deposit:

- $100

Trading platform:

- Quotestream

- Direct Pro

- ChoiceTrade Elite

- FINRA

- SIPC

ChoiceTrade Review 2024

deposit:

- $100

Trading platform:

- Quotestream

- Direct Pro

- ChoiceTrade Elite

- 1:3

- Options trading

Summary of ChoiceTrade Trading Company

ChoiceTrade is a moderate-risk broker with the TU Overall Score of 6.61 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by ChoiceTrade clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. ChoiceTrade ranks 21 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

The ChoiceTrade broker is aimed at cooperating with users who already have experience in trading on Forex and other exchanges and does not offer the most favorable conditions for beginners. The company is agog to cooperate with clients from any country, there are no restrictions on trading opportunities or opening accounts.

ChoiceTrade is a stockbroker that began providing services in 2000 and has steadily introduced ground-breaking technologies into its work. ChoiceTrade is aimed at working with investors who value order execution speed, a minimalistic approach to trading, and reliability. The broker is regulated by two bodies: FINRA (CRD#: 104021/SEC#: 8-52511) and SIPC. The latter regulator guarantees clients financial payments in case of unforeseen circumstances.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | $100 |

| ⚖️ Leverage: | 1:3 |

| 💱 Spread: | From $0 |

| 🔧 Instruments: | NYSE, AMEX, Nasdaq, OTCBB, CME shares, Dow Jones indices, ETFs, options |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with ChoiceTrade:

- A vast array of trading accounts for clients with different needs.

- The broker sets the lowest fees for users, regardless of the type of account.

- The broker is focused on cooperation with clients from different countries, the site interface is presented in more than 30 languages.

- Clients' financial assets are protected up to $500,000 by an independent regulatory body.

- Lightning-quick speed of order execution.

👎 Disadvantages of ChoiceTrade:

- The minimum deposit is $100, which is not always within the power of novice traders.

- The broker does not provide clients with training materials for development in the field of trading and investments.

- The company offers only two ways to replenish a trading account and withdraw earned funds; there are no electronic payment systems.

Evaluation of the most influential parameters of ChoiceTrade

Table of Contents

Geographic Distribution of ChoiceTrade Traders

Popularity in

Video Review of ChoiceTrade i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of ChoiceTrade

ChoiceTrade is a broker that provides favorable conditions for investors and experienced traders. The company is focused on continuous improvement of trading conditions, security, speed of trade executions, and quality of trading platforms. The minimum deposit and account requirements are quite high, and the client must link the trading account to their bank account to register with ACH or ACAT.

The company offers clients different types of accounts, including pension and children's accounts, with the possibility of re-issuing to the owner when he becomes an adult. ChoiceTrade specializes in investing, so there are no tools for active trading.

The broker is ready to cooperate with users from any country, and the site interface has been translated into more than 30 languages. The data that an investor needs to find out before opening a trading account is publicly available on the official website. If you did not find the information that you need, please contact the broker's support service.

Dynamics of ChoiceTrade’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

The broker allows its clients to manage investment portfolios and assets independently but also offers a service that will automate the investment process and make it somewhat easier and faster.

Autotrade/Autostage.

Autotrade/Autostage is a service that generates a trading signal and an order is automatically placed in the ChoiceTrade account on WatchPlus. This order does not work until it is confirmed by the investor himself by pressing the "TradeNow" button. Thus, the investor can check the parameters of the order, edit them, confirm or cancel the sending of the generated order to the market, and accept or reject offers to invest in a particular asset.

-

The service does not have to be used in work; the investor can activate this service for himself, if necessary.

-

The service is completely free to use. The investor can also refuse this service, and then connect again if the need arises. Subscription to the service is possible no more than once a month.

-

The service does not make decisions for the user. The right to open trades or close them remains with the account owner. The task of the service is to inform the investor.

-

The client can not only approve the execution of the order but also change its parameters. For example, the number of lots.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

ChoiceTrade’s affiliate program:

On the official website of ChoiceTrade, there is no information about the availability of a referral program for traders. The company focuses on working with active traders and investors and does not provide an opportunity to receive passive income.

