How Much Can I Make Trading Stocks?

Top commisison-free stock broker - Saxo Bank

How much you can make depends on your risk tolerance, market conditions, starting capital, and strategy. The stock market typically gives returns of around 10% annually. Different sources cite the success rate of stock traders as being between 1% to 50%. The average professional stock trader makes $101,223 per year, or roughly $8,400 a month.

When you think of stocks and the stock market, what words and images come to mind? For me, it’s money, money, money. Maybe I was too influenced by movies like The Wolf of Wall Street growing up, but I’m surely not alone in associating the stock market with huge amounts of money. But the question that usually follows that train of thought is, “how much money can you actually make trading stocks?”.

The answer varies broadly depending on a wide number of factors. Still, we can narrow down the numbers to give a fairly accurate estimate, using a combination of different traders’ experiences, hard facts, and some basic deductions. In this article, I’ll be sharing some of my experience with you in trading stocks, mixed in with data from reliable sources, to deliver an answer on how much money you can make in stocks.

-

How to make money by trading stocks?

Though there’s no easy or guaranteed way to make money trading stocks, you can maximize your chances of success by educating yourself extensively, creating a detailed trading plan and sticking to it, implementing stringent risk management, and applying discipline. One of the keys to success is discipline – stick to your goals and plan, and don’t give into emotions like fear or greed.

-

Can You Make A Monthly Income From Stocks?

Yes, you can, though the amount you can make depends on your starting capital. A successful trader might be able to make anywhere from 1-5% of their capital. So, if you had a starting capital of $100,000, you could consistently make $1000-$5000 per month, which would be enough monthly income to live off in most places.

-

Can you go negative in stock trading?

Yes. You can end up in the red either below your starting capital, or below zero, and owe money to your broker. Typically, this results from margin trading, short selling, options trading, using leverage, and high-risk trading strategies. Dropping below your bottom line is usually due to using borrowed capital.

-

Is it easy to trade the stock market?

Yes and no. Beginner investors can quite simply trade on stock market indices or ETFs long-term, and make a gradual, relatively slow profit with little risk. Trading individual stocks, or day trading the stock market, often requires a deeper understanding of markets and individual companies’ fundamentals, as well as knowing how to conduct technical analysis.

How much money can you make from stocks?

When I first began trading and investing in stocks, I was rather naïve and made a fair few losing trades. I was one of those people who hopped onto the January 2021 GameStop (GME) short-squeeze bandwagon, trying to profit from the mass buying of the stock by short sellers.

GameStop (GME) Stock chart.

Needless to say, I jumped on board too late and lost a considerable amount of money in a short amount of time. I entered a position high, and panic-sold when the price started dropping. I had made the mistake of giving into FOMO (Fear of missing out) and “buying the news”.

My unfortunate initiation into the stock market, though costly, taught me a lot of important lessons and drove me to try and learn everything I could about the stock market to avoid repeating the same stupid mistakes. I’ve since adopted carefully planned out strategies, employed stringent risk management, and applied emotional discipline. Thanks to my efforts to educate myself and invest more intelligently, I now have a much stronger idea of how to make a profit, and how much profit I can make.

I’ll break down the most important lessons here, and then explain how much profit I’m able to make.

-

Stick to the Plan: When trading or investing, it’s vital to outline your starting capital, financial goals, time horizon, and risk tolerance, and then formulate a plan that aligns with them. Your starting capital determines how much you can make on each position you enter. Your goals and time horizon dictate how much you should be aiming to make within a specified timeframe, and your risk tolerance helps decide how risky your investments will be, ultimately dictating how quickly you can reach your goals.

-

Diversify: One of the most crucial aspects of managing a portfolio is diversification. In my early days, my portfolio was focused on just a small handful of assets (3-4 at a time), leaving me overexposed to price movements in each. When one asset suffered a downturn, my overall bottom line was hit hard. It’s best to allocate your portfolio to a range of assets, and to pick a healthy number. Too many assets (50 or more) means you won’t profit much from significant gains on one asset, whereas too few (10 or less) means a large price change in one asset harms your overall portfolio too much. A portfolio should ideally have 25-30 assets in it.

-

Manage Risk: All traders or investors should apply stringent risk management. That means setting take-profit and stop-loss orders to automatically trigger the sale of an asset when it hits a price limit. As a younger trader, I’d chase losses rather than sell when I’d incurred a certain amount of loss. Setting limit orders that align with your trading plan means you won’t give into greed when you want your profits to keep going up, or chase losses when they go down. This contributes to emotional discipline too.

