deposit:

- $1

Trading platform:

- Mobile application

- Proprietary online platform

- IIROC

- CIPF

RBC Direct Investing Review 2024

deposit:

- $1

Trading platform:

- Mobile application

- Proprietary online platform

- From 1:1

- There are instruments with fixed profits

Summary of RBC Direct Investing Trading Company

RBC Direct Investing is a broker with higher-than-average risk and the TU Overall Score of 4.9 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by RBC Direct Investing clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. RBC Direct Investing ranks 58 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

The RBC Direct Investing broker offers trading conditions for novice investors, professionals, and clients who have short-term or long-term investment goals.

RBC Direct Investing is a Canadian broker that provides financial services to active investors. The company's activity is regulated by IIROC (The Investment Industry Regulatory Organization of Canada), which cooperates with CIPF (Canadian Investor Protection Fund). It guarantees payments to customers of RBC Direct Investing if the broker becomes insolvent. The broker offers stock assets as trading instruments.

| 💰 Account currency: | CAD, USD |

|---|---|

| 🚀 Minimum deposit: | 1$ |

| ⚖️ Leverage: | From 1:1 |

| 💱 Spread: | For stocks and ETFs — $9.95; for options — $9.95 + $1.25 per contract |

| 🔧 Instruments: | Stocks, mutual funds, ETFs, options, bonds, and GIC |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with RBC Direct Investing:

- Trading at RBC Direct Investing can be done with investor capital as well as with margin.

- Training materials are freely available on the broker's website.

- Communication with the support team is carried out conveniently for the user.

- If RBC Direct Investing becomes insolvent, the company's clients will receive financial compensation from the Canadian Investor Protection Fund.

- The broker offers a demo account so investors can test their trading skills without the risk of losing capital.

- Investors have an assortment of savings accounts available.

👎 Disadvantages of RBC Direct Investing:

- To open an account with RBC Direct Investing, a customer needs to have a pre-opened bank account with a Canadian bank.

- Only a paucity of methods for depositing and withdrawing funds.

- High fees for trading stocks, options, and exchange-traded funds.

Evaluation of the most influential parameters of RBC Direct Investing

Table of Contents

- Geographic Distribution

- Latest Comments

- Expert Review

- Latest RBC Direct Investing News

- Analysis of RBC Direct Investing

- Dynamics of the Popularity

- Investment Programs

- Trading Conditions

- Commissions & Fees

- Detailed Review

- Client Area of RBC Direct Investing

- User Reviews of RBC Direct Investing

- FAQs

- TU Recommends

Geographic Distribution of RBC Direct Investing Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of RBC Direct Investing

RBC Direct Investing is a Canadian stockbroker whose trading conditions are universal. The company is agog to cooperate with investors irrespective of whether they have experience in the stock market, and also offers bonuses in the form of the lowered trading commission for the professionals who make a considerable quantity of transactions. The broker indicates that opening a TFSA account is only available to residents of Canada or those with a Canadian bank account. There is no data on other accounts.

The company offers a fairly wide range of trading instruments, through which investors can create portfolios with wide diversification. Investors can trade with both cash and margin accounts, and RBC Direct Investing also offers several savings accounts for investors with different financial goals.

Clients can contact the support team both by phone and email. However, the broker warns that due to the high workload of the department, the answer may take a few days.

Dynamics of RBC Direct Investing’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

RBC Direct Investing is a company that offers trading conditions and instruments for beginners and experienced investors, as well as those who want to open an account for retirement savings. However, there are no offers for passive investing, including automatic trading, copying trades, or the ability to transfer the account to the broker's employees for management. RBC Direct Investing offers conditions exclusively for active investing.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Affiliate program from RBC Direct Investing

A referral program, for participation in which clients would receive financial bonuses for attracting new clients, is also absent from RBC Direct Investing.

Trading Conditions for RBC Direct Investing Users

Trading conditions of RBC Direct Investing are designed for beginners and professional investors as well as for users who want to open saving accounts. Trading with your personal funds, as well as margin trading, is available in the company. The broker offers stocks, bonds, options, mutual funds, exchange-traded funds, and fixed income assets as working instruments. Commissions depend on what instrument the trader uses. The commission for trades that are made through a representative of investment services is lower, but in this case, the investor pays a commission of $35 or 2.5% to the representative when trading assets with a value not exceeding $0.50. An investor should have an open account with RBC Royal Bank to make deposits or withdrawals.

