FXCentrum Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $10

- FXC Trader

- FSA

- 2017

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $10

- FXC Trader

- FSA

- 2017

Our Evaluation of FXCentrum

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

FXCentrum is a high-risk broker with the TU Overall Score of 2.87 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by FXCentrum clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. FXCentrum ranks 325 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

FXCentrum offers trading conditions more favorable than market average. It has tight spreads, no additional fees, and its activity is transparent. Multiple assets combined with high leverage provide high-profit potential, which is enhanced by the copy trading platform. Training helps novice traders get used to the platform faster. Experienced traders will also find a lot of useful materials here. The company is officially registered and is regulated by the Financial Services Authority (FSA). It uses negative balance protection and best practices of user data security, such as 3DS Verification.

Brief Look at FXCentrum

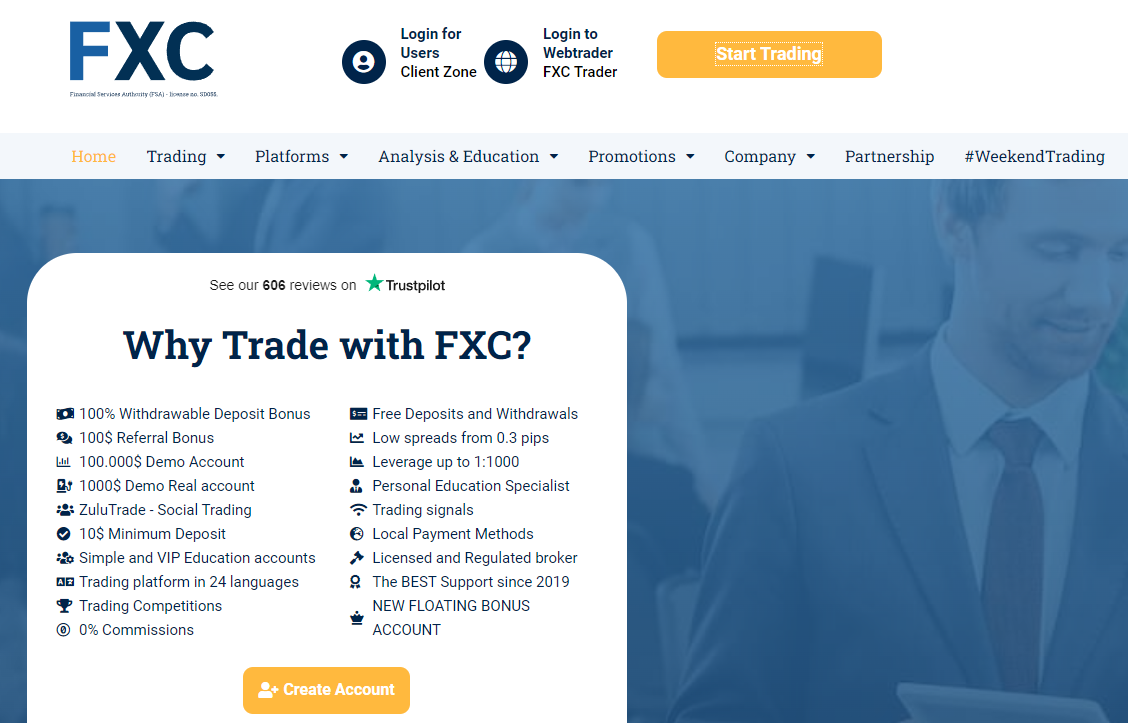

The FXCentrum (also FXC) broker offers access to currency pairs, indices, stocks, commodities, metals, cryptocurrencies, and CFDs. There are more than 2,200 assets. Three live account types that differ in trading conditions are available. There is a standard demo account and a demo-real account, which provides for transferring income to the main account after the trial period. The minimum deposit is $10, spreads are from 0.2-0.3 pips, and leverage is up to 1:1000. The broker offers its copy trading service on the ZuluTrade platform. In the near future, it plans to launch a referral program. FXCentrum offers training materials and personal managers, there are also free signals, and a range of tools for technical and fundamental analyses, including an economic calendar and newsfeeds with basic analytics. The broker's clients work through its proprietary trading platform FXC Trader, which is available in 24 languages with desktop and mobile versions. New clients can count on a welcome bonus, and the company also constantly holds contests with real cash prizes.

