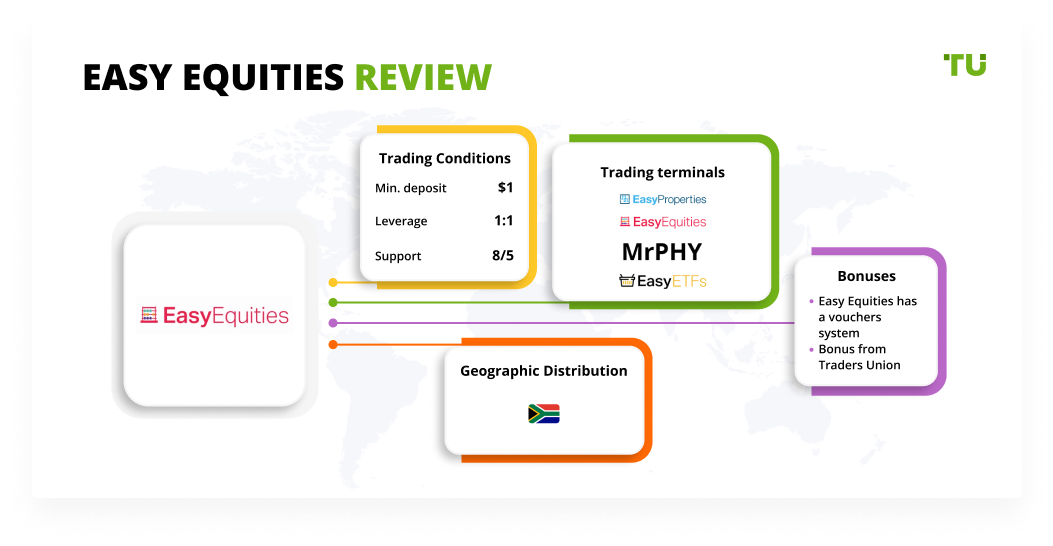

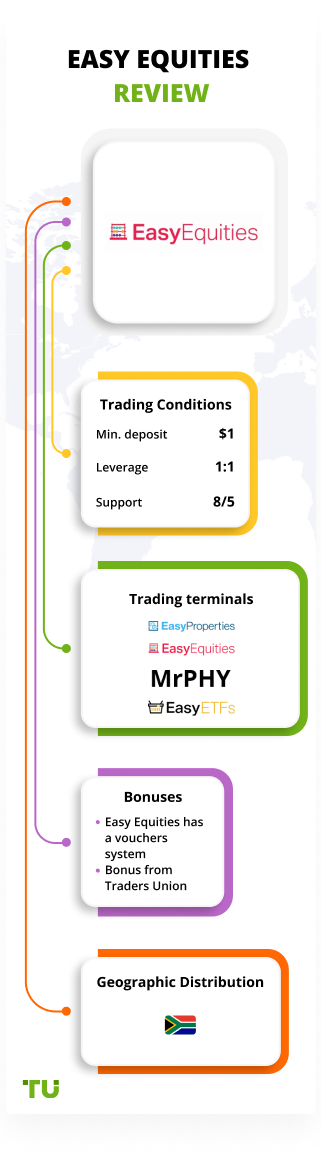

deposit:

- $1

Trading platform:

- EasyProperties

- EasyETFs

- Easy Equities

- MrPHY

Easy Equities (EasyEquities) Review 2024

deposit:

- $1

Trading platform:

- EasyProperties

- EasyETFs

- Easy Equities

- MrPHY

- 1:1

- Trading fractional shares is available

Summary of Easy Equities Trading Company

Easy Equities is a broker with higher-than-average risk and the TU Overall Score of 4.78 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Easy Equities clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. Easy Equities ranks 62 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Easy Equities is a broker for active and passive investors. The company provides optimal conditions for users regardless of their investment experience, and offers access to trading fractional shares and accounts for children under age.

