Lowest GBP/USD Spread Forex Brokers

Best Forex broker with tight GBP/USD spreads - Exness

Forex brokers with tight GBP/USD spreads 2024:

Exness - Average GBP/USD spread of 0.6 to 1.1 pips with leverage of up to 1:400.

IC Markets - Average GBP/USD spread of 0.4 to 0.8 pips with leverage of up to 1:500

RoboForex - Average GBP/USD spread of 0.8 to 1.5 pips with leverage of up to 1:2000

FP Market - Average GBP/USD spread of 0.5 to 1.0 pips with leverage of up to 1:500

Tickmill - Average GBP/USD spread of 0.7 to 1.2 pips with leverage of up to 1:500

In this article, the experts at TU delve into the offerings of leading Forex brokers such as Exness, IC Markets, and RoboForex. These platforms provide competitive spreads, ensuring cost-effective and efficient trading experiences.

-

What are the lowest GBP/USD spread Forex brokers?

Some of the best brokers with the lowest GBP/USD spreads include the likes of IC Markets, Exness, and RoboForex.

-

What is the best spread on GBP/USD?

The best spread on GBP/USD varies among brokers, but generally, competitive brokers offer spreads as low as 0.1 pips.

-

Which session is best to trade GBP/USD?

The London session (08:00 to 17:00 GMT) is often considered the best time to trade GBP/USD due to increased liquidity and price fluctuations.

-

Is GBP/USD the best pair to trade?

Whether GBP/USD is the best pair to trade depends on individual trading preferences and strategies. It's essential to assess factors like volatility and personal trading goals.

Best Forex brokers with GBP/USD support

| Broker | Minimum Deposit | Leverage | Average GBP/USD Spread (pips) | Trading Platforms |

|---|---|---|---|---|

$10 |

Up to 1:Unlimited |

0.6 - 1.1 |

MetaTrader 4 & 5, WebTrader |

|

$200 |

Up to 1:500 |

0.4 - 0.8 |

MetaTrader 4 & 5, cTrader, WebTrader |

|

$10 |

Up to 1:2000 |

0.8 - 1.5 |

MetaTrader 4 & 5, cTrader, WebTrader |

|

$100 |

Up to 1:500 |

0.5 - 1.0 |

MetaTrader 4 & 5, Iress, WebTrader |

|

$100 |

Up to 1:500 |

0.7 - 1.2 |

MetaTrader 4 & 5, WebTrader |

Pros and cons of trading GBP/USD

Trading the GBP/USD currency pair comes with both advantages and considerations that traders should be mindful of.

👍 Pros

• Liquidity

GBP/USD stands out for its high liquidity, making it one of the most actively traded currency pairs globally. This characteristic ensures that traders can swiftly enter and exit positions without causing substantial price movements.

• Low spreads

The pair typically features comparatively low spreads, providing traders with cost-effective transactions. This aspect is particularly beneficial for those employing short-term trading strategies, as it helps minimize transaction costs and potentially enhances overall profitability.

• Volatility opportunities

Periods of market volatility and uncertainty can serve as opportunities for traders to speculate on the GBP/USD pair. Volatility, when approached strategically, can be advantageous for those seeking dynamic market conditions.

👎 Cons

• Risk of volatility

While volatility presents opportunities, it also introduces risks. Significant price fluctuations during volatile periods can lead to unexpected losses, emphasizing the importance of risk management strategies.

• Geopolitical events

Events like the UK's decision to leave the European Union can introduce uncertainty, impacting the GBP/USD exchange rate. Traders need to stay informed about geopolitical developments that may influence the currency pair.

• Leverage and risk

The use of leverage in trading can amplify profits, but it comes with a heightened risk of significant losses. Traders utilizing leverage should exercise caution and implement risk management measures to navigate potential challenges effectively.

Factors that affect the GBP/USD

Various factors contribute to the dynamics of the GBP/USD exchange rates, spanning domestic influences, central bank policies, and global dynamics.

Domestic influences

Interest rates

Higher interest rates in a country attract investors seeking better returns, potentially increasing demand for the corresponding currency, thus affecting the GBP/USD exchange rate.

Economic indicators

Key indicators like GDP growth, employment data, inflation rates, and manufacturing output play a vital role in shaping exchange rates by reflecting the economic health of the UK and the US.

Trade balance

The balance of trade between the UK and the US impacts the exchange rate. Increased demand for GBP from US buyers, for instance, can strengthen the pound.

