deposit:

- $2

Trading platform:

- Freetrade Mobile

- FCA

Freetrade Review 2024

deposit:

- $2

Trading platform:

- Freetrade Mobile

- Not at your disposal

- No margin accounts are provided, day trading is prohibited

Summary of Freetrade Trading Company

Freetrade is a moderate-risk broker with the TU Overall Score of 5.41 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Freetrade clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. Freetrade ranks 41 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Freetrade is a long-term investment broker whose trading platform is designed specifically for UK traders.

Freetrade is an independent private start-up company headquartered in London and registered in 2016. In October 2018, it launched a trading app for iOS devices, and in April 2019, a terminal version for Android. Freetrade supports the Freemium pricing strategy and therefore offers its clients free-of-charge trading in US and UK securities. It is a member of the London Stock Exchange, regulated by the FCA (783189), and trades more than £1 billion every quarter. It currently serves over 700,000 UK investors. According to the British Bank Awards in 2019, Freetrade became the best platform for trading stocks, and it was the best platform for online trading in 2020 soon after that.

| 💰 Account currency: | GBP |

|---|---|

| 🚀 Minimum deposit: | From £2 |

| ⚖️ Leverage: | Not at your disposal |

| 💱 Spread: | No |

| 🔧 Instruments: | Stocks, REIT stocks, SPAC stocks, bonds, ETFs, exchange-traded commodities (ETCs), investment trusts, IPOs |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Freetrade:

- No trading fees for trades in stocks and ETFs listed on the US and UK exchanges.

- Vast array of investment assets such as stocks, ETFs, and investment funds; and you can conduct transactions with REIT, SPAC, and IPO securities.

- The minimum deposit available even for a beginner is £2.

- Convenient and multifunctional application for trading and managing investment accounts.

- FCA regulation and protection of funds from FSCS.

- Unlimited stock and ETF trades are available on all account types for basic and instant orders.

- On-site availability of free-of-charge training and detailed decoding of trading conditions.

👎 Disadvantages of Freetrade:

- Currently, you must be a resident of the UK to be able to invest through the broker's application. US citizens and dual US citizens cannot become Freetrade customers.

- The company does not offer trading in futures, options, and CFDs, nor does it offer margin accounts.

- Day trading is not available.

Evaluation of the most influential parameters of Freetrade

Geographic Distribution of Freetrade Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Freetrade

Freetrade allows you to invest in real stocks and securities rather than CFDs (Contracts for Difference), which is why its clients own the underlying assets. The brokerage is currently working to expand the available stock, add European stocks, and speed up withdrawals. At the end of 2021, Freetrade is slated to launch in Europe.

The broker offers clients general investment accounts as well as ISA and SIPP with tax incentives. On all account types, investors can make an unlimited number of trades in stocks and ETFs without commission for basic and instant orders. Trading operations, such as depositing and withdrawing funds, are carried out in the mobile application. It provides several levels of security like entering a PIN, access via Touch or Face ID.

Freetrade customers can only keep cash in their account in pounds sterling. For this reason, when purchasing US stocks, Freetrade exchanges GBP for USD, charging a conversion fee of 0.45% of the transaction amount upon placing an order. Also, customers are charged a monthly account service fee. But the main drawbacks of a broker for an active trader are the inability to trade intraday and use margins.

Dynamics of Freetrade’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

Freetrade prohibits day trading and offers long-term investment products: stocks (including REITs and SPACs), ETFs, investment managed trusts, and IPOs.

REIT stocks — investments with a stable dividend income — help to diversify the investment portfolio

Freetrade enables investors to invest in over 160 real estate investment funds (REITs) commission-free. A REIT can include properties of one or more types of real estates, such as residential buildings, retail buildings, warehouses, hotels, data centers, etc. Benefits and opportunities of REIT stocks:

-

Real estate funds can provide a stable dividend income. Their investors receive up to 90% of REIT profits in the form of dividends.

-

There is a huge variety of REITs to invest in. Freetrade clients get access to work with equity, retail, medical, mortgage, residential, office, industrial, and infrastructure funds.

-

REITs provide easier access to real estate markets. Funds' shares are traded on the stock exchange, so buying them is more liquid than buying physical property.

-

Real estate investment fund transactions are available on GIA accounts. Some REITs can be traded from ISA and SIPP accounts.

