deposit:

- $10

Trading platform:

- MT4

- 0%

Xero Market Review 2024

deposit:

- $10

Trading platform:

- MT4

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

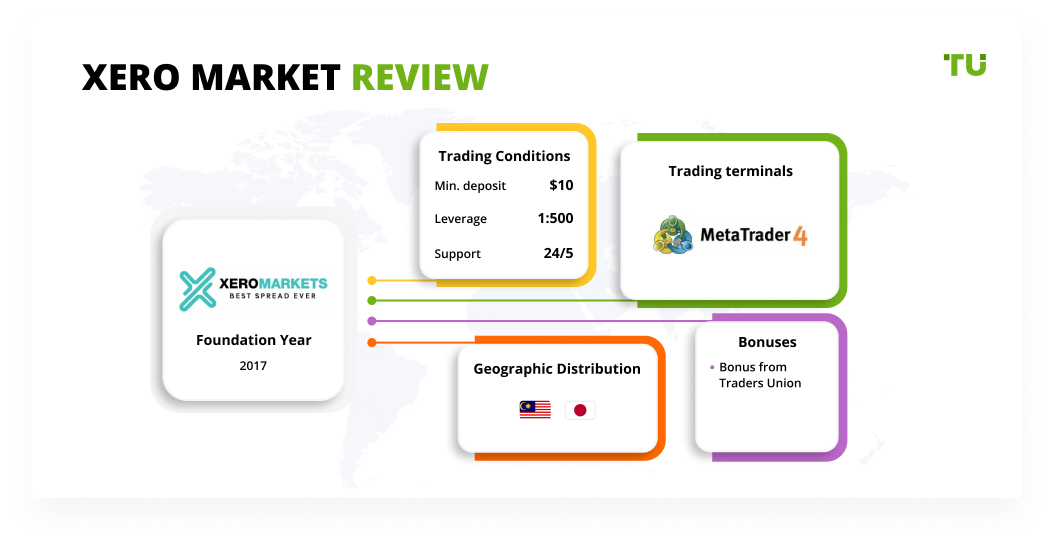

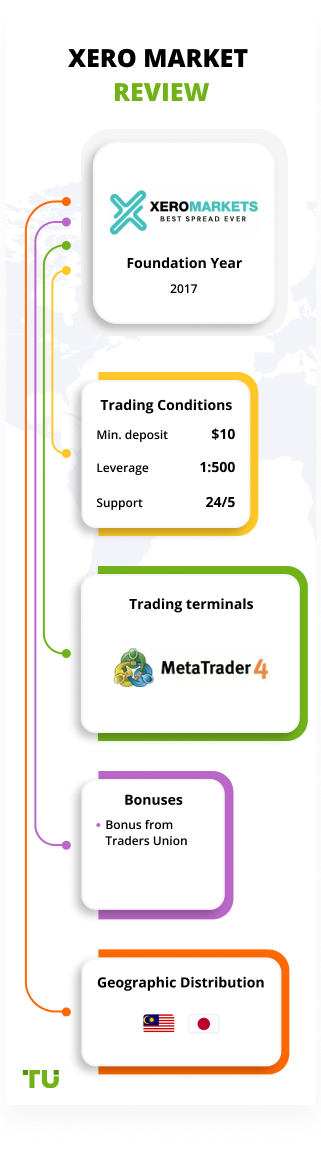

Summary of Xero Market Trading Company

Xero Market is a high-risk broker with the TU Overall Score of 2.32 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Xero Market clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. Xero Market ranks 383 among 414 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

XeroMarket is a mid-range broker for classic trading without complicated technical tools.

Xero Market (aka XeroMarket) is a relatively young, ambitious broker, currently operating in the classic Forex segment. The company was founded in 2017 and is registered under the jurisdiction of Saint Vincent and the Grenadines. XeroMarket is focused on the Asian market, but soon the company plans to obtain a license from a European regulator and expand its regional presence.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | from 10 USD |

| ⚖️ Leverage: | up to 1:500 |

| 💱 Spread: | from 0.1-3 pips |

| 🔧 Instruments: | Currency pairs, assets of commodity markets |

| 💹 Margin Call / Stop Out: | 100%/35%, respectively |

👍 Advantages of trading with Xero Market:

- Small entry threshold from 10 USD.

- Relatively small spread: broker’s markup is 1 pip per broker’s quote.

- Simplified version of trading conditions consisting of only one platform and two account types - nothing more.

- Withdrawal of money takes only 24 hours, except for bank payments.

- Leverage is up to 1:500.

👎 Disadvantages of Xero Market:

- No regulatory licenses.

