AETOS Markets Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $50

- MetaTrader4

- VFSC

- 2022

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $50

- MetaTrader4

- VFSC

- 2022

Our Evaluation of AETOS Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

AETOS Markets is a high-risk broker with the TU Overall Score of 2.92 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by AETOS Markets clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. AETOS Markets ranks 320 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Aetos Markets was incorporated in Australia, and when the client demand increased, it opened two more offices in the UK and Vanuatu. Currently, it is one of the major market participants, which offers generally competitive conditions for traders. There are two live account types plus a demo where the minimum deposit is only $50, and leverage is up to 1:400, which is the level of top brokers. Traders work with MT4, which is an absolute plus due to the extensive possibilities for customizing the trading platform. The broker does not impose trading restrictions on its clients. There are typical options for passive income, such as PAMM accounts and copy trading, which open up new opportunities for traders of different levels. Unfortunately, the broker does not provide its services in all regions, it offers only currencies and CFDs, and its technical support is less than prompt.

Brief Look at AETOS Markets

The broker offers two account types, plus a demo account and Traders work through MetaTrader 4 (MT4). There are no restrictions on trading strategies and methods, thus you can hedge, scalp, and use advisors. Among the available instruments are currency pairs and CFDs on indices, stocks, metals, energies, and cryptocurrencies. The minimum deposit is $50, regardless of the account type. Spreads start at 1.2 pips with a maximum leverage of 1:400. The allowed trade volume ranges from 0.01 to 50 lots. AETOS (also “Aetos”) Markets offers MAM and PAMM accounts and its own copy trading service. The broker’s clients can receive welcome and credit bonuses. The broker is headquartered in Australia, it is officially registered and regulated.

- The low entry threshold is expressed in a low minimum deposit, intuitiveness of the user account, and integration with a popular trading platform;

- Traders can work on a demo account for 14 days, then they must select one of two account types aimed at novice traders and experienced market participants;

- Profit potential is increased by a large number of available assets and leverage of up to 1:400;

- Traders have the opportunity to increase their income by becoming managers on PAMM accounts or signals providers in the copy trading service;

- Investors with different levels of experience can receive income with reduced risk when using passive income methods;

- Spreads are market average, fees are also average or below average, thus traders work with acceptable costs;

- Technical support is highly evaluated by users and experts, and it works 24/5.

- The broker provides services in different regions, but residents of Australia, Great Britain, Singapore, and some other states cannot join it;

- The company claims that, in addition to currency pairs, it provides access to the markets of indices, metals, and energies, but these trading instruments are available only in the form of CFDs;

- Client support can be contacted through the main channels 24/5, which means it is not available on weekends.

TU Expert Advice

Financial expert and analyst at Traders Union

The brand is owned by Aetos Capital Group, which is currently registered in Vanuatu and licensed by the Financial Services Commission (VFSC). It has been providing services since 2007. Thus, the reliability of the broker is beyond doubt, which is confirmed, among other things, by mostly positive reviews and the absence of open conflicts with its clients.

There are 29 currency pairs and dozens of CFDs on stocks, indices, metals, energies, and cryptocurrencies in the broker’s pool. This diversity is quite enough to implement a wide range of trading strategies and form a diversified portfolio. Yet, the broker does not limit its clients, it is only necessary to take into account limits on the trade volume and indicators of margin call and stop out.

Aetos Markets does not oblige traders to immediately deposit money into the account, they can try the demo for 14 days. After that they can trade, starting with a balance of $50, which is the basic account currency, other options are not available. That is, the broker offers an objectively low entry threshold. Trading conditions are also competitive. Spreads are from 1.2 pips (for the Advanced account), and fees are transparent. Traders work through MT4, which, along with the fifth version of the platform, provides the widest opportunities for individualizing the trading process.

The broker offers PAMM accounts and copy trading, but these services are not different from those of its competitors. More importantly, the company provides technical analysis tools, among which Autochartist takes a special place. This is a powerful combined type of analytical tool that displays charts, indicators, and patterns. It also analyzes events, volatility, and the effectiveness of trading signals. Since the service is fully integrated with MetaTrader 4, it greatly simplifies the life of the broker's clients.

