Is It Good To Invest In An Overvalued Stock?

If a stock is overvalued, its current market price is higher than its intrinsic value, which is calculated based on the company’s fundamental financial performance and growth prospects. Investing in overvalued stocks can be risky because there's a possibility of a price correction if the market reassesses the stock's true value.

In the volatile world of stocks, where intrinsic value and market price often exist in stark contrast, lies the intriguing concept of overvalued stocks. These are stocks whose market prices, buoyed by factors such as hype or speculation, exceed their inherent worth.

-

Overvaluation arises from market inefficiencies, positive news, FOMO, and speculation.

-

Tools like Yahoo Finance and Finviz screen for high P/E, P/B, and PEG ratios to identify overvalued stocks.

-

While overvalued stocks carry risks of correction, they can offer short-term growth; selling should be strategic, informed by reliable analysis.

For instance, companies like Tesla, Netflix and Zoom have had their moments in the limelight for their seemingly inflated stock prices. The question is, how does one identify and navigate investing in such stocks? Armed with the right tools and strategies, it’s a challenge that could potentially offer lucrative returns.

-

What Does It Mean If a Stock Is Overvalued?

If a stock is overvalued, its current market price is higher than its intrinsic value, which is calculated based on the company’s fundamental financial performance and growth prospects. This often occurs when investor sentiment is overly optimistic, disregarding the underlying financials.

-

What is stock outperform?

A stock is said to outperform when it yields a better return than a benchmark index or the average return of its industry peers. Analysts may designate a stock as 'outperform' when they expect it to do better than the market average over a certain period.

-

What is an overrated stock?

An overrated stock is one that receives a disproportionate amount of positive attention or high ratings from analysts or the media compared to its actual financial performance or business prospects. On the one hand, such a stock may not necessarily be overvalued but is often perceived as better than it truly is. On the other hand, an overrated stock can indeed be overvalued, as it's receiving excessive positive attention compared to its actual worth.

-

Why were stocks overvalued in the 1920s?

Stocks were overvalued in the 1920s due to rampant speculation, lack of regulation, a buoyant post-war economy that inflated earnings expectations, and the widespread use of margin lending, which allowed investors to borrow heavily to buy more stocks, pushing prices beyond sustainable levels. Other factors include a proliferation of new industries (such as automobiles and radio) that fueled investor excitement and contributed to the speculative bubble.

What is an example of overvalued stock?

To truly grasp the concept of overvalued stocks, let’s look into some real-world examples, such as Tesla and Zoom, which have been regarded as overvalued due to specific financial factors and market conditions.

For example, in early 2021, TSLA's share price rose sharply and its share price to earnings ratio was around the 1400 level.

TSLA Stock chart

This amazed market participants and, of course, talk of TSLA stock being overvalued was appropriate.

Similarly, Zoom proved to be overvalued, reaching $559 during the pandemic.

Zoom weekly chart

Despite its innovative business model and substantial market share in the online meetings industry, the company’s financial metrics didn't justify its stock price, leading many to label it as overvalued, which later proved true when the stock’s price collapsed after the pandemic.

Evaluating the intrinsic value of stocks in volatile market conditions is crucial to recognize overvaluations. One must conduct thorough research and fundamental analysis to avoid such risky investments.

Best Stock Brokers

Why are stocks overvalued?

Understanding why stocks become overvalued requires a deep dive into the nuances of market value versus intrinsic value, along with an examination of key influencing factors such as market inefficiencies, positive news, and the psychological phenomenon known as FOMO (Fear Of Missing Out).

Market value is the price at which a stock trades in the market, which can be swayed by a myriad of factors like market sentiment and supply and demand dynamics. On the other hand, intrinsic value is a more theoretical concept, calculated based on a company’s fundamentals like revenue, earnings, and growth potential.

When market value exceeds intrinsic value, a stock is deemed overvalued. This discrepancy can arise due to:

-

Market inefficiencies: Information asymmetry can lead to mispricing.

-

Positive news: A sudden surge of good news can inflate a stock’s price.

-

FOMO: Investors rushing to buy a hot stock can drive up its price.

-

Speculation: Unrealistic future expectations can result in overvaluation.

