Pros And Cons of Intuitive Trading

Intuitive trading has its pros and cons. The main advantage is the high speed of decision-making, which can result in good profits. The main disadvantage is that it is very risky, since the trader does not take the proper risk management measures.

Intuitive trading is an approach to trading that relies on the trader's intuition and experience. Traders who use intuitive trading do not use technical or fundamental analysis, but instead rely on their gut feeling to make decisions about buying or selling assets.

What is intuitive trading?

Intuitive trading is an approach to trading based on the use of intuition and personal experience of the trader, in addition to traditional data analysis and strategies. In this case, traders make decisions based on subjective market perceptions, without strict rules and formalized methods.

Key features of intuitive trading:

Emotional factor. Decisions are made based on personal experience and an intuitive sense of the market, which can be influenced by emotions.

Lack of strict rules. Unlike a systematic approach, intuitive trading is not always easily formalized. Traders may change their approach depending on the situation.

Risk inclination. Intuitive traders may be more inclined to take risks, as decisions are based on hunches rather than clearly defined signals.

Experience and intuition. Intuitive traders often rely on accumulated experience and market knowledge, developing an intuitive understanding of what actions might be successful.

Individual approach. Each trader develops a unique style and approach to intuitive trading, making this method often unpredictable and subjective.

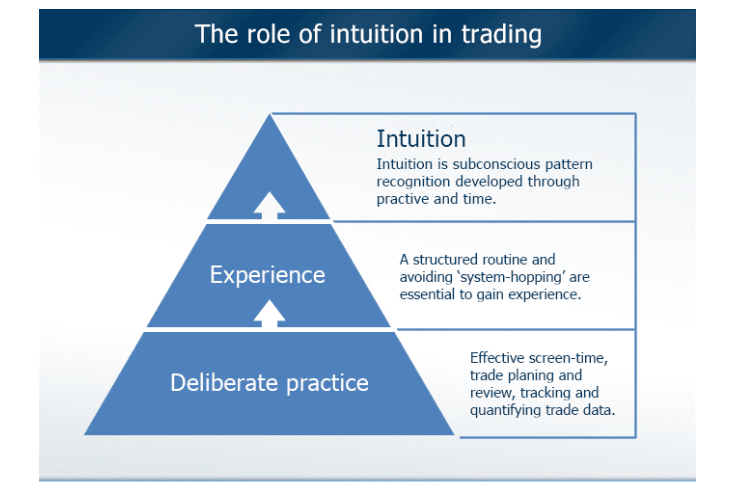

Image: The role of intuition in trading

👍 Advantages of Intuitive Trading:

• Fast and efficient. Intuitive trading allows traders to make decisions quickly, which can be especially helpful in volatile markets.

• Does not require complex tools. Intuitive trading does not require the use of complex tools, such as technical indicators or fundamental research. This makes it more accessible to beginner traders.

• Can be very profitable. Intuitive traders who are well-developed can be very profitable. They can use their strengths, such as their ability to quickly assess a situation and make decisions, to gain an edge in the market.

👎 Disadvantages of Intuitive Trading:

• Can be subjective. Intuitive trading is based on the trader's subjective assessments. This can lead to mistakes if the trader is unable to objectively assess the situation.

• Requires experience. Intuitive trading requires experience and practice. Traders who are just starting out may find it difficult to be successful with intuitive trading.

• Can be risky. Intuitive trading can be risky if the trader does not take the proper risk management measures.

Comparison of trading by technical analysis, fundamental and intuition

| Feature | Technical analysis | Fundamental analysis | Intuition |

|---|---|---|---|

|

Basis |

History of prices and volumes |

Economic data and news |

Trader's experience and knowledge |

|

Complexity |

Medium |

Complex |

Complex |

|

Accessibility |

Available to beginners |

Requires experience and knowledge |

Requires experience and practice |

|

Effectiveness |

Can be effective, but requires experience and knowledge |

Can be effective, but requires understanding of the economy |

Can be effective, but requires developing intuition |

|

Risks |

Can be risky if not used properly |

Can be risky if not used properly |

Can be risky if not used properly |

How to develop intuition skills in trading?

Intuition is the ability to quickly and accurately assess a situation without conscious logical analysis. It is based on the trader's experience, knowledge, and skills. An intuitive trader can quickly recognize patterns in market behavior and make an accurate forecast of its future direction.

Tips for developing intuition in trading:

Practice. The more you trade, the better you will understand your inner sense. Over time, you will learn to recognize patterns that are not visible to other traders.

Learn. Studying the basics of technical and fundamental analysis will help you better understand the market and make more informed decisions.

Develop critical thinking skills. Intuition should be based on logic and common sense. Learn to critically assess your decisions and identify errors.

Meditation and other self-development practices. Meditation helps to calm the mind and focus on the present moment. This can improve your ability to perceive intuitively.

Here are some specific exercises that can help you develop intuition in trading:

Before you open a trade, ask yourself: "What does my intuition tell me?". Pay attention to your sensations, emotions, and physical state.

Keep a journal in which you will record your intuitive sensations and the results of your trades. This will help you track your successes and failures.

Practice recognizing patterns in market behavior. Pay attention to the repetition of certain patterns and signals.

Talk to other experienced traders who use intuition in their trading. Learn about their methods and experience.

It is important to remember that intuition is a skill that takes time and practice. Do not expect to be able to immediately start making profitable trades using only your intuition. Start small and gradually increase your risk as you gain experience.

Tips for Intuitive Traders

Here are a few tips for intuitive traders that will help them increase their chances of success:

Train your intuition. The more you trade, the better you will understand your strengths and weaknesses.

Use risk management tools. This will help you protect your funds from losses.

Trust your gut. If you have a strong gut feeling about a trade, don't ignore it. However, it is also important to be aware of your biases and emotions.

Be disciplined. It can be tempting to follow your intuition even when it goes against your trading plan. It is important to stay disciplined and follow your plan, even if it means going against your intuition.

Be patient. It takes time to develop intuition. Don't expect to become an intuitive trader overnight.

If you want to try intuitive trading, start small and gradually increase your risk as you gain experience.

Conclusion

Intuitive trading can be an effective way to trade, but it also has its drawbacks. Traders who are considering using intuitive trading should be aware of these drawbacks and take steps to mitigate them.

Best Forex brokers

FAQ

Why is intuition important in trading?

Intuition is important in trading because it can help traders make quick and accurate decisions in a fast-paced market. It can also help traders to identify patterns and trends that may not be visible to other traders.

What is an intuitive trader?

An intuitive trader is a trader who relies on their gut feeling and experience to make trading decisions. They often have a deep understanding of the market and are able to quickly assess a situation and make a decision.

Does intuition work in trading?

Intuition can be a very effective tool for trading, but it is important to use it in conjunction with other methods, such as technical analysis or fundamental analysis. Intuition can help traders to make better decisions, but it is not a guarantee of success.

How to develop intuition skills in trading?

There are a few things that traders can do to develop their intuition skills:

-

Practice. The more traders trade, the better they will understand their gut feeling.

-

Learn from experience. Traders should pay attention to their successes and failures and learn from them.

-

Get feedback from other traders. Experienced traders can often provide valuable insights into the market.

-

Develop other skills. Traders should also develop their technical and fundamental analysis skills.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Fundamental Analysis

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.

-

4

Forex Trading

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly.

-

5

Risk Management

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Team that worked on the article

Alex Smith is a professional day trader for a proprietary trading firm within the foreign exchange (forex) and crypto markets. His area of expertise is day trading and swing trading within the 15min-4hr time frames for both the London and NY open.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).