deposit:

- $1

Trading platform:

- PowerDesk

- Web PowerDesk

- Fineco Mobile

Fineco Bank (FinecoBank) Review 2024

deposit:

- $1

Trading platform:

- PowerDesk

- Web PowerDesk

- Fineco Mobile

- Up to 1:50 for CFDs

- To use the terminal free of charge, you need to make at least 5 transactions per month or have a deposit of €250,000 or more

Summary of Fineco Bank Trading Company

Fineco Bank is a moderate-risk broker with the TU Overall Score of 5.47 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Fineco Bank clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. Fineco Bank ranks 40 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

The broker provides equal trading opportunities for all traders, regardless of their expertise and level of professional training.

FinecoBank is an Italian FinTech company that started its activities in 1999 and merged with UniCredit Xelion Banca in 2008. In 2018, after leaving UniCredit Group, FinecoBank became an independent bank, which also provides online trading services in the stock market. FinecoBank is regulated by the securities market supervisor Consob (Commissione Nazionale per le Società e la Borsa) and is a member of the Single Resolution Fund. The company is headquartered in Milan, Italy. FinecoBank received the Best Broker ICA award at the Italian Certificate Awards 2020 for its easy-to-use trading platform.

| 💰 Account currency: | Euro |

|---|---|

| 🚀 Minimum deposit: | From €1 |

| ⚖️ Leverage: | Up to 1:50 for CFDs |

| 💱 Spread: | From 1 pip for CFDs |

| 🔧 Instruments: | Stocks, options, bonds, futures, certificates of deposit, CFDs on currencies, stocks, commodities, ETFs, ETCs, and CWs |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Fineco Bank:

- No requirements for the size of the minimum deposit.

- Availability of a PowerDesk professional trading platform that is available on any device.

- A vast array of assets in the stock and foreign exchange markets.

- Fixed stock brokerage fee.

- Stock screener for all markets.

- Access to trade on weekends.

- Availability of full-time and online training courses in trading.

👎 Disadvantages of Fineco Bank:

- A fee is charged for using the trading terminal.

- No demo account or risk-free trial trading.

- A monthly account maintenance fee is charged.

Evaluation of the most influential parameters of Fineco Bank

Geographic Distribution of Fineco Bank Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Fineco Bank

FinecoBank provides only one type of account where trading CFDs, stocks, ETFs, bonds, futures, and options are available. Each client can use borrowed funds and the guaranteed margin reaches 50% of the total transaction value. However, when closing a position with a loss, there is a risk of a negative balance sheet.

For trading, FinecoBank provides clients with a proprietary trading platform, on which they can set pending orders, stop loss and take profit, as well as open market orders directly from charts. There is a desktop, mobile, and web version of the terminal. The interface of each of them can be customized to suit your trading strategy. More than 50 indicators for technical analysis are available.

After opening an account, the client gets access to trading more than 10,000 financial instruments on 26 stock exchanges, as well as online support from a personal financial advisor. The main disadvantages of FinecoBank are the presence of fees for servicing the account and using the terminal, as well as the absence of a demo account. Site language is in Italian only.

Dynamics of Fineco Bank’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

FinecoBank provides over 3,000 stocks, 5,000 funds, and 7,000 bonds for trading on 26 Italian and world exchanges.

Fam Target Fund: An exclusive offer from Fineco Bank

Fam Target is a ground-breaking solution that allows you to optimize the time to market at the most favorable moment and to minimize financial risks using a systematic approach. Features of investing through Fam Target:

-

The minimum investment amount is €1,000.

-

The initial portfolio is formed from CFDs that are less sensitive to market fluctuations.

-

The automatic transfer of the portfolio to the target composition of the fund (Fam Sustainable) is carried out gradually.

With the help of a financial consultant, the company is diversifying into a core portfolio of shares with an ESG (Environmental, Social, Governance) profile. The use of such a scheme significantly reduces risks and increases the return on investment.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

FinecoBank’s affiliate program

Currently, there are no partner programs on the FinecoBank website, but the broker offers professional investors cooperation as online financial consultants with training opportunities.

Trading Conditions for Fineco Bank Users

The FinecoBank broker allows clients to work on the 26 largest exchanges in the US and Europe with a fixed fee from €2.95 per share transaction and from €0.95 per contract on futures and options. The size of the margin depends on the type of transaction and can be up to 50%. There is no brokerage fee for CFD trading and leverage up to 1:50 is provided. There are no minimum deposit requirements.

