In 1976 Steve Jobs and Wozniak founded Apple

How to Buy Stock in Apple in 2024

If you didn’t already know, Apple is the very first publicly traded US company in the whole world to be valued at over two trillion US dollars. That’s because about two-thirds of the American population own one or more Apple products. Moreover, the annual revenue of Apple grew from 215.6 billion US dollars to 274.5 billion US dollars. The same is the case with its net income that rose from 45.7 billion US dollars to 57.4 billion US dollars.

What’s making Apple stock even more appealing is the recent stock split. According to the reports published on Apple’s official investor website, the shares of the tech giant had four for one split that brought the apple stock price from 499.23 dollars (at August 20th, 2020 closing) to only 127.58 US dollars (at August 31st, 2020 opening). In simple words, this split means that it has become even easier for the investors to purchase Apple stocks. That’s why Apple stocks are of great interest, and it continues to release new innovative products that gradually improve its financial performance that even Warren Buffett has huge investments in Apple.

As far as this matter is concerned, how Apple stocks are going to perform in the near and far future, the experts' report and apple stock forecast suggest that it will also be the first company to reach a three trillion-dollar mark. So, if you want to know how to invest in Apple, then keep reading this article till the very end. It contains all the important information and the fundamentals of Apple stock that you need to know.

General Overview of Apple Inc. Company

Steve Jobs, throughout his career as the founder of Apple, remained consistent in building a closed and perfect ecosystem, and because of his insistent behavior, he was forced to leave his own company. But the fact of the matter is that the company had to call him back later in 1997 when everything was in deep trouble. From that point onwards, Apple kept surprising the world with innovative products such as iPod in 2001, which was truly a blockbuster. Later on, when the company launched the iPhone in 2007, it shook the world and continues to do so to the present day.

Here are some of the most significant points about Apple stock.

-

-

On December 12th, 1980, the very first Apple share went public with 22 US dollars per share, and the company had a market capitalization of 1.2 billion dollars on that day

-

In 1985 Steve Jobs and Wozniak both left Apple, and because of the poor leadership after that, the company's stock price decreased to even below 2 US dollars per share.

-

In 1997 Steve Jobs returned to the company.

-

It only took a year for Steve Jobs to come up with an amazing product, and the very first iMac was unveiled in 1998.

-

In 2000 the company released Power Mac G4 Cube along with the Mac OS X.

-

In 2001 as mentioned, Apple launched iPod (a digital music player) that changed the music world.

-

In 2007 the revolutionary first smartphone iPhone was released, and it's still one of the best-selling smartphones even after more than 13 years.

-

In 2011 Steve Jobs resigned, and Tim Cook became the CEO of Apple. Steve Jobs also passed away later that year, but during his time, the total revenue of the company reached 110 billion US dollars, and the stock price was increased to 380 dollars per share. Moreover, Apple had a market capitalization of 360 billion US dollars in 2011.

-

In 2014 Apple stocks split, and the share price of AAPL dropped to 92.44 US dollars from 645.57 US dollars.

-

In 2015 Apple came up with Apple Music which is a subscription-based service.

-

In 2016 Apple drew the attention of Warren Buffet, an American business tycoon and one of the most successful investors, and he bought about 10 million AAPL shares.

-

In 2018 Apple managed to become the first US company to hit one trillion US dollars value.

-

On August 19th, 2020, Apple's stock news of hitting a staggering two trillion US dollars value stunned the whole world.

Top Facts About Apple for 2020

The shares of Apple remained unstoppable, especially in the first quarter of 2020. According to the CompareCamp report, Apple managed to secure the revenue (only against iPhone) of 55.96 billion US dollars only in the first fiscal quarter of 2020. Here are some of the most significant facts about Apple for 2020.

-

Apple secured 58.3 billion US dollars revenue in 2020’s first fiscal quarter and also had 11.25 billion US dollars of net profit in the same period as well.

-

Only in the US, Apple had 41.4 billion US dollars of revenue in the first fiscal quarter of 2020, which was recorded as the highest in the whole world compared to regions.

-

The iPhone, as always, was the best-selling product by Apple in March 2020 that generated a revenue of 28.96 billion US dollars.

-

According to Forbes, Apple also ranked as the sixth-largest public company globally, and it was the only tech organization that managed to secure its position in the top ten list.

-

Apple shipped about 37 million smartphones globally only in the first quarter of 2020

-

In the second fiscal quarter of 2020, the Services division of the company generated 13.4 billion US dollars of revenue.

What to Expect from Apple in 2024?

