Is Trading Central Reliable in 2024?

Trading Central is a leading financial research and analysis firm that provides investment insights and technical analysis for various financial markets. It offers several products, including automated analysis tools, pattern recognition software, technical and fundamental studies, user-focused approach, and 24/7 coverage across 85+ markets.

As any savvy trader knows, having an edge in today's cut-throat markets is paramount. Whether it's spotting emerging trends before others or utilizing powerful analytical tools, identifying opportunities before the competition can make all the difference. One platform striving to give traders such an advantage is Trading Central. As a leading financial analysis and research firm, Trading Central leverages both automated technology and human expertise to equip its users with professional-grade insights.

In this comprehensive review, we'll delve into Trading Central's arsenal of tradable weapons. We'll analyze its suite of technical analysis charts and indicators, pattern recognition capabilities for detecting lucrative setups, and bounty of research content from seasoned analysts. We'll also examine Trading Central's reliability, penetration across top brokers, and cost implications.

-

Is Trading Central free to use?

No, Trading Central is not directly accessible to individual traders. It is offered through brokerage partners as an add-on service. Traders need to check with their broker for pricing and account requirements.

-

Is Trading Central suitable for beginners?

While it caters to all experience levels, Trading Central is more suited to intermediate-advanced users given its technical focus.

-

Can I download Trading Central's charts and indicators?

Yes, Trading Central allows its technical tools like charts, indicators and trading signals to be downloaded and integrated with platforms like MT4 and MT5.

-

Does Trading Central publish trade setup alerts?

Yes, its Featured Ideas tool constantly scans markets for validated patterns and publishes timely trade alerts on emerging opportunities

What is Trading Central?

Trading Central is an advanced platform used by many investors to enhance their trading decisions. It offers a unique blend of analyst research and cutting-edge automated analytics. By harnessing the power of pattern recognition and catering to a diverse range of markets and languages, Trading Central equips traders with tools to navigate the financial landscape with confidence.

The core mission of Trading Central is to level the playing field for independent traders, enabling them to rival institutional traders with access to professional-grade research and analysis. Through its proprietary pattern-recognition applications, the platform diligently scans a vast network of 89 global markets, offering comprehensive coverage for over an astounding 75,000 instruments.

The fusion of analyst insights and automated analytics presents Forex traders with a comprehensive approach that goes beyond traditional market analysis. By providing investors with well-rounded and up-to-date information, the platform allows them to assess opportunities and mitigate risks across various markets worldwide.

Should I use Trading Central?

If you're an experienced investor seeking to bridge the gap between independent trading and institutional prowess, Trading Central offers a wide variety of features to support that. This platform is designed to provide you with advanced research and automated analytical tools that were once exclusively reserved for institutional investors.

Trading Central's features cater to intermediate and advanced traders, offering extensive benefits in the dynamic world of finance. One of its main tools is the Trading Central Featured Ideas indicator, a tool for monitoring market movements across a diverse array of currency pairs. This unique indicator empowers users to customize it according to their specific preferences, enabling them to fine-tune aspects like holding timeframes, bar sizes, technical chart patterns, and preferred currencies.

The platform's utilization of automated analytical tools, including pattern-recognition scanners, equips traders with valuable insights to make informed decisions in real-time. By integrating analyst research with these automated analytics, Trading Central provides a comprehensive approach that enhances the trading experience and boosts the potential for profitable outcomes.

