deposit:

- $500

Trading platform:

- MT4

- Web platform

- Desktop

- FCA

- GFSC

- 0%

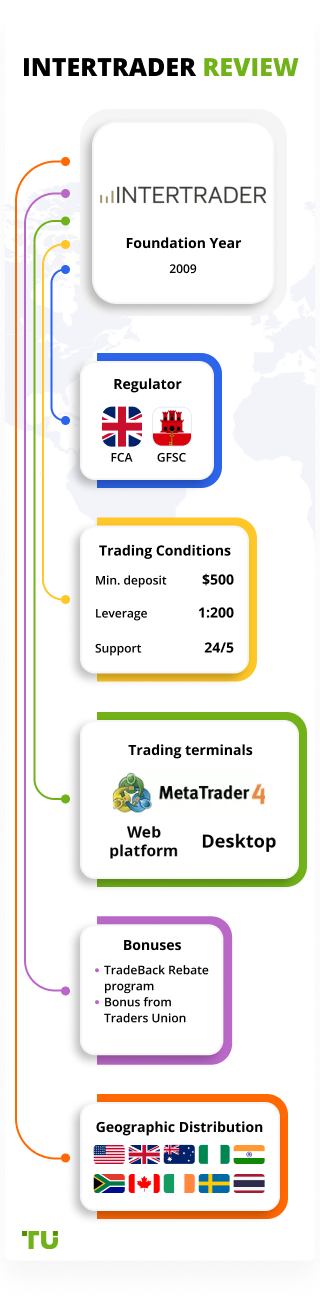

InterTrader Review (Inter Trader) 2024

deposit:

- $500

Trading platform:

- MT4

- Web platform

- Desktop

- FCA

- GFSC

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of InterTrader Trading Company

InterTrader is a broker with higher-than-average risk and the TU Overall Score of 4.81 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by InterTrader clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. InterTrader ranks 135 among 412 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

InterTrader has set a high threshold for the minimum deposit, which indicates its focus is on cooperation with experienced market traders.

InterTrader is an STP and ECN broker that has been providing services for trading Forex and CFD instruments since 2009. It is part of a large holding conglomerate called Entain Plc, which is one of the leaders in the field of sports betting and has offices on five continents. InterTrader is regulated by the Gibraltar Financial Services Commission (GFSC, 105224) and is registered with the UK Financial Conduct Authority (FCA, 597312). The broker uses the latest technology to provide trading services. It allows its clients to have direct access to financial markets around the world.

| 💰 Account currency: | USD, EUR, GBP |

|---|---|

| 🚀 Minimum deposit: | from 500$ |

| ⚖️ Leverage: | up to 1:30 (for retail traders), up to 1:200 (for professional clients) |

| 💱 Spread: | from 0.3 pips |

| 🔧 Instruments: | Fx, CFDs (indices, commodities, energies, and metals), stocks, and equity options |

| 💹 Margin Call / Stop Out: | N/A |

👍 Advantages of trading with InterTrader:

- Wide range of assets. With all types of accounts, you can make transactions with currency pairs, indices, commodities, energies, and metals.

- Low trading fees: spreads from 0.3 pips, commission per lot on ECN accounts for Forex instruments is 3 units of the main currency of the traded pair.

- The broker uses the No Dealing Desk system. The execution of clients’ orders depends solely on market liquidity and not on the dealing center.

- The possibility to make deposits and withdrawals using bank cards, Skrill, e-wallet, and bank transfers.

- Availability of PAMM and MAM trust accounts.

- Easy online account opening, no need to visit a brokerage office.

- A wide range of free trading instruments: advanced trading charts from IT-Finance, Autochartist, an economic calendar from Econoday, and multiple news feeds.

👎 Disadvantages of InterTrader:

- High minimum deposit of 500 USD/EUR/GBP.

- The broker does not provide cent accounts.

- There is no online chat on the website or in the personal account.

