Black Swans In Forex Trading Explained

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The term "Black Swan" was popularized by Nassim Nicholas Taleb, a former Wall Street trader and professor, in his 2007 book The Black Swan: The Impact of the Highly Improbable. A Black Swan event has three key characteristics:

- It is unpredictable and lies outside the realm of regular expectations.

- It carries a massive impact.

- After the fact, it appears predictable and explainable.

This article will discuss the key aspects of Black Swan events and how to handle them. We explore notable historical Black Swans in Forex and give key considerations for Forex traders.

Notable historical Black Swans in Forex and finance

Black Swan events can drastically alter Forex market dynamics, often resulting in significant currency fluctuations. For example, during the 2008 financial crisis, the US dollar initially strengthened as investors sought safe-haven assets, but later saw volatility as the crisis unfolded. Similarly, the COVID-19 pandemic led to sharp movements in currency pairs as governments implemented unprecedented fiscal and monetary measures. Having an understanding of these events can help you plan better around them.

Black Swan events have had dramatic effects on financial markets throughout history. Here are some notable examples:

The 1997 Asian financial crisis: Triggered by the collapse of the Thai baht, this crisis led to significant currency devaluations and economic turmoil across several Asian countries. For instance, the Thai baht lost half of its value, and Indonesia’s rupiah dropped by up to 80% against the US dollar, causing widespread financial instability.

The 2008 Global financial crisis: Sparked by the collapse of Lehman Brothers, this event caused a worldwide financial meltdown, leading to severe market contractions and economic recessions. Major currencies like the Euro and British Pound saw extreme volatility, with the Euro dropping from 1.60 USD to 1.25 USD in a matter of months.

The COVID-19 pandemic: In 2020, the pandemic caused unexpected disruptions to global economies, leading to massive volatility in Forex markets. The US dollar initially surged as a safe-haven currency, but later experienced volatility as different countries implemented various fiscal and monetary measures to counter the economic fallout.

9/11 terrorist attacks: The attacks on September 11, 2001, led to immediate market crashes and long-term economic consequences. The US dollar fell sharply against other major currencies, and global markets were in turmoil as investors sought safe-haven assets like gold and Swiss francs.

The dotcom crash: The early 2000s saw the bursting of the dotcom bubble, leading to massive losses in technology stocks and a broader market downturn. The US dollar index experienced significant fluctuations during this period as investor sentiment shifted dramatically.

| Event | Date | Impact on Forex markets |

|---|---|---|

Asian financial crisis | 1997-1998 | Major devaluation of Asian currencies, economic stagnation |

Global financial crisis | 2008 | Severe market contractions, collapse of major financial institutions |

COVID-19 pandemic | 2020 | Unprecedented market volatility, global economic disruptions |

9/11 attacks | 2001 | Immediate market crashes, long-term economic impact |

Dotcom crash | 2000-2002 | Massive losses in technology stocks, broader market downturn |

Forms of Black Swans in Forex trading

Black swan events in Forex trading can manifest in numerous ways, each with its unique triggers and impacts. Here are some of the various forms that black swans can take:

Economic Shocks

Unexpected Policy Changes: Central banks may unexpectedly change interest rates or monetary policies. For example, the Swiss National Bank's sudden removal of the CHF peg to the euro in 2015 caused massive market upheaval.

Financial Crises: Sudden financial crises, like the 2008 global financial crisis, can drastically impact currency values as investors rush to safe-haven assets.

Geopolitical Events

Wars and Conflicts: Outbreaks of war or geopolitical conflicts can cause immediate and severe reactions in the Forex market. The invasion of Ukraine by Russia in 2022 led to significant volatility in the ruble and other related currencies.

Political Instability: Political upheavals, such as coups or major governmental changes, can lead to rapid devaluation of a country’s currency.

Natural Disasters

Catastrophic Events: Earthquakes, tsunamis, and other natural disasters can have immediate economic impacts, affecting a nation’s currency value. For instance, the 2011 earthquake and tsunami in Japan led to significant movements in the yen.

Pandemics: The COVID-19 pandemic is a prime example, causing unprecedented market volatility and economic uncertainty globally.

Market Manipulation

Fraudulent Activities: Large-scale fraud or manipulation, such as the LIBOR scandal, can disrupt financial markets and currency valuations.

Sudden Market Moves: Flash crashes caused by algorithmic trading or other market manipulations can result in extreme, short-term volatility.

