deposit:

- £500

Trading platform:

- Mobile application

- FCA

-

FSCS

Also - AJ Bell cooperates with FSCS

AJ Bell Review 2024

deposit:

- £500

Trading platform:

- Mobile application

- 1:1

- No

Summary of AJ Bell Trading Company

AJ Bell is a moderate-risk broker with the TU Overall Score of 5.11 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by AJ Bell clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. AJ Bell ranks 51 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

AJ Bell is a broker for those who trade stocks, funds, indices, and ETFs.

AJ Bell is a stockbroker that facilitates traders to efficiently achieve their investment goals. The company is regulated by the UK Financial Conduct Authority (FCA 155593) and cooperates with the FSCS Compensation Fund. Stocks, mutual and investment funds, as well as bonds, securities, IPOs, and ETFs are the main trading instruments of AJ Bell.

| 💰 Account currency: | GBP |

|---|---|

| 🚀 Minimum deposit: | £500 for a dealing account; no requirements for other accounts |

| ⚖️ Leverage: | 1:1 |

| 💱 Spread: | from £1.50 to £9.95 per trade |

| 🔧 Instruments: | Stocks, funds, investment funds, mutual funds, ETFs, bonds, securities, IPOs |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with AJ Bell:

- Accounts for adult and minor clients.

- You can trade on your own or contact the company's employees via secure fax, phone and messages.

- The broker offers Islamic savings accounts that take into account the specifics of Sharia law.

- The company provides investment offers to help clients achieve their financial goals.

- You can trade through a web terminal or a mobile application.

- In the event of the company's bankruptcy, AJ Bell’s clients will get financial payments from its compensation fund.

- If necessary, you can apply to open a joint account.

👎 Disadvantages of AJ Bell:

- There is no option to verify trading terms on a demo account.

- It is not possible to trade stocks outside of business hours on the UK market.

Evaluation of the most influential parameters of AJ Bell

Geographic Distribution of AJ Bell Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of AJ Bell

AJ Bell is a stockbroker offering convenient investment tools for traders with different financial goals. It is good for clients who prefer systematic investment, as well as those who trade stock assets, stocks, ETFs, and IPOs. The broker offers four types of accounts comprising three savings and one dealing. A minimum deposit is set only for a dealing account. Also, AJ Bell offers accounts for minors and proponents of the Muslim faith.

AJ Bell offers different methods of investing. So, the client can transfer his portfolio to the management of a broker or independently manage his assets. The brokers’ clients have access to all investment offers and assets regardless of the type of account.

Only UK residents can open an account with the company, regardless of the country they currently reside in.

Dynamics of AJ Bell’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

AJ Bell specializes in providing investment services. Along with a broker, clients can accumulate funds for retirement, purchase a house, and also achieve other investment goals. Here clients can choose the best type of investment.

Types of funds at AJ Bell

When passively investing you simply need to choose one of the funds and indicate the amount to invest.

-

Asset management is fully performed by the broker. You aren’t required to know about trading in the markets or have experience in active investing.

-

Just select a fund that follows your financial goals and coincides with your desired investment type.

-

The annual fee for yield funds is 0.35% and the fee for growth funds is 1%.

AJ Bell Responsible Growth fund

This type of investment is good for those who are concerned about the ecology of the planet. The companies in which investments are made care about the environment and live up to the values of sustainable consumption.

-

AJ Bell has selected companies that have long maintained a reputation for being environmentally friendly.

-

The current fees don’t exceed 1%, and there is no commission for the purchase of funds.

-

This type of investment also requires no effort on the part of investors because the portfolio is managed by AJ Bell.

AJ Bell Ready-made portfolios

The broker offers clients a choice of four ready-made portfolios, which makes it easier for them to get started.

-

The company offers four genres of portfolios: Cautious, Balanced, Adventurous, and Profitable. You can choose the method of investment that suits your intentions and goals.

-

Portfolios include companies and funds selected by the broker from a broad list of premium funds.

-

Investors can adjust portfolios at their own discretion by adding or deleting funds and companies.

-

The ready-made portfolio is managed directly by the investor, not by AJ Bell employees.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

AJ Bell’s affiliate program

Broker AJ Bell offers clients opportunities for active and passive investment, so there is no affiliate program and the opportunity to get financial rewards for attracting new clients to the company.