-

Environment/Market-wide issues: Rarely happens, but as the Covid pandemic proved, an environment and market-wide issues can have a huge impact on stock prices

Recognizing the difference between market value and intrinsic value is integral to identifying overvalued stocks and making sound investment decisions. This can be done via fundamental analysis.

Is it better to be overvalued or undervalued?

The value of a stock comes into play when strategizing one’s portfolio. Overvalued stocks present a higher risk of price correction and potential losses. Investors who buy these stocks are betting on continued growth, but if the market corrects, they may find themselves holding stocks that are worth less than what they paid for.

On the other hand, undervalued stocks, those trading for less than their intrinsic value, can offer buying opportunities for investors seeking potential growth. These stocks are often targeted for their long-term appreciation potential. However, a low-priced stock isn’t always a bargain. It may be undervalued due to company-specific or market-wide issues.

How to find overvalued stocks

Identifying overvalued stocks is key to savvy investing and protecting one's portfolio from potential losses.

It is very important for an investor to "see" overvalued shares in time - let us remind you of the main signals that indicate this.

High P/E multiple

Overvalued stocks can be spotted through financial ratios and metrics, with the Price-Earnings (P/E) Ratio being the most common indicator. A high P/E compared to industry averages may signal overvaluation.

High PEG multiple

Recall: PEG is an analog of the P/E ratio, adjusted for EPS growth rate. It is the ratio between a company's price-to-earnings ratio (P/E ratio) and its annual EPS growth rate.

The benchmark value of the ratio is considered to be equal to 1. If less, it may mean that the company is undervalued relative to its potential net income growth. If the PEG is greater than 1, the company may be overvalued.

Weak wage growth

If a company's revenues and wages are not growing as fast as its stock price, it turns out that investors are paying a premium for a company that is not delivering the expected real earnings growth.

High debt-to-equity ratio

This situation means that the company is financing its current growth with risky (loan) capital and may not be able to service this debt.

Insider selling

If insiders, such as company executives or managers, are selling their shares, it may be a sign of liquidity problems and an attempt to save their personal capital from unnecessary risk.

Market Capitalization

If a company's market capitalization is much higher than its industry competitors, and its financials are not super profitable, it is a sure sign of excessive and unjustified investor confidence in such stocks.

To make an investment decision, all multiples and financial indicators should be used correctly and the overall situation in the company should be assessed comprehensively, taking into account industry indicators.

Investors have access to several tools and scanners for evaluating stock value, such as:

-

Trade Ideas: This platform offers real-time market scanning, AI-driven trade signals, customizable alerts, advanced charting capabilities, and time-saving data visualization

-

Barchart.com: This site provides real-time or delayed intraday stock and options data, as well as tools for tracking and analyzing investments

-

FinViz: Known for its screener, FinViz allows you to quickly find winners and losers based on technical and fundamental analysis.

