What Is The Best Time Of Day To Trade GBP/USD?

GBP/USD is a widely traded currency with extensive trading time. However, experts suggest that the best time of day to trade GBP/USD is between 12:00 to 15:00 GMT.

The Forex market, known for being the largest financial market in the world, offers traders a multitude of currency pairs to choose from. Among these, the GBP/USD pair is a popular choice, but is it always a good time to trade it? In this article, experts at TU will help you find the best times to trade GBP/USD, taking into account various factors such as volatility, economic events, and liquidity. Whether you're a seasoned trader or just starting your Forex trading journey, understanding the optimal times to trade this currency pair can significantly impact your success in the Forex market.

Is GBP/USD a good pair to trade?

Yes, GBP/USD is a popular and highly regarded currency pair for trading in the Forex market, contributing roughly 11% of the total trading volume. It offers several advantages that make it a good choice for both novice and experienced traders. One key advantage of trading the GBP/USD pair is its liquidity. It is one of the most heavily traded currency pairs globally, ensuring that traders can easily enter and exit positions without causing significant price disruptions. Additionally, GBP/USD usually offers relatively low spreads, which can help reduce transaction costs and enhance profitability, especially for those engaging in short-term trading strategies.

Also, the overlap of trading hours for GBP/USD with the London session, which is the most active time for this pair, is another advantage. This aligns well with European trading hours, making it convenient for traders in Europe to actively monitor and trade the currency pair during their regular business hours.

GBP/USD trading hours

The GBP/USD market open time is 24 hours a day, five days a week from Monday to Friday. However, trading hours for GBP/USD can be broken down into different sessions, each with its own level of market activity and volatility. Understanding these hours and their corresponding market conditions is crucial for traders looking to make informed decisions.

-

Asian session - This session includes trading centres like Tokyo and Singapore. It typically spans from 00:00 to 09:00 GMT. During the Asian session, GBP/USD trading activity is relatively low, leading to narrower price movements and lower volatility. Traders often consider this session as a period of consolidation and preparation for more significant market moves

-

European session - The European session, covering cities like London and Frankfurt, occurs from 08:00 to 17:00 GMT. This is when the trading activity for GBP/USD sees a notable uptick. The London session is known for its high liquidity and increased price fluctuations. Traders frequently focus on this session for opportunities due to the substantial trading volume

-

American session - The American session includes New York and operates from 12:00 to 22:00 GMT. This session is marked by continued high trading volume, especially during the overlap with the European session. As a result, GBP/USD can experience heightened volatility during this time

-

Overlapping sessions - The most significant market movements in GBP/USD often occur during session overlaps, such as the European and American overlap from 12:00 to 17:00 GMT. These periods are characterized by robust trading activity, as both sessions are operational simultaneously. Traders look to capitalize on the increased volatility and liquidity during these overlaps

The best times to trade GBP/USD

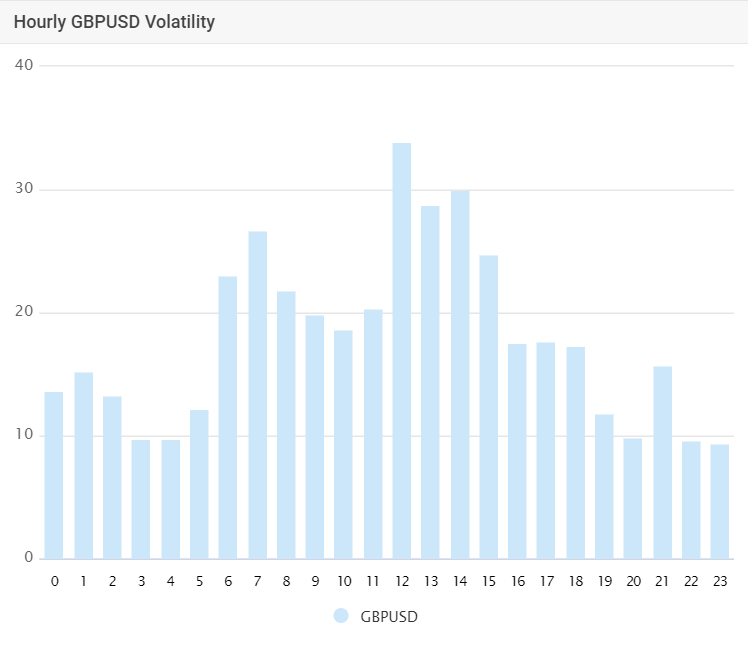

Image: GBP/USD volatility by hour, GMT Time Zone (Source: Myfxbook)

The best time to trade GBP/USD will vary depending on a lot of factors but historically it is seen that the Forex markets experience highest volatility on Wednesday and Friday and lowest volatility on Monday.

