Warning:

There is a high level of risk involved when trading leveraged products such as Forex/CFDs. Between 65% and 82% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Best Forex Brokers For Beginners

Best Forex Broker For Beginners - eToro

Best Forex Brokers for Beginners in 2024

eToro – Biggest copy trading community in the world (over 3,000 verified investors with copiers)

OANDA – Best for trading with advanced technical analysis tools (TradingView charts support)

IG Markets – Favorable Forex trading conditions (0 fees, avg. EUR/USD spread - 0.8)

Trading.com – Farouble Forex trading conditions (leverage up to 1:50, 70+ currency pairs)

FOREX.com – Diverse range of tradable assets (80+ currency pairs)

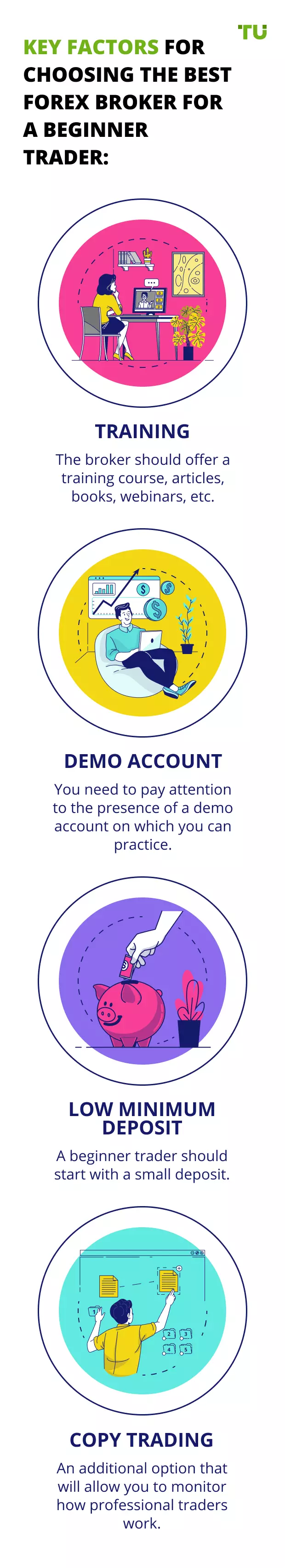

For beginners venturing into the world of Forex trading, choosing the right broker is a crucial first step. Trusted and regulated Forex brokers provide a solid foundation for novice traders, offering a range of beginner-friendly features such as demo accounts, low minimum deposits, user-friendly trading platforms, educational resources, and copy trading options.

In this article, Traders Union will explore the importance of Forex brokers for beginners and highlight the key qualities that make them stand out. Additionally, TU experts have compared these beginner-friendly tools and trading conditions in a convenient way to help new traders make informed decisions

What are the best Forex brokers for beginners?

When it comes to selecting the best Forex brokers for beginners, Traders Union experts take into account several important factors. These factors ensure that beginners have a smooth and user-friendly trading experience. Let's explore the qualities that are considered while preparing the rating:

Regulation. Trusted brokers are regulated by reputable financial authorities, which provides a layer of security for traders' funds and ensures fair trading practices.

Education. Beginner-friendly brokers offer comprehensive educational resources such as tutorials, webinars, and trading guides to help newcomers understand the basics of Forex trading.

Demo trading. A demo account allows beginners to practice trading strategies and familiarize themselves with the broker's platform without risking real money.

Accessibility. Brokers with low minimum deposit requirements provide accessibility to beginners with limited capital, allowing them to start trading with smaller amounts.

Social Trading. Social trading features enable beginners to follow and replicate the trades of experienced traders, gaining valuable insights and learning from their strategies.

Forex signals. Some brokers provide traders with valuable resources to enhance their trading strategy, including trading signals from reputable sources like Trading Central, as well as indicator-based tools and technical analysis reports, enabling traders to make informed decisions based on expert insights.

Other tools. Certain brokers provide many more different trading tools and features like technical analysis indicators, charting options, and customizable interfaces to support beginners as they progress in their trading journey. For example, some brokers provide traders with Autochartist.

