VT Markets Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MetaTrader4

- MetaTrader5

- ASIC

- FSCA

- FSC Mauritius

- 2015

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MetaTrader4

- MetaTrader5

- ASIC

- FSCA

- FSC Mauritius

- 2015

Our Evaluation of VT Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

VT Markets is a reliable broker with the TU Overall Score of 7.64 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by VT Markets clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews showed that the broker’s clients are mostly satisfied with the company.

VT Markets is a broker for Forex and CFD trading with low leverage and low spreads in the newest versions of MetaTrader platforms.

Brief Look at VT Markets

The VT Markets (Pty) Ltd broker is an international intermediary that offers transparent access to Forex and CFD trading. The company has been providing services since 2015 and is regulated by the Australian Securities & Investments Commission (ASIC: 516246), Financial Sector Conduct Authority of South Africa (FSCA: 50865), Mauritius Financial Services Commission (FSC: GB23202269). Its mission is to provide traders all over the world with the best terms without forced requotes, price manipulation, or trading restrictions. VT Markets (Pty) Ltd received over 13 awards in the field of online trading. It has been recognized as the Best MT4/MT5 Broker with the Lowest Trading Costs by the Global 100 Awards 2020.

- Financially stable parent company and reliable custodian bank.

- Over 230 assets of different classes are available for trading.

- It allows trading using STP, ECN, and Islamic accounts.

- A wide range of investment solutions from reputable third-party platforms.

- Margin trading with leverage up to 1:500 for cryptocurrency pairs.

- Average trading commissions on ECN and precise market spreads on all account types.

- Access to making trades in desktop and mobile terminals MetaTrader 4/5, as well as in the web version of MT4.

- The high minimum deposit for novice traders is $100.

- Lack of access to micro (cent) accounts.

- The list of available assets does not include cryptocurrencies and ETFs.

TU Expert Advice

Financial expert and analyst at Traders Union

The VT Markets brokerage is part of the Vantage Group with its main office based in Australia. In 2016 it opened a representative office in the Cayman Islands, which is currently regulated by the local Cayman Islands Monetary Authority. VT Markets serves over 10,000 clients, providing them with access to trading currency pairs and different types of CFDs.

The broker offers ECN and STP accounts, so traders with different trading experiences will feel comfortable here. Muslim clients can trade from swap-free accounts. VT Markets strives to provide favorable terms both for active market participants and for investors who prefer passive strategies. There is an affiliate program with high remuneration based on the CPA model.

The VT Markets firm provides standard leverage, retains average trading fees, and provides twenty-four/seven support on trading days. The broker offers a lot of analytics, trading tips, and market overviews, but most of them are available to clients who have deposited $1,000 or more. Another disadvantage of VT Markets is the lack of opportunity to make transactions with cryptocurrencies. Also, remember the regional restrictions. They concern residents of the USA and many other countries.

- You are conscious about your skill level as this broker caters to traders of all skill levels. They provide user-friendly mobile apps for beginners and powerful platforms like MetaTrader 4 and 5 for more experienced traders, ensuring that everyone can find a suitable trading solution.

- You are looking for regulated broker as This broker is regulated by reputable authorities including CIMA, ASIC, and FCA. Regulatory oversight provides you with a level of trust and assurance that the broker operates in compliance with industry standards and regulations, prioritizing the safety and security of your funds.

- You are based in the US as, you won't be able to trade with this broker as they do not accept clients from the US.

- You require low minimum deposit as minimum deposit for this broker is high at around $100. This can be a roadblock especially if you're a beginner trader or have limited funds to trade with.

VT Markets Summary

Your capital is at risk. Trading Forex and CFDs carries the risk of losing substantially more than your initial investment and should only be traded with money you can afford to lose. You don't own or have any rights to the assets that underly the derivatives (e.g. the right to receive dividend payments). Ensure you fully understand the risks involved. Trading leveraged products may not be suitable for all investors. Before trading, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

| 💻 Trading platform: | MetaTrader 4 (Desktop, Mobile, WebTrader), MetaTrader 5 (Desktop, Mobile) |

|---|---|

| 📊 Accounts: | Demo МТ4, Demo МТ5, Standard STP account, RAW ECN account, Islamicaccounts (STP and ECN) |

