deposit:

- $1

Trading platform:

- Proprietary Mobile app

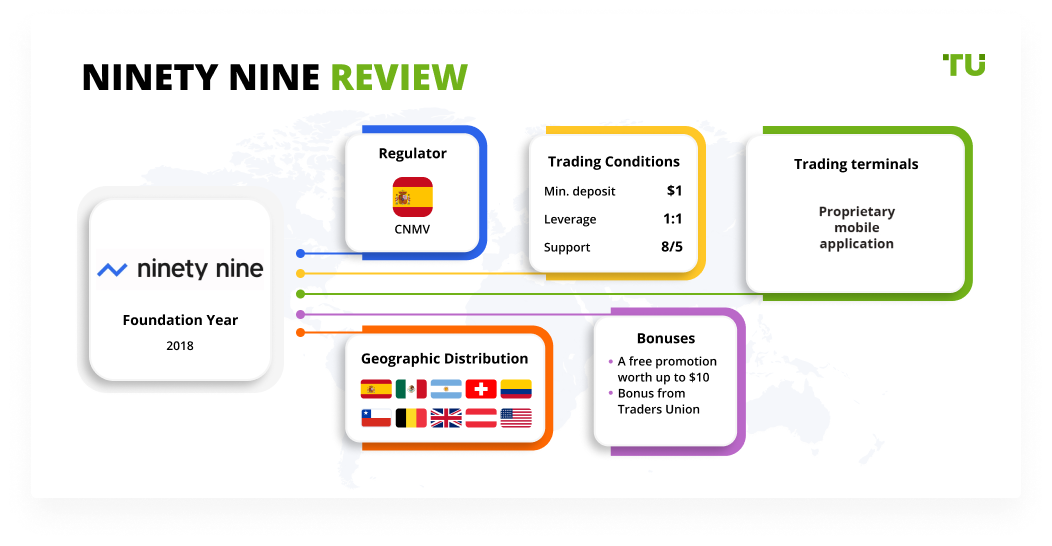

Ninety Nine Review 2024

deposit:

- $1

Trading platform:

- Proprietary Mobile app

- 1:1

- Limit and stop orders are not available, no desktop or web terminal

Summary of Ninety Nine Trading Company

Ninety Nine is a broker with higher-than-average risk and the TU Overall Score of 4.27 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Ninety Nine clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. Ninety Nine ranks 79 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

The Ninety Nine broker will be a real catch for Spanish traders for whom investing in international (including American) stocks is a priority.

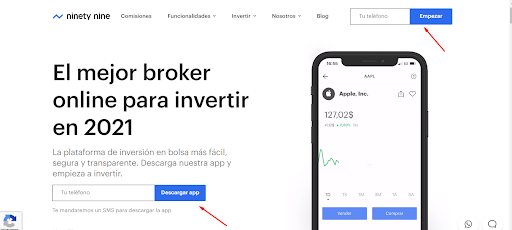

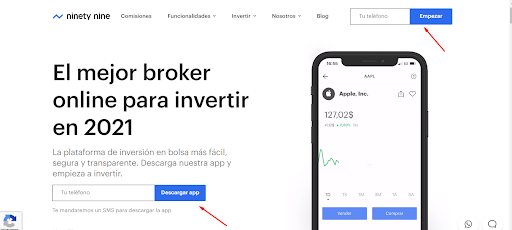

Ninety Nine is a Spanish broker that offers its clients access to international markets at some of the lowest rates. Operating since 2018, it is regulated by the Comisión Nacional del Mercado de Valores (CNMV) and supports 24-hour trading in US, Asian and European securities. Ninety Nine allows you to invest in a convenient proprietary mobile application and does not set minimum deposit requirements.

| 💰 Account currency: | EUR |

|---|---|

| 🚀 Minimum deposit: | From €0 |

| ⚖️ Leverage: | 1:1 |

| 💱 Spread: | No |

| 🔧 Instruments: | Shares, American Depositary Receipts (ADR), and IPOs |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Ninety Nine:

- Having a brokerage license from the National Securities Market Commission (CNMV) and being supervised by the Central Bank of Spain.

- Participation in the Spanish Investor Compensation Fund with protection up to €100,000 per client.

- Easy-to-use mobile application through which you can make transactions and manage your trading account.

- No commissions for trading American and some international stocks, for deposits or withdrawals by ordinary bank transfer, and account maintenance.

- Zero minimum deposit. The client can deposit any amount sufficient to cover 105% of the value of the asset selected for trading.

- Providing shares of American companies, which pay dividends to shareholders.

