Top Forex Trading Simulators

Best free Forex trading simulators 2024 - RoboForex

TOP free Forex trading simulators 2024:

RoboForex - best simulator for MT4

IC Markets - best simulator for ECN accounts

XM - best simulator for beginners

Exness - best Cent account simulator

eToro - best copy trading simulator

Tickmill - best simulator for comfortable training

If you’re a beginner trader who isn’t ready to risk their real money trading, you might consider using a forex trading simulator. Forex trading simulators have features and tools that allow you to learn the ropes of trading without the financial risk that comes with live trading.

In this guide, we talk about the benefits and risks of a forex simulator, the best forex broker simulators, and more.

-

Is simulated trading the same as paper trading?

Yes, simulated trading and paper trading both refer to practicing trades without risking real money.

-

How long can I use a Forex simulator?

Most brokers offer unlimited access to their simulators so traders can practice for as long as they need until ready to trade live. Some may limit demo accounts to 30 days to encourage live trading.

-

Is historical market data available on simulators?

Yes, most simulators like MT4 Strategy Tester use real historical price data, allowing backtesting of strategies on past market movements for accuracy.

-

How realistic are conditions on a Forex simulator?

Simulator conditions aim to closely mimic real live markets and trading conditions. However, they can't fully replicate the pressures of trading with one's own capital at financial risk.

What is a Forex Simulator?

A forex simulator is a piece of software that simulates real market conditions. This tool is a great way for new traders to trade and practice their strategies with virtual money. That way, they can trade without having to worry about risking their real money, while at the same time, learning the ropes.

In addition to trading, beginner traders can use forex simulators to see charts, indicators, and economic news as if it were happening live.

Simulated trading is similar to demo trading. But the difference is that simulated trading goes off of historical data. With simulated trading, you’re able to place your orders, modify them, or close them just like you’d be able to do if you’re trading live.

A forex trading simulator can not only help you practice trading, but it can also help you test new trading ideas. Therefore, you’ll be able to find out what works and what doesn’t.

The many benefits of using a forex trading simulator include:

-

A live trading environment

-

Ability to test your trading strategy

-

Implement new trading ideas to see how they work

-

Risk-fee trading with all the tools and features of live trading

Best Free Forex Broker’s Simulators

| Best For | Trial Period | Supported Assets | $ Virtual Limit | |

|---|---|---|---|---|

Best MetaTrader Simulator |

Not limited |

Forex, CFDs |

N/A |

|

Best ECN Account Simulators |

After 30 days of inactivity |

Forex, CFDs |

N/A |

|

Best for beginners |

Not limited |

Forex, CFDs |

$100,000 |

|

Crypto and Stock trading |

None |

Forex, CFDs |

$10,000 |

|

Forex copy Trading simulator |

Not limited |

Forex, CFDs, Cryptocurrencies, Stocks |

$100,000 |

|

Best simulator for comfortable training |

30 days |

Forex, Stocks, and Cryptocurrencies |

N/A |

RoboForex Demo

RoboForex

RoboForex is a great choice for active CFD traders. The exchange offers traders 36 forex currency pairs, four cryptocurrency pairs, 100+ commodities, 10+ index CFDs, 12,000+ equity CFDs, and 1,000+ ETFs.

RoboForex offers a demo account that gives traders the ability to minimize their risks in the course of their work on financial markets. Trading with virtual money on demo accounts is an easy way for beginner traders to avoid any losses in training or experimental processes.

RoboForex has a copy trading platform called CopyFX that has a large number of functionalities. You can also get acquainted with the amount of commission charged by the trader for transactions, the frequency of payment of the commission, etc.

RoboForex offers a social trading platform, which functions as an affiliate program. This allows you to promote the trader to which you subscribe. On the trader’s profile, there will be a link for partners. The person who attracts new subscribers to the exchange can earn a commission. The amount of that commission will be displayed on the trader’s profile.

To get started trading on CopyFX, you must have a MetaTrader 4 account. You can system of cross-copying allows for the correct connection of various account types of traders and investors.

