deposit:

- $1

Trading platform:

- SogoOnline

- SogoTrader

- SogoOptions

- SogoElite

- SogoMobile

- SogoApp

- FINRA

- SIPC

SogoTrade Review 2024

deposit:

- $1

Trading platform:

- SogoOnline

- SogoTrader

- SogoOptions

- SogoElite

- SogoMobile

- SogoApp

- Floating

- Low contract fees

Summary of SogoTrade Trading Company

SogoTrade is a moderate-risk broker with the TU Overall Score of 6.43 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by SogoTrade clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. SogoTrade ranks 24 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

The SogoTrade broker aims to cooperate with experienced traders and investors who are willing to pay higher trading commissions than competitors.

SogoTrade is a US registered broker that has been operating since 1986. It offers a wide range of stock market assets, proprietary trading platforms with built-in analytics, and forecasting tools. The broker is a member of FINRA (CRD#: 17912/SEC#: 8-35930) and SIPC, and has offices in New York and Chesterfield (Missouri). The company's regional service center also serves customers from China, Taiwan, and Hong Kong. In 2020, the financial portal GOBankingRates named SogoTrade as the best online broker for day trading and for novice traders.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | From $1 (Cash Account) From USD 2,000 (Margin Account) |

| ⚖️ Leverage: | Floating |

| 💱 Spread: | No |

| 🔧 Instruments: | Stocks, ETFs, Options, Mutual Funds, Fixed Income, Cryptocurrency (via Apex Crypto), Power Portfolios |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with SogoTrade:

- FINRA and SIPC membership.

- A variety of investment products for generating passive income, including diversified portfolios of securities with different levels of risk and reward.

- The minimum deposit for the Cash Account starts at $0.

- A wide range of analytical tools such as stocks and options, screeners, P&L calculators, daily newsletters, third-party analyst ratings, reviews, and more.

- The existence of a proprietary platform for online options trading.

👎 Disadvantages of SogoTrade:

- The broker withholds $2.88 for market trades in stocks, as well as a commission for each contract when trading options.

- There are no cash bonuses for opening an account or making a deposit.

- The minimum investment for working with investment portfolios is $25,000.

Evaluation of the most influential parameters of SogoTrade

Geographic Distribution of SogoTrade Traders

Popularity in

Video Review of SogoTrade i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of SogoTrade

The SogoTrade broker has been providing investment services for over 35 years and is considered a reliable company thanks to its membership in FINRA and SIPC. A wide range of products is available to customers. Here you can not only trade securities but also invest funds and open savings accounts for retirement and education.

SogoTrade offers traders a range of proprietary developments. For example, the broker has a specialized proprietary platform for trading options with fast execution, streaming quotes, unique analytical tools, and the ability to manage risks. Also, terminal users have access to SogoPlay, a service for forecasting and evaluating stock market assets.

An analysis of SogoTrade client reviews showed that traders are not satisfied with the size of trading commissions, as well as the impossibility of simultaneously using all the research tools offered by the company in any of the platforms. To conduct a complete asset analysis, users have to constantly switch from one terminal to another. At the same time, customers note the high-quality work of technical support and that there are no delays during the withdrawal of funds.

Dynamics of SogoTrade’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

SogoTrade offers clients a wide range of investment products and solutions. Here you can open trust accounts, invest in asset portfolios or order the development of a financial investment plan from the experts of SogoTrade Asset Management.

Power Portfolios: Investment Asset Management Solution from SogoTrade

For clients looking to invest, SogoTrade offers diversified portfolios with varying levels of risk, income, and asset percentage. The minimum investment is $25,000 to take advantage of SogoTrade Power Portfolios:

-

High Growth and Aggressive Growth are portfolios with an aggressive focus on the highest growth stocks. It’s ideal for investors over twenty years of age who do not feel uncomfortable with significant market fluctuations.

-

Moderate Growth is a portfolio mostly made up of stocks. Brings moderate annual dividend income and is not prone to market ups and downs. It’s designed for investors over 30 years old.

