What Is Finviz?

Finviz is a robust resource primarily tailored for stock trading. While it offers a powerful scanner and various tools, it may have limited utility for forex traders. For example, one way is to analyze currency ETFs.

Finviz, short for "Financial Visualization," is a comprehensive online platform designed to provide financial professionals, traders, and investors with a wide range of tools, data, and resources for analyzing financial markets.

Even when Finviz's primary focus is on stocks, it offers a range of tools and data that, if used judiciously, can significantly complement your forex trading strategy.

In this article, you will be introduced to Finviz's features to improve your forex trading by understanding Finviz, one of the best forex trading platforms. So, whether you're looking to stay updated on economic events, analyze currency pairs, or assess relative strength, this article will guide you to level up in forex trading through Finviz.

Start trading Forex and Stocks now with RoboForex!How to use Finviz in Forex trading?

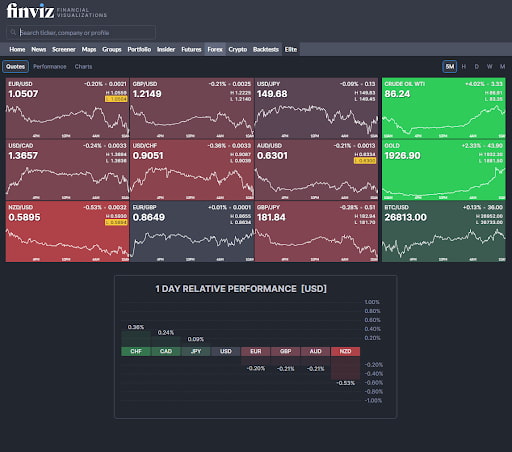

The image below is a screenshot of the Finviz forex section, which provides an overview of the available features and tools.

Finviz forex section. Source: Finviz.com

For forex traders, here are some of the main sections and chapters that can be relevant:

-

Forex charts. The main forex charts including currency pairs, gold and oil are all presented on one screen. Thanks to the user colors and concise interface, Finviz users can quickly get an overview of current trends on different timeframes.

-

News. Finviz provides information on economic events, announcements, and data releases that can impact currency prices.

-

Relative strength. The Relative Performance section can be used by forex traders to evaluate the strength of different currencies against each other.

The functionality presented above is only a small part of Finviz's features, but it seems to be all that forex traders can utilize.

However, this is only at first glance.

Best Forex brokers

Tip on using Finviz for Forex traders

Consider using stock market instruments that track trends in the foreign exchange market.

Currency ETFs can be considered as such. They can be used by stock traders to hedge currency risks.

Chart of FXE. Source: Finviz.com

The screenshot above shows how Finviz displays a chart of FXE, a fund that tracks the euro/dollar exchange rate.

And this is not the only such stock market tool. There are similar ones for the euro, as well as for other currencies - yen, pound, Australian dollar, etc.

You should make some effort to find out under which tickers these instruments are traded on the stock exchanges (it's not very difficult). And knowing them, you can apply some of FinViz's features to the currency market. Among them are:

-

automatic trendline builder;

-

a feature for saving trading ideas;

-

full screen mode.

And then buying Finviz paid tariff will be more justified for forex traders.

👍 Finviz pros

Finviz offers several advantages for forex traders:

• Nice interface. Finviz provides a user-friendly and visually appealing interface, making navigation and analysis more intuitive.

• Many tools. The platform boasts a wide array of tools, including stock screener, charting options, economic calendar, and news updates, giving traders a comprehensive toolkit.

• Backtesting strategies. Traders can backtest their strategies using historical data, which is an essential feature for refining and optimizing trading approaches.

• Customization options. Finviz allows traders to customize their experience by creating watchlists, setting up alerts, and applying filters, enabling a more personalized and efficient trading process.

👎 Finviz cons

Finviz has several limitations for forex traders:

• Stock-centric. Its primary focus is on stocks, which means that forex traders may find its forex-specific resources limited.

• Premium features. Some of the most useful features on Finviz require a paid subscription, which can be costly for traders on a budget.

• Limited real-time data. Free users might experience delays in accessing real-time data, potentially impacting their ability to make timely trading decisions

Conclusion

Finviz is a versatile financial analysis platform known for its user-friendly interface and an array of tools that encompass various financial markets. It primarily caters to stock traders, and its most valuable features may require a paid subscription.

Before relying on any information on Finwise or other online sources to make trading decisions, exercise caution. Always remember that trading with real money involves risk, and thorough research and education are key to making informed choices.

For further insights into forex trading and valuable resources for beginners, we recommend reading the article Forex Trading Sources for Beginners, understanding the new world of forex trading.

FAQs

What is the relative strength in Finviz?

Relative strength in Finviz is a tool that assesses the performance of securities, including currency pairs in the case of forex, relative to a chosen benchmark or the overall market.

Can you use Finviz for forex?

Finviz is a stock scanner, so straightforwardly you can't use it for forex trading. However, you can try Finviz to analyze stock market instruments that track currency quotes. For example, FXE is a fund that corresponds to the movement of the EUR/USD pair.

What is the relative performance indicator in forex?

The relative performance indicator in forex measures the performance of one currency pair compared to another, helping traders evaluate which pair is outperforming or underperforming in a given period.

What is a currency ETF?

Currency ETF or exchange-traded funds are a type of financial instrument which allows traders or investors to diversify their strategies in overseas currencies. The fund mimics the value of relative currencies and as a trader, you can gain through its fluctuations.

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Professionally, he has been a marketing professional running his agency for three years now. His agency helps finance projects to grow with the help of internet technologies. Upendra Goswami is an active investor and enthusiast of stocks and cryptocurrency.

Knows about

trading, blockchain, cryptocurrency, stock trading

Alumnus of

JECRC UDML College of Engineering, Jaipur

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.