A Step-By-Step Guide On Trading The Dead Cat Bounce Pattern

A dead cat bounce is a temporary rally during a decline that is followed by a continuation of the downtrend. To trade it:

-

Identify a market where the price has fallen significantly in the recent past

-

Identify the bounce, confirm with low volume, 50% Fibonacci level, candlesticks with long upper shadows.

-

Enter a short with a clear stop-loss and profit target.

The term 'dead cat bounce' references a brief and misleading recovery in the price of a declining asset, akin to the old saying, “even a dead cat will bounce if it falls from a great height.” Is this pattern an opportunity to buy? Rarely. It’s often a trap for bullish traders, and more commonly, a signal for selling or shorting.

-

Is a dead cat bounce bullish?

No, it is a temporary recovery in a bear market that precedes a continuation of the downtrend.

How do you identify a dead cat bounce?

Identifying a dead cat bounce requires a keen eye for detail and an understanding of market dynamics. The pattern typically emerges after a significant drop in price. Traders should look for a slight upward correction, which is usually accompanied by low trading volume, indicating a lack of new interest in buying the asset. The bounce is often followed by a continuation of the downward trend.

Example of a Dead Cat Bounce

The image provided showcases a classic dead cat bounce scenario. The asset experiences a sharp decline, followed by a small, temporary rise in price before continuing its downward movement. This rise is the 'bounce' and is usually considered a bear trap, catching out traders who may interpret the recovery as a trend reversal. Observing the chart, the bounce occurs after a steep decline, hinting at the pattern’s development.

Limitations in identifying a dead cat bounce

Traders often face the intricate challenge of distinguishing between a genuine recovery and a dead cat bounce. The primary limitation in identifying this deceptive pattern is its retrospective clarity. In real-time, as the price action unfolds, the bounce could deceptively resemble the initial stages of a market recovery.

The pattern’s confirmation only comes with the subsequent price action, i.e. when the asset fails to reach new highs and instead falls back to its prior lows or worse. This inherent delay places traders in a precarious position, making it crucial to wait for additional bearish confirmation before deciding on a course of action.

Tips for confirming the dead cat bounce pattern:

-

Price does not rise above the 50% level of the previous decline;

-

the speed of the rebound is less than the speed of the previous decline;

-

volume on the bounce tends to decrease, showing weakening demand;

-

the price reacts weakly to possible positive news;

-

a false bullish breakout of a local high and/or a candlestick with a long upper shadow may appear on the chart.

Thus, the discernment of a dead cat bounce becomes a matter of strategic patience, a recognition of the market's capriciousness, and an adherence to risk management principles to mitigate the impact of such uncertain patterns.

Best Forex brokers

Example of a dead cat bounce

The provided chart offers a textbook illustration of a dead cat bounce within the EUR/USD currency pair on a 4-hour timeframe. Following a pronounced downtrend, there’s a modest and temporary uptick in price, suggestive of a potential reversal. However, the essence of a dead cat bounce is the failure to sustain this recovery, and that's precisely what the chart demonstrates.

EUR/USD: Example of a dead cat bounce

Price makes an attempt to climb but is met with resistance, failing to push past previous highs, which signals weakness in buying pressure. The 'Test' indicated in the chart refers to the price's attempt to breach a support level, which it does not maintain, thereby reaffirming the bearish trend.

This sequence of lower highs after a brief rally encapsulates the dead cat bounce, warning traders of the false hope of a trend reversal before the market continues its downward course.

What Is the opposite of a dead cat bounce?

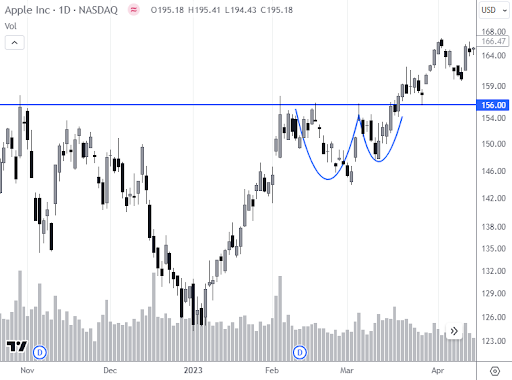

The opposite of a dead cat bounce is a bullish chart pattern known as the "cup and handle". Unlike the deceptive relief rally of a dead cat bounce, a cup and handle pattern indicates a potential continuation of an upward trend after a period of consolidation.

Cup and handle

The image illustrates a classic cup and handle formation on the daily chart of Apple Inc. The 'cup' is formed by a gradual decline followed by a rounding recovery, resembling the shape of a tea cup. This pattern reflects consolidation and is typically associated with bullish sentiment building strength. The 'handle' forms as a slight downward drift from the right rim of the cup, representing a final shakeout of weak holders before a potential upward breakout.

This pattern is characterized by a stabilization of price and a relatively smooth transition from a downtrend to an uptrend, suggesting that the previous bearish sentiment is waning and the bulls are gaining control. Traders often view the cup and handle as a sign to consider long positions in anticipation of a breakout and continuation of the uptrend.

