Best Trend Following Strategy to Master in 2024

The best Forex trend-following trading strategies are:

-

1

Moving Average - traditionally reliable for trend trading

-

2

Ascending/Descending Triangle Breakout - bullish/bearish continuation pattern characterized by a horizontal resistance/support line and a rising/falling trendline

-

3

Average Directional Index (ADX) - measures the strength of a trend

-

4

Bollinger Bands - suggests trades based on price volatility

-

5

MACD (Moving Average Convergence Divergence) - generates early signal along with idea about strength of a potential price movement with the help of histogram

In the fast-paced world of Forex trading, staying ahead of market trends is crucial for success. Traders who can effectively identify and follow trends have the potential to capitalize on profitable opportunities and maximize their returns. This is where trend following strategies and indicators come into play. By utilizing these powerful tools, traders can enhance their decision-making process and increase their chances of making profitable trades. In this article, the experts at TU will explore some of the best trend following trading strategies and indicators that traders can learn and incorporate into their trading approach.

What is a trend-following trading strategy?

A trend-following trading strategy is a popular approach used by traders to identify and take advantage of the prevailing direction of market trends. It operates on the assumption that asset prices have a tendency to continue moving in a particular direction for a certain period before reversing.

When an asset is in an uptrend, its price is generally rising over time, characterized by a sequence of higher swing highs and higher swing lows. Traders who employ an uptrend strategy aim to enter long positions, anticipating further price appreciation. They may choose to buy shares or other assets, expecting the uptrend to persist and provide opportunities for profit.

Trend-Following Trading Strategy

Conversely, a downtrend occurs when the price of an asset is declining over time, marked by a series of lower swing highs and lower swing lows. Traders who follow a downtrend strategy seek to enter short positions, expecting the price to continue its downward trajectory. They may sell the stock or other assets, and if the downtrend persists and reaches a certain level, they may decide to exit the market altogether.

Trend-Following Trading Strategy

A sideways trend, also known as a ranging or consolidating market, occurs when the price of an asset moves within a relatively narrow range without showing a clear upward or downward direction. During a sideways trend, the price bounces between support and resistance levels, creating a trading range. Traders may find it challenging to apply trend-following strategies during this phase as there is no sustained trend to capitalize on.

Trend-Following Trading Strategy

By aligning their trades with the prevailing trend, trend-following traders aim to capitalize on the momentum and potential profits associated with sustained price movements. These strategies focus on objectively identifying and participating in trends rather than attempting to predict market reversals or counter-trend movements.

It is important to note that trend-following strategies can be applied to various financial markets, including stocks, currencies, commodities, and indices. The key is to identify the presence of a clear and established trend, which can be done using various technical indicators and chart patterns.

Best trend following indicators and strategies 2024

When it comes to trend following in Forex trading, there are several effective strategies and indicators that traders can learn and apply to their trading approach. Let's explore some of the top trend following strategies along with their entry and exit points.

Moving Average

The moving average strategy is a widely used trend following indicator. Traders use moving averages to analyze trends and generate trading signals. When the price is above the moving average, it indicates an uptrend, and when the price is below the moving average, it indicates a downtrend. Traders can enter long positions when the price crosses above the moving average or when it comes near the support zone (on the moving average line) and exit when the price crosses below it.

Moving Average Strategy

Ascending Triangle Breakout

An ascending triangle is a bullish continuation pattern characterized by a horizontal resistance line and a rising trendline. The strategy involves entering a long position when the price breaks above the upper resistance line of the triangle. This breakout suggests an acceleration of the existing uptrend. Use appropriate stop-loss and take-profit levels to manage risk and maximize potential profits.

Ascending Triangle Breakout Strategy

Descending Triangle Breakdown

A descending triangle is a bearish continuation pattern characterized by a horizontal support line and a descending trendline. The strategy involves entering a short position when the price breaks below the lower support line of the triangle. This breakdown suggests a resumption of the existing downtrend.

Descending Triangle Breakdown Strategy

Contrarian Bollinger Bands

Bollinger Bands consist of three lines: an upper band, a lower band, and a middle band, which is a moving average. These bands provide a visual representation of price volatility and help traders identify potential trades. The Contrarian Bollinger Bands strategy is a modern trend-following approach that utilizes the Bollinger Bands indicator to identify potential buying and selling opportunities. The strategy involves taking a long position when the price breaks above the upper Bollinger Band and subsequently takes support on the dynamic support line (between the two bands), which suggests a potential bullish trend continuation. Conversely, a short position is taken when the price breaks below the lower Bollinger Band and faces resistance from the dynamic resistance line, indicating a potential bearish trend continuation. Exit points can be determined at the break of dynamic support for a long position and vice versa.

