5 Best Paper Trading Broker 2024

Best free paper trading broker - eToro

TOP free paper trading brokers:

-

1

eToro - Largest trade copy service

-

2

eOption - Low trading commissions

-

3

Revolut - Best transaction and investment app

-

4

Interactive Brokers - Best for Online Stock Trading

-

5

AvaTrade - The most secure trading platform

Paper trading is a simulated trading process where investors buy and sell stocks, bonds, options, futures, or currencies without using real money. The ability to paper trade gives investors a chance to test their investment strategies and hone their skills before putting any real money on the line. While many paper trading platforms are available, not all are created equal. This article will take a look at five of the best paper trading brokers for 2023. Each of these brokers offers something unique, whether it's advanced trading tools or a large selection of tradable assets. So, whether you're a beginner investor or a seasoned pro, one of these paper trading platforms is sure to meet your needs.

What Is a Paper Trading Broker?

Paper trading is simply the act of simulating trading with real money to practice and learn. It's a popular method used by many different types of traders in various markets, but it's particularly useful for forex (foreign exchange) traders. This is because the forex market is incredibly complex and can be difficult to navigate for even the most experienced trader.

A paper trading broker allows you to practice your trading strategies with "play money" without risking your real capital. This way, you can learn how to trade without fear of losing your hard-earned cash. In addition, paper trading can also help you test out new strategies or indicators to see if they are effective before using them with real money. All in all, paper trading is an essential tool for any forex trader who wants to improve their skills and learn how to trade successfully.

Top 5 Paper Trading Brokers 2024

eToro

The eToro broker was founded in 2007. The company promotes itself as a social trading platform working with traders from over 140 countries. The broker has several divisions operating under different jurisdictions and licensed by different regulators. For example, eToro (Europe) is licensed by the Cypriot regulator CySEC (109/10) and eToro (UK) is licensed by the British regulator FCA (583263). The broker also has a representative office in Australia and the USA. eToro Profile Details

eOption

The eOption broker (eoption.com) is an American stockbroker headquartered in Glenview, Illinois. It has been operating since 2007 and is a member of FINRA (CRD#: 7297/SEC#: 8-21765) and SIPC. It specializes in options trading and also acts as an intermediary in trades involving the popular securities classes. The company offers low trading commissions, super-fast execution of orders, and modern platforms with an advanced set of analytical tools. In 2020-2021, eOption was recognized as the best options broker by several resources such as Investopedia, The Tokenist, Benzinga, Investormint, and NerdWallet.

Revolut

Revolut is a British fintech company that has been providing investors with accounts for trading precious metals, cryptocurrencies, and stocks listed on U.S. exchanges since 2015. The broker offers its clients access to investing in stocks and ETFs on European stock exchanges. For organizations and private clients, the company offers a multi-currency account with the possibility of exchanging currencies at the current inter-bank exchange rate. Revolut is supervised by the Financial Services Authority (FSA).

Interactive Brokers

Interactive Brokers is among the best-known US investment companies, operating since 1977. The broker offers to trade currency pairs, but its basic instruments are stocks, CFD, indices, metals, ETF, futures, and other exchange market assets. The company is regulated by the US Securities and Exchange Commission (SEC), the US Financial Industry Regulatory Authority (FINRA), the UK Financial Regulatory Authority (FCA, 208159), and other international financial regulation commissions. In 2020, the broker was awarded the "Best Online Broker” (Barron's) and "Best Broker for Economical Investments" (NerdWallet) titles and got five stars in the Online Stock Trading for Traders category (Canstar). Also, the broker is popular in other countries. Here you can read reviews of Interactive Brokers in Canada, Singapore, Australia, Hong Kong, Ireland.

AvaTrade

AvaTrade was founded in 2006 in Dublin, Ireland. The company has offices in 10 countries. It currently has over 300, 000 registered users and processes more than 2 million transactions every month. These factors contribute to AvaTrade being a reliable and trusted broker. They are accredited across five continents and are one of the market leaders. The broker is regulated by the Australian Securities and Investment Commission (ASIC, 406684), the Japanese FSA ( 1662), and the South African FSCA ( 45984). AvaTrade holds accreditation by the Central Irish Bank ( C53877 ), the Abu Dhabi Financial Services Regulatory Authority (190018), and the British Virgin Islands Financial Services Commission ( SIBA/L/13/1049), CySEC ( 347/17). AvaTrade allows traders to trade stocks, securities, indices, cryptocurrencies, and currency pairs. In total, the offer more than 1,200 tools to customers.

