Trading Plan Templates For Different Trading Styles

A trading plan template is a structured outline that provides a comprehensive framework for traders to navigate the complexities of financial markets and includes trading objectives, trading strategies, risk management parameters, entry and exit criteria, timeframes, and emotional management strategies.

Having a well-defined trading plan is crucial for success in the financial markets. A solid trading plan provides structure, guidelines and objectives for traders to follow. It helps manage risk, keep emotions in check and increase consistency in trading decisions. While the core components of a trading plan remain the same, the exact structure can vary based on an individual's trading style and market approach. In this article, we provide sample trading plan templates tailored for different trading styles. Traders can use these templates as a starting framework, customizing them to suit their own trading methodology, instruments and risk appetite. With a well-crafted trading plan aligned to one's trading style, traders can systematically follow rules-based strategies for improved execution and profitability.

Best Forex brokers 2024

What is a trading plan template?

A trading plan template is a structured outline that provides a comprehensive framework for traders to navigate the complexities of financial markets. It encompasses various elements such as trading objectives, trading strategies, risk management guidelines, entry and exit criteria, timeframes, and emotional management strategies. The template serves as a strategic roadmap, helping traders make informed and disciplined decisions by outlining a systematic approach to their trading activities.

Trading plan acts as a guiding beacon in the unpredictable world of trading, offering a well-defined structure to help traders stay focused and organized. A trading plan helps traders define their goals, set clear strategies to achieve those goals, and articulate how they will manage risk effectively. It promotes disciplined trading by laying out specific rules for entry, exit, and position sizing, reducing the likelihood of impulsive decisions driven by emotions.

Furthermore, a trading plan template fosters adaptability by allowing traders to anticipate and plan for different market scenarios. It provides a benchmark against which traders can assess their performance and make necessary adjustments. Ultimately, a well-crafted trading plan template empowers traders to approach the markets with a coherent strategy, enhancing their chances of success and enabling them to navigate the challenges and opportunities that trading presents. A trading plan is an important part of a trading system. If you want to learn more about the basic elements of a trading system, read the Traders Union article.

Free trading plan templates (Download PDF)

Please note that the provided trading plan templates are intended as illustrative examples and should be viewed as starting points for your trading journey. As every trader's approach, strategies, and risk management preferences are distinct, it's crucial to personalize these templates to align with your unique trading style and goals. Think of these templates as adaptable frameworks that can be modified to better suit your individual needs. Remember to regularly review and adjust your plan to reflect changing market conditions and your evolving expertise as a trader. By customizing these templates, you can create a trading plan that is tailored to your strengths and objectives, enhancing your chances of success in the dynamic world of trading.

Trading plan rules

Crafting a trading plan is akin to building a sturdy vessel that guides traders through the unpredictable seas of the financial markets. This vessel, however, requires a set of well-defined rules to ensure safe navigation and maximize the potential for consistent success. These key trading plan rules serve as the compass, offering direction and discipline in a landscape often fraught with uncertainty.

Clear objectives. A trading plan must begin with specific and achievable objectives. Whether aiming for short-term gains, long-term growth, or income generation, these goals provide the foundation for all subsequent decisions

Defined strategies. Every trader operates with a unique approach. Documenting these strategies, whether technical analysis, fundamental analysis, or a combination, ensures that decisions are methodical rather than impulsive

Risk management. Managing risk is paramount. Establishing risk tolerance, setting stop-loss levels, and determining position sizes help protect capital from substantial losses

Entry and exit criteria. Precisely defining entry and exit points minimizes ambiguity and emotional decision-making. These criteria can be based on technical indicators, trend reversals, or market events

Timeframes. Trading plans should stipulate the preferred timeframes for executing trades. Different timeframes cater to distinct trading styles and risk appetites

Review and adaptation. The markets are dynamic, necessitating regular plan reviews. A trading plan should be flexible, allowing for adjustments in response to changing market conditions and personal growth

Journaling and analysis. Maintaining a trading journal to record executed trades and their outcomes aids in evaluating the effectiveness of the plan. This reflective practice facilitates continuous improvement

Emotion management. Acknowledging emotions and establishing mechanisms to prevent them from dictating decisions is crucial. A solid trading plan helps counteract emotional impulses

Diversification. Spreading investments across different assets mitigates risk by reducing exposure to a single market's volatility

As traders embrace these key trading plan rules, they elevate their trading endeavors from mere speculation to strategic, calculated execution. A well-structured trading plan with these guiding principles empowers traders to make informed decisions, manage risks, and navigate the complexities of the financial markets with greater confidence and resilience.

Are all trading plans the same?

Trading plans, much like the diverse landscapes of the financial markets themselves, exhibit a remarkable range of individuality and specificity. While the core elements of a trading plan – goals, strategies, risk management – remain constant, the nuances within these components vary significantly based on a trader's unique approach, risk tolerance, and trading style. This variation is precisely why traders cannot adopt a one-size-fits-all mentality when crafting their trading plans.