- Account opening and verification are fully digital procedures and are done directly in the mobile app of a smartphone or tablet.

👎 Disadvantages of Ninety Nine:

- The broker works only with residents and tax residents of Spain. Traders from the European Union can open an account if they live in Spain at the time of registration.

- High commissions for the conversion of currencies when exchanging the basic monetary units of the asset into euros, which is the only currency of the account.

- Deposits and withdrawals can only be made via bank transfers. Deposits and withdrawals to cards and e-wallets are not available.

Evaluation of the most influential parameters of Ninety Nine

Geographic Distribution of Ninety Nine Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Ninety Nine

Ninety Nine is a young Spanish broker, which has a reputable agency governing its trading affairs. It offers clients favorable conditions for trading securities of the U.S., Europe, and Asia. At the moment the company cooperates only with citizens and tax residents of Spain with DNI (Documento Nacional de Identidad) and foreigners from EU countries who are legally residing in Spain and have an identification number NIE (Numero de Identificacion de Extranjero).

Ninety Nine offers zero commissions for trading U.S. stocks, as well as free deposits and withdrawals by bank transfer. Regular deposits can't be called fast, as they usually take 12-24 hours. But customers have the option of speeding up the process and crediting the account within 15 minutes. To do this, choose an instant deposit and pay a fee of €5.

The broker does not provide borrowed funds, so investors can trade only with their own money. The unique offer of Ninety Nine is the opportunity to trade 24 hours a day, even when the stock exchanges are closed. The company executes the order requested by the client at the price quoted per share at the time of market opening. No additional commissions are charged for the service.

Dynamics of Ninety Nine’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

Ninety Nine is focused on medium and long-term investing rather than active trading. Its clients can not only invest in stocks but also receive dividends. At the same time, the broker does not allow working with ready-made asset portfolios, that's why potential investors have to form them themselves or ask for help from third-party money managers.

Ninety Nine’s investment income program allows dividends from U.S. companies

Ninety Nine allows its clients to buy shares of U.S. companies that pay dividends. With their help, investors can earn passive income without the need to follow the market and make transactions. All a trader needs to do is to buy a share of the company, which gives a share of the profits to its shareholders, and wait for the payment.

Features of receiving dividends from Ninety Nine:

-

A list of companies that pay dividends is displayed in the mobile trading app.

-

Dividends on preferred securities are paid based on the results of the reporting year, and on common (ordinary) securities — quarterly or every 6 months.

-

Funds are credited to the investor's account within three days after the custodian bank receives the money from the company.

-

When accruing dividends the client is charged a currency exchange fee (0.5%), because payments are made by American companies in USD, which are then converted to the account currency, which is in euros.

The final amount of income is the declared gross dividend amount minus a percentage of double taxation that applies to payments from foreign companies. The USA for its part withholds 15% or 30% (depending on the type of company); Spain withholds 19%. Thus, an investor receives €56.7 of €100 of dividends — €100 - €30 (€100 euros x 30%) - €13.3 (€70 x 19%).

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

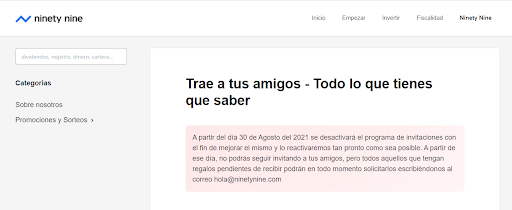

Ninety Nine’s affiliate program:

The broker does not currently have an affiliate program, but according to assurances from customer service operators, the company is working on developing one.

Trading Conditions for Ninety Nine Users

Ninety Nine offers trading in stocks, ADRs, and IPOs with its own funds. The broker does not provide leverage and only executes market orders. Its clients can only make deposits and withdrawals by bank transfer. The company does not have demo accounts. There is only one type of real trading account for all clients. Ninety Nine has no requirements for the size of the minimum deposit. The commission for each transaction is fixed and is €0 or €5.

