deposit:

- £1

Trading platform:

- Web platform

- Barclays Mobile App

- FCA

- FSCS

- FOS

Barclays Review 2024

deposit:

- £1

Trading platform:

- Web platform

- Barclays Mobile App

- 1:1

- Only UK securities available, no margin accounts provided

Summary of Barclays Trading Company

Barclays is a moderate-risk broker with the TU Overall Score of 5.23 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Barclays clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. Barclays ranks 47 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

The Barclays broker works only with UK investors who invest in local securities and use exclusively their funds for this.

Barclays is a British multinational bank founded in 1690. Since 1986 Barclays has been providing investment services. The broker is regulated by the Financial Conduct Authority (155595) and is a member of the FSCS Compensation Fund. The holding's banking services are used by more than 48 million clients from 50 countries, but investing through Barclays is available only to UK tax residents. The broker offers over 3,500 financial instruments, including stocks, investment funds, ETFs, and corporate and government bonds.

| 💰 Account currency: | GBP |

|---|---|

| 🚀 Minimum deposit: | From £1 |

| ⚖️ Leverage: | 1:1 |

| 💱 Spread: | Absent |

| 🔧 Instruments: | Shares, bonds, ETF, investment trusts |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Barclays:

- Control of financial activities by the Financial Conduct Authority (FCA) regulator.

- Availability of ground-breaking and user-friendly platforms (web and mobile) that allow you to manage accounts and make transactions.

- No requirements for the size of the minimum deposit on investment accounts.

- Access to research instruments and professional analytics.

- A simple pricing structure, transparent and modest fees.

👎 Disadvantages of Barclays:

- Limited choice of assets: only UK tax payers are eligible. There are no international securities or derivative financial instruments such as derivatives, futures, options, depositary receipts, etc.

- The company does not provide margin accounts and does not support leveraged trading. Clients can only trade with their hard-earned funds.

- Investment accounts can only be opened by UK residents over the age of 18. Broker services are not available to US residents, even if they reside in the UK.

Evaluation of the most influential parameters of Barclays

Geographic Distribution of Barclays Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Barclays

Barclays is a broker that has been providing investment services to UK residents since 1986. The company has no priorities regarding the types of investors. It offers comfortable conditions for both professionals in the securities market and half-baked newbies. The main activity is portfolio investment.

Barclays Bank withholds fixed fees for transactions and also charges a monthly (on SIPP accounts and also a quarterly) subscription fee. The broker's trading fees are a far cry from the lowest: a transaction with an ETF will cost £3, with other assets (including stocks), the fees grow to £6.

Barclays does not offer commission-free trading like other stockbrokers, and this is its main drawback. The company does not provide individual advice, but its website contains podcasts, instructional videos, and research center articles that greatly facilitate investment decisions.

Latest Barclays News

Dynamics of Barclays’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

Barclays provides access to thousands of investment assets, including stocks, bonds, and funds (ETFs and other investment funds), listed in the UK. At the moment, investing in securities on international markets is not available to the broker's clients.

Three ways to invest in Barclays

Experienced investors can create their investment portfolios with Smart Investor. Newcomers to securities trading and investors with minimal skills are assisted in building portfolios and a recommended list of Barclays’ funds. It includes more than 40 Investment Trusts and ETFs, which the company's experts consider to be promising under long-term strategies. The broker offers the following types of investment:

-

Smart Investor. An option for experienced and professional investors who can build their portfolio using the instruments and concepts of the Barclays Research Center. The investor chooses a tax-efficient account (Investment Account, ISA, or SIPP) and personally manages the portfolio. There are no requirements of a minimum investment amount, but it must exceed the commission for the purchase of securities.

-

Plan & Invest. An individual investment plan for clients who prefer long-term investments with the help of professionals. The digital service operates through Barclays Online Banking and the app, so you need to be a Barclays checking account holder to use it. Such investments have a minimum investment period of five years, with an initial investment of £5,000.

-

Ready-made Investments. Balanced investment portfolios consisting of funds with different levels of risk. The company offers investors five types of ready-made portfolios: Defensive, Cautious, Balanced, Growth, and Adventurous. The funds are managed by a team of investment experts from Barclays. Day-to-day investment decisions are made by Blackrock managers, leaders in passive portfolio management. There is no minimum deposit, but for a ready investment, the minimum purchase is £50.