Trading Conditions for AJ Bell Users

AJ Bell provides clients with conditions for comfortable passive investing and active management of their own portfolios to increase profitability. You can open both savings and trading accounts. The ecompany also offers similar types of accounts for minors. The minimum deposit for trading accounts is £500. Trading shares and stock assets are carried out directly on the broker's website or its mobile platform without additional software or tools. You can open an account with AJ Bell only in GBP, so if you trade assets in other currencies, the amounts will be automatically converted to British pounds sterling.

£500

Minimum

deposit

1:1

Leverage

24/7

Support

| 💻 Trading platform: | Trading is carried out from the personal account or through the mobile application for iOS, Android, Apple Watch, Apple TV, and Mac |

|---|---|

| 📊 Accounts: | SIPP, ISA, Lifetime ISA, Dealing account, Junior ISA, Junior SIPP, Junior dealing account |

| 💰 Account currency: | GBP |

| 💵 Replenishment / Withdrawal: | Debit card, check, online banking transactions are available for users who have a Cash accumulation center in the company |

| 🚀 Minimum deposit: | £500 for a dealing account; no requirements for other accounts |

| ⚖️ Leverage: | 1:1 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | The completion of the transaction depends on the funds that are stored in the client's account. Some funds may set the size of the minimum order |

| 💱 Spread: | from £1.50 to £9.95 per trade |

| 🔧 Instruments: | Stocks, funds, investment funds, mutual funds, ETFs, bonds, securities, IPOs |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | RSP (Retail Service Provider) |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | Savings account terms provide tax benefits for traders |

| ⭐ Trading features: | No |

| 🎁 Contests and bonuses: | No |

AJ Bell Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| SIPP (self-invested personal pension) | from £1.50 | No |

| Stocks and Shares ISA | from £1.50 | No |

| Lifetime ISA | from £1.50 | No |

| Dealing account | from £1.50 | No |

AJ Bell offers an Islamic account for Muslims who are residents of the UK.

the Traders Union also compared the fees charged by AJ Bell with the trading fees of competing companies, Ally and Charles Schwab. Find the results below:

| Broker | Average commission | Level |

| AJ Bell | $1.5 | Low |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Medium |

Detailed Review of AJ Bell

This broker offers convenient ways of active and passive investing. You can either engage in independent trading or entrust the investment to the broker. The main instruments at AJ Bell are stocks and various funds: exchange, mutual, and investment. It is also possible to trade indices and other stock assets.

AJ Bell by the numbers:

-

Over 345,000 clients have opened accounts with the company.

-

AJ Bell manages over £65.2 million.

-

Over 2,000 funds are available for the broker's clients.

-

Clients can open one of 4 types of accounts.

-

The minimum commission per trade is £1.50.

AJ Bell is a broker for discerning traders and investors

AJ Bell is suitable for users regardless of whether they have experience in investing or not. The company offers different trading accounts, as well as different investment instruments, so novice traders can open a savings account and get payments from the government, and more experienced investors can manage their portfolios on their own.

Trading in AJ Bell is carried out directly on the broker's website: a trader can always follow the My Account tab and get information about his capital, trades completed, financial transactions, etc. Also, you can set up auto transfers to an account and invest in the amount specified after a certain period (for example, every month). Trading is also available from the mobile app.

Useful AJ Bell services:

-

Latest market news. This section is regularly updated to keep the company's clients informed of developments in the stock and other markets.

-

Fee calculator. This allows calculating the amount of commission for a trading account, taking into account all the services used.

-

Investment articles. Here you can learn about innovations in legislation regarding benefits, retirement savings accounts, as well as study information about global market processes (inflation, volatility, etc.).

-

Analytical tools. This section is only available to traders who have opened a trading account with AJ Bell and includes portfolio comparison, alerts, etc.

-

List of investment funds. It is designed to enable investors to choose which funds in which to invest.

-

ETP screener. It allows you to select ETP based on your personal needs: it is enough to specify the desired criteria of an asset, and the screener will automatically select the appropriate tools.

-

Free investment guides. The site contains a section to download documents for free. These documents indicate the features of different AJ Bell accounts, basic trading principles, and various concepts about investing, as well as an overall guide for novice investors.

Advantages:

The broker doesn’t set the size of the minimum deposit. An exception is a dealing account, which requires £500 to open.

The company also has an Islamic account following the specifics of Sharia law.

Clients of AJ Bell can either trade independently or transfer their portfolio to the management of the broker's employees to get completely passive income.

The company offers a wide range of investment instruments, including stocks, bonds, and various funds (including investment, mutual and exchange-traded).