$1

Minimum

deposit

1:50

Leverage

24/7

Support

| 💻 Trading platform: | PowerDesk, Web PowerDesk, Fineco Mobile |

|---|---|

| 📊 Accounts: | Real Account |

| 💰 Account currency: | Euro |

| 💵 Replenishment / Withdrawal: | Bank transfer, Visa bank cards, FinecoBank cards, mobile application |

| 🚀 Minimum deposit: | From €1 |

| ⚖️ Leverage: | Up to 1:50 for CFDs |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | Not indicated |

| 💱 Spread: | From 1 pip for CFDs |

| 🔧 Instruments: | Stocks, options, bonds, futures, certificates of deposit, CFDs on currencies, stocks, commodities, ETFs, ETCs, and CWs |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Not indicated |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No |

| ⭐ Trading features: | To use the terminal free of charge, you need to make at least 5 transactions per month or have a deposit of €250,000 or more |

| 🎁 Contests and bonuses: | Yes |

Fineco Bank Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Real Account | From $0.95 | Yes |

The monthly fee for using the trading platform is €19.95. The experts at Traders Union also compared the size of brokerage fees for trading in FinecoBank with those of its competitors. Below is a comparative table of the results obtained.

| Broker | Average commission | Level |

| Fineco Bank | $0.95 | Low |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Medium |

Detailed Review of Fineco Bank (FinecoBank)

FinecoBank is a company that provides conditions for trading stocks, options, CFDs, and futures on European and American stock exchanges. As many as 5,500 funds and over 3,000 Italian and foreign stocks are available for investment. The improved screening system offered by FinecoBank makes it much easier for an investor to search for liquid assets by technical, fundamental, production, and industry parameters.

Achievements of FinecoBank in numbers:

-

More than 20 years of experience in financial markets.

-

Nearly 1.4 million customers worldwide.

-

Over 40 international banking and brokerage awards.

-

The bank's financial assets amount to €97.1 billion.

-

There are 1,266 employees that work in 410 physical offices.

-

As of March 2021, the company's net profit was €3.3 billion.

-

FinecoBank is a broker for experienced traders who use professional analytical tools during trading.

FinecoBank — Best Broker for Stock Trading

The FinecoBank broker offers to trade in shares using a guaranteed margin of 5-50%, which allows transactions with a minimum deposit. However, margin trading is not provided for other financial instruments. There is an opportunity to work on weekends and holidays, as well as to conduct short sales of shares not included in the client's portfolio when the market falls. To protect positions, automatic closing of orders by stop loss, take profit, and Trailing Stop is used.

The popular PowerDesk web platform makes it possible to work on the broker's website online. You can also trade in a convenient mobile application or through a desktop terminal. If there is €250,000 in the deposit after the closing of five transactions per month, the payment for using the terminal is not charged. Customers under the age of 28 are entitled to free-of-charge account maintenance.

Useful services of FinecoBank:

-

Fineco Book is a service that allows you to view quotes and charts, track orders, and set alerts.

-

A stock screener with a filter is divided into five macro categories.

-

FAM — automatic selection of assets for compiling an investment portfolio.

-

The economic calendar displays the nearest significant events in the stock markets.

-

Volume indicators: Bill Williams, trend, custom, and oscillators.

Advantages:

The ability to monitor the market and control open positions without using a trading terminal using the Fineco Book, which is posted on the broker's website.

Execution of orders for all instruments is available directly from the charts, without the need to change the interface.

With extended trading hours, traders can take advantage of market opportunities from 2:00 am to 11:00 pm ET every day, including weekends and holidays.

More than 1,200 shares are available for hedging.

With active trading, the software is provided free of charge.

If the conditions for the size of the trading volume are met, the FinecoBank broker reduces its fee to 50%.

How to Start Making Profits — Guide for Traders

For independent traders, FinecoBank offers a single account, the trading conditions on which may change depending on the size of the deposit and the client's activity.

Account types:

FinecoBank does not have a demo account, but half-baked traders can get help from a personal financial advisor if necessary.

FinecoBank provides trading conditions suitable for large investors.

Bonuses Paid by the Broker

For the first 3 months after registration, FinecoBank provides new clients with a reduced fixed rate for a contract on futures and options trading.

Investment Education Online

The Formazione section of the web portal contains training materials in video format. In it, beginners and experienced traders will find useful information on trading and exchanging assets.

At finecobank.com, you can sign up for free face-to-face courses and online trading basics. They are practical exercises and masterclasses from the leading specialists of the company.

Security (Protection for Investors)

FinecoBank is licensed to provide brokerage services and is controlled by the securities market supervisor Consob (Commissione Nazionale per le Società e la Borsa). The company is also a member of the Single Resolution Fund, a national guarantee fund.

