Trading platform:

- Neteller Wallet

- Central Bank of Ireland

- 180 countries

- 2.5%

Currencies:

- 28 currencies

cryptocurrencies:

- Yes

Summary of Neteller

Neteller is a British e-money system that enjoys high demand for online financial transactions: money transfers, making deposits for trading, gaming and also payment of utility bills, etc. The service gained popularity thanks to instant transactions and reliable personal information security. Today, millions of people from over 200 countries use Neteller. In this review, you will learn about the deposit/withdrawal methods on Neteller and the fees, as well as pros and cons of using this electronic payment system.

| 💼 Main types of accounts: | Personal Accounts |

|---|---|

| 💱 Multi-currency account: | 27 supported currencies |

| ☂ Deposit insurance: |

2.99% (min. USD 0.5) for transfers inside the system. Up to 4.99% for international transfers. |

| 👛️ Savings options: | HOT OFFERS and loyalty programme |

| ➕ Additional features: | Bonuses/Special offers |

👍 Advantages of trading with Neteller:

- Multilingual interface. Users from many countries all across the world use this electronic payment system. The company works both with private individuals and legal entities, offers interesting business solutions;

- Passive income options. The company offers an interesting affiliate program;

- High reliability and security level.The platform cares about the security of user data and funds: there is two-factor authentication, and a code for confirming transactions;

- Wide functionality. You can schedule payments and perform transactions automatically in this electronic payment system. Many financial companies are working with Neteller, offering the system as an available method of payment (Forex brokers, CFD, binary options brokers, betting and investment officers, casinos, etc.). Many online stores also accept Neteller as a payment method.

👎 Disadvantages of Neteller:

- Rather high internal fees (the exchange fees amount to 1.45% of the transfer amount), and there is also the service fee for inactive accounts;

- It is impossible to open a multi-currency account (only users of the bonus program can open an account in additional currency);

- If you refuse to verify your account, the functionality will be limited and limits inside the system will apply.

Analysis of the main features of Neteller

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Neteller

Neteller was initially created for active people who often transfer money online working with financial organizations, gambling or sport betting. The popularity of the electronic payment system that is considered one of the oldest in the market continues to grow. Users value its reliability, fast financial transactions and licensing (something not many other electronic payment systems can boast). Neteller certainly has some drawbacks, such as necessary verification for full access and increased limits and small number of withdrawal options. Also, Net+ card, which makes money transfers much easier, is available only to a limited number of users from authorized European Economic Area (EEA) countries.

Dynamics of Neteller’s popularity among

Traders Union’s traders, according to 2023 data

Investment programs, available markets, and products of Neteller

Neteller offers its customers the opportunity to get a prepaid card that offers a quick and one of the most affordable methods of withdrawal of electronic money. You can order the Net+ Card that will be automatically linked to your account. Due to legislative requirements, only clients residing in the European Economic Area (EEA) countries can obtain the card.

The residents of authorized European Economic Area (EEA) countries can order a virtual or physical Net+ Card. For the physical card, you will have to pay slightly over USD 10 (for registration and delivery). Also, whenever there is a transaction between different currencies, a user will have to pay a 3.99% currency exchange fee. The withdrawal fee is 1.75%. If you use your card to pay online, no fee will be charged (provided that no currency exchange is required). The limits for using the card include up to 10 withdrawals per day, and up to USD 1,000 one-time withdrawal limit. There is also a limit for cashless purchases: up to 50 transactions or USD 3,000 per day. You can get your virtual card for free, but keep in mind that you will only be able to use it for online purchases and payments. The daily limit is USD 200.

In order to order a card, you need to log into the payment system, find Net+ Card section in your Personal Area and click Get a Virtual Card or Get a Physical Card.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Neteller Money Transfer Terms & Conditions

Neteller supports more than 75 payment methods for depositing with a fee of 2.5%. To withdraw funds from the Neteller you can use a bank account, cards, electronic systems, and websites that work with the system. Fees vary depending on the selected payment channel and account type — Standard, True, and VIP.

Money can be sent to any Neteller user by phone number or email address. You can also transfer funds to bank accounts around the world. There are no fees for international transfers, so the sender of funds pays only a currency conversion fee. Receiving funds on Neteller is always free.

