AI Trading Bot in ChatGPT

Here are the steps to create a free trading bot using ChatGPT:

-

1

Sign up for an OpenAI account

-

2

Interact with ChatGPT

-

3

Request a trading bot code

-

4

Customize the generated code

-

5

Integrate the trading bot with a platform

-

6

Test the trading bot

-

7

Monitor and refine the trading bot

ChatGPT has opened up new possibilities for how artificial intelligence can be used to assist people. One intriguing application is using ChatGPT to create AI-powered trading bots that can analyze markets and make investment decisions automatically. These bots can interpret numerical data, and generate trading ideas and strategies.

We will look at some examples of trading bots that can be built using ChatGPT. The capabilities of language AI systems are advancing rapidly, and ChatGPT is at the leading edge. Harnessing these tools for financial analysis and trading signals a new era for AI in finance. This article will analyze the strengths and limitations of this exciting new application of conversational AI.

-

What types of trading strategies can the bot employ?

The bot can employ algorithmic trading strategies like momentum, mean reversion, pattern recognition, arbitrage, etc.

-

Does the bot require programming skills?

No programming skills are required as interaction happens in natural language. But having trading strategy and coding skills can help optimize performances.

-

Can the bot explain the reasons behind its trades?

Yes, prompts can be created for the bot to generate explanations of market hypotheses, signals, indicators and reasons for entering or exiting positions.

-

What ChatGPT subscription tier is required?

Higher tier Plus subscription is preferable, but the basic free one can also be used successfully.

ChatGPT trading apps

To say the least, ChatGPT offers valuable applications in the field of automated trading, with some of them being:

Strategy generation:

Utilize ChatGPT to generate trading strategies, indicators, or algorithms by providing specific parameters or market conditions as prompts. These strategies can be further refined and tested before implementation

Trading bot code:

Leverage ChatGPT to generate code for trading bots, tailored to your requirements and programming language of choice (e.g., Pine Script or Python). The generated code can be modified and integrated into trading platforms or APIs

Market analysis:

Although ChatGPT's knowledge is based on data up until 2021, it can still assist in gathering insights and analyzing historical market data. By combining ChatGPT with real-time data sources or APIs, you can develop a system that processes market information and generates trading signals

Strategy refinement:

Seek guidance from ChatGPT to refine and enhance your trading strategies. It can offer suggestions, identify potential issues, and propose alternative approaches, aiding in the improvement of your trading methodologies

How to create an AI trading bot with ChatGPT

Creating a trading bot using OpenAI's ChatGPT involves a step-by-step process that combines the capabilities of natural language processing and code generation. Let's explore each step in detail:

Sign up for an OpenAI account:

Visit the OpenAI website and sign up for a free account. You can also choose a convenient login option like Google or Microsoft, or simply provide your email address. To complete the setup, you will need to register your phone number and verify it using a confirmation code. This will grant you access to the ChatGPT interface