Minors can open accounts at AJ Bell.

There is no commission for maintenance of the account, inaction, or storage of financial capital.

How to Start Making Profits — Guide for Traders

AJ Bell has four account types that are suitable for long-term or short-term investment. A minimum deposit is not required, a dealing account is an exception. Any resident in the UK, including overseas citizens and their spouses, can trade with AJ Bell.

Account types:

The company also has a junior account which is suitable for users who are under 18.

Broker AJ Bell doesn’t provide a virtual account to test the trading conditions of the company and the client’s trading skills.

Bonuses Paid by the Broker

Broker AJ Bell is focused on cooperating with active investors and offers tools for systematic investment that are available to clients of all ages, including minors. Financial or other bonuses for trading, account opening, and other operations are not credited.

Investment Education Online

The AJ Bell website doesn’t have a section with training materials, but the broker provides its clients with the necessary information to stay current on the stock markets and competently manage their portfolios.

AJ Bell doesn’t provide an opportunity to test your knowledge of investing on a risk-free demo account.

Security (Protection for Investors)

The brokerage company AJ Bell is regulated and supervised by the FCA (UK Financial Conduct Authority). The regulator ensures that the broker fulfills its obligations to the FCA and its clients, otherwise the company will lose its license.

Also, AJ Bell cooperates with FSCS (Financial Service Compensation Scheme). It is an independent compensation fund providing financial benefits to traders in the event the company goes bankrupt. AJ Bell stores client funds in a transit or savings account selected directly by the client. You can check where your funds are stored in your personal account. The broker also cooperates with banks that are authorized by the PRA, regulated by the FCA, and cooperate with the FSCS.

👍 Advantages

- You can always check the location where your funds are stored

- The broker is regulated by the FCA

- The company provides clients with articles with rules that will help protect the account from fraudsters.

- AJ Bell cooperates with the compensation fund

- The broker carefully chooses banks for cooperation

👎 Disadvantages

- The broker doesn’t provide information on security measures used by AJ Bell to protect client accounts

Withdrawal Options and Fees

-

You can replenish your deposit or withdraw funds from your account using your personal account, in the Payments section. There, just indicate the amount and choose the method of transferring funds.

-

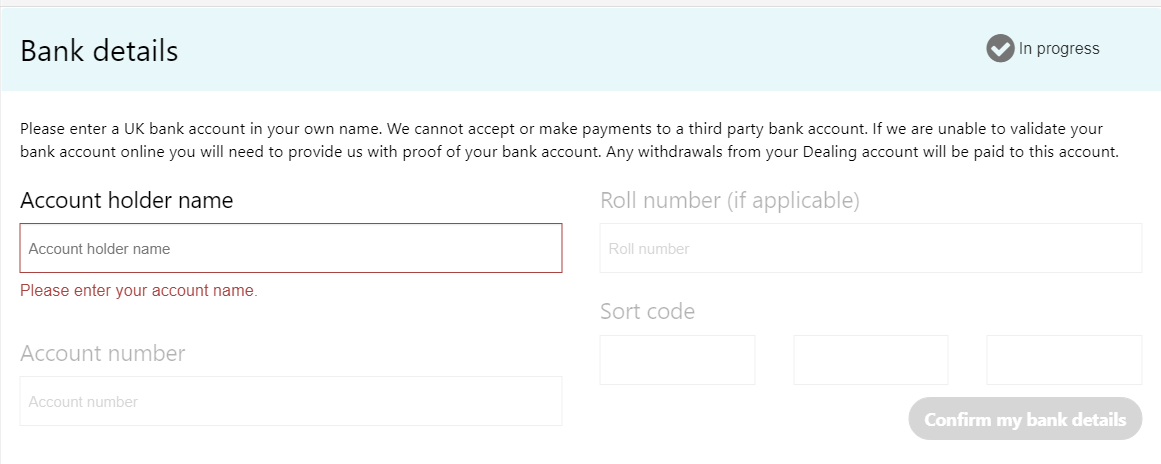

AJ Bell offers these transfer methods: debit card and personal check. Online banking can be used by traders who have a Cash accumulation center in the company. The SIPP account can be funded by the investor's employer by debit card or check.

-

Clients of the broker can set up recurring payments so that the amount selected by the trader is automatically credited to the trading account every month or at any other period.

-

Transfer by personal transfer is carried out within five days; replenishment and withdrawal of funds to a bank account are carried out within 1-4 days. Applications made through online banking are processed on the same day.

