Is Robinhood Safe? Is it Legit or Scam?

Typically, when you want to start trading or investing in stocks, you’ll consider what you want to invest in, trading strategies, and the risk you're willing to take. Another important thing you should look at is what broker you’ll use. Here, your choice will, to a large extent, be influenced by the broker’s pricing and fee structure, the investment instruments it offers, and its trading platform.

When you take all these factors into account, Robinhood ticks all the boxes. It allows you to invest in individual company stocks and ETFs without paying any commissions. In addition, it also allows you to invest in options, gold, and trade with cryptocurrencies. It's no wonder that, as of 2023, it has 31 million users.

Despite its popularity, though, many traders still want to know if Robinhood is legit or whether it’s safe to use. Luckily, we're here to help, and in this post, our independent expert will answer these questions in detail.

Trade only with trusted stock brokers. Make the right choice with the Traders Union stock brokers rating!

The Expert’s Guide on How To Identify a Scam Broker

Because of the popularity of stock trading and investing as described above, many new brokers are entering the scene with an increasing number of new and innovative platforms that all aim to make trading simpler and more profitable. Overall, this is a good thing, as it provides traders and investors with more options and tools they can use.

Unfortunately, this popularity also brings with it many brokers who use dishonest and unscrupulous means to scam traders and investors out of their hard-earned money. This means you should be able to identify scam brokers and avoiding at all costs.

To do this, we advise that you do proper research before depositing funds with a broker. This research involves that you go through a series of steps that will provide you with the information you need. You can think of these steps as a framework you can use to help you identify scam brokers.