Easy Equities (EasyEquities) is a US stock broker providing financial services in the international market. The company opens access to South African, American and Australian markets and provides an opportunity to trade fractional shares. Investors can choose an individual or corporate account and there are also accounts for children. EasyEquities is a part of two licensed financial services companies — First World Trader and Purple Group.

| 💰 Account currency: | ZAR, AUD, USD |

|---|---|

| 🚀 Minimum deposit: | 1 USD |

| ⚖️ Leverage: | 1:1 |

| 💱 Spread: | Fixed |

| 🔧 Instruments: | Stocks, ETF, ETN, mutual funds, IPO |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Easy Equities:

- Demo accounts with two base currencies to choose from: USA and ZAR.

- Low trading commissions and zero non-trading fees.

- An account for children under age.

- No required minimum deposit amount.

- A possibility to invest independently or use investment offers of the broker.

- Residents of the majority of countries can open an account with the broker.

- Fractional shares are among trading instruments available to traders.

👎 Disadvantages of Easy Equities:

- Deposit and withdrawal take several days.

- The broker offers very few methods of contacting customer support.

- There is no information about the authorities regulating the operation of Easy Equities.

Evaluation of the most influential parameters of Easy Equities

Table of Contents

Geographic Distribution of Easy Equities Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Easy Equities

Easy Equities (EasyEquities) is an international broker offering services to investors from different countries. The company has no restrictions based on the level of professionalism and offers optimal investing conditions that are suitable both to novice market players and to professionals. Specifically, the broker offers its clients pre-selected portfolios of stocks, which can be adjusted, if desired, and used to earn income.

EasyEquities offers several accounts to choose from, including accounts for active trading, savings account, and an account for trading fractional shares in properties. There are also kids’ accounts. There are no limitations on the deposit amount; an investor can deposit any amount of money. In addition to stocks, investors are offered mutual funds and ETFs, ETN, IPO, crypto. Transaction fee is only 0.25% from the transaction amount; a minimum of USD 0.01. Easy Equities does not charge non-trading fees.

However, when performing financial transactions, investors need to keep in mind that this process takes 2-3 working days on average. You also need to be attentive when withdrawing money from an international account, because the withdrawal fee is set by the bank the investor uses. There are not too many ways to contact the broker’s customer support and you cannot contact the company instantly.

Dynamics of Easy Equities’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

Easy Equities provides services to investors regardless of whether they have experience or not. For this reason, the broker provides an opportunity not only to earn a profit from independent trading, but also offers instruments for passive income, which are beneficial for novice investors and for professionals equally.

Baskets

This instrument is suitable both for the beginners and for more experienced market players. Easy Equities selects the so-called ‘baskets’ of instruments that allow you to earn a profit so that the client does not have to build a portfolio on their own; they can simply choose a predefined one.

-

An investor has the right to control the selection of stocks and, if necessary, delete the stocks that they consider unnecessary. However, the client cannot add stocks to the basket.

-

There is a fee for using Baskets.

-

The stocks put into one portfolio are carefully selected by EasyEquities experts.

-

The instruments the investor gets when using Baskets are automatically added to the already existing stocks. This means that Baskets is not a separate portfolio.

-

There is no rebalancing of Baskets.

-

Transactions per each stock collected into a basket are not summed up; they are calculated separately.

Bundles

This is a passive income option. The task of the investor is to choose an option suitable for him/her and trust an expert. An investor is not involved in the management of the portfolio.

-

There is a fee for using Bundles.

-

The instrument is designed for passive investing, which means that all decisions on asset management are made by an expert, the portfolio manager.

-

It is impossible to remove stock from the portfolio. It is impossible to buy stock in the Bundles separately.

-

Portfolio manager makes the decisions on portfolio rebalancing, buying or selling stocks, without the involvement of the investor.

-

There is one fee for all stocks in the portfolio. Investors do not pay for each stock separately.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Easy Equities’ affiliate program:

-

Referral Program. Easy Equities investors can refer new clients to the company and receive a financial reward. First, you need to open your own trading account with the broker, get your own referral link and share it with friends. An investor is awarded ZAR 50 for each user who opens an account on Easy Equities using the referral link. The same amount will also be credited to the referee’s account.

The partnership program provides you with additional income for promoting the broker and attracting new active users. Please note that the referral program is available only to the investors who opened their account with ZAR as the base currency. The program is not available for accounts with other base currencies.