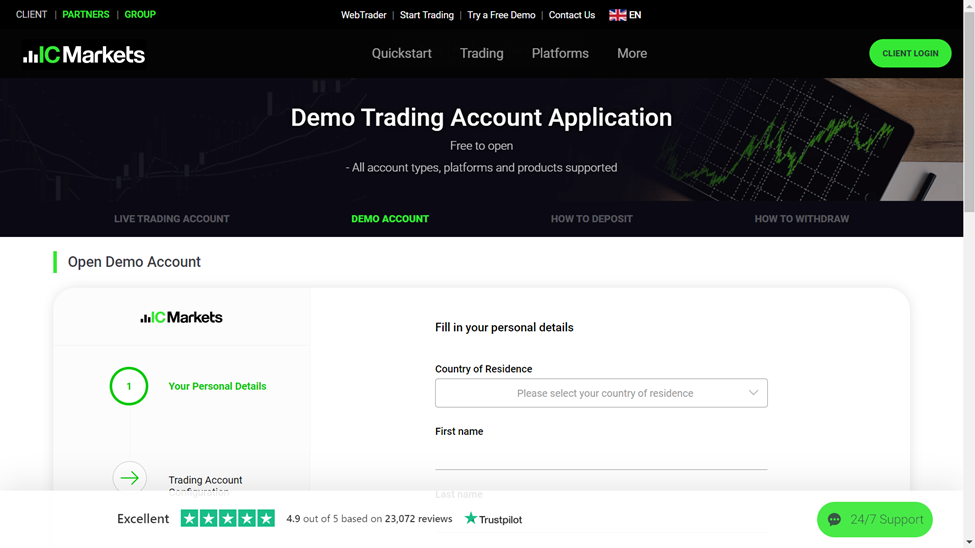

IC Markets Demo

IC Markets

IC Markets is one of the most popular forex trading exchanges in the world. On the platform, you can trade currencies, stocks, commodities, futures, bonds, and digital assets. Examples of forex currency pairs you can trade on IC Markets include:

AUDUSD

EURUSD

GBPUSD

USDCAD

USDJPY

IC Markets allows traders to open a demo account before getting started with live trading. A demo account with IC Markets allows you to enter the live market at no cost. You’re free to get familiar with the platform’s features without any risk.

You’ll be able to gain knowledge on how to determine lot sizes, how to execute an order, and how to set stop-losses and take-profit orders. Mistakes will happen in trading, so making those mistakes in a simulated environment is a great way to learn.

IC Markets’ demo account also provides a psychological benefit. You don’t have to fear losing real money if your trading strategies fail to work.

Opening a demo account with IC markets is simple. The broker allows you to trade on several different platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Once you learn the platform, you can open a live account with as little as $200. So, you don’t have to risk a lot of money when you make your first live trade if you make a mistake.

IC Markets offers Myfxbook AutoTrade, a service that allows you to copy the trades of any system you select directly into your IC Markets MetaTrader 4 account.With no order size restrictions or stop-loss/ take-profit distance limits, active traders can benefit from trading on IC Markets unparalleled spreads starting from 0.0 pips.

Myfxbook AutoTrade only shows systems that are profitable to the user. This means that you don’t have to look for those systems on your own. Plus, experts on the platform can only show the best income-generating profits chosen by the experts.

Only real accounts can provide trading signals, which helps to give you the peace of mind that your money is safe and properly handled through legitimate accounts.

You might also feel more confident with Myfxbook AutoTrade because trading systems are up-to-date with accurate statistics. Therefore, you’ll know that you’re trading with systems that have the best features for your needs and investment goals.

You also have complete control over the system, with the freedom and flexibility to remove or add trading systems at any given time. There are no hidden fees as the system maintains transparency.

You also don’t have to install complicated software or pay commissions based on trading volume. Using Myfxbook AutoTrade is easy. You just have to connect your trading account with Myfxbook and select the desired system or signal provider.

XM Demo

XM

XM does a great job in education. You can toy around with a demo account, watch trading platform tutorials, and learn from educational videos and high-quality webinars.

Their demo account gives you access to $100,000 in virtual money. A demo account with XM will allow you to test your trading abilities as you use virtual money.

After you’ve gained enough practice with a demo account and have learned how to place orders and make moves in the market, you can open a live account. In addition to a demo account, XM also offers different education materials, including a trading platform tutorial and educational videos

The platform provides over a 1,000 trading instruments, a spread as low as 0.6 pips. These instruments include forex, CFDs on stock indices, commodities (e.g. sugar, cocoa, wheat,etc.), stocks (over 600 companies), Metals (e.g. gold, silver, palladium, etc.), and energies (e.g. oil, gas, etc.). XM offers 55+ global currency pairs.