-

Balanced Growth. Balanced and Balanced Income are equities and bonds-balanced portfolios for those looking for low, but stable income and do not want to depend on market fluctuations. The broker has been recommending such solutions to clients aged 40 to 60.

-

Moderate Income is a bond-focused product that can generate moderate, stable dividend income. It’s suitable for clients over the age of 60 years.

-

Diversified Income and High Income are aggressive bond-focused portfolios that will experience slight ups and downs as the market moves. It’s recommended for investors over 60-70 years old and for those who need high income as soon as possible.

Expenses on underlying ETF assets range from 0.10% to 0.14% depending on the portfolio chosen. In addition to the commission for the underlying ETF assets, the investor pays extra for portfolio management consulting services. The financial advisor reports the exact amount of the fee during the discussion of the strategy over the phone.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

SogoTrade’s affiliate program

-

Refer a friend. A trader who connects a new client receives 25 free trades with stocks or options which is compensation for the basic commission fee. To accrue an affiliate reward, a referral must open an account, make a deposit of $500 or more and make at least one trade with stocks or options.

A partner can trade commission-free for 90 days after the grant of benefits. Referral rewards only apply to promotions that are worth $1 or more. The company does not set limits on the number of friends referred by the partner.

Trading Conditions for SogoTrade Users

The SogoTrade broker offers cash, margin, and investment accounts. The broker has not established the minimum deposit on cash accounts. However, when purchasing an asset at a price below $1 per share, the initial investment amount cannot be less than $100. Investing in prefabricated portfolios of securities is possible if the account balance is at least $25,000. The amount of available margin depends on the account balance. Minimum margin requirements for deposits from $2,000.

$1

Minimum

deposit

1:1

Leverage

13/5

Support

| 💻 Trading platform: | SogoOnline, SogoTrader, SogoOptions, SogoElite, SogoMobile, SogoApp |

|---|---|

| 📊 Accounts: | Margin Account, Cash Account, Individual Account, Joint Account, Business Account, IRA (Traditional IRA, Roth IRA, SEP IRA), Coverdell Education, UTMA/UGMA, and Trust Account |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Wire Transfer, Checks, ACH, Funds or Assets from Another Brokerage (ACAT) |

| 🚀 Minimum deposit: | From $1 (Cash Account) From USD 2,000 (Margin Account) |

| ⚖️ Leverage: | Floating |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 Spread: | No |

| 🔧 Instruments: | Stocks, ETFs, Options, Mutual Funds, Fixed Income, Cryptocurrency (via Apex Crypto), Power Portfolios |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Low contract fees |

| 🎁 Contests and bonuses: | Yes |

SogoTrade Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Cash Account | From $25 | Yes |

| Margin Account | From $25 | Yes |

Account verification will cost $10. There is no commission for maintenance and account closure. Also, the Traders Union specialists compared the average commissions of SogoTrade and other stock brokers. In the table below you will find a comparison of companies by this indicator.

| Broker | Average commission | Level |

| SogoTrade | $25 | High |

| Charles Schwab | $11 | Medium |

| Ally Bank | $4 | Low |

Detailed Review of SogoTrade

The SogoTrade broker offers clients a wide range of trading assets and investment products, as well as proprietary online trading platforms with powerful market research tools. The company operates in compliance with the requirements of the FINRA regulator, uses advanced data transmission technologies to ensure the fastest possible execution of trades, and provides qualified support to its clients.

About SogoTrade broker in figures:

-

Has been working in the securities market for over 35 years.

-

Has its own insurance policy in the amount of USD 150 million.

-

Offers 6 proprietary trading platforms.

SogoTrade is an American broker for trading, investing, and accumulating funds

SogoTrade is a platform through which traders around the world can trade stocks and options, invest in ETFs, mutual funds, and fixed income instruments. A client who opens an account with this broker can trade on his own or receive passive profit by involving the company's financial experts. SogoTrade offers a wide range of savings accounts, so US citizens have the opportunity to combine investment and trading activities with financial planning.

