Best Autochartist Brokers Reviews

The best autochartist broker - RoboForex.

Traders now have the ability to identify market patterns, set critical alerts, and fine-tune trading strategies thanks to Autochartist, a useful technical analysis tool. Selecting an Autochartist broker is a crucial decision to make because not all brokers provide the same degree of Autochartist integration and support. Experts at Traders Union have also gone above and beyond in creating a comprehensive, easy-to-follow guide to assist you in selecting the Autochartist broker.

Do you want to start trading Forex? Open an account on Roboforex!Warning:

There is a high level of risk involved when trading leveraged products such as Forex/CFDs. Between 65% and 82% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

What is Autochartist and how to use it

Autochartist, with its many useful features, is a strong technical analysis tool that traders can use to improve their trading tactics.

Key features of Autochartist

Pattern recognition: Autochartist looks for different chart patterns, like triangles, flags, and head and shoulders patterns, by scanning the financial markets. This enables traders to predict future changes in price.

Volatility analysis: By measuring market volatility, traders can modify their risk-reduction plans as necessary.

Alerts and notifications: To make sure traders do not miss out on possible setups, Autochartist can be configured to send alerts and notifications when particular chart patterns or trading opportunities appear.

Performance statistics: Traders have access to performance statistics that provide information about the likelihood of success for various chart patterns.

Market reports: Autochartist gives users access to daily market reports that include insightful information about important price levels and possible trading opportunities.

Key features of Autochartist

Using Autochartist effectively requires a systematic strategy after selecting the right broker:

-

1

Choose assets: Selecting the financial instruments you wish to trade or analyze with Autochartist should be your first step. This can include stocks, commodities, Forex currency pairs, and more.

-

2

Alert setup: You can instruct the tool to notify you when particular trends or price points are found. You can subscribe to these alerts via email, the trading platform, or mobile notifications.

-

3

Pattern interpretation: Examine the patterns that Autochartist identified and the analysis that goes with them. Recognize the effects they may have on future price fluctuations.

-

4

Risk management: Adjust your risk management tactics, such as placing take-profit and stop-loss orders, by using the volatility analysis and performance data.

-

5

Constant learning: Use the insights to inform your trading decisions by staying current with Autochartist's daily market reports.

Pros and cons of Autochartist

These are the benefits and drawbacks of using Autochartist, which can be a useful tool in your trading tool box.

👍 Pros

• Time-saving analysis: The process of spotting possible trading opportunities and chart patterns is automated by Autochartist. By doing this, traders avoid wasting important time on manual analysis.

• Improved decision-making: Autochartist gives traders data-driven insights through its pattern recognition and volatility analysis, which may help them make better decisions and possibly increase the accuracy of their trades.

• Alerts and notifications: To make sure traders do not miss out on possible setups, Autochartist can send out real-time alerts and notifications when particular patterns or trading opportunities appear.

👎 Cons

• Cost of subscription: Certain brokers may charge a fee for using Autochartist.

• This can raise trading expenses, particularly for traders with limited funds.

• Over-reliance: There is a chance that traders will rely too much on Autochartist and neglect their own research and judgment, which are critical for long-term trading success. It should supplement a trader's knowledge and abilities, not replace them.

Best Autochartist brokers

RoboForex

RoboForex is a brokerage company that was founded in 2009. RoboForex is a leading software developer in the Forex industry and one of the best Forex brokers based on client reviews.

RoboForex is recognized as a reliable partner by the most respected financial market experts. The company has won numerous prestigious awards. The RoboForex group of companies has an international license to provide services from FSC Belize (license No. 000138/437).

The minimum deposit in RoboForex is $10. Leverage up to 1:2000. Traders choose RoboForex for reliability, favorable trading conditions, minimum spreads, and commission fees. The company is recommended for beginner traders and experienced investors.

Tickmill

The Tickmill Group introduces a new standard in the provision of brokerage services. The focus on innovation is what the company is proud of and why traders choose it. The trading conditions of the broker are appreciated by scalpers and traders who use EAs because Tickmill provides minimal spreads. The Group has earned many awards among them “Best Forex Spreads” and “Best Forex Trading Experience” in 2022.