| 💰 Account currency: | USD, EUR, GBP, CAD, and AUD |

| 💵 Replenishment / Withdrawal: | Neteller, Skrill, FasaPay, e-wallets, Alternative Payment Methods (APM), Credit/debit cards, bank wire, Bitcoin, and USDT |

| 🚀 Minimum deposit: | From USD 100 |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 1.2 pips (Standard), from 0.0 pips (ECN) |

| 🔧 Instruments: | Currency pairs, CFDs on US and Hong Kong stocks, indices, commodities, energy resources, ETFs, bonds, and precious metals |

| 💹 Margin Call / Stop Out: | 80%/50% |

| 🏛 Liquidity provider: | Bank of America, Barclays, BNP Paribas, Crédit Agricole, HSBC, and JPMorgan Chase, etc. |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution, Pending Orders |

| ⭐ Trading features: | No cryptocurrencies are among the assets available for trading |

| 🎁 Contests and bonuses: | Welcome bonus, deposit bonus, trading cashback, Traders Union |

The clients of VT Markets can trade using over 200 instruments with leverage up to 1:500. Trades can be made in the MT4 or MT5 terminal. PAMM accounts, algorithmic trading, and copying trades of successful traders are available. The minimum deposit for all types of accounts is $100 or the equivalent in euros, pounds sterling, Canadian or Australian dollars. VT Markets accepts payments by requisites, from cards, e-wallets, and APMs. It is also possible to make deposits in cryptocurrency.

VT Markets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

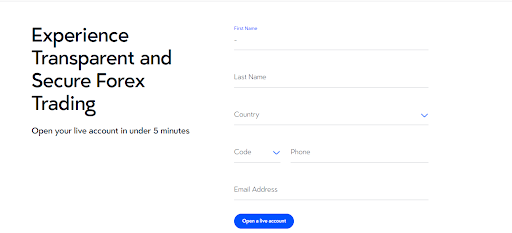

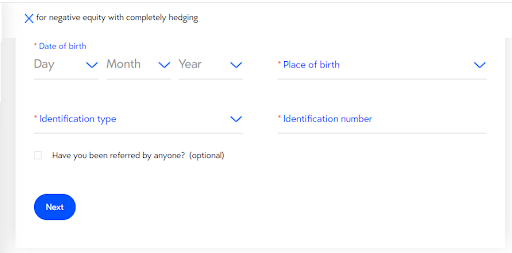

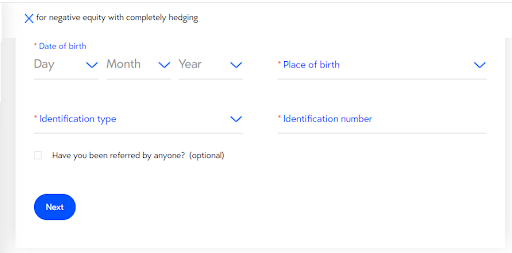

Register with this broker to create a user account on VT Markets' website. The standard procedure consists of the following steps:

At the top of any page on the VT Markets official website, click Open a Live Account.

Enter your full name, email address, and phone number on the registration form.

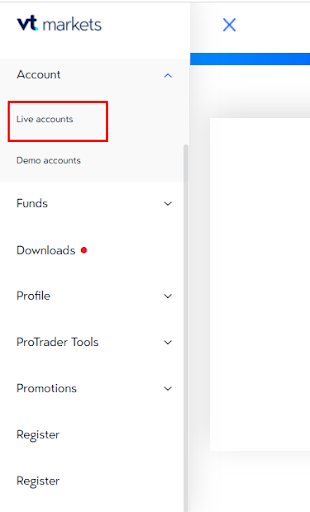

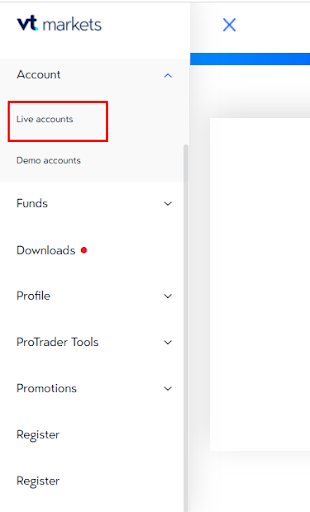

After being redirected to the Personal Account, select Live Account from the menu on the left sidebar.