With all of those rules in mind, let’s explore how much could be made from trading stocks. I’ll use figures from my approach, but those numbers can be substituted depending on your own strategy.

In the name of diversification, I aim to hold roughly 25-30 assets in my portfolio at any given time, made up of about 90% stocks and 10% cryptocurrencies. Crypto is probably the riskiest asset class, while stocks are moderate to high risk, meaning my portfolio is quite high risk. You might opt for less risky assets.

For risk management, I use position sizing. I put about 2-3% of my overall capital into any position I enter. A good rule of thumb for most traders is to risk no more than 1-2% of your trading capital on any single trade, though that might be more appropriate for a portfolio holding 50 assets.

To further manage risk, you should determine your risk-reward ratio. This involves assessing the potential return on an investment compared to the amount of risk undertaken.

Example. If you enter a trade with a potential profit of $200 and a risk of $100, the risk-reward ratio would be 2:1 ($200 profit / $100 risk). An ideal risk-reward ratio is 2:1 or 3:1. I use take-profit and stop-loss orders to implement a ratio of 3:1. I usually set the take-profit order at 30% above my opening position, and stop-loss at 10% below, which is generally considered quite conservative.

Best stock brokers

How much money can be earned from stocks

So, using the conditions outlined above, let’s say I started out with $10,000 – though I haven’t quite reached that much starting capital just yet! In this scenario, I open 25 positions worth $400 on assets with growth potential. I set take-profit orders at $520 (30% above open) and stop-loss orders at $360 (10% below).

Depending on the probability of the trades being successful, prevailing market conditions, and unforeseen events that impact the prices of each asset, the overall strategy could go either way.

Positive outcome

Let’s say market conditions were favorable and 60% (15) of my trades went the way I wanted, while 40% (10) did not. If each take-profit and stop-loss limit was reached, that comes to 15 trades worth $520 and 10 trades worth $360, totaling $11,400 – an 11.4% increase from my starting capital of $10,000.

This would be considered a healthy amount of profit, though the timeframe of this occurring would largely determine if this is a desirable profit margin. 11.4% growth in one year would be roughly in line with the overall stock market (S&P500), but a lower number than some traders would aim for.

Negative outcome (more realistic)

Now imagine the trades went in the other direction for any number of reasons, leading to only 28% being successful and 72% not. That means 18 losing positions would now be worth $360 ($6480 total) and 7 successful trades would be worth $540 ($3,780), resulting in a total of $10,260.

While this is still an increase of 2.6% from my starting capital, it is far below what we would be aiming for. However, still making a small profit when 72% of trades were unsuccessful is a better outcome than incurring losses.

What percentage of stock traders are successful?

Some of the numbers presented above are not necessarily realistic, and a trader would need to select stocks carefully to achieve them. Other factors, such as market conditions, company fundamentals, industry trends, market sentiment, and world events, could all impact the success rate of any given trade. This makes it almost impossible to predict how successful your trading will be.

Figures from a wide range of sources all paint a different picture of what percentage of stock traders end up succeeding. One 2005 study found that half of US traders turned a profit after costs and fees, while another 2004 study found only 20% succeeded. A 2004 Berkeley research paper revealed only 13% of day traders make money, yet a 2014 study puts that number at only 1%. I explored the numbers in more detail, using credible academic sources, here: Is Stock Trading Actually Profitable?

Stock trader salary

So far, we’ve only looked at what returns a stock trader could expect to see based on a percentage of their funds. We’ve assumed that a trader would be trading a fixed amount, and the profit they make would be determined by their starting capital. But what about professional traders who get paid a salary?

Some professional traders are employed by financial firms or proprietary trading firms and receive a salary or performance-based compensation rather than trading their own capital. It’s much simpler to find information on how much these types of stock traders make as the data is widely available online.

