According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- 100$

- MT4

- MT5

- AMarkets App

- FinaCom

- MISA

- FSC

- FSA

- 2007

Our Evaluation of AMarkets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

AMarkets is a reliable broker with the TU Overall Score of 7.77 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by AMarkets clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews showed that the broker’s clients are mostly satisfied with the company.

AMarkets is a broker that is more suitable for professional trading. Everything here is designed to accommodate trading with EAs and that is the broker’s strength. The weakness of the broker is that it won’t be easy for traders without experience to work here.

Brief Look at AMarkets

AMarkets provides a wide range of trading instruments, including Forex, stocks, commodities, and cryptocurrencies.

With average execution speeds of 35-50ms and floating spreads from 0 pips on the ECN account, it implements a low-latency environment suitable for high-frequency and scalping strategies. Leverage up to 1:3000 is available across account types. Traders can utilize advanced analytical tools like AutoChartist, Trade Analyzer, Sentiment Indicator, and a large database of EAs. The broker’s copy trading platform allows investors to seamlessly copy successful trading strategies. While offshore regulated, the broker offers additional security through a compensation fund and independent third-party audits. AMarkets LTD is registered and licensed as an international brokerage and clearing company in the Island of Mwali (Comoros) with license number T2023284 and supervised by the Mwali International Services Authority (MlSA).

AMarkets provides a robust environment for those looking for advanced trading conditions.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Order execution speed is 35–50 ms (average market indicator is 200–500 ms);

- Average market spreads from 0.3 pips (average market indicator is from 0.5 pips);

- Newest passive investment platform – AMarkets Copy Trading;

- A set of analytical tools, including signals, risk management tools, and algorithmic trading, is integrated into the user account;

- Compensation fund of up to EUR 20,000 per each client.

- Expert advisors with basic settings are unprofitable. Launching templates without preliminary testing is strongly not advised.

- There is no information about how the rating of managers is formed and how much can the provided statistics be trusted;

TU Expert Advice

Financial expert and analyst at Traders Union

AMarkets is one of those brokers that make earning convenient and comfortable. First of all, I’d like to highlight its high order execution speed and narrow spread on STP accounts: up to 0.1 second and from 1.3 pips respectively. These are very competitive indicators for orders that are directly transferred to liquidity providers. The company is positioned as a platform for algorithmic trading and PAMM investing, which is why the narrow spread and nearly instant order execution are the broker’s key advantages.

AMarkets will be more suitable for those, who already have trading experience or are serious about getting the result. The minimum deposit is USD 100, which rules out those who came to Forex by accident, expecting quick and easy returns. The company is primarily interested in those who want to learn to make money, and AMarkets is prepared to give such traders everything for a successful start. The website features a very strong analytical base, signal providing services, and robots with descriptions of settings. There is a free VPS service for a separate category of clients.

AMarkets has been a partner of Traders Union for several years, ranked among the top brokers in the TU rating thanks to its reliability, attractive trading conditions and positive reviews of traders.

- You focus on cryptocurrencies. AMarkets offers 27 major cryptocurrencies that are traded with spreads from 1.3 pips, leverage up to 1:500, and no fee.

- You want to earn from copy trading. The broker has a proprietary copy trading service with average order execution speed of 0.03 seconds. The service provides ranking of strategies, and manager’s work is transparent for investors, who can flexibly customize copying.

- You are going to use free bots. AMarkets offers 50 proprietary bots that require large deposits and almost always trade at a loss according to client reviews.