Should I Paper Trade?

Paper trading is the process of simulating real-world trading with play money to practice and gain experience. Many new traders ask, "should I paper trade?" and the answer is always yes! Here are the top 5 reasons you should paper trade before risking your capital.

Testing Different Strategies

Paper trading gives you the perfect environment to test different forex trading strategies without risking real money. If a strategy isn't working or profitable, you can simply discard it and move on.

Gather Performance Data

When you paper trade, you can track your progress and gather data on your performance. You'll know your key metrics regarding your trading performance and know where to improve. Some top metrics are the average win-to-average loss ratio, a strategy's win percentage, average time in a trade, profit factor, and maximum drawdown, among others. This data can be very useful later on when you're ready to start trading with real money.

Get Comfortable With the Platform

Most forex brokers offer demo accounts that allow you to paper trade online on their platforms. This is a great way to get familiar with the paper trading platform and learn how to use all of its features before actually putting any money on the line.

No Capital At Risk

This is probably the most important reason for paper trade. When you're using play money, there's no risk of losing real capital. This means you can focus on learning and developing your skills without worrying about losing your hard-earned money.

Gain Confidence in Your Method

One of the main reasons many new traders fail is their lack of confidence in their ability to trade profitably. Paper trading can help boost your confidence by allowing you to see that your method can be successful. You'll learn different execution trades for different market environments and test out different order types for more seamless trading.

You Can Learn From Your Mistakes

Perhaps the most valuable benefit of paper trading is that it allows you to make mistakes and learn from them without consequence. In the real world of forex trading, mistakes can be costly. However, the same mistakes are simply part of the learning process in paper trading.

Overall, paper trading is an essential tool for any trader who wants to be successful in forex trading. It allows you to test different strategies, gather performance data, get comfortable with platforms, and gain confidence in your ability to trade profitably - all without risking any real capital!

Top 5 Best Paper Trading AppsHow Does Paper Trading Platform Work?

In the simplest terms, a forex paper trading platform is a digital marketplace where buyers and sellers can trade various currencies. Transactions are executed through an online broker, and prices are based on real-time market rates. Because paper trading platforms are designed to mimic the real forex market, they can be an invaluable tool for learning how to trade currencies without risking any real money.

Most paper trading platforms offer a wide range of features, including live quotes, charting tools, and news feeds. Many platforms also allow users to set up limit and stop-loss orders, as well as trailing stops. This allows paper traders to test out different strategies and see how they would perform in the real world. Best of all, many forex paper trading platforms are available for free. As such, they provide an excellent way for beginner traders to get started in the forex market without any financial risk.

What Assets Can I Paper Trade?

When it comes to paper trading, the sky's the limit. Pretty much any asset that you can trade on a real-life exchange can also be traded on a paper trading platform. This includes stocks, bonds, commodities, currencies, and even cryptocurrency. Of course, some assets are more commonly traded than others. For example, stocks are a popular choice for paper trading because they are relatively easy to buy and sell, and there is a lot of publicly available information about individual companies.

However, paper trading platforms also offer plenty of opportunities for those interested in less mainstream assets. For example, you can paper trade a variety of commodities, including oil, gold, and coffee. Cryptocurrency is another popular choice for paper trading, with platforms offering users the chance to trade digital assets without worrying about market volatility. So whatever your asset of choice may be, there's a good chance you'll be able to find a paper trading platform that suits your needs.

Can I Paper Trade for Free?

Many people are interested in paper trading but are unsure if it's possible to do it for free. The answer is yes. There are several ways you can paper trade online without paying any fees. One way is to use a demo account with a brokerage firm. Most firms offer demo accounts so potential customers can try their services before committing to a real account. Another way to paper trade free is to use one of the many online simulators. These simulators allow you to place trades in a simulated environment without risking any real money.

How to Choose a Paper Trading broker?

When it comes to online trading, one of the most important decisions you will make is choosing a broker. With so many options available, knowing where to start can be difficult. However, by considering a few key factors, you can narrow down your choices and find a broker that best suits your needs.

Trading Platform

The trading platform is the software you will use to place and manage your trades. Make sure to choose a user-friendly platform that offers all the features and tools you need. Some brokers also offer mobile trading apps, which can be convenient if you need to trade on the go. Search for the best paper trading app for the ultimate experience.