By the sum of the factors, TU cannot attribute Aetos Markets to the best of the best; however, this is a steadily growing company with adequate trading conditions. Traders, among other things, are attracted by special bonuses that start with an increased balance. Among the minuses, one can note regional restrictions and the absence of real assets, except for currency pairs.

AETOS Markets Summary

| 💻 Trading platform: | MetaTrader 4 |

|---|---|

| 📊 Accounts: | Demo, General, and Advanced |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Visa and MasterCard bank cards, online transfer systems, and e-wallets |

| 🚀 Minimum deposit: | $50 |

| ⚖️ Leverage: | Up to 1:400 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Floating, from 1.2 pips |

| 🔧 Instruments: | Currency pairs and CFDs on indices, metals, stocks, energies, and cryptocurrencies |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No |

| ⭐ Trading features: |

Demo account available for 14 days; Two live account types; Currency pairs and CFDs are available; Average market spreads and fees; PAMM accounts and copy trading; Many useful tools for market analysis |

| 🎁 Contests and bonuses: | Yes |

If a broker offers multiple live account types, the minimum deposit usually depends on the type of account chosen by a trader. Aetos Markets has two account types, namely General and Advanced, with a similar deposit of $50. Leverage does not depend on the account type but on the asset. The highest trading leverage of 1:400 is always applied to currency pairs. Traders can work with less leverage or no leverage at all. The broker's technical support can be contacted via call center, email, and live chat. Tickets are answered by email. Managers are available 24/5.