- You are used to trading on platforms other than MetaTrader. MT solutions are quite popular, but there are many traders who prefer trading through RTrader, cTrader, NinjaT

AMarkets Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | МТ4, МТ5 (all modifications), AMarkets App |

|---|---|

| 📊 Accounts: | Standard, Fixed, ECN, Zero |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Visa/Mastercard, Bank Transfer, МИР, UZCard, HUMO, Perfect Money, Neteller, FasaPay, Bitcoin. Ethereum, Litecoin, Tether (USDT TRC20, ERC20). AdvCash, Skrill, QIWI (for certain regions) |

| 🚀 Minimum deposit: | $100 / €100 |

| ⚖️ Leverage: | Up to 1:3000 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,2 pips |

| 🔧 Instruments: | Currencies, assets of stock and commodity markets, cryptocurrencies |

| 💹 Margin Call / Stop Out: | 50–100% / 20–40% |

| 🏛 Liquidity provider: | N/A |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market Execution |

| ⭐ Trading features: | Cryptocurrency trade; COT indicator; Cayman indicator; Autochartist. |

| 🎁 Contests and bonuses: | Yes |

Trading conditions of AMarkets are attractive for those who aim at long-term cooperation with the broker and are prepared to grow professionally. The minimum deposit is USD 100.

AMarkets operates based on STP and ECN models and executes orders of the clients at a speed of up to 100 ms (30-50 ms on average). This kind of high order execution speed allows traders to trade successfully with AMarkets. All clients of the broker have access to trading news, phone dealing and negative balance protection. Using ready-made robots and EAs is allowed. Traders can use the broker’s copy trading service to earn passive income.

AMarkets offers accounts with floating (from 0.0 pips) and fixed (from 3 pips) spreads. On an ECN account, a commission per lot is charged in the amount of $2.5 (one side), while there is no commission per lot on Standard and Fixed accounts. For trading, the broker offers MT4 and MT5 platforms and also MultiTerminal based on MetaTrader 4 for simultaneous management of several accounts. In addition to cash back and bonus for switching from another broker, AMarkets offers real money for income earned on a demo account, as well as promotions and lotteries.

AMarkets Key Parameters Evaluation

Video Review of AMarkets

Share your experience

- Best

- Last

- Oldest

BG Sofia

BG Sofia Transparent conditions with no hidden fees

Limited number of promotions compared to some other brokers

GB Dundee

GB Dundee  GB Bristol

GB Bristol Easy customization for personal preferences

No significant drawbacks noted in this review, but some users might prefer more advanced features or integrations depending on their trading style.

