Upright Overview 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Plus500 - Best Forex broker for 2025 (United States)

Upright is a cutting-edge platform for real estate investors, linking licensed investors with carefully selected residential real estate loans. It offers opportunities for passive income through fractional investments in various loan products secured by first-position mortgages.

Upright is a platform specializing in passive real estate investing through short-term, hard money loans. Accredited investors can choose individual loans or pooled funds, offering exposure to the real estate market without directly managing properties. Upright has a 10.8% average annualized return and a 99.7% principal repayment rate, achieved through a focus on debt-based investments secured by first-lien mortgages. This review will delve deeper into Upright's investment offerings, platform features, potential risks, and its overall suitability for passive real estate investors.

What is Upright?

Upright is a platform designed for real estate investment, connecting linking licensed investors with carefully selected residential real estate loans. Unlike some other platforms that mainly offer equity investments, Upright places its emphasis on offering secured loans backed by first-position mortgages. Accredited investors have the opportunity to generate passive income by making fractional investments in these loans.

Upright site

Upright siteIn addition to attracting investors, Upright also functions as a direct financial provider for real estate investors and developers in search of financing for their housing projects. Its diverse range of loan options includes renovation loans, ground-up construction loans, investment portfolio loans, and debt-service coverage ratio (DSCR) rental loans, all featuring favorable rates and terms.

One distinguishing feature of Upright is its emphasis on debt-focused investment rather than equity-based models common on other platforms. This strategy aims to reduce risk, as investments are backed by collateral. In case of borrower default, Upright can utilize a first-position mortgage to legally enforce payment. Notably, the platform boasts a 99.7% success rate in returning at least the principal investment.

With an average annualized return of 10.8%, Upright presents itself as a good investment option for both real estate investors and borrowers alike.

Best stock brokers

Basic features of Upright

Upright operates as a two-sided online platform that connects accredited investors with real estate borrowers seeking financing. On one side, the platform screens and presents residential property deals from borrowers to accredited investors. To invest, individuals must meet certain wealth or professional criteria, such as having a net worth exceeding $1 million, earning over $200,000 annually, or being a licensed investment professional. Investors can choose from various mortgage investment products with differing terms, returns, and minimum investments, though all products have a lockup period restricting early withdrawals.

Upright Basic features

Upright Basic featuresOn the other side, Upright provides financing options for real estate borrowers engaging in short-term projects like renovations or new constructions, as well as longer-term residential mortgages. Short-term "hard money" loans up to 15 months require a clear strategy for repaying investors. Longer-term loans over 15-30 years aim for faster, more flexible approval compared to traditional lenders. Prospective borrowers must demonstrate proven experience with multiple past real estate projects and have a network of relevant professionals.

The application process rigorously evaluates each project, mandating criteria such as the borrower's minimum equity investment, conservative loan-to-value ratios, and comprehensive documentation validating after-repair property values through appraisals, market analyses, and more. Borrowers must also provide detailed project plans, inspection reports, exit strategies, and other due diligence materials that Upright carefully reviews before potentially funding the deal through its investor network.

Upright investing

Upright offers various types of loans tailored to different investor preferences and risk appetites.

