Is Day Trading Haram Or Halal?

Top commission-free stock broker - eToro

Intraday trading's permissibility in Islam varies. Some scholars argue it aligns with Shariah principles, while others caution against its speculative nature. Adhering to ethical guidelines and consulting knowledgeable scholars is crucial for Muslims considering intraday trading.

In this article, TU experts will delve into the intricacies of intraday trading within the context of Islamic finance principles. They will explore varying viewpoints on the permissibility of day trading, emphasizing the importance of adhering to Shariah guidelines. Key topics of discussion include the concept of genuine ownership, avoidance of interest-based transactions, and the ethical considerations surrounding speculative behavior. Additionally, experts will highlight alternative investment options that align with Islamic principles, providing readers with insights into halal investment opportunities in the financial market.

-

Is intraday trading haram in Islam?

The permissibility of intraday trading in Islam varies among scholars due to differing interpretations of Shariah principles.

-

Is intraday trading gambling?

Some scholars consider intraday trading akin to gambling due to its speculative nature, while others view it differently.

-

Are day traders rich?

Success in day trading varies; while some traders achieve wealth, others may incur losses due to the inherent risks involved.According to statistics, more than half of beginners lose money in their first year of trading.

-

What is Day Trading?

Day trading involves buying and selling financial assets within the same trading day to profit from short-term price movements, requiring quick decision-making and market analysis skills.

Is it legal in islam to do Intraday trading?

In Islam, the practice of intraday trading, where you buy and sell stocks within the same day, can be deemed permissible under certain conditions. It's important to understand that Islamic finance principles focus on ownership. When you buy a stock, you become its rightful owner, and selling it later the same day is acceptable because you possess ownership.

However, there are aspects to be cautious about. Short selling, where you sell a stock you don't own, is generally not allowed as it goes against the principle of ownership. Additionally, it's essential to avoid using margin accounts that accumulate interest, as interest (riba) is prohibited in Islam.

While some scholars debate the temporary ownership gap that occurs during trade settlement, the majority view ownership as transferring upon transaction completion.

Best brokers for intraday trading

What Islamic authorities says about Intraday trading?

In the Islamic community, there are differing opinions on whether intraday trading, also known as day trading, is permissible under Shariah law.

Spreads, swaps and exchange commissions have been given an official religious and legal interpretation by the Islamic Consulate on Fiqh of the Muslim World League, which conducted a study on the issue of margin trading (18th Meeting, Makkah, 10-14/3/1427 AH, or 8.04-12.04.2006).

Islam defines riba as both the process and the result of charging interest on any kind of capital, "...for what you give in growth, so that it may increase in the wealth of people, is not increased in the eyes of Allah" (Surah "Romans", ayat 39).

In modern interpretation it is customary to distinguish:

-

Riba al-Nasi'ah - income on deferred payment;

-

Riba Fadl - markup on goods.

A hard riba is considered a swap, since this amount acts as an addition to the loan, but even trading accounts where the broker has waived this fee do not exclude margin trading arrangements that are contrary to Shari'ah.

The two facts are variants of Riba al-Nasi'ah:

-

Agency (pooling of loan and reimbursement) i.e. leverage and spread, which is interpreted as a fee for that loan.

-

The absence of the fact of explicitly receiving the result of the deal (commodity, currency, gold, securities).

Various scholars and authorities have shared their thoughts on this matter, drawing from different interpretations of Islamic principles. Let's take a closer look at these perspectives:

Different Views

Islamic scholars hold differing opinions regarding whether intraday trading is halal (permissible) or haram (forbidden). Some argue that it's acceptable under certain conditions, while others believe it resembles gambling and speculative behavior, making it impermissible.

Examples of Opinions

-

Intraday Short Selling — One contentious aspect is short selling, where traders sell stocks they don't own, expecting prices to fall. Many scholars consider this practice impermissible because it involves selling assets one doesn't possess.

-

Conditions for Trading — The permissibility of intraday trading is debated based on conditions outlined in Islamic finance principles. These include the nature of the company's business, avoiding interest-based transactions, and following ethical guidelines.

-

Trade Settlement and Ownership — Some scholars argue that even though trade settlement may take a few days, the buyer assumes ownership and risk immediately upon the transaction. Others see this temporary ownership gap as problematic from a Shariah perspective.

By considering different perspectives and consulting reputable sources, individuals can make informed decisions about intraday trading within Islamic teachings.

How to keep day trading halal?