Evaluation of the most influential parameters of InterTrader

Table of Contents

Geographic Distribution of InterTrader Traders

Popularity in

Video Review of InterTrader i

InterTrader Latest Comments for 2023 i

Share your experience

- Best

- Last

- Oldest

Expert Review of InterTrader

InterTrader has been providing brokerage services for over 12 years and it specializes in Forex and CFD margin trading. The company offers retail traders market-neutral execution on ECN and STP accounts, Black premium service for professional clients, and Prime services for institutional trading. The regulators are FCA (UK) and GFSC (Gibraltar). The parent company Entain Plc is a member of the FTSE 100 and is listed on the London Stock Exchange.

Broker InterTrader offers two types of accounts. STP accounts are available through proprietary terminals, and ECN can be opened in the MetaTrader 4 terminal. All account types offer tight market spreads from 0.3 pips and leverage up to 1:30 (for non-professional trading).

Although the broker maintains a low trading commission, it is not designed for beginners. The minimum deposit is 500 units of the base currency of the account (US dollars, euros, or pounds sterling). In addition, there is no opportunity to open a cent account to work with minimal risks.

Latest InterTrader News

Dynamics of InterTrader’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

The services of InterTrader are popular not only among active traders but also among market participants who cannot or do not want to trade themselves. Passive investors can entrust their capital to experienced PAMM and MAM account managers. It is also possible to use automated advisors. Professional traders can earn passive income through referral programs or register as trust account managers.

InterTrader offers PAMM, МАМ, and expert advisors as options for passive investment

InterTrader allows its Forex traders several solutions to generate income without trading independently. Passive investors can invest in trust accounts or resort to the help of robotic programs that will not only analyze the market but also make transactions.

Investment programs from InterTrader:

-

Percent Allocation Management Module (PAMM). The funds of the manager and the investor are transferred to one trading account in MT4. The manager uses it to complete transactions. Drawdown or profit is distributed between the manager and the investor in the percentage specified in the contract.

-

Multi-Account Manager (MAM). The principle of operation is similar to PAMM, but in the MAM system, the accounts of investors and the manager are separated from each other. The transactions made by the manager and are automatically copied to the accounts of the connected investors. You can work with MAM only in MT4.

-

Expert Advisors. The Broker’s clients who have chosen MetaTrader 4 as a trading terminal can install advisors for automatic and semi-automatic trading. The investor himself determines the options that are suitable for his strategy.

Every InterTrader client can become an investor. To do this, you need to install the MT4 terminal, select an acceptable type of investment and make a minimum deposit. The broker’s clients can also be account managers, but this requires obtaining the status of a licensed professional trader.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

InterTrader’s affiliate program

The broker offers the following partnership models to institutional clients:

-

Asset managers;

-

Money managers;

-

Introducing Brokers (IB: — CPA, revenue share, hybrid model);

-

Fix-API.

There is no information on the company’s website about referral programs available to retail traders.

Trading Conditions for InterTrader Users

InterTrader’s clients can trade major and minor currency pairs, as well as CFDs on stocks, indices, commodities, and energy products from STP and ECN accounts. The broker provides MT4 as well as proprietary terminals. Maximum leverage for retail traders for major currency pairs is 1:30. For minor pairs, such as gold and major indices, it is 1:20; for minor indices and commodities (excluding gold), it is 1:10; and for stocks, it is 1:5. Professional clients can use the leverage of 1:20 when trading stocks; of 1:100 when trading commodities (except gold); and of 1:200 when trading other instruments.

$500

Minimum

deposit

1:200

Leverage

24/5

Support

| 💻 Trading platform: | Web-based platform, desktop platform, МТ4 desktop, МТ4 mobile |

|---|---|

| 📊 Accounts: | Demo МТ4, web account, MT4 account |

| 💰 Account currency: | USD, EUR, GBP |

| 💵 Replenishment / Withdrawal: | Wire transfer, debit and credit cards, Skrill |

| 🚀 Minimum deposit: | from 500$ |

| ⚖️ Leverage: | up to 1:30 (for retail traders), up to 1:200 (for professional clients) |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | from 0.3 pips |