Trading Conditions for ChoiceTrade Users

ChoiceTrade has been providing its services on the market for over 20 years and continues to actively develop to provide its clients with the best service, trading conditions, and high profits. The broker offers various assets for long-term investment, yet, there are no instruments for active trading. The minimum amount for replenishing a trading account is $100; the size of the fee depends on the trading instrument and methods of replenishment of the deposit and withdrawal of funds. Transactions through ACH involve a minimum fee and transactions through ACAT can be as high as $75.

$100

Minimum

deposit

1:3

Leverage

8/5

Support

| 💻 Trading platform: | Quotestream, Direct Pro, ChoiceTrade Elite |

|---|---|

| 📊 Accounts: | Joint, Сustodial, Special, IPS accounts |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | ACH, bank transfers |

| 🚀 Minimum deposit: | $100 |

| ⚖️ Leverage: | 1:3 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 Spread: | From $0 |

| 🔧 Instruments: | NYSE, AMEX, Nasdaq, OTCBB, CME shares, Dow Jones indices, ETFs, options |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Not indicated |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Options trading |

| 🎁 Contests and bonuses: | No |

ChoiceTrade Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Joint account | $30 per trade | From $0 to $75, depending on the payment system |

| Custodial account | $30 per trade | From $0 to $75, depending on the payment system |

| Special account | $30 per trade | From $0 to $75, depending on the payment system |

| IPS | $30 per trade | From $0 to $75, depending on the payment system |

The broker's arsenal includes assets suitable for long-term investment and there are no currency pairs and other instruments for active trading. There is also no information about swaps (position transfer to the next day). Traders Union analyzed and compared the commission rates in ChoiceTrade with the trading fees of other companies popular among traders such as TradeStation and Etrade. Based on the comparison, we identified three levels of commissions: low, medium, and high.

| Broker | Average commission | Level |

| ChoiceTrade | $30 | High |

| TradeStation | $0.53 | Low |

| ETrade | $1 | Medium |

Detailed Review of ChoiceTrade

The ChoiceTrade broker is ready to cooperate with global investors. The only condition that must be met during registration is linking a bank account to a trading account. After registration, the investor will have full-fledged access to the broker's functionalities: trading assets, trade analyses, and others. The broker does not place restrictions on the level of investor experience, however, we warn you: ChoiceTrade sets a fairly high level of the minimum deposit. There are no training materials on the broker's website.

For traders who are considering cooperation with the ChoiceTrade broker, we suggest that you familiarize yourself with the statistics of the company:

-

More than 20 years in the financial services market.

-

Protection of client funds up to $500,000.

-

The company is regulated by two independent regulators.

-

Fees for orders start at $0.

ChoiceTrade is a company for experienced investors

The company's clients have at their disposal tools that allow them to receive significant profits from long-term investments. The number of assets depends on the type of account that the user selected during registration.

The ChoiceTrade broker offers investors a choice of three trading platforms that are designed for clients with different requests and needs.

Useful services of ChoiceTrade:

-

News. Information about the latest developments in the world of finance and investment.

-

Extended charts. The add-on allows you to thoroughly analyze the market situation and choose the most profitable point to enter the market.

-

Real-time alerts.

-

Trader Finder scans.

-

Heatmaps.

-

Option spread strategies.

-

Power Basket.

-

WatchPlus

Advantages:

There is no link to the city or country from which to trade. A trader can make deals from anywhere in the world.

Low fees.

Partnerships with financial regulators allow the broker to protect client funds up to $500,000.

A vast array of trading accounts for traders with different professional backgrounds.