-

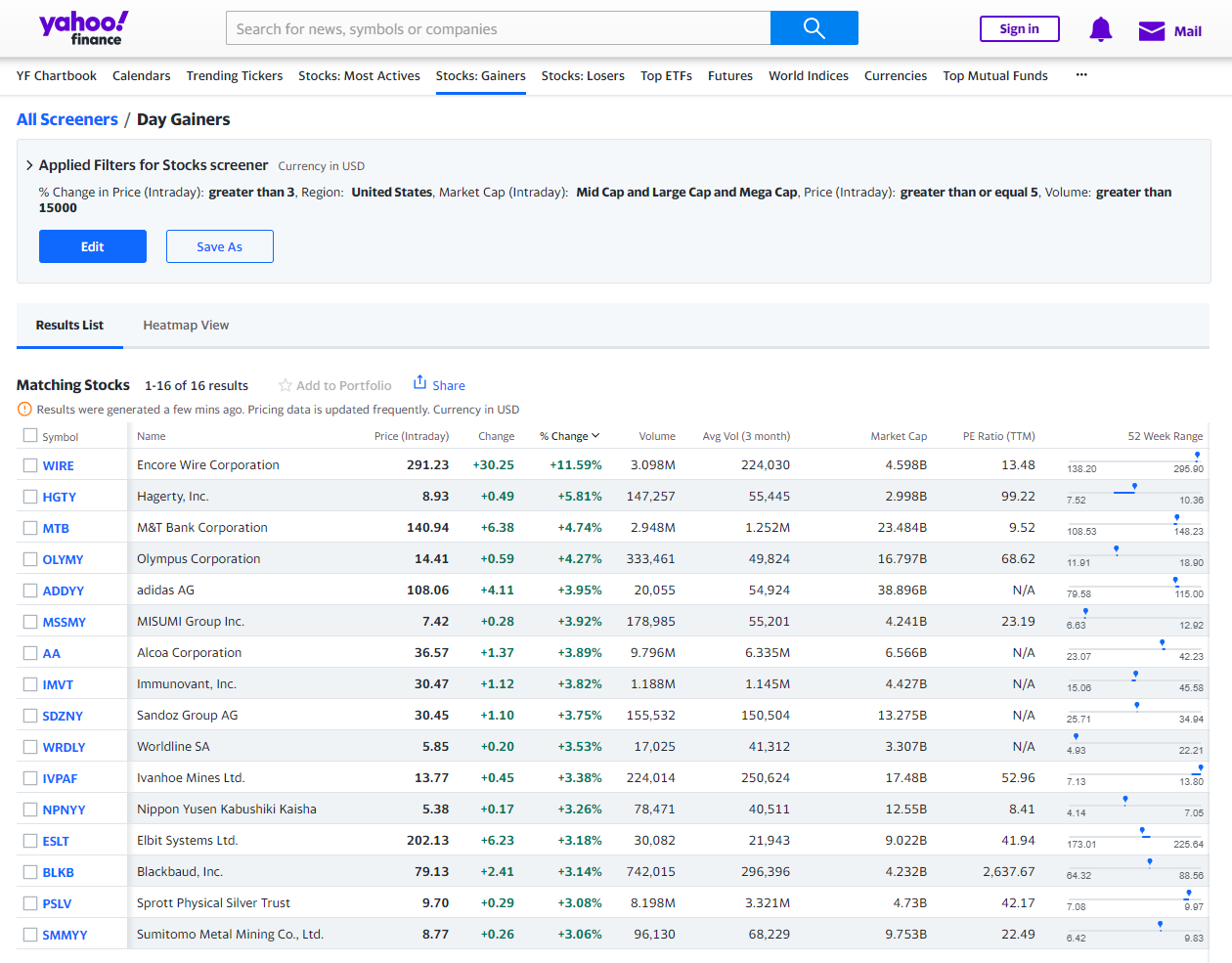

Yahoo Finance: Offers customizable filters based on financial metrics, aiding in the detection of stocks with inflated valuations.