- Unique demo-real account provides for 30-day trading with virtual funds and transferring all the income to the main account;

- Minimum deposit is only $10, spreads are below market average, and there are no trading or withdrawal fees;

- The broker offers thousands of assets that can be traded with leverage up to 1:1000 without restrictions;

- ZuluTrade social trading platform is recognized as one of the easiest to learn, it is transparent, convenient, and functional;

- FXCentrum provides its clients with extensive training, which includes both articles and regular webinars taught by experts;

- Three live accounts make it possible to choose the optimal trading conditions based on the client's preferences and Islamic accounts are available upon request;

- Technical support works 24/7, and managers can be contacted by phone, email, and tickets on the website.

- Copy trading is the only passive income option because a referral program is not yet available;

- Free withdrawal of funds is possible only once a month, the second withdrawal will cost $10, the third and subsequent will cost 2.5% of the withdrawal amount;

- The broker does not provide its services in Cuba, North Korea, Iraq, and some other countries. For citizens of the Russian Federation and other states blacklisted by the FATF (Financial Action Task Force), trading with FXCentrum is difficult.

TU Expert Advice

Financial expert and analyst at Traders Union

FXCentrum is owned by WTG Ltd, which was founded by financial markets experts. Therefore, it is not surprising that this broker has implemented the best solutions in the segment, providing it with speed, reliability, and security. All this is confirmed by simple facts. For example, the broker has never been hacked and the execution speed does not exceed 30 ms. Immediately, it must be said that the company is regulated, it has a valid license from the Seychelles Financial Services Authority. Thus, traders can have no doubts about the reliability of this broker, as well as that it fulfills its obligations and has no registered conflicts with its clients.

In terms of trading conditions, FXC outperforms many of its competitors. Spreads start from 0.2-0.3 pips, while most are from 1-1.2 pips. Also, there are no trading fees, which minimizes traders’ costs. There are no withdrawal fees for the first withdrawal each month; $10 is charged for the second withdrawal, and 2.5% is withheld for all subsequent withdrawals. Such a curious condition is rare, although it hardly makes trading with the company less profitable. However, this is not what truly distinguishes FXCentrum from its competitors. First, it is necessary to note demo accounts, as there are two of them. The first is standard, and the second allows you to transfer the received profit to a live account after 30 days of trading.

FXC offers its own trading platform. Expert testing did not reveal weaknesses in the software as it works quickly, is easy to use, and has all the declared functions. However, traders who are accustomed to MetaTrader solutions should understand that in terms of customization options, few platforms can compare to them. FXC Trader is practical, especially the mobile version, but you will have to use additional tools for in-depth analytics. Accordingly, both the proprietary platform and the broker itself are satisfactory. There are thousands of assets in the FXC pool, the leverage is twice as high as the market average. Except for scalping, there are no restrictions on trading, and you can use advisors. Copy trading is represented by the well-known ZuluTrade service. Unfortunately, there are no joint accounts, referral programs, and similar solutions. But there are excellent bonuses, including a no-deposit treat.

FXCentrum Summary

| 💻 Trading platform: | FXC Trader |

|---|---|

| 📊 Accounts: | Demo, demo-real, Zero, Standard, and VIP FXC |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Visa, MasterCard, Ozow, Perfect Money, AstroPay, and Help2Pay |

| 🚀 Minimum deposit: | $10 |

| ⚖️ Leverage: | Up to 1:1000 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Floating from 0.2-0.3 pips or fixed at 1 pips |

| 🔧 Instruments: | Currency pairs, cryptocurrencies, indices, stocks, commodities, metals, and CFDs |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No |

| ⭐ Trading features: |

Standard demo account plus a unique demo-real account; Three live account types; Over 2,200 assets; Tight spreads; No trading fees; Integration with ZuluTrade copy trading service; Many tools for technical and fundamental analyses; High leverage |

| 🎁 Contests and bonuses: | Deposit bonus, regular contests, rebates from Traders Union |

The minimum deposit almost always depends on the account type, if a broker offers several options. FXCentrum is no exception: Zero and Standard accounts require a minimum of $10, while the VIP FXC account requires a minimum deposit of $1,000. FXCentrum’s trading leverage is not determined by the account type, but by the traded asset, and can be up to 1:1000. This situation is rare, as usually leverage is limited to the account type selected by a trader. Technical support is available 24/7 via phone, email, and tickets on the website.