Regulation

When it comes to choosing a paper trading broker, regulation should be one of your top priorities. Even though you're not actually investing any money, you're still trusting your broker with important information about your information.. If your broker isn't regulated, there's no guarantee that they'll keep your information safe.

Some of the most trusted regulatory bodies include the Securities and Exchange Commission (SEC) in the United States, the Financial Conduct Authority (FCA) in the United Kingdom, and the Australian Securities and Investments Commission (ASIC).

Best Forex Trading RegulatorsMarket Range

It is also important to consider the range of markets you can trade with a particular broker. If you are interested in trading more than just currencies, choose a broker that offers a wide range of markets, such as cryptocurrencies, commodities, and more. This will give you greater flexibility and allow you to take advantage of more opportunities.

Customer Support

Customer support is another important factor to consider when choosing a broker. Make sure to choose a broker that offers 24/7 customer support in case you need assistance with placing or managing your trades. You should also check to see if the broker offers live chat, email, or phone support.

Educational Materials

Many brokers also offer trading education services, which can be helpful if you are new to online trading. These services can include webinars, educational articles, and even one-on-one coaching. If you are serious about trading, choose a broker that offers comprehensive education services.

Broker Reputation

Don't forget to check the broker's reputation before making your decision. You can do this by reading online reviews from other traders or checking out industry awards and accolades. A good way to get started is by checking out our list of top-rated paper trading brokers. By considering all of these factors, you can narrow down your choices and find the best paper trading broker for your needs.

How to Choose a Forex BrokerHow to Paper Trade?

All you need to do to get started with paper trades is to make an account, get verified if you are a U.S. resident, and access your paper trading or demo account. Your capital will be ready to go and you can start trading immediately. We recommend watching a few tutorials on how to actually trade stocks or your specific instrument of choice before getting started.

Choose Your Trading Strategy

Traders have the option of choosing between scalping, day trading, and swing trading. These are the main trading strategies of professional investors. Realistically, your trading style should depend on the time that you are willing to spend on physically trading. If you don’t want to spend all day staring at a screen, then swing trading might be better. If you want to be a full-time trader, then day trading is the right choice. This is the beauty of paper trading – you can test all these strategies out without losing funds.

Placing Orders

Placing a paper trade order is the same as placing a real order on Webull. Simply search for your stock’s ticker of choice, choose to buy or sell that order, decide how much virtual money you’d like to invest, and then submit your order.

Consider Real Money Trading

When a trader finds the right strategy and receives a stable income on their paper account, it's time to start thinking about switching to real trading. Webull is an excellent choice for traders who want to experiment with a demo account and then transition to a real account. Plus, Webull offers two free stock shares after registration.

Best Free Crypto Paper Trading AppsWho Should Try Paper Trading?

Paper trading is a helpful tool for many people involved in the trading industry. Let's explore who can get the most value from using this tool.

Beginner Traders

New traders can use paper trading to learn without any risk. It helps them understand how markets work and builds their confidence without losing real money. It is a practice ground where they can make mistakes and learn from them freely.

Investment Professionals

Even expert traders use paper trading to test new ideas. They can try out different strategies without any financial risk. It is a safe space to see if a new plan will work before using it in the real market.

Traders Recovering from Losses

After facing a loss, a trader can use paper trading to start again without pressure. It helps them rebuild their approach to trading and regain their confidence without the fear of losing more money.

Technical Analysis Practitioners

People who use complex analysis to make trading decisions find paper trading beneficial. They can test their theories and analysis methods without any real-world consequences. It gives them a chance to refine their skills before applying them in the real market.

Diversification Experimenters

Traders looking to spread their investments across various assets use paper trading to experiment. They can test different combinations of assets to see how they perform together, helping them make informed decisions for their real portfolios. It is like a testing lab where they can try out their investment mixes safely.