The Tickmill group of companies includes:

-

Tickmill Europe Ltd regulated by the CySEC, 278/15 (Cyprus);

-

Tickmill Ltd regulated by the FSA, 09369927 (the Seychelles);

-

Tickmill UK Ltd regulated by the FCA, 733772 (UK);

-

Tickmill Asia Ltd regulated by the Labuan FSA, MB/18/0028 (Labuan, Malaysia);

-

Tickmill South Africa (Pty) Ltd regulated by the FSCA, 49464 (SAR).

Before you register, see which of the group’s companies you are signing up with, as trading conditions depend on it.

FxPro

The FxPro broker was registered in July 2006 in Cyprus. The company’s activities are licensed by financial regulators: CySEC, 078/07 (Cyprus), Bahamas SCB (SIA-F184), FCA, 509956 (UK), and South African FSCA (45052). FxPro is successfully operating in more than 170 countries for retail and institutional clients. The broker has received more than 85 awards, including “Best Forex Trading Platform” and “Best Trading Platform”. FxPro has become known for providing the best trading tools. With FxPro broker, traders can trade more than 70 currency pairs, futures and stocks (Twitter, Apple, Google). The broker has over 2,100 trading assets in its pool, including cryptocurrencies, which are subject to the account type. The basic set of assets is available on cTrader accounts, the full set is available on accounts opened on MT4 and MT5. FxPro sets high safety standards with the client's funds being kept in large international banks. They are insured and separated from the broker's equity.

Amarkets

AMarkets is an international company with dozens of offices in Europe and the CIS. It was established in 2007, but its structure has gone through major changes since then. Initially, the company was called AForex. Over time, the brand became a symbol of reliability and European quality service standards. Today, AMarkets is a modern ECN broker, actively developing both “trading for beginners” and professional algorithmic trading.

Forex4you

The broker Forex4you started in 2007. The company provides a full range of active and passive trading services in the Forex market. The company runs its operations in the British Virgin Islands, under the license BVI FSC (license number SIBA/L/12/1027). Forex4you is committed to responsibility and professionalism. In 2018, according to Le Fonti, the company was awarded the ‘Best Broker’ which is the highest award achievable, and prior to this it has consistently won and received nominations for awards including ‘Forex Broker of the Year’ and ‘Best Service Quality’ nomination.

IC Markets

IC Markets is a brokerage company established in 2007 in Sydney, Australia. IC Markets group of companies provides access to financial markets across the world. The group has offices located in different regions enabling IC Markets to work with traders from practically any jurisdiction legally and in compliance with the local law. The companies of the group hold the following licenses: Raw Trading Ltd. is licensed by the SFSA (SD018), Seychelles, International Capital Markets Pty Ltd by the ASIC(ACN: 123 289 109), Australia, and IC Markets (EU) Ltd by the CySEC (362/18), Cyprus. IC Markets is also a member of the Financial Commission, an independent organization that deals with disputes and has an insurance fund with up to EUR 20,000 coverage per each trader.

Admirals

Admiral Markets was founded in 2001. In more than 20 years of operation, a regional Estonian broker has grown into an international financial group of companies providing access to over-the-counter markets in more than 130 countries, as well as to exchange-traded stock instruments. Following the 2021 rebranding, Admiral Markets became Admirals. The updated platform received new integrated risk management solutions.

The Admirals group of companies comprises:

-

Admirals AU Pty Ltd.

-

Admiral Markets UK Ltd.

-

Admiral Markets Cyprus Ltd.

-

Admiral Markets AS Jordan Ltd.

Regulators of the Admirals group of companies include FCA (UK, 595450), CySEC (Cyprus, 201/13), ASIC (Australia, 410681), JSC (Jordan, 57026), and CIPC (South Africa, 2019 / 620981 / 07).

OctaFX

OctaFX is a broker of choice for investors worldwide who wish to trade CFDs on highly favorable conditions, including lower entry thresholds and short to medium-term trading strategies. OctaFX was launched in 2011, and has grown to be on the edge of the industry today. OctaFX offers top services for both traders who choose live trades and investors who choose copy trading. Today, OctaFX is proud to serve over 6.6 million customers globally as an intermediary to the financial markets. The company mainly focuses on the countries of the Asia-Pacific region, in particular India, Indonesia, Malaysia, and others. OctaFX is a world-known broker that has won more than 60 awards. Minimum deposit: from USD 25.