Political stability and risk

The perceived political stability and risk in both countries can influence their currencies and subsequently affect the GBP/USD exchange rate.

Bank of England (BoE)

Similar to how the Federal Reserve affects the US dollar, the Bank of England influences the British pound. Decisions made by the Bank of England's monetary policy committee (MPC) have the potential to impact the GBP/USD pair, with both the BoE and the Fed reviewing rates eight times a year.

Inflation

Inflation figures serve as critical indicators of the Fed's and BoE's stance on interest rates. Central banks often adjust interest rates to manage inflation, impacting the GBP/USD exchange rate.

Employment data

Statistics on employment in the US and the UK provide insights into the economic health of both nations, influencing government and central bank policies on economic stimulus.

Global dynamics

Interest rate differentials

Differences in interest rates between the UK and the US can sway the attractiveness of one currency over the other, thus impacting the GBP/USD exchange rate.

EUR/USD exchange rate

There is a positive correlation between the GBP/USD and EUR/USD exchange rates, meaning changes in one may influence the other.

Oil prices

Oil prices influence trade deficits/surpluses in the UK, US, and eurozone, which, in turn, can impact the GBP/USD exchange rate.

Brexit-related politics

While Brexit-related politics significantly influenced the GBP/USD exchange rate in recent years, its impact might be diminishing. However, it remains a factor worth monitoring.

Best time to trade GBP/USD

Understanding the best times to trade GBP/USD is essential for informed decision-making in the Forex market, which operates 24 hours a day, five days a week.

| Session | Time (GMT) | Cities | GBP/USD Activity | Characteristics |

|---|---|---|---|---|

00:00 - 09:00 |

Tokyo, Singapore |

Relatively low activity, narrow price movements, lower volatility |

Viewed as a consolidation phase, preparing for significant moves |

|

08:00 - 17:00 |

London, Frankfurt |

Increased trading activity, notable uptick in volatility |

London session known for high liquidity, focus for many traders |

|

12:00 - 22:00 |

New York |

Sustains high trading volume, and heightened volatility |

Significant activity, especially during European overlap |

|

Overlapping Sessions |

12:00 - 17:00 |

European and American overlap |

Robust trading activity, increased volatility and liquidity |

Opportunities for traders during simultaneous sessions |

| Optimal Trading Times | Remarks |

Historical Trends |

|

Highest Volatility |

Wednesdays, Fridays |

Lower Volatility |

Mondays |

Volatility Patterns During the Day (All Times in GMT) |

|

00:00 - 06:00 |

Lower Volatility |

06:00 - 12:00 |

Gradual Increase in Volatility |

12:00 - 15:00 |

Peak Volatility of the Day |

15:00 - 23:00 |

Declining Volatility Trend |

What to look for in a Forex broker that supports GBP/USD?

Selecting the right Forex broker for trading GBP/USD involves assessing various factors to ensure a secure and efficient trading experience.

License

Make sure a reputable financial authority has licensed and regulated the broker. This provides assurance that the broker operates within legal frameworks, adhering to industry standards and protecting traders.

Trading platform

Evaluate the trading platform offered by the broker. A user-friendly, reliable, and technologically advanced platform is crucial for executing trades effectively. Look for features like real-time market data, charting tools, and order execution capabilities.

Transparent fees and commissions

Understand the broker's fee structure. Transparent and competitive fees, including spreads and commissions, are vital to managing trading costs. Hidden fees can erode profits, so clarity in the fee structure is essential.

Trading tools and resources

Assess the broker's provision of trading tools, educational resources, and market analysis. A broker that equips traders with valuable insights and tools enhances the overall trading experience.

Customer support

Access to responsive and helpful customer support is very important. Look for brokers that offer support through various channels, such as live chat, email, or phone. This ensures assistance is readily available when needed.

How much is pound to dollar trading?

The rate of GBP/USD in Forex is constantly fluctuating. At the time of writing, 1 GBP is equal to 1.26 USD, and one USD is worth 0.79 GBP. The rate of GBP/USD sits at 1.2607. If you were to trade the currency pair, however, there would be additional costs to factor into the overall price. They are as follows:

Commissions: Some brokers charge a commission for executing a trade. This can be a flat fee or a percentage of the trade value. Typical rates can be $40 per $1 million traded. So a trade worth £100,000, or $126,070, you’d multiply that by 0.000040, and get a commission of $5.0428.