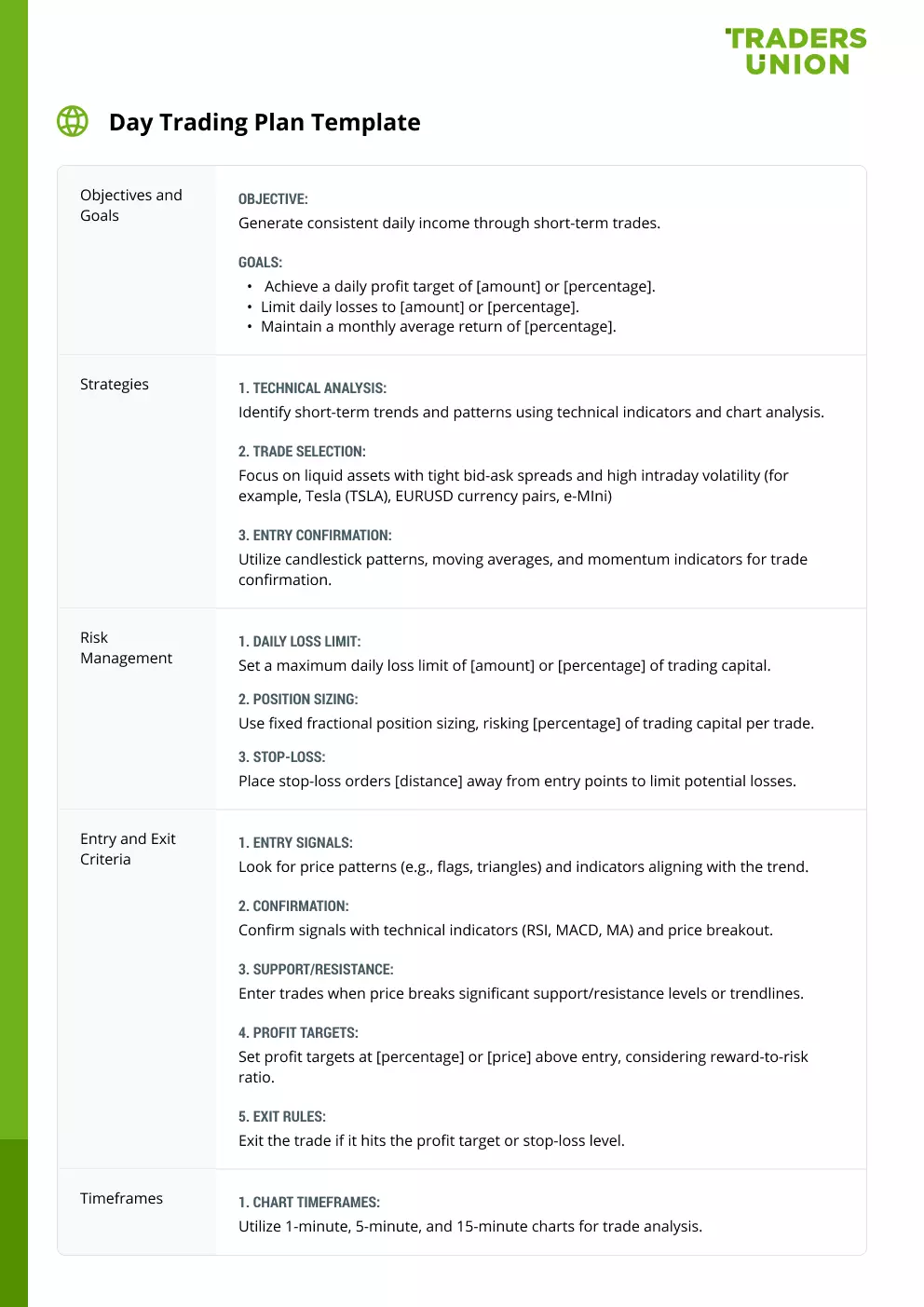

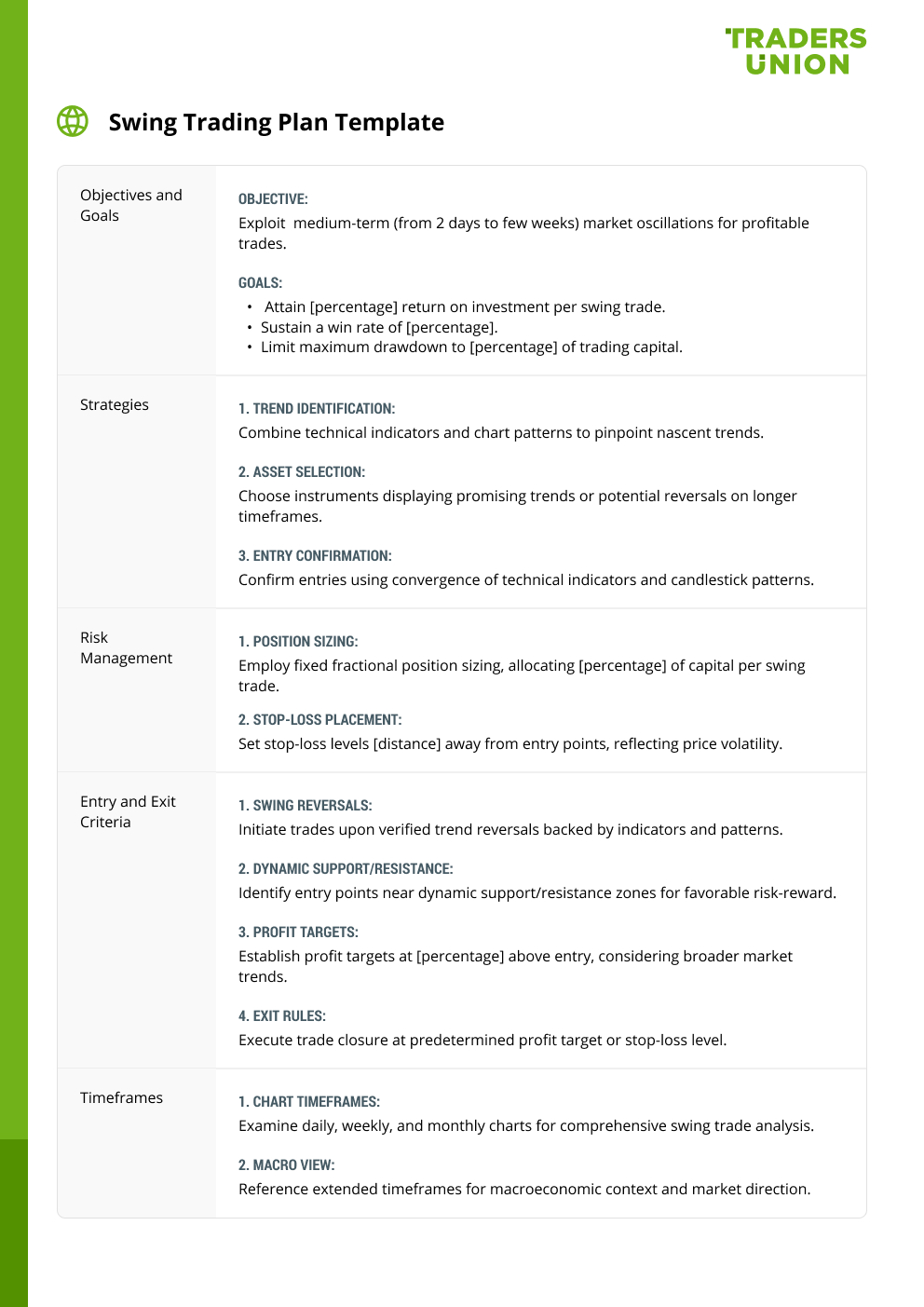

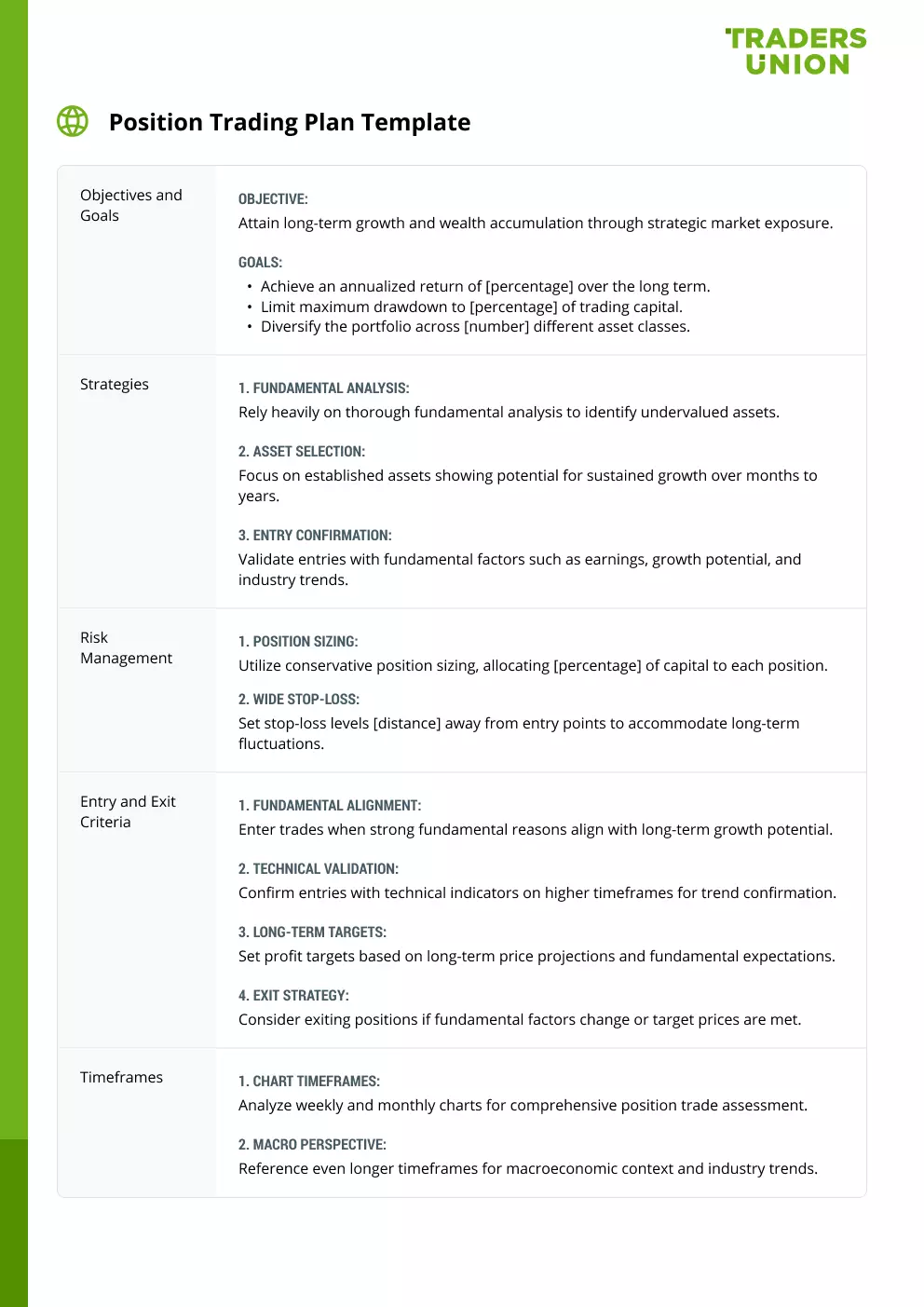

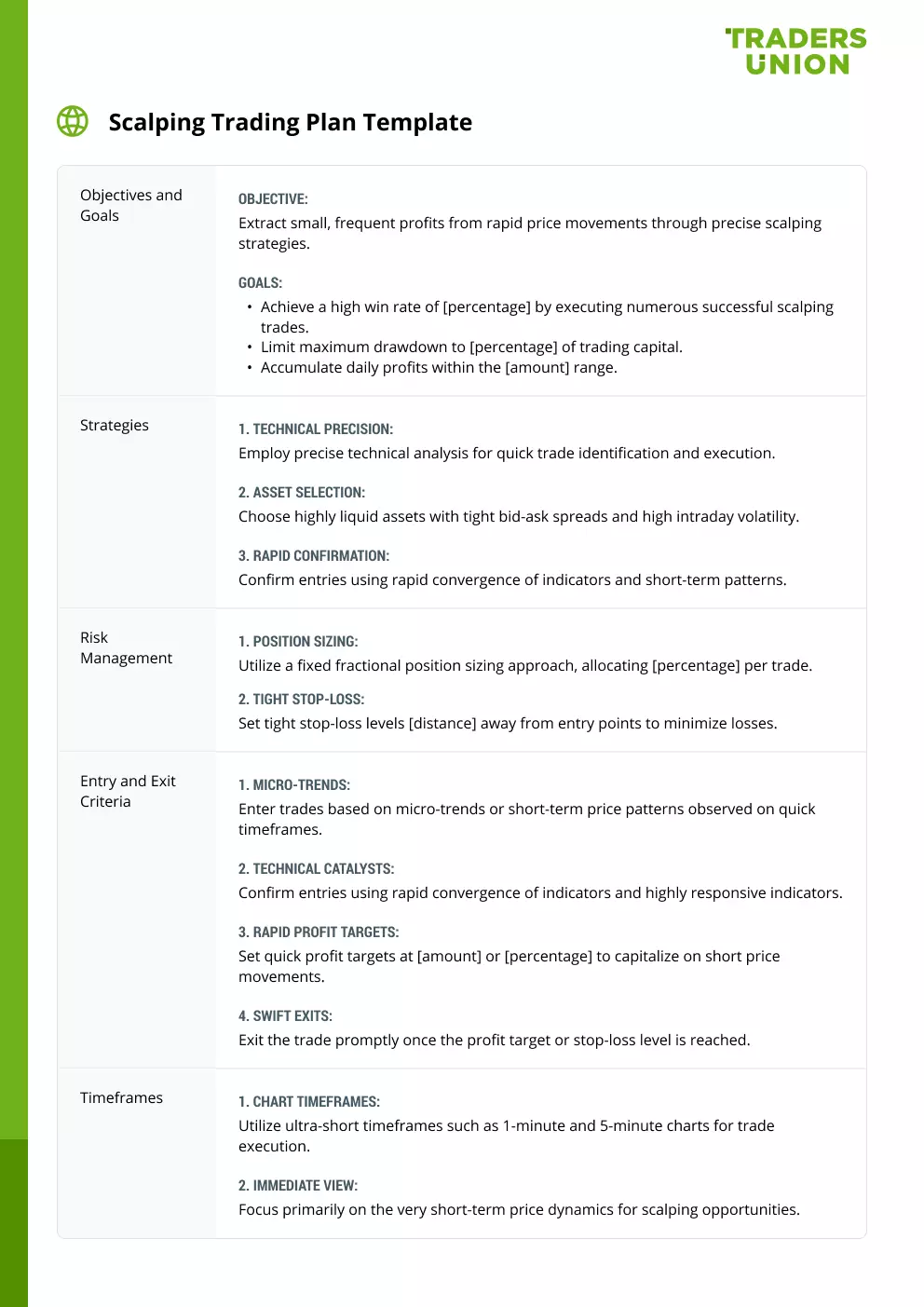

The diversity in trading plans emerges from the myriad trading styles that traders adopt, such as day trading, swing trading, position trading, and algorithmic trading, each requiring distinct strategies, timeframes, and risk management tactics. The market instruments being traded – whether it's stocks, Forex, commodities, or cryptocurrencies – also play a role in shaping the specifics of a trading plan. Additionally, individual preferences, risk appetites, and market knowledge further contribute to the personalized nature of trading plans. Recognizing these differences and tailoring a trading plan accordingly enhances its effectiveness and aligns it with the trader's objectives.