Bollinger Bands Strategy

MACD (Moving Average Convergence Divergence)

The MACD (Moving Average Convergence Divergence) strategy is a versatile and widely used technique in Forex trading. It enables traders to assess market trends and momentum within a specific time frame by examining the relationship between moving averages and stock price momentum. By understanding the signals generated by the MACD indicator, traders can identify potential entry and exit points for their trades. The entry point for the MACD strategy (in a downtrend) occurs when the MACD line crosses below the signal line. This crossover generates a sell signal, indicating that a trader can consider entering a short position.

Moving Average Convergence Divergence Strategy

Average Directional Index (ADX)

The Average Directional Index measures the strength of a trend. Traders can consider entering a long position when the ADX line is above a certain threshold (e.g., 25) and rising, indicating a strengthening trend. They can exit the position when the ADX line starts to decline, suggesting a weakening trend.

-Strategy.png)

Average Directional Index (ADX) Strategy

Breakout Strategy

The Breakout strategy focuses on identifying significant price breakouts from consolidation patterns or key support/resistance levels. Traders seek opportunities when the price breaks above a resistance level or below a support level, indicating a potential entry point. This strategy aims to capture the momentum of a new trend. For the exit point, traders can employ various techniques such as trailing stops, target levels based on support/resistance zones, or the completion of a specific price pattern.

Breakout Strategy

Another illustration for breakout strategy can be an uptrend entering into a short-lived consolidation before breaking-out into another uptrend. The same is visualized in the following illustration:

Breakout Strategy

Trendline Trading

Trendline Trading strategy involves drawing trendlines by connecting consecutive higher lows in an uptrend or consecutive lower highs in a downtrend. Traders can use trendlines to identify potential entry and exit points. When the price breaks above a downtrend line or below an uptrend line, it may indicate a trend reversal or continuation. Traders can enter a trade based on these trendline breaks and exit when the price shows signs of a potential reversal or reaches a predetermined target.

Trendline Trading Strategy

Flag Pattern Strategy

The Flag Pattern strategy is a dynamic approach that focuses on capturing continuation patterns within an ongoing trend, whether it is ascending or descending. Flag patterns are reliable indicators that suggest the current trend is likely to resume after a temporary pause in the asset's price movement. Traders can enter a trade when the price breaks out of the flag pattern in the direction of the prevailing trend. Exit points can be determined using techniques like trailing stops, Fibonacci extensions, or target levels based on the size of the flagpole.

Flag Pattern Strategy

Benefits of trend-following strategies

Trend-following strategies offer a range of benefits for traders, making them an attractive approach to navigate the markets. Here are some of the key advantages of utilizing a trend-following strategy:

Profit potential:

Trend-following strategies are designed to capture the momentum of a trend, whether it's an upward or downward movement. By entering trades aligned with the prevailing trend, traders can potentially ride the trend and realize substantial profits. Trends can persist for extended periods, and trend followers aim to capitalize on these sustained price movements to maximize their returns

Simplicity:

One of the notable advantages of trend-following strategies is their simplicity. Traders only need to identify the direction of the trend and take positions accordingly. This straightforward approach makes trend following accessible to both novice and experienced traders, eliminating the need for complex analysis or intricate trading techniques

Time efficiency:

Trend-following strategies do not demand constant monitoring of the markets. Once a trend has been identified, traders can establish their trades and allow them to run until signs of a potential trend reversal emerge. This time efficiency is particularly beneficial for traders with limited availability for active trading, as it reduces the need for continuous market surveillance

Diversification:

Trend-following strategies can be applied across various financial markets, including stocks, commodities, currencies, and indices. This versatility allows traders to diversify their portfolios and take advantage of trends in different markets simultaneously. By spreading their investments across multiple markets, traders can mitigate risk and potentially enhance their overall trading performance

Lower transaction costs:

Compared to day trading Forex strategies, trend-following strategies generally involve holding positions for more extended periods. This reduced frequency of transactions leads to lower transaction costs, including reduced commissions and spreads. As a result, traders following trend-following strategies can benefit from cost savings, ultimately improving their profitability