| 🔧 Instruments: | Fx, CFDs (indices, commodities, energies, and metals), stocks, and equity options |

| 💹 Margin Call / Stop Out: | N/A |

| 🏛 Liquidity provider: | Proprietary agregator |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | Advisors are allowed, the size of each subsequent deposit is fixed at 50 USD/EUR/GBP |

| 🎁 Contests and bonuses: | Yes |

Comparison of InterTrader with other Brokers

| InterTrader | RoboForex | Eightcap | Exness | Pocket Option | FxGlory | |

| Trading platform |

Desktop, Desktop MT4, Mobile MT4 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | Pocket Option, MT5, MT4 | MT4, MobileTrading, MT5 |

| Min deposit | $500 | $10 | $100 | $10 | $5 | $1 |

| Leverage |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | 8.00% |

| Spread | From 0.3 points | From 0 points | From 0 points | From 1 point | From 1.2 point | From 2 points |

| Level of margin call / stop out |

1% / 1% | 60% / 40% | 80% / 50% | No / 60% | 30% / 50% | 20% / 10% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Instant Execution, Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Broker comparison table of trading instruments

| InterTrader | RoboForex | Eightcap | Exness | Pocket Option | FxGlory | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | Yes | Yes | No |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | No |

| Stock | Yes | Yes | Yes | Yes | Yes | No |

| ETF | No | Yes | No | No | No | No |

| Options | Yes | No | No | No | No | No |

InterTrader Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Web account | from $6 | Yes |

| MT4 accounts | from $3 | Yes |

There are commissions for swaps (moving a position to the next day).

The table below shows the comparative results of the average commission of three Forex brokers, which are InterTrader, RoboForex, and FxPro.

| Broker | Average commission | Level |

| InterTrader | $4.5 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed Review of InterTrader

This STP and ECN broker partners with various liquidity providers that offer the best prices for the traded asset. Most orders are executed by the broker on an over-the-counter (OTC) basis, but the stock trades are executed through a regulated market or multilateral trading system (MTF). At the same time, InterTrader executes transactions without a dealing center (NDD), which allows traders to trade directly at interbank rates. In addition to trading currency pairs and CFDs, its clients have access to transactions with shares of 250 leading companies in the UK, USA, Germany, Japan, and Australia.

InterTrader by the numbers:

-

More than 12 years of experience in the Forex market.

-

The parent company, Entain, has been in existence for over 20 years and is licensed in 20 jurisdictions on 5 continents.

InterTrader is a broker that offers optimal trading conditions for professional traders

This broker provides services to retail, professional, and institutional clients. InterTrader assigns a Professional status to a trader if he meets two of the three criteria, which are: he has made more than 10 transactions of significant volume per quarter within one year; has assets worth more than €500,000; and has been trading professionally in the financial sector for at least 12 months. The InterTrader Black premium service is available to clients who qualify. It allows you to trade stocks on margin, including over the phone, use algorithmic trading strategies, and participate in open and closed auctions through a personal manager.

InterTrader’s clients can trade through its proprietary desktop and standard web platforms, as well as MetaTrader 4 mobile and desktop terminals. Traders can choose the classic MT4 interface or the improved Direct MT4. Mobile apps are compatible with iPhone, iPad, and Android devices.

Useful services of InterTrader:

-

Advanced trading charts from IT-Finance. Traders who use the proprietary desktop and web platforms get access to more than 70 indicators with the possibility to customize and fully utilize historical data.

-

Autochartist. A tool to automatically analyze patterns and scan multiple markets in real-time.

-

Economic calendar from Econoday. Schedule of upcoming global events in the financial sector.

-

Newsfeeds on the site. Market-relevant news covers the main events of the week that can influence trading decisions. Each news item is carefully analyzed by financial experts at InterTrader and is accompanied by their comments and opinions.

-

RANsquawk (also, Ransquawk) news feed. Contextualized economic news, analysis, and commentary in real-time from Sunday to Friday.

Advantages:

The broker offers STP and ECN accounts, which allow each client to choose the best option for routing liquidity.