Also, the volatility is lower during initial trading hours of 00:00 to 06:00 GMT and then starts increasing from 06:00 to 12:00 GMT with the highest volatility of the day coming from 12:00 to 15:00 GMT. After that, the volatility experiences a downward trend for the remaining hours of the day, i.e., from 15:00 to 23:00 GMT.

What affects GBP/USD?

GBP/USD, like all currency pairs, is influenced by a variety of factors. Understanding these factors is important for traders looking to make informed decisions when trading this pair.

-

News trading - News releases from key central banks and economic institutions significantly impact GBP/USD. For example, the Bank of England's policy decisions and statements can have a profound effect on the pound's value. Similarly, the U.S. Federal Reserve (FED) plays a crucial role in shaping the U.S. dollar's performance. Traders often closely monitor interest rate decisions, monetary policy statements, and economic outlooks from these institutions to gauge future currency movements

-

Intraday trading using patterns - Many traders rely on technical analysis and patterns to make intraday trading decisions. Patterns like head and shoulders, double tops or bottoms, and candlestick patterns are used to identify potential trend reversals or continuation. These patterns help traders determine entry and exit points during short-term trading

-

Long-Term trading using fundamentals - Fundamental analysis involves assessing the underlying economic and financial factors influencing a currency pair. For GBP/USD, this includes studying the overall health of the UK and U.S. economies. Indicators like GDP growth, employment figures, inflation rates, and trade balances can provide insight into long-term trends. Additionally, factors like political stability and trade relationships can also influence the currency pair over extended periods

-

Geopolitical events - Geopolitical events, such as elections, trade negotiations, and international conflicts, can significantly impact GBP/USD. For instance, Brexit developments had a profound effect on the pound, leading to significant fluctuations. Traders should stay informed about such events and their potential implications

-

Market sentiment - Market sentiment, often reflected in economic indicators like consumer confidence or the Purchasing Managers' Index (PMI), can impact currency movements. A positive outlook on the UK or U.S. economy can boost the pound or the dollar, while negative sentiment may lead to depreciation

Pros of trading the GBP/USD currency pair

Trading the GBP/USD currency pair offers several advantages that attract traders from various parts of the world, especially those with an interest in European and American markets. Here are some of the key benefits of trading GBP/USD.

-

Low spreads - The GBP/USD pair typically offers lower spreads compared to many other currency pairs. Low spreads reduce trading costs, making it more attractive for traders, especially those engaged in short-term trading strategies. This feature can potentially result in lower transaction costs and increased profitability

-

Ideal for Europe-based traders - GBP/USD trading hours align well with European trading hours. The London session, which overlaps with the end of the Asian session and the beginning of the American session, is the most active time for GBP/USD trading. This period is particularly advantageous for traders in Europe, making it easier for them to monitor and trade this pair during their regular business hours

-

Abundance of fundamental data - The GBP/USD pair offers a wealth of fundamental data and news events. This abundance of information allows traders to make well-informed decisions. Major economic events from both the UK and the U.S., such as GDP reports, employment data, inflation figures, and central bank statements, provide traders with ample opportunities for analysis and trading strategies

-

Diverse trading strategies - GBP/USD is versatile, accommodating a wide range of trading strategies. Whether you prefer short-term, intraday trading or long-term investments, this currency pair can suit your trading style

-

Diverse trading hours - Due to the overlapping trading hours of the London and New York sessions, traders have flexibility in choosing when to trade GBP/USD, ensuring that trading opportunities are not confined to a specific time of day

While trading GBP/USD offers numerous advantages, traders should also be aware of the potential risks involved, including market volatility and economic uncertainties. It's essential to employ risk management strategies and stay informed about relevant news and events that may impact the currency pair.

Best Forex brokers

Summary

For GBP/USD trading, traders should aim to capitalize on the benefits of trading during the recommended hours, such as the London session overlap, when the market is at its peak activity. Trading during these times can reduce exhaustion and offer more favorable conditions for active traders. However, traders must also take care to understand the associated risks as the GBP/USD pair can be volatile and unpredictable. They are urged to stay informed about economic events, central bank decisions, and other factors that can influence this currency pair.

FAQs

What is the best session to trade GBP?

The best session to trade GBP is during the London session overlap (12:00 AM to 15:00 GMT) when the market is most active and offers high liquidity for GBP/USD traders.

How to trade GBP USD successfully?

Successful GBP/USD trading involves thorough research, using both technical and fundamental analysis, and managing risk with stop-loss orders. Trading during the London session overlap and staying updated on key economic events can also enhance your success.

How many pips does GBP/USD move daily?

GBP/USD typically moves around 110 to 170 pips per day, but this can vary based on market conditions and economic events.

What is the average daily trading volume for GBP/USD?

The average daily trading volume for GBP/USD is somewhere close to $350 billion, making it one of the most liquid currency pairs in the Forex market.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).