- No visible technological competitive advantages.

- No transparency in trading conditions.

Evaluation of the most influential parameters of Xero Market

Table of Contents

Geographic Distribution of Xero Market Traders

Popularity in

Video Review of Xero Market i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Xero Market

XeroMarket is a new broker, so it’s too early to talk about its significant achievements. To start, the company chose a niche within traditional trading: two types of STP and ECN accounts with a corresponding range of commissions. They have a standard set of assets: currency pairs, metals, oil, the standard MT4 platform. Based on the list of countries where the broker does not provide services, XeroMarket works with European clients. Nevertheless, the platform is clearly aimed at the Asian market. Perhaps, in the future, the broker will expand the range of trading assets, add additional services, and will compete in the European market.

XeroMarket has no licenses yet. This is a minus because there is no one to protect the interests of traders, and in the event you have a claim, there is no point in sending it to a regulator within the home jurisdiction of the broker—which is Saint Vincent and the Grenadines. One more issue: Mastercard and Visa are gradually introducing restrictions in several countries on accepting payments in favor of brokers without licenses. When XeroMarket customers will face this issue is a matter of time. Since you can withdraw money only to the account from which the funding was made, this issue can turn out to be serious.

The spread on the STP account is +1 pips over the spread of the liquidity provider. The ECN spread is from 0 pips with a fixed commission of 5 USD per 1 lot. In theory, the conditions are not bad, taking into account a deposit of 10 USD or more. You can find out what they are in practice by downloading the MT4 platform. My overall impression of XeroMarket is that it has a good start, but no variety. There are only 77 trading assets, a lack of stock and cryptocurrency assets, and technical tools. All this puts the broker in a difficult position in terms of competition. Perhaps in the future, everything will change for the better.

Dynamics of Xero Market’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

For investors, XeroMarket offers Copytrader, a service for copying trades. Each client can register as a trader or investor. Each investor can choose from a list of traders whose strategies are most suitable in terms of earning capacity, profitability, and risk level and copy their trades to his account.

Advantages of the Copytrader social trading model:

-

It does not require knowledge of technical and fundamental market analysis. Traders’ transactions are copied automatically. The investor is expected to choose the best trader.

-

It saves the investor time. The trader opens transactions for the investor and the investor can deal with other issues. In return, the investor pays the trader a part of his profit in the form of a commission, the amount of which is set by the trader.

-

It optimizes risks. The built-in risk management model allows you to limit the level of an investor’s loss if something goes wrong for a trader.

Another alternative is to use the signal copying service from MetaQuotes. The service is available after registration on the MQL5 website using the MT4 platform.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

XeroMarket’s affiliate program

-

Introducing Broker (IB) is a standard referral program that provides for building a network of referrals and receiving daily rewards for their active trading. The advantages are transparent conditions, personal manager, and a flexible tariff policy.

The referral program management program is available after registering a separate account with the “IB Portal”. The broker provides all marketing materials it has as well as informational assistance.

Trading Conditions for Xero Market Users

The Xero Market website contains general trading conditions that capsulize the broker’s offer. The number of trading assets is 77, there are two accounts with deposits of 10 USD and 100 USD. There are no contract specifications available without registration, but they can be found after opening an account without replenishing a deposit and linking it to MT4.

$10

Minimum

deposit

1:500

Leverage

24/5

Support

| 💻 Trading platform: | МТ4 |

|---|---|

| 📊 Accounts: | Regular, ECN |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Visa, Mastercard, banking systems and exchange offices in Thailand, Malaysia, Indonesia, standard bank transfers, FasaPay, Neteller |

| 🚀 Minimum deposit: | from 10 USD |

| ⚖️ Leverage: | up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | from 0.1-3 pips |

| 🔧 Instruments: | Currency pairs, assets of commodity markets |

| 💹 Margin Call / Stop Out: | 100%/35%, respectively |

| 🏛 Liquidity provider: | N/A |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Instant execution, Market execution |

| ⭐ Trading features: | There is a fee for inactivity on the account |

| 🎁 Contests and bonuses: | Yes |

Comparison of Xero Market with other Brokers

| Xero Market | RoboForex | Pocket Option | Exness | Vantage Markets | Forex4you | |

| Trading platform |

MT4 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5, WebTrader, Mobile Apps | MT4, MobileTrading, MT5 |

| Min deposit | $10 | $10 | $5 | $10 | $50 | No |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:10 to 1:1000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.1 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0.1 points |

| Level of margin call / stop out |

100% / 35% | 60% / 40% | 30% / 50% | No / 60% | 100% / 50% | 100% / 20% |

| Execution of orders | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | Yes |

Broker comparison table of trading instruments

| Xero Market | RoboForex | Pocket Option | Exness | Vantage Markets | Forex4you | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | Yes | No | No |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | No | Yes | Yes | Yes | Yes | Yes |

| Stock | No | Yes | Yes | Yes | Yes | Yes |

| ETF | No | Yes | No | No | No | No |

| Options | No | No | No | No | No | No |

Xero Market Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Regular | from 2$ | No |

| ECN | from 1.2$ | No |

XeroMarket charges a swap fee for the transfer of open trades to the next day. The size of the swap depends on the type of asset. You can find swap data in the specification in MT4. There is a triple swap.