FXCentrum Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

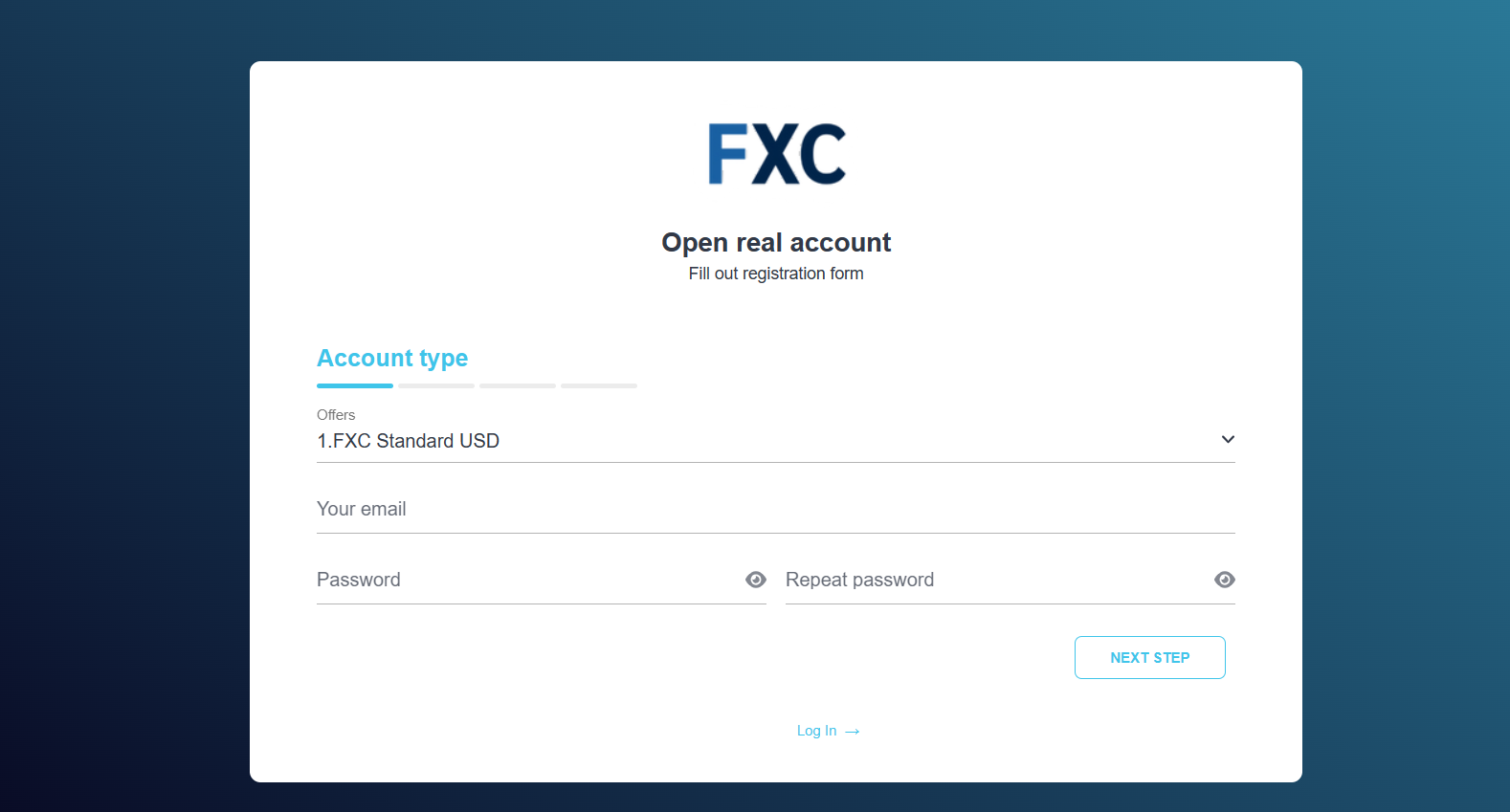

To start working with the broker, register on its website, create a user account, open a trading account, and make a deposit. TU experts have compiled a step-by-step guide on registration and the features of the user account.