Best Forex brokers with options for beginners in 2024

Forex Brokers Tools for Beginners Compared: To further assist beginners in their decision-making process, let's compare the listed brokers based on important tools and features.

| Brokers | Overall score | Minimum deposit | Free educational tools | Cent Account | Demo Account | Social Trading | |

|---|---|---|---|---|---|---|---|

5.6 |

50$ |

|

|||||

5.3 |

No |

|

|||||

5.98 |

$450 |

|

|||||

5.5 |

from 5 USD |

|

|||||

5.26 |

$1000 |

|

|||||

5.17 |

No |

|

|||||

4.37 |

$1 |

|

|||||

4.35 |

From $0 (from $2,000 to activate margin trading opportunities) |

|

|||||

3.58 |

$1 |

|

|||||

3.35 |

€1 |

|

Top 3 Forex brokers for beginners

eToro

The eToro broker was founded in 2007. The company promotes itself as a social trading platform working with traders from over 140 countries. The broker has several divisions operating under different jurisdictions and licensed by different regulators. For example, eToro (Europe) is licensed by the Cypriot regulator CySEC (109/10) and eToro (UK) is licensed by the British regulator FCA (583263). The broker also has a representative office in Australia and the USA. eToro Profile Details

🏛 Regulation: |

CySEC, FCA, ASIC |

💱 Spread: |

2 points |

💻 Trading platform: |

MobileTrading, WebTrader |

💰 Accounts: |

USD |

🚀 Minimum deposit: |

50$ |

💼 PAMM-accounts: |

|

📈️ Min Order: |

$1 (when copying transactions) |

🔧 Instruments: |

Currencies, assets of stock and commodity markets, cryptocurrencies |

OANDA

The name OANDA is an acronym for “Olsen & Associates” or “Olsen AND Associates”. It is registered in the United States and provides its clients with a wide range of financial services in most countries of the world. The company was founded in 1996 and is currently regulated in four jurisdictions. The main regulator of the broker is the UK Financial Conduct Authority (FCA). Oanda Canada is licensed by IIROC. The company has several significant awards to its credit, including a victory in the category "Best Forex Trading Technologies" from the UK Forex Awards, "Best Trading Platform" from FX Week, as well as "Best Customer Service" from the US Foreign Exchange Report.

🏛 Regulation: |

FSC (BVI), ASIC, IIROC, FCA |

💱 Spread: |

0 points |

💻 Trading platform: |

WebTrader, MetaTrader4, Mobile platforms, MetaTrader5 |

💰 Accounts: |

USD, EUR, HKD, SGD |

🚀 Minimum deposit: |

No |

💼 PAMM-accounts: |

|

📈️ Min Order: |

0,01 lot |

🔧 Instruments: |

FX, Indices, Bullion, Commodities, Crypto |

IG Markets

The Forex broker IG Markets is a structural subdivision of the IG Group corporation. Its securities are listed on the London Stock Exchange and are included in the FTSE 250 index. IG Markets is a UK registered company created in 1974, but since its inception, its representative offices have appeared in some other European countries. Since 2014, a retail line of brokerage services has been opened. The international division of the broker is registered in Bermuda and licensed by the Bermuda Monetary Authority (54814). The main activity of the broker is the provision of services for trading financial derivatives (CFDs).

🏛 Regulation: |

FCA, BaFin, CySec, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, NFA, BMA |

💱 Spread: |

0.6 points |

💻 Trading platform: |

MetaTrader4, Web platform, ProRealTime, Trading apps |

💰 Accounts: |

USD |

🚀 Minimum deposit: |

$450 |

💼 PAMM-accounts: |

|

📈️ Min Order: |

0.01 |

🔧 Instruments: |

Currencies, assets of stock and commodity markets, cryptocurrencies |

Why Forex brokers matter

Forex brokers play a vital role in enabling individuals to participate in the foreign exchange market. Without a broker, it would be virtually impossible to access the global Forex market and execute trades. Forex brokers act as intermediaries, connecting traders to the market and providing them with the necessary tools and platforms for trading. They also offer essential services like order execution, account management, and customer support. In summary, Forex brokers are the gateway to the Forex market for beginners and experienced traders alike.

How to start Forex trading wisely?

Forex trading involves inherent risks such as market volatility, leverage, and unpredictable events, which is why this guide emphasizes the importance of education, accuracy, and proper risk management to navigate the complexities of the market effectively and minimize potential losses. To start your Forex career wisely you can follow such Traders Union expert’s advices:

Educate yourself about the basics of Forex. Learn about the currency market, trading terminology, fundamental and technical analysis, risk management, and trading psychology.

Develop a trading strategy. Define your trading goals, timeframes, risk tolerance, and preferred trading style. Create a plan that outlines your entry and exit strategies, position sizing, and risk management rules.

Start with a demo. Practice trading with virtual funds on a demo account provided by a reputable broker. Familiarize yourself with the trading platform, test your strategy, and gain confidence without risking real money.

Consider a Cent account or copy trading tool. Explore options such as a Cent account, which allows trading with smaller position sizes using real money but with reduced risk. Alternatively, consider copy trading, where you can follow and replicate the trades of successful traders.These trading opportunities carry lower risk levels, providing traders with a more secure environment to engage in their trading activities.