Next, enter the date and place of birth, type of identification (national ID card, passport, driver's license) and identification number.

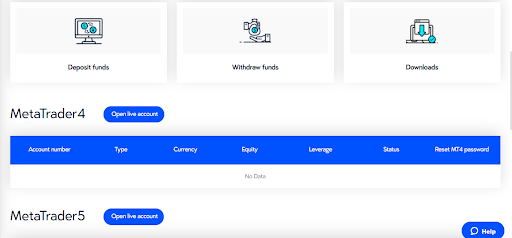

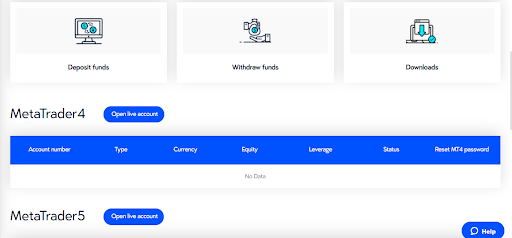

More actions that are available in VT Markets user account:

The main sections of the user account:

-

Downloads — downloading the trading platform.

-

ProTrader Tools — Market buzz, economic calendar, analyst recommendations, selected investment ideas.

-

Allows opening live and demo accounts.

-

Funds — allows access to deposits or withdrawals, transfer of funds between accounts, transaction history, and decoding of payments.

-

Promotions — allows access to bonuses.

Regulation and Safety

VT Markets is a trademark of VT Global Pty Ltd is authorised by the ASIC (licence number - 516246).

VT Markets is representative offices are authorized and regulated in different jurisdictions. In South Africa, it is supervised by the Financial Sector Conduct Authority FSCA (license number - 50865), and in Mauritius by the FSC (license number - GB23202269). VT Markets' client funds are stored in segregated accounts at the Commonwealth Bank of Australia (CBA), the largest Australian bank with a AA rating and a market capitalization of $120 billion.

Advantages

- Australia's largest bank acts as the depository

- You can file a complaint against the broker to the regulator

- CIMA allows trading with high leverage and the use of e-wallets for payments

Disadvantages

- You cannot open a trading account without providing scanned copies of documents

- CIMA doesn’t compensate traders if a broker declares bankruptcy

Account Types

The VT Markets broker offers two types of accounts with different execution models (STP and ECN). Each of them can be opened both in MetaTrader 4 and MetaTrader 5 terminals. Islamic accounts are also available (similar to STP and ECN, but without swap fees). Leverage on all account types is up to 1:500, a margin call is up to 80%, and a stop out is up to 50%.

Account types:

You can open a demo account in mobile and desktop terminals, as well as in WebTrader.

The terms of VT Markets will definitely suit professional traders who work on ECN accounts. Also, the broker offers standard accounts adapted for market participants with little or no trading experience.

Deposit and Withdrawal

-

Money from company accounts can be withdrawn to cards, bank accounts, electronic and cryptocurrency wallets. Trading profits and any account balance exceeding the initial deposit may be transferred by bank transfer.

-

Withdrawal requests are processed within 24 hours. Receipt of funds takes from 1 to 7 business days depending on the transfer method chosen. For example, the money is credited in 3-5 business days by bank transfer. Systems providing instant withdrawal are also available.

-

If the client withdraws 100 or more units of the account base currency, no payment processing fee is charged. Otherwise, a fee of 20 USD/EUR/GBP/CAD/AUD is applied depending on the account currency.

-

The first withdrawal per month via bank wire is free (the broker covers the fee charged by the bank). An international wire transfer costs $25. EPS commissions for Fasapay is 0.5%; for Skrill, it is 1%; and for Neteller, it is 2%.

Investment Options

The VT Markets clients can make money by active trading, and the broker also offers a wide range of solutions for passive investors, but they don’t guarantee that the investor will make a profit in every case. Affiliate programs, which bring money for attracting new users, can also be referred to as investment offers.

Methods for generating passive income in VT Markets

The VT Markets firm offers investment solutions from partners ZuluTrade and MetaQuotes. These include:

-

Advisors. In the MetaTrader 4 platform, traders can connect to over 1,000 expert advisors (EA) to perform analysis and/or execute trades for them.