AETOS Markets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

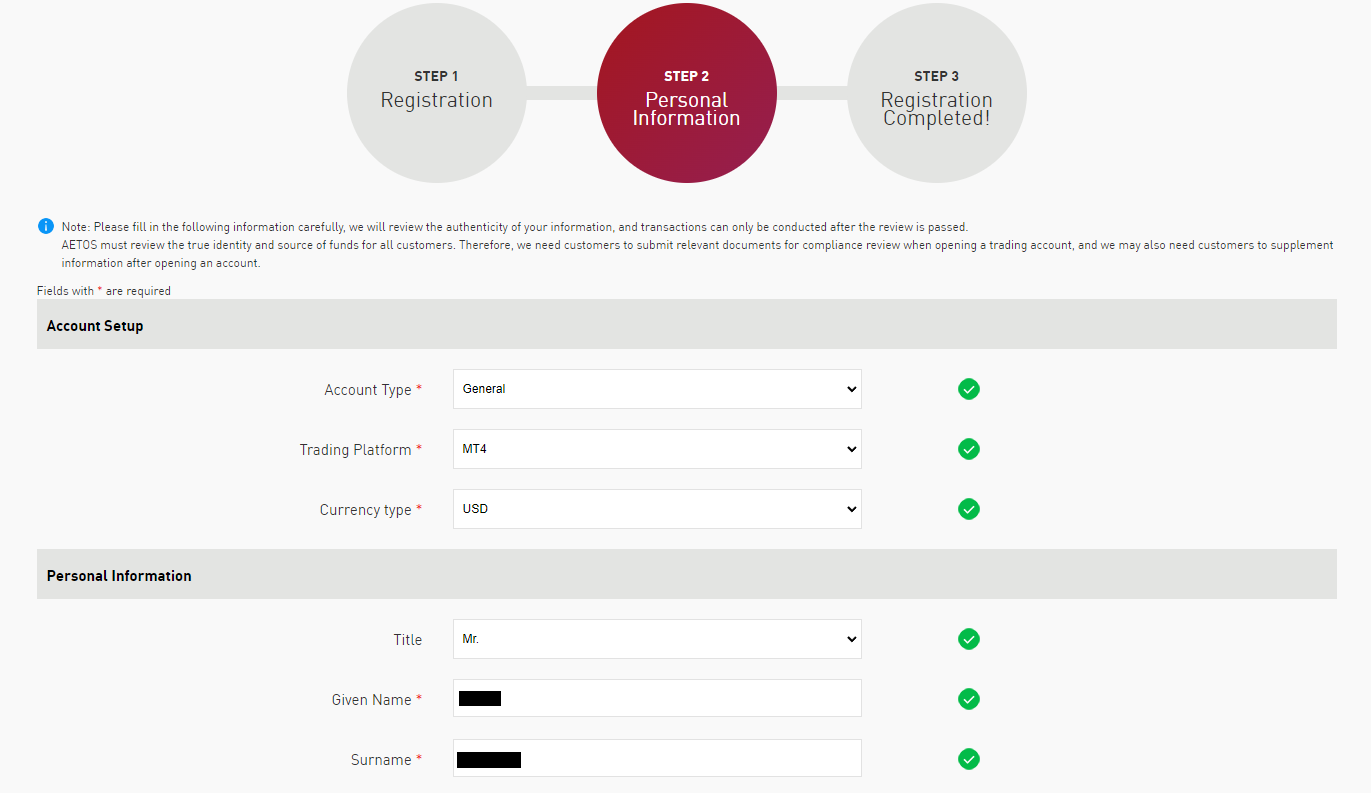

Trading Account Opening

To start working with the broker, register on its official website, confirm your personal information, and make a deposit. After that, it will be possible to trade through MT4. Below is a step-by-step registration guide describing the features of the Aetos Markets’ user account.

Go to the broker's website, select the interface language at the top right, and click the "Live Accounts" button. You can also click the "Demo accounts" button, but in this example, TU will show how to register a live one.