Go to the broker's website and click the “Start Trading” button in the upper right corner. You can also click the “Create Account” button.

Indicate your first and last names, email, phone number, and country of residence. Make a password and enter it twice. Then agree to the terms of cooperation by ticking the box, and click the “Create Account” button.

An email will be sent to the specified address with a link to confirm registration. Click it. To enter your user account, use your login and password.

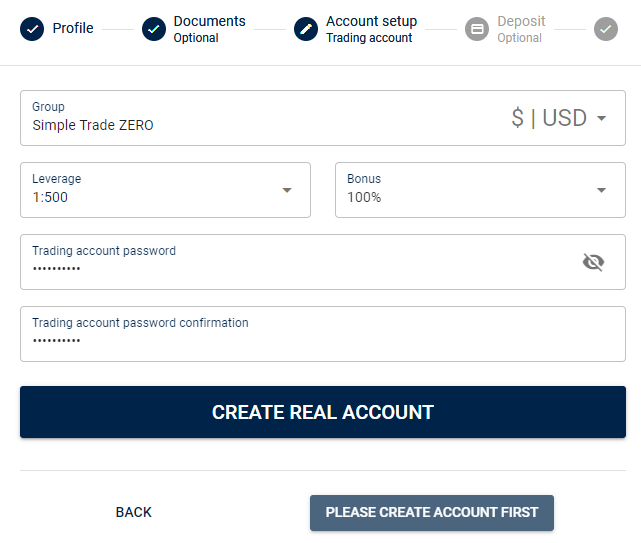

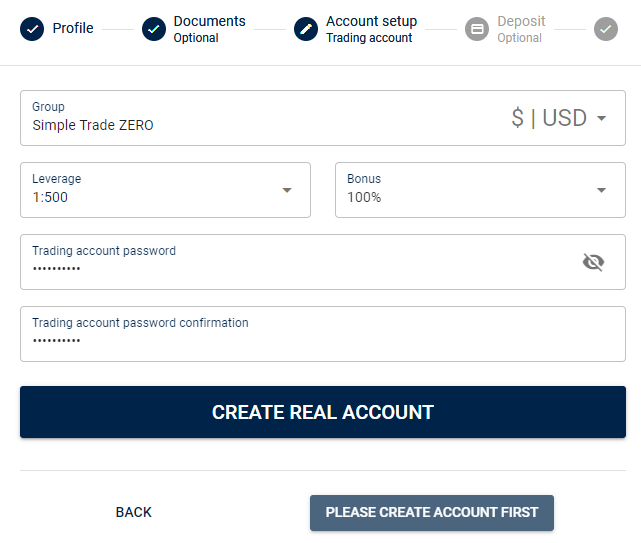

Enter your date of birth and registration address. Then upload your identity documents, following the instructions. Next, select the account type, leverage, and bonus amount. Create a password to your trading account and enter it twice. Click the “Create Real Account” button.