SC

SC Transparent trading conditions

Could offer more educational materials for beginners

GB London

GB London  GB Newtownards

GB Newtownards Low spreads

No significant drawbacks so far

GB Glasgow

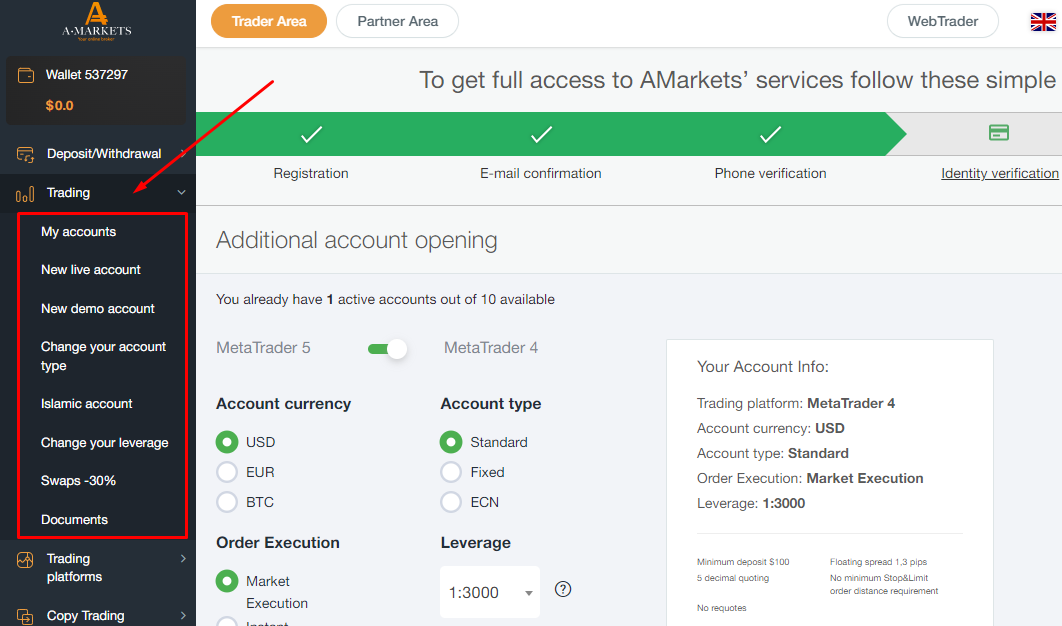

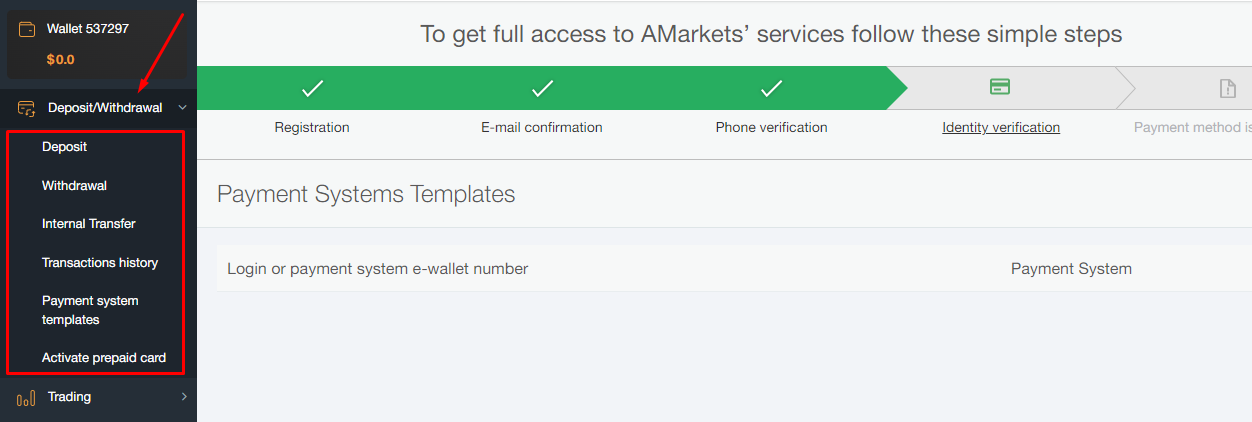

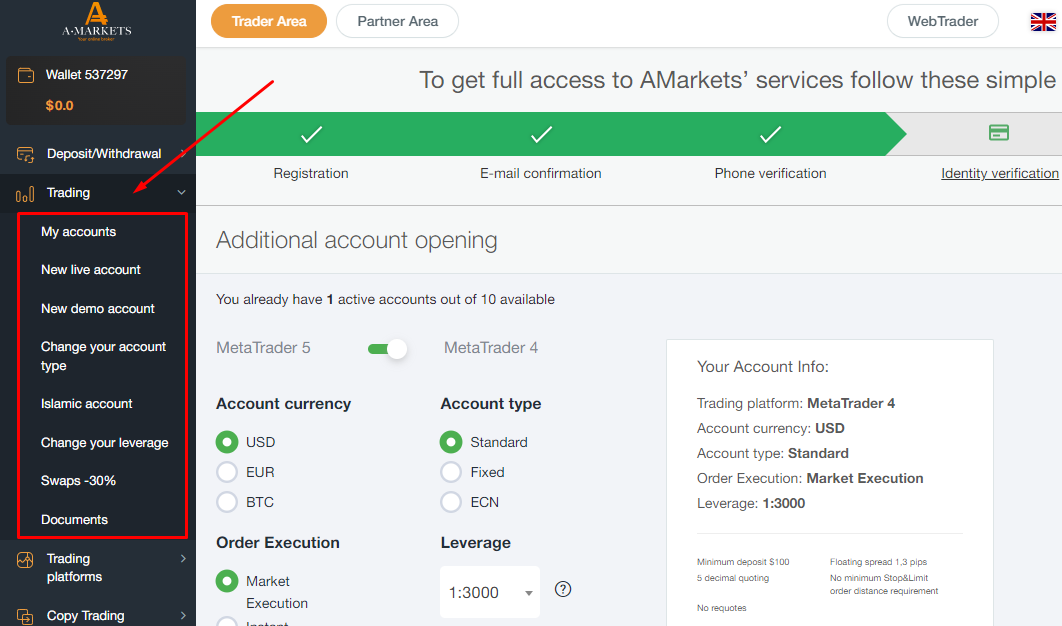

