Robinhood Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- Robinhood platforms

- Floating

- There is no broker's commission on multiple instruments

Our Evaluation of Robinhood

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Robinhood is a moderate-risk broker with the TU Overall Score of 6.85 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Robinhood clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Robinhood is well-suited for beginner investors seeking a simple and affordable way to engage with financial markets. However, potential users should be aware of the platform's limitations and consider them carefully in light of their individual investment goals and region of residence

Brief Look at Robinhood

Robinhood is an investment platform founded in April 2013. The platform offers commission-free trading of stocks, exchange-traded funds (ETFs), options, and cryptocurrencies. Robinhood is regulated by the Financial Industry Regulatory Authority (FINRA) in the U.S. and the Financial Conduct Authority (FCA) in the U.K. It is also a member of the Securities Investor Protection Corporation (SIPC) and the Federal Deposit Insurance Corporation (FDIC). With an intuitive interface, the platform simplifies access to financial markets, allowing clients to start investing with as little as $1. Robinhood has continuously expanded its offerings since its launch, recently adding features such as credit cards and a dedicated educational section for beginner investors.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- No commission trading.

- Access to trading stocks, ETFs, options, futures, and cryptocurrencies.

- User-friendly platform.

- Fractional share trading.

- Educational resources for beginner investors.

- Availability of a mobile app.

- Provision of analytical data.

- Limited selection of cryptocurrencies.

- No access to international markets.

- Limited advanced technical analysis tools.

TU Expert Advice

Financial expert and analyst at Traders Union

Robinhood has revolutionized the investment landscape by making investing accessible to a broad audience. With commission-free trading and minimal deposit requirements, the platform has attracted millions of users, particularly among younger generations. Its intuitive interface and educational resources enable novice investors to quickly grasp the basics of trading.

Robinhood is an excellent choice for beginners seeking simplicity and accessibility. However, it is essential to carefully review the platform's features and limitations to ensure they align with your investment goals. Despite its numerous advantages, Robinhood has faced criticism and regulatory scrutiny, raising questions about its long-term reliability.

Since February 2018, U.S. residents have been able to trade cryptocurrencies on Robinhood. As of December 2023, this service was extended to residents of the European Union. In March 2024, Robinhood launched in the United Kingdom, offering investments in stock market assets listed on U.S. exchanges, with plans to expand its services and supported regions. Currently, the platform's limited range of investment tools and lack of access to international markets may not meet the needs of all investors, particularly those with more advanced trading requirements

Robinhood Summary

| 💻 Trading platform: | Robinhood platforms |

|---|---|

| 📊 Accounts: | Margin account, Cash account, Crypto account |

| 💰 Account currency: | USD, EUR |

| 💵 Deposit / Withdrawal: | Wire Transfer, ACH, Debit Card, Instant Bank Transfers |

| 🚀 Minimum deposit: | $1 (Cash account, Crypto account), $2,000 (Margin account) |

| ⚖️ Leverage: | Floating |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 1 fractional share, $1 for cryptocurrencies |

| 💱 EUR/USD spread: | Zero fees on cryptocurrencies, stocks, ETFs and options |

| 🔧 Instruments: | Equities, ETFs, exchange-traded options, cryptocurrencies, American Depositary Receipts (ADRs), OTC instruments, gold, futures |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Exchange |

| ⭐ Trading features: | There is no broker's commission on multiple instruments |

| 🎁 Contests and bonuses: | Yes |

Robinhood offers simple and cost-effective trading options for investors. With zero fees for buying and selling stocks, ETFs, and options, the platform is accessible to investors of all experience levels. A minimum deposit of just $1 allows traders to start trading with small amounts. The platform also supports commission-free cryptocurrency trading. Traders can access analytical tools such as customizable charts and technical indicators to make better informed decisions.