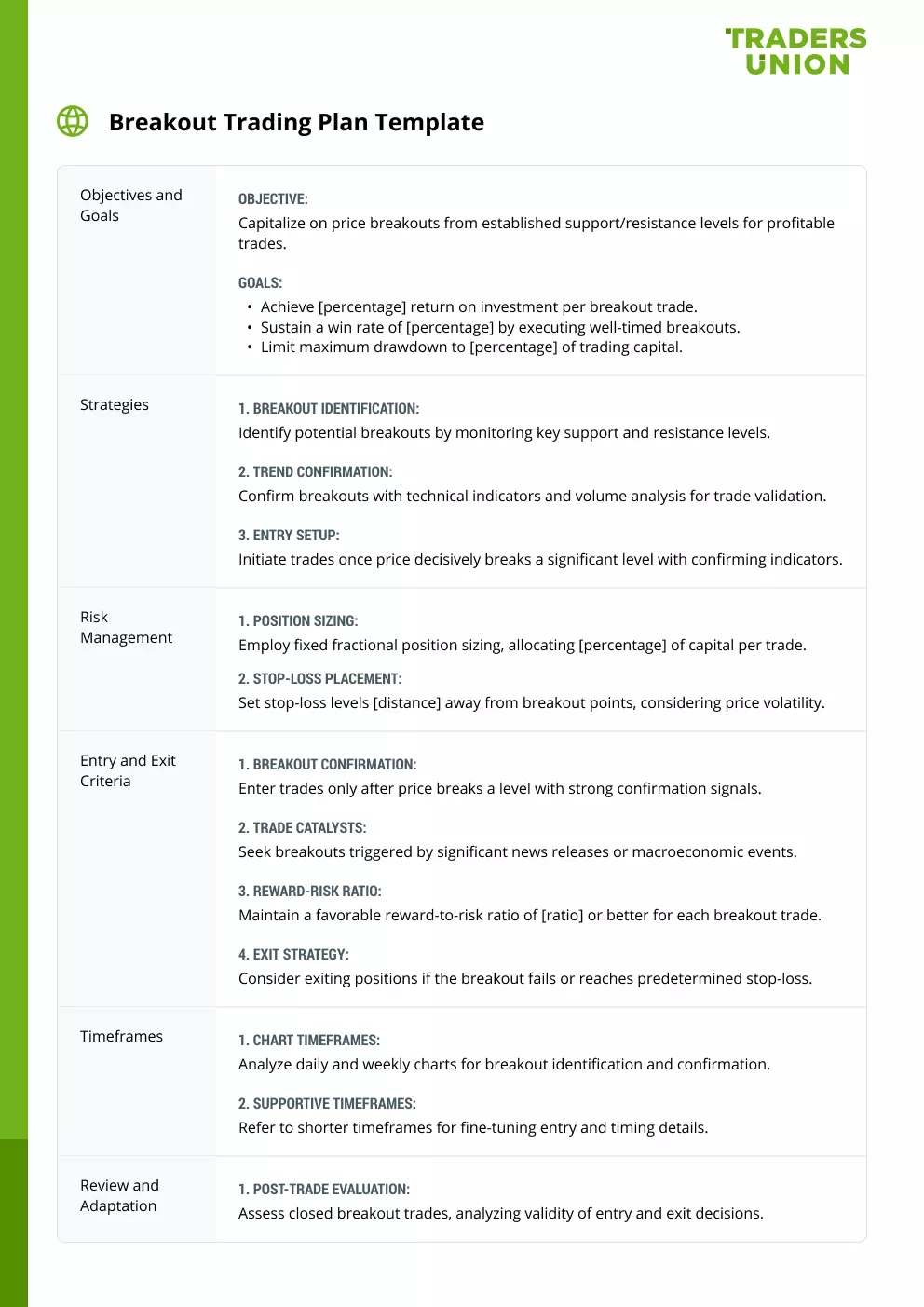

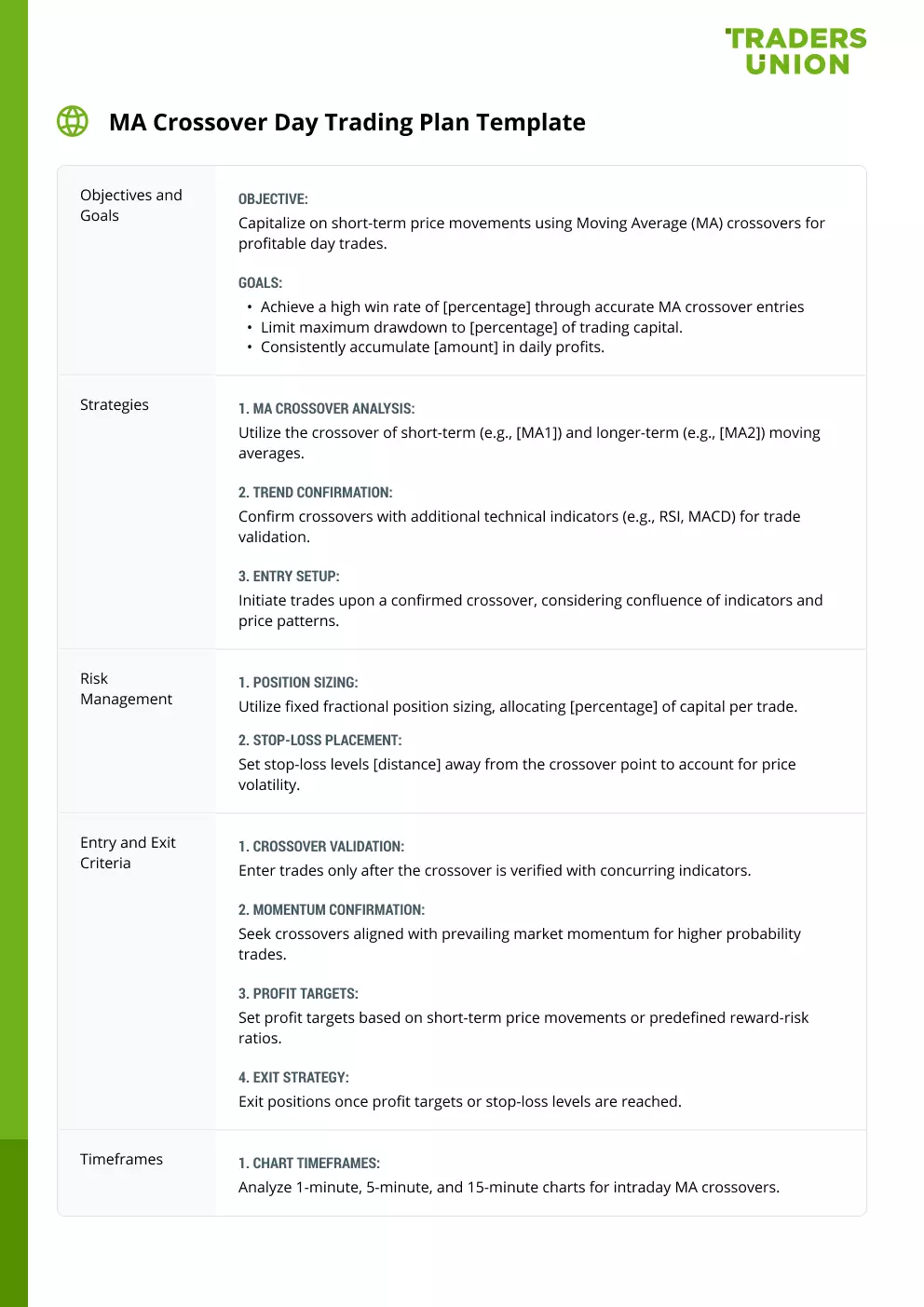

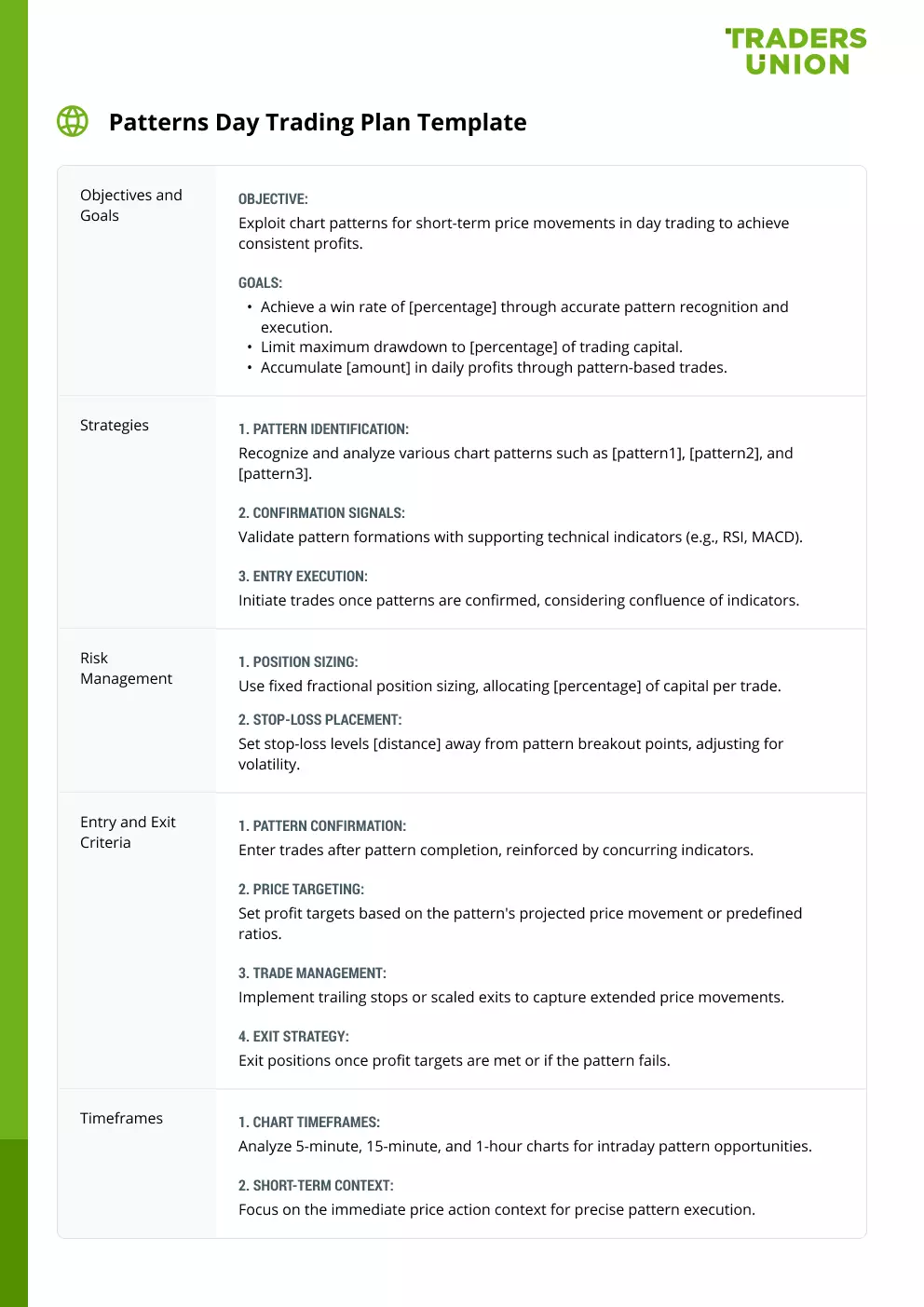

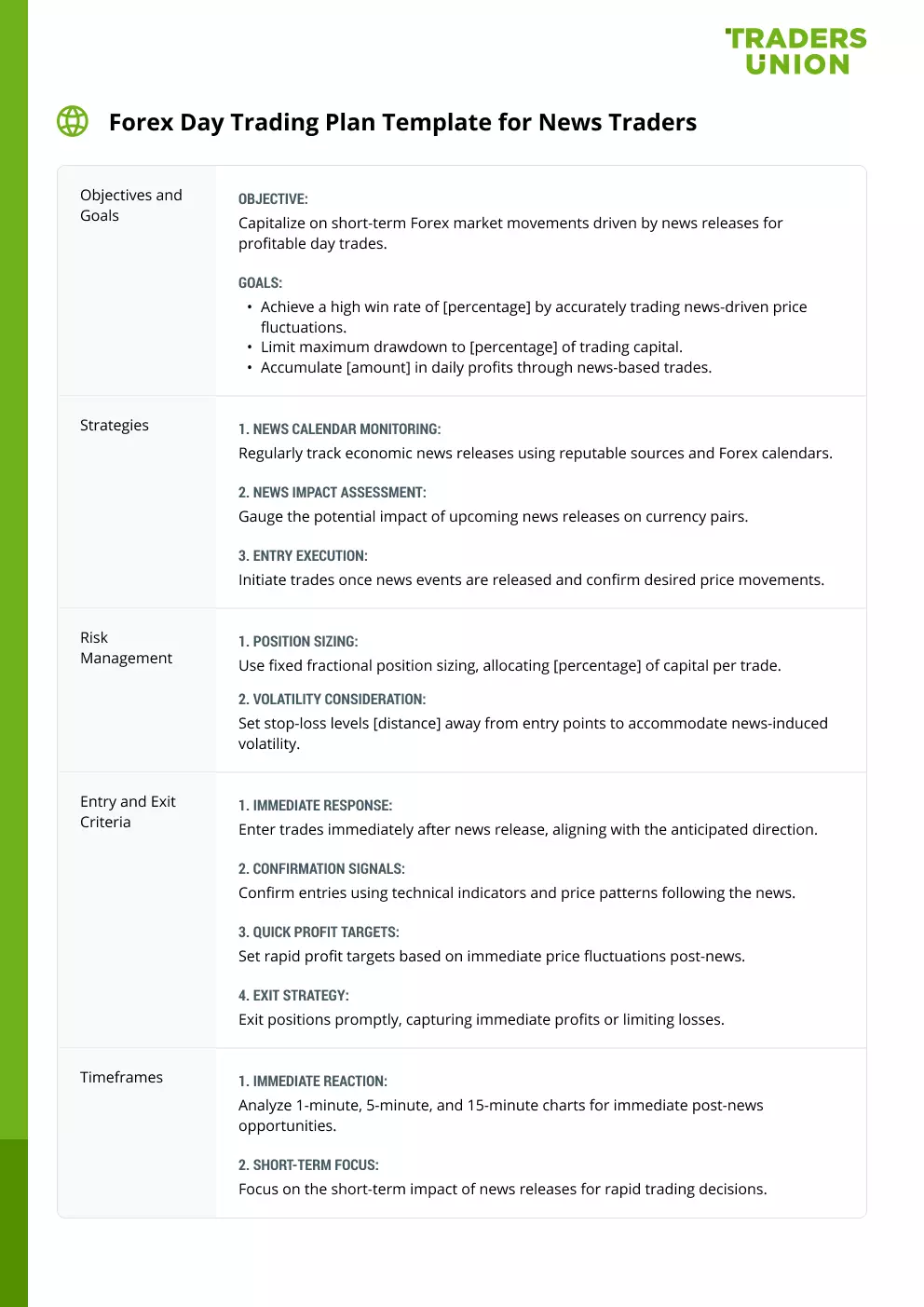

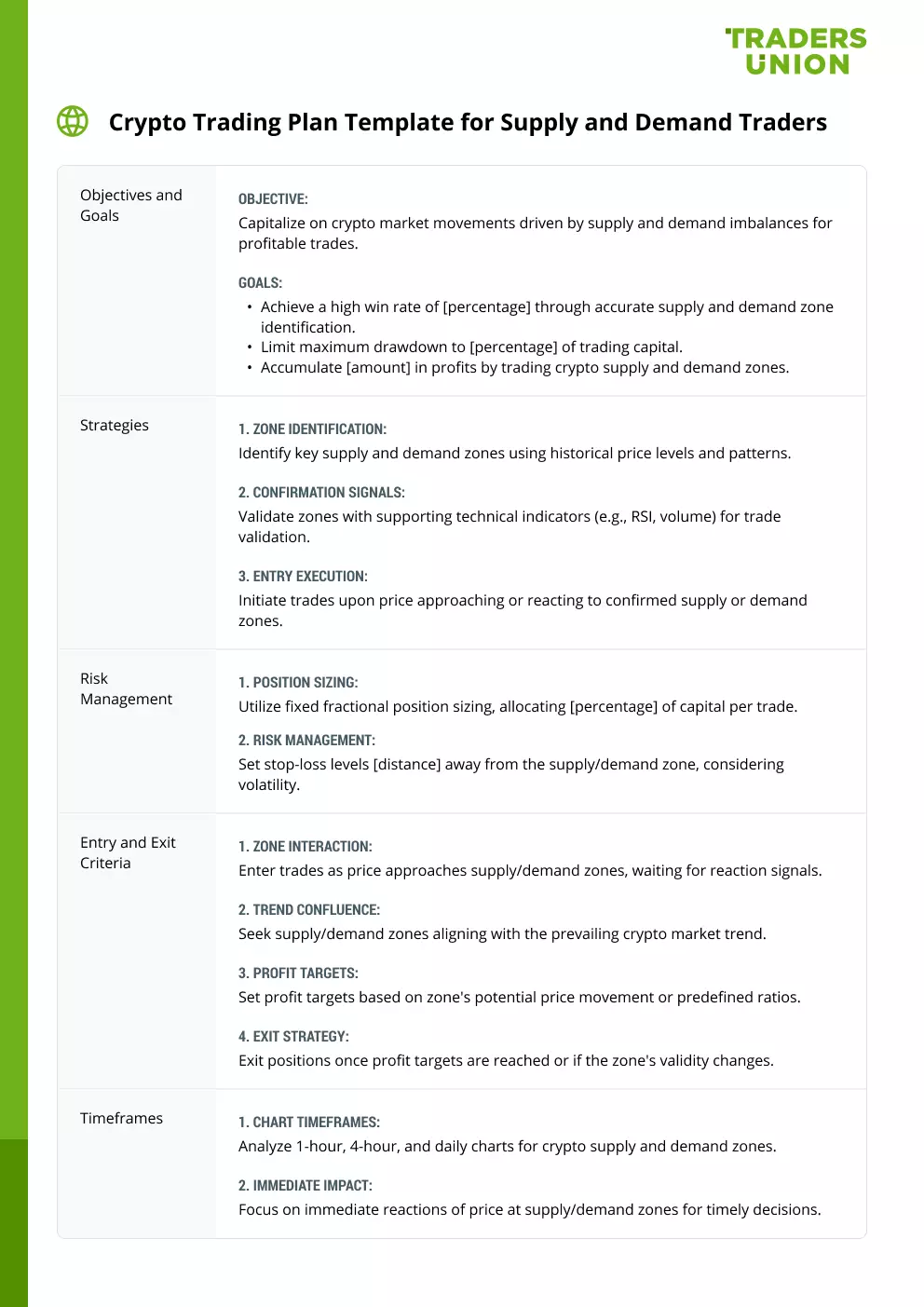

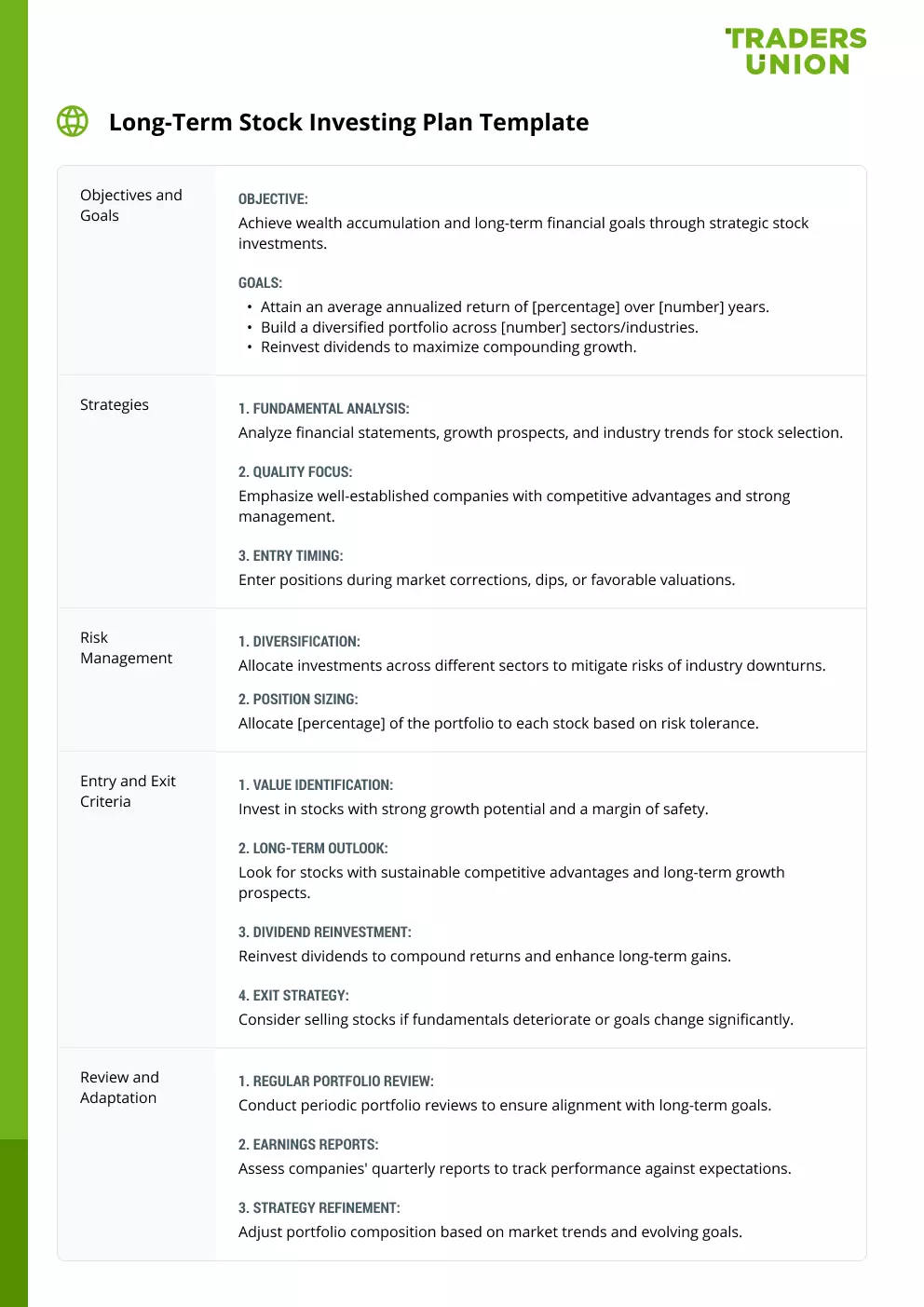

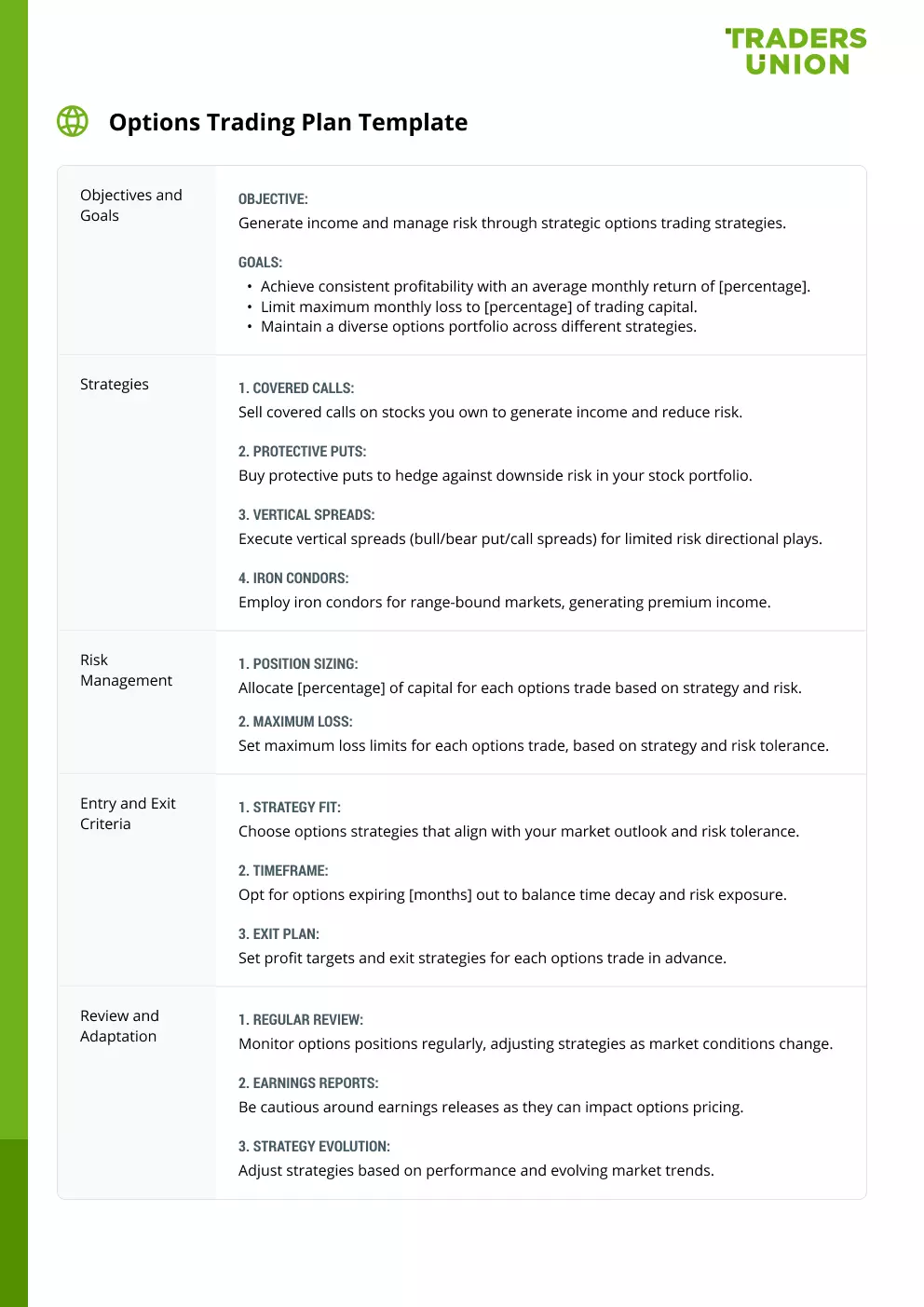

To address this need for tailored trading plans, Traders Union experts have meticulously curated trading plan templates for various trading styles.

How to customize a trading plan template

Customizing a trading plan template to suit your trading style involves several key steps. Remember, customization is about tailoring the template to enhance its compatibility with your unique trading approach. By following these steps, you'll create a personalized trading plan that aligns with your strategies, risk tolerance, and objectives:

Define your trading style. Begin by clearly identifying your trading style, whether it's day trading, swing trading, position trading, or a combination. Understand the timeframes you'll be operating in, the frequency of trades, and the strategies that resonate with your approach

Adapt strategies. Modify the strategies outlined in the template to align with your chosen trading style. If you're a day trader, focus on strategies suited for short-term price movements. For longer-term investors, emphasize strategies that align with fundamental analysis and long-term trends

Tailor risk management. Adjust risk management parameters according to your risk tolerance. Customize position sizing, stop-loss levels, and maximum drawdown percentages based on what aligns with your comfort level

Fine-tune timeframes. Customize the timeframe analysis to match your trading style. If you're a day trader, focus on shorter timeframes like 5-minute or 15-minute charts. For long-term investors, prioritize daily and weekly charts

Address psychological factors. Modify the emotional management section to address psychological challenges specific to your trading style. If you're a day trader, include strategies to manage the stress of rapid decision-making. For long-term investors, emphasize patience and discipline during extended holding periods

Expert Opinion

While templates provide a good starting point, it's vital that traders truly understand the purpose and importance of each section before customizing. Don't simply copy templates - take time to thoughtfully consider your individual goals, personality, strengths, and weaknesses. Your trading plan should be an accurate reflection of who you are as a trader.

Two areas I recommend traders spend special focus on are defining their edge and managing risk. When outlining strategies, be honest about what approach you have an advantage with. Don't just list popular strategies - find what really works for you based on your skills and market perspective.

Equally important is ensuring your risk management is emotionally as well as financially robust. Set stop losses at a level you're fully committed to adhering to, even during drawdowns. Clearly define under what conditions you'll exit trades or take a break from the markets. How you manage inevitable losses could be the difference between long-term success and failure.

With a dedication to continually reviewing and improving your plan over time, it will become a trusted roadmap to guide your decision-making.

FAQs

How do I create a trading plan template?

Creating a trading plan template involves outlining your trading objectives, defining strategies, setting risk management parameters, and detailing entry and exit criteria. Consider your trading style, goals, and risk tolerance to ensure the plan suits your needs.

Can I customize a trading plan template?

Absolutely, customization is vital. While templates provide a foundation, adapting them to your unique trading style, strategies, and risk management is crucial to match your preferences and maximize effectiveness.

How often should I change my trading plan?

Regular review is key. Reevaluate your trading plan periodically, particularly when market conditions change or your trading objectives evolve. Adapt as needed to stay aligned with your current goals and market dynamics.

Should I customize my trading plan to different asset classes?

Yes, customization is important across different asset classes. Each asset class has its nuances, so tailoring your trading plan to fit the characteristics of specific asset classes can optimize your trading strategies and outcomes.

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.