The Neteller Personal Account owner can buy and sell cryptocurrencies, as well as transfer them to other users of the system. The minimum purchase amount is $1. Also, owners of verified Neteller Personal Accounts from EEA countries can receive a prepaid Net+ Prepaid Mastercard. It can be used to withdraw cash from any ATM and make purchases in over 35 million stores around the world.

| 💼 Main types of accounts: | Personal Accounts |

|---|---|

| 💱 Multi-currency account: | 27 supported currencies |

| Deposit terms and conditions: | All main methods are available |

| Loan terms and conditions: | Deposit options and withdrawal options |

| ☂ Deposit insurance: |

2.99% (min. USD 0.5) for transfers inside the system. Up to 4.99% for international transfers. |

| 👛️ Savings options: | HOT OFFERS and loyalty programme |

| Types of payment: | Transfers to a bank account, debit/credit card, electronic payment systems, digital currencies, exchanges |

| ➕ Additional features: | Bonuses/Special offers |

Comparison of Neteller with other e-payment systems

| Neteller | Advcash | Payeer | Skrill | 2Checkout | Stripe | |

| Supported Countries | 180 countries | 150 countries | 127 countries | 200 countries | Over 200 countries | 48 |

| Supported Currencies | 28 currencies | 9 currencies (USD, EUR, GBP, RUB, BRL, TRY, UAH, KZT, VND) | 3 fiat currencies (USD, EUR, and RUB) and most cryptocurrencies | 40 currencies | All currencies | 135 |

| Support for cryptocurrencies | Yes | Yes | Yes | Yes (deposit) | No | No |

| Subscription fee | 2.5% | No, only transaction fees | No, transaction fees only | No, only transaction fees | 3.5% + 0.35$, 4.5% + 0.45$ or 6% + 0.60$ per transaction | 2.9% + 30 cents per account |

| Payment acceptance equipment | Yes, Net+ Cards | No, only software | No, online only | No, only online | No, only online | No, just the software |

Neteller Commissions & Fees

For deposits from USD 20,000 (or an equivalent), the fee is not charged. In all other cases, the deposit fee is 2.50%.

As for withdrawal, everything depends on the chosen method. For example, the fee for transfers to Skrill is 3.49% of the amount, and if you use Visa – from 0 to 7.5% (the same fee is applied for MasterCard).

The following fees are charged for transfers:

-

Depending on the account level: 2.99% + USD 0.50 for NETELLER Standard, and 1.45% + 0.50% for NETELLER True;

-

For international transfers: up to 4.99%;

-

For sending funds to other users of Neteller: 2.99% (min. USD 0.50). Receipt of money is always free;

-

For currency exchange, the system charges a 4.49% fee plus the average statistical rate of the interbank market (for VIP participants it is only 1%).

Traders Union also compared Neteller’s fees with similar types of fees on other e-payment systems.

| FastSpring | 2Checkout | Neteller | |

| Payment commission | 5.9% + $0.95 | 3.5% + 0.35$, 4.5% + 0.45$ or 6% + 0.60$ per transaction | 2.99%, min USD 0.50 |

| Deposit commission | 2% (max $20) | Depending on the payment method | 2,5% |

| Withdrawal commission | $5 | Depending on the payment method | 0%-3.99%, Bank Transfer - 10$ |

| Commission for international transfers | 8.9% | Depending on the payment method | Up to 4.99% |

Neteller is owned by Paysafe Financial Services Limited, which is a part of UK-based Paysafe Group. The company’s headquarters are located at: 7 Floor, 25-27 Canada Square, London E14 5LQ, United Kingdom. The reference number of the official legal entity registration is 4478861. It is authorized by the Financial Conduct Authority under the Electronic Money Regulations. The check showed that the license FRN: 900015 is valid.

The company takes care of the security of user funds. You can turn on two-factor authentication and also set a personal code for confirming financial transactions. Other security measures of the payment system include:

-

Regular monitoring of accounts and account blocking for attempting fraud;

-

Encrypted data. The information in the rooms is transferred to the system automatically and you are not even required to specify your account number, only your password, which is sent encrypted, and your email.

Detailed review of Neteller

The British Neteller payment system is operated by Skrill Limited and has been operating since 1999. At the moment, it is one of the most widely used EPSs worldwide. The popularity of Neteller is due to the absence of regional restrictions, versatility, and convenience. The platform is available in 11 languages and can be used both for personal purposes (transfers, payment for services, goods, etc.) and for business. Neteller is regulated by the Financial Conduct Authority — a financial supervision authority in the UK.

