deposit:

- $1

Trading platform:

- Proprietary platform SoFi

- FINRA

- SIPC

- FinCEN

SoFi Invest Review 2024

deposit:

- $1

Trading platform:

- Proprietary platform SoFi

- floating

- Pattern Day Trader should maintain an account balance from $25,000

Summary of SoFi Invest Trading Company

SoFi Invest is a reliable broker with the TU Overall Score of 7.27 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by SoFi Invest clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews showed that the broker’s clients are mostly satisfied with the company. SoFi Invest ranks 10 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

SoFi Invest is a broker providing a service to the stock market. The company's financial regulators are SIPC and FINRA. Available trading instruments in SoFi Invest: managed portfolios, stocks, and ETFs. The company is more suitable for traders who prefer long-term trading strategies. SoFi Invest cooperates with clients from the USA. SoFi Invest is ideal for novice investors and those with other accounts with Social Finance, Inc. (SoFi).

SoFi (Social Finance, Inc.) is an investment company founded in 2011 by graduates of Stanford Business School to provide federal and private student loans. The SoFi Invest division appeared in 2019 to provide brokerage services to active traders and passive investors from the United States. Currently, the broker is a member of FINRA (CRD#: 151717/SEC#: 8-68389) and SIPC and serves over 1,800,000 clients. SoFi Invest offers to invest in stocks (including fractional ones), cryptocurrencies, ETFs, and IPO.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | from 1 USD |

| ⚖️ Leverage: | floating |

| 💱 Spread: | absent |

| 🔧 Instruments: | Stocks (including fractional ones), ETFs, cryptocurrencies, IPOs |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with SoFi Invest:

- Membership with FINRA and SIPC. These organizations monitor the broker’s compliance with the rules specified in the Client Agreement.

- Clients can combine transactions with stock market instruments with lending, insurance, and financial planning.

- Providing clients with two types of investment: active trading with securities and a passive option with asset management by an automated advisor.

- No commissions for trading stocks and ETFs, or asset portfolio management.

- Possibility to invest in fractional shares of companies.

👎 Disadvantages of SoFi Invest:

- Only US residents can open an account with this broker.

- To invest in an IPO, you need to have more than $3000 on your account.

- Day traders can trade if they have an amount of $25,000 or more on their account.

Evaluation of the most influential parameters of SoFi Invest

Table of Contents

Geographic Distribution of SoFi Invest Traders

Popularity in

Video Review of SoFi Invest i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of SoFi Invest

The SoFi Invest stockbroker does not require a minimum amount to open an account, so it is good for beginner investors looking for an easy way to make money in the financial markets. Also, investing with SoFi Invest is a great option for those who already have active accounts with SoFi, because the client can easily transfer money between SoFi Money and SoFi Invest accounts.

SoFi Invest may not be suitable for more advanced investors, as the broker does not offer stop-loss and sell-at-loss securities to offset capital gains tax liabilities. At the same time, the company offers active and automated investing, free access to certified financial planners, and the opportunity to invest in fractional shares of companies.

SoFi Invest is a reliable company that is a member of FINRA and SIPC. It has also applied for registration with the Securities and Exchange Commission (SEC). A special thing of SoFi Invest is that currently, only US citizens can open accounts with the company.

Dynamics of SoFi Invest’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

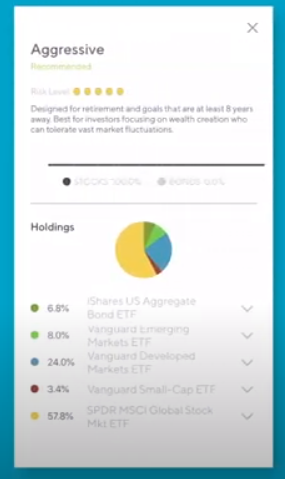

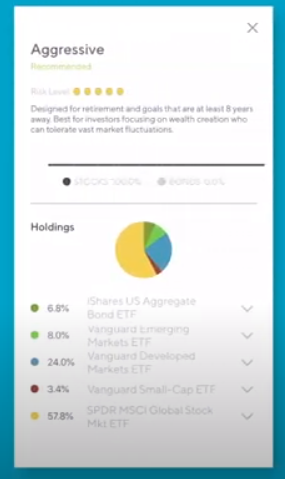

SoFi Invest offers asset management services called “Automated Investing”. Investors are connected to the service for free, but they pay basic commissions and expenses for ETF funds.