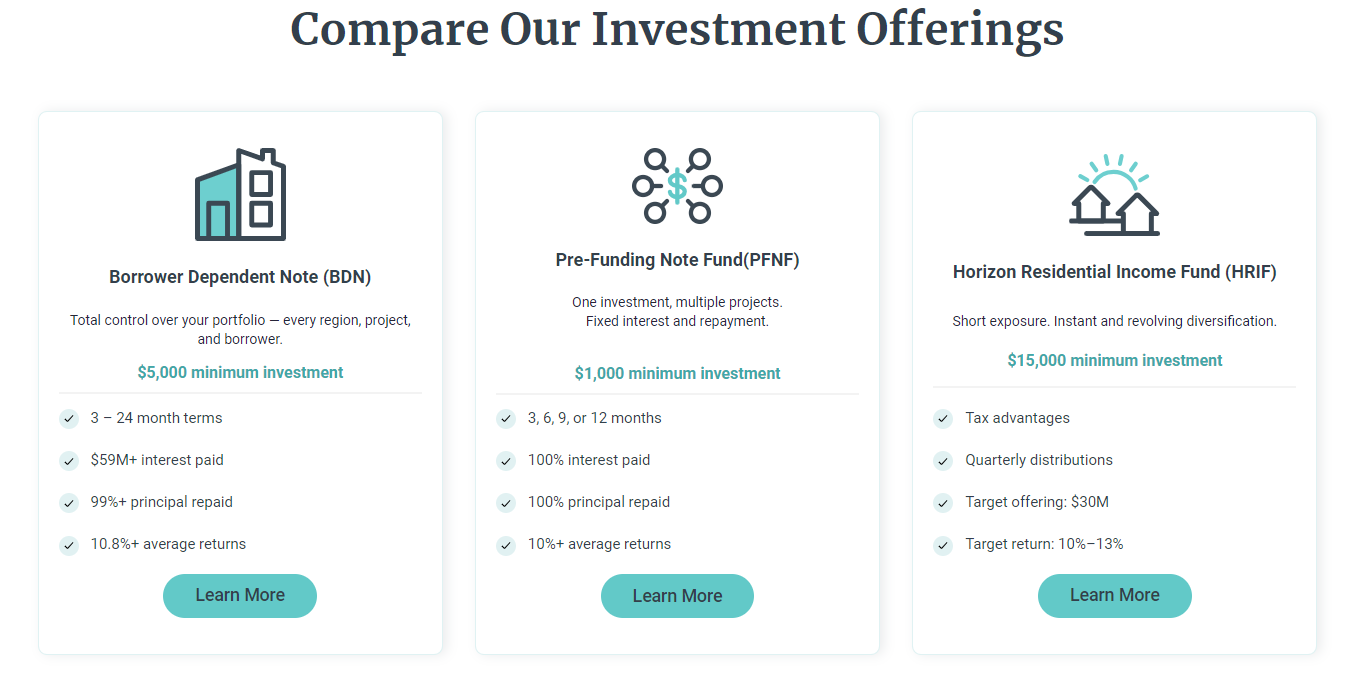

Borrower Dependent Notes

These are short-term, hard money loans typically sought by real estate investors for projects lasting from three to 24 months. Most commonly, these loans fund new construction or home rehab projects. As an investor, it's crucial to thoroughly evaluate each deal's fundamentals. While Upright has a 99% return of principal invested and an average annual return of 10.8%, it's important to note that individual note performance may vary. Each loan requires a minimum investment of $5,000, meaning investors may need a substantial portfolio to achieve diversification.

Borrower Dependent Notes

Borrower Dependent NotesPre-Funding Note Fund

Alternatively, investors can opt for Upright's line of credit, known as the Pre-Funding Note Fund. This fund serves as a line of credit for underwriting Upright's loans. Investors can select fixed terms ranging from three to 12 months with a low minimum investment of $1,000. Although Upright advertises an average return of 10%, actual returns depend on the APR advertised at the time of investment, with the current rate standing at 10.5%. While similar to a certificate of deposit (CD) in terms of paying set interest rates, it's important to recognize the inherent risks despite Upright's track record of principal repayment.