Neteller in numbers:

-

The platform has been operating for over 23 years.

-

Available in more than 200 countries.

-

Supports 27 currencies.

-

Offers 78 deposit options.

Neteller is the most convenient and secure system of instant electronic payments

Neteller has taken care of the maximum convenience of its clients. The first advantage of the system is the almost instant receipt of money. If the user plans to use a third-party device but does not want to go through an additional security check every time, then they can add it to the "Trusted Devices" list. Also, by enabling the "Remember me" option, the user can quickly navigate to the page of the selected seller without having to enter an identifier from five personal devices. At the first login, the system remembers the login and password entered for authentication and no longer requests them for 6 months. At the same time, the data remains completely secure thanks to multi-level encryption.

You can use Neteller payments from any device. The system is available in all browsers (the web platform works on PCs, laptops, and smartphones) and as mobile apps.

Useful Neteller options:

-

Knect. A loyalty program that allows you to earn points for making certain transactions. They can be exchanged for e-money, gift cards, or shopping vouchers.

-

Sending money by phone number. The user can add contacts to the Neteller profile to transfer funds with one click.

-

"Exclusive offers" section. Here you can find promotions and bonus programs from partners — virtual casinos, forex brokers, and cryptocurrency exchanges.

-

Withdrawal of cryptocurrencies. Using Neteller, you can convert fiat money into digital currency and transfer it directly to a cryptocurrency wallet address. The service is available in limited countries.

Pros:

-

High level of security of users' data and money.

-

Zero fees for international transfers.

-

The system is global and works on an international level.

-

The possibility of using not only debit but also credit cards for transferring funds to bank accounts abroad.

-

The recipient of the funds does not pay any fees.

-

The service offers a reduced transfer fee for verified users using the mobile app.

You can use Neteller without providing identity documents for verification, but in this case, the transfer amounts will have limits (daily, weekly, and monthly).

Types of accounts in the Neteller payment system

This is a multi-level payment system, where users can develop their account. There are three account levels:

-

NETELLER Standard. This is a basic level assigned to all new users of the system

-

NETELLER True. This level becomes available once you’ve successfully passed verification, topped up your account and downloaded mobile apps (for smartphones, tablets)

-

NETELLER VIP. Users with this level receive a number of benefits, including loyalty rewards. VIP clients are also ranked by levels.

Banking features

Neteller is a progressive electronic wallet that supports various deposit and withdrawal options. It is easy to find the one that suits you the best. Specifically, there are over 40 deposit and withdrawal methods offered by the system (depending on the chosen region). Among them are:

-

Bank transfer;

-

Debit/credit cards (Visa, Maestro, MasterCard);

-

Electronic payment systems: Skrill, YandexMoney, Qiwi;

-

Exchanges.

All offered deposit options are available in your Personal Area. You can view them in the Money In section.

There are also various withdrawal options, including:

-

Bank transfer;

-

Electronic payment systems: Skrill;

-

Payment online, on the websites that accept payments from Neteller (Merchant Site);

-

Online exchanges.

You can choose the best option, as each differs by rules and fees. The list of account currencies is quite extensive with 27 possible options (the most frequently used are USD, EUR, and others).

Social programs of Neteller

Everybody can earn passive income in Neteller by joining the affiliate program. To promote the offer, users are provided with customer support and everything that is required for promotion, including links, banners, articles, guides and other useful content. A partner earns 20% revenue share for attracted clients. Here’s an example: a referral transfers USD 1,000 to a merchant site that pays 1.5% to Neteller. As a result, the partner’s revenue share is calculated as follows: 1000*1.5*20% = USD 3. The system is simple and beneficial.

How to open an account at Neteller

In order to use Neteller waller, you need to register on neteller.com. The procedure is free and literally takes 5 minutes. To start click Join for Free in the top right corner.

A registration form will open in a new window, where you will need to provide the following information:

-

Email;

-

Password for accessing your Personal Area (at least 8 characters, must have at least one number and one capital letter);

-

Currency (EUR, USD or any other from the list);

-

Personal information. You will also need to provide your phone number, zip code and your date of birth.

You need to carefully read NETELLER Terms of Use and agree to them. The next step is checking your security question. If you’ve noticed a mistake/inaccuracy, you can fix it.