$1

Minimum

deposit

1:1

Leverage

8/5

Support

| 💻 Trading platform: | Proprietary mobile app |

|---|---|

| 📊 Accounts: | Real account |

| 💰 Account currency: | EUR |

| 💵 Replenishment / Withdrawal: | SEPA wire transfer, OpenBank |

| 🚀 Minimum deposit: | From €0 |

| ⚖️ Leverage: | 1:1 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | Not indicated |

| 💱 Spread: | No |

| 🔧 Instruments: | Shares, American Depositary Receipts (ADR), and IPOs |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Citadel Securities, Instinet Europe Ltd. (Nomura Group) |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Limit and stop orders are not available, no desktop or web terminal |

| 🎁 Contests and bonuses: | No (except via the Traders Union) |

Ninety Nine Commissions & Fees

For transactions with international shares, the company applies a currency conversion fee (0.5% of the transaction amount), since the client trades assets in foreign currencies, but keeps funds on deposit in euros. Withdrawal of funds is made without deduction of additional fees. There is no fee for inactivity. Deposit by ordinary bank transfer is free, but a fee of €5 is charged when selecting instant payment in mobile online banking.

| Account type | Spread (minimum value) | Withdrawal commission |

| Real account | From $2.5 | No |

The broker does not charge non-trading commissions for deposits or withdrawals, but they can be withheld by the banks that process payments.

The table shows the average commission for trading with three stock brokers: Ninety Nine, Charles Schwab, and Ally Bank. For better clarity, the Traders Union analysts have assigned a classification level of commission to each of them.

| Broker | Average commission | Level |

| Ninety Nine | $2.5 | Low |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Medium |

Detailed Review of Ninety Nine

Ninety Nine is an execution-only brokerage company, meaning its employees do not advise or manage client assets. Its focus solely on execution orders allows it to offer Spanish traders some of the lowest commissions for trading U.S. equities. The broker has been providing services since 2018, but already has a license from the Spanish regulator CNMV; and it participates in the investor compensation fund, and cooperates with Nasdaq, NYSE, and the largest local banks.

Ninety Nine offers zero commissions for:

-

selling and buying certain international and all U.S. stocks;

-

maintaining custody of client funds and securities;

-

dividend accrual;

-

provision of the trading platform;

-

inactivity;

-

account maintenance;

-

deposit and withdrawal of funds.

Ninety Nine is a broker for trading international and U.S. stocks, IPOs, and ADRs

Before 2021, the broker gave its clients the ability to trade only ADRs and U.S. stocks. However, the company's motto is embedded in its name: Ninety Nine wants to make the stock market available to 99% of the EU population. For this reason, the broker expanded the list of assets available for trading and added IPOs and international stocks of Canada, Great Britain, Japan, China, Sweden, Germany, and Finland. Ninety Nine stands for maximum security of client funds, so it outsourced to the credit institution Cecabank services for storage and administration of deposits.

Ninety Nine offers customers a proprietary mobile app for trading that is compatible with Android and iOS devices. The company does not allow trades to be made from a desktop or web terminal. The mobile platform has limited functionality. It has no technical indicators and almost no research tools.

Useful services of Ninety Nine:

-

Fundamental data. The mobile terminal displays basic indicators of international companies, such as EBITDA and gross profit for the period.

-

Colecciones. A section of the site that groups stocks by industry. The investor can select securities of companies whose activities are related to tourism, oil production, or entertainment. Also available are lists of assets in which some of the best fund managers, Ray Dalio and Berkshire Hathaway specialists, led by Warren Buffet, invest.

-

Blog. A section with reviews, trading ideas, market analysis, and tutorials about investing in securities.

-

Stock search features in the mobile terminal. Users can find promising securities both by name and by ticker ID.

-

Newsfeed. News digests are displayed on the website and in the trading app. When you click on an asset, current news related to it appears on screen.

Advantages:

This broker offers a simple and transparent commission system. The amount of the trading fee is displayed in the application when making a transaction.

The client can place orders when the market is closed. At the same time, the broker does not charge extra for this convenience.

The technical support quickly responds to questions and gives detailed answers.

The Blog section of the website is regularly updated with new articles with useful analytical information, reviews, and trading strategies.

The broker does not set limits on the number of available trades and daily withdrawals.

The trading account can be deposited through the mobile bank.

Ninety Nine delivers free of charge to all clients (both retail and professional) real-time market quotes, basic fundamental data, and news.

How to Start Making Profits — Guide for Traders

Ninety Nine currently offers retail traders only one type of trading account. After being awarded the "Professional" status, the client can be provided with individual trading conditions, but to receive them you must have a capital of €500,000 or more.

Types of accounts:

Ninety Nine offers favorable trading conditions to traders from Spain and EU residents with Spanish citizenship who want to invest in U.S. stocks with zero commissions.

Bonuses Paid by the Broker

A free promotion worth up to $10

It is received by a client whose referral link opened an account and actively traded. The company also gives a share to the referred trader. The securities are determined at random. The main condition for the bonus accrual is that the referral must make at least one transaction. An unlimited number of new users can be connected to the referral link, but the shares are available for no more than €300 per year. Since August 30, 2021, the bonus program has been temporarily deactivated for improvement. The broker promises to resume it shortly.