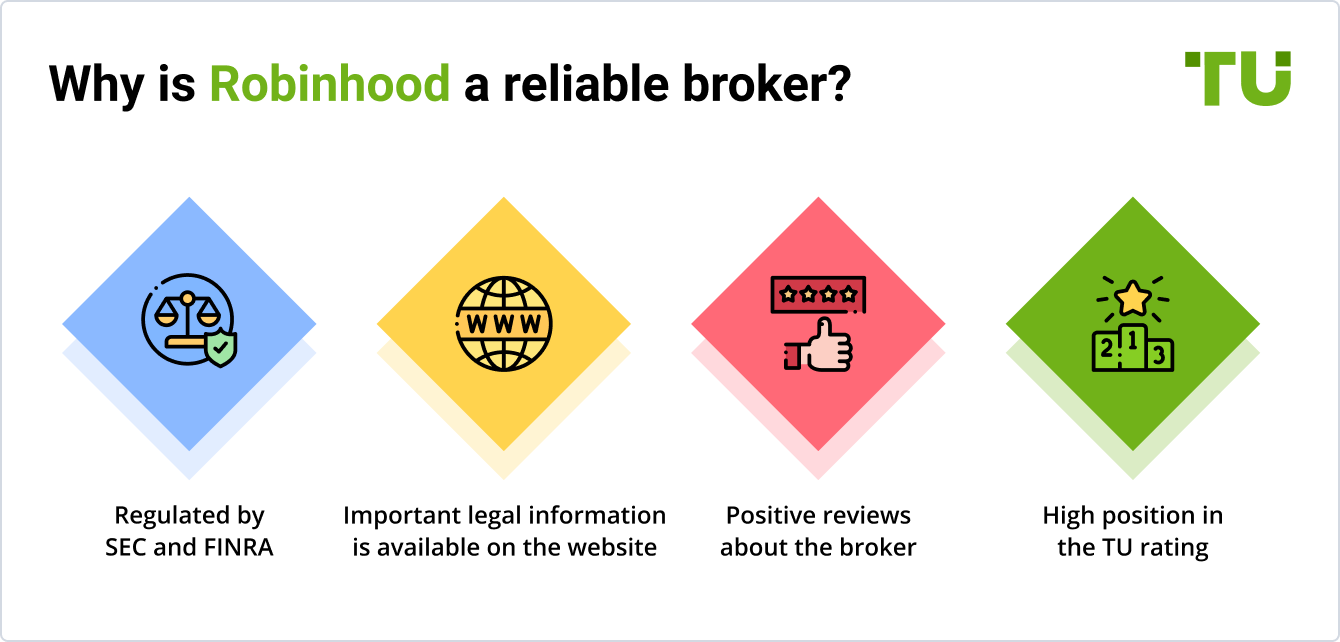

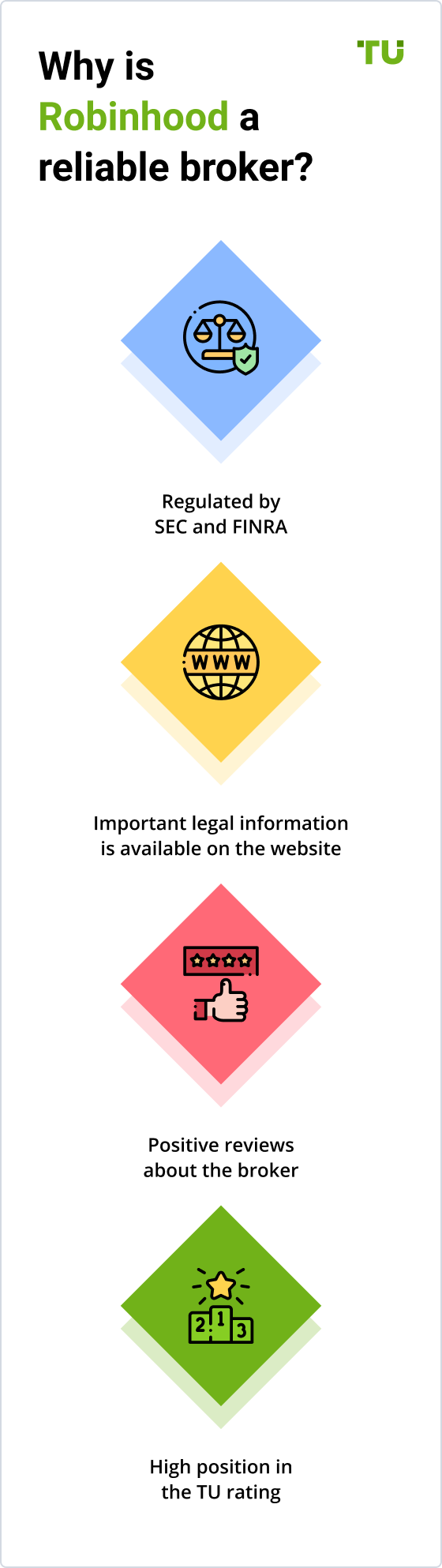

When you work through these steps, you’ll look at:

-

Regulation. The first thing you need to consider is whether the broker is licensed and regulated to provide brokering services. Generally, regulatory authorities require that brokers be honest and transparent and have safeguards in place to protect their customers’ money.

-

Reviews. The next thing you'll do is check user reviews on the broker. In this way, you can see what other customers are saying about the broker. In turn, this will give you a good idea of how trustworthy the broker is.

-

Transparency. The third step is ensuring that the broker is completely transparent. In other words, it should make all its information and the risks of using its platform available freely.

-

Traders Union Rating. The Traders Union rating service simplifies the process of choosing a broker. This is because we've analyzed and collected reviews about brokers so you don’t have to. So, as your final step, you'll check the broker's rating on Traders Union.

With these steps in mind, let's look at Robinhood in more detail to see whether it’s legit.

Step 1: Is Robinhood Licensed and Regulated?

Regulatory authorities typically require that brokers be honest and transparent in their dealings with customers. As a result, customers should always know what they're investing in and what the risks are. Also, regulators often require that brokers have insurance and safeguards in place to ensure their customers’ money is protected against fraud or loss.

So, is Robinhood regulated and licensed? It provides its services to its customers through its family of wholly owned subsidiaries of Robinhood Markets LLC which includes Robinhood Financial LLC, Robinhood Securities LLC, and Robinhood Crypto LLC.