Also, Traders Union’s analysts made a comparative analysis of the spread level between XeroMarket and its competitors. It is based on the EUR/USD pair and the average spread for one full lot on the Regular account. The commission is indicated in monetary terms.

| Broker | Average commission | Level |

| Xero Market | $1.6 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed Review of Xero Market

The Xero Market broker has been providing services on international OTC financial markets for only a few years. This is both a pro and a con. The downside is that the company does not yet have competitive advantages; they have a limited number of assets, there is no flexibility in tariff policy and no proprietary technical tools. But there are some advantages such as the company is confidently working on the Asian market and they have plans to conquer Europe. This means that pretty soon they will have the licenses of European regulators and the arsenal of trading assets will expand. Consequently, the broker will offer new proprietary developments for comfortable trading.

XeroMarket by the numbers:

-

Presence in over 10 countries.

-

More than 16,000 active traders.

-

More than 10 international awards.

Xero Market is a broker for those who want to learn how to make money in Forex

The Xero Market broker operates according to the classic hybrid STP/ECN model. In the STP model for the Regular account, traders’ orders are formed into pools and are sent to the liquidity provider. The provider offers an interbank spread, to which XeroMarket adds 1 pip for its commission. Spreads are close to fixed, but there is a delay in order execution. The ECN model assumes direct output of traders’ orders to ECN platforms. They have a floating market spread, and minimal conditions in a liquid market. There is a fixed broker commission per lot.

The main trading platform of the broker is MT4 with new build versions. XeroMarket does not prohibit adding custom indicators and advisors to the terminal. The broker also offers the Copytrade service for copying trades. To learn whether it is a separate platform or integrated into the MT4, check with the support team. Each client of the broker can become a trader and an investor. The traders get 10-30% of the investor’s profit.

Useful services of Xero Market:

-

Market analysis. This is a news section with general analytical reviews, but it mainly focuses on the Asian markets.

-

Economic calendar. This contains a list of upcoming events that may have an impact on the quotes of currency pairs and assets of the commodity markets.

Other services and applications are under development.

Advantages:

No withdrawal fees.

There is a service for copying transactions.

Relatively narrow spread for currency pairs.

There are Islamic accounts, but they don’t provide a demo account.

How to Start Making Profits — Guide for Traders

XeroMarket offers two types of accounts: Regular (with STP execution) and ECN. The basic conditions are the same for both accounts: leverage is up to 1:500, stop-outs are 35%, and the minimum transaction volume is 0.01 lot.

Account types:

There is no demo account. To test the strategies and functionality of the broker, you can use the Regular account with the maximum leverage.

Bonuses Paid by the Broker

Promotional offers are temporary. They may be extended, or the company may offer new promotions with similar conditions. The most common promotion formats are:

-

The opportunity to win 10,000 US dollars or more when funding the deposit with one payment of 100 US dollars and having the volume of transactions on the account from 1 lot.

-

Promotions for partners. You can get office furniture, smartphones, etc.

-

Gifts for subscribers. Replenishment of the deposit is not required, and those who subscribed and invite friends on social networks have a chance to get a gift.

-

There are prizes for a fixed number of turnovers on the account.

Please contact the support service for more information.

Investment Education Online

Educational materials can be found in the top menu - in the “Learn to trade” section. Here you will find the Xero Academy Learning Platform. You will get access to all educational materials after registration.

There are no cent accounts, therefore we recommend start testing the broker’s conditions on a Regular account with a deposit of 10 USD or more.

Security (Protection for Investors)

XeroMarket does not yet have regulatory licenses. It does not disclose information about partner banks either. In the future, licenses are expected to be obtained, but the exact date is not yet known. For its part, the broker guarantees the protection of clients’ information, personal data, and money.