Start with the right deposit. Once you are comfortable with your trading skills, open a live standard trading account with a regulated broker. TU experts recommend starting with a modest sum of money that will not strain your budget, but is still significant enough to allow for proper risk management. Avoid using excessive leverage and focus on maintaining a balanced approach to your trading strategy.

Deposit more funds only if you have regular profits. This approach helps manage risk and ensures that you have a proven track record of successful trading.

Remember, Forex trading requires continuous learning, practice, and adaptation. Stay updated with market news, refine your strategies, and always prioritize risk management to enhance your chances of success in the Forex market.

Where can I learn Forex?

Traders Union offers a valuable Forex trading library with a wide range of strategy reviews and Forex trading guides. Additionally, traders can utilize

Trading books serve as an invaluable source of knowledge, offering a wealth of information and insights for traders to enhance their understanding and skills in the field of trading.

Educational tutorials provided by brokers.

Social trading networks, where traders share their strategies and explanations, and access free.

Forex educators and mentors for additional learning resources.

Forex website and blogs with valuable information.

Richest Forex traders' life stories can help you to delve into their approaches and experiences, gaining valuable insights that can enhance your understanding of their strategies and perspectives.

Top 10 Forex terms to learn

Pip - the smallest unit of price movement in forex trading.

Spread - the difference between the bid and ask price, representing the cost of trading.

Leverage - the use of borrowed funds to amplify potential returns or losses in trading.

Margin - the collateral required by brokers to open and maintain trading positions.

Stop Loss - predetermined order that automatically closes a trade to limit potential losses.

Take profit - predetermined order that automatically closes a trade to secure profits.

Currency pair - the quotation of one currency against another in the forex market.

Fundamental analysis - examining economic, political, and social factors to assess currency value.

Technical analysis - evaluating historical price patterns and indicators to predict future price movements.

Lot - the standardized trading size, typically representing a certain number of units of the base currency.

Is Forex trading a good idea for beginners?

Forex trading can be challenging, and it's common for beginners to experience losses. However, the potential for substantial profits exists for skilled traders. The decision to pursue Forex trading depends on the individual's commitment to education, practice, and developing trading skills.

Top 2 pros of Forex trading for beginners:

Profit potential. Successful traders can generate significant profits in the Forex market due to its high liquidity and volatility.

Flexibility and accessibility. Forex markets operate 24/5, providing flexibility for individuals to trade at their convenience. Additionally, the market offers low entry barriers, allowing beginners to start with a small investment.

Top 2 cons of Forex trading for beginners:

Risk and volatility. Forex markets can be highly volatile, which can lead to substantial losses if proper risk management is not implemented.

Complexity and learning curve. Forex trading requires a solid understanding of fundamental and technical analysis, risk management, and market dynamics, which can be overwhelming for beginners.

Is Forex worth it? How much can I earn?

The worth of Forex trading depends on an individual's skills and discipline. Forex trading is a skill-based business where success relies on comprehensive education, practice, and the ability to adapt to changing market conditions. With discipline and persistence in education, individuals can potentially achieve substantial wealth through Forex trading. However, if one lacks the necessary commitment to learning and discipline, it may not be advisable to venture into Forex trading.

For novice traders, it is advisable to focus on honing their skills and executing each trade wisely, employing proper strategies and risk management techniques. Profits will naturally follow as your skills and expertise develop over time.

What are alternatives to active Forex trading?

If you are uncertain about having enough time and skills to actively engage in forex trading, alternative options such as copy trading, position trading, and PAMM accounts can be considered. However, it's important to note that these options also involve investment risks, and individuals should approach them with attentiveness and caution.

Copy trading software allows beginners to automatically replicate the trades of successful traders, benefiting from their expertise and potentially generating profits.

PAMM (Percentage Allocation Management Module) accounts enable beginners to invest in managed accounts managed by experienced traders who handle trading activities on their behalf.

Forex position trading involves holding trades for an extended period, taking advantage of long-term market trends rather than actively trading on short-term price fluctuations.

What are the best Forex trading platforms for beginners?

A Forex trading platform is a software application provided by brokers that allows traders to access the forex market, execute trades, and manage their accounts. Here's a brief review of the top three commonly used platforms, with an emphasis on beginner-friendliness:

MetaTrader 4 (MT4) is widely recognized and favored by traders of all levels. It offers a user-friendly interface, comprehensive charting tools, a wide range of technical indicators, and the ability to automate trading through expert advisors (EAs). MT4 provides an extensive community and educational resources, making it beginner-friendly and suitable for those starting out.

