Upward Trend In Trading. Definition And Meaning

Uptrend is a market condition in which prices are generally rising. Uptrends can be identified by using moving averages, trendlines, and support and resistance levels. Here are some key characteristics of an uptrend:

-

The highs of each candle are higher than the highs of the previous candles.

-

The lows of each candle are higher than the lows of the previous candles.

-

The trend is likely to continue until prices break below the important support level.

An uptrend is a market condition in which the majority of market participants expect prices of financial assets to increase in the future. The words "bullish", "rally" are often used to describe uptrends.

Understanding uptrends is crucial for investors and traders as it helps them make informed decisions about when to buy or hold assets, anticipating continued positive momentum.

This article will discuss the uptrend, its characteristics and definition and how to trade uptrends.

-

Why buy in an uptrend?

Opting for purchasing in an uptrend proves beneficial as it aligns with the positive flow of the market. In an uptrend, prices consistently increase, indicating positive sentiment and the potential for more gains. Traders often buy in uptrends to take advantage of the upward movement and ride the momentum for profitable trades.

What is an upward trend?

An uptrend is a positive movement in the market where the prices of assets consistently rise over a period. Think of it like the value of stocks or other investments rising steadily.

Now, let's understand how this appears on a price chart.

Example of an up-trend in the stock market

Example. Look at the graph showing the prices of an S&P 500 index over time. The stock market has been on a rising trend for almost 2 years after the panic associated with the spread of the coronavirus.

Visually, you'll see a series of higher highs and higher lows. The highs are the peaks, showing the highest prices reached, and the lows are the valleys, indicating that even the lower points are higher than before.

Best stock brokers

Characteristics of uptrends

Understanding the features of uptrends is essential for navigating the dynamic landscape of financial markets.

-

Bullish sentiments. Uptrends are associated with positive feelings, reflecting optimism among market participants. This positive outlook stimulates buying activity, further driving the upward trajectory of the asset's price. Positive economic indicators, favorable news, or strong corporate performance often contribute to this bullish sentiment, reinforcing the upward trend.

-

Increasing momentum. In an uptrend, momentum builds as the asset's price consistently rises. This is evident in the series of ascending peaks on the price chart, showcasing the growing strength of buyer interest. Traders often see this mounting momentum as a robust signal of a thriving uptrend, indicating potential opportunities for profitable trades.

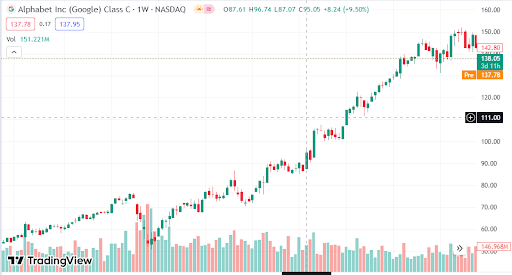

Example of an accelerating up-trend in the GOOG stock market

How to identify uptrends

Identifying uptrends is important for traders, empowering them to make informed decisions and capitalize on potential profit opportunities. While chart patterns and indicators serve as valuable tools for recognizing uptrends, defining these trends presents challenges amid market fluctuations and conflicting signals.

Chart Patterns

Chart Patterns for uptrend identification include observing:

-

Higher highs and higher lows, where a series of ascending peaks and troughs signifies strengthening upward momentum.

-

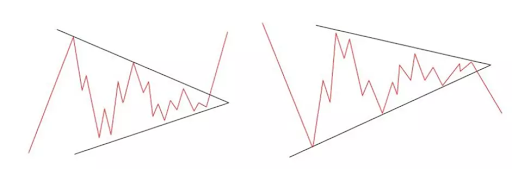

Triangles, especially ascending triangles, are also seen as continuation patterns, indicating a likely persistence of the uptrend.

Triangles pattern

-

Upward-sloping channels, formed by connecting successive higher highs and higher lows, further denote a sustained uptrend, aiding traders in identifying entry and exit points.

Indicators

Indicators for Uptrend Confirmation encompass:

-

The moving average is the indicator that provides dynamic support and resistance levels because its position is not static but changes according to a set period. That's why we have the 200-period MA or the 50-period MA.

Moving averages indicator

-

MACD Indicator, signaling a strengthening uptrend when the MACD line crosses above the signal line and histogram bars are above zero.

Example of up-trend and behavior of MACD, and MA indicators of different periods

However, Challenges in defining trends arise due to market fluctuations, where temporary pullbacks can occur even within an uptrend, making it challenging to ascertain its continuity. Conflicting signals from technical indicators add complexity, as divergent readings may arise, such as moving averages suggesting an uptrend. At the same time, the RSI indicates overbought conditions, hinting at a potential reversal.

How to trade uptrends?

Effectively trading uptrends involves implementing strategic approaches that align with the upward price movement.

A key strategy is buying at support levels, representing areas where prices historically bounced back, indicating potential entry points for trades. Identifying support levels through chart patterns, like trendlines or channels, assists traders in buying during periods of weakness, aiming to capitalize on the resumption of the uptrend.

Another crucial strategy is selling at resistance levels, representing areas where prices historically struggled to advance. Selling at these levels allows traders to secure profits before potential resistance, potentially preventing a reversal.

Utilizing stop-loss orders is fundamental for managing risk in uptrend trading. These orders automatically exit trades if the price falls below a predetermined level, preventing significant losses in case of an unexpected market reversal. Implementing stop-loss orders ensures traders maintain control over risk exposure and can limit potential losses.

Conclusion

A profound understanding and effective utilization of uptrends are indispensable for traders and investors. Uptrends offer valuable insights into market sentiment, empowering participants to make well-informed decisions. Recognizing uptrend characteristics, applying identification techniques, and implementing strategic trading approaches are key to fostering a successful trading carrier.

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Professionally, he has been a marketing professional running his agency for three years now. His agency helps finance projects to grow with the help of internet technologies. Upendra Goswami is an active investor and enthusiast of stocks and cryptocurrency.

Knows about

trading, blockchain, cryptocurrency, stock trading

Alumnus of

JECRC UDML College of Engineering, Jaipur

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.