Spread: The spread is the difference between the buying (ask) and selling (bid) prices of a currency pair and represents the broker's profit on a trade. For example, on a GBP/USD rate of 1.2607, a broker might have a bid price of 1.2605 and an ask price of 1.2609. This means a trader pays 1.2609 to buy the currency pair, and the broker pays 1.2605 to a trader selling the pair. Lower spreads are generally more favorable for traders.

Swap: Usually called “rollover” fees, this is the interest paid a trader pays for holding a position overnight. It can be a cost or gain depending on the direction of the trade and the interest rate differentials between the two currencies. If for example you sold GBP 10,000 and bought USD (short position), a rollover charge of -0.55 would be worth GBP 10,000 x 0.000055 = USD 0.55. Swap rates are applied at midnight on the platform’s time, and only applied on open positions. Rollover rates are often triple on Wednesdays to account for the weekend.

Other Fees: Some brokers might charge for depositing or withdrawing your funds. Leaving an account inactive for a period of time specified by each brokerage, can also result in fees. Lastly, some platforms or brokers charge for their services, so simply using them could cost you as a trader. Make sure to check all fees and charges before creating an account.

Below is a breakdown of Traders Union’s three favorite Forex brokers, and their spread and commission for trading GBP/USD.

| GBP/USD Broker | Spread | Commission | Best for |

|---|---|---|---|

0.0 |

$3.50 per lot per trade |

Low Spreads |

|

0.0 to 0.3 |

$2.00 per lot per trade |

500+ CFD Choices |

|

0.2 |

$7.00 per $100,000 transaction |

100% execution of order guarantee, 99.35% instant |

Bear in mind that the table above is simply to give a rough idea of the spread and commission charged by various brokers. After you have created an account, brokers reserve the right to change the size of commissions and spread based on changing market conditions.

You can read more about our top choices for Forex brokers here: Forex Brokers List for 2024 — the Reliable & Licensed.

What time is GBP/USD most volatile?

When trading Forex, dynamics levels of volatility can have an impact on your performance. More volatile markets can provide more opportunities for trading, as prices can experience significant movements in a short period. Higher volatility also often corresponds to increased liquidity in the Forex market, making it easier for you to enter and exit positions without significant price slippage. Additionally, volatility is often associated with the formation of trends, so if you’re a skilled trader, you could use rising volatility levels to identify changing market conditions and trends.

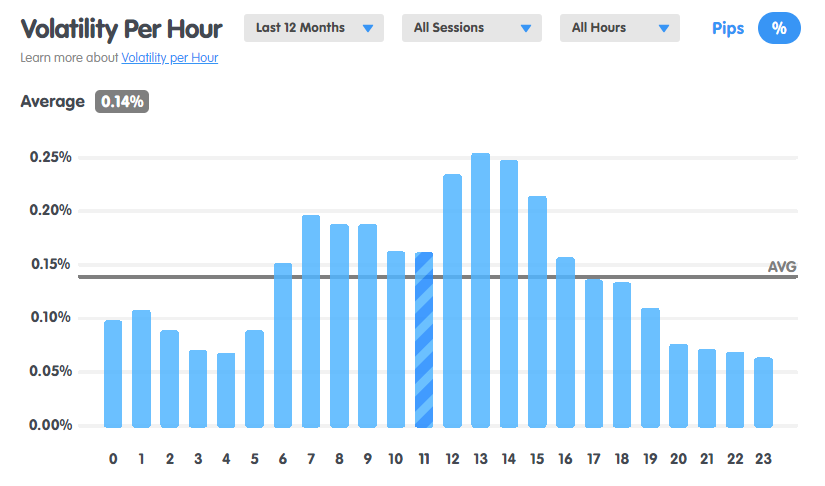

For the GBP/USD currency pair, volatility levels change drastically throughout the day. The GBP/USD pair is rated fourth highest in volatility out of the major currency pairs, providing ample opportunity for profitable trades. From 6AM to 5PM (UTC), volatility is above average. It’s at its highest from 12PM to 4PM (UTC), due to the US market session beginning, and the European session overlapping it. Daily volatility is lowest from 8PM to 6AM UTC.