How to Start Making Profits — Guide for Traders

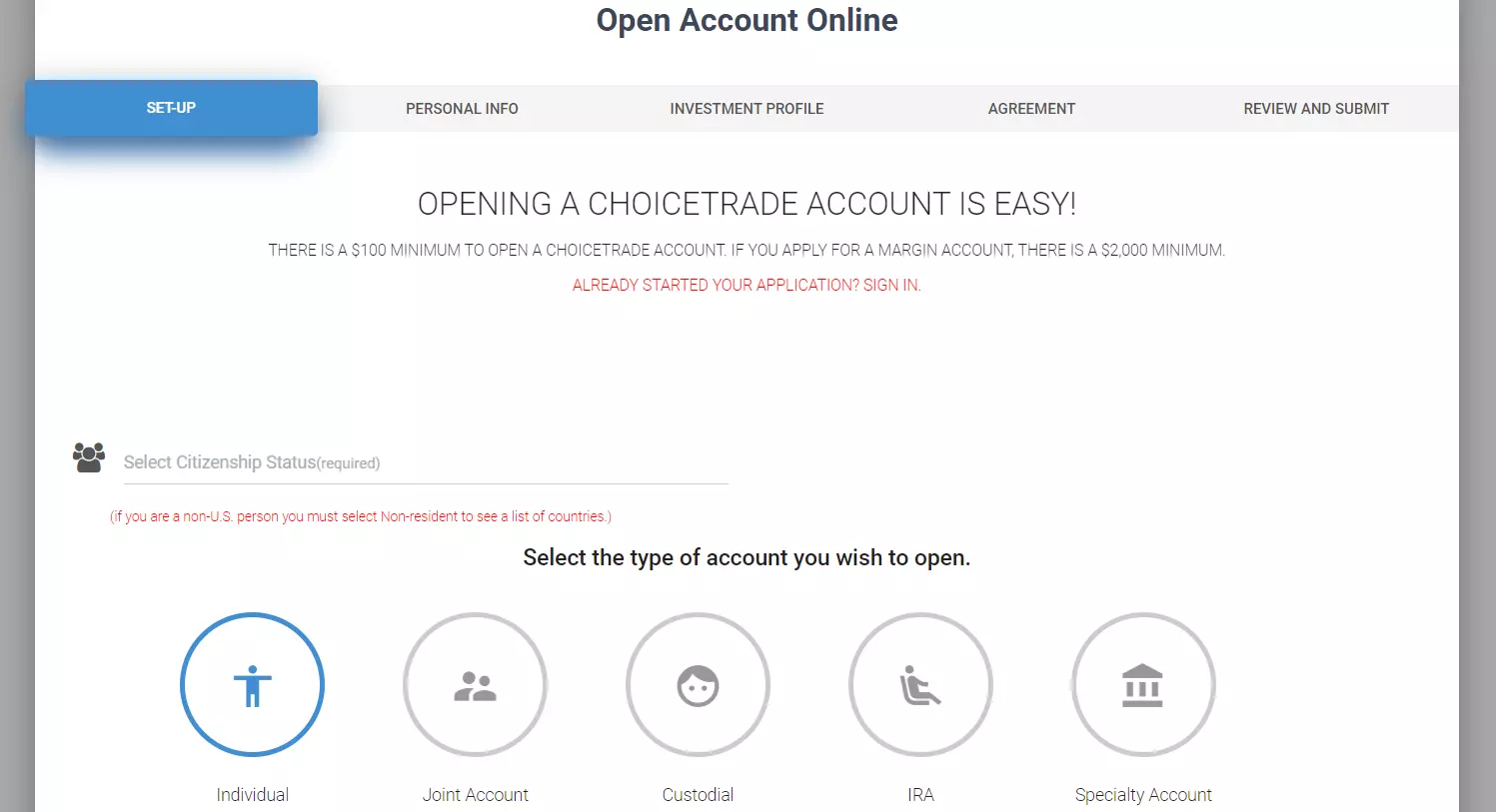

The first step towards cooperation with the ChoiceTrade broker and active trading is registration on the company's website. To make the trading conditions meet your needs, we recommend that you first familiarize yourself with the types of accounts offered by this broker.

Account types:

Accounts differ among themselves in the number of owners and persons who have access to the trading account. The ChoiceTrade company specializes in investing, taking into account the specifics of the market. There is no demo account.

Bonuses Paid by the Broker

The ChoiceTrade broker does not provide financial or other bonuses for its clients. The main bonus that traders receive in cooperation is reliable and accurate execution of transactions, low commissions, and protection of client funds.

Investment Education Online

The ChoiceTrade company focuses on the development of trading platforms and favorable working conditions for traders and investors. Training materials are not provided by the broker. Answers to the most popular questions among customers can be found in the Support section, and in the FAQs subsection. The broker also enables users to conduct financial research.