MetaTrader 5 (MT5) is an upgraded version of MT4, offering enhanced features such as additional markets to trade (including stocks and commodities), a more advanced scripting language, and improved backtesting capabilities. While MT5 provides more versatility, it may have a steeper learning curve compared to MT4, making it more suitable for traders with intermediate to advanced skills.

cTrader is known for its user-friendly interface, customizable charts, and advanced order execution capabilities. It provides a modern and intuitive trading experience, with features like depth of market (DOM) display and a wide selection of built-in technical indicators. cTrader's simplicity and beginner-friendly interface make it appealing to traders new to the forex market.

Overall, both MT4 and cTrader offer beginner-friendly platforms with comprehensive features and educational resources. MT5, while more advanced, can also be suitable for beginners willing to invest time in learning its additional functionalities.

What is the minimum Forex investment?

Forex minimum investment can vary depending on several factors, including the broker and the type of trading account. Generally, the minimum investment can range from as low as $10 to a few hundred dollars.

Some brokers offer cent accounts, which allow traders to start with smaller position sizes and lower investment requirements. With cent accounts, traders can trade in micro lots, which represent a fraction of a standard lot. This enables beginners to enter the Forex market with minimal risk and a smaller initial investment (from $10).

On the other hand, standard accounts typically require a higher minimum investment, ranging from a few hundred dollars to a few thousand dollars, depending on the broker. These accounts provide access to full-size lots, allowing for greater flexibility in position sizing.

Can I start trading Forex without investment?

While it is technically possible to start trading Forex without investment by utilizing a minimum investment as low as $10 or exploring opportunities with Forex prop companies that offer funds without evaluation fees, it can be challenging due to the additional trading skills required to overcome the challenges and achieve success. Starting with at least $200 is recommended for a more feasible trading experience.

How to develop a Forex trading strategy?

It is crucial for beginners to start their trading career with a well-developed trading strategy for several reasons. Having a strategy provides a structured approach to trading and helps beginners navigate the complexities of the Forex market.

To develop your trading strategy follow such tips:

Educate yourself through research, online courses, trading communities, mentorship, and demo account practice to grasp different forex approaches.

Define your goals. Clearly identify your trading objectives and what you aim to achieve to choose your approach.

Determine your timeframe. Choose the trading timeframe that aligns with your goals and suits your trading style. TU experts recommend beginners to start with h4 and a bigger timeframe.

Choose a market. Select the currency pairs you wish to trade based on your research and interests.

Develop entry and exit rules. Establish clear criteria for entering and exiting trades based on technical or fundamental indicators.

Test your strategy. Backtest your trading strategy using historical data to evaluate its performance and effectiveness.

Utilize a demo account. Implement and refine your strategy on a demo account to gain practical experience without risking real money.

Maintain a trading journal to track and analyze your trades, helping you identify patterns, learn from mistakes, and improve your trading performance.

Use risk management techniques. It involves determining the appropriate position size for each trade, setting stop-loss orders to limit potential losses, and establishing profit targets to secure gains.

Popular Forex trading strategies for beginners

Traders Union experts highly recommend commencing Forex trading with small positions and adopting conservative trading strategies that predominantly employ a trend trading approach. By starting small and focusing on conservative tactics, traders can mitigate risks and gradually build their expertise while analyzing and capitalizing on long-term market trends. Here are some of the most common Forex trading strategies.

To mitigate emotional and volatility risks, it is advisable to begin Forex trading by focusing on higher time frames, ranging from H4 (4-hour) to 1 day charts. Trading on these longer timeframes provides a more comprehensive view of the market, allowing traders to minimize the impact of short-term fluctuations and emotional reactions.

Trend following

Trend following trading is a popular and effective Forex strategy that is well-suited for beginners. This strategy focuses on identifying and capitalizing on trading opportunities that align with the prevailing price trend in the market.

Trend trading is considered optimal for beginners due to its relative simplicity and clarity. This strategy eliminates the need for complex indicators and allows beginners to focus on identifying trends and determining entry and exit points.

To implement the trend trading strategy, beginners should start by identifying the overall trend direction using basic settings such as moving averages or trend lines. These tools help in determining the strength and stability of the trend. Additionally, beginners should consider the duration of the trend, whether it is short-term, medium-term, or long-term, to align their trading approach accordingly.

EURUSD daily chart

Price action trading

This strategy involves analyzing and interpreting the movement of price on a chart to make trading decisions, rather than relying heavily on indicators or other technical tools.

Price action trading is considered optimal for beginners due to its simplicity and focus on understanding the raw price movements. By studying candlestick patterns, chart patterns, and key levels of support and resistance, beginners can gain valuable insights into market dynamics and make informed trading decisions.