The SogoTrade broker offers a wide range of proprietary trading platforms, including for mobile devices such as SogoMobile, SogoApp. Each terminal has its characteristics and is fully customizable according to the needs of individual investors and traders. So, SogoOnline is a simple and powerful web-based platform for trading stocks, exchange-traded funds (ETFs), and options. SogoOptions is for trades with options. SogoElite and SogoTrader are universal terminals with streaming quotes, interactive charts, with fast and quality execution.

Useful services of SogoTrade investment:

-

Morning Call. Daily research on eight stocks and ETFs, which the company sends by email before the market opens. Time-tested indicators, dozens of charts, and mathematical approaches are used to obtain up-to-date data appropriate for different investing styles.

-

SogoPlay. A service that provides professional analytics and a list of effective strategies. Traders also get access to trading ideas for various classes of securities with risk and reward assessments, and tools to quickly find the most promising assets.

-

ValuEngine. Proprietary forecasting model for stocks, including ADR, which uses advanced quantitative methods, technical analysis tools, and historical data.

-

Research Center. A resource designed for a detailed analysis of the financial performance of global companies whose shares are quoted on the stock market. It also contains the latest news, screeners, and leaderboards for asset growth.

Advantages:

Broker accounts can be opened by non-US traders. The company currently serves clients from 149 countries.

A wide range of trading instruments is available - more than 2,000 types (including penny stocks), 3,400 commission-free mutual funds.

Clients can place different types of orders - market, limit, stop limit, trailing stops, trailing stop limit.

For shares under $1, the minimum investment is $100.

The SogoTrader platform supports the Extended Hours Trading option.

The user's personal account is reliably protected from unauthorized entry by third parties. To enter the system, you must enter a unique phrase, mark the image selected during registration and enter a 4-6-digit PIN using the encrypted on-screen keyboard.

The company does not charge fees for opening, maintaining or closing accounts, nor for providing terminals.

How to Start Making Profits — Guide for Traders

SogoTrade offers accounts for trading and investing, as well as a line of savings accounts. Clients can open individual, joint, and business accounts.

Account types:

The SogoTrade brokerage company does not provide demo accounts through any of the trading platforms.

SogoTrade cooperates with both private traders and investors, as well as with companies and financial corporations. The broker offers a wide range of trading, investment and savings accounts that meet the needs of clients with a wide variety of strategies.

Bonuses Paid by the Broker

Rebate

Clients who trade in the assets of the GERM ETFMG fund receive a discount of $3 for every 1,000 shares, subject to purchase on an open order (non-market limit order).

Investment Education Online

Training materials on investing in the stock market are available in the Education Center section. All information provided is intended for novice traders who do not even have basic knowledge of the securities market.

The information is written in simple language and divided into blocks for quick and convenient search.

Security (Protection for Investors)

The broker is registered under the trademark SogoTrade, Inc. Its activities are regulated by the Financial Industry Regulatory Authority (FINRA). SogoTrade is also a member of the Securities Investor Protection Corporation (SIPC), which has a compensation fund.

SIPC pays each client with securities accounts up to $500,000 (including $250,000 in case of cash claims) in the event of the broker's financial insolvency. Also, its own clearing company SogoTrade, Inc., acquired an additional insurance policy to protect the assets and funds of traders for a total amount of up to USD 150 million.

👍 Advantages

- The company has its own insurance policy

- Any trader who opens an account can file a complaint with FINRA

- Clients are protected from SIPC

👎 Disadvantages

- SIPC does not protect against loss of market value of securities

- You cannot open an account without identity verification

- Payments via cards and e-wallets are not supported

Withdrawal Options and Fees

-

Withdrawal requests sent before 2:00 pm CST will be processed on the same business day. Those that are sent later will arrive on the next business day. Only verified clients can apply for a withdrawal.