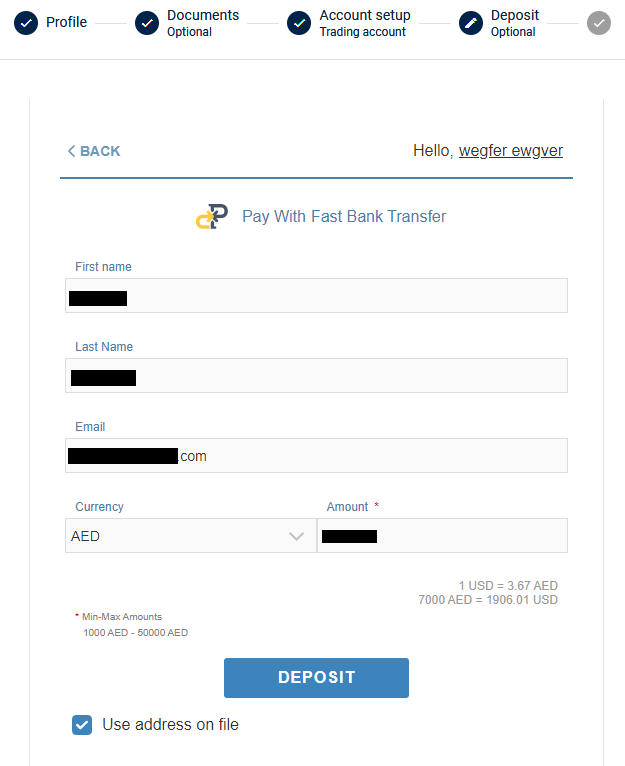

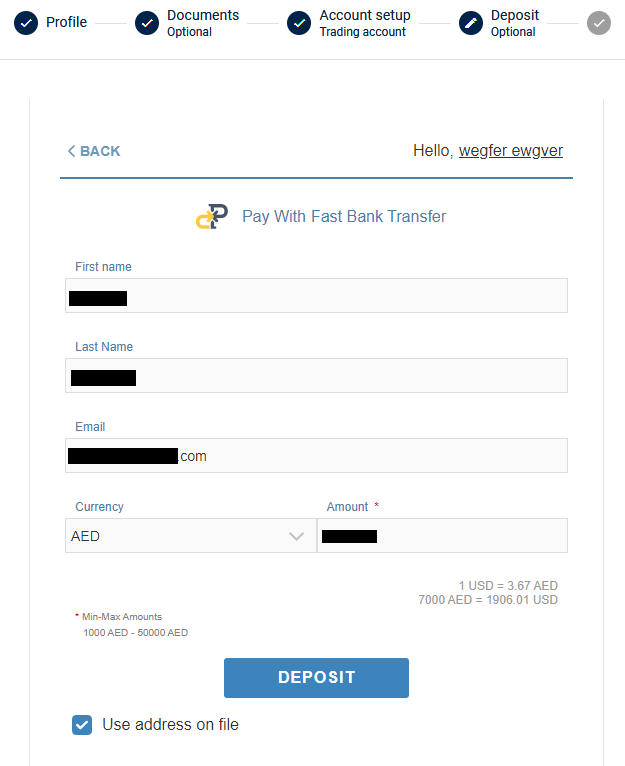

Choose the appropriate deposit option. Make a deposit following the instructions on the screen. After that, you will get full access to your user account and will be able to download the platform and start trading.

Features of the user account:

Accounts. Here, there is a list of all your active trading accounts, account details, and main function details;

Deposits. This section is for depositing funds to the active account balance;

Withdrawals. This option allows submitting withdrawal requests;

Profile. Trader's personal information, which can be edited, is kept here;

WebTrader. The button allows you to go to the web version of the broker's trading platform;

Refer a friend. This block is for a referral program. You can generate a code, but the bonuses are not active yet;

Promotions. This is a list of all current bonuses that the broker's clients can receive;

Contacts. This block provides for creating a ticket for contacting the broker's support team.

Regulation and safety

Brokers can provide two significant guarantees, which are registration and regulation. If they are officially registered, then traders are dealing with real financial institutions operating legally. The regulator’s control acts as a guarantor of transparent activity and the fulfillment by a broker of its obligations to clients. Finally, it makes sense to study user reviews, as they help to make an objective assessment of a broker’s work. FXCentrum is registered in Seychelles and is licensed by FSA. Most of the reviews are positive. But traders should keep in mind that it is better to study reviews on trusted portals like Traders Union, where administrators carefully check the information and filter out fakes.

