Trading Divergences: An Ultimate Cheat Sheet

Different types of divergences that occur in trading are:

Regular divergence - Indicates potential trend reversal

Hidden divergence - Shows continuation of the current trend

Bullish divergence - Signals potential uptrend reversal

Bearish divergence - Suggests potential downtrend reversal

RSI divergence - Measures price momentum discrepancies

MACD divergence - Gauges trend momentum shifts

Ever felt the market is about to shift but the price chart isn't telling the whole story? In such cases, divergence can be your secret weapon. This cheat sheet will equip you to identify these hidden clues, where price action contradicts a technical indicator, potentially signaling a trend reversal or continuation.

What does divergence mean in trading?

In trading, divergence refers to a situation where the movement of an asset's price and a technical indicator shows disagreement. Essentially, it suggests that the current trend may be losing strength and could potentially change direction.

What are the different types of divergence in RSI?

Divergence in technical analysis, including the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), refers to discrepancies between price movements and indicator movements.

Here's an explanation of the types of divergence you've mentioned:

Regular divergence

Bullish regular divergence: This occurs when the price of an asset forms a lower low while the RSI indicator forms a higher low. It suggests that the downtrend may be losing momentum and a potential reversal to the upside could occur.

Bearish regular divergence: This occurs when the price forms a higher high while the RSI indicator forms a lower high. It indicates that the uptrend may be losing strength and a potential reversal to the downside could happen.

Hidden divergence

Bullish hidden divergence: This occurs during an uptrend when the price forms a higher low while the RSI indicator forms a lower low. It suggests that the upward momentum is strong, even though the price may be temporarily retracing.

Bearish hidden divergence: This occurs during a downtrend when the price forms a lower high while the RSI indicator forms a higher high. It indicates that the downward momentum is strong, even though the price may be experiencing a temporary rally.

RSI divergence

RSI divergence refers to situations where the price movement and the RSI indicator show inconsistencies, signalling potential shifts in market direction. Traders use RSI divergences to identify entry and exit points based on the differences between price action and RSI readings.

MACD divergence

MACD divergence is a concept similar to RSI divergence but involves the Moving Average Convergence Divergence (MACD) indicator. It highlights differences between the MACD indicator and price movements, providing insights into potential trend reversals or continuations in the market.

Best Forex Brokers

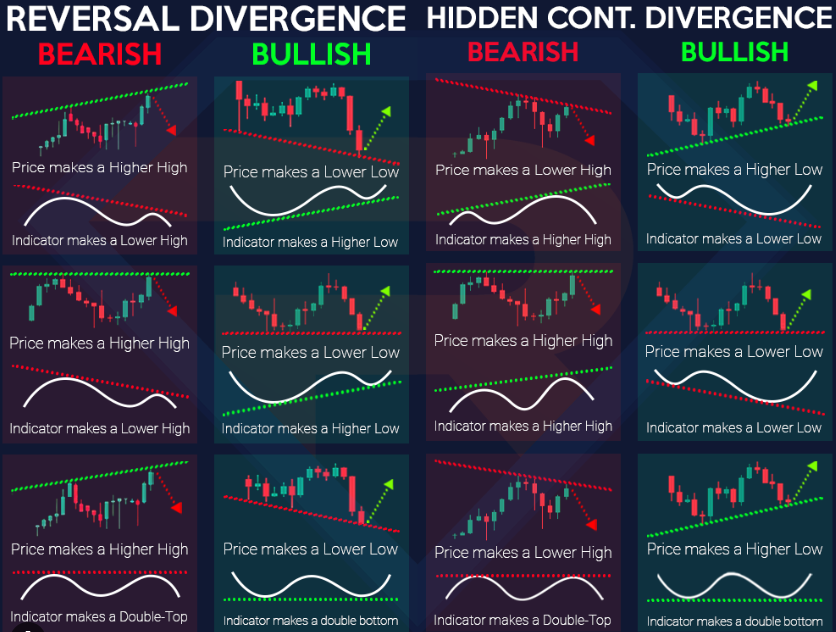

Divergence cheat sheet

The cheat sheet below shows different visual representations of bullish and bearish divergence for regular and hidden divergence.