Technological Failures

Cyber Attacks: Major cyber-attacks on financial institutions or trading platforms can disrupt Forex trading and cause panic selling or buying.

System Failures: Significant technological failures, such as outages on major trading platforms, can prevent traders from executing orders, leading to price swings.

Key considerations for Forex traders

Understanding how Black Swan events affect market volatility and liquidity can help traders of all levels. These events often lead to extreme price movements and can cause major disruptions in market liquidity.

For beginner traders, recognizing the signs of a Black Swan event and implementing basic risk management strategies is very important. Simple tactics like setting stop-loss orders and diversifying investments can help mitigate potential losses during unforeseen market disruptions. Learn more about trading strategies which help to minimize risks in our article What is the best Forex trading strategy .

Advanced traders can employ more sophisticated techniques such as hedging and advanced risk management strategies. For example, using options and futures contracts can provide a buffer against adverse price movements. Developing a stable trading strategy that can withstand extreme market conditions should be the goal for experienced traders.

Managing risks associated with Black Swans

Maintaining an emergency fund, setting appropriate leverage ratios, and continuously monitoring and adapting trading strategies can help mitigate the impact of these unpredictable events.

Integrating both fundamental and technical analysis can enhance traders' preparedness for potential Black Swan events. Each type of analysis provides unique insights that, when combined, create a comprehensive strategy to judge the unpredictable nature of the Forex markets.

Fundamental analysis

This type of analysis helps traders anticipate market movements based on real-world events and economic data. For example:

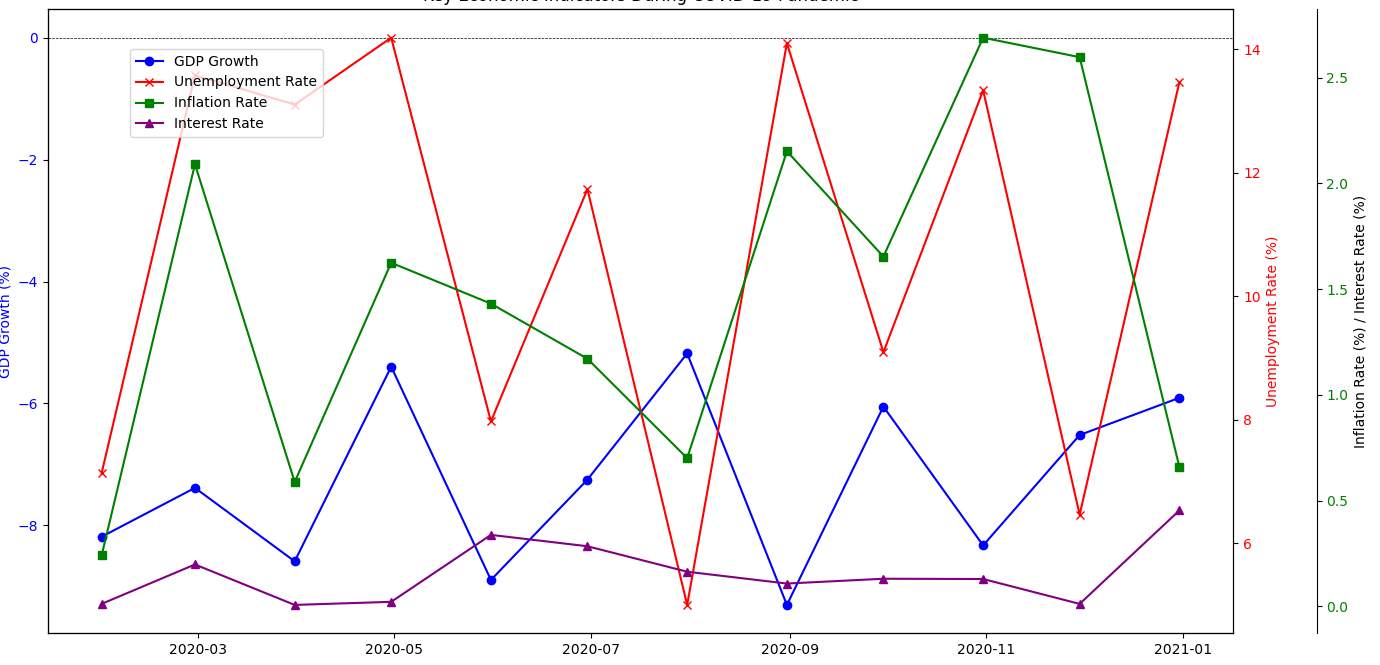

Monitoring key economic indicators such as GDP growth rates, unemployment rates, inflation, and interest rates can provide early warnings of potential market disruptions. For instance, during the COVID-19 pandemic, sharp declines in GDP and skyrocketing unemployment rates indicated severe economic distress, leading to significant Forex market volatility.