The company guarantees safety to its customers. Its activities are controlled by regulators in the UK and Gibraltar, and traders’ funds are kept in separate accounts in European banks.

Residents of the UK do not pay tax on transactions with Forex instruments.

The broker provides a proprietary desktop terminal, web platforms, and the MT4 terminal, plus MT4’s desktop and mobile programs.

Clients are allowed to use expert advisors in the MetaTrader 4 terminal to automate analytical or trading processes.

Professional traders get access to the UK, European, and US stock exchanges, Level 2 quotes, and telephone dealing.

Due to the use of the No Dealing Desk model by InterTrader, there are no requotes when executing orders, that is, a new trader’s position is either opened at the requested price or rejected if there is not enough liquidity.

How to Start Making Profits — Guide for Traders

InterTrader offers two types of accounts. Both of them allow you to trade CFDs and Forex without a dealing center. Leverage is from 1:5 to 1:200, depending on the traded assets and the client’s status. The minimum initial deposit is 500 USD/€/£, each subsequent deposit cannot be less than 50 USD /€/£.

Account types:

The broker’s clients can test the conditions on demo accounts, however, they are available only on desktop and mobile MT4 terminals.

This STP and ECN broker is primarily aimed at professional market traders. However, retail traders who can invest in Forex from $500 can also trade here.

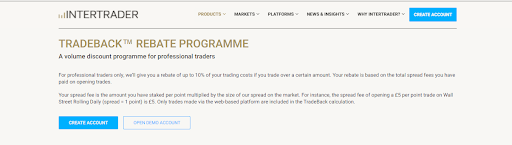

Bonuses Paid by the Broker

TradeBack Rebate program

This is a three-tier loyalty program that gives professional clients a discount based on the spread. The amount of the reward depends on the trading volume. If the amount of transactions is from £500 to £1,999, the trader receives a 5% discount; from £2,000-£4,900, he gets 7.5%; and for more than £5,000, he receives a 10% discount on the transaction.

Investment Education Online

The basic concepts of Forex and the principles of trading in the financial markets are described in the News&Insight section of this broker’s website. However, the information provided allows only a superficial study of the topic. On its platform, the company focuses on news and analytics, rather than educational materials.

The broker provides demo accounts, which are an effective tool for gaining practical trading skills without risking capital.

Security (Protection for Investors)

InterTrader is a tradename of Intertrader Limited, a company registered with the UK Financial Conduct Authority (FCA) under number 597312. The Gibraltar Financial Services Commission (GFSC) is its official regulator.

Intertrader Limited is owned by Entain Plc (formerly GVC Holdings) with a capital of over £10 billion (as of June 2021) and is listed on the London Stock Exchange. InterTrader’s retail clients are protected by the Gibraltar Investor Compensation Scheme (GICS). If for any reason the broker is unable to fulfill its financial obligations, under the GICS each client can claim compensation of up to €20,000.

👍 Advantages

- The broker keeps clients’ funds in segregated bank accounts

- GICS compensation is available for retail traders

- Each client can contact the regulator with a complaint

👎 Disadvantages

- FCA prohibits leverage for retail traders beyond 1:30

- You cannot open an account without verification.

- Professional clients do not participate in the GICS compensation scheme

Withdrawal Options and Fees

-

The broker processes withdrawal requests within 24 hours of receipt.

-

Money can be withdrawn by bank transfer, debit and credit cards, or Skrill, but only to the same account which was used when making the deposit.

-

The money will be credited to the receiving account within 3-5 days after the approval of the withdrawal application.

-

The minimum withdrawal amount is 100 USD/€/£. The number of withdrawals is unlimited.

-

If the broker makes the first withdrawal within 24 hours (from 12:00 of the current day to 12:00 of the next day, UK time), it is free of charge. Each subsequent withdrawal of less than 1,000 USD/€/£ will cost 5 USD/€/£. Subsequent withdrawals of an amount exceeding 1,000 USD/€/£ carry no commission.

-

However, the receiving bank may charge a fee for the transfer of funds.

Customer Support Service

The support team is active around the clock from Monday to Friday.