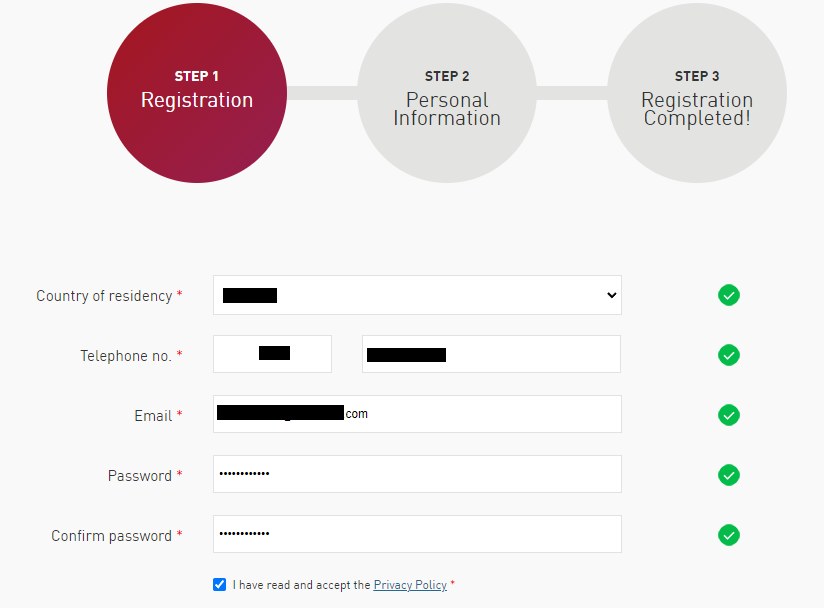

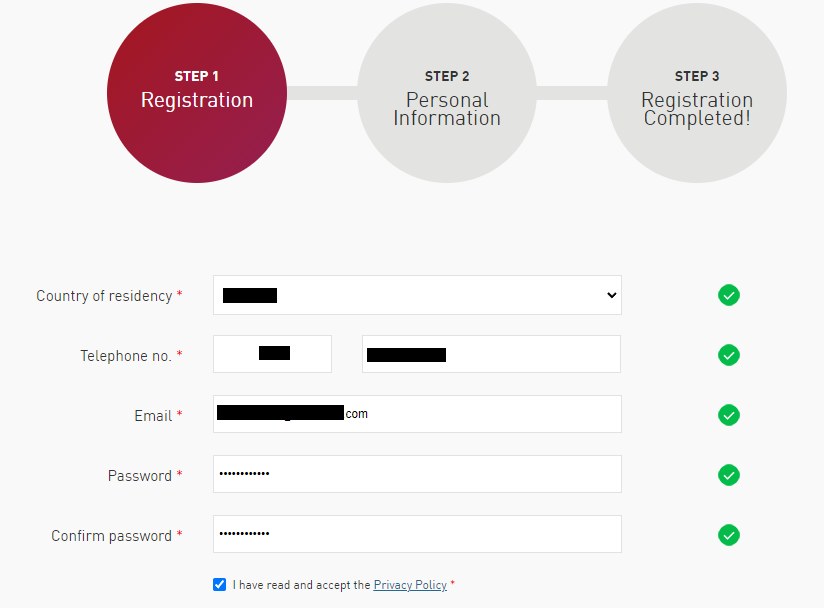

Select your country, and enter your phone number and email. Make a password and enter it twice. Agree to the processing of data by ticking the box, and click the "Next" button.

Select the account type (General or Advanced), trading platform (MT4), and account currency (USD). Specify your title, then enter your first and last names. Specify the type of identity document and enter its number. Then enter your date of birth and registration address. Answer a few questions, agree to the broker’s conditions by ticking the boxes, and click the "Confirm" button.

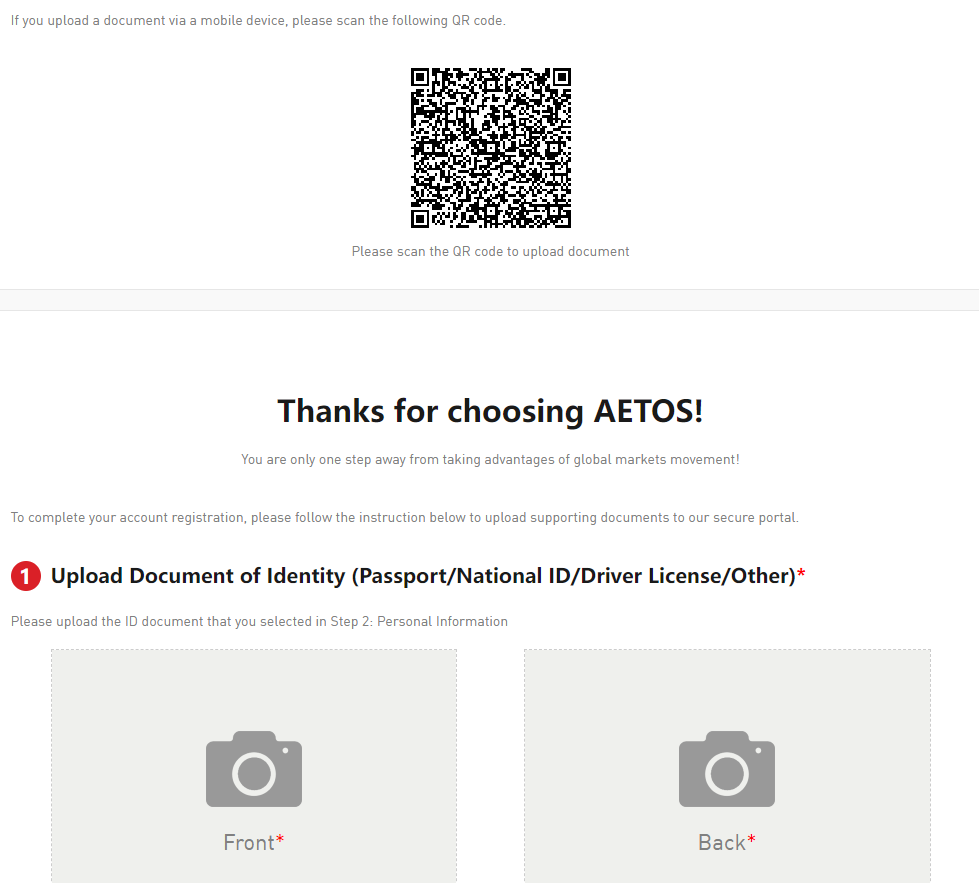

Upload a photo/scan of your identity document (use the document specified in the previous step). After that, click the "Confirm" button.

You have completed registration, now wait for confirmation of verification to make a deposit and start trading. The first link (in the screenshot below) will take you to the trader's user account, the second one will allow you to download the distribution kit of the trading platform.