-

REITs are exempt from corporate tax on any income earned from the rental business. Only dividends accrued to investors are subject to income tax.

Investing in REIT real estate funds is a fantabulous chance to diversify your portfolio of assets and invest in residential or commercial properties without purchasing them physically.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Freetrade’s affiliate programs

-

"Referral program". Freetrade awards a one-time free promotion worth between £3 and £200 to a current customer if a referral signs up on the mobile app using their link. There is a chance to get a share in British and American companies.

The shares are selected at random and become available 7-10 days after the referred client deposits the general investment account and fills out the W-8BEN form. The referral must make a deposit within 30 days after registration.

Trading Conditions for Freetrade Users

The Freetrade broker offers favorable conditions for UK investors who use long-term strategies. To start investing, you need to deposit at least £2 into your account. All trading and financial transactions are carried out by Freetrade clients in a convenient mobile application. The company does not support intraday and margin trading, both are behaviors it considers to be high-risk for investors. Freetrade does not charge trading fees for stock and ETF trades or withdrawal fees.

$2

Minimum

deposit

1:1

Leverage

24/7

Support

| 💻 Trading platform: | Freetrade Mobile (iOS и Android) |

|---|---|

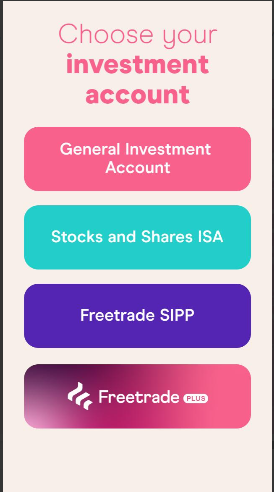

| 📊 Accounts: | General Investment Account, ISA, Plus, SIPP |

| 💰 Account currency: | GBP |

| 💵 Replenishment / Withdrawal: | Bank transfer via Open Banking and TrueLayer, debit card via Google Pay and Apple Pay, ISA asset transfer from another broker |

| 🚀 Minimum deposit: | From £2 |

| ⚖️ Leverage: | Not at your disposal |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | Not indicated |

| 💱 Spread: | No |

| 🔧 Instruments: | Stocks, REIT stocks, SPAC stocks, bonds, ETFs, exchange-traded commodities (ETCs), investment trusts, IPOs |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | No margin accounts are provided, day trading is prohibited |

| 🎁 Contests and bonuses: | Yes |

Freetrade Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| General Investment Account | From 0.5% | No |

| ISA | From 0.5% | No |

| SIPP | From 0.5% | No |

| Plus | From 0.5% | No |

When trading on foreign markets, Freetrade charges a currency exchange fee of 0.45% of the transaction amount. A comparison of the terms of Freetrade and other stockbrokers showed that they do not charge commission for trades in stocks and ETFs.

| Broker | Average commission | Level |

| Freetrade | $0.5 | Low |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Medium |

Detailed Review of Freetrade

Freetrade is a stock broker that offers over 700,000 clients free-of-charge stock and ETF trading in a user-friendly mobile app. Currently, the company provides services only to UK tax-based residents — however, at the end of 2021, Freetrade intends to enter the international market and begin serving investors from the Netherlands and Ireland, and then from all over Europe.

The range of Freetrade instruments for trading:

-

more than 4,000 shares;

-

over 200 ETFs;

-

over 140 investment managed trusts;

-

over 160 real estate investment funds (REITs);

-

shares of over 40 Special Purpose Acquisition Companies (SPAC).

Freetrade is a stockbroker for long-term investment in US and UK securities

Freetrade offers trading in securities of both UK and US companies. An investor can invest in UK stocks that are listed not only on the FTSE 100 but also in smaller markets such as the FTSE 350 and AIM. As for US stocks, Freetrade provides clients with access to the securities of the largest US corporations such as Apple, Amazon, and Tesla, which are listed on the NYSE and Nasdaq. In addition to stocks and ETFs, traders with Freetrade accounts can invest in companies that have recently passed IPOs, without paying commissions.