Key features of Trading Central

Trading Central offers a suite of advanced features that cater to investors of all experience levels, enabling them to make well-informed decisions based on high-quality market data presented in a user-friendly and easily understandable format. Let's delve into some of its standout features:

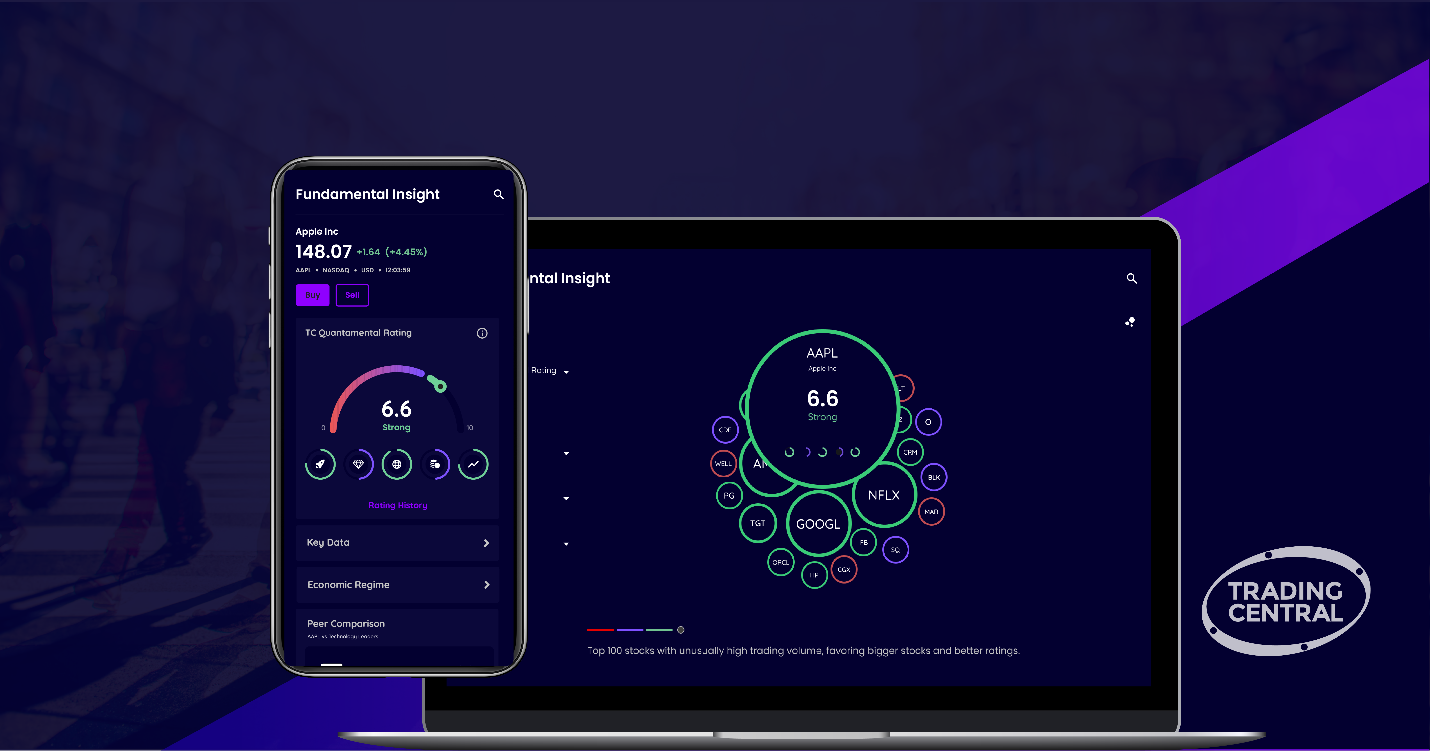

Fundamental Insight

Fundamental Insight

Sourse: Trading Central

With Trading Central's Fundamental Insight, users can access and interpret complex financial data effortlessly. This feature empowers investors to gain important insights, including trending views, nowcasting, target prices, and TC Quantamental Ratings. By presenting these crucial data points in a digestible manner, traders can navigate complex markets seamlessly.