Robinhood Key Parameters Evaluation

Video Review of Robinhood

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

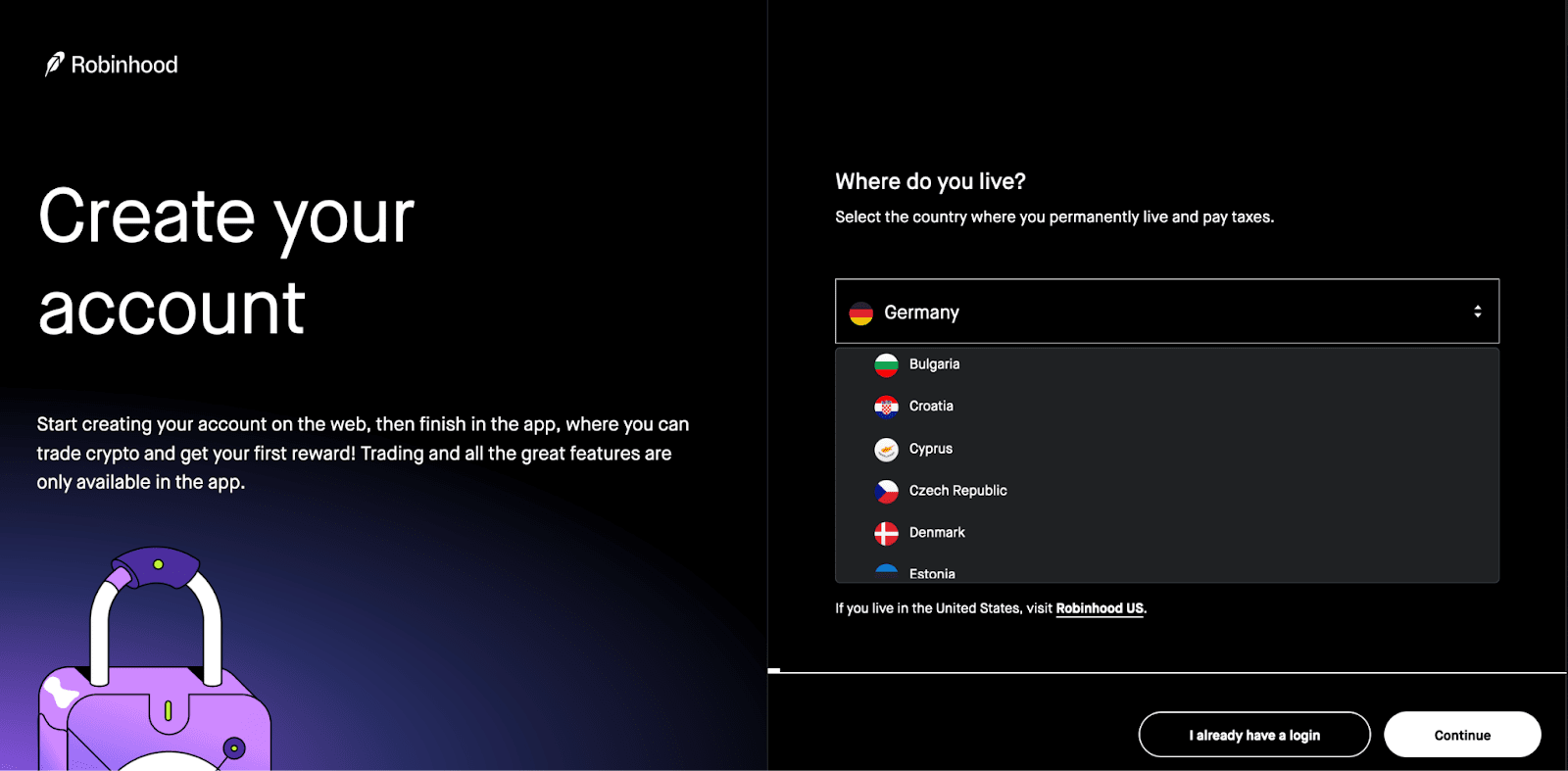

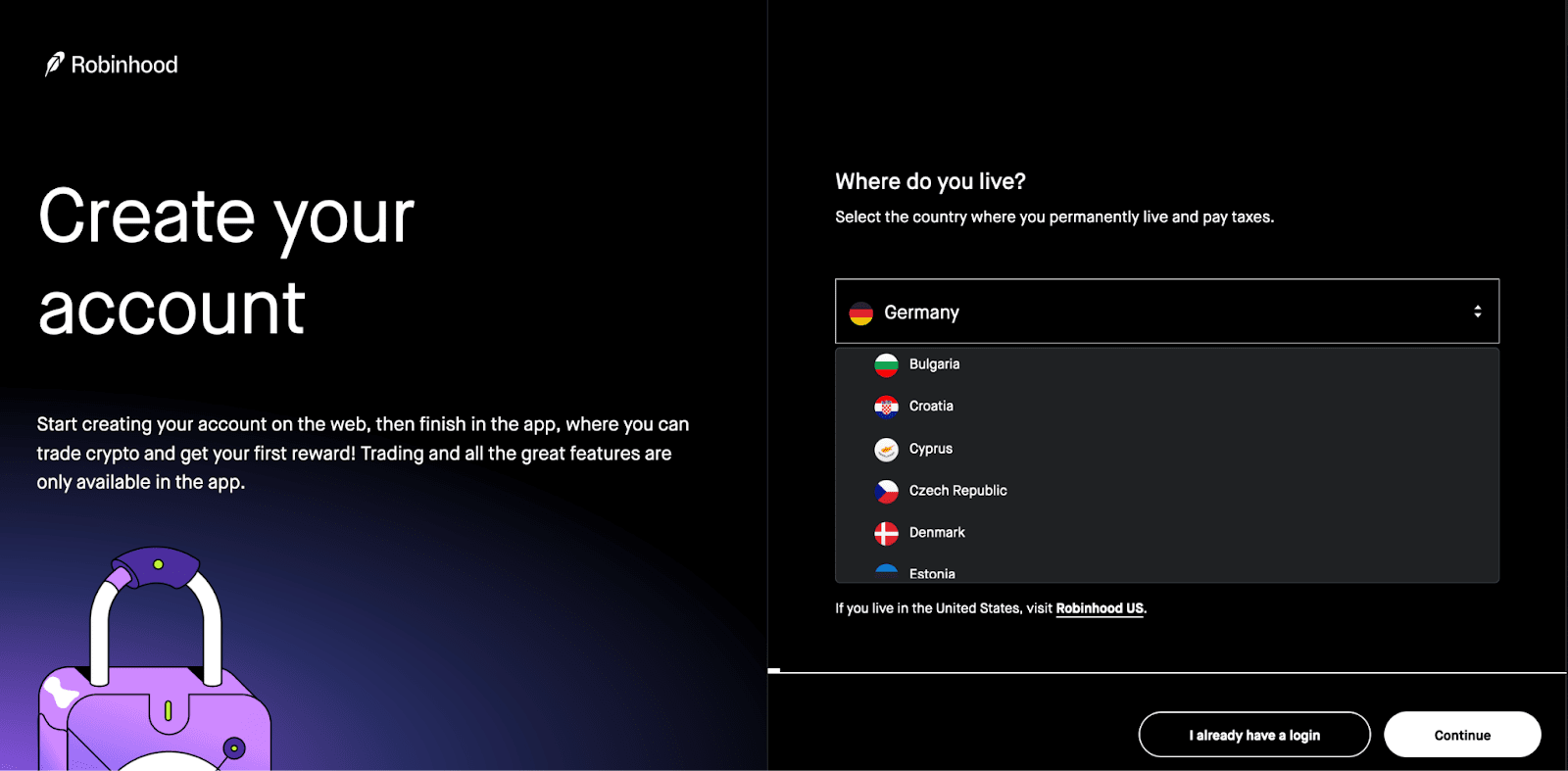

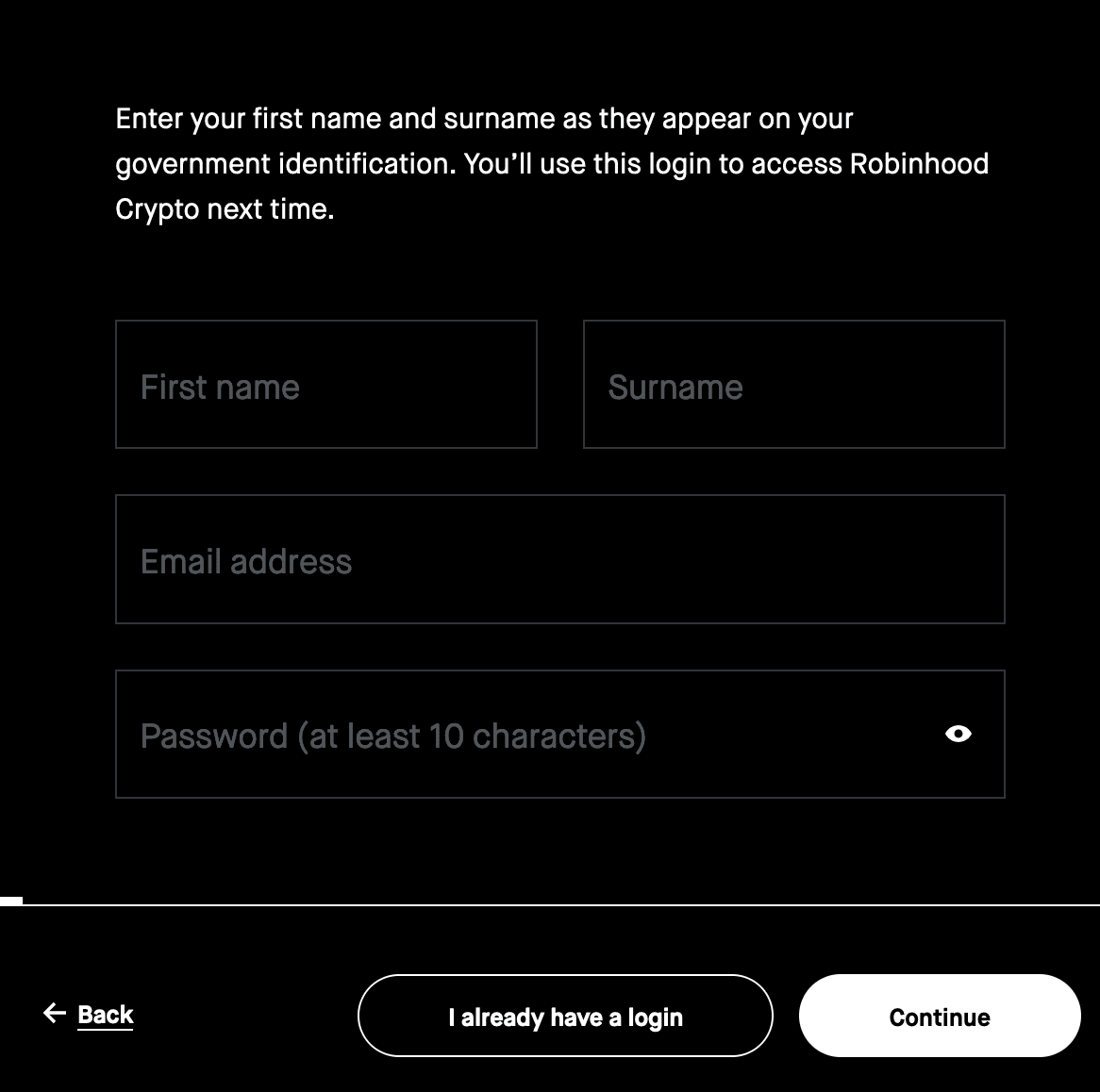

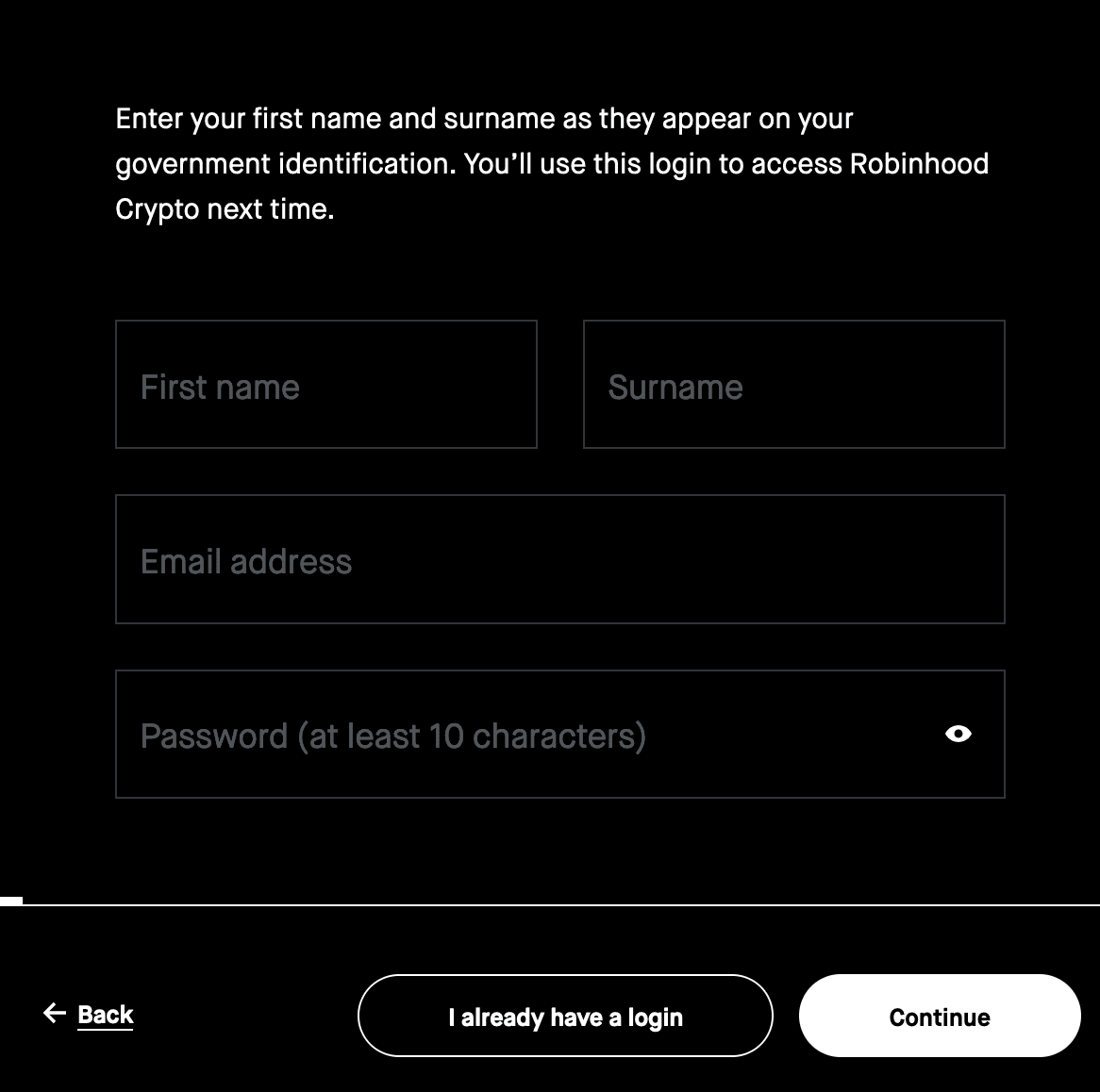

To access your Robinhood account, register an account on the website. Here’s a step-by-step guide:

At the top of the Robinhood website, select the U.S., UK, or EU to navigate to the website for your specific region. Click Sign Up or Get Started to begin registration.