Pre-Funding Note Fund

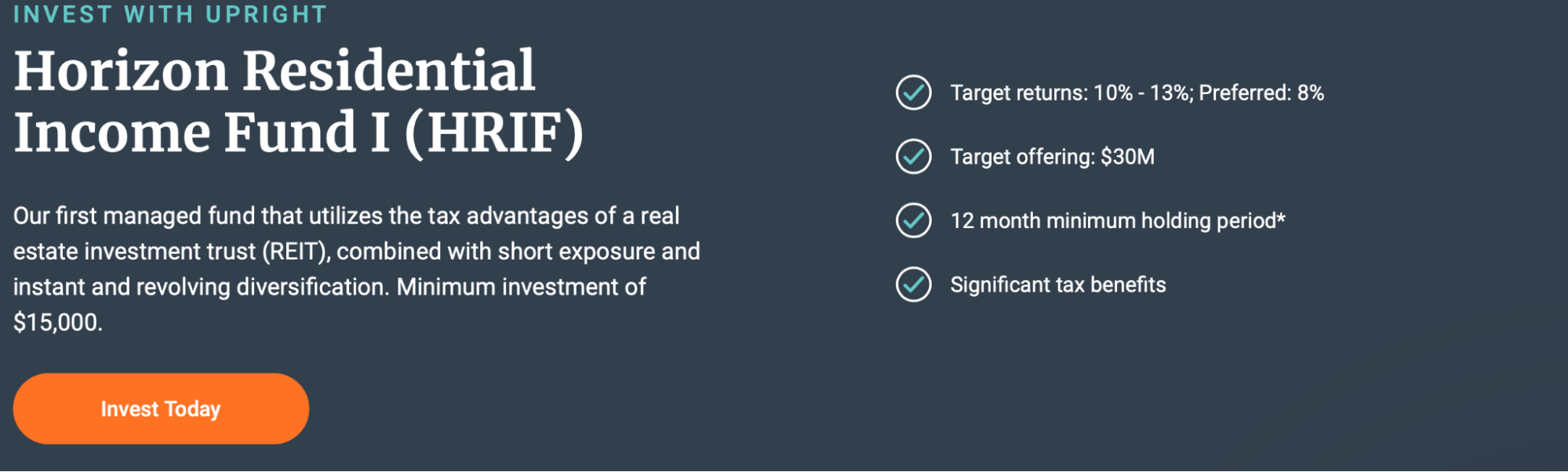

Pre-Funding Note FundHorizon Residential Income Fund

This fund, a privately held Real Estate Investment Trust (REIT), focuses on short and medium-term real estate loans. Investors commit to a one-year lock-up period, during which funds cannot be withdrawn. After this period, investors may request a return of funds, typically distributed within 90 days. Investors receive an 8% preferred return, with any additional profits above 8% split 80% to investors and 20% to fund managers.