This completes the registration and account creation procedure. A confirmation email with an account ID will be sent to the email address you provided.

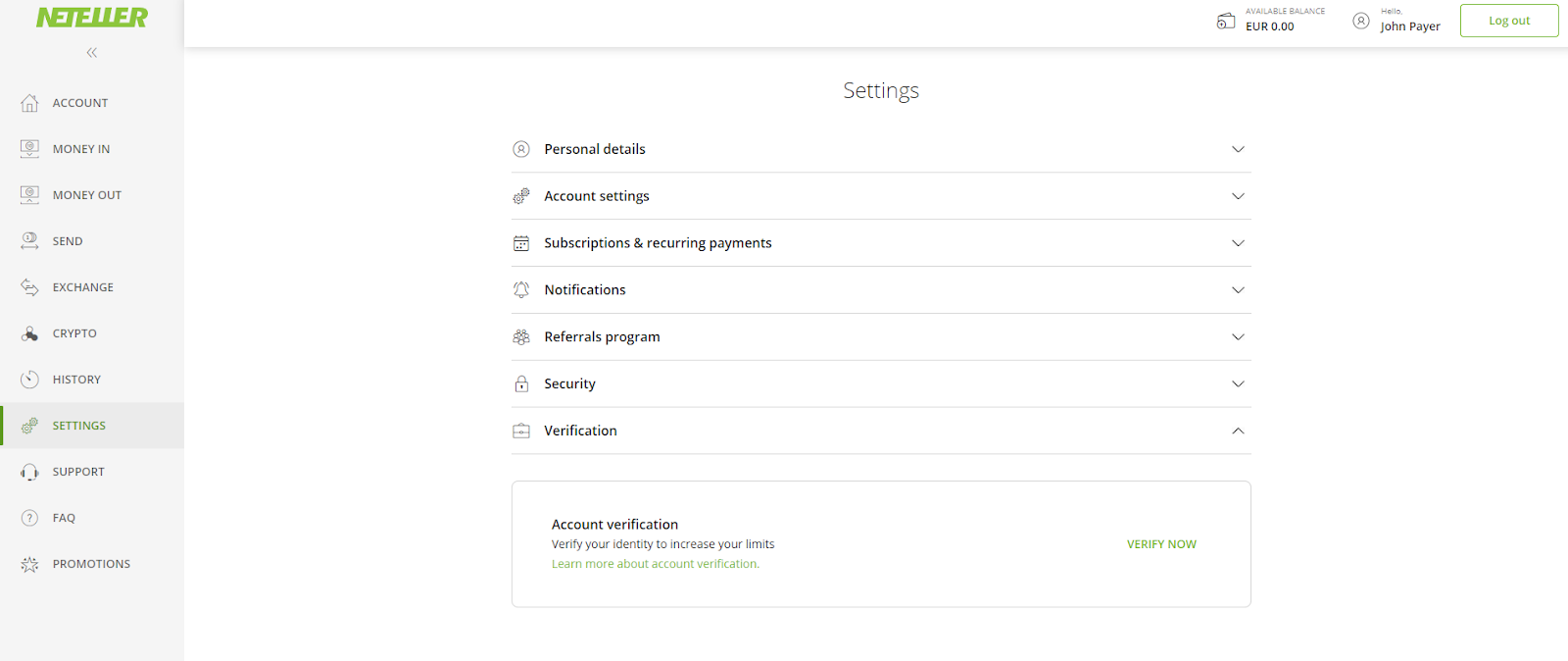

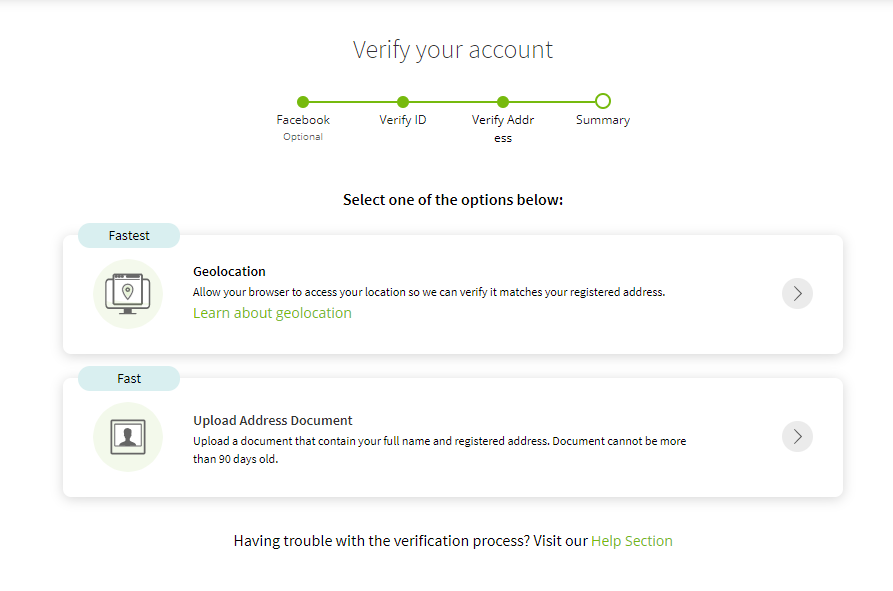

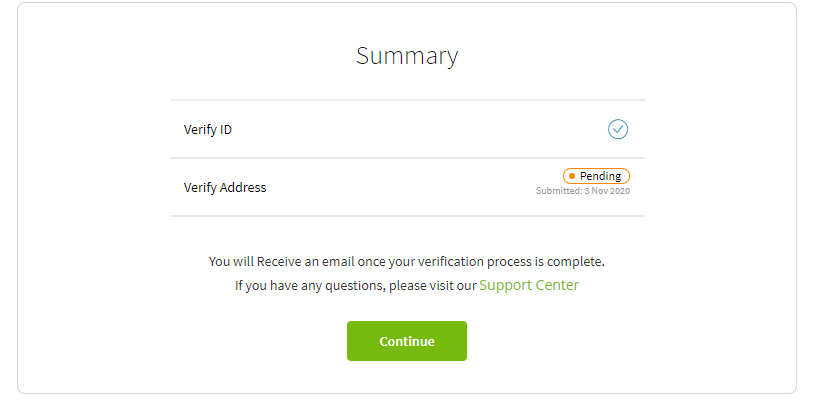

Verification in Neteller is not considered mandatory. However, if you want to have higher transaction limits and withdraw money at an ATM or transfer to your bank account, you will have to pass verification. IMPORTANT! In order to launch verification, you need to deposit at least USD 10 to your account.