Figure 1 Volatility of GBP/USD by hour (Source: babypips.com)

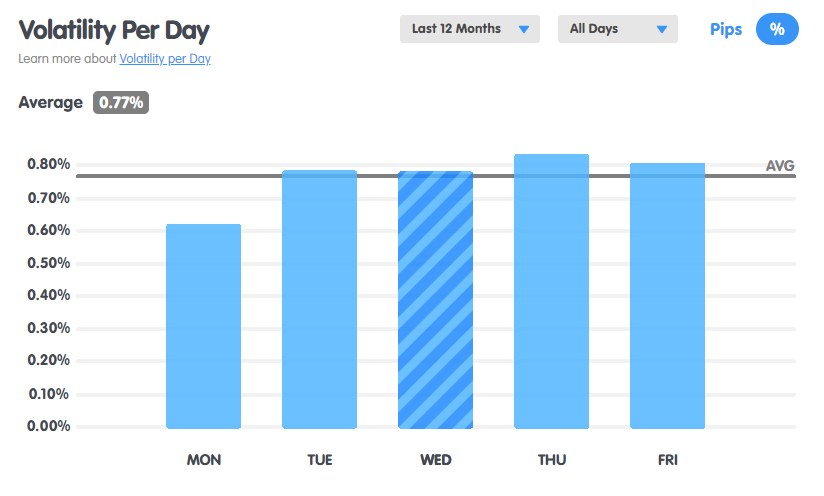

Certain days also experience higher levels of volatility for trading GBP/USD, though they generally don’t vary that much. Mondays see the lowest volatility, while Tuesdays through to Fridays all have higher-than-average volatility. Thursday is the most volatile day.

Figure 2 Volatility of GBP/USD by day (Source: babypips.com)

Will GBP/USD go up or down?

Though nobody can predict the future, skilled traders and analysts can make fairly accurate speculations on the future movement of GBP/USD price movements, and enter trades based on them. When assessing current trends and whether they’re losing momentum or going strong, it’s important to consider the historical movement too and determine whether the trend is short-term, long-term, or something in between. The currency pair might be in a downtrend today, but in a general uptrend on a wider timescale.

GBP/USD, 5-minute chart

A short-term trader or day trader looking at the movement of GBP/USD using 5-minute candles, for the past day, would make a different trade to that of a long-term trader.

Consider the chart above, where GBP/USD is at 1.26216. The pair saw a sudden spike between 16:00 and 18:00, meeting resistance near the 1.26400 level, before a reversal and gradual downward momentum. Here, the trader can recognize a bearish “head and shoulders” (SHS) pattern and open a short position where the price made a break of the support (shown by the blue line).

GBP/USD, 4-hour chart

On the other hand, a long-term trader observing GBP/USD’s price over the past three months on a 4-hour candle chart would notice a different trend and draw a different conclusion. In the above GBP/USD chart, the price is moving within an ascending channel shown by the blue lines, and the MACD indicator is showing bullish sentiment. Therefore, a long term trader can most likely be set to maintain an existing long position.

Whenever entering a trade on any Forex currency pair, make sure to assess the long-term and short-term trends in line with your trading style, strategy and financial goals. For Traders Union’s up-to-date forecasts on GBP/USD, check out: Pound to Dollar (GBP to USD) Signals and Price Predictions.

What is the best strategy for GBP/USD?

The best strategy for trading GBP/USD often involves a combination of different approaches:

Technical Analysis: You can utilize a variety of tools including chart patterns, indicators (e.g., Moving Averages, Relative Strength Index), and other technical tools to identify trends, support/resistance levels, and potential entry/exit points, similar to how we did in the example above.

Fundamental Analysis: Stay informed about economic indicators, interest rates, political events, and other fundamental factors affecting the GBP and USD. Make sure to regularly track news related to the currency pair to help you make informed decisions. Events in the USA and other major economies tend to have an impact on GBP/USD. Traders Union provides a Forex economic calendar that details important upcoming events which can affect the prices of currency pairs: Forex economic calendar.

Behavioral Analysis: Consider market sentiment and trader behavior. Behavioral analysis involves understanding how market participants react to news and events, providing insights into potential price movements. For example, if the Bank of England announced an interest rate hike, you may anticipate a strengthening of the GBP due to the associated positive economic outlook. You would observe how traders react, looking for signs of bullish sentiment or a lack thereof, and enter trades accordingly.

Forex trading can be rather complicated, even with a popular currency pair like GBP/USD. In our guide, we explain how to trade GBP/USD: Beginner's Guide to Trading the GBP/USD Pair.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

-

3

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

4

Leverage

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

-

5

Index

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.