Automated Investing via robo-consultants without human intervention

A client who wants to invest in stock market instruments informs SoFi Invest of his investment goals and based on that the broker constructs a diversified portfolio. It consists of a wide range of risk mitigation assets. The investor does not need to monitor the market: Automated Investing uses computer algorithms to provide financial advice and manage portfolios.

The main principles of automated investing from SoFi Invest are:

-

The broker does not charge any fees for consulting services or asset portfolio management.

-

Portfolios are automatically rebalanced quarterly and during market fluctuations. The adjustment of securities is performed by a robotic program.

-

There is no minimum amount to start investing. You can invest from 1 USD.

Connecting to the automated investment platform makes it possible to invest money without transferring it to active management. Moreover, such a decision is a way to avoid the occurrence of possible human errors when making an investment decision.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

SoFi Invest affiliate program

-

Referral program — a partner can receive up to $10,000 per year. The amount of remuneration depends on the recommended service and the number of connected referrals.

A partner can generate referral links with recommendations for personal and student loans, investment products, obtaining a credit card, and opening cash accounts. This offer is not available to customers in Ohio, Michigan, or Vermont.

Trading Conditions for SoFi Invest Users

SoFi Invest offers a convenient application for trading and investing in stocks, cryptocurrencies, ETFs, and IPOs. No commission is charged for trades in stocks and ETFs. Also, with zero commissions, the investor can purchase fractional shares of Stock Bits. SoFi Invest does not have a minimum deposit, however, Pattern Day Traders should have at least $25,000 on their account. Otherwise, the account may be limited under FINRA’s daily trading margin requirements. Pattern Day Trader consists of traders who trade securities four or more times within five business days, and the number of daily transactions is more than 6% of the total trading activity for the same period. The minimum order size for the purchase of cryptocurrency is $10, and the maximum is $50,000 per client per day.

$1

Minimum

deposit

1:1

Leverage

5/8

Support

| 💻 Trading platform: | Proprietary platform SoFi (Web and Mobile) |

|---|---|

| 📊 Accounts: | Robo Accounts Active, Self-Directed Account (Margin и Cash), Retirement Accounts (Traditional IRA, Roth IRA, SEP IRA, Traditional Rollover IRA) |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Wire transfer, payments through the automated clearing house ACH, transfer of assets from another brokerage company (ACAT), checks |

| 🚀 Minimum deposit: | from 1 USD |

| ⚖️ Leverage: | floating |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 Spread: | absent |

| 🔧 Instruments: | Stocks (including fractional ones), ETFs, cryptocurrencies, IPOs |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | no data |

| 📱 Mobile trading: | available |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Pattern Day Trader should maintain an account balance from $25,000 |

| 🎁 Contests and bonuses: | available |

SoFi Invest Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Self-Directed Account (Margin и Cash) | from $5 | Available when withdrawing with a wire transfer |

| Robo Accounts Active | from $5 | Available when withdrawing with a wire transfer |

There is no commission for managing portfolios of assets through Automated Investing; and there are no opening and account maintenance fees. Traders Union compared the trading fees charged by US stock brokers for trading stocks. For better clarity, all the data obtained during the analysis are presented in the form of a table.

| Broker | Average commission | Level |

| SoFi Invest | $5 | Medium |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Low |

Detailed Review of SoFi Invest

SoFi Invest is a subsidiary of the financial holding Social Finance, Inc., specializing in investment and brokerage activities in the stock market. It provides services to US citizens who trade securities or prefer long-term passive strategies. The company offers zero commissions on a range of instruments (stocks, ETFs, and managed portfolios) and guarantees the protection of client’s funds through SIPC and FINRA memberships.

SoFi Invest achievements in numbers:

-

The broker serves more than 1,800,000 clients.

-

As of March 2021, the company manages about $338.7 million.

-

More than $10 million of referral bonuses were paid to the partners.

SoFi Invest is the company for trade, investment, and financial planning

SoFi Invest is an investment product that offers two types of accounts. The first of these is an active trading account that allows traders to buy securities and cryptocurrencies. The second type of account is an investment account controlled by a robot advisor, which offers users portfolios that are pre-created taking into account the level of risk and available capital. Clients of SoFi Invest have access to planning and wise investing guides, various types of calculators, and daily newsletters.