Here are seven tips for beginners to ensure their day trading activities align with Islamic principles:

-

Begin with a Sincere Intention — Start your trading journey with the intention of earning a lawful livelihood and providing for your family. Avoid being driven by greed and prioritize honest efforts, seeking blessings from Allah.

-

Educate Yourself — Take the time to learn about Islamic finance and the rules governing halal trading. Understand concepts such as ownership, interest (riba), and speculative behavior from reliable sources and scholars.

-

Invest in Shariah-Compliant Stocks — Choose to invest in companies whose core activities align with Shariah principles. Avoid stocks of businesses involved in haram activities like alcohol, gambling, or interest-based finance. Utilize screening tools to identify halal stocks.

-

Steer Clear of Short Selling and Margin Trading — Refrain from engaging in short selling, which involves selling stocks you don't own, as it contradicts Islamic principles. Likewise, avoid margin trading, which often incurs interest charges, by sticking to cash-based transactions.

-

Hold Stocks with Genuine Ownership — Purchase shares with the genuine intention of ownership, avoiding speculative behavior where you rapidly buy and sell stocks without actual ownership. Consider holding onto stocks for a reasonable period, even if you're day trading.

-

Cultivate a Mindset Free from Gambling Mentality — Guard against treating day trading like gambling by setting clear goals, risk limits, and stop-loss orders. Approach the stock market as a platform for legitimate investment, rather than a place for risky speculation driven by greed.

-

Practice Charity (Sadaqah) — Dedicate a portion of your profits to charity (sadaqah) to purify your wealth and seek blessings in your earnings. Be mindful of those less fortunate and share your success with them.

Alternative investment options for muslims

Experts have highlighted below some alternative investment options for Muslims that adhere to Islamic principles

Halal Stocks (Equities)

-

Consider investing in shares of companies that operate ethically and in line with Islamic guidelines.

-

Focus on businesses involved in permissible activities like technology, healthcare, and real estate.

-

Use screening tools to identify Shariah-compliant stocks and avoid those engaged in haram activities such as alcohol and gambling.