Investment Education Online

Ninety Nine offers a limited set of training materials. There are no video tutorials or webinars on the company's website. Useful information for beginners can be found in the Guía de inversión section. The Blog section offers a selection of easy-to-understand articles about investing and financial culture.

The broker does not provide a demo account and does not allow you to invest in fractional shares, so trading from a real account is the only option for its clients to get hands-on experience with securities.

Security (Protection for Investors)

Ninety Nine is the trading brand of Ninety Nine Financial Markets, which is regulated by the Comisión Nacional del Mercado de Valores (CNMV), which is the main financial markets supervisory body in Spain. The license number is 292.

Also, the broker's activity is controlled by the Commission on the Prevention of Money Laundering (Sepblac) and the Central Bank of Spain. Ninety Nine is registered as a qualified intermediary with the IRS to be able to work with US securities. All its clients are members of the Fondo de Garantía de Inversiones (Fogain) compensation fund, which guarantees investment protection of €100,000 per account.

👍 Advantages

- An insurance policy is available.

- The most reputable regulator and the National Bank of Spain govern the company

- Client funds and securities are kept in segregated accounts with the major Spanish bank Cecabank

👎 Disadvantages

- The broker does not work with residents of the United States, Australia, or Asian countries

- Deposits and withdrawals can only be done via wire transfer

- Proof of citizenship or residence in Spain required for registration

Withdrawal Options and Fees

-

The customer can apply for withdrawals at any time of the day or night and there is no limit on the number of withdrawals. However, the daily withdrawal limit is €10,000.

-

The company's clients can only withdraw funds by bank transfer. Payments to cards (credit and debit), electronic, and cryptocurrencies are not available.

-

The broker does not charge for the withdrawal of funds from the trading account to the bank account, but the fee may be charged by the financial institution servicing the client's personal account.

-

Soon, the company plans to add the possibility of instant withdrawal. The estimated cost of the service is €5 per transaction.

Customer Support Service

The support team is available via email and live chat from Monday to Friday from 9:30 till 18:30 (GMT+2).

👍 Advantages

- In-app chat operators respond within 30 seconds

👎 Disadvantages

- Email response comes within 30 minutes to 5 hours after the question sent

- Can't be reached by phone

- Support is in 9/5 mode

- Operators only answer in Spanish

Channels of communication offered by this broker:

-

email;

-

chat in the mobile app and on the website;

-

WhatsApp;

-

messengers on Twitter, LinkedIn, and Instagram.

The answer to the question asked in the chat on the site goes to the email address specified by the user when opening the trading account.

Contacts

| Foundation date | 2012 |

| Registration address | Calle Antonio 31, 28029, Madrid, Spain |

| Official site | https://ninetynine.com/ |

| Contacts |

Email:

hola@ninetynine.com,

|

Review of the Personal Cabinet of Ninety Nine

Registering with Ninety Nine and opening a trading account is done through a mobile app. Only owners of telephone numbers with code +34 can install it. Here is a short instruction on how to get started with the broker and create your personal cabinet:

For a link to download the mobile app on the home page of the official website, enter your phone number in one of the boxes.

After installing the application, you need to register. The company will require personal information (first name, last name, address, nationality), identification number (DNI or NIE), email address, and then come up with a strong 8-digit password. You also need to specify your investment experience.

After that, you need to go through an automatic identity verification process. At the moment it is only available to owners of passports registered in the European Union. To do it, you need to put to hold up to the camera the front and back sides of the document, and then go through facial recognition.

Also to open a trading account you need to sign an agreement by entering a special code. The company sends it by SMS message or by automatic call.

This is an obligatory step is to register your IBAN. Later on, it will be used to deposit and withdraw money from your trading account.

Enter the email and password you specified during registration to enter your Live Account.

The following actions are available in the personal account area of Ninety Nine:

1. Making a deposit.

2. Buying and selling stocks.

1. Making a deposit.

2. Buying and selling stocks.

Also in the personal account traders can:

-

Management of the trading account.

-

History of payments and ready-made transactions for the specified period.

-

Search shares and ADRs by name or ticker ID.

-

Statistics on accrued dividends.

-

Live chat for quick connection with a technical support operator.

-

Viewing news and fundamental data on selected assets.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Ninety Nine rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Ninety Nine you need to go to the broker's profile.

How to leave a review about Ninety Nine on the Traders Union website?

To leave a review about Ninety Nine, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Ninety Nine on a non-Traders Union client?

Anyone can leave feedback about Ninety Nine on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.