According to Traders Union’s experts, the top 12 trend reversal patterns include 6 chart patterns: Head and Shoulders, Flag Pattern, Double Top, Engulfing Pattern, Morning Star, and Piercing Line, and 6 candlestick patterns: Hammer, Three White Soldiers, Doji, Evening Star, Dark Cloud Cover, and Three Black Crows.

Top 12 Chart Patterns To Spot the Market Reversal

In the ever-evolving world of financial markets, traders and investors are continuously seeking innovative and reliable techniques to identify opportunities and maximize their returns. One such indispensable skill set is the ability to recognize trend reversal patterns, which can provide valuable insights into potential shifts in market dynamics. In this comprehensive guide, the TU experts will delve into the top 12 trend reversal patterns that every market participant should master. They will begin by defining what a trend reversal pattern is and its significance in the financial markets. Following this, they will explore the best reversal chart patterns, providing you with an understanding of these key formations and their implications. Lastly, they will delve into the best reversal candlestick patterns, highlighting their unique characteristics and offering insights into how they can be effectively utilized in your market analysis.

By understanding these crucial chart formations, including the most effective candlestick and chart patterns for both bullish and bearish reversals, you will be well-equipped to make more informed decisions and capitalize on market fluctuations with increased precision and confidence.

What is a trend reversal pattern?

A trend reversal pattern signifies a change in the direction of a financial instrument, such as a stock, as it moves in the opposite direction from its previous trajectory. For instance, an uptrend turning into a downtrend or a downtrend transforming into an uptrend are classic examples of trend reversals.

Trend reversals can be classified as bullish or bearish reversals. In an uptrend, which is characterized by bullish price action, the instrument consistently achieves higher highs and higher lows. A bullish reversal occurs when this pattern ceases, and the instrument starts making lower highs and lower lows, indicating a shift in direction from upward to downward.

Conversely, a bearish trend reversal follows a similar pattern but in reverse. In a downtrend, the bearish price action is marked by lower highs and lower lows. When the price stops descending to form lower lows and instead establishes a higher low, followed by a consistent pattern of higher highs and higher lows, it signifies a bearish trend reversal. In essence, the price direction changes from a downward trajectory to an upward one.

Best reversal chart patterns

Head and Shoulders Pattern

The Head and Shoulders pattern is a highly-regarded trading technique for detecting trend reversals by analyzing specific chart formations. This method relies on spotting a price pattern consisting of a central peak (the head) flanked by two lower peaks (the shoulders). Evaluating the market's behavior around these critical formations allows traders to make well-informed decisions about entry, exit, and risk management.

Entry Point: The entry point for the Head and Shoulders pattern is identified when the pattern is completed, as indicated by a break below the neckline (a support level connecting the lows between the head and shoulders). Traders should monitor the price action and volume during the break for additional confirmation.

Exit Point: To establish exit points using this pattern, measure the pattern's height and use Fibonacci retracement levels for potential take-profit zones. Setting a stop-loss order above the right shoulder can help minimize potential losses in case the pattern fails.

Head and Shoulders Pattern

Wedge pattern

A wedge pattern can be a signal for either bullish or bearish price reversals, characterized by three common features: converging trend lines, declining volume as the pattern progresses, and a breakout from one of the trend lines. The two forms of the wedge pattern are the rising wedge (indicating a bearish reversal) and the falling wedge (signaling a bullish reversal).

Entry Point:

Rising Wedg: As a rising wedge pattern suggests the potential for falling prices after a breakout of the lower trend line, traders should consider entering a short position or using derivatives after the breakout occurs.

Falling Wedge: For a falling wedge pattern, traders should look for bullish reversal signals and consider entering a long position or using derivatives that benefit from the security's increase in price after the breakout above the upper trend line.

Exit Point: For both rising and falling wedge patterns, traders can use Fibonacci retracement levels to determine suitable take-profit levels. Additionally, setting a stop-loss order above the second peak (for rising wedge) or below the lowest point (for falling wedge) can help minimize potential losses.

Wedge pattern

Double Top Pattern

The Double Top pattern is a highly respected reversal pattern identifiable across various chart types. This pattern often suggests that an asset's current trajectory is about to change, reversing its course and moving in the opposite direction. The Double Top is characterized by two separate peaks at approximately the same price level, with a trough between them, commonly referred to as the neckline.

Entry Point: Consider entering a short position when the price breaks below the neckline after the formation of the second peak and as the price starts to retreat towards the neckline. Monitor the volume during the break for additional confirmation.

Exit Point: Consider exiting a short position at a distance similar to that between the neckline and double-top-high. Alternatively, traders can also set a predetermined exit point based on their risk-reward calculations.

Double Top pattern

Rounding Bottom pattern

The Rounding Bottom pattern is a well-regarded reversal pattern that can be identified across various chart types. This pattern often indicates that an asset's current direction is about to shift, reversing its course and moving in the opposite direction. The Rounding Bottom is characterized by a gradual, curved decline in price followed by a steady, curved ascent, resembling a bowl or saucer shape.