Both experienced traders and newcomers to the stock exchange can invest in UK securities through Barclays. To do this, you need to open one of three investment accounts with a broker and choose a trading strategy.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Barclays’ affiliate program

At the moment, the broker has no affiliate programs.

Trading Conditions for Barclays Users

You do not need to deposit to open an account with Barclays. Investors who have formed their portfolio of assets can start with any amount that can cover the commission for the transaction. A web platform and mobile applications are provided for trading. An interest rate is charged on free funds in investment accounts. The company does not offer margin trading with leverage. The currency used in investment accounts is GBP only.

£1

Minimum

deposit

1:1

Leverage

8/5

Support

| 💻 Trading platform: | Web platform, Barclays Mobile App (Android, iOS) |

|---|---|

| 📊 Accounts: |

|

| 💰 Account currency: | GBP |

| 💵 Replenishment / Withdrawal: | Debit cards, wire transfer, online banking, transfer of assets from ISA or GIA Accounts of another broker, Check-in mobile app, Apple Pay, Android Pay, Pingit, via Barclays Bank Cashier (cash or check) |

| 🚀 Minimum deposit: | From £1 |

| ⚖️ Leverage: | 1:1 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 Spread: | Absent |

| 🔧 Instruments: | Shares, bonds, ETF, investment trusts |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Barclays Bank UK |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Only UK securities available, no margin accounts provided |

| 🎁 Contests and bonuses: | Yes |

Barclays Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Investment Account | From £3 | No |

| ISA | From £3 | No |

| SIPP | From £3 | No |

Stamp duty for the acquisition of shares in the UK is 0.5%, and in Ireland, it’s 1%. The Panel of Takeovers and Mergers (PTM) also charges £1 on all UK stock trades over £10,000.

The experts at Traders Union compared the fees for trading in shares of Barclays Bank and stockbrokers Ally and Charles Schwab. The results of the study are presented in the table below. It should be borne in mind that Barclays makes it possible to trade only securities listed on the UK stock exchanges. Access to international shares (including the United States) is closed to its clients.

| Broker | Average commission | Level |

| Barclays | $3 | Low |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Medium |

Detailed Review of Barclays

Barclays is not only a world-famous bank but also a broker that offers clients to invest in securities listed on the UK stock exchanges. The company allows you to invest in stocks, bonds, exchange-traded funds, and investment trusts. At the same time, the client can form a portfolio on his own or entrust this mission to Barclays experts, which allows not only experienced but also novice investors to carry out exchange trading.

Barclays Q1 2021 financials by the numbers:

-

Total revenue - £5.9 billion.

-

Profit before tax - £2.4 billion.

-

The cost/income ratio is 61%.

-

The return on equity ratio (RoTE) is 14.7%.

Barclays is a long-term investment broker

Barclays offers clients the best pricing for LSE-listed securities from select RSPs and marketplaces. Investors can invest in over 2,500 funds and 1,000 stocks, as well as UK corporate and government bonds. The broker publishes trading ideas, fundamental data on stocks and ETFs, and blockbuster trading news. However, the range of charting tools is limited, which suggests that Barclays is focused on long-term strategies rather than active trading.

The broker's clients can invest and manage accounts through its web platform and Barclays’ mobile apps. A desktop terminal is not provided. The mobile application is protected from unauthorized access with an 8-digit PINsentry security code and 128-bit data encryption. It also provides an automatic logout if the user is inactive for 10 minutes.

Useful services:

-

Investing insights — in-depth market analysis with comments from financial experts.

-

Investment strategies — analyses of up-to-date investment strategies, which are carried out by independent and internal analysts of the company.

-

Word on the Street is a podcast where leading investment experts discuss the latest financial news and events.

-

Market analysis — articles about various markets and key asset classes.

-

Smart Investor with Clare Francis — videos in which Barclays’ Savings and Investment Director discusses investments in simple terms.

-

Active Trader is a paid research platform from partner Web Financial Group (WFG) that delivers real-time pricing, streaming charts, and Level 2 data.

Advantages:

You can open an account online, and filling out the registration form takes no more than 10 minutes.

The monthly subscription fee is charged only after the customer has made a deposit.