XM's web platform has many features, including a clear fee report, good customizability (for charts, workspace), and order confirmation. And if you’re a beginner, you might also appreciate that XM offers competitive fees, including low stock CFD fees and no withdrawal fee.

XM offers an easy account opening process. The process is quick, and the broker requires a low minimum deposit. For new traders, this is quite an attractive feature.

XM gives users many choices in terms of trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5). You can use MT4 to trade over 1,000 markets.

The MT5 platform offers additional features. It has a market depth function and more than 80 analytical objects. These options can help you make a profit. In addition to these features, MT5 supports trading in single-stock CFDs.

XM offers a Mirror Trader that enables XM clients to increase their trade potential along with different features, such as automatic strategy trading. It basically means automated trading with specific strategies.

Exness Demo

Exness

Exness is a forex and CFD broker that offers access to a wide range of trading instruments, including crypto, forex, metals, indices, stocks, and commodities.

Exness offers a free demo trading account for beginners, allowing them to practice forex trading in a 100% risk-free environment.

The Exness demo account doesn’t have an expiration date, which gives you the ability to learn the markets risk-free for as long as you wish. When you sign up for the Exness Demo account, you’ll get $10,000 USD in virtual funds.

Unfortunately, if you’re looking for a wide range of assets or instruments to trade, Exness may not be the best choice. But if you’re solely focused on forex, you’ll likely appreciate the platform since their primary focus is their forex instrument.

However, they do have some stocks, crypto, metals, and energies. The fees for these assets depend on the asset itself as well as the type of account you signed up for. Only with the standard cent account will you not have access to all the available assets and instruments.

What makes the features of Exness stand out from other brokers is that they don’t charge inactivity fees, deposit, or withdrawal fees. And in many cases, the platform allows you to make instant withdrawals. Exness also provides a transparent price history by providing tick-level data across all instruments.

Wondering if Exness is good for beginners? It’s great for both new and experienced traders. If you’re a new trader, you can take advantage of the intuitive Trading Terminal platform, which is a great stating point. Are you an advanced trader? You can take advantage of the advanced tools available on the MetaTrader platform and get extremely high leverage.

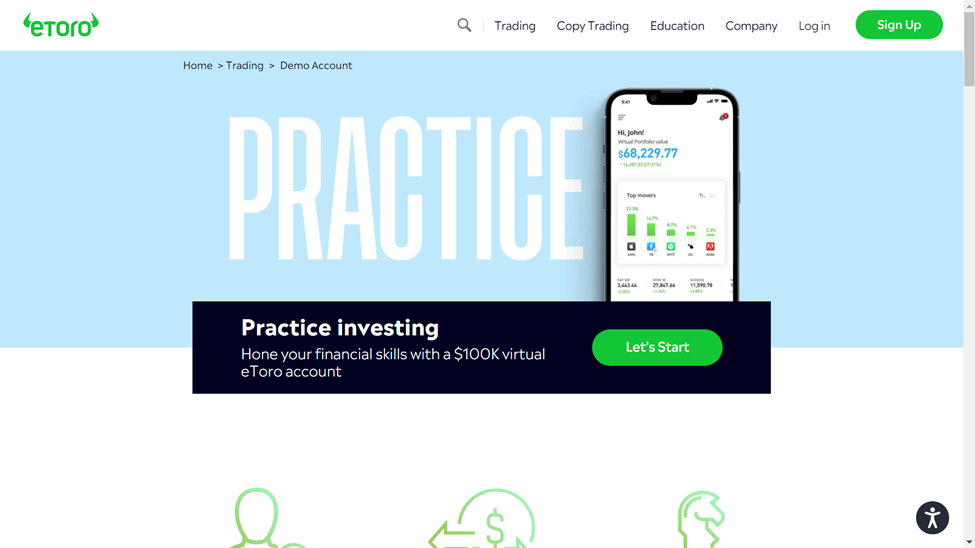

eToro Demo

eToro

eToro offers a forex trading exchange that’s great for beginners. It offers a way for forex traders to test forex trading, portfolio copy trading, and free stock trading.

On eToro, the markets are open from 9:30am to 4pm ET during normal business days (Monday to Friday). The available assets eToro has to offer include:

Stocks

Indices

ETFs

Currencies

Commodities

Cryptoassets

In terms of forex trading currency pairs, eToro offers over 45, with the most popular ones being EUR/USD, GBP/USD, NZD/USD, and AUD/USD.

eToro’s copy trading feature allows beginner investors to copy the trades of popular investors on the platform. These popular investors are given a risk score that’s visible to all users to mitigate risks.