-

The broker withdraws funds by check, mail, bank transfer, or payment via ACH.

-

There are no fees for transfers via ACH. For outgoing bank transfers within the United States, the broker withholds a commission of $25. Outgoing international transfers cost $50. The cost of mailing a check on weekdays is $5, and on weekends the commission is $25. The overnight fee is $50.

-

If a customer has made a deposit via ACH within the last 60 days, he can withdraw funds in the same way (requests for a check or bank transfer are not accepted).

-

If, when withdrawing funds, the client specifies a different bank account (and not the one from which the deposit was made), the broker can set a 60-day limit on payment processing.

Customer Support Service

Support Hours: Monday through Friday, 7:00 am to 8:00 pm (ET).

👍 Advantages

- Wide range of communication methods

- Unregistered users can contact technical support specialists

👎 Disadvantages

- No 24/7 online chat

- There are only 2 support languages available: English and Chinese

Available communication channels with customer service staff:

-

online chat;

-

telephones;

-

email

-

fax;

-

regular mail;

-

messengers using Facebook, Twitter;

-

Skype;

-

feedback form.

Online chat is available on the website and in the user's personal account.

Contacts

| Foundation date | 1998 |

| Registration address | 1 McBride and Son Center Dr. Suite 288 Chesterfield, MO 63005 |

| Regulation |

FINRA, SIPC |

| Official site | sogotrade.com |

| Contacts |

Email:

services@sogotrade.com,

|

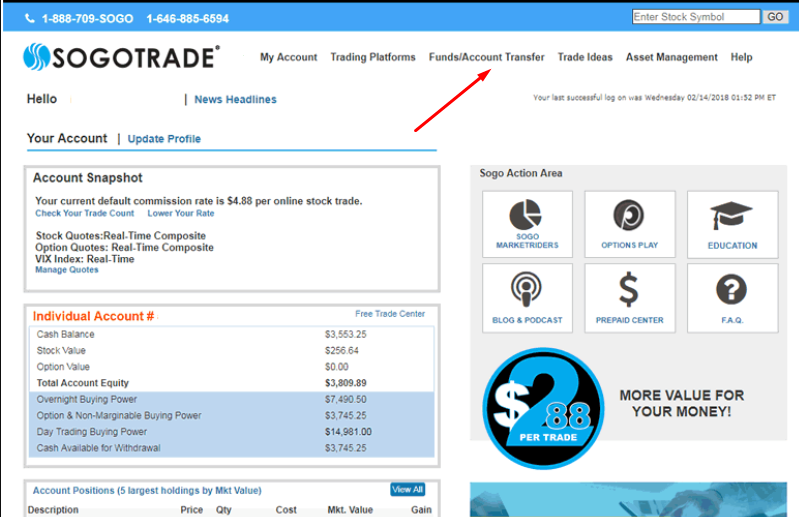

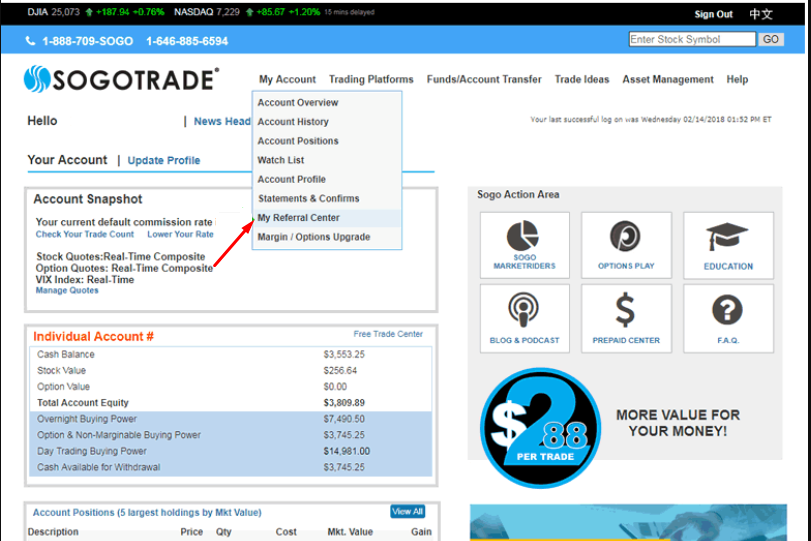

Review of the Personal Cabinet of SogoTrade

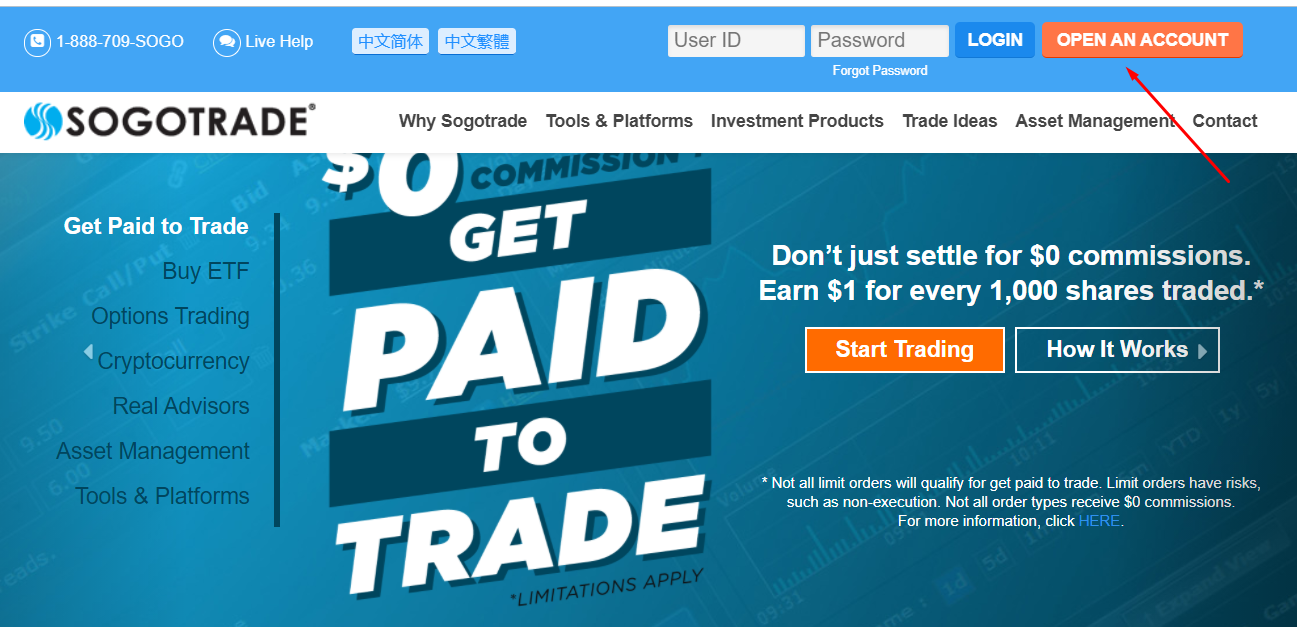

A quick guide to getting started with SogoTrade follows:

First, you need to register. To do this, go to the broker's website, open its main page, and then click the Open Account button.

After that, fill out the form for opening an account. Select Individual, enter your first name, last name, phone number, and email. Create a password, a security question and answer, a personal phrase, and a 4-6-digit PIN. Then select an image from those suggested by the system. To open an account, a US citizen, permanent resident (green card holder) or E, F, H, L, TN and O visa holder must provide a valid Social Security Number (SSN) and an Individual Taxpayer Identification Number (ITIN). Residents of other countries and holders of A, B, F, G, J, O, P, or R visas will need a copy of a valid photo ID and proof of address for the last three months (e.g., utility bills). To enter your personal account, enter your PIN, image and personal phrase (this will need to be done with each authorization).