Horizon Residential Income Fund

Horizon Residential Income Fund Invest offerings of Upright

Invest offerings of UprightUpright loans

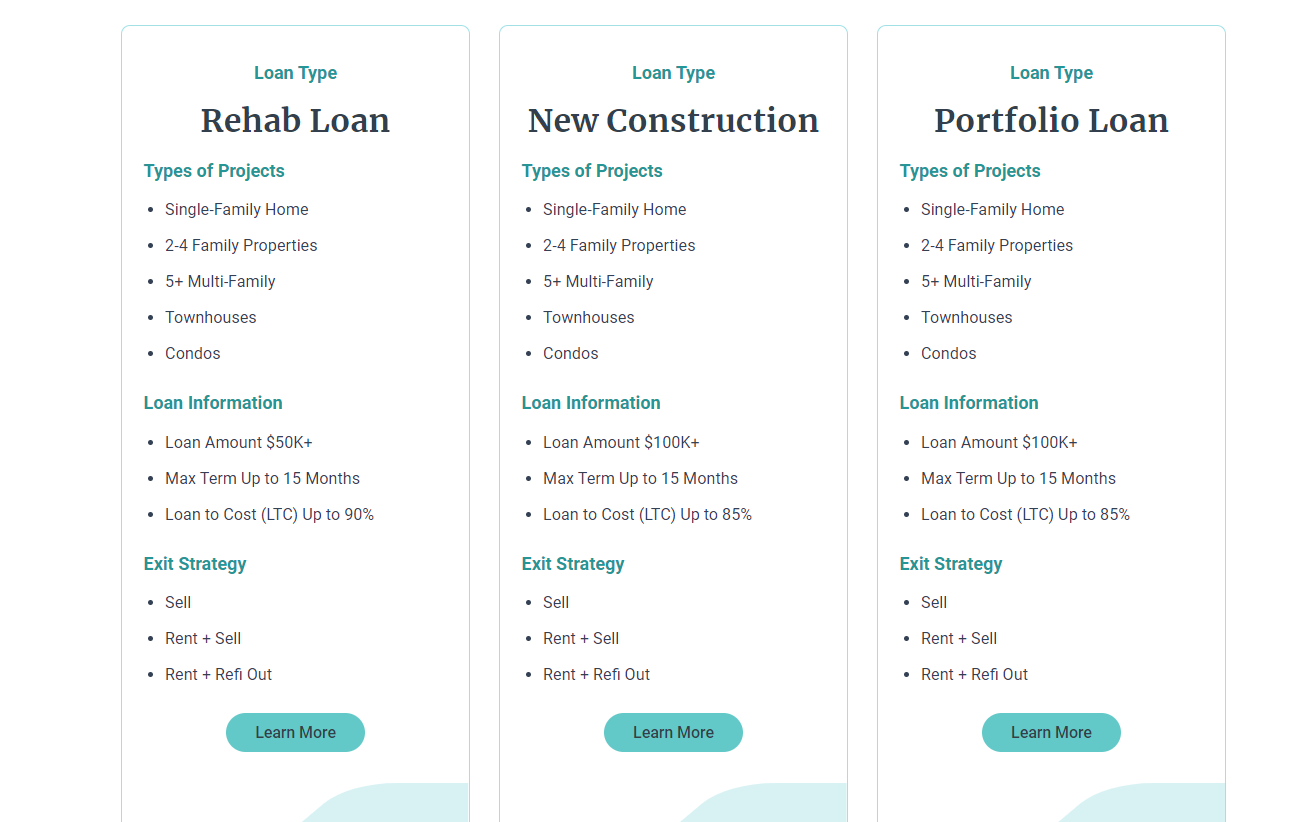

Rehab Loan

A rehab loan is a short-term, hard money loan used to purchase and renovate a real estate property, commonly employed in fix-and-flip or fix-to-rent projects. Unlike FHA 203K rehab loans, these loans cannot be used for owner-occupied properties. They cover a significant portion of the purchase and renovation costs, typically for single-family homes, 2-4 family properties, 5+ multi-family units, townhouses, and condos. The loan term can extend up to 15 months, with a loan-to-cost (LTC) ratio of up to 90% and coverage for construction costs up to 100%. The exit strategy usually involves selling the property, renting it out and then selling, or refinancing it.

Hard Money Loans for New Construction Projects

A construction loan is a short-term, hard money loan secured by the value of the property to be constructed. It covers a portion of the land purchase, if necessary, as well as construction supplies and labor. These loans are available for single-family homes, 2-4 family properties, townhouses, and condos. The maximum loan term is 15 months, with an interest-only payment structure and a loan-to-cost ratio of up to 85%. Construction costs are covered up to 100%, and the exit strategy typically involves selling, renting and then selling, or refinancing.

Hard Money Loans for Investment Portfolios

Portfolio loans enable borrowers to purchase multiple properties for their real estate business. These loans can be a single loan or multiple loans, depending on the borrower's needs. They are available for single-family homes, 2-4 family properties, townhouses, and condos. The loan term can extend up to 15 months, with an interest-only payment structure and a loan-to-cost ratio of up to 85%. Construction costs are covered up to 100%, and the exit strategy typically involves selling, renting and then selling, or refinancing.

Loan offerings of Upright

Loan offerings of UprightIs Upright safe and can it be trusted?

Upright has a strong track record, making it a safe and trustworthy option for investors. Founded by Matt Rodak, the company focuses on providing quick access to capital for borrowers while offering investors the chance to earn passive income through real estate loan investments. With over $2 billion managed and a 99.7% principal return rate, Upright demonstrates reliability. It maintains a low Loan-to-Value (LTV) ratio, ensuring a healthy reserve in case of foreclosure, and has transparency, a low uncured default rate, and venture capital funding. However, there are potential drawbacks, such as low investment volume and operating in states without a nonjudicial foreclosure option, which could lead to foreclosure delays.