-

The fee for recurring investments online is £1.50 GBP for all types of accounts. The broker also charges a monthly fee for stocks, securities, and other asset storage directly from the client's account. Storage of funds is free.

Customer Support Service

Contact support if you encounter problems: during registration, replenishing the account, working with assets, or other operations.

👍 Advantages

- The broker offers 9 emails addresses for resolving withdrawal and replenishment issues, general questions, questions about dealing services, and other problems

- You can contact AJ Bell in many convenient ways

- The website contains a FAQs section.

- You can send secure messages to support from your AJ Bell personal account

👎 Disadvantages

- Support is only available during business hours

- It is impossible to contact company employees on Sunday

This broker provides the following communication channels for existing clients and potential investors:

-

a phone call to the number indicated in the "Contact us and help" section;

-

write a letter to one of the broker's emails.

-

click on the "Feedback" button to leave feedback on the AJ Bell website;

-

follow the "Contact us and help" section.

-

Send information using the messenger service of social networks such as Facebook, YouTube, Twitter, and LinkedIn.

Contacts

| Foundation date | 1990 |

| Registration address | AJ Bell You Invest, 4 Exchange Quay, Salford Quays, Manchester, M5 3EE |

| Regulation |

FCA, FSCS Also, AJ Bell cooperates with FSCS |

| Official site | https://www.youinvest.co.uk/ |

| Contacts |

Email:

newbusiness@youinvest.co.uk,

|

Review of the Personal Cabinet of AJ Bell

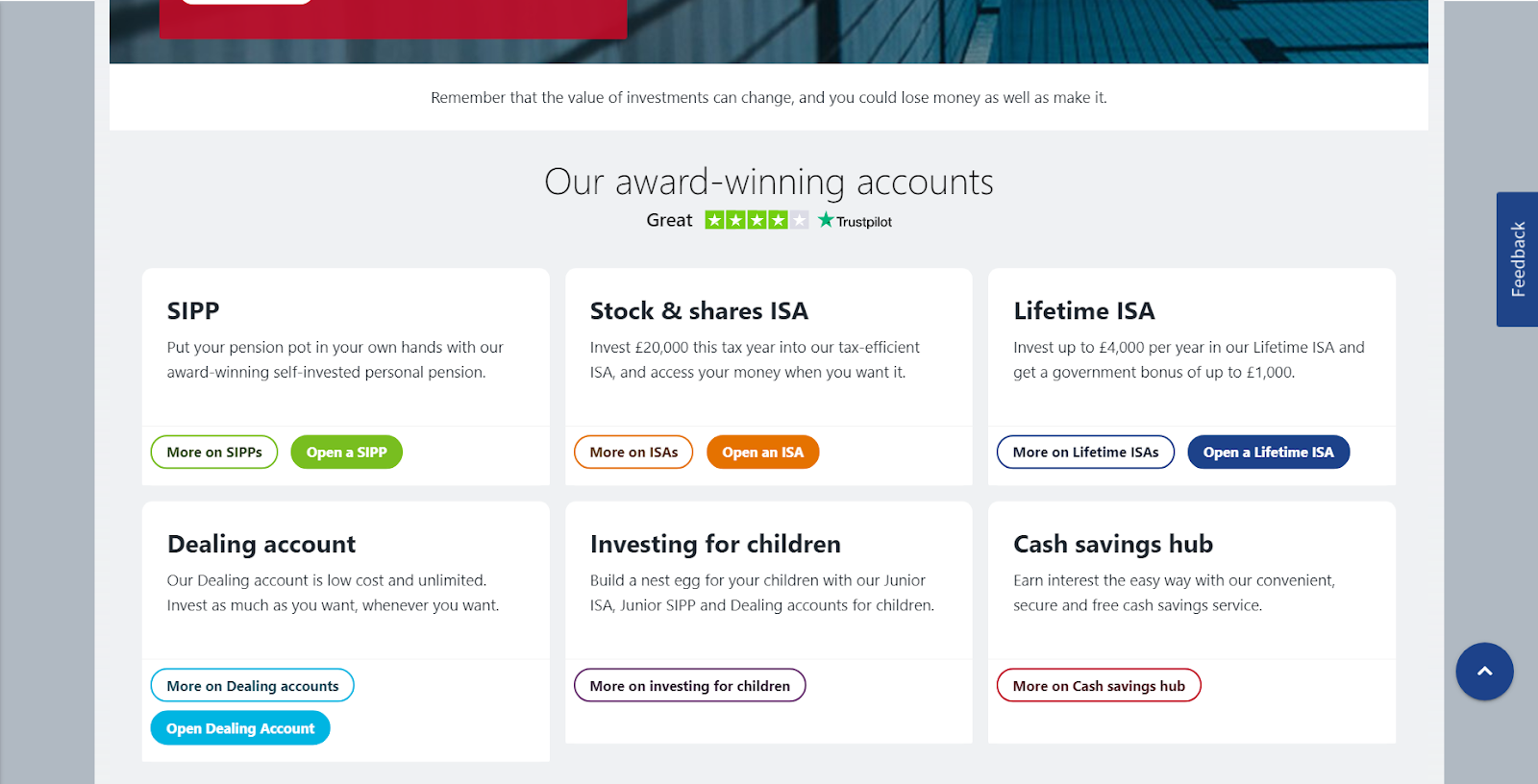

You can start investing and trading only after opening a personal account with AJ Bell. Please find a brief guide below:

The following options are available from the AJ Bell personal account:

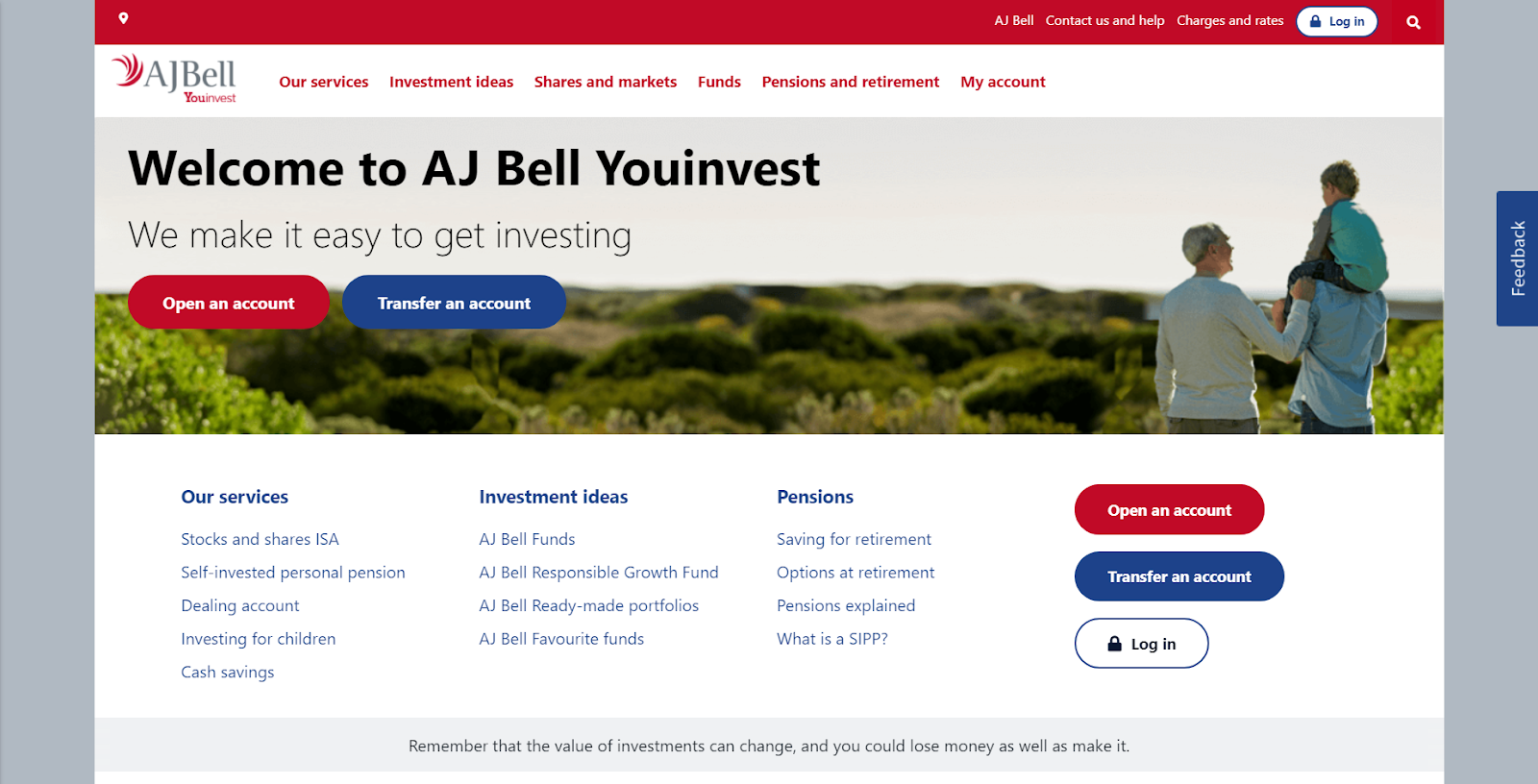

Follow the official website of the broker AJ Bell. Click on the "Open an account" button on the main page to open an account.