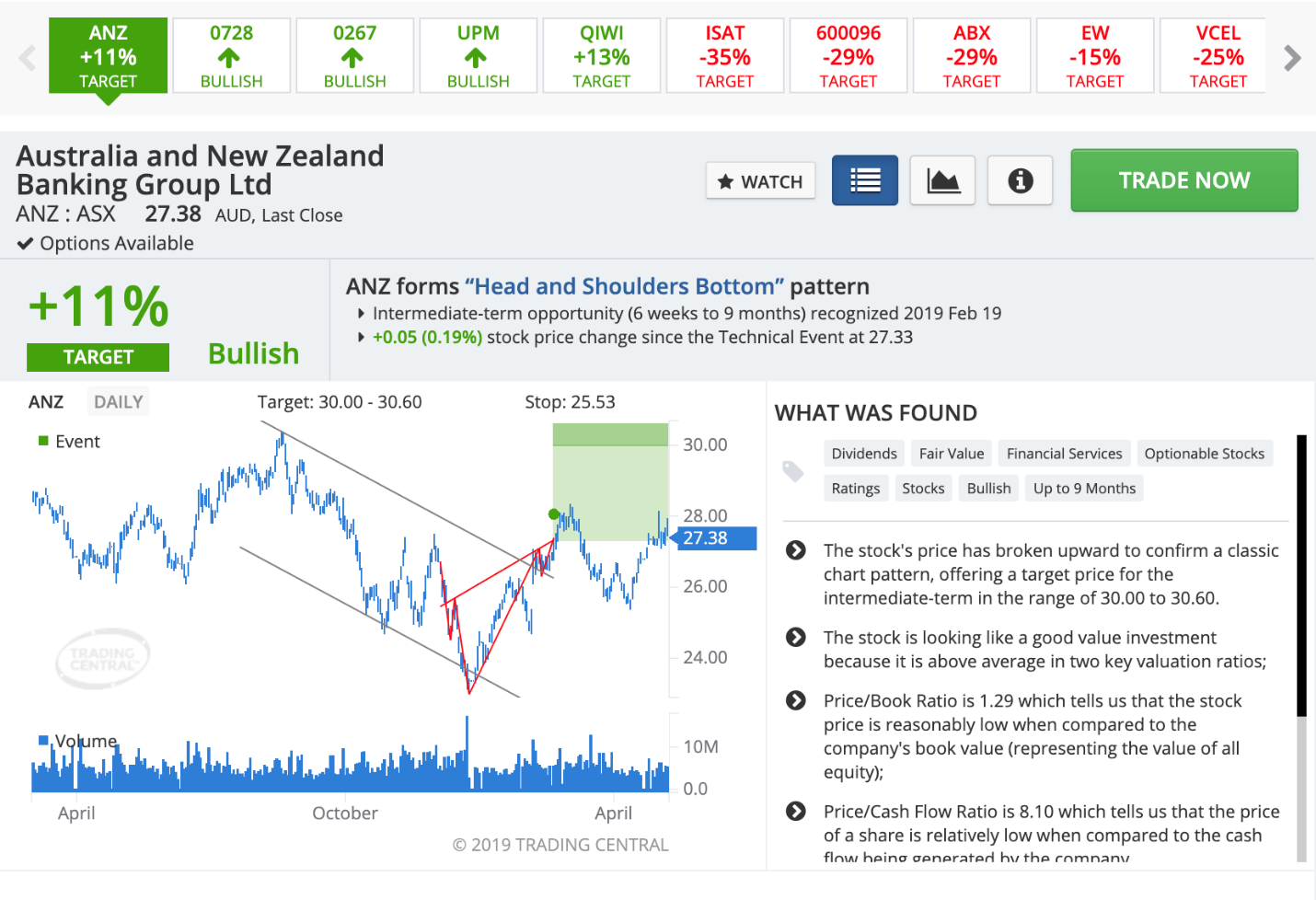

Featured Ideas Tool

Featured Ideas Tool

Sourse: Trading Central

Trading Central's Featured Ideas Tool presents around 10 meticulously researched trading ideas, backed by robust algorithms and insights from industry experts. The tool's fast and efficient algorithm performs real-time market scans, providing thorough analysis and saving valuable time for traders. Each featured idea is presented with a detailed breakdown, so that traders can understand the logic behind the idea. Additionally, investors can closely monitor the performance of these ideas over time.