Just like any other form of investment, there are always risks involved. Upright, in particular, is not FDIC-insured, which means that any non-invested deposits could potentially be lost in the unfortunate event of bankruptcy. Moreover, invested funds come with their own set of risks, such as fluctuations in the regional real estate market and project-specific challenges. While Upright boasts a 99.7% principal payout rate, it fails to provide clear information regarding interest payouts or the wait times for overdue payments.

- Pros:

- Cons:

- Potential for high yields on Hard Money Loans

Investing through Upright presents the potential for earning substantial returns, especially with hard money loans. These loans typically involve higher interest rates, offering investors the opportunity to achieve significant yields on their investments - Passive exposure to real estate investments

Upright offers investors the chance to gain exposure to the real estate market passively. This means investors can participate in real estate investments without actively managing properties or dealing with the day-to-day responsibilities associated with property ownership - Relatively short terms on loans

Loans facilitated by Upright typically have shorter terms compared to traditional real estate investments. This allows investors to potentially realize returns on their investments within a shorter timeframe, providing liquidity and flexibility in managing their investment portfolio

- Requirement of accredited investor status

One of the limitations of investing through Upright is the requirement of being an accredited investor. This accreditation necessitates meeting specific financial criteria, potentially excluding some individuals from participating in Upright's investment opportunities - Less liquid investment

Investments made through Upright are less liquid compared to traditional investment funds. Unlike stocks or mutual funds, where investors can easily buy or sell their holdings on the market, funds invested in real estate loans through Upright are tied up for the duration of the loan term, limiting liquidity - Inherent investment risks

Like any investment, Upright carries inherent risks. Despite the potential for high returns, there is no guarantee of principal repayment, meaning investors could potentially lose their invested capital. Additionally, real estate investments are subject to market fluctuations and other external factors that could impact investment performance