If their score exceeds a certain point, their trades can no longer be copied by other users. This allows beginner traders to only copy the trades that are most likely to succeed and make profits. To use the copy trading feature, you must invest at least $200 with eToro.

In addition to copy trading, eToro offers a demo trading account that allows you to make mistakes and experiment with different investment strategies without any financial risk.

This type of account comes with $100,000 in demo funds, and you can use it for as long as you wish. You can switch your demo account to a live trading account with just a click of a button. eToro’s demo account also allows you to try out eToro’s trading platform and gain the experience to trade with confidence.

Tickmill Demo

Tickmill is a well-known broker that provides a demo account for users to learn and practice forex trading. The demo account is risk-free, meaning you can practice without worrying about losing real money. It’s available on the widely-used MT4 trading platform.

The Tickmill demo account is like a virtual trading playground. It lets you experience trading in real-time and use different trading tools. You get to play with virtual money, and you can try out various trading strategies to see what works best. Plus, you get to see real-time market data, which can help you understand how prices move.

One great thing about this demo account is that it's unlimited. So, you can use it for as long as you like until you feel confident enough to start real trading. You can access it either through the Tickmill website or their mobile app, so it’s easy to use whenever you want.

The demo account gives you a chance to get to know the Tickmill platform and its features. It offers more than 180 trading instruments from different markets like Forex, stocks, and even cryptocurrencies. This way, you can get a taste of trading in different markets.

Overall, Tickmill's demo account is a handy tool for anyone who wants to learn trading. It's like a practice field where you can train and build your skills before getting into the real game. It’s all about learning and gaining confidence without taking risks.

How to Get Started with RoboForex

Step 1

To begin, navigate to the RoboForex homepage on your internet browser. On the main page, locate the option for "Open a Demo Account".

Step 2

Click on the "Open a Demo Account" button. This action will redirect you to the account creation page. Enter your personal details, including your full name, email address, and phone number, to register.

Step 3

After filling in the details, click on the "Register" button. Subsequently, RoboForex will send you a confirmation code to your provided email address. Open your email, retrieve the confirmation code, and input it on the RoboForex site to verify your account.

Step 4

Once your account is verified, log in using the credentials you set up during registration. You will now have access to your demo account.

Best Forex Simulation Software Developers

MT4

The MT4 Trading Simulator Pro you can simply choose any date in the past and replay the market starting from that day. The simulator copies live market conditions that have taken place in the past.

When you take advantage of forex simulation on MT4, you can:

-

Get full control of your trading experience by choosing any instrument, timeframe, or range of time for your simulation. You can also change the pace of your simulation by slowing it down, speeding it up, or pausing it.

-

Use MT4 indicators

-

Use MT4 templates

-

Gain access to balance/equity graph and trade history

-

Save your trading results as HTML report

TradingView

TradingView allows simulated trading by giving you the ability to trade with “fake” money and practice buying and selling currencies. The trading and market conditions are essentially the same as if you were trading with real money. The only difference is that you can practice trading without any of the risk. The TradingView system tracks your orders and you can see how much Profit or Loss (PnL) you have on your account. As a result, you can gauge how good you are at trading.

To use Paper Trading, log in to your TradingView account. You’ll get $100,000 in virtual money, which you can reset at any time. The chart features “buy/sell” buttons, allowing you to enter orders quickly.

Forex.com

Forex.com offers a suite of trading platforms that are custom built to deliver maximum performance, flexibility, and speed. When you sign up on the platform, you’ll gain access to sophisticated trading features, integrated market insights, professional charting tools, and more. Using the software, you’ll be able to Backtest automated trading strategies with real historic price data.

Should I Try Forex Simulators?

Forex Simulation Benefits For Beginners

A risk-free environment: With a forex simulator, you can place trades on a demo account without having to worry about losing real money. As a result, you can devote your full attention to learning how to trade since emotions aren’t involved.

Live simulated quotes: Price quotes on forex simulated trading are similar to the price quotes in a live trading environment.

Adjustable timing: With real trading, you must wait for the daily candlestick to close. But when you use a forex simulator, you can adjust the speed. This gives you access to more candles, trades, and practice, all within a short period of time. In fact, one day's worth of data appears in only one minute on a good forex simulator.