On June 20, 2020, FinecoBank was awarded the highest EE + stability rating in the stock market according to Standard Ethics criteria. In case of a crisis, it is envisaged to create a Unified Insolvency Fund, which is financed by intermediaries from the Eurozone countries without attracting public funds. Trading CFDs is a foreign exchange transaction and is not regulated.

👍 Advantages

- In controversial situations, you can reach out to the supervisory authority

- Resolution of the insolvency directive is in force

- The company has its proprietary service for monitoring the safety of personal data of customers

- Membership in the National Guarantee Fund

👎 Disadvantages

- CFD trading is not monitored by supervisors

- The choice of payment systems at the request of regulators is limited

- Verification of personal and payment data is a mandatory procedure

Withdrawal Options and Fees

-

Withdrawals are made through a mobile application, by bank transfer, to a FinecoBank card or another bank.

-

You can withdraw no more than €50,000 to a bank account per day. The minimum withdrawal amount via the mobile application is €3,000.

-

Bank transfers to UniCredit Group accounts and withdrawals via the application are free of charge. However, an additional fee may be charged by the intermediary bank or the payee.

-

For foreign clients, withdrawal to a Visa card through branches that are part of the UniCredit group is free of charge. Transferring funds to cards of other banks costs €1.45.

-

Withdrawal via a mobile application or to a card takes 48 hours, but a bank transfer is carried out within 5 working days.

Customer Support Service

For all questions, you can contact the technical support service by phone 24/7.

👍 Advantages

- Online chat

- Contact support at any time of the day

- Possibility to contact any of the physical offices

- Availability of accounts in social networks

- The site has a FAQs section with answers to frequently asked questions

👎 Disadvantages

- You can reach out to support only in Italian

- On weekends, you can only contact Support by phone

This broker provides the following communication channels:

-

phone call to the numbers indicated on the website;

-

send a request by email as indicated on the website;

-

ask a question in the online chat;

-

contact via Instagram, Facebook, or Twitter;

-

send SMS;

-

use the automatic telephone assistant Voice Portal;

-

visit the office in person.

To ask the support team a question, it is not necessary to have an account on the broker's website. This can be done even without registration.

Contacts

| Foundation date | 1999 |

| Registration address | Piazza Francesco Durante, 1120131 Milan, Italy |

| Official site | https://finecobank.com/ |

| Contacts |

Phone:

800.92.92.92

|

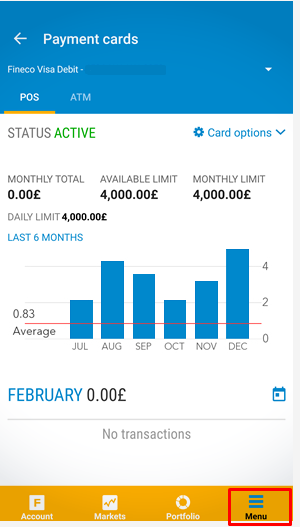

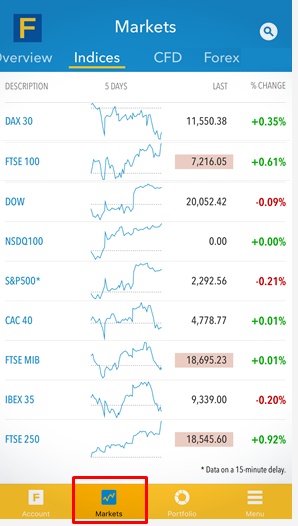

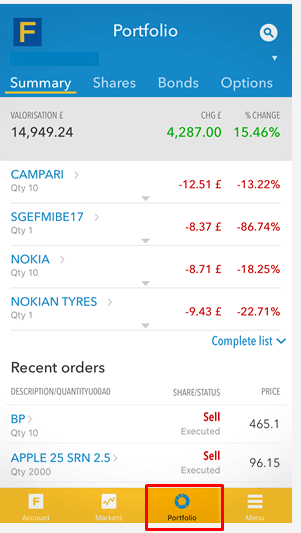

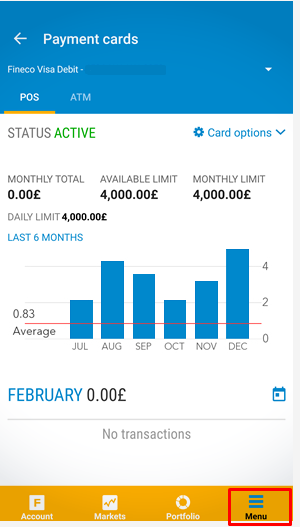

Review of the Personal Cabinet of Fineco Bank

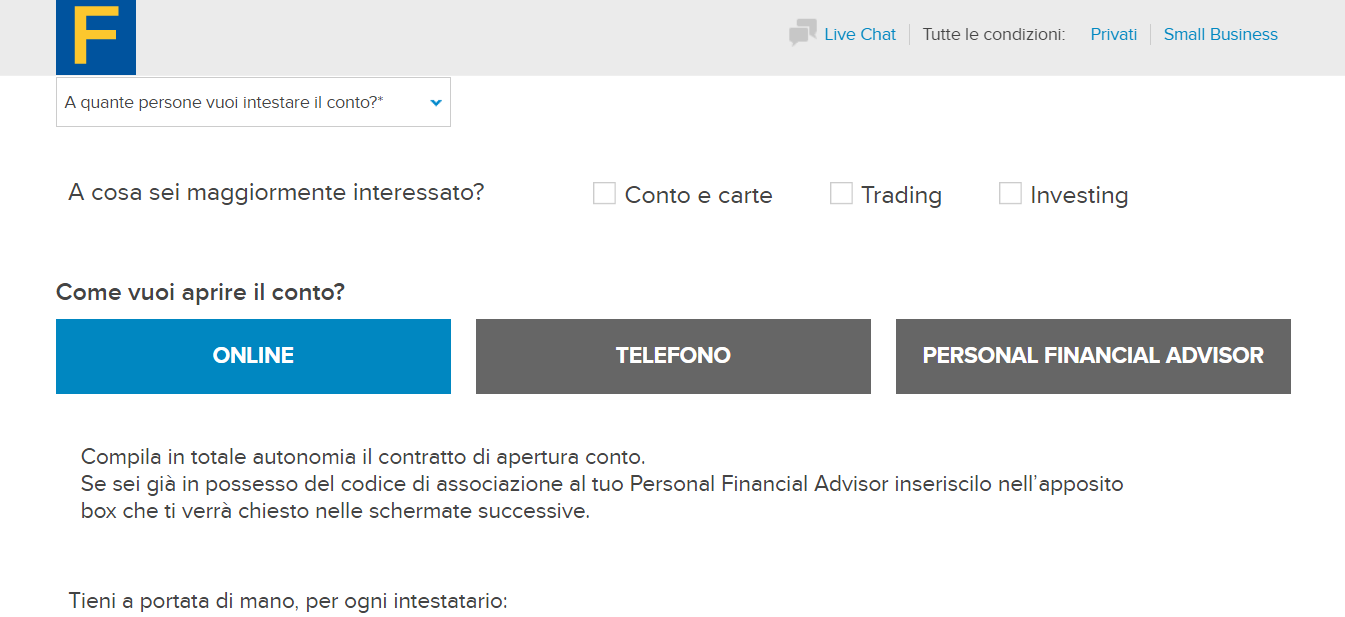

To start cooperation with FinecoBank:

Go to the broker's website and click Apri il conto on any page. The button is located in the upper right corner of the screen.

After going to the registration page, fill out a form in which you indicate your personal data, ID card number, and tax return. Registration can also be done by phone or with the help of a financial advisor, after submitting a request.

After entering the data requested by the broker, an email is sent to the email address specified during registration with instructions on how to activate the account. After that, access to the personal account opens.

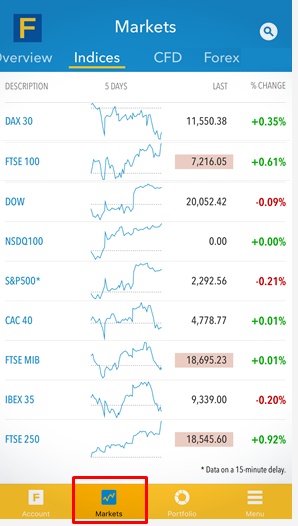

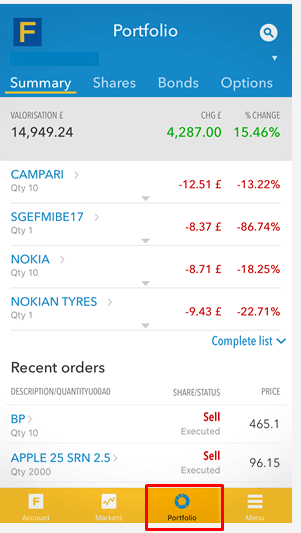

The personal account contains these sections:

1. Account:

2. Markets:

3. Portfolio:

4. Menu:

1. Account:

2. Markets:

3. Portfolio:

4. Menu:

In the Account Management > Conditions section of your personal account, you can see:

-

conditions of the current account;

-

provided discounts and bonuses.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Fineco Bank rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Fineco Bank you need to go to the broker's profile.

How to leave a review about Fineco Bank on the Traders Union website?

To leave a review about Fineco Bank, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Fineco Bank on a non-Traders Union client?

Anyone can leave feedback about Fineco Bank on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.