What causes a dead cat bounce?

A dead cat bounce is typically caused by a temporary stabilization in the downward momentum of an asset, leading to a short-lived and often misleading uptick in its price. The image provided shows the Gold Spot/U.S. Dollar chart, which exhibits instances that could be interpreted as dead cat bounces.

Dead cat bounces on the gold market

In the chart, each bounce follows a sharp decline in price, suggesting a momentary pause in selling pressure. This can happen for several reasons: oversold conditions may prompt a technical correction, speculative traders might attempt to capitalize on the perceived low prices, or there could be a minor positive shift in news or market sentiment that provides temporary relief.

However, these factors do not change the underlying bearish sentiment that dominates the market.

In the absence of substantial buying interest or a change in the fundamental outlook, the recovery lacks the momentum to instigate a genuine reversal. The volume during these bounces is typically low, indicating that the rise is not supported by strong investor confidence.

As a result, the price fails to make significant higher highs and soon resumes its downward trend, confirming the dead cat bounce pattern.

Dead cat bounces can be a trap for early buyers. When they close their positions with a loss, it will help the bears to continue the downtrend.

How do you trade a dead cat bounce?

Trading a dead cat bounce requires a strategic approach, with steps tailored to navigate the pattern's deceptive nature. Here’s a step-by-step guide:

-

Identify the downtrend: Confirm a significant and sustained downward trend in the asset’s price history.

-

Spot the bounce: Look for a small upward price movement following the downtrend. It should be relatively low volume and not accompanied by any significant fundamental changes.

-

Confirm the pattern: Wait for price action to indicate that the uptrend is not a reversal; typically, this is shown by the price failing to set a higher high and the bounce losing momentum.

-

Enter the trade: Once the bounce is confirmed, consider entering a short position, betting that the price will continue to decline.

-

Set stop-losses: To limit potential losses if the pattern does not play out as expected, set a stop-loss just above the recent high of the bounce.

-

Take profits: Determine a target level for taking profits, which could be the previous low or a set percentage from the entry point.

Pros and cons of trading the dead cat bounce pattern

The dead cat bounce pattern, while offering a distinctive opportunity for traders, comes with its own set of risks and rewards. It's imperative for traders to weigh these carefully, considering both the potential for profit and the likelihood of misjudgment. Here’s a more detailed look at the advantages and disadvantages of trading this particular pattern.

👍 Advantages:

• Defined strategy: The dead cat bounce provides a clear-cut trading strategy with explicit entry and exit points, which can be identified through technical analysis, offering a structured approach to potentially profitable trades.

• Profit potential: For those who can accurately identify and act on this pattern, there is a significant opportunity for short-term profits, as the post-bounce decline can be quite predictable.

• Favorable risk-reward: When a dead cat bounce is correctly identified, and trades are executed with discipline, the setup can offer an attractive risk-reward ratio, especially with tight stop-loss controls in place.

👎 Disadvantages:

• Complex identification: The challenge in trading a dead cat bounce lies in its identification; it requires a nuanced understanding of market dynamics and the ability to distinguish between a mere bounce and a genuine reversal.

• Timing sensitivity: The success of trading this pattern hinges on precise timing. Entering too soon or too late can lead to missed opportunities or losses, making the timing of entry and exit critical.

• Volatility and false signals: The inherent volatility in markets can lead to false signals, with what appears to be a dead cat bounce actually being the start of a reversal, leading to incorrect trading decisions and potential losses.

Dead cat or market reversal?

Bitcoin/U.S. Dollar

Discerning between a dead cat bounce and a market reversal is one of the most challenging aspects of trading. The image in reference shows the Bitcoin/U.S. Dollar chart on a 3-day timeframe, which presents a scenario that could be perceived as either a series of dead cat bounces or potential reversals.

To differentiate between the two, traders often use volume as a primary indicator. In a dead cat bounce, the upward movement in price is typically accompanied by low volume, indicating a lack of conviction and an insufficient influx of new money to support a continued rise.

Conversely, a genuine market reversal is generally characterized by increased volume, suggesting a strong shift in market sentiment and the presence of buying pressure that can sustain the upward trend.

The broader market context should also be taken into account. It includes understanding the overall trend, considering macroeconomic factors, and analyzing other correlated markets. For instance, if the wider market is bearish and the asset's price starts to rise without significant volume and without change in the broader conditions, it's more likely to be a dead cat bounce rather than a reversal.

Summary

The dead cat bounce is a crucial pattern for traders to recognize, marked by a temporary recovery in a bear market that is misleadingly short-lived. Identifying this pattern hinges on understanding chart dynamics, monitoring trading volume, and maintaining a perspective on the broader market context.

While trading a dead cat bounce offers potential for profit, it requires skillful timing and a clear strategy, underscored by the risks of misidentification and the challenges posed by market volatility.

Correctly distinguishing between a mere bounce and a true market reversal is a skill that comes with experience and a deep understanding of market mechanics. Traders should approach this pattern with caution, strategic planning, and a robust risk management framework.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.