All the tools of your trading platform are at your disposal: A forex simulator gives you a wide range of tools to leverage that can help you analyze the market. While embarking on your simulated trading adventure, you can use all the tools of your trading platform to analyze the market. As a result, you can get familiar with the tools as well as the many features of the trading platform itself.

Test trading strategies risk-free: You can test various trading strategies risk-free. Then, you can choose the one that’s best for you. The strategy should match your personality and trading style. As a result, you should be able to confidently move on to a real trading account.

Forex Simulation Limitations

The main issue with using a free trading simulator is that it won’t exactly mimic the real trading experience. There’s nothing quite like trading with real money. In fact, there are many factors of trading with actual money that don’t apply when you’re trading in a simulated market. These factors include

Your risk tolerance

Your investor profile

Initial capital

Investment horizon

Taxation in your country

The stress of having real money at risk

Risk management and money management strategies

How to Get Started

Step 1

eToro's demo mode simulates real-world trading, allowing beginners to learn how to trade by practicing for free. To get started, visit the eToro website homepage. Navigate to the menu option that says Trading, and hover your mouse over it. Choose Demo Account from the drop-down menu.

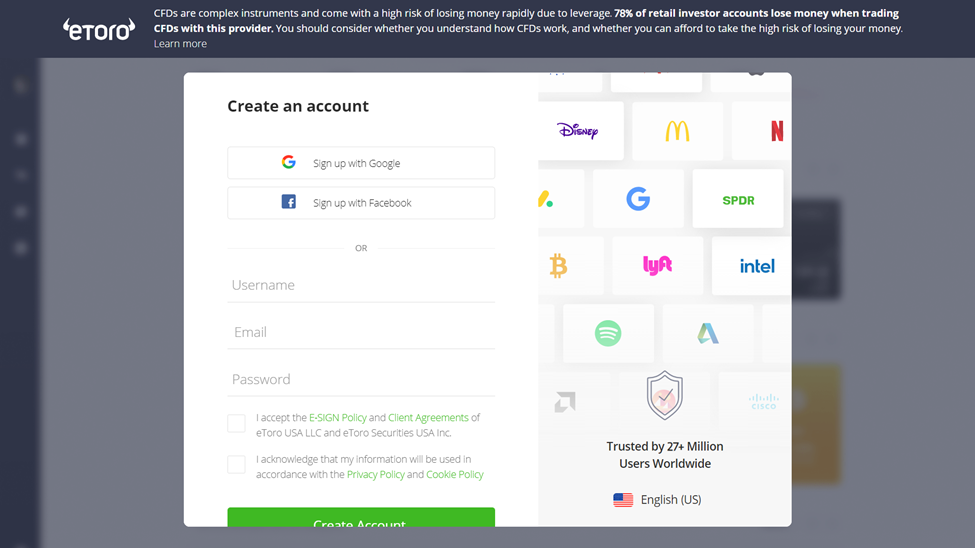

Step 2

Click the “Let’s Start” button at the top of the page. Create an account by either signing up with Google or Facebook, or make a username, email, and password. Verify your email address by entering the code that was sent to your email.

Creating an Account

Step 3

After confirming your email, log in to your account and get start trading.

How to Simulate Forex Trading

Trade as though it's real money. Don't take unnecessary risks just because it's not real money. Follow your trading plan and emotions as if it were real. Set realistic trading goals and limits - вefine the amount of virtual money you'll start with, the maximum risk per trade, number of trades per day/week, etc.

Practice different trading strategies. Use your simulated account to test different technical indicators, risk management techniques, or try out new strategies. Simulate real-world scenarios, place limit, stop and trailing orders. Practice hedging strategies and trading during volatile market events.

Record and analyze your trades. Review your trading activity and look for patterns in your wins/losses. Identify mistakes and areas for improvement.

Switch to a live account slowly. Only trade real money when consistently profitable on your simulated. Start small to minimize initial risks.

The key is to treat simulated trading like real trading as much as possible. Use the opportunity to practice skills and strategies in a risk-free environment.

Summary

Using a forex simulator is a great way to learn the ins and outs of forex trading without the risk that comes with live trading. By using real, historical market data, forex simulators give you the ability to see what real trading is like so that you can learn the markets.

There are many platforms that provide forex trading simulation. The one you choose depends on the platform’s ease of use, fees, and other key factors that matter to you.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.