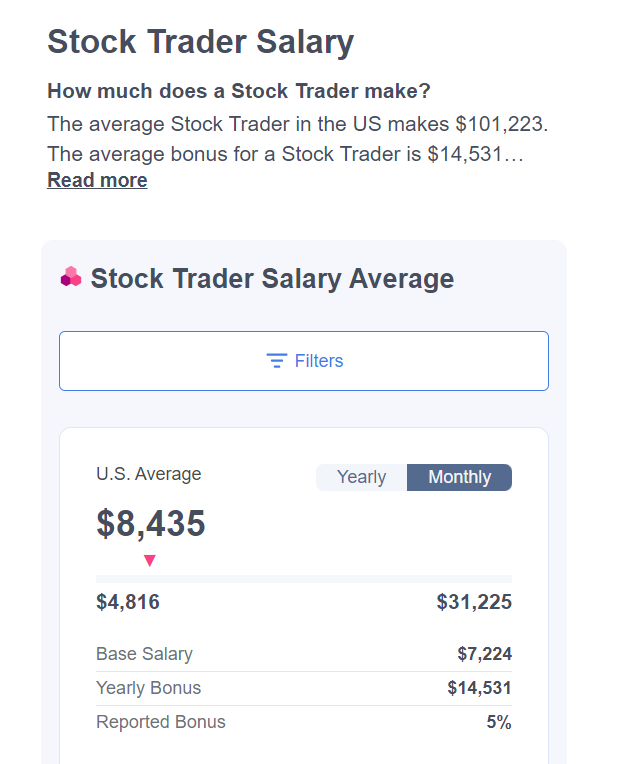

According to Comparably, a website for workplace information transparency, the average annual salary for a US stock trader is $101,223, with an average yearly bonus of $14,531. The salaries range from $57,794 all the way up to a staggering $374,698. Recruitment website Zippia reports a more modest average annual salary of $90,179, with entry-level traders supposedly making $56,000 a year.

Stock trader salary. Source: comparably.com

Those numbers are quite attractive, but perhaps not as much as you might expect, especially when the average salary across all employment in the US is $56,316.

In fact, if you were an independent/retail trader with enough capital saved up, you could potentially make more than a professional trader annually, and keep all of the profit for yourself. If you started with $100,000 of your own capital, and engaged in riskier trading to make 60% in one year (roughly what professional traders make), you could quickly end up making more than a professional trader by reinvesting your capital. In the first year you’d make $60,000 (60%), but if you reinvested it all and managed 60% annually over consecutive years, you’d pull in $96,000 the second year and $153,600 the third! And it would all go to you, rather than the firm you’re employed by.

So, working for yourself using your own capital could possibly pay better than trading for a salary. The tricky part, of course, is getting enough capital to trade in the first place.

How to maximize your monthly income from stock trading?

-

Risk management: Any trader worth a pound will tell you that implementing stringent risk management into your strategy is key to finding success. Managing risk helps to preserve capital, minimize losses, control emotions, and maintain consistency. Set stop-loss and take-profit orders that adhere to your trading plan, use position sizing to prevent overexposure and disproportionate losses, and diversify your portfolio to reduce the impact of adverse movements in any single position.

-

Discipline: I can’t stress enough how important it is to employ discipline in your trading. That means always sticking to your plan and strategy, no matter what emotions get in the way. In my early trading days, I learned the hard way that chasing a loss or being greedy almost never pays off. On one of my earliest trades, I lost 99.76% on Amyris Inc. (AMRS), because I kept thinking the price would turn around and I’d recoup my losses. I waited until the company went completely bankrupt, and lost my whole investment. Never let emotions dictate your trades, just utilize cold and pure logic.

-

Timing: Choosing when to trade is just as important as, if not more than, knowing how or what to trade. TU expert Vuk Martin says “The first hour and last hour of a trading day are the busiest and offer the most opportunities.” However, another TU stock expert, Tobi Opeyemi Amure, writes “You must choose trading hours that align with your personal schedule and preferences while considering the market's characteristics.” Determine which times throughout the trading day work best for you, accounting for volatility and your own goals and risk tolerance.

Of all these tips, timing may be the most important factor in succeeding in trading stocks. To quote Vuk Martin once more: “Timing is often considered an essential factor that can significantly influence the success of your transactions.”

The time of day and the specific day of the week can both impact the outcome of your trades. You can read timing your trades here: What is the Best Time to Buy and Sell Stocks?

Conclusion

At the end of the day, it’s difficult to put an exact number on how much profit you can generate. I aim for 10-20% profit per year, though some traders willing to take on more risk can achieve numbers closer to the 50-60% range. Achieving a portfolio growth of 10% and above per year is considered healthy growth.

Your success rate and profit margins will be determined by a long list of factors, including the broader stock market conditions, company fundamentals, the timing of your trades, and unforeseeable market events. For the best chances of success, make sure to carefully lay out a detailed trading plan, implement risk management, be emotionally disciplined, and conduct thorough research on each trade you enter.

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).