How to Get Started with the Best Free Paper Trading Account

Getting started with paper trading is a straightforward process, especially when using platforms like eToro, which offers free demo accounts. Here is your step-by-step guide to setting up and initiating your journey in paper trading using eToro:

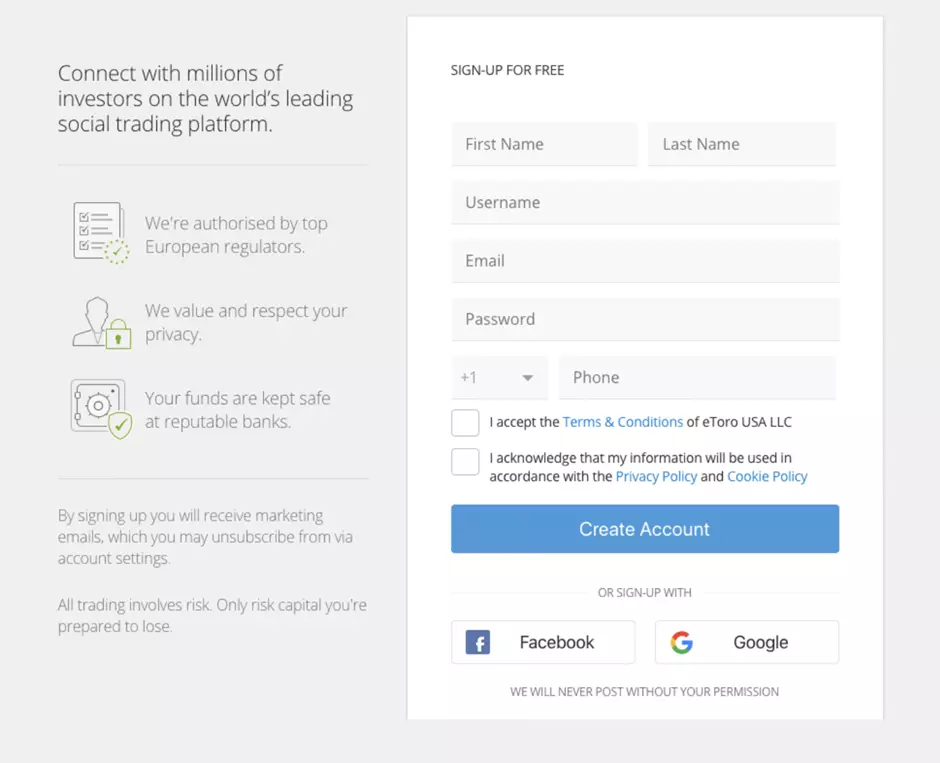

1 Create Your Account

Navigate to the eToro website and hit the "Sign up" button to initiate the process. You'll be prompted to provide basic details such as your name, email, and a secure password. If you prefer, you have the option to sign up through your Google or Facebook account for a faster process.

Creating an eToro Account

2 Email Verification

Upon completion of the sign-up process, check your inbox for a verification email from eToro. Click the link enclosed to verify your email address and activate your account.

3 Explore the Demo Account

Post-verification, you'll find yourself on the eToro platform, where your demo account awaits. This is where you familiarize yourself with the array of features available, including but not limited to the watchlist, news feed, and the different trading charts available for analysis.

4 Engage in Virtual Investment

Your demo account grants you access to a generous virtual fund of up to $100,000, facilitating risk-free practice. Utilize the search function to find and select assets - be it stocks, cryptocurrencies, or commodities, and delve into trading by reviewing asset details and performances.

5 Track Your Trades

Once you venture into trading, the portfolio screen becomes your go-to to track the performance of your virtual investments. It delineates open and closed positions, and the overarching account balance. Enhance your trading strategy by setting stop loss and take profit levels to manage the associated risks optimally.

Summary

It is essential to choose the best paper trading broker that suits your trading style and needs. Different brokers offer different features, and it is essential to find one that provides the tools and resources you need to succeed. While there are many brokerages to choose from, we believe that these are the best paper trading brokers for 2023.

They offer a comprehensive suite of tools and resources, including advanced charting, powerful analytical tools, and real-time market data. They also provide excellent customer support, which is essential for any trader.

FAQ

What are paper trading brokers?

Paper trading brokers are online brokers that allow investors to trade stocks, bonds, and other securities using "play money." This is a great way to learn about the market and test out investment strategies without putting any real money at risk.

What are the benefits of using a paper trading broker?

The benefits of using a paper trading broker include being able to practice and test out strategies without risking any capital, gaining experience with the platform and interface of the broker, and building confidence in your abilities as a trader.

What should I look for in a paper trading broker?

When choosing a paper trading broker, it's important to consider your goals and objectives. Make sure to compare pricing, account minimums, and the features and tools that each platform offers. You'll also want to read reviews from other investors before making your final decision.

How do I open a paper trading account?

Opening a paper trading account is easy! Just create an account with one of the brokerages listed above and get some "virtual money" into your account. Then you're ready to start paper trading.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.