The broker does not use terminals of third-party software developers but offers a proprietary platform adapted to the various needs of its users. The terminal is presented in two iterations - web and mobile. A desktop version is not available. Through a single application, the company’s clients can manage cash, savings, and investment accounts, as well as arrange loans, credits, and mortgage loans.

SoFi Invest’s useful services:

-

SoFi Daily Pod. Daily podcasts of stock market news and events to listen to on the SoFi app or on Apple, Spotify, and Amazon.

-

Investing 101 Center. A section with information about investing, which will be useful to both beginners and experts.

-

Calculators. The broker’s website has special tools for calculating investments, the number of debt payments on loans, and mortgage payments.

Advantages:

The minimum deposit to start trading and making passive investments starts from $1.

There are zero commissions for trading stocks and ETFs and automated asset portfolio management.

There is a referral program and a SoFi Member Rewards loyalty program. The company also periodically offers bonuses for the first account deposit.

Clients get free access to certified financial planners.

Cryptocurrency trading is available 24/7.

All trading and financial operations are performed by clients via an application - a proprietary terminal developed by Social Finance, Inc.

How to Start Making Profits — Guide for Traders

The broker SoFi Invest offers traders accounts for active trading and passive automated investing. Each client can have one individual taxable Active Invest brokerage account and several Active Invest IRAs. There is no limit on the number of available Automated Invest accounts.

Account type:

Currently, SoFi Invest does not provide demo accounts to its clients.

The broker offers accounts adapted to different strategies like active trading, passive investing, and financial planning investments.

Bonuses Paid by the Broker

SoFi Member Rewards

Program members can earn points by performing various activities in the app or accounts. Traders and investors can convert the accrued points into shares of stocks or cryptocurrency.

Chance to win from $5 to $1000

After opening an account for active trading, its owner participates in the drawing of a bonus, which can later be converted into fractional shares or other securities. The participant determines the amount of possible reward on his own, for example, 5, 10, 25, 100, or 1000 USD.

The higher the selected amount, the lower the likelihood of receiving funds. So, when choosing a bonus of $5, the chance to win is 85.488%, in the case of $1000 it is only 0.028%.

Investment Education Online

A section of the official website called SoFi Learn is devoted to learning the basics of financial planning, investing, and the principles of accumulating money. There is a handy filter that allows you to sort the submitted articles by topic or life stage.

The broker does not provide a demo account, so the knowledge gained can only be applied in real trading conditions.

Security (Protection for Investors)

The holding company Social Finance, Inc. (SoFi) includes several companies. Brokerage services and active investment products are offered by SoFi Securities LLC, a member of FINRA and SIPC. SIPC insurance coverage is up to $500,000 per client (but not more than $250,000 for monetary claims).

Automated investing and advisory services are provided by SoFi Wealth LLC, a SEC-registered investment advisor company. Cryptocurrency transactions and accounts are handled by SoFi Digital Assets, LLC, which according to the US Treasury Department’s Financial Crimes Enforcement Network (FinCEN) qualifies as a monetary services company. All securities are cleared and stored by APEX Corporation.

👍 Advantages

- SIPC insurance policy is available to active investors

- You can file a claim with FINRA

👎 Disadvantages

- SIPC protection does not apply to cryptocurrency accounts

- Identity verification and complete information on sources of income are required

- The choice of payment systems is limited

Withdrawal Options and Fees

-

Funds from accounts can be withdrawn to a bank account using Wire Transfer or Automated clearing house (ACH).

-

The money is credited to the account within 1-3 business days after confirmation of the withdrawal request.

-

The application can be submitted two working days after the last transaction is completed, and the deposit must be made at least 5 days before the withdrawal request is made.

-

There is no commission for withdrawals through ACH. For wire transfer withdrawals, the broker will withhold a fee of $25 per transaction.

-

The fee for a payment returned via ACH due to a request for a larger amount than available at the time of application is $15.

Customer Support Service

Support is available Monday through Thursday from 5:00 am to 17:00 and Friday from 5:00 am to 16:00 (PT).