Technical Indicators and Charts

Technical Indicators and Charts

Sourse: Trading Central

Trading Central offers a range of technical indicators and charts to identify new trading opportunities. Investors can integrate these indicators into popular trading platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5) with ease. The inclusion of directional perspectives and an alternative scenario pivot point tool enhances the overall technical analysis experience, providing valuable target levels for different market directions.

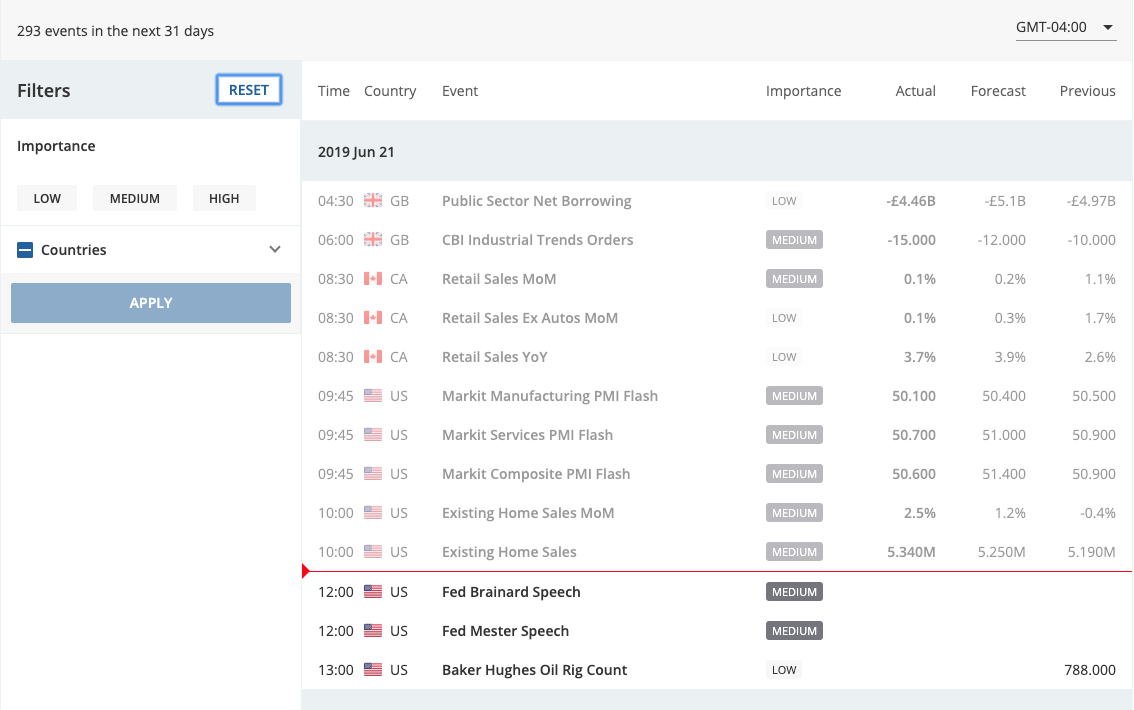

Economic Calendar

Economic Calendar

Sourse: Trading Central

Trading Central's interactive Economic Calendar provides a dynamic alternative to standard static charts. This feature offers a comprehensive overview of key economic events and their potential impact on the markets, assisting traders in making timely and informed decisions.