Trading Conditions for Easy Equities Users

Easy Equities provides opportunities for active and passive investing. The broker works with traders from different countries and provides a possibility to earn a profit to users who have no stock trading experience. Easy Equities provides access to the following instruments: stocks, ETFs, ETN, mutual funds and IPO. The broker offers individuals, corporate, savings and kids accounts. There are three account currencies: USD, AUD, ZAR. The instruments available to the client depend on the chosen account currency: American, Australian, South African. The broker also offers its clients Baskets and Bundles investment instruments, which make the investing process easier or automated. The trading is carried out on the broker’s proprietary platforms; the mobile application is available for iOS and Android.

$1

Minimum

deposit

1:1

Leverage

8/5

Support

| 💻 Trading platform: | Easy Equities, EasyETFs, MrPHY, EasyProperties |

|---|---|

| 📊 Accounts: | Individual, Kids, Company & Legal Entities, TFSA, RA, EasyProperties |

| 💰 Account currency: | ZAR, AUD, USD |

| 💵 Replenishment / Withdrawal: | ETF, SID, debit/credit card, EasyFx Transfer, transfer between TFSA accounts |

| 🚀 Minimum deposit: | 1 USD |

| ⚖️ Leverage: | 1:1 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 Spread: | Fixed |

| 🔧 Instruments: | Stocks, ETF, ETN, mutual funds, IPO |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Trading fractional shares is available |

| 🎁 Contests and bonuses: | Vouchers are available |

Easy Equities Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| ZAR | from $0.01 | No withdrawal fee, on withdrawals in USD the fee is charged and its amount depends on the bank, through which the transaction is performed |

| USD | from $0.01 | No withdrawal fee, on withdrawals in USD the fee is charged and its amount depends on the bank, through which the transaction is performed |

| AUD | from $0.01 | No withdrawal fee, on withdrawals in USD the fee is charged and its amount depends on the bank, through which the transaction is performed |

| TFSA | from $0.01 | No withdrawal fee, on withdrawals in USD the fee is charged and its amount depends on the bank, through which the transaction is performed |

| RA | from $0.01 | No withdrawal fee, on withdrawals in USD the fee is charged and its amount depends on the bank, through which the transaction is performed |

| EasyProperties | from $0.01 | No withdrawal fee, on withdrawals in USD the fee is charged and its amount depends on the bank, through which the transaction is performed |

We have not discovered hidden commissions and fees on Easy Equities.

We also compared trading commissions of Easy Equities with other stock brokers — Ally and Charles Schwab. As a result, each broker was assigned a level of commissions. The results of the analysis are in the table below.

| Broker | Average commission | Level |

| Easy Equities | $0.01 | Low |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Medium |

Detailed Review of Easy Equities

Easy Equities is an international stock broker providing financial services to investors from South Africa, America, Australia and other countries. The company’s target audience are the clients with experience in investing as well as the beginners. The broker offers the optimal trading conditions for both categories. In particular, novice investors can obtain basic knowledge in the Learn section, which features free educational materials, and then test the information they obtained using a demo account. The company offers six live accounts, including accounts for active trading, and also savings and fractional share trading accounts. As for the ownership types, there are individual and corporate accounts. EasyEquities provides an opportunity to open a Kids account as well.

Easy Equities in figures:

-

Minimum execution fee — USD 0.01.

-

Over 1,000,000 users opened accounts in Easy Equities.

-

Customer support is available 24h.

-

Deposit and withdrawal takes 2-3 working days.

Easy Equities is a broker for investors with different levels of expertise in the field.

Investors are the target audience of Easy Equities, and the broker provides an opportunity to earn a profit both for independent portfolio management and for passive investing. The latter is possible if the investor uses the Bundles instrument, which allows to invest money without interfering with trading transactions, i.e. the portfolio is entirely managed by an expert. Easy Equities also offers Baskets, pre-selected portfolios with stocks, which can be adjusted, if necessary. The other source of passive income is the referral program of the broker – Easy Equities awards ZAR 50 to the referrer and referee for every client of the investor who opened an account using the referral link and made a deposit.

In order to perform transactions, investors can use the broker’s proprietary platforms. Easy Equities also offers mobile applications for iOS and Android, which make mobile trading possible.