👍 Advantages

- None

👎 Disadvantages

- Traders are not protected

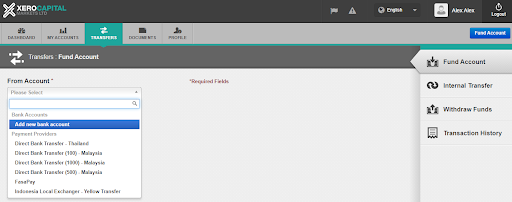

Withdrawal Options and Fees

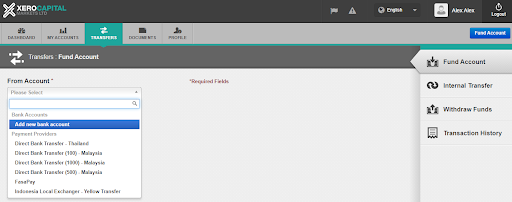

-

The broker does not set limits on the number of deposits and withdrawals.

-

Account currency is the US dollar. Check with the broker’s support team about the possibility of internal conversion, provided that the account is replenished with a different currency.

-

Withdrawal options: targeted bank transfers through banks in Malaysia and Thailand, Visa, local exchange offices in Indonesia, Mastercard, FasaPay. In some cases, transactions via Neteller are possible.

-

Withdrawal application processing time is about 24 hours. Time of withdrawal to electronic payment systems is up to 3 hours. The time for withdrawing money through a bank is 3-7 working days.

-

There is an inactivity commission for accounts left dormant for 6 or more months.

Customer Support Service

The support service is open 24 hours a day except on weekdays.

👍 Advantages

- In the online chat, you can ask a question without being a client of the broker

- Support available in 6 languages

👎 Disadvantages

- Support works 24/5

- You cannot ask a question in Russian

This broker provides the following communication channels for its clients:

-

Online chat. It is available from almost any broker’s page.

-

Social networks and messengers.

-

Phone number and email. They can be found in the header of the “Client Agreement” document in pdf format.

Registration on the XeroMarket website to contact customer support is optional.

Contacts

| Foundation date | 2020 |

| Registration address | Suite 305, Grith Corporate Centre P.O. Box 1510, Beachmont Kingstown St. Vincent and the Grenadines |

| Official site | https://xeromarkets.com/ |

| Contacts |

Email:

support@xeromarkets.com,

|

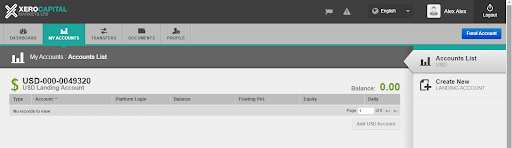

Review of the Personal Cabinet of Xero Market

Register with the Traders Union’s website. You can open an account directly with the XeroMarket website. But by opening it using the link from the Traders Union’s website, you can get partial compensation for the spread, and it’s free.

How to open an account with XeroMarket:

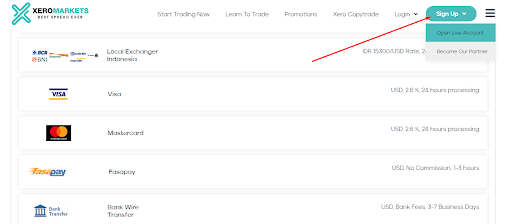

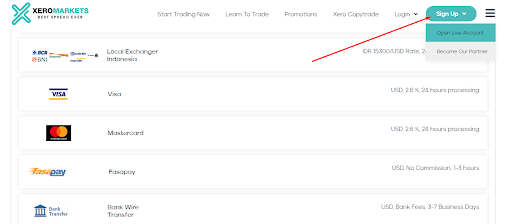

On any tab of the website in the upper right corner, click the “Sign Up” button and select “Open Live Account”

Fill out the registration form, it takes up to 10 minutes to complete. No initial confirmation of the email address is required. You can immediately enter your personal account using the specified email and password.

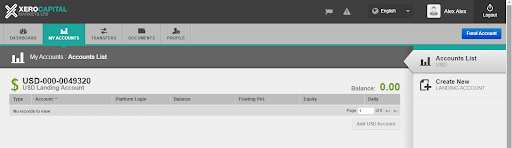

The functionality of XeroMarket’s personal account:

1. Managing opened accounts:

2. Management of external and internal transactions:

1. Managing opened accounts:

2. Management of external and internal transactions:

Also in the personal account, the trader has access to:

-

Statistics on open/closed transactions.

-

Current market quotes.

-

Verification. Possibility to make changes to the profile.

Articles that may help you

FAQs

Do reviews by traders influence the Xero Market rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Xero Market you need to go to the broker's profile.

How to leave a review about Xero Market on the Traders Union website?

To leave a review about Xero Market, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Xero Market on a non-Traders Union client?

Anyone can leave feedback about Xero Market on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.