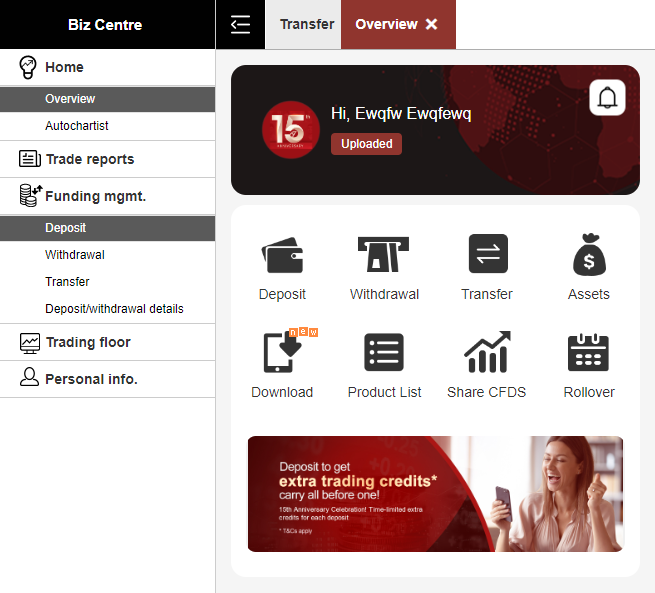

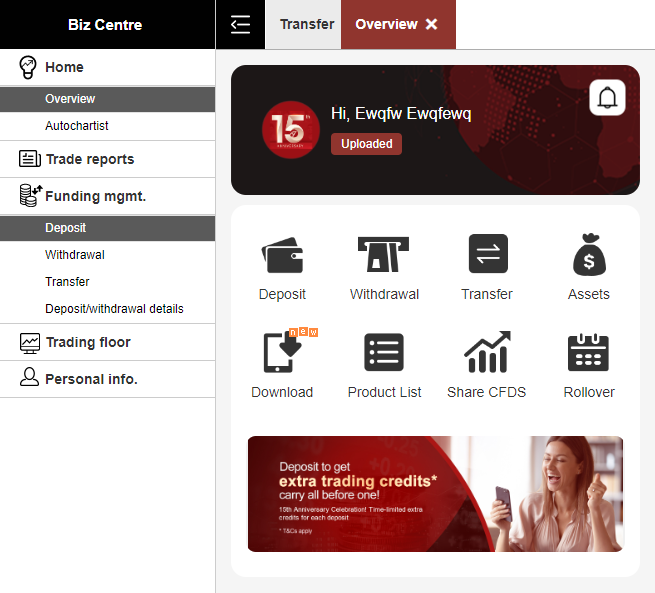

After the managers check your documents, you can make a deposit. To do this, click the appropriate button on the dashboard or go to the "Funding Management" section and then select the "Deposit" tab. Follow the instructions on the screen.

Features of the user account:

Overview. This is the main dashboard, which contains frequently used functions and information about trader's accounts;

Autochartist. It is a comprehensive service that allows you to receive basic analytics for any asset;

Orders. This section contains information about all open trades;

Trading history. This option displays a list of closed trades;

Reports. This function allows you to get a typical trading report for a specified period;

Deposit/withdrawal details. These blocks are needed to initiate the deposit/withdrawal process;

Transfer. This function allows you to transfer funds from one trading account to another;

Details. This block includes all financial transactions with detailed information about each of them;

List of assets. This block contains all available instruments (except for CFDs on stocks) with an indication of trading parameters;

CFDs on stocks. Securities are listed in a separate block, where detailed information on them is also provided;

Personal info. This menu includes several blocks that allow you to edit personal information and security settings.

Regulation and safety

When checking brokers for security guarantees, pay attention to three points. The first point is registration, which indicates the legal activities of a broker. The second point is regulation, which means transparency of conditions and security for traders. The third point is reviews, which show what kind of experience, either positive or negative, a broker's clients have received. Aetos Markets has all three points. The company is registered in Australia, Great Britain, and Vanuatu with offices in them all. The broker is regulated by the Vanuatu Financial Services Commission (VFSC) under license number 700450. Reviews of the broker are mostly positive. Thus, traders can be sure that the broker fulfills its obligations to its clients, and also reliably protects their funds and personal information.