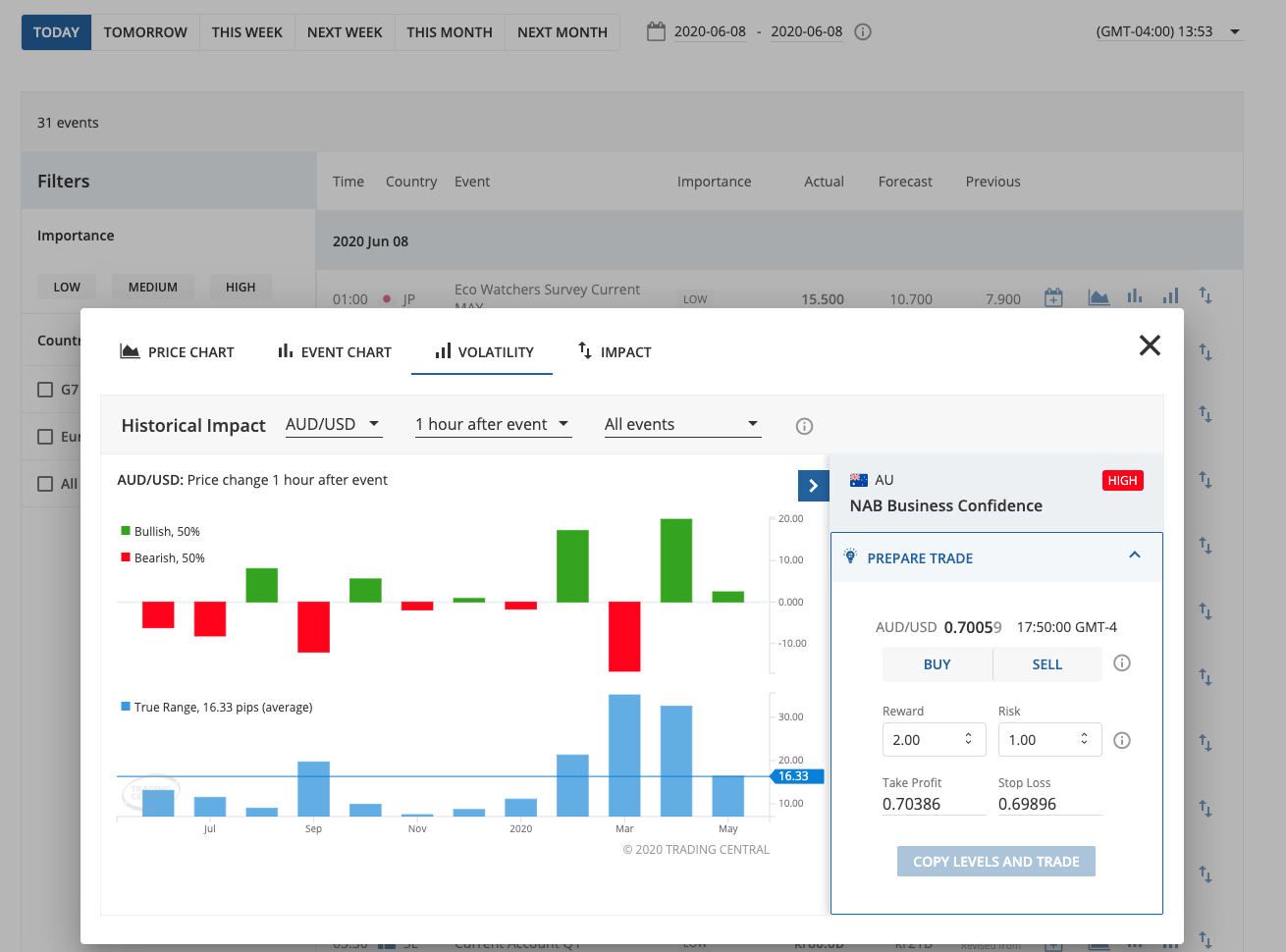

Economic Insight Tool

Economic Insight Tool

Sourse: Trading Central

The Economic Insight Tool is a fundamental feature of Trading Central that provides users with comprehensive economic analysis and insights. It covers a wide range of economic indicators, such as GDP growth, inflation rates, employment data, central bank decisions, and other macroeconomic factors that can impact financial markets. Through this tool, traders can stay updated on the latest economic developments and trends, helping them anticipate potential market movements and make more strategic trading decisions. The platform typically presents this data in an easily digestible format, using charts, graphs, and written analysis to facilitate comprehension for traders of varying experience levels.