👍 Advantages

- Operators answer questions by email within 1-2 hours

- Can be contacted via social networks

👎 Disadvantages

- Doesn’t work on Saturdays and Sundays

- There is no online chat

InterTrader provides the following communication channels for its clients:

-

phone;

-

email;

-

letter to this address: London EC2V 5DE;

-

via ready-made contact form from the support section;

-

via messenger on Facebook, Twitter, or LinkedIn.

Company representatives answer questions from clients, as well as traders who have not yet opened a trading account with InterTrader.

Contacts

| Foundation date | 2005 |

| Registration address | City Tower, 40 Basinghall St, London EC2V 5DE |

| Regulation |

FCA, GFSC |

| Official site | https://www.intertrader.com/ |

| Contacts |

Email:

support@intertrader.com,

Phone: +44 203 364 5189 |

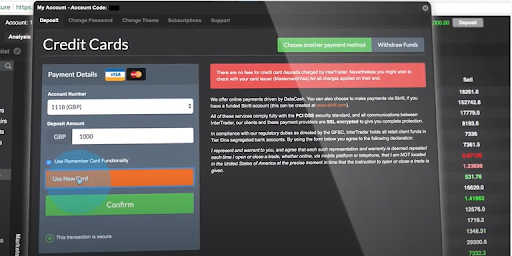

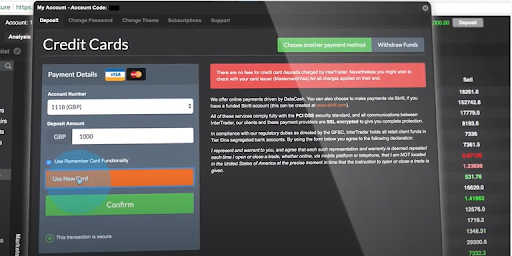

Review of the Personal Cabinet of InterTrader

To register with InterTrader and create a personal account, do the following:

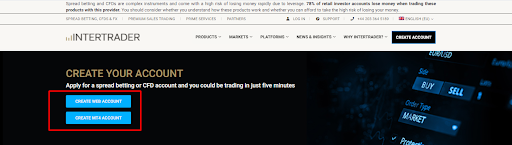

Go to the official website of the company and click Create Account on its main page.

Choose the account type.

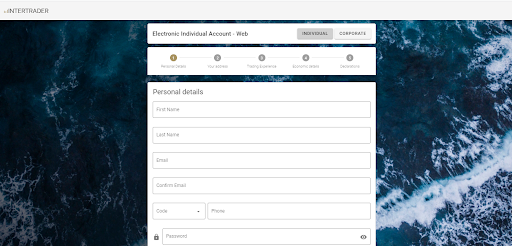

Fill out the registration form, indicating your name, surname, phone number, and email.

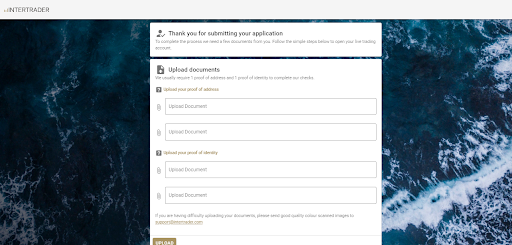

Attach scans of your passport and a document confirming your residence address.

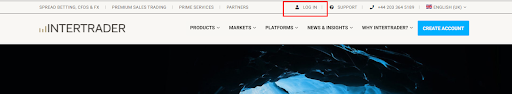

After confirming the data used on the application for opening a trading account (the corresponding letter comes to the email specified during registration), you need to log in to your personal account. To do this, click the Log In button, and then enter your username and password.

The following is also available in the InterTrader personal account:

1. Deposit and withdrawal of funds:

2. Making transactions on the web platform:

1. Deposit and withdrawal of funds:

2. Making transactions on the web platform:

Also, in the personal account you can:

-

Create watchlists.

-

Set up price alerts.

-

Configure and connect to charts and other indicators.

-

View and sort open and executed orders.

-

Manage accounts.