Entry Point: In a Rounding Bottom pattern, consider entering a long position when the price breaks above the level immediately prior to the start of the initial decline, signaling a breakout from the pattern's low point. As the stock recovers and completes the pattern, monitor the volume for confirmation, as it ideally increases alongside the rising price.

Exit Point: To establish an exit point, identify the price level at the start of the initial decline and use it as a target for taking profit. Additionally, set a stop-loss order below the lowest point of the rounding bottom to minimize potential losses.

Rounding Bottom pattern

Cup and Handle pattern

The Cup and Handle pattern is another well-recognized bullish pattern found across various chart types. This pattern typically implies that an asset's current uptrend is likely to reverse/continue towards the bullish side after a period of consolidation. The Cup and Handle is characterized by a "U"-shaped cup followed by a handle with a slight downward drift, resembling a teacup with a handle.

Entry Point: In a Cup and Handle pattern, consider entering a long position when the price breaks above the upper trend line of the handle. You can place a stop buy order slightly above the trend line or wait for the price to close above it before placing a limit order slightly below the breakout level.

Exit Point: To establish an exit point, measure the distance between the bottom of the cup and the pattern's breakout level, and extend that distance upward from the breakout. For example, if the distance is 20 points, set a profit target 20 points above the handle. Stop-loss orders can be placed either below the handle or below the cup, depending on your risk tolerance and market volatility.

Cup and Handle pattern

Triple Bottom pattern

The Triple Bottom pattern is a rare and highly effective reversal pattern. This pattern typically indicates that the asset's current downtrend is nearing its end, and a reversal is imminent. The Triple Bottom is characterized by three consecutive lows at or near the same level, with a clear downtrend leading up to the formation. A horizontal support line connects the lows, while a neckline connects the highs of the rebounds.

Entry Point: In a Triple Bottom pattern, consider entering a long position when the price breaks above the neckline following the third unsuccessful attempt by sellers to push the price lower. This break signals the activation of the pattern and suggests that buyers have gained control.

Exit Point: To set an exit point, measure the distance between the neckline and the horizontal support line, and use this distance to project a target price above the neckline. Additionally, place a stop-loss order below the horizontal support line to minimize potential losses.

How to Use Triple Top Pattern in Forex Trading

Triple Bottom pattern

Best reversal candlestick patterns

Hammer

The Hammer candlestick pattern emerges when the low of a financial instrument significantly exceeds its opening price but eventually rebounds to close near the opening price. The extended lower shadow of this pattern tells us that sellers initially managed to drive the price down; however, buyers reclaimed control and pushed the price back up, hinting at a potential bullish reversal.

Entry point: Consider entering a long position when a Hammer pattern appears at the end of a downtrend or near significant support levels. Additionally, confirm the bullish reversal with the presence of a subsequent green candle or other supporting technical indicators.

Exit Point: Use a combination of moving averages and support levels to determine an appropriate exit point. As the price rises and approaches a moving average or key support-turned-resistance level, consider exiting the trade to lock in profits before a potential reversal.

The Hammer candlestick pattern

Engulfing Candle Pattern

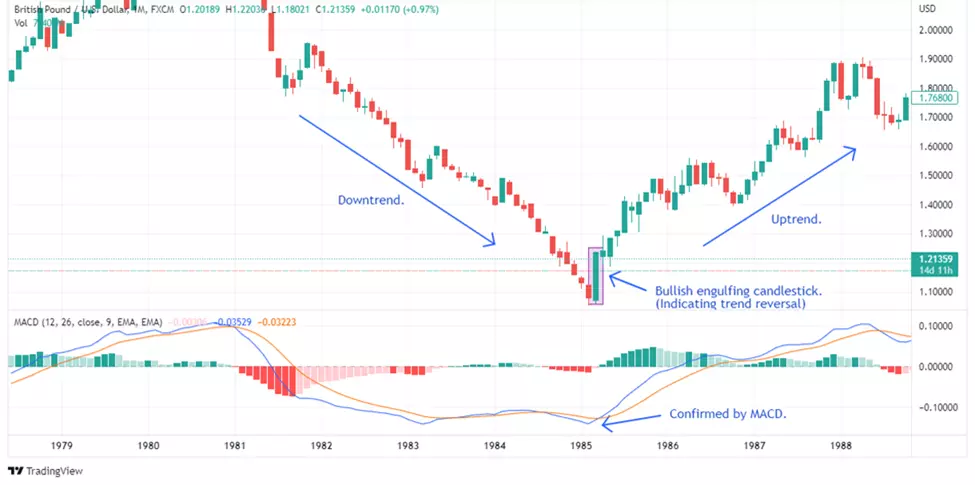

The Engulfing Candle Pattern is a powerful two-candle pattern that often appears when a prevailing trend, either upward or downward, begins to lose momentum. This pattern is marked by a smaller candlestick followed by a larger one that completely engulfs the preceding candle. Spotting this pattern can signal an opportune moment to enter a trade in the direction opposite the previous trend.