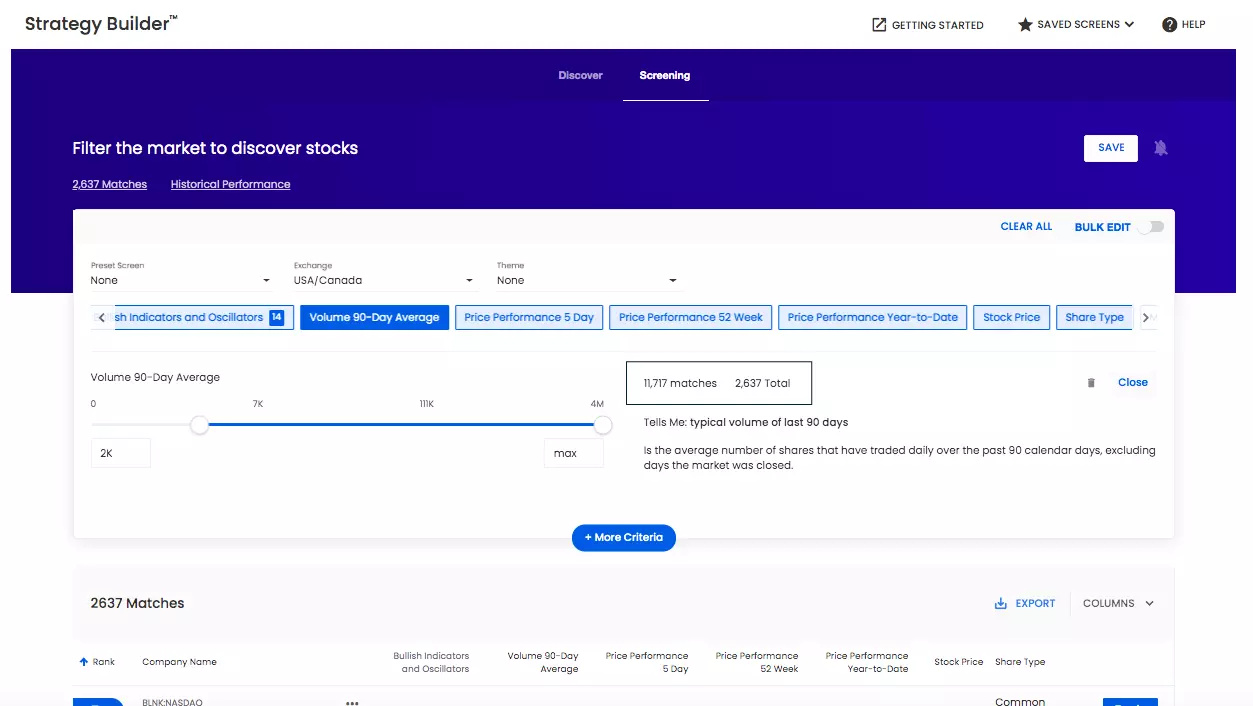

Strategy Builder

Strategy Builder

Sourse: Trading Central

The Strategy Builder feature of Trading Central is a prominent tool that caters to both beginner and experienced traders alike. This tool allows users to create customized trading strategies based on various parameters and market conditions. Traders can set their preferred risk tolerance, timeframes, technical indicators, and other relevant criteria to design trading strategies that align with their individual preferences and goals.

Through this feature, users are also given the ability to backtest their strategies. By using historical data, traders can assess the performance of their designed strategies in past market conditions. This helps traders refine and optimize their strategies before applying them in live trading situations.

Expert Analysts (EAs)

Trading Central also employs a team of expert analysts who possess in-depth knowledge and experience in the financial markets. These analysts are at the core of the platform's services and play a vital role in generating trade ideas, conducting technical and fundamental analysis, and providing regular market commentaries.

The insights and recommendations offered by these expert analysts are based on their extensive research and market expertise. Subscribers of Trading Central gain access to reports and real-time commentaries authored by these EAs, which can serve as valuable resources for traders seeking reliable and professional guidance.

What are the technical analysis tools available in Trading Central?