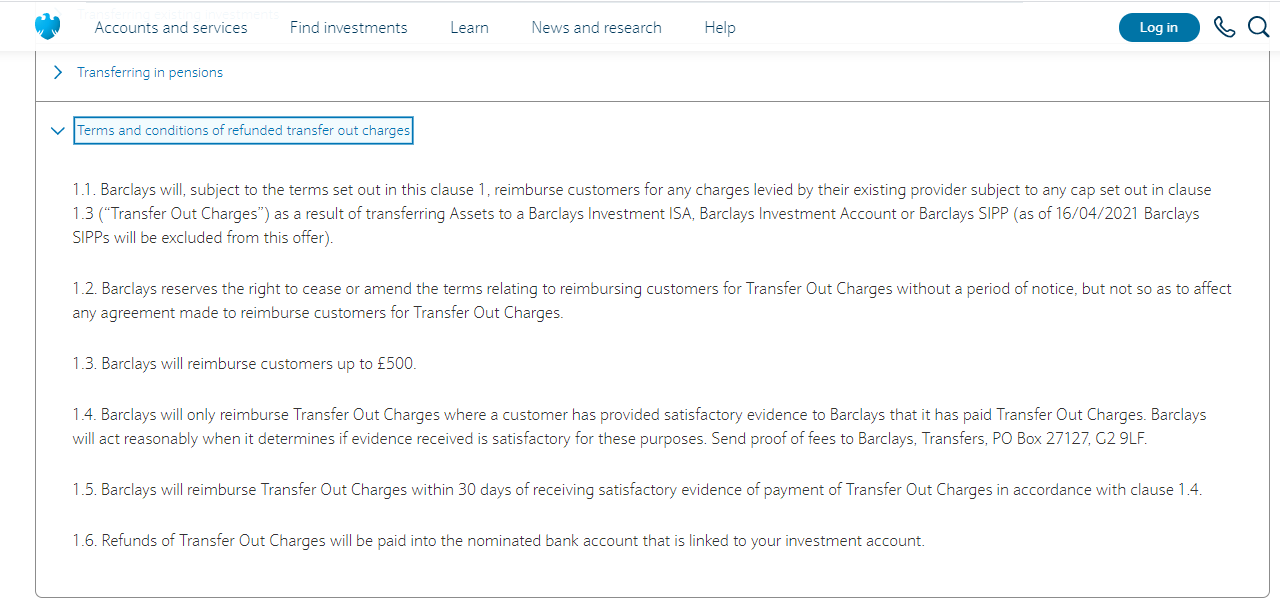

Compensation is available for commissions (up to £500) charged by another broker for transferring assets to Barclays.

Prompt assistance with any questions — by phone or via online chat.

A single Barclays app gives you access to all your open accounts — investment and banking.

How to Start Making Profits — Guide for Traders

Barclays offers clients current bank, savings, and investment accounts. The latter is only available to UK tax residents.

Account types:

Barclays does not have a demo account, but there is no monthly subscription fee until the account is funded. That is, an investor can open an account, study the platform, and then close it (free of charge) if the trading conditions do not suit him.

Bank accounts in Barclays can be opened by residents of any country, but investments can only be by UK citizens who have an account with a local bank.

Bonuses Paid by the Broker

Investment Saver

When opening a GIA, a client can connect a function that allows him to receive interest on his uninvested funds. From June 2, 2020, the broker charges 0.01% per annum. Bonus money is paid monthly. They cannot be withdrawn, but they can be transferred to a trading account and further used for investment. The bonus is not available for ISA and SIPP accounts.

Compensation of fees for transferring assets from another broker

Barclays will reimburse the customer up to £500 within 30 days of the request. Funds are returned to the bank account specified at the time of application, linked to the GIA and ISA accounts. SIPP Asset Transfer Compensation is not awarded.

Investment Education Online

There is a lot of educational information on the Barclays Bank website. Investment resources are available at Investment resources. When you go to the Learn section, a securities section opens, which is designed for beginners with minimal investment experience.

Also in the training section, you can find investment ideas, learn about ready-made asset portfolios, and view lists of available funds.

Security (Protection for Investors)

Investment services and products are provided by Barclays Investment Solutions Limited, a member of the London Stock Exchange and the NEX, which is regulated by the Financial Conduct Authority (FCA). The company is registered under number 2752982. Barclays Bank UK Plc, which provides banking services, is controlled by the Prudential Regulation Authority (No. 759676 in the register of financial services).

Barclays also participates in the Financial Services Compensation Scheme (FSCS), which guarantees its customers compensation in the event the company stops its activities. The maximum payout is £85,000 per investor. In the event of Barclays' violation of its obligations, each client can file a written complaint with the Financial Ombudsman Service (FOS), an independent body established by the UK government to resolve disputes between financial companies and their clients.