If the EU is selected, specify your country of residence. For the U.S. and UK, the registration process starts automatically.

Fill out a short form, by entering your first and last name (as in your documents), email, and create a password.

Additional features of Robinhood’s user account allow traders to:

-

Link bank accounts and cards to their profile.

-

Verify their identity.

-

Deposit funds into their account.

-

Withdraw profits.

-

View details about their investment portfolio.

Regulation and safety

Robinhood is a regulated broker. In the U.S., it is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). In the U.K., Robinhood is overseen by the Financial Conduct Authority (FRN: 823590). ts cryptocurrency services are provided under a license from the New York State Department of Financial Services.

Client funds held in Robinhood accounts are insured by the Federal Deposit Insurance Corporation (FDIC) for up to $2.5 million per client.

Advantages

- Investment protection

- Legal services in the EU, UK, and the U.S.

Disadvantages

- Cryptocurrency assets are not FDIC-insured or SIPC-protected

- SEC actions that include fines for misleading clients, warnings about violations in the cryptocurrency division

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Margin account | $0 | Yes |

| Cash account | $0 | Yes |

| Crypto account | $0 | Yes |

Storage fees, regulatory fees, and service charges may apply.

The table below compares Robinhood's commissions to those of other brokers.

| Broker | Average commission | Level |

|---|---|---|

|

$0.0 | |

|

$4 |

Account types

To cater to diverse trader needs, Robinhood offers two types of investment accounts (Margin and Cash accounts) and a dedicated live cryptocurrency account. The account choice depends on individual needs and strategies.