Trading Central presents a comprehensive array of price analysis tools and indicators, designed to equip traders with valuable insights for their market analysis and decision-making process. Let's dive into the key technical analysis tools available on the platform:

Charting tools

Trading Central offers a versatile set of charting tools, including line charts, bar charts, and candlestick charts. These graphical representations allow traders to visualize market data and gain a deeper understanding of price movements, historical trends, and potential patterns that may influence their trading strategies.

Trend analysis

Trend analysis is a vital component of Trading Central's technical analysis toolkit. It involves identifying the prevailing direction of a market trend and assessing its strength. Traders can leverage this feature to discern whether the market is experiencing an uptrend, downtrend, or moving sideways, aiding them in making well-informed trading decisions.

Pattern recognition

Recognizing chart patterns is crucial for traders seeking potential market reversals or continuation signals. Trading Central's pattern recognition tools efficiently identify chart patterns such as Head and Shoulders, Double Tops, Triangles, and more. By identifying these patterns early on, traders can anticipate potential market movements and optimize their trading strategies accordingly.

Pros and cons of Trading Central

👍 Pros

•

Automated analysis tools

One of the key advantages of Trading Central is its offering of automated analysis tools. These powerful tools eliminate the need for manual market analysis, allowing traders to make timely and well-informed decisions. The automated nature of these tools ensures that traders can quickly respond to price fluctuations and capitalize on opportunities without delay

•

Trading opportunity screening

Trading Central’s pattern recognition software and algorithms can help traders in identifying trends and market opportunities. With these tools, traders are more likely to identify important chart patterns, such as Head and Shoulders, Double Tops, and more. Recognizing these patterns promptly can help traders anticipate potential market reversals or continuation signals, enhancing the accuracy of their trades.

•

Technical and fundamental studies

The platform empowers traders to conduct both technical and fundamental studies. Technical analysis allows traders to study price action and market trends, while fundamental analysis focuses on analyzing financial statements and economic indicators. This combination of analysis methodologies provides traders with a comprehensive understanding of market dynamics, enabling them to make well-rounded and informed decisions.

•

User-focused approach

Based on user reviews, Trading Central places a strong emphasis on understanding the needs of its users. The platform continuously develops and tailors its solutions to cater to the diverse requirements of traders. By putting the user first, Trading Central ensures a seamless and intuitive trading experience, making it an attractive choice for traders of all experience levels.

•

All-day coverage

Another notable advantage of Trading Central is its 24-hour coverage across a wide range of markets. Whether it's stocks, Forex pairs, ETFs, or indices, traders have access to crucial analysis and insights round-the-clock. This comprehensive coverage allows traders to stay on top of market developments regardless of their geographical location or time zone.

👎 Cons

•

Primarily targeted towards professional traders

One potential drawback of Trading Central is its technical analysis focus, which may be more suitable for professional traders or experienced investors. Novice traders may find the technical aspects overwhelming or challenging to comprehend initially.

•

Limited direct support

While Trading Central offers tools and resources, the platform's direct support options are limited. The absence of live chat or direct email contact may hinder immediate assistance for traders facing issues or seeking prompt clarifications.

•

Broker dependence

One important consideration for traders is that accessing Trading Central's services and tools relies on their online broker's partnership with the platform. This broker dependence could potentially restrict access to Trading Central's offerings for traders who are not associated with cooperating brokers.

Trading Central comparison

| Feature | Trading Central | Seeking Alpha | TradingView |

|---|---|---|---|

Markets Covered |

Multiple |

Wide Range |

Global |

Analysis |

Expert Analysts |

Community-based |

Technical |

Technical Tools |

Extensive |

Basic Charts |

Comprehensive |

Platform Compatibility |

Broker Integration |

Web, Mobile App |

Web, Desktop |

User Interface |

Slick Dashboard |

Intuitive |

User-friendly |

Cost |

Broker-dependent |

Freemium Model |

Freemium Model |

Is Trading Central legit?