Advantages

- Traders can contact the broker’s technical support

- The broker’s clients can submit complaints to FSA

Disadvantages

- No opportunity to contact regulators that do not control the broker’s activities

- No opportunity to address any financial controller outside Seychelles

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Zero | $10 | First withdrawal of the month is free |

| Standard | $3 | First withdrawal of the month is free |

| VIP FXC | $2 | First withdrawal of the month is free |

A loyal fee policy is always a conceptual advantage, and FXCentrum offers favorable conditions in this sense. Nevertheless, experienced traders are well aware that it is possible to confirm the advantages of any broker if its conditions are compared with the offers of its competitors. TU experts have compiled a comparative table showing numbers for FXCentrum and two of its leading competitors.

| Broker | Average commission | Level |

|---|---|---|

|

$5 | |

|

$1 | |

|

$8.5 |

Account types

The first thing to decide is the account type. Zero is suitable for novice traders who are aimed at active trading with a limited group of instruments. Also, various options for self-education are available here. The Standard is more versatile due to the extended pool of assets and additional options, and the spread is reduced, but the amount of bonuses is also reduced. Due to the high deposit, VIP FXC is more suitable for experienced market participants. Here the minimum trade volume is increased and spreads are even lower. The second point is the expediency of working with a copy trading platform. This option is not suitable for every trader, but in addition to potential profits, it can become a source of a unique experience. Finally, traders should read educational materials and decide on a priority strategy in order to correctly use the tools of technical and fundamental analyses offered by the broker. In the future, you can always contact support, which works 24/7.

Account types:

Usually, traders open a demo account to get acquainted with a broker and then switch to one of the live accounts. FXCentrum offers to open a demo-real account in order to trade virtual currency and also to earn real funds that can be transferred to the main account after a month, but only as a bonus. Traders select their main account based on their experience and strategic preferences.

Deposit and Withdrawal

-

If traders work on a standard demo account, they do not receive real profits and cannot withdraw earnings;

-

If traders choose a demo-real account, they can transfer all their income to a live account after one month;

-

Funds received through a demo-real account can be used in trading and withdrawn under certain conditions;

-

Funds earned with bonuses are also withdrawn subject to the conditions specified in the promotion description;

-

Money earned on a live account without using bonus funds is withdrawn at any time;

-

To withdraw your profit, submit a withdrawal request using the appropriate option of the user account;

-

There is no fee for the first withdrawal per month, for the second withdrawal a $10 fee is charged;

-

The third and subsequent withdrawals per month are subject to a fee of 2.5% of the withdrawn amount;

-

Processing of withdrawal requests takes from a few minutes to 24 hours from the moment of their submission;

-

Traders can withdraw funds using Visa, MasterCard, Ozow, Perfect Money, AstroPay, and Help2Pay.

Investment Options

Many brokers offer additional options for earning money, except for active trading. As a rule, these are various investment solutions such as cryptocurrency staking or copy trading. Services for copying trades are especially popular, they are even more common than joint accounts, which have long become a traditional option for passive income for many traders. The reason is that copy trading involves more than just a secondary source of income. It is also an opportunity to learn the strategies and methods of the traders whose signals are being copied. However, it is important that the service works transparently and that there are many professional participants with extensive experience and a high win rate. FXCentrum offers only this solution, as at the moment it does not have MAM or PAMM accounts or a referral program.

ZuluTrade copy trading service

This is a popular copy trading service primarily because it offers favorable conditions. All platforms of this type work on a similar principle. Traders can register as signals providers and broadcast their trades to everyone. Users registered as investors connect to selected providers and automatically duplicate their trading decisions to their accounts, but with additional parameters. For example, a signals provider bets $500, a connected investor can change his particular bet to $100. If the trade is successful, everyone makes a profit in proportion to their bets, plus each investor pays a small fee to the signals provider. If the trade is unsuccessful, everyone loses their bets. Since providers use their own funds, they have a vested interest in success. And investors, in addition to profit, get a unique experience by watching the work of a successful colleague.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Customer support

Technical (client) support is needed by all brokers to help their clients. All traders sooner or later face questions to which they cannot find answers on their own. They also need regular consultations and advice. If support is not prompt or not competent, traders may become disappointed with a broker and leave for a competitor. FXC offers professional client support available 24/7. Many communication channels, such as phone, email, and tickets on the website are available.

Advantages

- Non-clients of the broker can contact technical support

- All communication channels are available 24/7

Disadvantages

- There is no live chat, which is preferred by most traders

If you need help or advice, contact FXCentrum client support via:

-

call center;

-

email for individuals;

-

email for legal entities.

