders Union affiliate link, you will get a partial compensation of the spread for each trade closed.

To open an account:

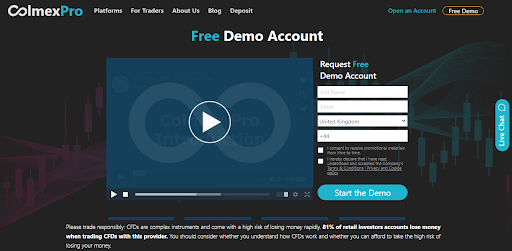

Click on the "Free Demo" or "Open an Account” button located in the upper right corner on any page of the Colmex website. Complete the registration form.

After filling out the registration form for a demo account, a request will be automatically sent to the broker's support service. You will get a letter with account activation to your email within 5 minutes. To open a real account, go through the 5-stage registration process.

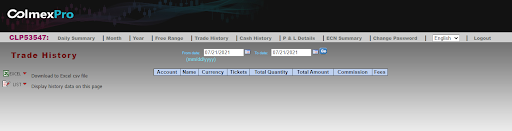

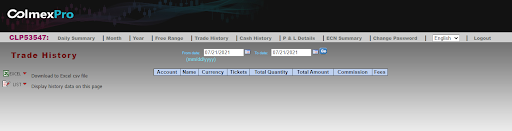

Features of the Colmex personal account:

Extra functions within the Colmex personal account:

-

Statistics on internal and external transactions.

-

Statistics on income and loss in the context of different categories of assets.

-

Statistics on ECN accounts.

Regulation and Safety

The Colmex Pro broker provides services in the European and Asian regions and is licensed by the CySEC 123/10 (Cyprus) and the South African regulator (46990). The broker also guarantees the protection of client deposits placed in European banks and the protection of transactions from outside interference.

Advantages

- The license availability indicates that the broker periodically undergoes an external audit

Disadvantages

- It is not licensed by SEC, FCA, or BaFin regulators that are considered the most reputable in the world

- The interests of private traders are almost unprotected

Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Basic | $14.5 | Yes |

| Semi Standard | $7 | Yes |

| Standard | $4 | Yes |

| VIP | $3 | Yes |

| Premium VIP | $2 | Yes |

There is a swap fee for transferring open positions to the next day. Also, the Traders Union analysts compared Colmex's trading terms with similar terms of its competitors. At Colmex, the commission for all currency pairs of the Basic account within the Forex group was taken as a basis. The competitors used the average spread for the EUR/USD currency pair as a basis.

| Broker | Average commission | Level |

|---|---|---|

|

$6.1 | |

|

$1 | |

|

$8.5 |

Account Types

Colmex Pro offers over 10 types of accounts, which are divided into logical groups and subgroups. The differences between the groups are in the model for commissions accrual and in the approach to determining the trading volumes. The difference between the subgroups is in the commission accrual base. Differences between the types of accounts in each subgroup are in the amount of the minimum deposit, the amount of commission, and trade volumes.

Group types:

There is a demo account to study the trading terms but It has functional limitations.

Deposit and Withdrawal

-

Deposit and withdrawal currencies are USD, EUR, and GBP. In case of replenishment or withdrawal of funds in another currency, the broker automatically converts the money at the internal rate linked to the bank rate.

-

Replenishment is free of charge.

-

Fund withdrawals are free of charge with one withdrawal per month for an amount less than $500. In other cases, the commission is $40 or €30.

-

Fund withdrawals may be through Visa, MasterCard, or PayPal. Other options are possible, but they are not specified in detail on the broker's website.

-

The terms for processing the application and withdrawing money is not specified on the Colmex website.

Investment Programs, Available Markets and Products of the Broker

At the moment, the Colmex broker has no investment offers. The company has chosen a policy of promoting active trading services with an emphasis on the stock market, so don’t wait for investment programs to arrive. The only passive investment opportunity for clients of Colmex Pro is the use of signals from the MetaQuotes service built into MT4.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Colmex Pro’s affiliate program:

The broker's policy provides for brand promotion by constantly improving the quality of services provided, expanding the product range and technological solutions. Attracting customers through an affiliate program has not yet been provided.

Customer Support

The support service assists 5 days a week around the clock. It doesn’t work on weekends or holidays.

Advantages

- Available 24/5

Disadvantages

- Doesn't answer simple questions in the chat. Transfers correspondence to email. The holdover time between replies by email is about 10 minutes

- Answers are not comprehensive or professional. You need to ask many leading questions.

This broker provides the following communication channels for its clients:

-

via online chat;

-

by phone numbers, as indicated on the website;

-

contact form;

-

via email.

Contacts

| Foundation date | 2010 |

|---|---|

| Registration address | 117 Makariou III Avenue & Sissifou (ex Lefkosias-Limnazousas) Street, Quarter of Apostoloi Petrou & Pavlou, 3021 Limassol, Cyprus. |

| Regulation | CySEC |

| Official site | https://colmexpro.com/ |

| Contacts |

+357 25 030036

|

Education

Colmex’s policy also provides for cooperation with professional traders. Therefore, there is no training section on its website.

A demo account is provided for self-study.

Comparison of Colmex Pro with other Brokers

| Colmex Pro | RoboForex | Pocket Option | Exness | FBS | 4XC | |

| Trading platform |

MT4, Colmex Pro 2.0 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading | MT5, MT4, WebTrader |

| Min deposit | $500 | $10 | $5 | $10 | $1 | $50 |

| Leverage |

From 1:1 to 1:400 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 1.4 point | From 0 points | From 1.2 point | From 1 point | From 0.2 points | From 0 points |

| Level of margin call / stop out |

50% / 10% | 60% / 40% | 30% / 50% | No / 60% | 40% / 20% | 100% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | $5 | $50 |

| Cent accounts | No | Yes | No | No | Yes | No |

Detailed Review of Colmex Pro

Colmex is a professional trading broker with a focus on stock market instruments. The pricing model and trading terms are designed to streamline conditions for novice and passive traders. Deposits on almost all accounts are from 2-3 thousand dollars. Trading in structured products such as options, ADRs, ETFs, and investing in IPOs, harbor confusing and sometimes conflicting terms and commissions. Thus, the broker immediately shows that it is focused on serious cooperation and is aimed at institutional clients.

Colmex by the numbers:

-

Over 11,000 trading assets; 500+ options; 2000+ shares; and 350+ ETFs are available for trade.

-

Over 8,000 active traders.

-

The average order execution speed is 31ms or less.

Colmex is the stockbroker for institutional clients

Colmex is a stockbroker that brings traders’ transactions to the OTC market using a pass-through order processing method. The classic ECN scheme is also kept here and it works on Forex accounts.

The broker's trading platforms are MT4 and Colmex Pro. Colmex Pro is available in two versions: MultiTrader and 2.0. Both versions are similar and significantly superior to MT4 in several technical parameters. For example, there is a Level 2 Depth of Market that allows you to see the volumes of orders for each quote. The number of basic indicators has increased by 2x. These platforms are optimal for trading stock assets, while MT4 is more suitable for Forex trades.

Colmex has no useful services yet. The broker's team allows the development of their proprietary applications, scripts, and tools to simplify and automate trading and memberships. But so far, the main goal of Colmex Pro is to optimize the existing model of interaction between traders and global financial markets.

Advantages:

Access to non-standard stock assets that are classified as professional exchange and OTC markets.

Availability of an insurance fund of up to €20 thousand for each account.

Proprietary advanced trading platform.

There is a demo account to create a general idea of the broker's capabilities and platform functionality.

User Satisfaction