ChoiceTrade does not offer its clients a demo account, which would allow them to apply various trading strategies and test their knowledge of trading without financial risks. Transactions can be made exclusively on live trading accounts.

Security (Protection for Investors)

The ChoiceTrade brokerage company is a member of the corporation for the protection of investors in securities. It is also registered with the Securities and Exchange Commission. The regulators of the broker's activities are such bodies as FINRA (Financial Industry Regulation Authority) and SIPC (Securities Investor Protection Corporation).

Cooperation with SIPC is an additional guarantee for investors in the protection of their funds. In the event of unforeseen circumstances, clients can receive financial compensation in the amount of up to $500,000, with $250,000 of that provided in cash. The constant development of the broker and the use of ground-breaking technologies make the personal data of clients completely confidential and protected from hacking.

👍 Advantages

- The company is regulated by independent regulatory bodies

- Broker's clients are assured that their funds are under reliable protection

- ChoiceTrade compensates users for financial loss in case of emergencies

👎 Disadvantages

- Users cannot keep their funds in segregated accounts

- There is no information about the location of the broker's real office

Withdrawal Options and Fees

-

Replenishment of the trading account and withdrawal of funds can be made in the user's account. Open your account, select the account with which you want to make transactions, and apply for a withdrawal. For transactions, a bank account is used, which is linked to a trading account at ChoiceTrade.

-

Different methods of replenishment of the deposit and withdrawal of funds involve a different amount of commission. So when working with an ACH account, there is no fee for transactions, but the same operations through ACAT are less profitable since a fee of $25 or more is charged for each transaction.

-

For information on the timing of crediting funds, check with the employees of the bank with which you cooperate. Broker does not provide such data.

-

The main account currency is USD. There is no data on the website about the possibility to use other currencies when trading in ChoiceTrade.

-

The client will be able to start trading only after he has linked a bank account to his trading account.

Customer Support Service

When trading, registering, making a deposit, or withdrawing funds, users often face difficulties. To make the work of traders as convenient as possible, the ChoiceTrade broker offers assistance in solving most problems and questions.

The support service provides traders with assistance on weekdays from 9:00 to 17:00.

👍 Advantages

- There are diverse methods for reaching support

- The broker's website has a FAQs section that contains answers to frequently asked questions

👎 Disadvantages

- There is no way to contact company employees at any time

- There is no built-in chat on the ChoiceTrade website

ChoiceTrade offers its clients the following methods of contacting support:

-

a call to company employees at one of the phone numbers specified in the Contact section;

-

filling out the feedback form;

-

letter to the company's email.

Contacts

| Foundation date | 1999 |

| Registration address | 197 State Route 18 Suite 3000 East Brunswick, NJ 08816 United States |

| Regulation |

FINRA, SIPC |

| Official site | choicetrade.com |

| Contacts |

Email:

service@choicetrade.com,

|

Review of the Personal Cabinet of ChoiceTrade

To access the stock and other markets, the user first needs to open his account with the ChoiceTrade broker. To do this, go to the official website of the broker. On the main page in the upper right corner, there is a button labeled Open an account. Click on it.

Now a page has appeared in front of you where you can select the type of trading account and indicate whether you are a US citizen, a resident of the United States, or another country.