HFM

HFM is a broker owned by the HF Markets Group, offers a wide variety of account types, and has the widest selection of trading assets and high-quality software. HFM also has favorable trading conditions and instant execution of orders. Plus, a solid list of tools and services allow everyone to choose the best option. The broker's reliability is confirmed by the license of several regulators. The company's work experience in the financial, brokerage and other services market is over 10 years. Within that time, HFM has received 35 prestigious awards. For trading, MetaTrader 4 and MetaTrader 5 trading terminals are used. The HFM broker focuses on traders from Europe. The company offers a variety of investment options and is suitable for both novice and professional traders.

Avatrade

AvaTrade was founded in 2006 in Dublin, Ireland. The company has offices in 10 countries. It currently has over 300, 000 registered users and processes more than 2 million transactions every month. These factors contribute to AvaTrade being a reliable and trusted broker. They are accredited across five continents and are one of the market leaders. The broker is regulated by the Australian Securities and Investment Commission (ASIC, 406684), the Japanese FSA ( 1662), and the South African FSCA ( 45984). AvaTrade holds accreditation by the Central Irish Bank ( C53877 ), the Abu Dhabi Financial Services Regulatory Authority (190018), and the British Virgin Islands Financial Services Commission ( SIBA/L/13/1049), CySEC ( 347/17). AvaTrade allows traders to trade stocks, securities, indices, cryptocurrencies, and currency pairs. In total, the offer more than 1,200 tools to customers.

How to choose the best Autochartist broker?

Brokers typically offer Autochartist for free on a limited number of account types, though some will offer it on all account types. Here are three important considerations for novices when choosing the best Autochartist broker:

-

1

Research broker reputation: To start, look into and assess possible Autochartist brokers' reputations. Seek out reputable brokers who have been in business for a while and are licensed.

-

2

Autochartist integration: Find out how much Autochartist integration the broker offers. It is possible that some brokers offer a more seamless and user-friendly Autochartist experience than others.

-

3

Support and education: Select a broker who provides novices with informational materials and assistance. When learning how to use Autochartist, having access to webinars, tutorials, and customer support can be quite helpful.

How to start trading with Autochartist

Autochartist can be used as a desktop application, web terminal, or plugin for other platforms like cTrader, MT4, and MT5. Because Autochartist installation is so simple, it only takes a few minutes. Assuming you already have a MetaTrader account, just go to Autochartist, download the plugin, and follow these step-by-step instructions to get started.

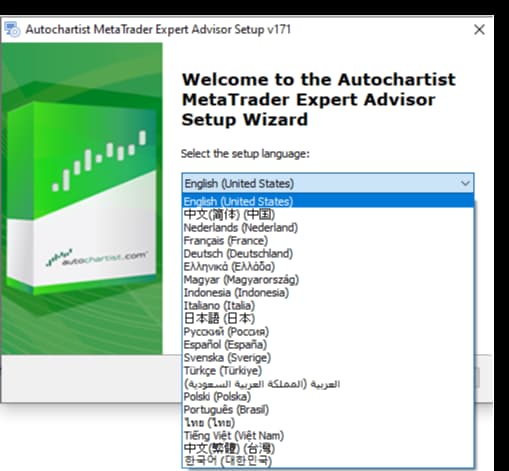

Step 1: Following the download, you'll be asked to choose a language for installation. Please select your desired language settings, and then go on to press OK.

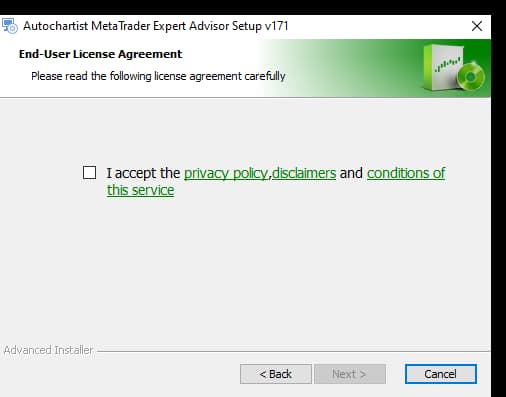

Step 2: After selecting your desired language, you will have to agree to the terms of service, privacy statement, and disclaimers. Read and accept the terms of service, then click the next button to proceed.