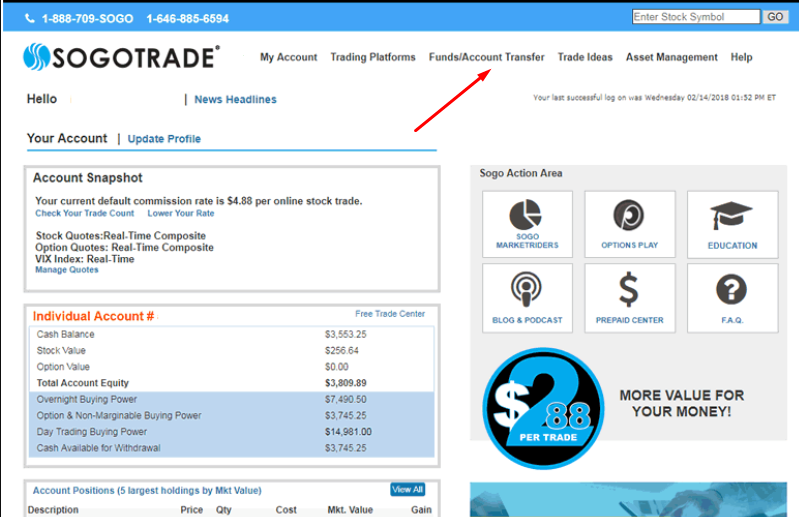

The following functions are available in the SogoTrade personal account:

1. Account replenishment and transfer of funds between accounts:

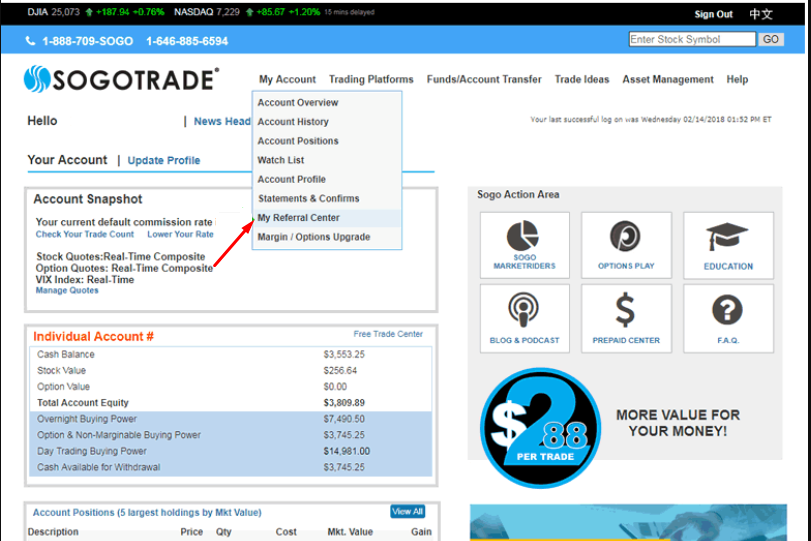

2. Formation of statistics on the Refer a Friend affiliate program:

1. Account replenishment and transfer of funds between accounts:

2. Formation of statistics on the Refer a Friend affiliate program:

Also in the personal account, there are the following sections:

-

Trading platforms. Here you can download desktop terminals or go to the web version for trading through a browser.

-

Trade ideas. A section with research, forecasts, and ratings from the company's experts and third-party specialists Barchart Market Data Solutions, Morningstar, and Zacks Investment Research.

-

Asset Management. Connect to accounts managed by SogoTrade financial advisors and receive reports on the performance of your chosen investment strategy.

-

Help. Allows you to quickly contact technical support specialists.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the SogoTrade rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about SogoTrade you need to go to the broker's profile.

How to leave a review about SogoTrade on the Traders Union website?

To leave a review about SogoTrade, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about SogoTrade on a non-Traders Union client?

Anyone can leave feedback about SogoTrade on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.