Trading Central demonstrates its credibility and legitimacy by complying with regulations set by relevant global authorities. In the US, the platform is a registered investment advisor under the SEC, ensuring its operations abide by the legal framework and providing investors with added confidence.

Is Trading Central free or paid?

Trading Central operates as a service exclusively available to professional trading desks and brokers, making it inaccessible to individual investors on a standalone basis. The platform is typically offered as part of subscription packages provided by these professional entities.

For individual investors seeking to utilize Trading Central's features, the platform's integration with professional trading desks and brokers becomes the primary route of access. By including Trading Central in their subscription packages, these brokers provide their clients with access to the platform's powerful tools and analysis.

The decision to limit access to professional trading desks and brokers ensures that Trading Central's services are tailored to meet the needs of serious traders who require robust market analysis and research capabilities. While individual investors may not have direct access, they can still benefit from Trading Central's offerings through their chosen broker or trading desk.

Best brokers that support Trading Central

When it comes to accessing Trading Central's powerful tools and analysis, partnering with the right broker becomes essential. Two reputable brokers that support Trading Central and offer a wide range of trading options are Exness and IC Markets.

Exness

With over 200,000 clients worldwide, Exness is a prominent CFD broker known for its diverse offerings. The platform caters to traders interested in over 100 Forex pairs, a select range of cryptocurrencies, 70+ stock CFDs, indices, and commodities. Traders on Exness can choose from nine account types available on both the MT4 and MT5 platforms.

Exness stands out as an excellent choice for traders due to its array of impressive features. The platform offers both MT4 and MT5 platforms, accommodating traders with diverse preferences and trading strategies. Additionally, Exness provides competitive spreads, enabling cost-efficient trading for its clients. With over 100 Forex pairs available, traders have a wide selection of trading options, ensuring ample opportunities to capitalize on market movements. Furthermore, Exness goes the extra mile by offering 24/7 customer service, ensuring prompt assistance whenever needed. Lastly, Exness also offers a free VPS service for traders who deposit at least 500 USD. This feature guarantees reliable and uninterrupted trading experiences, empowering traders to seize opportunities in the dynamic financial markets.

Traders on Exness have the advantage of utilizing Trading Central's signals to develop effective strategies and plan their trades. These signals incorporate various analytical approaches, offering valuable insights across different market conditions and timeframes. The signals are conveniently available in the Personal Area or the Exness Trade app.

| Parameter | Exness Group |

|---|---|

Minimum deposit |

USD 15 - USD 50 |

Fees class |

Low Fees |

Deposit method |

Bank transfer, Credit card, E-Wallets, Crypto wallet |

Withdrawal method |

Same as deposit methods |

Withdrawal fee |

No withdrawal fees charged by Exness |

Time to open account |

Upto 24 hours (Complete verification) |

Inactivity fees |

Nil |

IC Markets

Another prominent broker supporting Trading Central is IC Markets, which provides installable third-party plugins from Trading Central and AutoChartist. IC Markets offers an extensive range of 3,583 tradable instruments across its entities based in Australia, Cyprus, and Seychelles. The broker offers three account options, including the commission-free Standard account (spread only), and the commission-based Raw Spread and cTrader Raw Spread accounts.

IC Markets also delivers in-house technical and fundamental analysis content through its blog, providing valuable insights for traders. Additionally, the platform offers daily updates in its market analysis section and features videos from Trading Central.

| Parameter | IC Markets |

|---|---|

Minimum deposit |

USD 200 |

Fees class |

Low |

Deposit method |

Bank / wire transfer, PayPal, credit card, Skrill, Neteller, UnionPay, Bpay, FasaPay and Poli |

Withdrawal method |

Same as deposit methods |

Withdrawal fee |

No withdrawal fees charged by IC Markets |

Time to open account |

Within 1 Business Day (Complete verification) |

Inactivity fees |

No inactivity fee charged by IC Markets |

Glossary for novice traders

-

1

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

2

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

3

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

4

CFD

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

-

5

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).