👍 Advantages

- The broker and bank are supervised by the UK's most reputable regulators

- In the event of bankruptcy of a company, its clients can receive compensation for funds from FSCS

- Every investor can file a claim with FCA or FOS

👎 Disadvantages

- The client's investment account must be linked to his bank account with a UK financial institution

- To pass verification, you must provide tax documents

- All payments are made only through a linked UK bank account

Withdrawal Options and Fees

-

To withdraw money, you must first transfer funds from your investment account to your linked UK bank account using online banking. The limit on the amount of one transfer is £250,000. There are no restrictions on the number of transfers.

-

The customer can then transfer funds to a debit card or receive cash from their bank's cash desk or ATM.

-

If the customer is outside the UK at the time of withdrawal, they can transfer funds by international bank transfer. SEPA payments are made only in euros, and SWIFT payments are made only in the currency chosen by the client.

Customer Support Service

To contact the company directly, customers can use the chat in the application or on the website or call the numbers indicated in the Contact us section. Chat operators are available 24/7. Telephone support is available Monday through Thursday from 7:30 am to 7:00 pm, and Friday from 7:30 am to 6:00 pm (GMT + 1).

👍 Advantages

- In the application and the chat on the site, you can contact support 5 days during office hours

- Phone numbers listed are for calls within the UK and abroad

- Several ways to communicate

- Broker representatives answer questions in popular messengers

- There is a separate communication channel for people with disabilities

👎 Disadvantages

- Inability to call on weekends and holidays

This broker provides the following communication channels for existing clients and potential investors:

-

phone numbers, as indicated on the website;

-

fax;

-

email;

-

chat in the application;

-

Apple Business Chat;

-

SignVideo (a service for deaf or hearing challenged people who communicate in British Sign Language);

-

Facebook Messenger;

-

Twitter - @BarclaysUK or @BarclaysBizChat;

-

LinkedIn profile;

-

Barclays also has a YouTube channel.

Contacts

| Foundation date | 2060 |

| Registration address | 1 Churchill Place, London E14 5HP |

| Regulation |

FCA, FSCS, FOS |

| Official site | https://www.barclays.co.uk/ |

| Contacts |

Phone:

0800 279 3667

|

Review of the Personal Cabinet of Barclays Bank

The procedure for opening an account with a broker differs depending on whether the potential investor is a client of Barclays Bank. If you already have a checking account with this bank, you can open an investment account through the Barclays Mobile Banking app. If there is no bank account, then you need to register on the broker's website. Below is a brief instruction on how to open an account on the website:

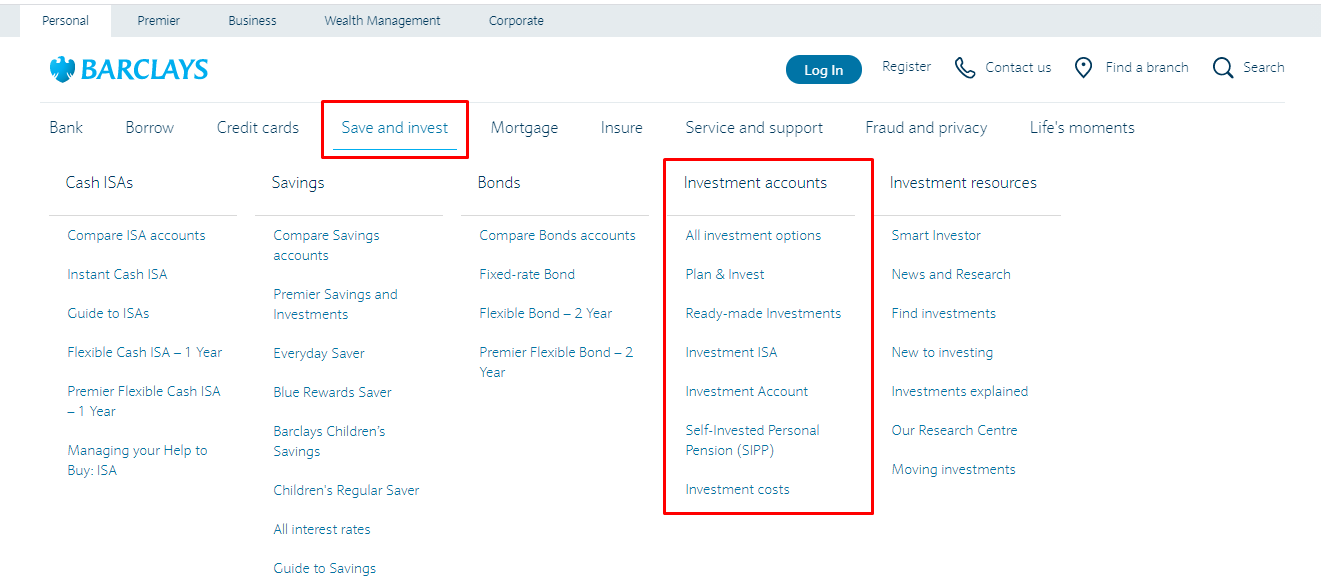

On the main page, click Save and Invest and in the drop-down list select the type of investment account you want to open.

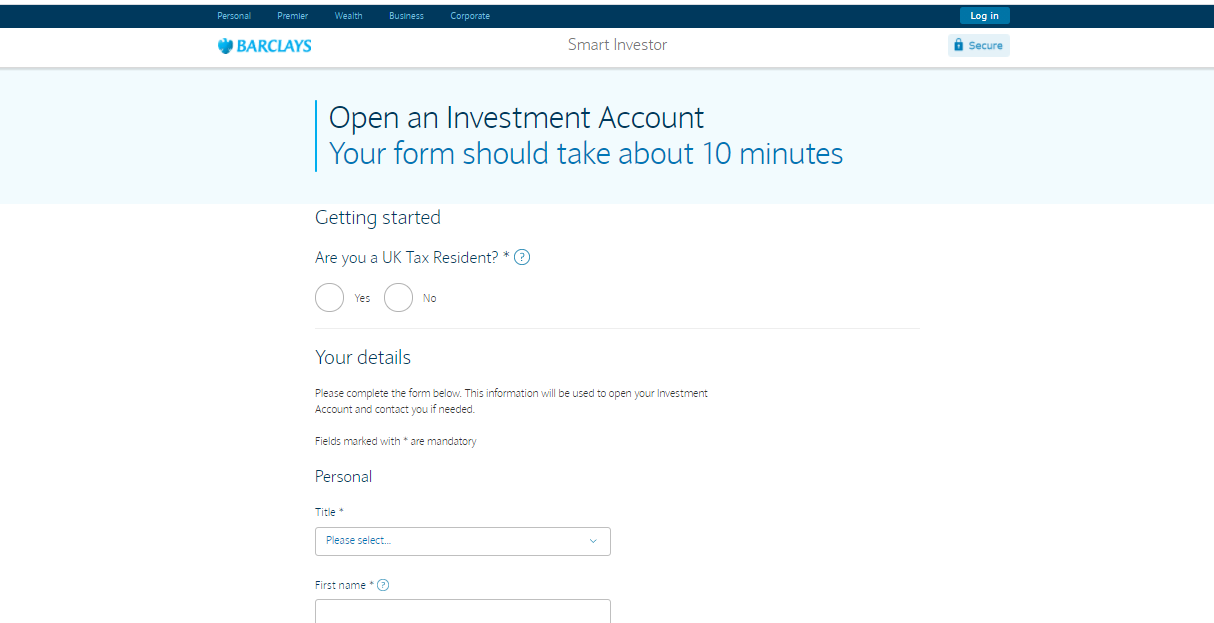

Then click the button as shown in the screenshot below:

Fill out the registration form with your personal details. Also at this stage, you need to confirm that you are a UK tax resident. After that, the broker will request a bank account number, which will be linked to the Investment Account for its further replenishment:

Features of the personal account:

Payment transactions for all types of accounts, including cash, savings, and investment:

Asset search:

Payment transactions for all types of accounts, including cash, savings, and investment:

Asset search:

Also, the following actions can be performed in a Barclays personal account:

-

Transfer the interest that was accrued to your non-invested funds to your investment account.

-

View and track a portfolio of assets.

-

Manage investments.

-

Perform daily banking transactions such as view and manage accounts, transfer money, set up a direct debit, etc.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Barclays rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Barclays you need to go to the broker's profile.

How to leave a review about Barclays on the Traders Union website?

To leave a review about Barclays, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Barclays on a non-Traders Union client?

Anyone can leave feedback about Barclays on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.