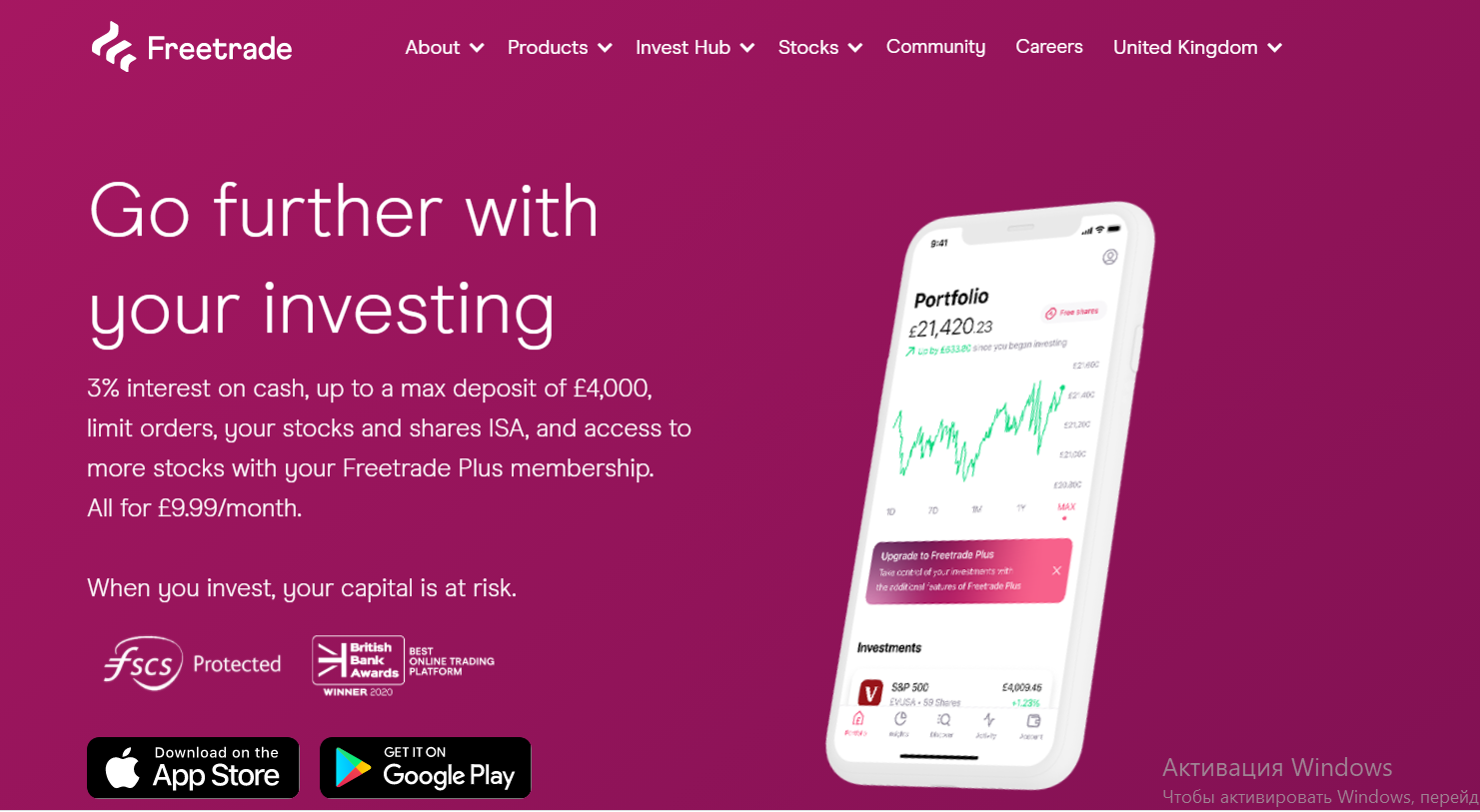

Freetrade currently does not have a desktop or web terminal, so its clients can only trade through mobile apps compatible with iOS and Android operating systems. The company's website contains the following basic requirements for devices: iOS 10.3 for iPhone and 14 for iPad, and Android 7.0, and higher. The app can only be downloaded from UK software stores and cannot be installed on jailbroken smartphones.

Useful Freetrade services:

-

Investment fee calculator. A potential client can calculate how much he will save by trading with Freetrade. The calculation is made based on the entered data: account type, size of the initial portfolio, number and amount of transactions per year, terms of investment placement.

-

Calendar of upcoming IPOs. Allows you to track the most anticipated public offerings that will take place soon. The user can sort offers by industry and also view a list of recent IPOs.

-

Free distribution of letters by email. Clients can subscribe to receive company news, daily market, and key events in the world, and materials for deep diving into investing.