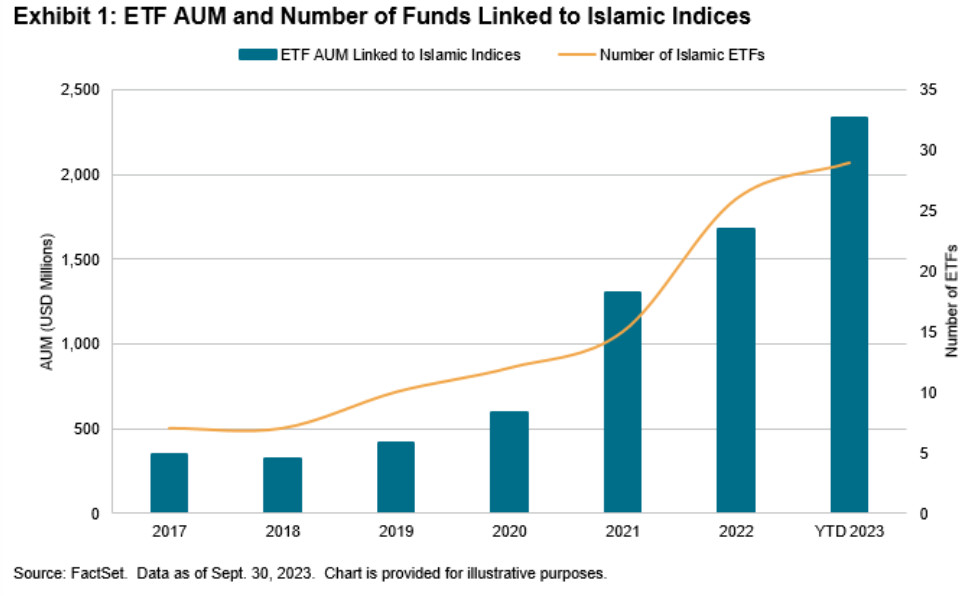

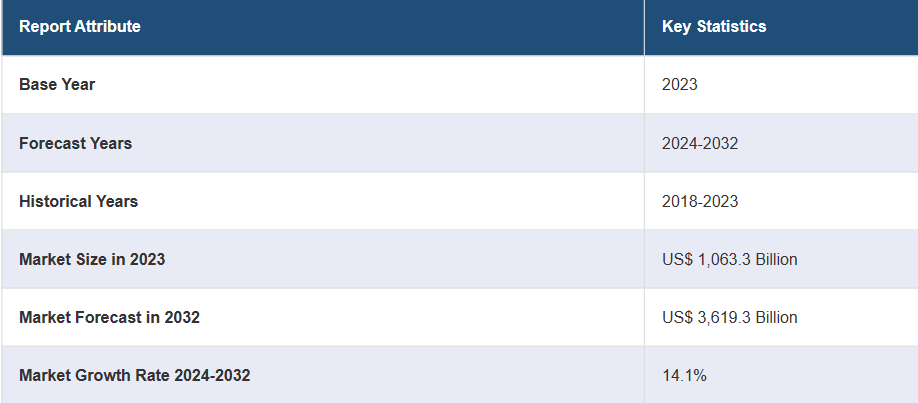

Islamic Mutual Funds and ETFs

-

Explore mutual funds and ETFs that follow Islamic principles and invest in halal assets.

-

These funds are managed by professionals who ensure investments comply with Shariah guidelines while aiming for competitive returns.

Some of the top ETFs you can invest that adheres to Shariah Law are

| ETF Name | Last 5-Year Return | Year-to-Date (YTD) Return | Expense Ratio |

|---|---|---|---|

Wahed FTSE USA Sharia ETF (HLAL) |

12.50% |

5.20% |

0.50% |

S&P 500 Sharia Industry Exclusions ETF (SPUS) |

9.80% |

3.70% |

0.35% |

SP Funds S&P Global REIT Sharia ETF (SPRE) |

8.20% |

4.10% |

0.45% |

Wahed Dow Jones Islamic World ETF (UMMA) |

11.30% |

6.00% |

0.55% |

ETFB Green SRI REITs ETF (RITA) |

10.00% |

4.80% |

0.40% |

SP Funds Dow Jones Global Sukuk ETF (SPSK) |

6.50% |

2.30% |

0.30% |

Sukuk (Islamic Bonds)

-

Sukuk are interest-free bonds issued by governments or corporations, providing returns based on underlying assets like real estate and infrastructure.

-

They offer fixed income and adhere to Islamic principles by avoiding interest-based transactions.

Real Estate Investment

-

Invest in real estate properties that generate rental income and align with Islamic values.

-

Avoid properties associated with haram activities like bars and casinos, focusing instead on ethical investments that offer steady returns and potential appreciation.

Precious Metals (Gold and Silver)

-

Consider investing in gold and silver, which are deemed halal investments.

-

These metals act as a hedge against inflation and currency fluctuations, offering stability to your investment portfolio.

Cryptocurrencies (with Caution)

-

Some cryptocurrencies may be permissible according to certain scholars.

-

Conduct thorough research and seek guidance before investing, as the speculative nature of cryptocurrencies requires caution.

| Cryptocurrency | Description |

|---|---|

Well-known and widely accepted cryptocurrency, considered halal. |

|

Platform for smart contracts, analyzed for Sharia compliance. |

|

Facilitates low-cost international transfers, recognized as halal. |

|

Peer-to-peer currency, certified halal and similar to Bitcoin. |

|

Provides affordable financial services globally, compliant with Sharia. |

|

Privacy-focused crypto with enhanced security, adheres to Sharia. |

|

DigiByte (DGB) |

Fast and secure, favored by Muslim investors due to halal certification. |

Supports decentralized apps, aligned with Islamic principles. |

Islamic Crowdfunding Platforms

-

Participate in crowdfunding campaigns that fund ethical projects and businesses in line with Islamic principles.

-

These platforms support initiatives in areas like social impact, education, and healthcare, offering opportunities for socially responsible investing.

Proprietary Trading on Swap-Free Accounts

-

Explore proprietary trading opportunities on swap-free accounts, which enable trading without interest charges.

-

Prop trading allows active trading within Shariah-compliant parameters, aligning with Islamic finance principles.

-

With prop trading, traders can participate in the financial markets while adhering to Islamic guidelines regarding interest (riba) and speculative behavior.

Summary

In conclusion, the debate surrounding intraday trading in Islam underscores the importance of adhering to Shariah principles and seeking guidance from knowledgeable scholars. While opinions vary, it's crucial for individuals engaging in day trading to ensure ownership of stocks, avoid interest-based transactions, and prioritize ethical conduct. Beginners should approach trading with sincerity, educate themselves on Islamic finance, and focus on Shariah-compliant investment options. Alternative investments like halal stocks, Islamic mutual funds, Sukuk, real estate, and precious metals provide avenues for lawful earnings while avoiding haram activities. By embracing these principles and exploring alternative investment opportunities, Muslims can navigate the financial markets in accordance with their faith.

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.