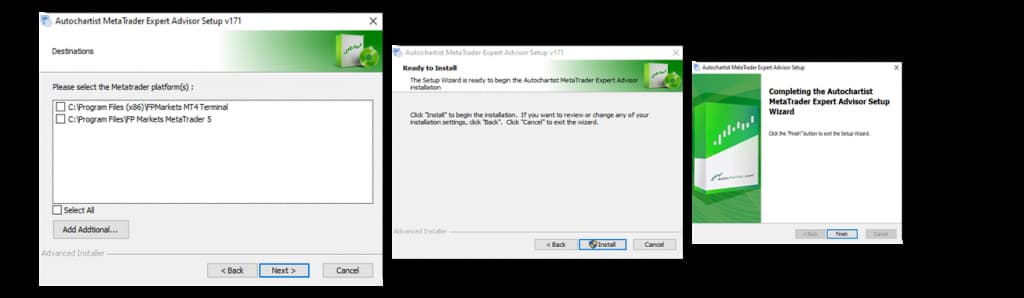

Step 3: In the next step, you will have to choose the MetaTrader 4 or 5 platform to install the plugin. Once chosen, click the Install button to begin the download. After the download, click the Finish button to finish the installation process, then restart the MetaTrader platform.

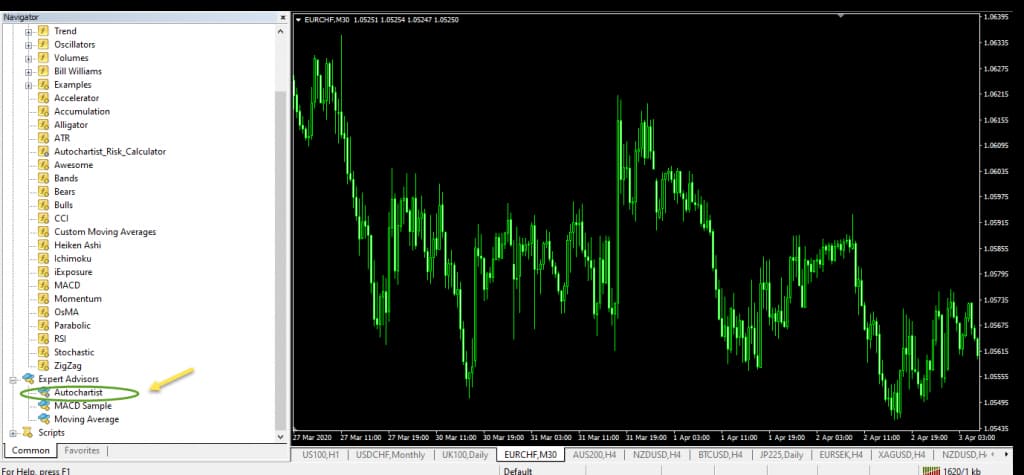

Step 4: After restarting your MetaTrader platform, locate the Autochartist plugin in the Navigator folder under Expert Advisors. You can then simply drag and drop the Autochartist MetaTrader plugin onto your chart to start trading with it.

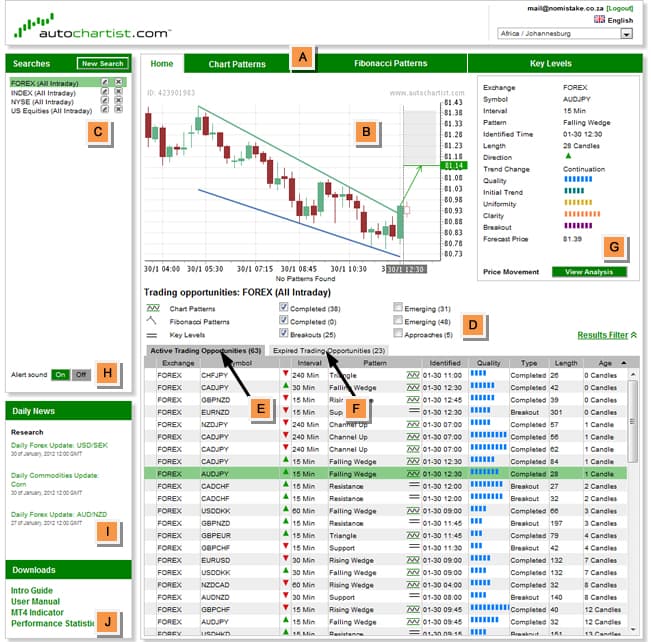

Autochartist interface

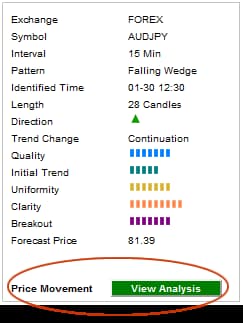

Autochartist is a technical analysis tool used for identifying potential trading opportunities in the financial markets. Autochartist will automatically display the data that has already been loaded if this is your first time using it. Let’s take a detailed look at the Autochartist interface.