$1

Minimum

deposit

1:1

Leverage

24/7

Support

| 💻 Trading platform: | Proprietary trading web platform, mobile app for iOS and Android |

|---|---|

| 📊 Accounts: | Cash account, margin account, TFSA, RRSP, RRIF, RESP, Non-Personal account |

| 💰 Account currency: | CAD, USD |

| 💵 Replenishment / Withdrawal: | Transfers from RBC Royal Bank account, check, online banking, in-kind transfer, and full or partial asset transfer |

| 🚀 Minimum deposit: | 1$ |

| ⚖️ Leverage: | From 1:1 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 Spread: | For stocks and ETFs — $9.95; for options — $9.95 + $1.25 per contract |

| 🔧 Instruments: | Stocks, mutual funds, ETFs, options, bonds, and GIC |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No |

| ⭐ Trading features: | There are instruments with fixed profits |

| 🎁 Contests and bonuses: | Points for trading (RBC Rewards) are available if a trader has an RBC credit card |

RBC Direct Investing Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Cash account | From $9.95 | No data |

| Margin account | From $9.95 | No data |

| TFSA | From $9.95 | No |

| RRSP | From $9.95 | $50 |

| RRIF | From $9.95 | No data |

| RESP | From $9.95 | No data |

| Non-Personal account | From $9.95 | No data |

The service fee is $25 per quarter. The fee does not apply to investors who have more than $15,000 in their trading account or all of their RBC Direct Investing trading accounts in the aggregate.

We also compared the trading fees at RBC Direct Investing to those of other stock brokers. The results of the comparison are presented in the below table.

| Broker | Average commission | Level |

| RBC Direct Investing | $9.95 | Medium |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Low |

Detailed Review of RBC Direct Investing

The trading conditions of RBC Direct Investing are versatile: they are suitable for both novice investors and professionals. At RBC Direct Investing, investors can receive profit only for actively trading on the market and there are no programs that feature automatic trading, copying of transactions, or a referral program. However, the broker provides clients with the opportunity to open savings accounts for various financial purposes such as pensions, education, and others. The company also has an account for trading on behalf of the organization, margin accounts, and cash accounts.

RBC Direct Investing by the numbers:

-

The company has brick-and-mortar offices in four Canadian cities.

-

The broker reimburses investors a $200 fee if they transfer $15,000 or more to the account.

-

$0 is the commission for trading mutual funds.

-

TFSA's withdrawal fee is $0.

RBC Direct Investing is a broker for beginners and professionals who prefer active investing

The following trading instruments are available for RBC Direct Investing clients: shares, options, exchange-traded funds (ETFs), mutual funds, and also instruments with fixed profitability (e.g., GICs, bonds, and securities). The broad range of assets allows investors to create portfolios with a high level of diversification, and in the investor community, clients can find useful information and investment ideas from more experienced peers. Investors can keep up-to-date with the broker's Inspired Investor magazine, which features articles on investment topics as well as news from the worlds of technology and finance.

RBC Direct Investing traders can use three trading platforms, including the broker's proprietary web platform, which only requires internet access via a browser; therefore, no additional software installation is required. Trading from a smartphone is best done through the RBC Direct Investing mobile app.

Useful services of RBC Direct Investing:

-

Inspired Investor magazine. Three times a week the broker publishes information about the current market situation, new technologies, investment ideas, and the spotlights of its clients who have achieved financial success.

-

Newsletter. Clients of RBC Direct Investing can subscribe to its newsletter to be updated on the latest trading and financial news and events.

-

FAQs. In this section, the broker collected the 10 most frequently asked questions. Users can also use the search bar at the top of the webpage to find the information they need.

Advantages:

The company has a wide selection of savings accounts, and there are also cash and margin accounts.

An investor can create a portfolio with a high level of diversification, as RBC Direct Investing has many trading instruments available.

Communication with the support team is done in ways that are convenient for the client.

The broker's clients can visit the offline offices of RBC Direct Investing in Toronto, Montreal, Calgary, and Vancouver.

The broker cooperates with the CIPF, which provides reliable protection of client capital.

The company focuses on clients with various levels of professionalism and provides free training materials.

How to Start Making Profits — Guide for Traders

The RBC Direct Investing broker offers its clients several types of accounts, including savings accounts, as well as accounts for direct trading. Working with stock assets is available for all account holders.

Types of accounts:

Also, traders before opening a real account can practice on a demo account, which completely excludes the possibility of financial risks, but also does not allow earning money.