Advantages

- Traders can contact the broker’s technical support

- The broker’s clients can apply to VFSC

Disadvantages

- No opportunity to contact international regulators

- No opportunity to address local financial authorities outside Australia, the UK, and Vanuatu

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| General | $20 | No |

| Advanced | $12 | No |

The broker does not charge a deposit or withdrawal fee. However, in most cases, there are fees charged by other parties involved in the process, such as a bank or an online transfer system. Take these costs into account so that in the future you do not present unreasonable claims to the broker. The table below compares the trading conditions of Aetos Markets and two top brokers. This will allow you to evaluate the profitability of its proposal.

| Broker | Average commission | Level |

|---|---|---|

|

$16 | |

|

$1 | |

|

$8.5 |

Account types

When a broker offers several account types, choosing the right one can be a difficult task. After all, accounts differ in trading conditions, sometimes very significantly. The Aetos Markets General account is a standard trading account where all financial instruments offered by the broker are available. It differs from Advanced in higher spreads and lower leverage. That is why in most cases Advanced is the preferred option.

Account types:

Typically, traders adhere to the following progression: they open a demo account to get acquainted with a broker (Aetos Markets offers it for 14 days) and, if everything is in order, they switch to a live account, focusing on their trading preferences when choosing an account type.

Deposit and Withdrawal

-

As soon as traders open live accounts and start trading, their balance increases subject to successful trades;

-

At any time traders can submit withdrawal requests through their user accounts on the broker's website;

-

Withdrawals to bank accounts, Visa/MasterCard bank cards, e-wallets, and through online transfer systems are available. The broker does not charge a withdrawal fee;

-

The broker processes withdrawal requests within one business day.

Investment Options

Many brokers offer different opportunities for passive income. For example, it can be an investment in a partner startup or cryptocurrency staking. But often more traditional solutions for the segment are meant. These are joint accounts, copy trading, and partnership (referral) programs. Aetos Markets does not have a referral program for individuals, although there is a special offer for corporate clients. Below are the available options.

MAM and PAMM accounts

This is a special type of joint account, which today is considered the most convenient and productive. To simplify, PAMM consists of a manager account and sub-accounts of investors. Managers execute trades while combining the capital of each investor with their own capital. Investors, for their part, set limits on how much money managers can use from their accounts. If a trade is successful, everyone makes a profit in accordance with their bets, and managers also charge a fee from investors for their services. If a trade fails, everyone loses their bets. PAMM managers earn higher profits, and investors earn with reduced risk. All sides are positive.

Copy trading

In some ways, the copy trading service resembles PAMM accounts, but in this case, providers do not have access to investors' funds. Their trades are automatically duplicated on investors’ accounts, who set trade amounts themselves. When the signals providers succeed, investors connected to them also receive a profit proportional to their bets. Here, providers also charge a fee on investors' profits. When a trade fails, everyone loses their bets. Copy trading is quite comparable to PAMM accounts in popularity, and both methods can bring significant income to traders and investors.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Customer support

Technical support is necessary for a broker because traders regularly face situations that they cannot resolve on their own. Consultation or advice may be required due to traders’ inattention or a system failure, as no platform is protected from such moments. If traders contact support and wait too long for a response, or if the support is not sufficiently thorough, traders may leave for a competitor. After all, no one likes to waste time and money if a broker does not have the necessary competencies. That is why Aetos Markets offers support that works 24/5 and can be contacted via call center, email, live chat, and tickets on its website.

Advantages

- Non-clients of the broker can contact technical support

- Support is available round-the-clock, even at night on weekdays only.

- Traders can receive prompt and competent assistance from managers

Disadvantages

- Support is not available on weekends

Whether you are the broker’s client or want to become one, you can contact client support at any time using the following communication channels:

-

call center in Australia and the UK;

-

email;

-

live chat on the website and in the user account;

-

tickets in the Contact Us section of the broker’s website.

The broker has three physical offices. You can visit any of them, but call in advance to check the working hours because the offices are not available around the clock.