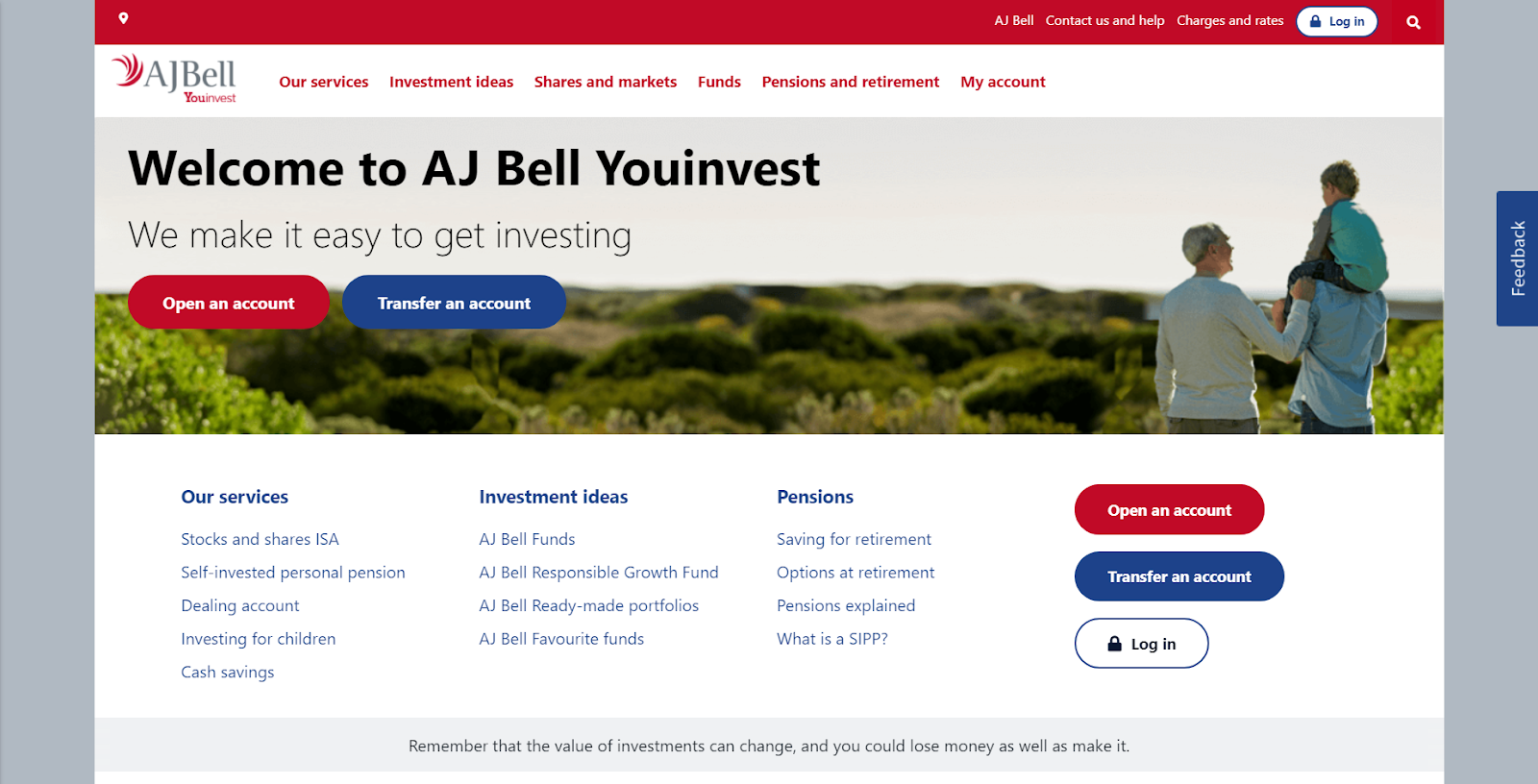

Select the type of account you need: SIPP, Stock & Shares ISA, Lifetime ISA, Dealing account. Here you can learn more about each of the account types, as well as find information on investing in an account for minors and a money savings center.