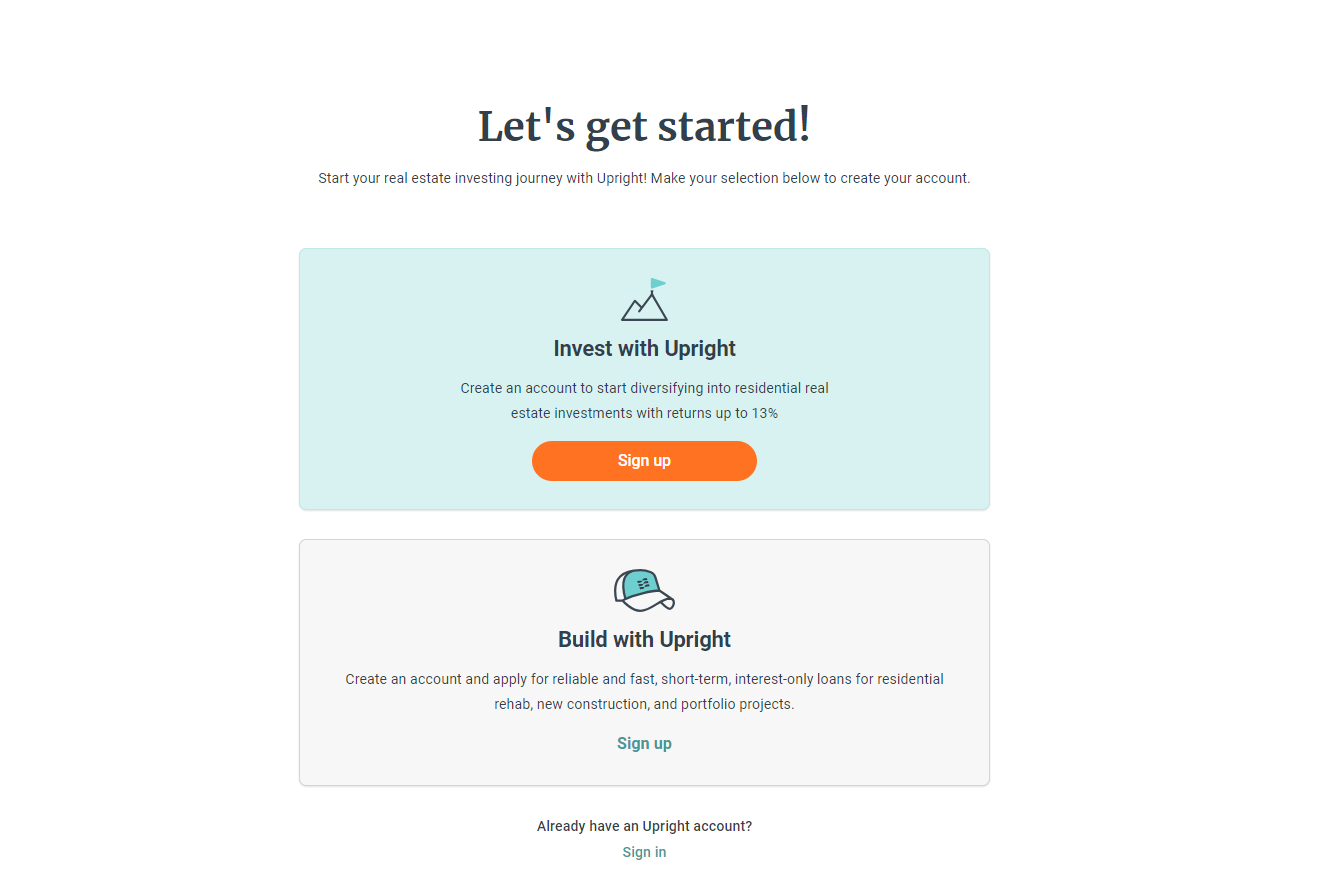

How to start using Upright?

To begin using Upright, locate and click the "Sign Up" button located in the upper right corner of the Upright website. Once clicked, you'll need to confirm your accreditation status and provide basic information such as your full name, email address, and phone number

How to start using Upright

How to start using UprightAfter submitting your details, you'll receive an email containing a temporary password, which you can use to log in to the Upright platform. Once logged in, you can explore the platform, read the Private Placement Memorandums, and browse available investment opportunities

Before investing, you'll need to verify your identity by providing additional information such as your Social Security Number, Date of Birth, and a US-based address. Additionally, you'll need to agree to the site's terms and connect your bank account to facilitate investments