Robinhood Financial is a member of the Financial Industry Regulatory Authority (FINRA) and is registered as a broker dealer at the Securities Investor Protection Corporation (SIPC). This means that customer securities are protected up to $500,000 including $250,000 for claims for cash. In addition, customers who opt into Robinhood's Cash Management feature are eligible for FDIC insurance.

In turn, Robinhood Securities LLC provides brokerage clearing services and is also registered at the SIPC, while Robinhood Crypto LLC provides cryptocurrency trading and is licensed in over 20 jurisdictions in the US.

Considering the above, Robinhood is properly regulated and licensed to provide its services to customers across the United States and has the necessary insurance and safeguards in place to protect its customers’ funds.

Step 2: What Do Robinhood Reviews Say?

Once you've established that a broker is properly licensed and regulated, you’ll need to look at some customer reviews to get an idea of how trustworthy the broker is. Here Robinhood also performs well with most reviews being positive or neutral. This indicates that it is trustworthy.

Step 3: Is Robinhood Transparent?

Now for the next step, you'll need to check whether the broker is transparent, and this will also typically involve some research on the history of the company to find out how long it's been operating, when it was started, and whether it was involved in any major scandals or controversies.

Robinhood was established in April 2013 to provide easy access to the financial markets to its customers. Since then, the company has grown significantly and was listed on the NASDAQ on 29 January 2023.

It has, unfortunately, been involved in some controversies over the years. For example, in March 2020 it suffered a systemwide outage that prevented users from opening and closing positions. As a result, many users suffered losses, but Robinhood indicated that they would offer compensation to these users.

Also, like many other brokers, Robinhood restricted the trading of certain stocks during January 2023 following an effort by users of the r/wallstreetbets subreddit to drive up their price.

Despite this, Robinhood is still transparent and makes all its information, regulatory details, policies, disclosures, trading conditions, and risks available on its website.

Step 4: Robinhood’s Trader Union Rating

The final step is to check how Robinhood performs on the Traders Union broker ratings. Here, it also performs well with an overall score of 9 and it has consistently ranked in the top 10 because of its good customer reviews, favorable trading conditions, and beginner-friendly trading platform.

Is Robinhood a Scam? Is Robinhood Legit? Our Expert’s Verdict

To make it easier for you to choose the right broker, Traders Union keeps a record of and blacklists scam brokers. Robinhood is not on this list, has never been, and we have no reason to suspect that it's a scam or that it's not legit.

On the contrary, as mentioned above, Robin Hood is on our list of top brokers based on the fact that it's well established, properly licensed and regulated, expert and overall customer reviews.

Summary

When you want to invest in the stock market, it's vital that you do your research before choosing a broker. If you don't, you could get caught up in a scam and lose your hard-earned money. To do this, there are several things you should look at and consider to find the information and clarity you need.

Hopefully, this post helped illustrate these considerations in more detail. To learn more about stock market investing, the best brokers, and trading strategies, visit Traders Union for more details.

FAQs

When it comes to Robinhood, let’s look at some frequently asked questions many traders and investors have.

How long has Robinhood been operating?

Robinhood was founded in April 2013 and has been in operation for almost 8 years.

Is Robinhood a good broker?

Robinhood currently has an overall rating of 9 out of 10 on our broker ratings and has consistently featured in our top 10 based on its good customer reviews, favorable trading conditions, and beginner-friendly trading platform.

Is Robinhood safe?

Robinhood is a well-establish and properly regulated and licensed broker. It also has the necessary insurance in place to safeguard customers against losses.

How do I open a Robinhood account?

To open an account, you’ll need to go to its website and click on Sign Up.

Glossary for novice traders

-

1

Brokerage fee

A brokerage fee, also known as a commission, is a fee charged by a brokerage or financial institution for facilitating and executing financial transactions on behalf of clients. Brokerage fees are typically associated with services related to buying or selling assets such as stocks, bonds, commodities, or mutual funds.

-

2

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

3

SIPC

SIPC is a nonprofit corporation created by an act of Congress to protect the clients of brokerage firms that are forced into bankruptcy.

-

4

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

5

Forex Trading

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).