Other than iPhones, Apple also expects its other products and services to earn even more revenue in 2023. According to CFO Luca Maestri, the management of Apple expects that all of the other services and products will grow double digits in the fiscal quarter of December. It indicates that the company is sitting on multiple growth drivers that most probably will support it to get to a higher gear in 2023. That’s why Yahoo Finance analysts estimate that Apple will experience about a 15 percent increase in revenue.

| Title | Apple inc. |

|---|---|

| Index | DJIA S&P 500 |

| Stock Ticker | AAPL |

| Price* | $128.98 |

| Market Cap | 2151.3 B |

| Income | 57.41B |

| P/E Ratio | 39.48 |

| Dividend Yield | 0.64% |

| Earnings per share (EPS) | $3.27 |

Why Buy Stocks in Apple: Investing VS Speculation

Speculating is basically a practice of guessing the upcoming stock values and investing without the knowledge to seek abnormally high returns. But in data-roolrip="Traders Union / Interesting articles /How to Buy Stocks Online: Key Rules and Life Hacks How to Buy Stocks Online: Key Rules and Life Hacks"reality, speculating comes with a very high probability of failure. On the other hand, investing is about investing in valued stocks and waiting patiently for a long time to make a profit. This typically keeps risk at average or below-average. Of course, investing can cause loss as well, as it always comes with risks. Apple may collapse completely like many other organizations, but it has tremendous potential, and the probability of growth is higher. If this possibility didn't exist, then the opportunity for investors wouldn't exist as well. That's why it's always important to learn about the history of the company you're interested in to better understand how to buy shares in the stock market.

👍 Pros

The secular growth remains robust

China headwinds are easing

Big services are growing, such as Apple Arcade and Apple TV+

The trajectory of growth looks great

The stock prices of Apple are lower than its competitors

👎 Cons

The antitrust risks regarding App Store loom large

The economic war with China is cyclical, and turbulence is around the corner

Apple’s hardware install base is shrinking as the services grow larger

112.72 billion US dollars of total debt

The stock is still a little costly as compared to historical standards

Fundamental Analysis of Apple Inc (NASDAQ: AAPL) stock

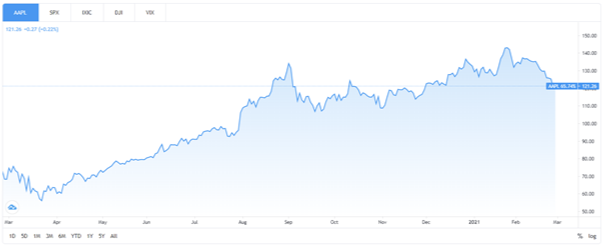

You can also go through quarterly and annual company reports that Apple officially launches. It will provide you with all the important information such as expenses, sources of income, financial results, operations, etc., regarding the company. It’s also wise to learn about the factors such as growth rate, PE (Price to Earnings) ratio, and dividend yield (especially dividend is one of the reasons why you want to buy shares Apple. Here is Apple's current stock chart.

Fundamental Analysis of Apple Inc (NASDAQ: AAPL) stock

Apple Stock News

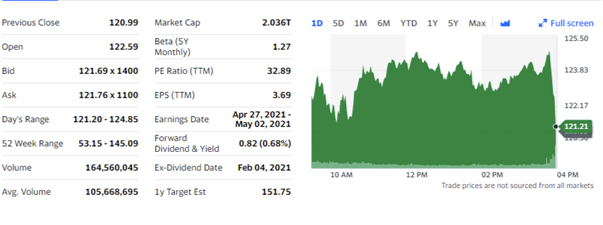

The best way to figure it out is to continuously keep in touch with the Apple stock news. Here is the current summary of apple stock.

Apple Stock News

Currently, iPhone 12 is the best-selling product by Apple, and in 2023 iPhone sure will come up with iPhone 13. Critics and experts suggest that it will be the next big Apple stock growth driver. Other than iPhone, wearables and services have given Apple a boost in Sales. In the December quarter fiscal, the revenue of Apple services grew about 24 percent to 15.8 billion US dollars. The services include Apple Arcade, Apple TV+, Apple Music, Apple Pay, iCloud, AppleCare, App Store, etcetera.

You also have to keep in mind that currently, the company is facing antitrust scrutiny in the USA because of its App Store policies that now require a 30 percent commission fee. However, Apple has reduced this fee for the small developers to 15 percent, but still, the stocks tendered down a little because of this new policy.

Meanwhile, the Accessories, Home, and Wearables by Apple also have experienced a 30 percent increase that makes up about 13 billion US dollars in the December quarter fiscal. It includes Beats headphones, AirPods, Apple Watch, Apple HomePod, etc.

There are also rumors that Apple is currently working on a self-driving electric car project, but this news failed to lift up the AAPL stock.

What does Wall Street think About Apple Stock?

Should You Buy Apple Stock Now?