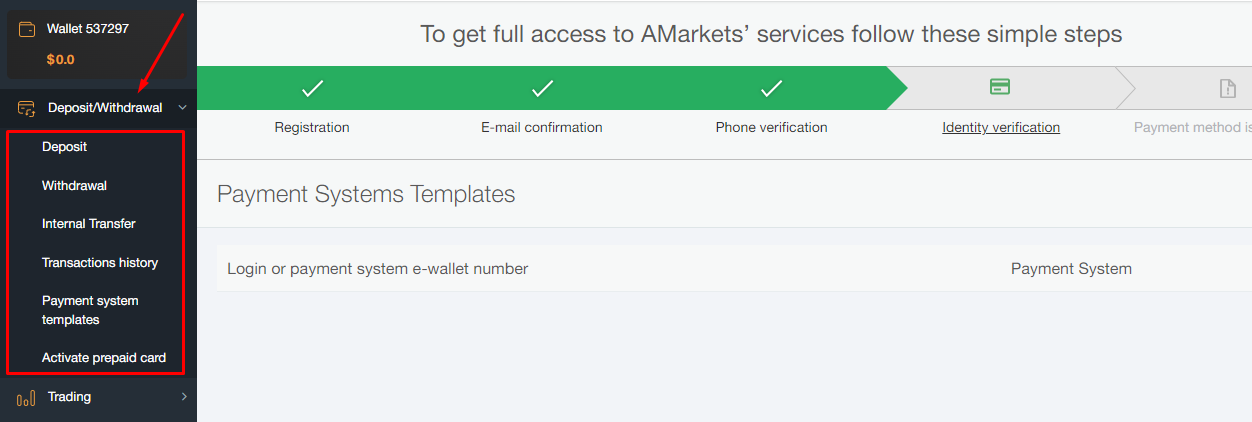

GB Glasgow Trading Account Opening

Before you start working with AMarkets, you need to register for free on the Traders Union website and follow the referral link to the broker’s website. This will provide you with an opportunity to save on the spread in the future. Then, take the following steps:

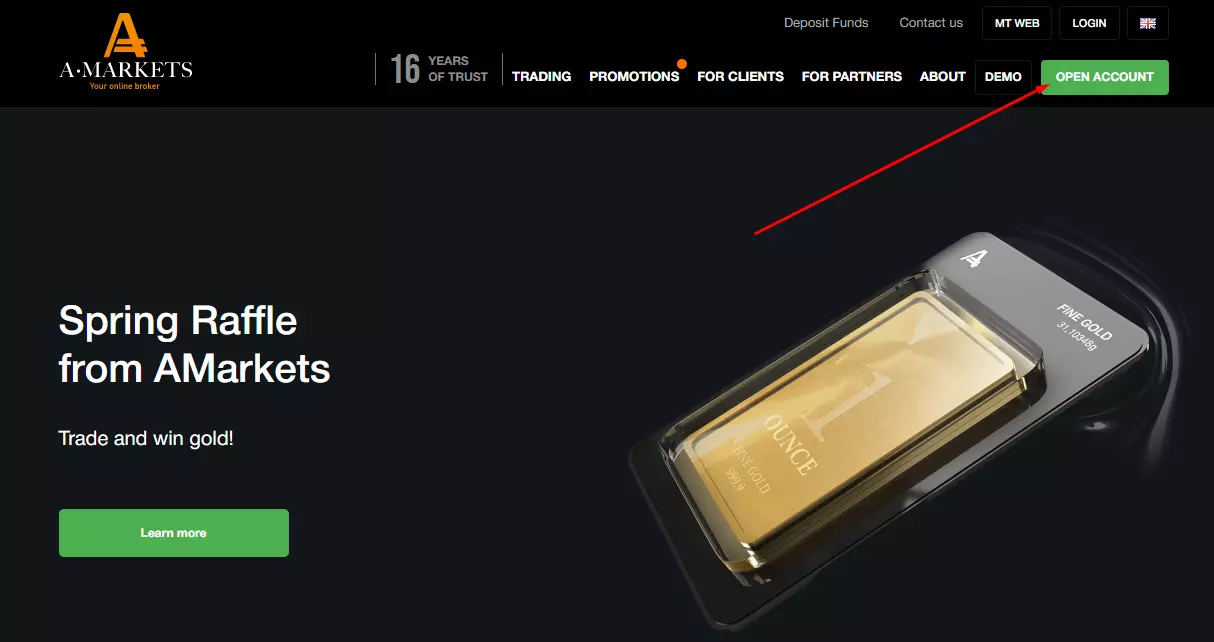

On the homepage of AMarkets, select one of two options: open a demo account or a live account:

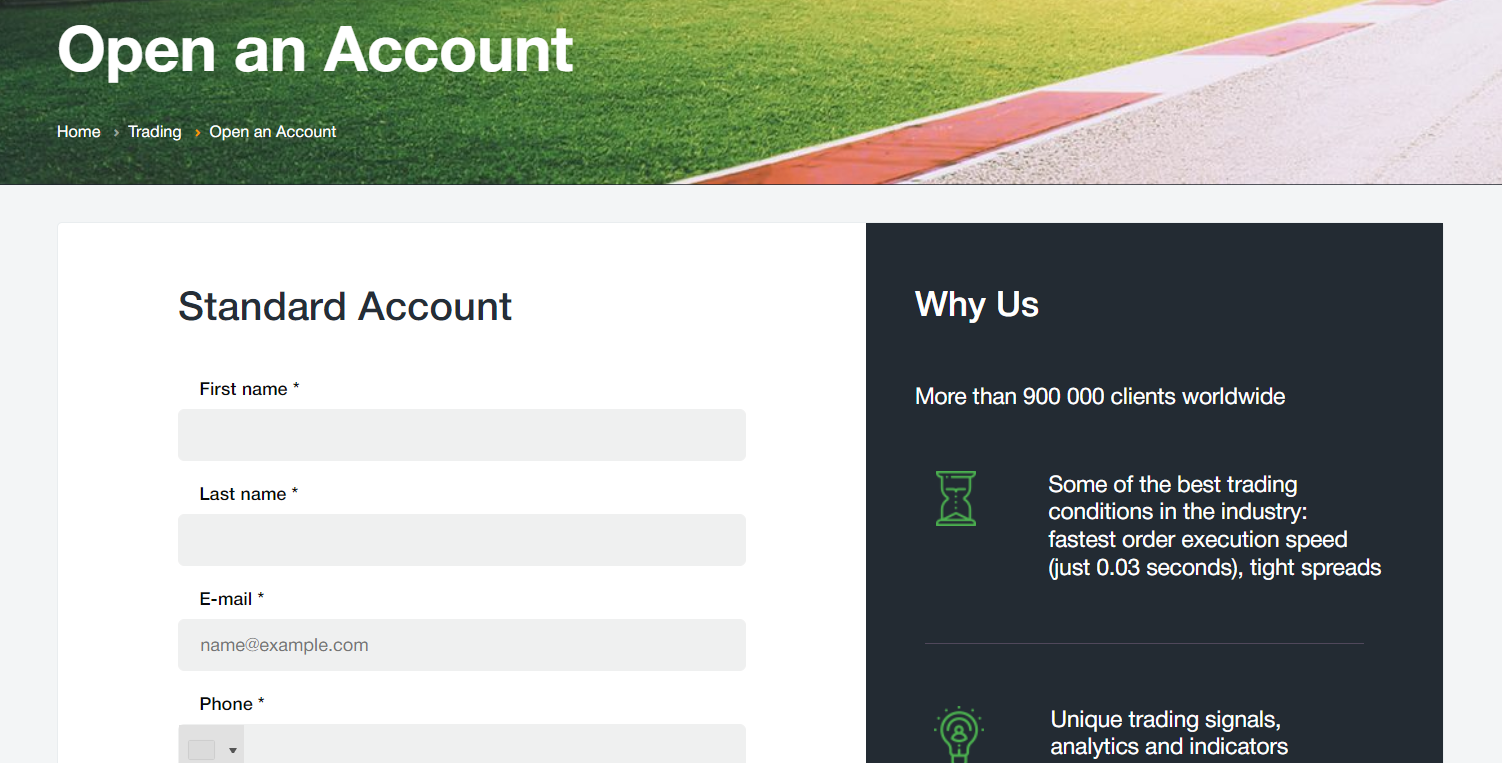

Provide your First Name, Last Name, E-mail and Phone. After that you will be offered to download the platform and link your account using the specified login and password. Click on the web terminal and log into your account.

Features of the user account:

Other features of the user account:

-

Access to the broker’s analytical tools, such as sentiment indicator, advisors, etc.;

-

Access to the copy trading platform and trading platforms;

-

Information on achievements and cash back;

-

Access to AMarkets’ resources.

AMarkets - How to open, deposit and verify a trading account | Firsthand experience of Traders Union

Regulation and safety

AMarkets has a safety score of 5.3/10, which corresponds to a Medium security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Track record over 18 years

- Not tier-1 regulated

AMarkets Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FSC (Cook Islands) FSC (Cook Islands) |

Financial Supervisory Commission, Cook Islands | Cook Islands | No specific fund | Tier-3 |

SVG FSA SVG FSA |

Financial Services Authority of St. Vincent and the Grenadines | St. Vincent and the Grenadines | No specific fund | Tier-3 |

The Financial Commission The Financial Commission |

The Financial Commission | International | Up to €20,000 | Tier-3 |

| MISA (Mwali) | Mwali International Services Authority | The Comoros | No specific fund | Tier-3 |

AMarkets Security Factors

| Foundation date | 2007 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker AMarkets have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- Withdrawal fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of AMarkets with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, AMarkets’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

AMarkets Standard spreads

| AMarkets | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,8 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,3 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,8 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,7 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

AMarkets RAW/ECN spreads

| AMarkets | Pepperstone | OANDA | |

| Commission ($ per lot) | 2 | 3 | 3,5 |

| EUR/USD avg spread | 0,2 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,4 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with AMarkets. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

AMarkets Non-Trading Fees

| AMarkets | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0,5-1,8 | 0 | 0 |

| Withdrawal fee, USD | 1 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

There are several account types offered on the website of AMarkets. Two of them are STP accounts with sending client orders directly to the liquidity providers; they are more suitable for classic trading. ECN account type, which brings trades directly to ECN systems, is suitable for professional high-frequency trading.

Account types:

You can explore the features of the accounts and the platform using a demo account.