How to create an AI trading bot with ChatGPT

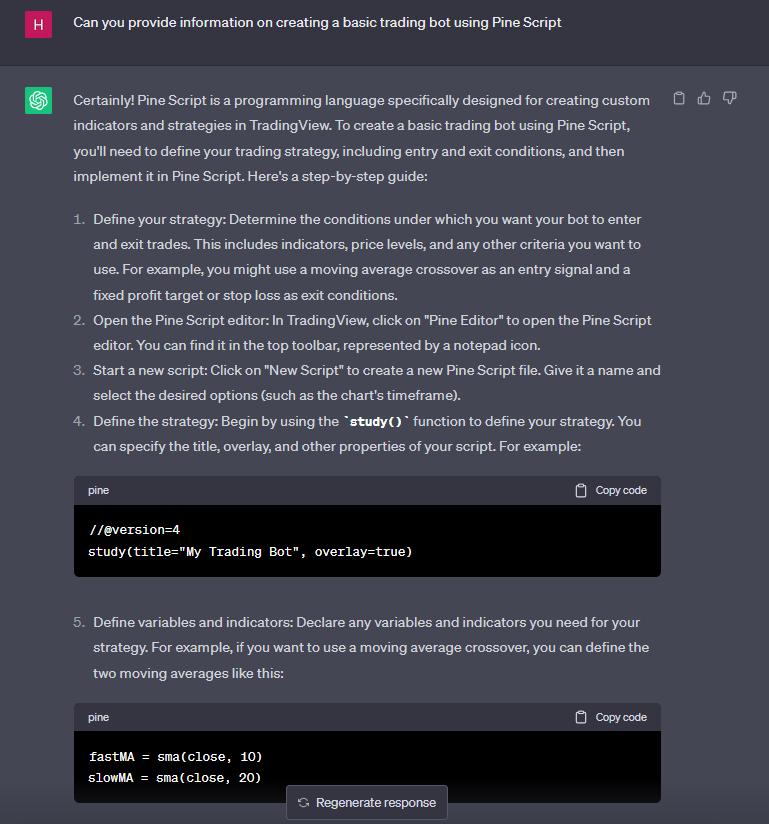

Interact with ChatGPT:

Once you have access to ChatGPT, start by typing a prompt that describes what you are looking for. ChatGPT will respond with relevant information based on its training and knowledge. It's important to be creative and experiment with different prompts to get the desired results. If the initial response doesn't meet your expectations, try refining your prompt or providing additional instructions to ChatGPT

Example Prompt:

"Can you provide information on creating a basic trading bot using Pine Script?"

How to create an AI trading bot with ChatGPT

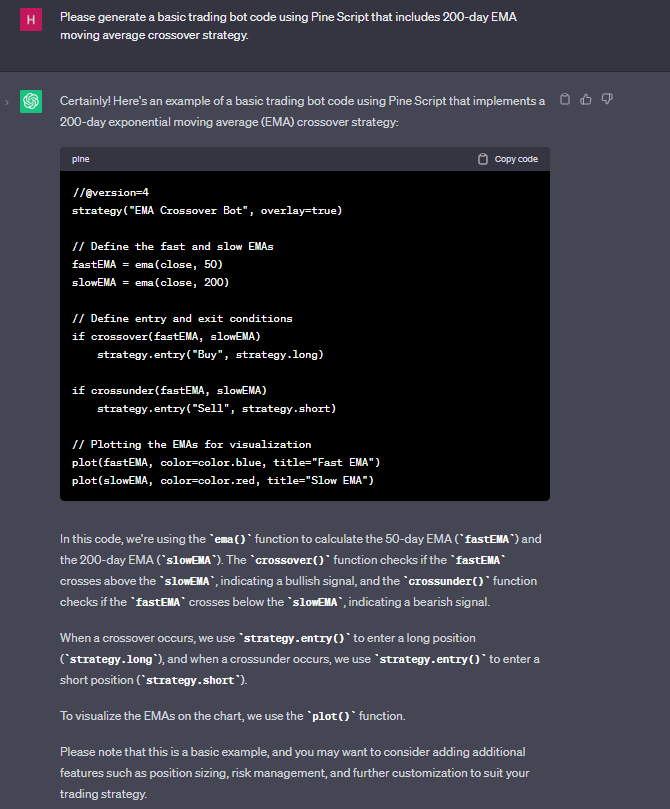

Request a trading bot code:

ChatGPT can generate code snippets for trading bots based on your specific requirements. You can even prompt the model to create code using popular trading languages like Pine Script or Python. Craft your prompt to be specific about the functionality, indicators, or strategies you want the trading bot to incorporate

Example Prompt:

"Please generate a basic trading bot code using Pine Script that includes a 200-day EMA moving average crossover strategy".