-

Signals. VT Markets doesn’t provide clients with their own trading signals, but they have access to data from Trading Central, MetaQuotes Software, and Acceage.

-

PAMM and MAMM help both investors and professional account managers generate passive income.

-

Copy trading. VT Markets clients can connect to social trading platforms such as ZuluTrade and trading signals services in MT4 and MT5.

To become an investor, it is enough to open any type of real account, make a minimum deposit and choose the priority method of passive income. Only a professional trader licensed to offer financial services or has a legal opinion issued in the jurisdiction of his activity can become a PAMM and/or MAM account manager.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

VT Markets’ affiliate programs

-

Affiliates. Affiliates receive remuneration CPA (Cost Per Action) for each referred trader. Its size depends on the affiliate's country of residence, the tariff plan (Standard or Standard+), and the trading activity of referrals. To get CPA, a referral shall deposit at least $500 and close 2 standard FX or Spot Gold lots.

-

Introducing Brokers is a program for companies and legal entities who want to provide brokerage services under the VT Markets brand. IBs receive a spread rebate of up to $8 for each lot closed by a referral.

VT Markets’ affiliate programs are not available in all jurisdictions. For example, residents of the USA, Australia, the Russian Federation, and other countries cannot register using the referral link. All introducing brokers work following the legislation of their region.

Additional Trading Tools

VT Markets provides various tools to assist clients in finding trading opportunities with profit potential. These include:

-

Market Analysis. Up-to-date reviews and forecasts on Forex and other markets appear on the broker's website daily on weekdays.

Additional Trading Tools of VT Markets - Market analysis -

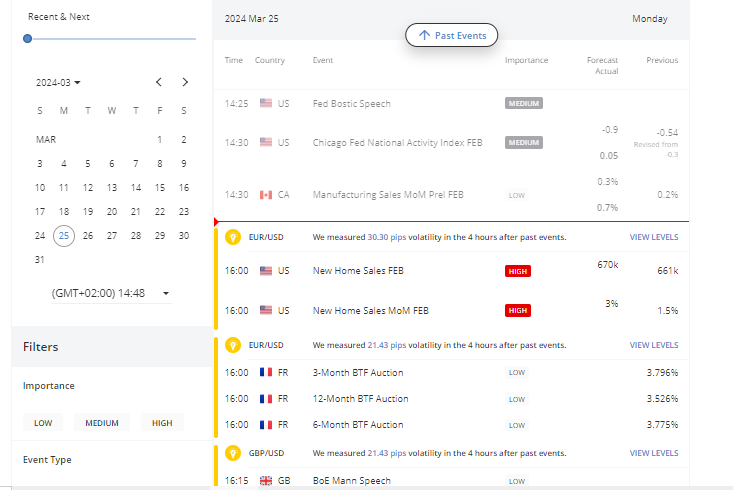

Economic calendar. It is a convenient tool for obtaining summarized information on fundamental indicators and geopolitical events. It contains data reflecting the state of the economy of a particular country or region, including employment reports, expenditures, and consumer sentiment.

Additional Trading Tools of VT Markets - Economic calendar -

Automated trading. The broker provides MetaTrader trading platforms, which allow copying Forex signals from various providers and using Expert Advisors developed by many developers.

Additional Trading Tools of VT Markets - Automated trading -

Blog. It's a collection of useful articles, educational materials, important events, and news. The blog includes a glossary of key Forex and CFD terms. Additionally, the company publishes its own market research and tips for beginners in trading non-exchange financial instruments.

Additional Trading Tools VT Markets - Blog

Customer Support

Client support works around the clock 5 days a week.

Advantages

- Quick response from online chat operators

- Support is available in 12 languages.

Disadvantages

- Saturday and Sunday are days off

- You can't call a company representative

To contact support, you can:

-

send your request to info@vtmarkets.com;

-

ask a question in the online chat on the website and in the user account;

-

request a call back;

-

send a request on the company's Facebook or Twitter profiles.

If you have a question when the support team is not working, click on the "Chat" icon and ask a question indicating your email address. Support representatives will answer by email during working hours.