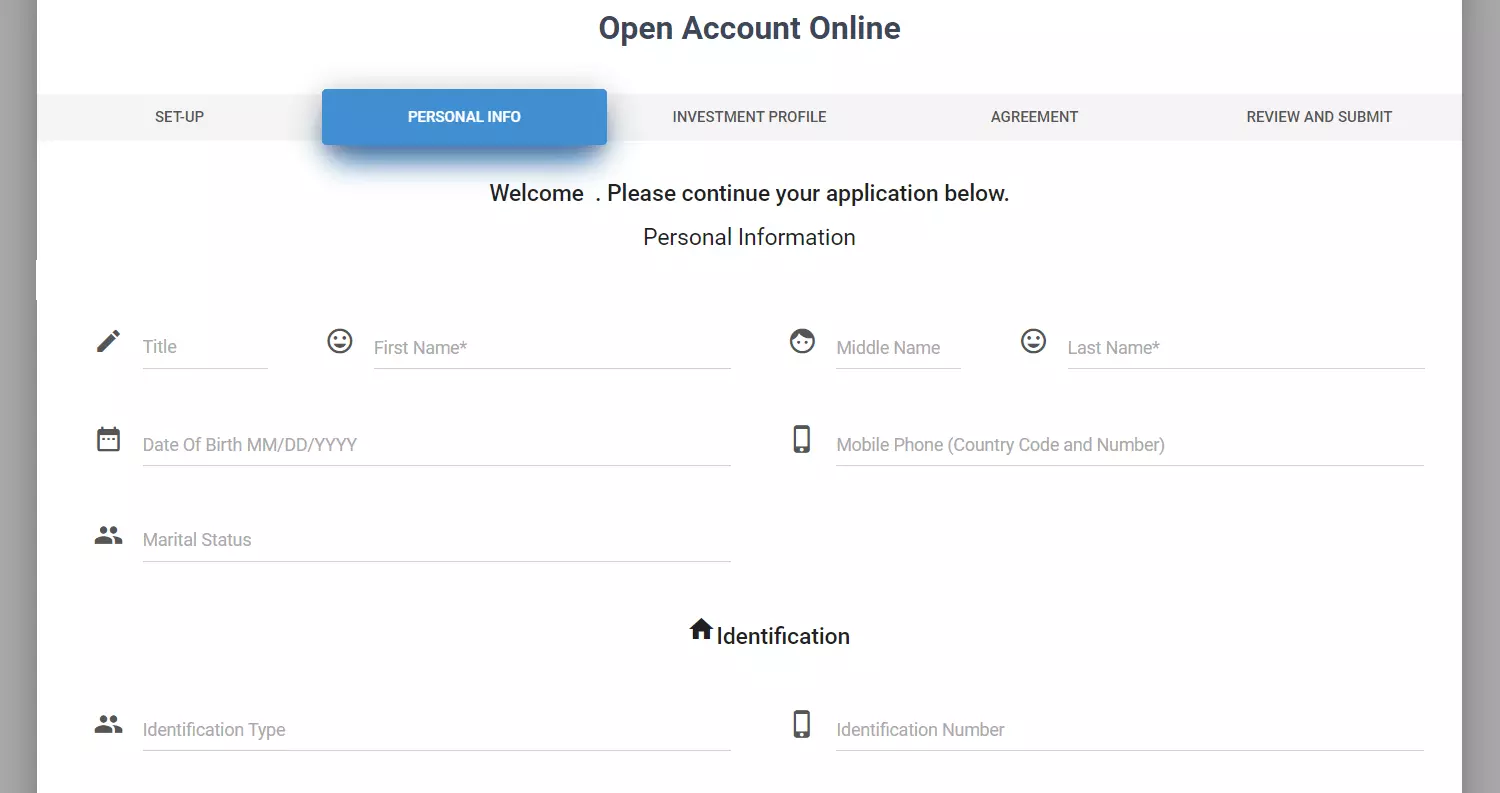

The next step is to fill out the questionnaire with personal data: last name, first name, address, postal code, phone numbers, marital status, additional addresses.

Then provide the broker with information about the source of income, the amount of annual income, liquid assets, if any.

-

Now fill in the affiliate information block.

-

Select the preferred trading account privileges. Trading on margin or cash, the purpose of the trade.

-

Indicate if you have experience in investing and desired goals that you want to achieve while working with ChoiceTrade brokers.

-

Review the Customer Agreement and other documents that govern ChoiceTrade.

-

Then a page will open with the data that you specified during registration. Check if you have entered your data correctly. After verification, you can send a request for cooperation to the ChoiceTrade broker.

You will receive confirmation of opening an account or refusal sent to the email which you indicated during registration.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the ChoiceTrade rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about ChoiceTrade you need to go to the broker's profile.

How to leave a review about ChoiceTrade on the Traders Union website?

To leave a review about ChoiceTrade, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about ChoiceTrade on a non-Traders Union client?

Anyone can leave feedback about ChoiceTrade on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.