The company has profiles on Facebook, Twitter, YouTube, Instagram, Telegram, and TikTok. There you can also contact managers. Subscribe to the broker to stay up-to-date with its latest news.

Contacts

| Foundation date | 2017 |

|---|---|

| Registration address | Office 5B, HIS building, Providence Mahé, Seychelles House of Francis, Room 302, Ile Du Port, Mahé, Seychelles |

| Regulation | FSA |

| Official site | https://fxcentrum.com |

| Contacts |

(+44) 7418354103

|

Education

Traders seek to gain knowledge from different sources such as eBooks, blog articles, or webinars. After all, trading alone is not enough to be successful in the long run; relevant theoretical training is required. Therefore, some brokers offer FAQs, articles, or training courses. FXCentrum offers extensive educational content in a variety of formats, ranging from specialized articles and analytical briefs to online lectures with experts.

Novice traders will definitely find a lot of useful information on the website. It is important that the broker offers free ready-made courses in addition to separate training blocks. Experienced market participants are unlikely to find much unique material, but some points may be useful to them, especially participation in webinars, which are VIP discussions for the owners of the respective accounts.

Comparison of FXCentrum with other Brokers

| FXCentrum | RoboForex | Pocket Option | Exness | Octa | Vantage Markets | |

| Trading platform |

FXC Trader | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MetaTrader4, MetaTrader5 | MT4, MT5, WebTrader, Mobile Apps |

| Min deposit | $10 | $10 | $5 | $10 | $25 | $50 |

| Leverage |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.2 points | From 0 points | From 1.2 point | From 1 point | From 0.6 points | From 0 points |

| Level of margin call / stop out |

No | 60% / 40% | 30% / 50% | No / 60% | 25% / 15% | 100% / 50% |

| Execution of orders | No | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Detailed review of FXCentrum

WTG Ltd is registered in Seychelles and has a strong technological base. Its clients get access to thousands of assets with high execution speeds. No user reviews report that the broker's trading platform is inconvenient, works slowly, or produces transaction errors. But when the broker decided to provide copy trading services, it did not develop its own, instead, it partnered with ZuluTrade. This service is recognized as the top in its segment. Thus, FXC provides its clients with cutting-edge solutions using best practices. There are many other examples, such as the introduction of virtual server technology, negative balance protection, and data security with the 3DS Verification function.

FXCentrum by the numbers:

-

Over 2,200 trading instruments;

-

25,000 deposits;

-

15,000 withdrawals;

-

$500,000 issued as bonuses;

-

0 client complaints to the regulator.

FXCentrum is a reliable broker for working with various assets

The reliability of the company is ensured primarily by the fact that it is officially registered and operates under the control of world-class regulators. In addition, the broker does everything to make its clients work comfortably. This includes a convenient trading platform, different types of orders, negative balance protection, and 24/7 technical support. FXCentrum’s clients can trade currency pairs, cryptocurrencies, stocks, indices, commodities, and metals. This diversity is an advantage, since the more tools available to traders, the wider the list of strategies they can use. Moreover, a varied pool allows traders to form a diversified portfolio, as a result of which the negative trend of one group of assets can be compensated for by a stable and progressive position of another.

Useful services offered by FXCentrum:

-

ZuluTrade. It is not the broker’s service, but a third-party solution used by many companies. It is a simple and transparent platform for copying trades;

-

FXC Trader. This is FXC’s proprietary trading platform. It is convenient and reliable. It is excellent for novice and experienced traders;

-

Economic calendar. This is a typical service that displays the most significant events from the world of politics and economics affecting quotes. It provides for making forecasts.

Advantages:

The broker has a low entry threshold due to a small minimum deposit, a free demo account, and a unique demo-real account;

Three live account types differ in basic parameters, which provides for choosing the optimal trading conditions;

The broker's own trading platform demonstrates high stability and functionality, and has an intuitive interface;

Thousands of assets, leverage above market average, and a copy trading service increase traders’ profit potential;

Technical support is highly evaluated by experts, it is competent, and works 24/7.

User Satisfaction