Account types:

Deposit and withdrawal

-

Withdrawals can be made via standard bank transfers (no fees) or instant transfers (1.75% fee, minimum $1).

-

Funds are deposited within 2–5 business days, while instant transfers are processed within minutes.

-

Withdrawal limits depend on the transfer type and are displayed in the Transfers section.

-

Only settled funds are eligible for withdrawal. After selling assets, the funds become available within one business day.

-

Document verification is required for withdrawals from new accounts.

-

Potential errors or delays may occur due to account restrictions or exceeding limits.

Investment Options

Robinhood offers several ways to earn passive income. Key methods include:

-

Annual percentage yield on uninvested cash. The standard APY is 4.25%, increasing to 5% for Robinhood Gold subscribers.

-

Automatic investing. Traders can set up recurring purchases of stocks or ETFs for a specified amount, helping to accumulate investments and take advantage of dollar-cost averaging.

-

Round-ups program. Robinhood Cash Card holders can enable automatic rounding up of everyday purchases, with the difference invested into selected assets.

Additionally, clients can invest in dividend-paying stocks, which provide another form of passive income.

Robinhood’s partnership program

Robinhood features a referral program that allows existing clients to earn additional income by inviting new clients. Program rules:

-

The referrer earns a reward once their referral registers via the invite link, completes verification, and links a card or bank account.

-

The minimum withdrawal amount is $50.

-

There is no limit on the number of referrals.

-

Both referrers and referrals receive free stocks valued between $5 and $200.

Robinhood also offers partnership programs for businesses and legal entities.

Customer support

Chat is available 24/7. Phone service is available Monday through Friday from 07:00 to 21:00 (ET).

Advantages

- You can request a phone call

- Chat is available in the user account 24/7

Disadvantages

- Crypto division is unavailable by phone

- Chat can be used by registered traders

Contact methods are:

-

Through the in-app chat feature.

-

By phone.

-

Via email.

-

Through Robinhood’s social media profiles.

Contacts

| Foundation date | 2013 |

|---|---|

| Registration address | 85 Willow Road, Menlo Park, CA 94025 |

| Regulation | FINRA, FCA |

| Official site | https://robinhood.com/us/en/ |

| Contacts |

Education

Robinhood offers extensive educational resources for investors seeking to deepen their understanding of finance and investing. The materials are presented in an accessible format, making them valuable for both beginners and experienced investors.

Robinhood prioritizes financial education, offering tools to empower clients to make informed investment decisions and manage their finances effectively.

Detailed review of Robinhood

Robinhood is a user-friendly platform for trading and investing. Its mission is to democratize investment services and provide access to financial market opportunities for a wide audience. As a regulated broker operating in the U.S., the European Union, and the U.K., Robinhood employs multi-factor authentication and is a member of compensation funds, ensuring a reliable and secure platform for financial transactions.

Robinhood by the numbers:

-

10+ years in the market.

-

More than 24.4 million clients.

-

Over 11 million active clients.

-

95% client retention rate.

Robinhood is a progressive investment platform with a simple interface

Robinhood offers commission-free investing in over 6,000 stocks, exchange-traded funds (ETFs), and options, with a minimum investment of just $1. The platform offers access to more than 500 American Depositary Receipts (ADRs). The platform also supports trading of over 40 cryptocurrencies, including Bitcoin (BTC), Dogecoin (DOGE), Ethereum (ETH), and Shiba Inu (SHIB), with a $1 minimum investment. Margin trading is also available.

For active traders, Robinhood provides advanced tools such as futures and index options trading, facilitating diversified strategies and expanding market access.

Robinhood’s analytical services:

-

Sherwood Snacks. Financial news presented in simple, easy-to-understand language for a wide range of investors.

-

Robinhood Legend. A desktop platform featuring customizable charts, technical indicators, and analytical tools, free for all clients.

-

Robinhood Gold. Premium access to margin trading, Morningstar analytics, and higher yields on cash balances.

-

Robinhood Cash Card. A debit card with a round-up feature that automatically invests spare change, integrating everyday spending with investment goals.

Advantages:

Automatic investing options.

Low minimum deposit requirements.

Fast registration and verification.

Provision of tax documents.

Customizable price alerts.

The company prioritizes the security of client data and funds, offering multi-factor authentication and 24/7 client support.

Latest Robinhood News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i