Useful services offered by Easy Equities:

-

Learn Section. The section features information for investors that will help them take the first steps in investing. The information is available in the form of video tutorials on different topics.

-

Help Center Section. Before contacting Easy Equities customer support, a client is advised to review this section, which features answers to the frequently asked questions.

Advantages:

The broker works with investors from different countries.

Investors’ funds are held in separate accounts and Easy Equities has no access to them.

The company offers accounts for children.

The broker charges zero non-trading commissions.

Demo accounts are available to investors to test their trading skills.

Easy Equities provides access to trading fractional shares.

Trading conditions of the company are suitable for active and passive investing.

How to Start Making Profits — Guide for Traders

Easy Equities works with traders from different countries, although the US and Australian residents cannot open accounts with ZAR as base currency with the broker.

Account types:

There are two demo accounts: a virtual USD account with a balance of $10,000, and ZAR with ZAR 100,000.

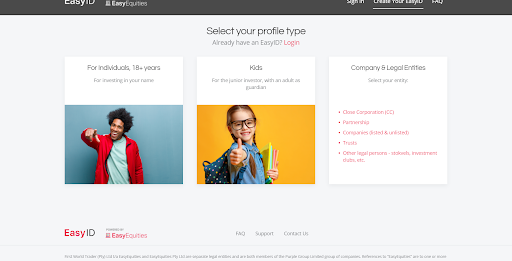

Easy Equities also provides a possibility to open accounts with the following types of ownership: individual (for independent trading), corporate and kids account.

Bonuses Paid by the Broker

Easy Equities has a vouchers system

Every client can buy a voucher and send it as a gift to a friend. The minimum amount is ZAR 50, while the funds the client uses to buy the voucher must be freely available on his/her account. Otherwise, the broker will reject the application for purchasing the voucher. The broker charges 1% fee and also takes into account VAT when the voucher is sent to another user.

Investment Education Online

Easy Equities is a broker that provides investment opportunities to its clients regardless of whether they have experience or not. There is a section on the company’s website featuring educational materials that can help the beginners understand the basics of investing and provide additional information to the more experienced traders.

Users can test new trading strategies and their trading skills on free demo accounts. There are two virtual demo accounts: a USD account with a balance of $10,000, and ZAR account with ZAR 100,000.

Security (Protection for Investors)

Easy Equities is a subsidiary of First World Trader, an authorized financial services provider (reference number FSP: 22588). Also, Easy Equities is a part of Purple Group, a company that also provides financial services and is quoted on JSE (reference number FSP: 46315). Easy Equities ensures reliable security of the funds of its clients. In order to safeguard the funds of the investors in case Easy Equities files for bankruptcy, the broker holds them in a separate company. This is how it works: Easy Equities opens an account in the name of the user with FWT Nominees and specifies that the client is the true owner of the funds kept in the account. Easy Equities does not have access to these funds.

To protect personal data, the broker recommends users to use reliable passwords and also check email in order to monitor the activity on their trading account.

👍 Advantages

- The funds of the clients are held separately from the broker’s equity

- Easy Equities sends reports on all actions performed on the client’s account

- The broker is a part of two licensed companies, providing financial services

👎 Disadvantages

- Two-factor authentication is unavailable

- The broker does not specify the authorities, regulating the operation of Easy Equities

Withdrawal Options and Fees

-

Deposit and withdrawal of funds is performed in the Personal Account, in My Funds tab. Easy Equities offers several methods to perform the transactions: a wire transfer, ETF, SID, EasyFx Transfer. Also a transfer between TFSA accounts is available.

-

The period for crediting the money to the deposit and personal account depends on the method the trader used; it ranges from 2 to 3 working days.

-

It is desirable to submit a request for withdrawal on the working days, as the transactions are not performed on the weekends and holidays. The requests are accepted from Monday to Friday.

-

There is no deposit fee. There is also no withdrawal fee, with the exception of international transfers, where the bank determines the size of the commission.

Customer Support Service

Traders may experience problems during registration, trading, performing transfers or other actions. Easy Equity provides customer support to solve any issues. You can contact it using special tickets.