The head and shoulders pattern

To implement the price action trading strategy, beginners should focus on learning and recognizing common price patterns such as pin bars, engulfing patterns, and inside bars. They should also pay attention to important support and resistance levels and observe how price reacts around these areas.

It's crucial for beginners to practice price action analysis on a demo account and develop a keen eye for reading price patterns and understanding market behavior. Risk management should also be an integral part of this strategy, ensuring that proper stop-loss and take-profit levels are set for each trade.

Breakout Trading

This type of strategy involves identifying and capitalizing on price breakouts from established support and resistance levels, indicating a potential shift in market momentum.

Breakout Forex trading is considered optimal for beginners due to its straightforward nature and clear entry and exit signals. Traders focus on identifying strong range borders and patiently wait for a breakout to occur. This strategy allows beginners to take advantage of volatility and potential new trends in the market.

To implement the breakout trading strategy, beginners should start by identifying key support and resistance levels using basic tools like trend lines or horizontal levels. They monitor the market closely for price movements that break above or below these levels. Once a breakout occurs, beginners can enter the market with a well-defined entry point and set appropriate stop-loss and take-profit levels.

It's important for beginners to exercise caution and verify the validity of breakouts before entering trades. False breakouts can occur, leading to potential losses. Therefore, it's recommended to use additional indicators or confirmation techniques to filter out false signals and increase the probability of successful trades.

By understanding breakout patterns, practicing on a demo account, and implementing proper risk management, beginners can effectively utilize the breakout trading strategy to capture profitable trading opportunities in the Forex market.

What currency pairs are best for beginners?

For beginners, it is advisable to focus on the most traded and easily accessible currency pairs, such as EUR/USD, GBP/USD, USD/JPY, USD/CHF, USD/CAD, and GBP/JPY. These pairs are popular among traders and offer several advantages for beginners. They provide high liquidity, which ensures smooth execution of trades, and often have lower spreads, reducing trading costs. Additionally, these pairs tend to exhibit greater stability, making them more predictable and suitable for beginners to analyze and understand market movements.

What is the best time to trade Forex?

The best time to trade Forex depends on various factors. For long-term strategies, Wednesday and Monday are considered favorable days. On the other hand, for short-term strategies, Wednesday and Thursday are often preferred. These days tend to offer better market conditions and increased trading activity.

Furthermore, it's essential to consider the time of day for optimal trading opportunities. Generally, the best trading times occur between 06:00-12:00 GMT and 18:00-00:00 GMT. During these periods, multiple major financial centers, such as London, New York, and Tokyo, are active, resulting in increased market liquidity and potential for favorable price movements.

However, it's important to note that market conditions can vary depending on economic news releases, geopolitical events, and other factors that impact currency volatility. Therefore, traders should always stay informed and adapt their trading strategies accordingly.

Expert Opinion

The choice of a broker is the most important task of a person aiming at long-term cooperation and positive results. There are dozens of brokers, many have quite similar trading conditions, and many have licenses, so it is not surprising that to a beginner, the choice may seem difficult.

Let me share my professional opinion on choosing a broker:

Technical support is vital. If support responds quickly and substantively, it's always pleasant to work with such a broker.

Real spread. Not the one stated on the broker's website, but the actual spread. You can check it using a script on a demo account. Scripts for many platforms are available online for free.

Withdrawal. Speed and zero fees. This aspect can be tested with a minimum deposit. Deposit some funds, make a few symbolic trades, and try to withdraw.

Conclusion: Open at least 5 demo accounts with different brokers and try working with them for a few weeks, for example, by opening the same trades on all accounts. The results will speak for itself.

FAQ

Is $1000 good to start in Forex?

Starting with $1000 in Forex can be a reasonable amount for beginners, but it's important to manage risk carefully and consider transaction costs and leverage when determining trade sizes.

What is the easiest forex trading platform?

MetaTrader 4 (MT4) is often considered one of the easiest forex trading platforms due to its user-friendly interface, comprehensive charting tools, and availability of educational resources.

Which broker can I start trading with $1?

Some brokers, like Exness and RoboForex, offer cent account options where you can start trading with as little as $1, allowing you to get started with a small amount of capital.

Is forex easier to trade than crypto?

Whether forex or crypto trading is easier depends on individual preferences and market knowledge, as they both have unique characteristics and risk factors that require understanding and expertise.

Can forex be easy?

While forex trading can be challenging and requires learning and practice, with dedication, education, and the use of proper strategies, it is possible to develop the necessary skills and find success in the forex market.