Events such as elections, political instability, or international conflicts can lead to sudden market shifts. For example, the Brexit referendum in 2016 caused the British pound to plummet due to the uncertainty surrounding the UK's departure from the EU.

Central bank decisions on interest rates and monetary policy can also lead to volatile effects on currency values. For instance, the Federal Reserve's aggressive interest rate cuts during the 2008 financial crisis were aimed at stabilizing the economy but led to significant movements in the Forex markets.

Technical analysis

Key technical analysis tools include:

Chart patterns. Recognizing patterns such as head and shoulders, double tops and bottoms, and triangles can help traders predict potential market movements. For instance, an ascending triangle might signal an upcoming continuation, allowing traders to position themselves accordingly.

Indicators and oscillators. Tools like Moving Averages, Relative Strength Index ( RSI), and Bollinger Bands provide insights into market momentum and potential overbought or oversold conditions. For example, during the COVID-19 pandemic, the RSI for many currency pairs reached extreme levels, indicating potential reversal points.

Support and resistance levels. Identifying key support and resistance levels can help traders set entry and exit points. For example, if a currency pair repeatedly bounces off a specific support level, it might be a good entry point, while a break below this level could indicate a bearish trend.

Black Swan events are inherently unpredictable

Surviving in the Forex market during Black Swan events requires a blend of knowledge, vigilance, and adaptability. Based on my experience, I suggest that traders should always expect the unexpected and prepare for potential catastrophic events. The Forex market changes too quickly, so it's important to keep up with the latest economic news, market trends, and geopolitical developments.

Black Swan events are inherently unpredictable, so always have a contingency plan. Use both technical and fundamental analysis to gain a comprehensive view of the market. This dual approach enables you to make more informed decisions, combining the strengths of both analytical methods.

Lastly, learn from past events. Understand how markets reacted previously and which strategies succeeded or failed. This historical perspective will guide your responses when faced with future Black Swan events.

Conclusion

Understanding and preparing for Black Swan events is important for anyone involved in Forex trading. These rare and unpredictable events can cause significant market disruptions, leading to severe financial consequences if not managed properly. By staying up to date, expecting the unexpected, and refining your risk management strategies, you can work through the turbulent waters of the Forex market more effectively.

Remember, the key to managing Black Swan events lies in preparation, vigilance, and flexibility. By integrating these principles into your trading strategy, you can better protect your investments and thrive in even the most unpredictable market conditions.

FAQs

What is the Black Swan event theory?

The Black Swan event theory, developed by Nassim Nicholas Taleb, describes rare, unpredictable events with significant impact. These events are beyond normal expectations and often rationalized after their occurrence.

How can traders prepare for Black Swan events?

Traders can prepare for Black Swan events by implementing robust risk management strategies, such as diversifying their portfolios, setting stop-loss orders, maintaining an emergency fund, and using hedging techniques like options and futures. Staying informed about global economic conditions and continuously monitoring market trends can also help in better preparation.

Why are Black Swan events hard to predict?

Black Swan events are hard to predict because they lie outside the realm of regular expectations and historical data. Their rarity and unexpected nature make them difficult to foresee, and they often defy conventional risk assessment models. It is only after they occur that their predictability becomes apparent in hindsight.

What impact do Black Swan events have on Forex markets?

Black Swan events can cause significant disruptions in Forex markets, leading to extreme currency fluctuations, increased volatility, and liquidity crises. For instance, during the 2008 financial crisis, major currencies experienced sharp movements, and market dynamics changed rapidly as investors sought safe-haven assets.

Related Articles

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Economic indicators — a tool of fundamental analysis that allows to assess the state of an economic entity or the economy as a whole, as well as to make a forecast. These include: GDP, discount rates, inflation data, unemployment statistics, industrial production data, consumer price indices, etc.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Black swans are a term that was introduced by Nassim Taleb, denoting global unpredictable events that can radically change the situation.

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.