Bonuses Paid by the Broker

Clients who have a bank account with RBC Royal Bank participate in the RBC Rewards program. The investor can use the points they earn as a contribution to investment or to pay fees.

Investment Education Online

RBC Direct Investing maintains an Investing Academy section for beginners to learn how to manage their portfolios competently while experienced investors can improve their skills and raise the effectiveness of their work. It contains information to help clients stay informed about market events, as well as other useful instruments.

Investors can test their skills and evaluate RBC Direct Investing trading conditions on a virtual demo account which avoids financial risks.

Security (Protection for Investors)

The financial activities of the RBC Direct Investing broker are supervised by the Investment Industry Regulatory Organization of Canada (IIROC). The organization is responsible for auditing brokerage and other financial institutions and verifying the quality of customer service as well as their fulfillment of obligations to the regulatory organization and the broker’s investors.

Client funds are protected by the Canadian Investor Protection Fund (CIPF). The Fund guarantees financial compensation to RBC Direct Investing clients if the broker fails financially. The Fund pays compensation of up to $1 million if an investor files a complaint with the CIPF within 180 days of the bankruptcy of the broker. Thus, customers of RBC Direct Investing do not have to worry about the safety of their capital.

RBC Direct Investing also guarantees the safety and protection of investors' personal information. The company uses SSL (Secure Socket Layer) encryption and a multi-level firewall structure to block unauthorized access to the accounts of RBC Direct Investing clients. In cases where an unauthorized user has accessed myAlpari and committed unauthorized actions, the broker is obligated to pay compensation to the investor in the amount of 100%. Please note that compensation will be paid only if the client did not disclose his personal data to third parties.

👍 Advantages

- The company is regulated by IIROC

- If RBC Direct Investing goes bankrupt, CIPF will provide financial payouts to investors

- The broker provides strong protection of investors' personal information, as well as information on how an investor can protect themselves from fraud

👎 Disadvantages

- Client funds are not held in segregated accounts

Withdrawal Options and Fees

-

Customers of RBC Direct Investing can use the following methods to deposit funds: transfer of funds from their RBC Royal Bank account, deposit a personal check, use online banking, and in-kind transfers. Investors can also transfer their assets, including securities, in whole or in part to RBC Direct Investing.

-

The total time that funds or assets are transferred to a trading account depends on the transfer method. Money transactions through RBC Royal Bank take from 3 to 5 working days and in-kind transfers take from 6 to 8 working days. Money or in-kind transfers through RBC Dominion Securities take 5 business days. RESP transfers and transactions through other institutions with electronic processing take 10 business days, and without electronic processing, it will take from 25 business days.

-

RBC Direct Investing does not charge for deposits. The fee for withdrawal from the RSP account as well as unblocking a LIRA is $50. For each additional withdrawal from RIF, LIF, RLIF, PRIF, or LRIF accounts an investor pays a $25 fee, and RBC provides two free withdrawals per year to holders of these accounts. There is no fee for withdrawals from TFSA accounts.

Customer Support Service

The Broker RBC Direct Investing assists its clients in matters related to account opening, transactions, and trading operations. To get an answer to your question or to solve a problem, investors can simply contact the support service.

👍 Advantages

- The broker offers different ways to contact support

- Traders can send an email any day of the week and at any time of the day

- Telephone calls are accepted from Monday through Friday

👎 Disadvantages

- The broker's call center is closed on weekends and nights

- Responses by email may take several days.

This broker provides the following communication channels for its clients :

-

send a standard letter to the company;

-

send a fax to the specified number;

-

Call one of the numbers listed in the "Contact Us" section using either the toll-free number; the number for customers from “other” countries; or the number for customers who speak Cantonese or Mandarin;

-

send an email.

RBC Direct Investing clients can also visit one of the broker's offline offices in Toronto, Montreal, Calgary, and Vancouver.