👍 Advantages

- Easy Equities clients can contact the trading department in order to solve issues related to trading

- There is a FAQ section on the broker’s website with the answer to the most frequently asked questions

👎 Disadvantages

- There are no methods for instantly contacting customer support

- Customer support replies within 24 hours on tickets

- Few methods of contacting customer support

There are several ways to contact customer support:

-

Create a request for a ticket;

-

Call the trading department on the phone (from 9:05 to 16:40).

Easy Equities representatives are also registered on social media: Facebook, Twitter, YouTube.

Contacts

| Foundation date | 1998 |

| Registration address | 16th floor, 25 Owl St, Braamfontein Werf, Johannesburg, 2092 |

| Official site | https://www.easyequities.co.za/ |

| Contacts |

Email:

tradingdesk@purplegroup.co.za,

|

Review of the Personal Cabinet of Easy Equities

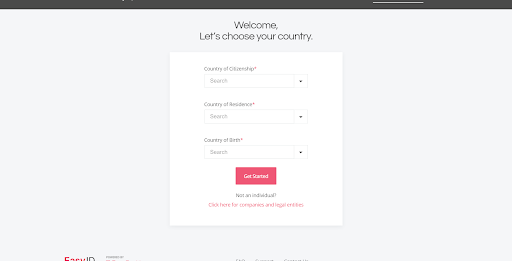

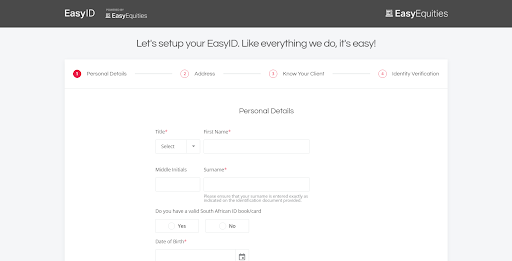

You can start trading assets or investing with Easy Equities once you open an account with the broker. For this, take the following steps:

Visit the broker’s official website. On the Home page, in the upper right corner click on the Register button in order to open a trading account.

In the short form, provide your country of birth, country of residence and country of citizenship.

Select the account type: Individual, Kids, Company & Legal Entities.

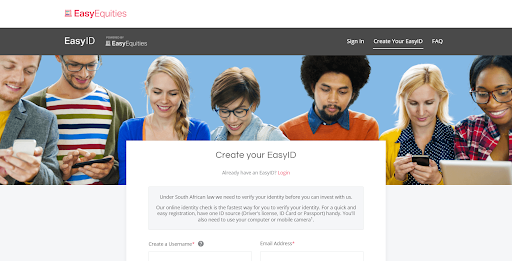

Fill out a form with personal information: create a username, password, provide email and specify how you learned about Easy Equities, enter a referral code (if you have it). Tick the box agreeing to processing of your personal data.

Add personal data: provide your first and last name, marital status. Also tick the appropriate box under the question of whether you have a valid South African ID card. Enter your date of birth, gender, contact number and select the security question.

Provide your address: your place of residence, city, country, postal index.

The next step is filling out the KYC (Know your client): provide your source of income, sector of current income, range of income (amount). The broker also asks if you have investment experience and if you are inclined to take risks.

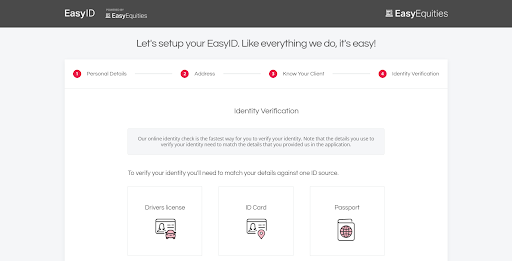

The last step is identity verification, where you choose one of the following: passport, driver’s license or ID card.

Personal Account also features the following tabs:

-

Financial.

-

Trading.

-

Client.

-

Information.

-

Education.

-

Support.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Easy Equities rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Easy Equities you need to go to the broker's profile.

How to leave a review about Easy Equities on the Traders Union website?

To leave a review about Easy Equities, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Easy Equities on a non-Traders Union client?

Anyone can leave feedback about Easy Equities on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.