Entry point: In a bullish engulfing pattern, initiate a long position once the second candlestick is completed and accompanied by increased volume, adding validity to the trade setup.

Exit Point: When engaging in a long trade, it is advisable to exit the position when the price reaches significant resistance levels, demonstrates signs of reversing, or when a bearish reversal pattern emerges.

The Engulfing Candle Pattern

Doji

A Doji candlestick pattern occurs when a security's opening and closing prices are nearly equal, resulting in a candlestick with a small or nonexistent body and potentially long shadows. This pattern represents market indecision, as neither buyers nor sellers could gain control, and may signal a potential trend reversal or continuation, depending on the context of the preceding candles and overall market trend.

Entry point: A Doji pattern alone is not a strong signal for entry. However, when it appears in conjunction with other technical indicators or patterns, it can provide valuable insight. Look for confirmation from subsequent candles or other technical indicators to identify potential trend reversals or continuations.

Exit Point: When trading with a Doji pattern, use trendlines to determine potential exit points. Draw trendlines connecting recent highs and lows to identify a price channel. Exit the trade when the price approaches or breaks the opposite trendline, signaling a potential change in trend direction.

A Doji candlestick pattern

Evening Star

The Evening Star pattern comprises three candlesticks: a long green candle, a small-bodied candle (either green or red) that gaps higher, and a long red candle that closes within the range of the first candle. The pattern indicates a weakening uptrend, with the small-bodied candle representing market indecision, followed by a robust red candle that suggests a bearish reversal.

Entry point: After the small-bodied candle appears, signaling market uncertainty, watch for the emergence of the long red candle. Once the red candle closes within the range of the first green candle, consider initiating a short position, as this indicates a potential bearish reversal.

Exit Point: With the Evening Star pattern, implement a profit target based on a percentage retracement of the previous uptrend. Utilize the Fibonacci retracement tool to identify potential support levels (such as 38.2%, 50%, or 61.8%) and consider exiting the trade when the price reaches one of these levels.

The Evening Star pattern

Dark Cloud Cover

The Dark Cloud Cover pattern is a two-candle pattern with a long green candle followed by a long red candle that opens higher than the previous day's high but closes more than halfway below the midpoint of the first candle. The second candle's strong close indicates a shift in market sentiment, suggesting that the bears are gaining control.

Entry point: When a Dark Cloud Cover pattern appears at the end of an uptrend or near significant resistance levels, consider entering a short position. Confirm the bearish reversal with the presence of a subsequent red candle or other supporting technical indicators.

Exit Point: For the Dark Cloud Cover pattern, consider employing a trailing stop-loss to capitalize on potential downward momentum while protecting your trade from sudden reversals. Adjust the stop-loss as the price continues to decline and exit the position when the stop-loss is triggered.

The Dark Cloud Cover pattern

Piercing Line Pattern

The Piercing Line pattern is an easily recognizable two-candle formation that can help you spot potential market changes. It consists of a long red candle followed by a long green candle. The green candle opens below the red candle's lowest point but ends up closing more than halfway above the middle of the red candle. This strong finish of the green candle indicates that the market is shifting, and buyers are gaining strength.

This pattern is mostly seen in stocks, as they can experience price gaps overnight. However, it may also be found in other types of assets when examining weekly charts.

Entry point: When the long green candle closes above the middle of the red candle, it's a sign that buyers are starting to take control. This is a good time to consider buying, as it suggests the market is becoming more bullish. To further validate the trade setup, monitor the volume during the emergence of the green candle.

Exit Point: To decide when to exit the market and set a target price, look for important resistance levels or spots where the price reversed in the past. To calculate a target price, measure the distance from the lowest point of the green candle to the highest point of the red candle. Add this distance to the highest point of the green candle, and you'll have a target price.

The Piercing Line pattern

Summary

By mastering these powerful patterns, including the Head and Shoulders, Flag Pattern, Double Top, and Engulfing Pattern, along with essential candlestick formations like the Hammer, Three White Soldiers, Doji, Evening Star, Dark Cloud Cover, and Three Black Crows, traders can identify crucial turning points in the market with greater accuracy. These patterns, coupled with well-defined entry and exit points, will help traders make more informed decisions and capitalize on profitable opportunities in various market conditions.

FAQs

What is the best trend reversal pattern?

The best trend reversal pattern depends on the trader's preference and experience. That being said, the Head and Shoulders pattern is widely regarded as one of the most reliable and easily recognizable reversal patterns.

What is the 3 candle rule?

The 3 candle rule refers to a pattern that necessitates the formation of three candles in a particular sequence, indicating that the existing trend has lost momentum and a potential reversal in the opposite direction may be imminent.

What is the most successful chart pattern?

The most successful chart pattern varies depending on the market and trader's experience. Nevertheless, the Flag Pattern is often considered highly effective, as it signifies the likelihood of a trend continuation after a temporary pause.

Which candlestick pattern is most powerful?

The most powerful candlestick pattern depends on the context and trading strategy. However, the Engulfing Pattern is frequently deemed as a potent indicator of trend reversals, showcasing the potential for a change in the market's direction.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).