Deposit and withdrawal

AMarkets received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

AMarkets provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- BTC available as a base account currency

- Bank card deposits and withdrawals

- Low minimum withdrawal requirement

- Minimum deposit below industry average

- PayPal not supported

- Limited deposit and withdrawal flexibility, leading to higher costs

- Wise not supported

What are AMarkets deposit and withdrawal options?

AMarkets provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Skrill, Neteller, BTC, USDT, Ethereum.

AMarkets Deposit and Withdrawal Methods vs Competitors

| AMarkets | Plus500 | Pepperstone | |

| Bank Wire | No | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are AMarkets base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. AMarkets supports the following base account currencies:

What are AMarkets's minimum deposit and withdrawal amounts?

The minimum deposit on AMarkets is $100, while the minimum withdrawal amount is $1. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact AMarkets’s support team.

Markets and tradable assets

AMarkets provides a standard range of trading assets in line with the market average. The platform includes 532 assets in total and 44 Forex currency pairs.

- 44 supported currency pairs

- 532 assets for trading

- Passive income with bonds

- No ETFs

- Futures not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by AMarkets with its competitors, making it easier for you to find the perfect fit.

| AMarkets | Plus500 | Pepperstone | |

| Currency pairs | 44 | 60 | 90 |

| Total tradable assets | 532 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products AMarkets offers for beginner traders and investors who prefer not to engage in active trading.

| AMarkets | Plus500 | Pepperstone | |

| Bonds | Yes | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Trading platforms & tools

AMarkets received a score of 7.25/10, reflecting an average offering in terms of trading platforms and tools. The broker covers essential functionality but may fall short in some advanced features or platform diversity compared to leading competitors.

- Free VPS for uninterrupted trading

- Trading bots (EAs) allowed

- One-click trading

- MetaTrader is available

- Strategy (EA) Builder is not available

- No access to cTrader and its advanced tools.

- No access to a proprietary platform

Supported trading platforms

AMarkets supports the following trading platforms: MT4, MT5. This selection covers the basic needs of most retail traders. We also compared AMarkets’s platform availability with that of top competitors to assess its relative market position.

| AMarkets | Plus500 | Pepperstone | |

| MT4 | Yes | No | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | Yes |

| TradingView | No | Yes | Yes |

| Proprietary platform | No | Yes | Yes |

| NinjaTrader | No | No | No |

| WebTrader | No | Yes | Yes |

Key AMarkets’s trading platform features

We also evaluated whether AMarkets offers essential trading features that enhance user experience, accommodate various trading styles, and improve overall functionality.

Supported features

| 2FA | Yes |

| Alerts | Yes |

| Trading bots (EAs) | Yes |

| One-click trading | Yes |

| Scalping | Yes |

| Supported indicators | 50 |

| Tradable assets | 532 |

Additional trading tools

AMarkets offers several additional features designed to enhance the trading experience. These tools provide greater automation, deliver advanced market insights, and help improve trade execution.

AMarkets trading tools vs competitors

| AMarkets | Plus500 | Pepperstone | |

| Trading Central | No | No | No |

| API | No | No | Yes |

| Free VPS | Yes | No | Yes |

| Strategy (EA) builder | No | No | Yes |

| Autochartist | No | No | Yes |

Mobile apps

AMarkets supports mobile trading, offering dedicated apps for both iOS and Android. AMarkets received a score of 7/10 in this section, indicating a generally acceptable mobile trading experience.

- Indicators supported

- Mobile alerts supported

- Solid iOS user feedback, with a rating of 4.7/5

- Mobile 2FA not supported

We compared AMarkets with two top competitors by mobile downloads, app ratings, 2FA support, indicators, and trading alerts.

| AMarkets | Plus500 | Pepperstone | |

| Total downloads | 1,000,000 | 10,000,000 | 100,000 |

| App Store score | 4.7 | 4.7 | 4.0 |

| Google Play score | 4.8 | 4.4 | 4.0 |

| Mob. 2FA | No | Yes | Yes |

| Mob. Indicators | Yes | Yes | Yes |

| Mob. Alerts | Yes | Yes | Yes |

Education

There is an Education section on the AMarkets website, where you can find a brief basic course on how to start trading, how the process of making trades works and what the methods of forecasting are, as well as many other things.