Before opening an account, study the risks that are possible when investing.

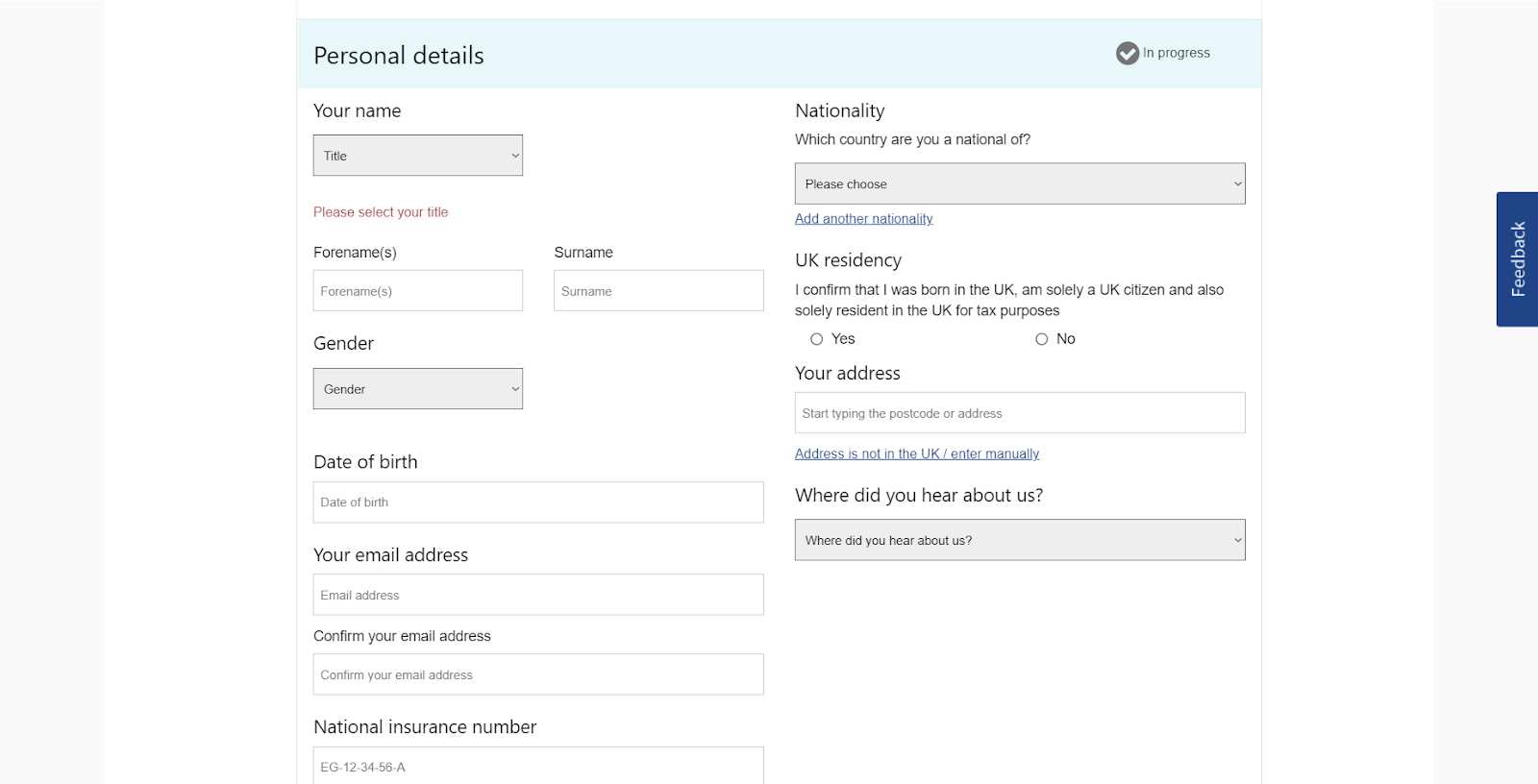

Please indicate your personal information: name, surname, status, place of residence (whether you are a UK resident), date of birth, and email address to contact.