How to create an AI trading bot with ChatGPT

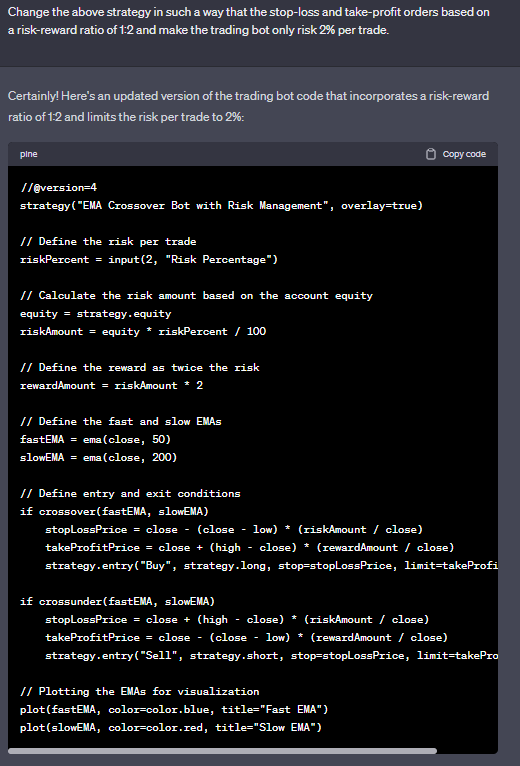

Customize the generated code:

After receiving the trading bot code from ChatGPT, carefully review it and make necessary modifications or improvements to align with your trading preferences and strategies. It's essential to understand that while ChatGPT can provide code snippets, it may not always generate flawless or complete code. Therefore, you should have a basic understanding of programming and trading concepts to effectively customize the generated code. You can add additional indicators, implement risk management rules, or incorporate specific entry and exit conditions into the trading bot code

How to create an AI trading bot with ChatGPT

Integrate the trading bot with a platform:

Once you have customized the trading bot code, you need to integrate it with a suitable trading platform. Depending on your trading preferences, this could be a platform like TradingView, Amibroker, or a cryptocurrency exchange such as Binance. Integration may involve working with APIs, setting up authentication mechanisms, and understanding the technical requirements of the chosen platform

Test the trading bot:

Before deploying the trading bot in a live trading environment, it's crucial to thoroughly test its functionality and performance. Utilize historical market data or create a simulated environment to evaluate how the bot behaves under different market conditions. Analyze its ability to generate accurate trading signals and execute trades effectively. Based on the test results, make any necessary adjustments or refinements to the code to enhance its performance

How to create an AI trading bot with ChatGPT

Monitor and refine the trading bot:

Once the trading bot is deployed and actively trading, closely monitor its performance on an ongoing basis. Continuously analyze its trading results, evaluate its risk-reward ratio, and review its adherence to your predefined trading strategies. Consider using ChatGPT to seek suggestions, guidance, or further assistance in refining and improving the trading bot's capabilities

Pros and cons of AI trading bots

AI trading bots offer numerous benefits as well as some drawbacks when utilized in the financial markets. Here are the advantages and disadvantages of incorporating AI trading bots into your trading strategy:

👍 Pros

• Enhanced decision-making:

AI trading bots possess the ability to rapidly process and analyze vast quantities of data, enabling them to potentially make more informed trading decisions and increase profitability

• Emotion-free trading:

Unlike humans, AI trading bots are not influenced by emotions such as fear or greed. This absence of emotional bias can lead to more objective and rational trading decisions

• 24/7 market participation:

AI trading bots can operate continuously without experiencing fatigue, allowing them to seize opportunities in the market at any time, including outside of regular trading hours

• Multi-market capabilities:

AI trading bots can simultaneously monitor and trade across multiple markets. This capability expands the potential for capturing profitable trades in various asset classes or financial instruments

• Automated trading:

AI trading bots can execute trades autonomously, eliminating the need for constant human intervention. This feature frees traders from monitoring the markets constantly, enabling them to focus on other activities

👎 Cons

• Algorithm reliance:

The performance of an AI trading bot heavily depends on the quality of its underlying algorithm. Poorly designed or flawed algorithms can lead to underperformance or even losses

• Manual setup complexity:

While AI trading bots can operate independently, setting up the trading parameters requires manual configuration. This process may demand a certain level of expertise and time investment to optimize the bot's performance

• Limited adaptability:

AI trading bots may struggle to adapt swiftly to sudden changes in market conditions or unforeseen events. These limitations can result in missed opportunities or potential losses if the bot fails to adjust effectively

Tips to keep in mind while creating an AI trading bot

When developing an AI trading bot, there are several important considerations to keep in mind. Follow these tips to create an effective and successful trading bot:

Define your trading strategy:

Clearly outline your trading strategy before beginning the development process. This involves determining the technical indicators, risk management rules, and entry and exit criteria that your bot will follow. A well-defined strategy sets the foundation for your bot's decision-making process

Choose the right programming language and platform:

Select a programming language and platform that align with your needs and expertise. Python is a popular choice due to its extensive libraries and user-friendly nature. Additionally, consider the compatibility of your chosen language with the APIs of the trading platforms you intend to use

Prepare data for training and testing:

Collect and pre-process historical market data to train and test your AI trading bot. Ensure the data is clean, accurate, and representative of the market conditions your bot will encounter. Quality data is essential for building robust and reliable predictive models

Implement machine learning algorithms:

Utilize appropriate machine learning algorithms to construct predictive models based on your trading strategy. Experiment with different algorithms and employ feature engineering techniques to discover the most effective model for your specific needs

Backtest your trading bot:

Conduct thorough backtesting to assess the performance of your AI trading bot using historical data. This process helps identify potential issues, optimize your strategy, and instill confidence in your bot's capabilities before deploying it in live markets

Implement risk management:

Incorporate risk management rules into your trading bot to safeguard your investments. This involves setting parameters for stop-loss orders, determining position sizing techniques, and implementing diversification strategies to manage risk effectively

Monitor and update your bot:

Regularly monitor your bot's performance and update its algorithms as necessary to adapt to changing market conditions. Continuously tracking your bot's performance allows for ongoing improvements and ensures that outdated strategies are avoided

Ensure security and compliance:

Take necessary security measures to protect your trading bot from unauthorized access and potential security breaches. Additionally, ensure that your bot adheres to all applicable regulations and guidelines pertaining to automated trading

Trading frequency:

Choose a trading bot that aligns with your preferred trading style, whether it's scalping, day trading, or swing trading. Different bots may have varying trading frequencies that suit different strategies and market conditions

Market conditions:

Consider how a trading bot performs under different market conditions. Look for bots that demonstrate consistent performance across a range of market environments, including both trending and ranging markets. This versatility ensures the bot's effectiveness in various scenarios

Is AI Trading Legal?

Contrary to popular misconceptions, using AI for trading is not illegal. In fact, many financial organizations and professional traders actively embrace AI tools to gain a competitive edge in the financial markets. However, users need to ensure compliance with financial laws and adhere to regulatory guidelines when using AI trading bots.

Like traditional trading, AI trading is also subject to the same legal frameworks where regulators are keen on ensuring investor protection and maintaining market integrity. Traders integrating AI trading bots into their strategies should seek professional advice where necessary. Additionally, they should be aware of the legal implications of using AI-driven strategies.

Using AI tools such as ChatGPT trading bot is within the legal framework governing financial markets. As a result, various regulatory authorities, including the SEC (Securities and Exchange Commission) in the United States and their counterparts in other countries, encourage the use of AI in trading. These regulatory bodies just require users to implement transparency, risk management protocols, and fair and ethical trading practices.

Regulatory authorities regularly monitor markets to establish any irregularities, whether from traditional traders or AI traders. Active monitoring from these agencies prevents insider trading, market manipulation, and other illegal activities. Traders using AI-driven trading strategies must be aware of the scrutiny and ensure that they comply with all legal standards.

While AI trading is legal, users must also employ ethical standards. Traders must prioritize responsible AI usage. Such responsibility avoids actions that could pose unintended or systemic risks to the market. Additionally, such responsibility also aligns with broader ethical principles and legal requirements.

It is important to note that legal frameworks may vary across different jurisdictions. Therefore, traders must familiarize themselves with the regulations governing AI trading in their specific jurisdiction. Seeking consultation or legal advice can provide clarity on compliance requirements within your region.

Alternatives: best AI trading bots

Market Chameleon

|

Costs |

Free Version: $0, Stock Trader: $39/month, Options Trader: $69/month, Earnings Trader, $79/month, Total Access, $99/month |

|

Supported Markets |

Stocks |

In addition to providing actionable information about market sentiment, Market Chameleon offers a number of tools to help traders gain an edge.