Contacts

| Foundation date | 2015 |

|---|---|

| Registration address | Level 16,309 Kent Street,SYDNEY NSW 2000, Australia |

| Regulation |

ASIC, FSCA, FSC Mauritius

Licence number: 516246, 50865, GB23202269 |

| Official site | vtmarkets.com |

| Contacts |

+61 02 9054 9999

|

Education

The VT Markets website has a lot of useful information for novice traders. It is placed in the Education and FAQs sections. There are also instructional videos on the site that explain the basic concepts of Forex.

An effective training tool is a demo account, through which you can practice making transactions without the risk of losing money.

Comparison of VT Markets with other Brokers

| VT Markets | RoboForex | Eightcap | Exness | IC Markets | Libertex | |

| Trading platform |

MetaTrader4, MetaTrader5 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, cTrader, MT5, TradingView | Libertex, MT5, MT4 |

| Min deposit | $100 | $10 | $100 | $10 | $200 | 100 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:30 for retail clients |

| Trust management | Yes | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 1 point | From 0 points | From 0.1 points |

| Level of margin call / stop out |

No / 50% | 60% / 40% | 80% / 50% | No / 60% | 100% / 50% | 50% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Detailed Review of VT Markets

The VT Markets broker adheres to the "Innovation makes a difference” concept. For this reason, it uses advanced technology and offers the most popular online trading terminals on the market. Its clients have access to real ECN accounts with unprocessed spreads, mobile trading, and 24/7 support. VT Markets offers accounts with different execution types, as well as training and Islamic accounts.

VT Markets' success by the numbers:

-

Over 9 years working as a financial intermediary in Forex and CFD trading.

-

Offers access to over 1000 trading assets.

-

Cooperates with 14 major liquidity providers.

-

Serves over 200,000 opened trading accounts.

VT Markets is a broker for leveraged FX and CFD trading

VT Markets offers a wide range of assets. Its clients can trade 40 currency pairs and spot gold contracts with leverage up to 1:500. The leverage on soft commodities (cocoa, coffee, cotton, orange juice, unrefined sugar) is 1:20, 1:100 on Silver Spot, and up to 1:333 on energy commodities (Crude Oil, Natural gasses, Gasoline, and Gasoil). Traders also get access to transactions with CFDs on shares of the 50 largest companies in the United States and Hong Kong, with a leverage of 1:20. High leverage (up to 1:333) is provided for trading 15 stock indices, including SP 500, DJ 30, US 2000.

The VT Markets broker offers familiar Forex traders software such as MetaTrader 4 and MetaTrader 5 terminals. MT4 is presented in three versions: desktop, mobile, and WebTrader. MT5 platform requires installation on your computer, laptop, smartphone, or tablet. The web version is not available.

VT Markets’ useful services:

-

Forex signals. The broker's clients get access to signals from third-party providers such as MetaQuotes Software, Trading Central, and Acceage.

-

Economic calendar. It allows traders to stay abreast of important news and events that may affect the financial markets.

-

Trading Central MT4 tools. VT Markets clients who deposited $1,000 and more get access to innovative Alpha Generation indicators, an economic calendar with news from 38 countries, Economic Insight, and Featured Ideas data.

-

Forex calculators. The company's website has a currency converter as well as Fibonacci, Pivot, SL/TP levels, and SL/TP amount calculators.

-

Market analysis. Daily summaries of analytical data based on technical and fundamental analysis. They are provided on the site in two formats, text and video.

-

ProTrader tools. These include Market Buzz (news on 35,000 traded assets), featured ideas, economic calendar, and analysts’ views (opinions on 80,000 instruments). The tools are available to clients whose deposit exceeds $1,000.

-

Daily newsletter. A daily report that includes Trading Central's research, market reviews and sentiment, analysts' opinions, and coverage of the major economic events of the trading day. The newsletter is available free of charge to traders with an account balance of $1,000 or more.

Advantages:

Traders have access to several social trading platforms.

Ability to trade using expert advisors, scripts, and robots.

A wide range of payment systems, including instant deposits and withdrawals.

Prompt twenty-four/seven support via email and chat 5 days a week.

Several types of bonuses — for a deposit (not only the first but also subsequent ones) and trading cashback.

Easy and quick online account opening.

The broker allows different trading styles and strategies, including scalping and hedging positions.

User Satisfaction