👍 Advantages

- Broker clients can contact operators via online chat

👎 Disadvantages

- It doesn’t work on Saturdays and Sundays

- Chat is not available for unregistered users

Available communication channels with customer support specialists include:

-

a call to the phone number indicated in the Contact Us section on the website;

-

email;

-

online chat (only for clients with open accounts);

-

Facebook and Twitter Messengers

The company’s offices are located in San Francisco, New York, and Healdsburg (CA).

Contacts

| Foundation date | 2015 |

| Registration address | 234 1st Street, San Francisco, CA 94105 |

| Regulation |

FINRA, SIPC, FinCEN |

| Official site | sofi.com |

| Contacts |

Email:

investsupport@sofi.com,

|

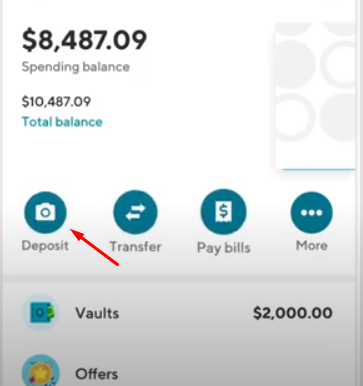

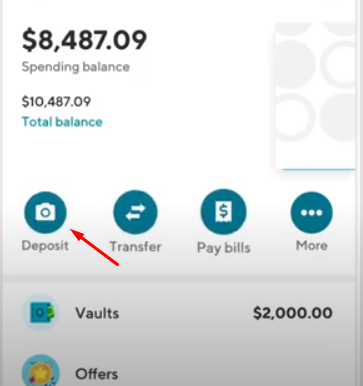

Review of the Personal Cabinet of SoFi Invest

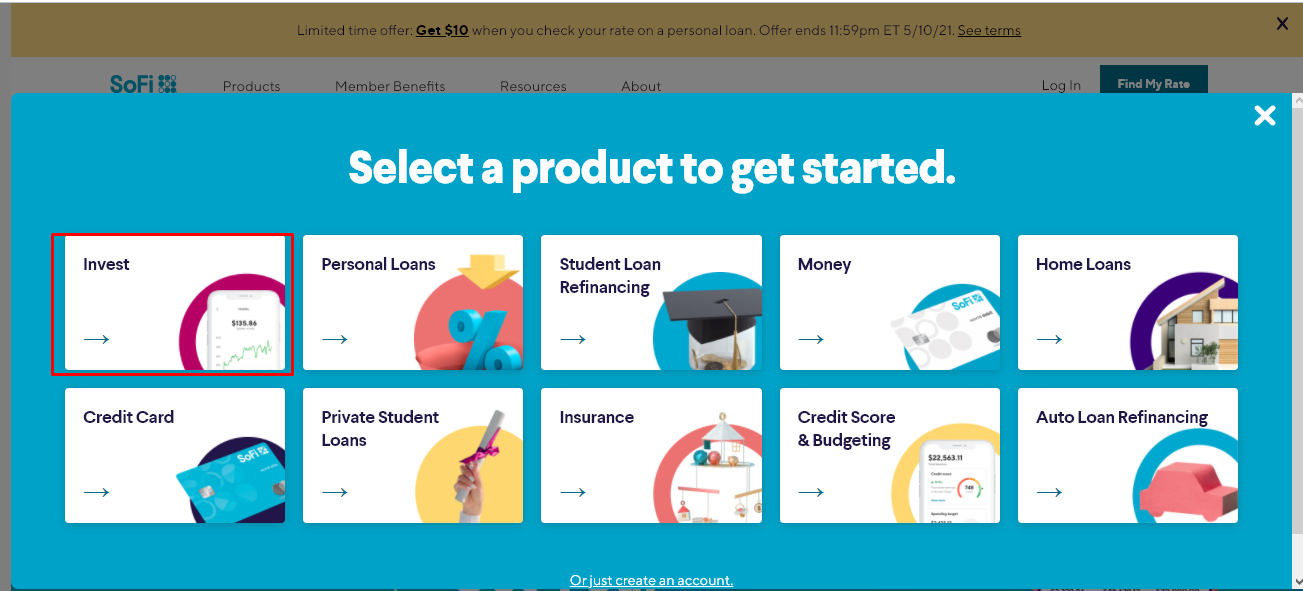

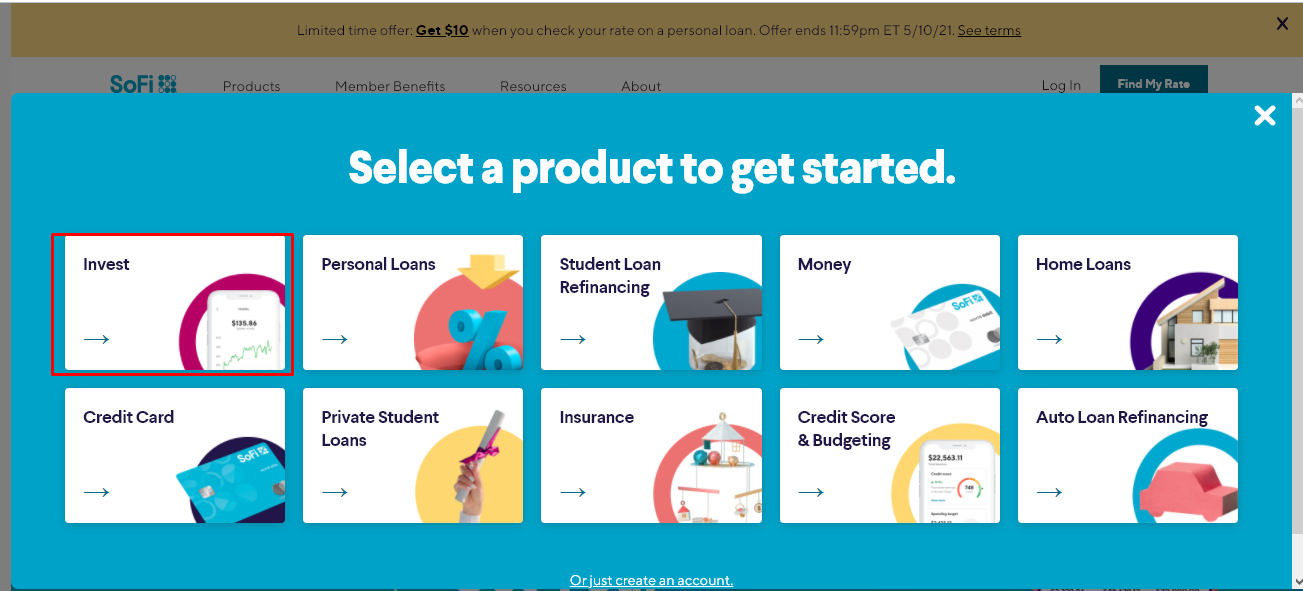

To start trading or investing with SoFi Invest, you need to open a brokerage account. This can only be done by persons over 18 years of age with American citizenship, residing within the 50 states of the United States and the District of Columbia. Brief instructions for opening an account:

Go to the official website of Social Finance, Inc. (www.sofi.com), and on its home page, click the “Find My Rate” or “Become a member” button. Then select the service you are interested in. If you plan to use a broker as an intermediary for transactions with stock market assets, then click on Invest.

Enter your first name, last name, state of residence or registration, email, create a password. Next, you need to choose the priority type of investment - active (asset trading or IRA) or automated. Then enter your address - residence address or APO, FPO, DPO (if you are military) - and a valid Social Security Number (SSN). The broker opens an account after checking the provided information on income and scanned copies of documents.

In the SoFi Invest personal account, the broker’s client can:

1. Top up all open cash and investment accounts:

2. Choose automated investment strategies:

1. Top up all open cash and investment accounts:

2. Choose automated investment strategies:

Also in the personal account, the trader has access to:

-

Management of credit funds, cash, and trading accounts.

-

Trading assets via a web terminal, tracking market data in real time.

-

Formation of statistics for the referral program.

-

Number of points for the SoFi Member Rewards loyalty program

Disclaimer:

Your capital is at risk. Via Sofi Invest's secure website. Your capital is at risk.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the SoFi Invest rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about SoFi Invest you need to go to the broker's profile.

How to leave a review about SoFi Invest on the Traders Union website?

To leave a review about SoFi Invest, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about SoFi Invest on a non-Traders Union client?

Anyone can leave feedback about SoFi Invest on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.