1. Dashboard (A): This is where you find tools and options for customizing your analysis. It typically includes features like setting parameters for market scanning, an overview of chat patterns, fibonacci patterns, and more.

2. Pattern display (B): This section showcases various technical patterns identified in the market. These patterns could include chart patterns (like triangles, wedges, heads, and shoulders), Fibonacci patterns, or other technical formations. The pattern display area visually represents these patterns for easier identification.

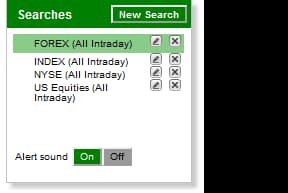

3. Search pane (C): A search pane contains a set of criteria defined by you. This is where you can input specific criteria or preferences for the types of trading opportunities you want to find. You might set parameters like the type of patterns you're interested in, volatility thresholds, or specific financial instruments.

4. Results filter (D): One easy way to narrow down the kinds of trading opportunities you might be interested in is to use the results filter. It allows you to filter the results generated based on your specific criteria.

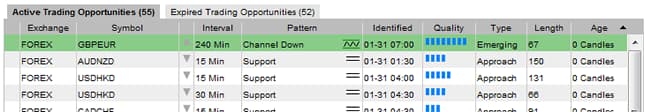

5. Results pane (Active Trading Opportunities) (E): When you log in, this section of the dashboard is always open. It displays currently active or potential trading opportunities that meet the criteria and patterns set in the search pane. It shows the identified opportunities, including the pattern detected, potential entry and exit points, and other relevant information for making informed trading decisions.

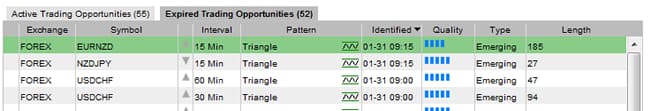

6. Results pane (Expired Trading Opportunities) (F): All expired results for your search highlighted in the search pane are listed in this section, which displays historical trading opportunities that were once active but are no longer regarded as valid.

7. View analysis (PowerStats) (G): This section provides statistical data or analytics into the relative movement of all instruments. This is a great help when creating new trading strategies or enhancing and reassessing current ones.

8. Sound switch (H): This is a simple control panel that allows users to turn on or off sound notifications for alerts or specific events.

9. Daily news pane (I): This pane offers you access to Autochartist's daily and weekly commentary that is published in top news wires, along with useful news updates and market insights.

10. Downloads pane (J): This is where you can access additional resources, reports, and instructions for Autochartist’s MetaTrader plugin.

FAQs

What is the win rate of Autochartist?

Since Autochartist is a technical analysis tool that finds patterns and possible trading opportunities, it does not have a set win rate. Success in trading using Autochartist depends on various factors, including market conditions and individual trading strategies.

How can I get an Autochartist for free?

With some brokers, Autochartist is usually available for free. A lot of brokers provide Autochartist to their customers as an additional tool. Find out from your broker whether Autochartist is accessible for free.

What are the benefits of Autochartist?

Autochartist offers several advantages, such as the capacity to recognize trading opportunities and chart patterns, reduce the time required for market analysis, deliver real-time alerts, improve decision-making, and provide insightful information about future price movements.

What is an Autochartist?

Traders use Autochartist, a potent technical analysis tool, to find trading opportunities and chart patterns in a variety of financial markets. To help traders make better trading decisions, it automates the analysis process and offers alerts and insights.

Team that worked on the article

Winnifred Emmanuel is a freelance financial analyst and writer with years of experience in working with financial websites and businesses. Her expertise spans various areas, including commodities, Forex, stocks, and cryptocurrency. Winnifred tailors her writing to various audiences, including beginners, while also providing useful insights for those who are already familiar with financial markets.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.