Regular bullish divergence: price makes higher highs but the indicator makes lower highs

Regular bearish divergence: price makes lower lows but the indicator makes higher lows

Hidden bullish divergence: price makes lower lows but the indicator makes higher lows

Hidden bearish divergence: price makes higher highs but the indicator makes lower highs

Divergence cheat sheet

How do you trade divergence correctly?

Let’s take the example of RSI divergence. The RSI is a momentum oscillator that measures the speed and strength of price movements. A lower RSI reading typically indicates that the asset is oversold, and a higher RSI reading indicates that the asset is overbought. In the chart, you can see the price of the Euro (EUR) is making lower lows, while the RSI indicator is making higher lows.

In this case, the fact that the RSI is making higher lows even though the price is making lower lows suggests that there is underlying bullish strength in the market. This could be because buyers are starting to step in even though the price is still falling.

RSI is making higher lows, indicating bullish divergence

Next, let’s consider MACD divergence. The MACD (Moving Average Convergence Divergence) is a trend-following momentum indicator that measures the difference between two exponential moving averages. A higher MACD reading typically indicates bullish momentum, and a lower MACD reading indicates bearish momentum. In the chart, which shows the price of the Euro (EUR) against the US Dollar (USD), the price is making higher highs, but the MACD indicator is making lower highs.

In this case, the fact that the MACD is making lower highs even though the price is making higher highs suggests that there is underlying bearish weakness in the market. This could be because sellers are starting to step in even though the price is still rising.

MACD is making lower lows, signalling bearish divergence

Now, it is important to also understand that trading divergence effectively goes beyond merely identifying the discrepancy itself.

Here are some essential considerations:

Confirmation

Divergence serves as a signal of potential weakness or reversal, but it's not foolproof. Seek confirmation from other technical indicators or price action patterns that validate the reversal. This could include factors such as support/resistance levels, trendline breaks, or increased trading volume. These factors strengthen the likelihood of a successful reversal.

Placement

Avoid entering the trade immediately at the point of divergence. Instead, wait for a price pullback (in cases of bullish divergence) or for confirmation through candlestick patterns like a bearish engulfing pattern. This cautious approach enhances the probability of entering the trade at a favorable point.

Risk management

It's imperative to implement proper risk management techniques. Utilize stop-loss orders to mitigate potential losses, as divergences can sometimes result in false signals. This precautionary measure helps safeguard against adverse market movements.

Seek strong divergences

Not all divergences carry the same weight. The strength of a divergence correlates with its extremity. For instance, if the price continues to reach new highs or lows while the indicator forms lower highs or lows, the divergence is considered stronger. Focusing on such robust divergences enhances the reliability of the trading signal.

What is the most accurate divergence indicator?

The most popular and commonly used divergence indicators are:

Moving Average Convergence Divergence (MACD)

This classic indicator compares two exponential moving averages to gauge price momentum. It's reliable for spotting bullish divergence when price forms lower lows while MACD forms higher lows, and conversely for bearish divergence.

Relative Strength Index (RSI)

Acting as an oscillator, RSI measures the speed and change of price movements. When price trends downwards but RSI trends upwards, it signals bullish divergence, and vice versa for bearish divergence.

Awesome Oscillator (AO)

Similar to MACD but with a simpler calculation, AO assists in swiftly identifying divergences.

Additionally, there are some less common but intriguing divergence indicators available on platforms like TradingView:

VWAP Divergence

This indicator contrasts price action with the Volume-Weighted Average Price (VWAP), aiding in filtering out false divergences influenced by volume fluctuations.

YD_Divergence_RSI+CMF

A custom indicator blending RSI and Chaikin Money Flow (CMF) to pinpoint divergence, providing insights into buying and selling pressure alongside momentum shifts.

How do you master divergence in trading?

Confirmation is important

Recognize that divergence alone does not guarantee a reversal signal. Seek confirmation from other technical indicators such as support/resistance levels, trendline breaks, or increased trading volume to reinforce your trading decision.