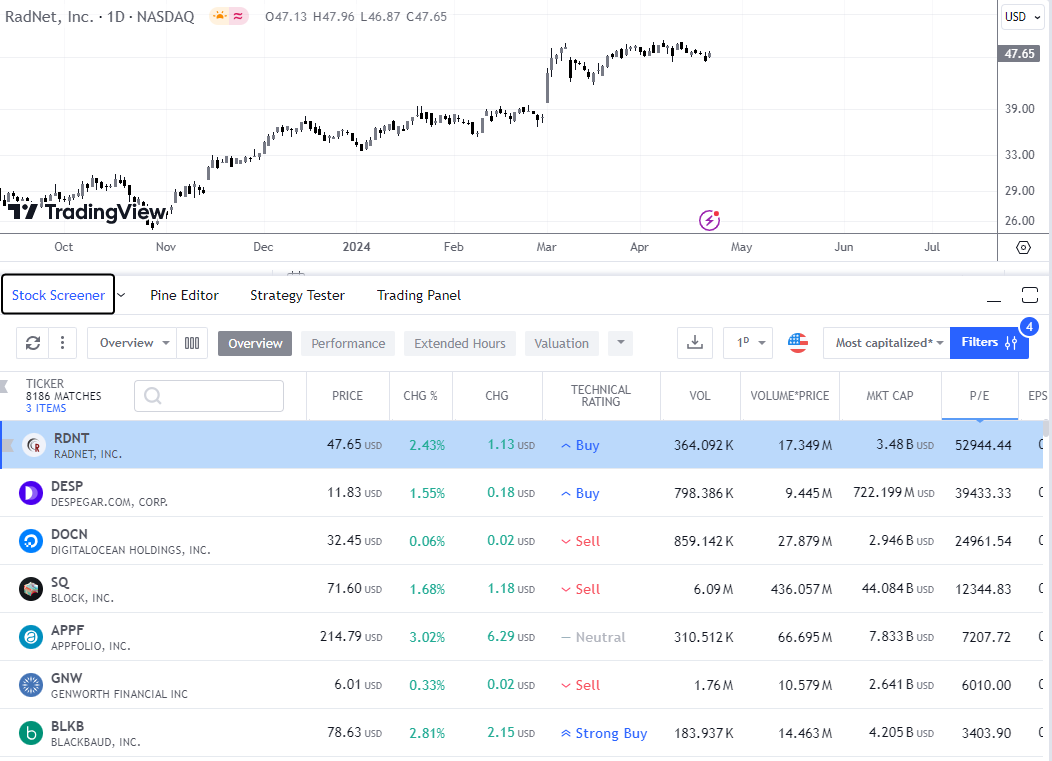

We would like to mention TradingView platform, which allows you to work with financial performance of companies.

TradingView allows you to search for overvalued stocks

When setting up a scanner to find overvalued stocks, focus on valuation ratios (high P/E, P/B, and PEG ratios), growth discrepancies (stock price growth vs. earnings growth expectations), and profitability metrics (such as declining ROE). Monitoring these parameters can help investors filter out stocks that might not justify their current market prices.

Should you buy overvalued stocks?

Utilize fundamental analysis tools like high P/E ratios, PEG ratios, and P/B ratios, which can help identify such stocks.

Ready-made list of stocks that are rated overvalued on Yahoo Finance

However, buying overvalued stocks can be risky as their prices may not sustain in the long run. Here are some tools and strategies to help:

-

Use stock screeners or scanners to filter out stocks with high valuation ratios;

-

Subscribing to software providing in-depth analysis and comparison of stocks;

-

Keep an eye on market news and trends for any unrealistic growth expectations or hype;

-

Consult with financial advisors for personalized recommendations.

Should you sell overvalued stocks?

Deciding whether to sell overvalued stocks can be a complex process, requiring a keen understanding of financial metrics, use of quality tools like Finviz, TradingView, Morningstar, and Thinkorswim, and a consistent eye on market trends and expert insights.

It’s critical to identify stocks with high P/E or PEG ratios, which often signal overvaluation. Remember, often the stock market can remain irrational longer than you can remain solvent. So, don’t rush to sell just because a stock appears overvalued. Market sentiment, momentum, and other factors can cause an overvalued stock to continue rising.

Therefore, keep an eye on market trends, use reliable financial analysis tools, and consult experts before making a selling decision. Selling overvalued stocks should be a strategic move, not a panicked reaction.

What to do if a stock is overvalued?

There are several strategies you can implement to protect your investments and potentially maximize returns.

The first step is to conduct thorough research. Fundamental analysis can provide insights into a stock’s intrinsic value. If a stock appears overvalued, it might be wise to reduce or sell your holdings.

In addition to this, consider these strategies:

-

Implement stop-loss orders. This can protect your investments from significant drops in price.

-

Diversify your portfolio. Spreading your investments across different assets can mitigate risk.

-

Seek advice from financial professionals. They can provide expert guidance tailored to your specific circumstances.

-

Consider shorting overvalued stocks. This is a strategy typically used by experienced investors.

Expert opinion

Always compare a stock's growth narrative with its actual numbers. Overvalued stocks often tell a compelling story that their financials don't support. Trust the numbers, not the hype.

Summary

So, while overvalued stocks may seem like a risky bet, they’re not necessarily a no-go. It all comes down to your investment strategy and risk tolerance. Tools like stock screeners and fundamental analysis can help you identify and navigate these stocks. But remember, diversification is key, professional advice can be invaluable, and if you’re a beginner, always start small.

In investing, there are no guarantees, but with careful analysis and strategy, you can make informed decisions that align with your financial goals.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

4

Fundamental Analysis

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.

-

5

FOMO

FOMO in trading refers to the fear that traders or investors experience when they worry about missing out on a potentially profitable trading opportunity in the financial markets.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).