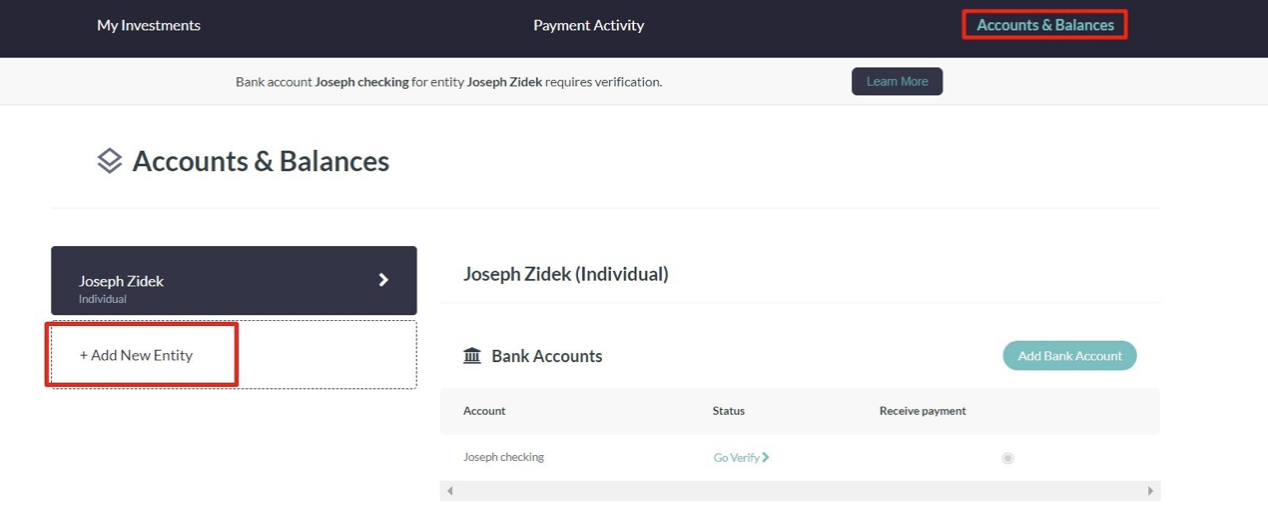

Once identity verification and bank account connection are complete, you can select investments and proceed with funding them. If you're creating an investing entity, go to the "Accounts and Balances" tab on your dashboard, click on "Add New Entity," select the appropriate entity type, and enter the required information. Once your investing entity is set up, you're ready to start investing through Upright

How to identity verification

How to identity verificationHow do I become an accredited real estate investor at Upright?

To become an accredited real estate investor at Upright, you must meet certain financial criteria set by the Securities and Exchange Commission (SEC). This includes having a net worth of at least $1 million, either individually or jointly with a spouse (excluding the value of your primary residence). Alternatively, you must have earned an income exceeding $200,000 individually (or $300,000 jointly with a spouse) in each of the past two years and expect the same for the current year. Another pathway to accreditation is by being an investment professional with specific licenses such as Series 7, Series 65, or Series 82.

Entities like corporations, partnerships, or trusts can also qualify as accredited investors if their assets exceed $5 million. Certain financial institutions and registered entities also qualify under SEC regulations.

When signing up to invest with Upright, you can indicate that you are an accredited investor. However, Upright requires verification of your accredited status through a third-party investor identity solution. This verification process typically takes less than five minutes, and you'll receive confirmation via email within one business day.

Expert opinion

I think that Upright offers a straightforward path for passive real estate investing, which can be attractive for those seeking diversification in their investment portfolio. By focusing on short-term, hard money loans, Upright aims to provide investors with potential for good returns. However, it's crucial to recognize the inherent risks, like the absence of a guarantee on the invested amount and possible delays in foreclosure proceedings in certain states. To minimize risks, investors might consider spreading their investments across different types of real estate, like residential, commercial, or industrial properties. While Upright's investment options are appealing, it's wise to approach with careful consideration and conduct thorough research before diving in.

Summing up

Upright offers a range of services aimed at passive real estate investing, catering to both investors and borrowers. For investors, Upright provides opportunities to invest in borrower-dependent notes, access the Pre-Funding Note Fund, or participate in the Horizon Residential Income Fund. Each option varies in terms of investment duration, return rates, and risk levels. Upright's loan offerings include rehab loans, which cover the purchase and renovation of properties, new construction loans for building projects, and portfolio loans for purchasing multiple properties. These loans typically have short terms, competitive interest rates, and options for various property types, providing investors with flexibility and potential for returns.

FAQs

What is Upright?

Upright is a real estate investment platform, offers licensed investors lucrative residential real estate loan options, offering opportunities to invest in various loan products secured by first-position mortgages.

How to earn on Upright?

Investors can earn passive income on Upright by investing in real estate loans through borrower-dependent notes, the Pre-Funding Note Fund, or the Horizon Residential Income Fund. These investments offer potential returns based on the performance of the underlying real estate projects.

Is Upright safe?

Upright has established itself as a safe platform for real estate investing, having a solid track record and transparent operations. However, like any investment, there are inherent risks involved, and investors should conduct thorough due diligence before investing.

How much money do I need to start on Upright?

To start investing on Upright, you typically need to meet the accreditation requirements set by the Securities and Exchange Commission (SEC), which include having a net worth of at least $1 million or meeting certain income criteria. Additionally, the minimum investment amount varies depending on the specific investment product chosen (from $5,000).

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

George Soros is a prominent billionaire investor and philanthropist known for his involvement in financial markets, including forex trading. He gained fame for his successful currency speculation in 1992 when he famously bet against the British pound, earning him a significant profit and the nickname "The Man Who Broke the Bank of England." Soros is also known for his political and philanthropic activities through organizations like the Open Society Foundations.

SIPC is a nonprofit corporation created by an act of Congress to protect the clients of brokerage firms that are forced into bankruptcy.