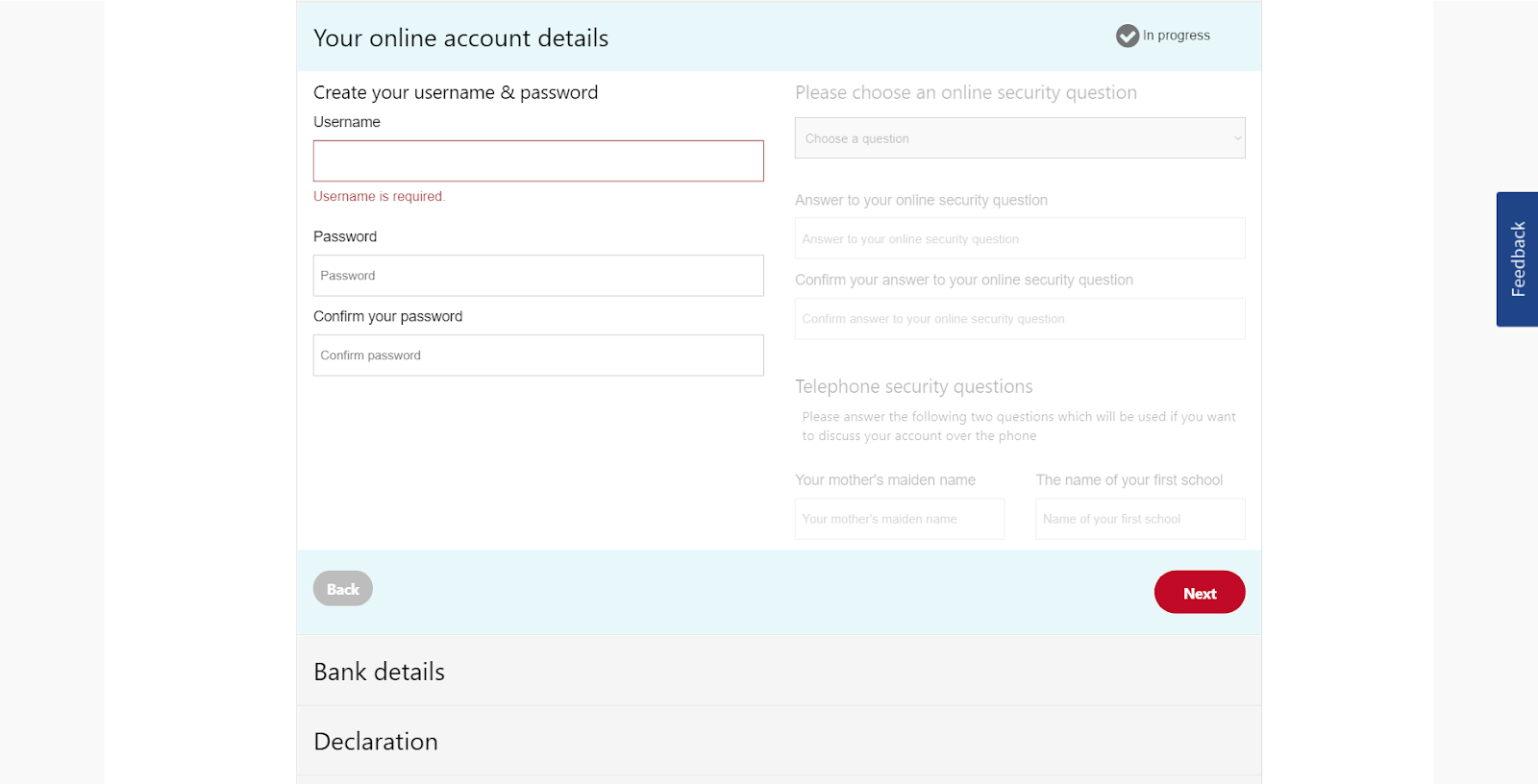

Come up with a username that you will use later as a login to enter your personal account. Also, come up with a password and indicate the answer to security questions (you will need it if you forget the password), and two more questions for authentication via the phone.

Enter your bank card details.

To complete the registration procedure, read the declarations and provide information about your income.

Communication with broker representatives and support service.

Access to viewing financial transactions on accounts.

Access to viewing the history of trades and transactions.

Applications to withdraw funds

Replenishing an account.

Access to the broker's regulatory documents.

Extra services of a broker.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the AJ Bell rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about AJ Bell you need to go to the broker's profile.

How to leave a review about AJ Bell on the Traders Union website?

To leave a review about AJ Bell, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about AJ Bell on a non-Traders Union client?

Anyone can leave feedback about AJ Bell on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.