Contacts

| Foundation date | 1997 |

| Registration address | RBC Direct Investing Inc. Royal Bank Plaza, 200 Bay Street, North Tower P.O. Box 75 Toronto, Ontario M5J 2Z5 |

| Regulation |

IIROC, CIPF |

| Official site | https://www.rbcdirectinvesting.com/ |

| Contacts |

Phone:

1 (888) 722-2388

|

Review of the Personal Cabinet of RBC Direct Investing

You can get access to the trading opportunities of RBC Direct Investing after you open a trading account with the company. Find out how to do it below in these short step-by-step instructions:

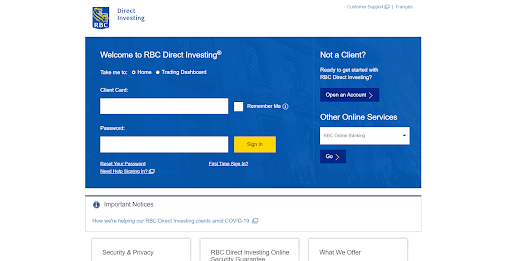

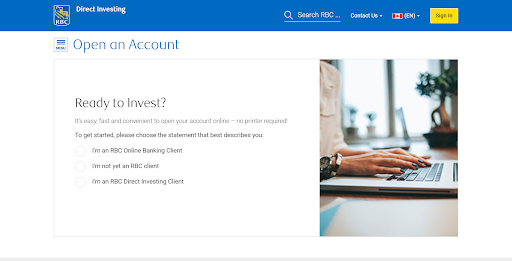

Visit the official website of the broker RBC Direct Investing. On the home page, in the upper right corner of the panel, you will see the "Sign In" button. Click on it to get started.

If you already have a trading account, fill out a short questionnaire to access your Live Account (aka “personal account”). To open a new trading account, click on the "Open an Account" button to the right of the questionnaire.

Indicate if you are an RBC Direct Investing customer.

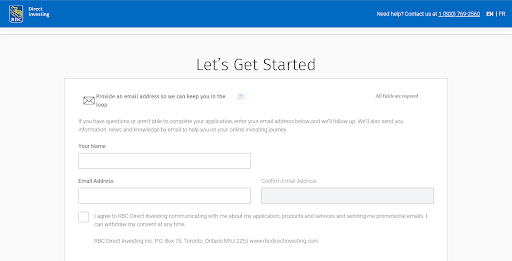

Fill out this short form with your name and email address. Confirm your email address.

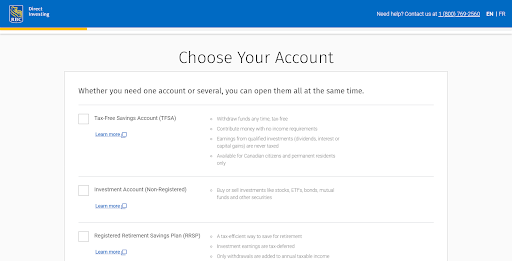

Read an overview of RBC Direct Investing's accounts and choose from the following options: TFSA, Investment Account (Non-registered), or Registered Retirement Saving Plan (RRSP).

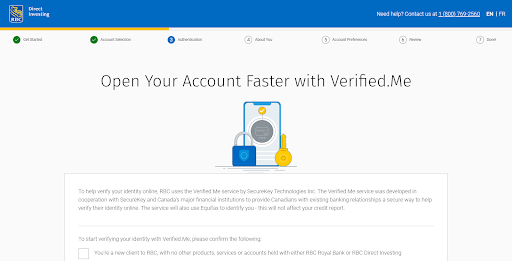

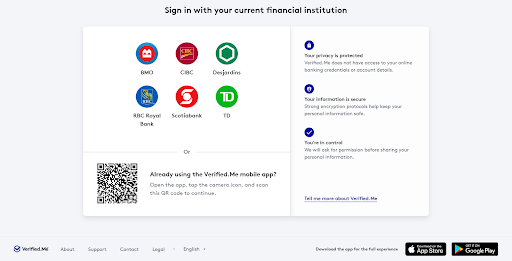

Verify your identity through the Verified.Me application. The investor must have a credit card from one of the Canadian banks listed: BMO Bank of Montreal, CIBC, Desjardins, Scotiabank, or TD Canada Trust. The third point is the confirmation of the specified phone number: if necessary, the broker will send a one-time access code to the number provided.

After confirming your identity, you must choose a financial institution with which to open an account for RBC Direct Investing. The user can also use a QR code.

After completing registration on the RBC Direct Investing website, the client will have access to:

-

His personal account on the broker's website.

-

Communication with representatives of the broker.

-

Ability to invest and enter non-trading transactions.

-

Access trading accounts for conducting transactions.

-

History of all personal trading and financial operations.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the RBC Direct Investing rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about RBC Direct Investing you need to go to the broker's profile.

How to leave a review about RBC Direct Investing on the Traders Union website?

To leave a review about RBC Direct Investing, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about RBC Direct Investing on a non-Traders Union client?

Anyone can leave feedback about RBC Direct Investing on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.