Contacts

| Foundation date | 2022 |

|---|---|

| Registration address | PO Box 1276, Government Building, 278 Kumul Highway, Port Vila, Vanuatu |

| Regulation | VFSC |

| Official site | https://www.aetoscg.com/ |

| Contacts |

+61(2)99292100, +44(0)2081049400

|

Education

Traders constantly study expert materials, participate in webinars, and learn from the experience of professionals. And they are right, otherwise it will be difficult for them to execute successful trades. After all, the market does not stand still. Some brokers offer their clients training programs, which range from FAQs to full-fledged courses. Aetos Markets does not provide anything like that, but only newsfeeds with analytics. This cannot be called a disadvantage, because brokers are not required to organize training for traders.

Aetos Markets assumes that its clients know at least the basics of the market. This is a fair position because the vast majority of traders come to this broker after first studying the basic materials. Then everything depends on practice.

Comparison of AETOS Markets with other Brokers

| AETOS Markets | RoboForex | Pocket Option | Exness | Octa | Forex4you | |

| Trading platform |

MetaTrader4 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MetaTrader4, MetaTrader5 | MT4, MobileTrading, MT5 |

| Min deposit | $50 | $10 | $5 | $10 | $25 | No |

| Leverage |

From 1:1 to 1:400 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:10 to 1:2000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 1.2 point | From 0 points | From 1.2 point | From 1 point | From 0.6 points | From 0.1 points |

| Level of margin call / stop out |

No | 60% / 40% | 30% / 50% | No / 60% | 25% / 15% | 100% / 20% |

| Execution of orders | No | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | Yes |

Detailed review of AETOS Markets

This brand has been on the market for 15 years. In 2007, Aetos Capital Group announced the creation of one of the most powerful trading platforms. The goal has been achieved, as traders from 100 countries work with the platform, and the number of trades exceeds 100,000 per day. The broker has a powerful technological stack that guarantees fast order execution. It works with Tier-1 liquidity providers that provide for relatively tight spreads and avoids high trading costs for traders. Aetos Markets offers modern MAM and PAMM accounts with flexible settings, and the broker's copy trading service is recognized as one of the simplest, fastest, and most convenient. Trading is carried out through MetaTrader 4, which is known as one of the most versatile and can be easily customized.

Aetos Markets by the numbers:

-

Minimum deposit is $50;

-

Free demo account is available for 14 days;

-

Up to $50,000 of welcome bonus;

-

Maximum leverage is 1:400;

-

Maximum trade volume is 50 lots.

Aetos Markets is a broker for trading currency pairs and CFDs

There are many companies that offer only CFDs. They are called CFD brokers. CFDs have their advantages, but more often traders prefer platforms where there are other financial instruments. Aetos Markets, being founded by professional market participants, provides clients with access to two types of markets — currency pairs and CFDs. This allows traders to diversify their portfolios so that the negative trend of one financial instrument is offset by the stable and progressive position of others. In addition, different types of instruments expand the trader's strategic options, especially when the broker, for its part, does not set any restrictions. Thus, the site is really convenient for most users. An exception may be professional traders who prefer not to work with CFDs on stocks and indices, but directly with the instruments themselves.

Useful services offered by Aetos Markets:

-

Autochartist. This is a comprehensive service that offers a chart of asset quotes and detailed analytics on it, including forecasts of volatility, price ranges, and optimal entry points;

-

Copy trading. The platform for copying trades is integrated with the broker's website, which allows signals providers to receive additional profit, and investors to make income with reduced risks;

-

Virtual dedicated server. This service allows traders to automate their work on high-performance remote equipment that works stably 24/5.

Advantages:

Dozens of currency pairs and CFDs combined with leverage up to 1:400 guarantee high-profit potential;

Opportunity to receive passive income on joint accounts and a built-in copy trading service;

Many tools for technical analysis allow you to make balanced and accurate forecasts;

Convenient user account and a customizable MT4 provide comfortable personalized working conditions;

The broker operates 100% transparently, thus all fees are known in advance, and traders always know exactly the conditions of the executed trades.

User Satisfaction