Emotional discipline:

Trend-following strategies rely on objective criteria, such as trend direction and specific entry and exit rules. By adhering to a predefined trading plan, traders can minimize emotional decision-making, which is often driven by fear or greed. This disciplined approach helps traders maintain consistency and avoid impulsive trading decisions, leading to improved overall performance

Tips to keep in mind while trading a trend-following strategy

When implementing a trend-following strategy, there are important factors to keep in mind to maximize your trading success. Consider the following tips to enhance your approach and increase your odds of capturing and following profitable trends:

Buy high, sell higher:

In a trend-following strategy, the objective is to enter trades when prices are already rising (in an uptrend) or falling (in a downtrend). The idea is to ride the trend by buying securities at higher prices and selling them at even higher prices. This approach allows traders to capitalize on the momentum of an established trend

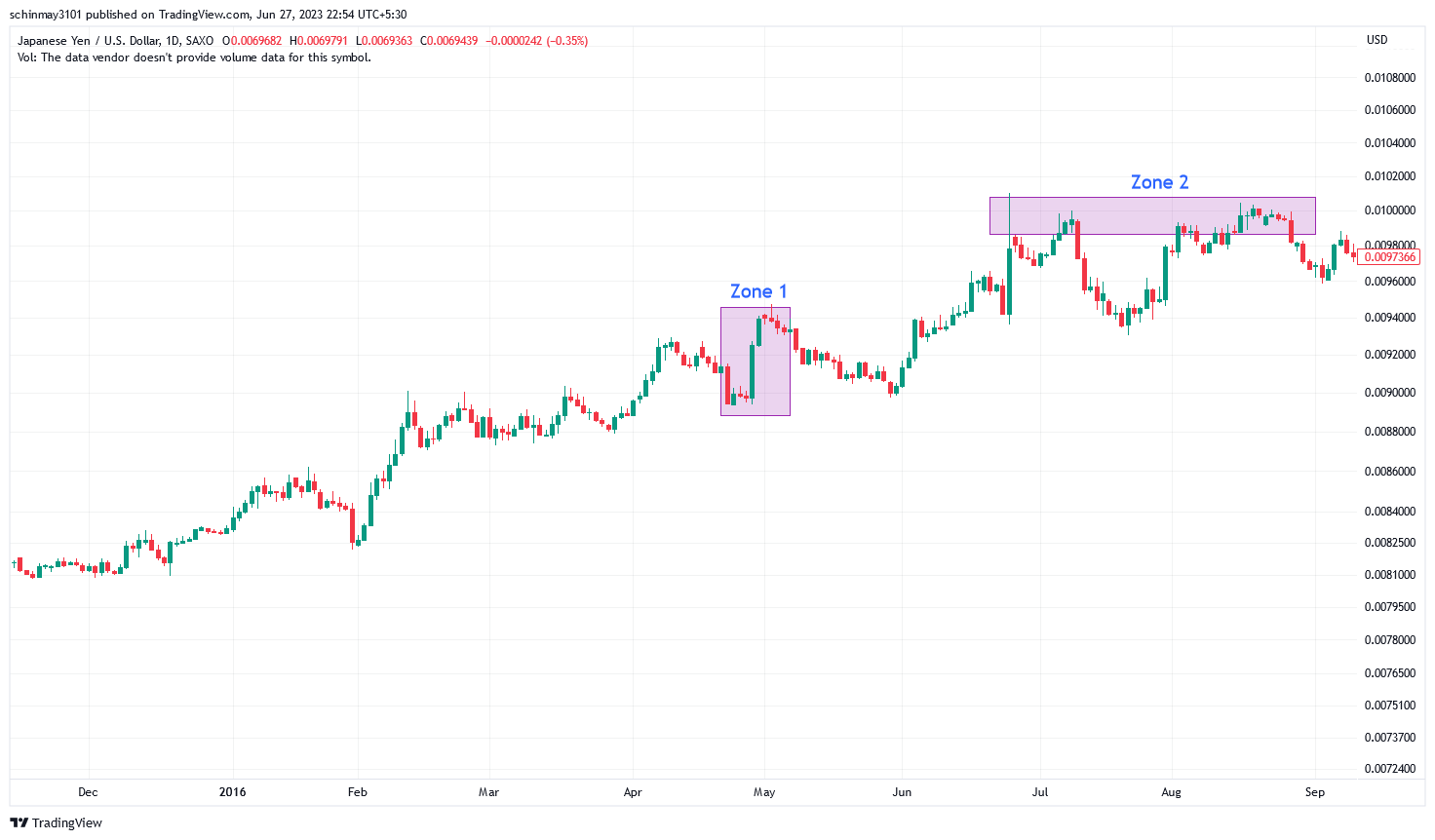

Trend-following chart

For an instance, look at the chart above, where the price is in a clear uptrend. A trend following trader would ideally act on a buy signal in Zone 1, which although is already higher but still gives reasonable assurance for trend continuation. The exit point would be at any peak in Zone 2, based on exit calls generated by the trader’s strategy.

Avoid market predictions:

Trying to predict future market movements can cloud your judgment and lead to costly trading mistakes. Instead of speculating on the market direction, focus on following the price action. By objectively observing and analyzing the actual price movement, you can make more informed trading decisions based on the current trend

Continuing our previous example, if a trader tried to predict that a downtrend would begin based on the length of the uptrend, and entered a short sell position, they would have undertaken a loss-taking trade, simply because they tried to predict against the trend instead of just following it.

Trend-following chart

Implement effective risk management:

Risk management is crucial in any trading strategy, including trend following. It is important not to risk more than a fraction of your trading capital on each trade. By setting appropriate stop-loss orders or employing risk management techniques such as position sizing, you can protect your capital and manage potential losses

Trend-following chart

If a trader entered the position at the top of Zone 1, they could have placed a stop-loss order at the price corresponding to the horizontal line in the above image. That level displays a broken-out resistance (turned into a support), which, if broken, could be a good cue for exiting a long trade. We can see that the price did not return to the stop-loss level and moved towards Zone 2, meaning that profit-booking was possible for the trader without triggering their stop loss.

Set stop-loss targets:

While trend-following strategies may not have specific profit targets, it is essential to establish stop-loss targets. A stop-loss order is a predetermined price level at which you will exit a trade to limit potential losses. This helps protect your capital and ensures that you exit a trade if the trend shows signs of reversing