Strategic trade placement

Refrain from entering trades immediately upon detecting divergence. Instead, wait for a price pullback (in cases of bullish divergence) or for confirmation through candlestick patterns (in cases of bearish divergence) before initiating a trade. This cautious approach enhances the likelihood of entering at favorable market conditions.

Consider the strength of divergence

Understand that not all divergences carry the same significance. Expert Mikhail Vnuchkov says that divergences with more pronounced discrepancies between price movements and indicators tend to yield stronger potential signals. Pay attention to extreme divergences where the price continues to form new highs/lows while the indicator indicates the opposite trend.

Beware of false signals

Acknowledge the possibility of divergences leading to false signals. Implement proper risk management techniques by setting stop-loss orders to mitigate potential losses if the market moves against your anticipated direction.

Engage in paper trading

Utilize paper trading platforms to practice implementing divergence strategies in a risk-free environment. This allows you to refine your skills, experiment with different approaches, and gain confidence before committing real capital.

Develop a comprehensive trading plan

Establish a well-defined trading plan that delineates your entry and exit points, risk management strategies, and how you'll incorporate divergence alongside other technical analysis tools. Having a structured plan enhances consistency and helps you navigate the complexities of trading with divergence effectively.

A few practical remarks

The reliability of the signal depends on the correct oscillator setting

Before a divergence situation, the asset should show stable volatility for at least one trading day

Speculation (news, large option closures, force majeure, etc.) easily breaks divergence and increases the risk of false situations

All direct divergence (divergence) situations are more reliable than convergence options

The higher the interval on which the divergence is clearly visible, the higher the probability of its realization

To assess divergence, you can reduce the period of analysis: if there is a repetition of the situation, you can enter on the signal of a smaller timeframe

Exit from the deal is carried out or at the formation of reverse divergence, according to the manifestation

Setting stops when trading on any divergence schemes is mandatory!

Summary

In trading, divergence refers to a situation where the movement of an asset's price and a technical indicator show disagreement, potentially signaling a weakening trend or impending reversal. There are two main types of divergence: negative and positive. Negative divergence occurs when the price makes higher highs while the indicator makes lower highs, indicating a potential downtrend reversal, while positive divergence happens when the price forms lower lows while the indicator forms higher lows, suggesting a possible uptrend reversal. It's crucial to confirm divergence signals with other technical indicators like support/resistance levels and trendline breaks.

Additionally, understanding the strength of divergence, practicing with paper trading, conducting backtesting, and developing a comprehensive trading plan are essential steps to mastering divergence trading effectively.

FAQs

What is divergence in trading?

Divergence in trading refers to a discrepancy between the price movement of an asset and a technical indicator, potentially indicating a weakening trend or a reversal. In Forex trading, divergence occurs when the price of a currency pair moves in the opposite direction to a technical indicator.

Is the divergence signal bullish or bearish?

The divergence signal can be either bullish or bearish, depending on the direction of the price movement compared to the direction of the indicator.

How to trade divergences?

To trade divergences, look for confirmation from other technical indicators, such as support/resistance levels or trendline breaks. Practice cautious trade placement, and implement proper risk management techniques.

Is divergence trading profitable?

Divergence trading can be profitable when executed correctly, but it carries risks like any trading strategy. Success often depends on a trader's ability to accurately identify and interpret divergence signals alongside effective risk management.

Glossary for novice traders

-

1

BaFin

BaFin is the Federal Financial Supervisory Authority of Germany. Along with the German Federal Bank and the Ministry of Finance, this government regulator ensures that licensees abide by eurozone laws.

-

2

Day trading

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

-

3

Backtesting

Backtesting is the process of testing a trading strategy on historical data. It allows you to evaluate the strategy's performance in the past and identify its potential risks and benefits.

-

4

Trading divergence

Trading divergence in Forex involves identifying when the price of a currency pair and an oscillator (such as RSI, MACD, or Stochastic) move in opposite directions, indicating potential trend reversals or continuations.

-

5

CFD

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).