-

PE Ratio

PE (Price to Earnings) ratio is basically the valuation ratio of the existing share value of the company as compared to the last 12 months' per-share earnings. If the PE ratio is higher than the average (between 13 to 15 on the S&P 500), then you can expect a good profit.

-

Recommendations by Analyst

As mentioned, it’s always better to look for analyst recommendations before buying shares of any company. As far as the analyst recommendations of Apple are concerned, they still have a strong buy rating. But you should always explore the recommendations before making your final decision.

-

Future Plans

Considering the future plans of the company you’re interested in is also an important factor. We have already mentioned that the iPhone generates the biggest part of Apple's revenue, but still, the company is not solely dependent on that.

-

Dependency

It’s not only the iPhone that is one of the biggest dependency factors of Apple. China also plays an important role as it manufactures iPhones as well as other hardware. So much so that only the business of Apple in China makes up about 20 percent of the company's revenue. So, you need to read all the related news about Apple and China, as well as we all know that the political landscape of China and America is not going in the right direction.

-

Don’t Actually Believe Everything You Hear and Read

If you are a serious investor and want to buy apple stocks, then you must not believe every report you read or every news you hear. In fact, you must cross-check it by going to reliable sources to make sure if any news is true or not. Moreover, understand the impact of the rumors and news as well because they can also change the value of stocks.

Should You Buy Apple Stock Now?

Step 1. Choosing a Broker

First, you need to find a suitable online broker that offers all the important features and tools that you need. Consider comparing the features that different brokers offer and then decide which suits your needs the best.

Step 2. Opening a Brokerage Account

Once you have chosen your online broker, the next step is to open your brokerage account. Consider it opening a bank account but over the internet. Some brokers take some days to cross-check your information, and some offer a quick account opening process.

Step 3. Buying Apple stock

Once you have opened your account, the next step is to deposit money to the account and then buy the apple stocks by selecting the number of shares and pressing the buy button. Consider exploring the different order types such as market order and a limit order.

What Are the Risks of Buying Apple Stock?

Here are some of the most significant risks of buying Apple stocks that you must take into account before investing.

-

Too iPhone dependent

-

China Exposure as discussed earlier.

-

The high valuation could be the critical mass

-

The antitrust risks regarding App Store

-

Too much debt

Five Tips for Investing in Apple Stock

Here are five of the most valuable tips for investing in Apple Stock:

-

1

Focus on the long-term perspective.

You should always prefer long-term strategies, which means that you should make fewer transactions and wait patiently to earn larger gains. The long-term investment allows you to at least earn 200 pips per trade.

-

2

Choose a large reputable stockbroker.

It's always important to choose a stockbroker with better repute and reliability. Not only does it help its customers, but you also receive the promised services and a better trading experience.

-

3

Assess your financial capabilities.

You must understand your financial capabilities as well to make sound and informed investing decisions. It allows you to plan and budget ahead of time and avoid becoming over-indebted.

-

4

Diversify your portfolio with other stocks.

Diversification of portfolio means that you must not put all of your eggs in one basket. It reduces the risk factors as your investments are allocated across multiple financial industries, instruments, and many other categories.

-

5

Consider investment alternatives.

Alternative investments mean the options to change your volatility exposure and to earn more returns beyond holding bonds and stocks. It can be a compelling choice to have a diversified portfolio.

Summary

FAQ

Can you buy Apple stock directly?

No, you cannot buy apple stocks directly from Apple. But you can use any online brokerage to invest in Apple stocks.

Does Apple pay a dividend?

Yes, Apple pays dividends as in 2020, the amount per dividend that the company paid to its shareholders was 2.62 US dollars.

What was the recent Apple stock split?

The most recent split took place on August 31st, 2020 that brought the apple stock price from 499.23 dollars (at August 20th, 2020 closing) to only 127.58 US dollars (at August 31st, 2020 opening).

Apple News free on iPhone?

You can access the Apple News application through iPhone, but you need to buy a monthly subscription to access the content on the News+ app.

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses who want to improve their Google search rankings to compete with their competition.

Over the past four years, Alamin has been working independently and through online employment platforms such as Upwork and Fiverr, and also contributing to some reputable blogs. His goal is to balance informative content and provide an entertaining read to his readers.

His motto is: I can dream or I can do—I choose action.

Bruce Powers is an expert trader and technical analyst with over 20 years of experience in Forex, commodities, ETFs, cryptocurrencies and other assets. He is an active trader, technical and fundamental analyst, media commentator, educator and a writer. As an author for Traders Union, he contributes his deep analytical skills, expertise and understanding of the global economy and financial markets to provide market analysis and insights. Powers is also a frequent guest on business TV news shows.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.