You can test the knowledge you obtained by using a demo account.

Customer support

Customer support service of AMarkets provides support 24 hours a day, 5 days a week.

Advantages

- Live chat and phone support

- Multilingual support

Disadvantages

- Does not work on weekends

There are several ways to contact customer support:

-

By calling the phone numbers specified on the website, by ordering a call back;

-

By email specified in the Contacts on the website;

-

On a live chat on the broker’s website; the response comes within 1 minute;

-

By instant messengers and social media.

Support is available from the broker’s website and your personal account.

Contacts

| Foundation date | 2007 |

|---|---|

| Registration address | Suite 305, Griffith Corporate Centre 1510, Beachmont, Kingstown, Saint Vincent and the Grenadines |

| Regulation | FinaCom, MISA, FSC, FSA |

| Official site | amarkets.com |

| Contacts |

+44 330 777 22 22

|

Comparison of AMarkets with other Brokers

| AMarkets | Bybit | Eightcap | XM Group | Vantage Markets | FxPro | |

| Trading platform |

MT4, MT5, AMarkets App | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, TradingView, ProTrader, Vantage App | MT4, MobileTrading, MT5, cTrader, FxPro Edge |

| Min deposit | $100 | No | $100 | $5 | $50 | $100 |

| Leverage |

From 1:1 to 1:3000 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:500 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0 points |

| Level of margin call / stop out |

50% / 20% | No / 50% | 80% / 50% | 100% / 50% | 100% / 50% | 25% / 20% |

| Order Execution | Market Execution, Instant Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed Review of AMarkets

AMarkets has been providing access to international financial markets since 2007. The company is interested in seeing its clients succeed, trying to create the best conditions for trading. Today, AMarkets is a company ranked among the Top 5 European brokers in terms of the number of successful clients. For this reason, the broker offers novice traders a free comprehensive trading course, daily webinars with professional traders and also nice bonuses for a quick start.

AMarkets in figures:

-

1,000,000+ clients worldwide;

-

550+ trading instruments;

-

18+ international awards.

AMarkets — latest automated trading technologies

AMarkets is an STP and ECN broker offering one of the fastest order execution speeds in the Forex market. Over 90% of client orders are executed at a speed of up to 100 ms. Thanks to this advantage, AMarkets is considered one of the best brokers for algorithmic trading. There are such additional tools in the user account such as trading signals, trading analyzer, sentiment indicator, and many more.

AMarkets also offers instruments for passive investing. The copy trading service allows users to copy trades of other traders. The trading platforms are the classic MT4 and MT5 as well as the AMarkets App. There is also a browser version with simplified functionality that does not require installation.

Analytical tools and additional services of AMarkets are:

-

Derivatives expiration table. This is a reminder of delivery dates of the basic asset for derivative financial instruments;

-

Information about trading schedule, taking into account winter/summer time in different jurisdictions and information about payment of dividends;

-

VPS servers. Access to servers is available from anywhere in the world, trading is possible even without electricity and internet. There are several options for renting servers with a monthly fee of $9.90 per month;

-

VPN and AMarkets Access extension for Google Chrome. It is a list of paid and free VPN services, through which the user can access AMarkets applications and tools from any jurisdiction.

Advantages:

Compensation fund in the amount of EUR 20,000 in case of unforeseen situations;

Professional analytics and unique instruments for manual and automated trading;

One of the fastest order execution speed in the market;

A possibility to earn passive income by using copy trading.

AMarkets does not limit the use of various trading methods: algorithmic trading is supported, locking and hedging is allowed and there are no limitations on the minimum position holding.

Latest AMarkets News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i