Trend-following chart

For an instance, for a Zone 1 entry, a stop-loss target could have been set as the range of the most recent swing (6% for our case as denoted by the price range tool on the chart). A trader who had set a 6% stop-loss target from this entry point would have gotten 3 chances to exit this trade profitably, given that the target price (as denoted by the horizontal line across the chart) was hit thrice.

Diversify your market exposure:

Rather than focusing solely on one market, consider diversifying your trades across various markets. This can increase your chances of capturing and following different trends simultaneously. By spreading your trades across different markets, you mitigate the risk of relying on a single market and potentially enhance your overall trading performance

Does trend-following strategy work?

Yes, trend-following strategies have demonstrated their effectiveness and potential profitability in the financial markets. These strategies are based on a straightforward principle of capitalizing on upward price movements by buying and taking advantage of downward price movements by selling. By following the trend, traders aim to ride the momentum and capture profits from sustained price trends.

One of the key advantages of trend-following strategies is their simplicity. They rely on identifying the prevailing trend and taking positions accordingly, without the need for complex indicators or predictions. This simplicity makes it easier for traders to implement the strategy and reduces the risk of overcomplicating their trading decisions.

Furthermore, trend-following strategies often exhibit low correlation with other types of trading strategies. This means that when combined with other approaches or investment strategies, trend-following strategies can provide diversification benefits. The low correlation helps reduce overall portfolio risk and has the potential to enhance overall returns.

Best Forex brokers 2024

FAQs

What is the most successful trading strategy?

There is no single trading strategy that guarantees success as market conditions can vary. Different strategies work for different traders based on their goals, risk tolerance, and market conditions.

Is trend trading the best strategy?

Trend trading can be a highly effective strategy, especially in markets with clear and sustained trends. However, the best strategy ultimately depends on individual preferences and market conditions.

What is following the trend trading strategy?

Following the trend trading strategy involves identifying and capitalizing on established trends in the market. Traders aim to enter positions in the direction of the trend and stay in the trade until signs of a trend reversal appear.

What is the win rate for trend-following strategy?

The win rate for a trend-following strategy can vary depending on various factors such as market conditions, time frame, and specific trading rules. According to various experts, it is common for trend-following strategies to have a win rate ranging from 30% to 50%, with profitability achieved by maximizing gains during winning trades and managing losses during losing trades.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).