The unusual options volume scanner is one of the most useful tools. Using this scan, you can find stocks with higher-than-normal options trading rates. You can also use Market Chameleon to identify potential catalysts that can be used to determine if the options activity is a worthwhile investment opportunity or merely rumor-driven hype.

Additionally, Market Chameleon provides a straightforward market sentiment report using a more flexible options order flow screener. You can monitor the market's bullish and bearish activity over time, or track stocks in your watchlist. On top of this, some screeners automatically display top bullish and top bearish stocks based on recent option activity.

A wide variety of traders can take advantage of Market Chameleon. There is a simple, automated option screener for gap-and-go stocks, as well as a sophisticated, highly customizable option screener. If you want to pay for access to some of the restricted tools, Market Chameleon offers a variety of features that make it a more worthwhile overall platform.

Trade Ideas

|

Costs |

Premium: $167/month, Standard, $84/month |

|

Supported Markets |

Stocks |

With Trade Ideas, traders can find day trading opportunities using artificial intelligence. With three cutting-edge AI stock trading bots at its disposal, Trade Ideas backtests US stocks in real-time for high probability trades.

A major reason for signing up with Trade Ideas is its artificial intelligence algorithms. A key focus of this company is to provide traders with data-driven trading opportunities. Currently, three AI systems are in operation, each applying 70 different strategies.

There are few services that offer fully automated stock trading, but Trade Ideas has become one of the most popular.

Trend Spider

|

Costs |

Advanced: $97/month, Elite: $67/month, Premium: $33/month |

|

Supported Markets |

ETFs, stocks, indices, futures and commodities, cryptocurrencies, and forex |

With TrendSpider's unique machine learning algorithm and stock market platform, it offers advanced automatic technical analysis. Traders and investors of all levels can use this stock analysis software.

With the help of TrendSpider's proprietary algorithm, traders can identify trends in the Forex market by scanning historical market data. Human traders then use this information to make profitable and effective trades based on these trends.

By using TrendSpider's Trading Bots, you can automate virtually any task with a fully automated, position-aware bot. Before launching a Trading Bot, you need to tone and perfect your strategy using the platform's Strategy Tester.

The Trading Bots feature allows you to trigger an event automatically when certain conditions are met from your strategy. Depending on the trading bot, it could post to a private Discord server, or it could trigger an order routing system that places trades at a brokerage or exchange.

You can customize trading bots to fit exactly your strategy because they are highly flexible and customizable. With a cloud-based system, they never expire, and work on a timeframe from 15 minutes up.

With TrendSpider's all-in-one platform, you can scan and screen for better trade setups, save time with smart charts, improve trade timing with dynamic price alerts, and more.

TrendSpider offers the following features:

Trading Bots

Dynamic Price Alerts

Asset Insights

Backtesting

Raindrop Charts

Expert Opinion

It's important to recognize that modern algorithmic trading has become extremely competitive. The most sophisticated trading firms and hedge funds invest heavily in developing proprietary strategies and systems using advanced machine-learning techniques.

Against this backdrop, the basic strategies and code snippets generated through ChatGPT are unlikely to provide a lasting edge. Modern markets evolve rapidly, and other market participants employ highly optimized algorithms that can identify and exploit even the simplest of patterns within minutes or seconds.

ChatGPT's limited access to real-time and historical market data can hinder its ability to design strategies that remain effective in changing market conditions. What worked in the past may not work in the future as the field progresses. Traders need algorithms refined through rigorous backtesting against vast amounts of high-quality intraday market data, together with dynamic feedback loops enabling constant optimization and adaptation.

While ChatGPT can serve as a starting point to generate trading ideas, the complexity, resources, and expertise required to compete at the highest levels of algorithmic trading far exceed what an AI assistant in its current form can provide.

In essence, any strategies or code produced by ChatGPT would need to be thoroughly backtested, optimized, and refined by a human trader with domain expertise. ChatGPT alone cannot create "out-of-the-box" trading bots that will be profitable.

Glossary for novice traders

-

1

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

2

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

3

Risk Management

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

-

4

Scalping

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

-

5

Forex Trading

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).