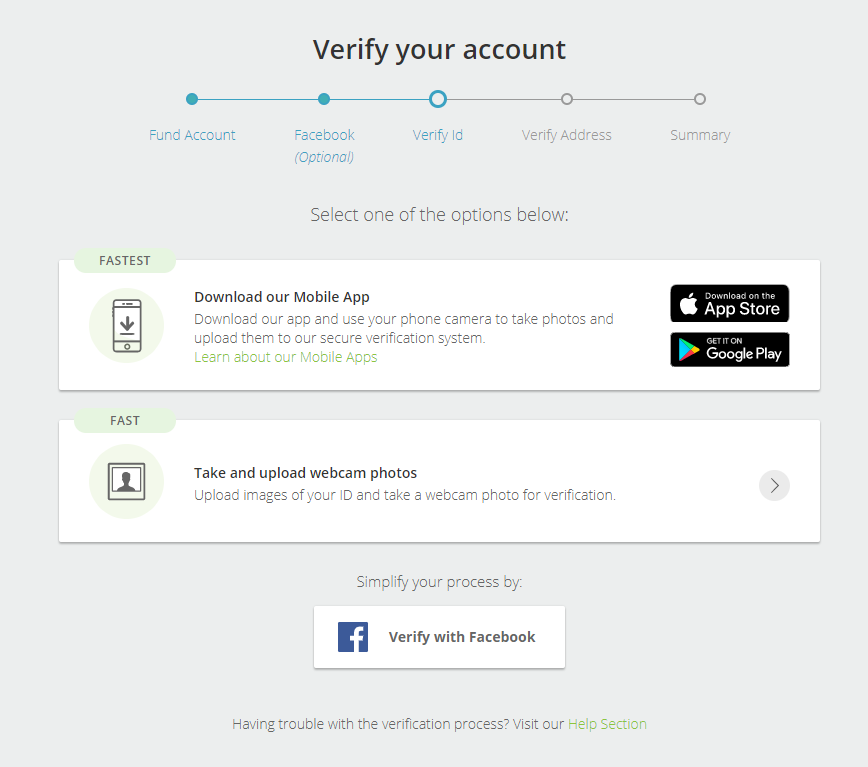

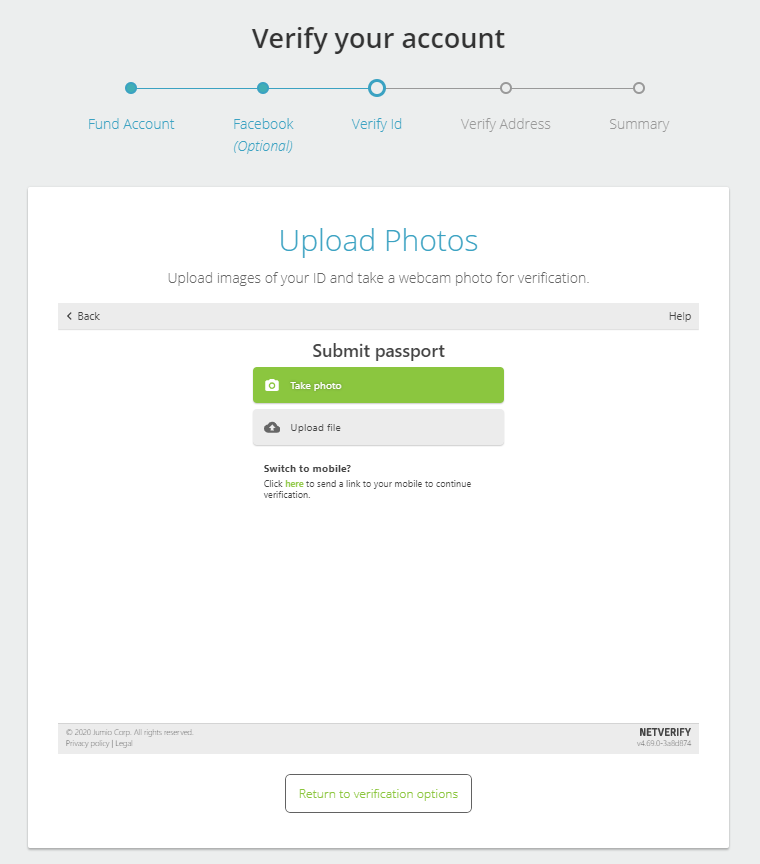

You can start the procedure by clicking on the corresponding banner titled Verification in your Personal Area. The algorithm is as follows:

-

Upload your ID photo (passport or ID card);

-

Take a selfie using the Mobile App or your webcam;

-

Provide a document to confirm your registered address. It can be a bank statement or a utility bill (the documents must be issued within the last 90 days) with your registered address and full name on it.

The verification procedure takes 1-3 working days. You can monitor the results of verification in your Personal Area.

All limits are lifted for verified users and they can use the full functionality of the electronic payment system.

Technical support

There are "Support center" and "FAQs" sections on the Neteller website, which describe in detail the system's conditions and fees. These sections also contain guidelines for creating a Personal Account, going through the verification process, and making payments.

Also on the website and in the Personal Account section, there is a bot that helps you get a quick answer to your questions. The virtual assistant is available 24/7. To contact the technical support operator, you can use a communication form or make a phone call. You can also use a chatbot to request assistance from a specialist.

The Personal Account contains the phone numbers of nine regional representative offices. There is a phone number for international calls; it is serviced by the British representative office. Phone support is provided on different days and hours, while the working hours of operators depend on the country. Calls are paid according to the rate of the local telecom operator, and there is no possibility to request a callback.

Disclaimer:

Your capital is at risk. Via Neteller's secure website. Your capital is at risk.

FAQs

Does the Neteller payment system work officially?

Yes. The payment system is officially registered and licensed for financial activities.

Is it possible to withdraw money to a bank card from a Neteller account?

Neteller customers can withdraw money to debit and credit cards of any bank.

Can I buy cryptocurrency through Neteller?

By means of the Neteller wallet, you can replenish your account on a cryptocurrency exchange and buy cryptocurrency.

Does Neteller have a mobile app?

Yes. The Neteller payment system offers a convenient mobile application for money transfers.

Traders Union Recommends: Choose the Best!

Via Advcash's secure website.

Via Payeer's secure website.

Via Skrill's secure website.