Advantages:

Affiliates and their referrals each receive one free promotion worth £3-200.

All Freetrade accounts are subject to the Financial Services Compensation System (FSCS) with payouts of up to £85,000 per customer.

An investment account is opened and replenished online — in a mobile application.

The monthly maintenance fee for ISA, SIPP, and Plus accounts is £3-9.9. The GIA General Investment Account without tax credits is provided free of charge.

In the mobile application, you can reach out to the technical support representatives 24/7.

Freetrade focuses on long-term investing in clients' funds, therefore, day trading using margins is not available here. At the same time, the broker offers passive investors a wide range of products to form a diversified portfolio of assets.

How to Start Making Profits — Guide for Traders

UK residents who trade in securities can operate from one or more investment accounts. The broker offers 4 types of accounts with a minimum deposit of £2.

Account types:

Currently, the broker's clients cannot test the offered trading conditions on training (demo) accounts.

Freetrade offers favorable conditions to UK investors who not only trade in securities but also want to receive tax benefits on their retirement savings.

Bonuses Paid by the Broker

Free Share

An investor who signs up on the mobile app using a current Freetrade client link and then deposits within 30 days of opening a GIA account will receive one free share worth £3-200. Securities of the USA and Great Britain are provided. Promotions are selected at random and are credited 7-10 days after the account is credited.

Investment Education Online

Freetrade has a lot of educational materials that can help newbies start investing. Useful information can be found in the Learn and Help sections. The site also has a Community — a forum with ideas and discussions on exchange trading.

Freetrade does not provide for the application of the acquired knowledge in practice without financial losses, since the company does not provide demo accounts.

Security (Protection for Investors)

Freetrade is the trade name of Freetrade Limited, a company registered in England. It is a member of the London Stock Exchange and is regulated by the FCA — the UK Financial Conduct Authority (license 09797821).

Freetrade complies with all relevant FCA regulatory standards, including keeping customers' money and securities in segregated accounts. Registered traders' assets are protected by FSCS up to £85,000 per client. The broker regularly undergoes financial audits by the independent consulting company PwC. Also, its clients can send a complaint to the Financial Ombudsman Service free of charge.

👍 Advantages

- Operations are supervised by a reputable financial regulator

- Customer funds and assets are held in segregated accounts

- In case of violation by the broker of the agreement on the provision of services, registered traders can file a complaint with the supervisory authority

👎 Disadvantages

- Wire transfers are the only way to withdraw funds

- You cannot open an account without providing the UK National Insurance number

Withdrawal Options and Fees

-

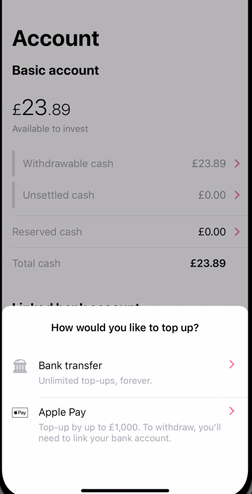

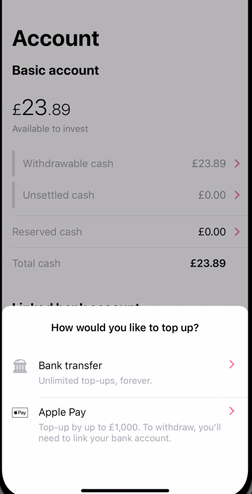

A withdrawal request is made in the mobile application through the "Account" menu. To be able to deposit and withdraw money, you must link your UK bank account to your Freetrade account. Withdrawals to cards or e-wallets are not permitted.

-

Customers can only withdraw funds via Apple Pay or Google Pay if they have used them to deposit via bank transfers.

-

It takes 3-5 business days to process your withdrawal request by bank transfer.

-

Cash from a sold investment cannot be requested for withdrawal until it is paid and credited to the account. Usually, the money appears on the balance in 2-3 business days after the completion of the transaction.

Customer Support Service

Live communication with support representatives is carried out through the chat segment of the Freetrade mobile application.

👍 Advantages

- You can reach out to the support team 24/7

- Long wait for a response on Twitter and Facebook

👎 Disadvantages

- Online chat is unavailable on the website

- No phone support

A broker's clients can:

-

contact operators through the chat of the Freetrade application;

-

write to email;

-

send a letter by regular mail.

Also, company profiles are featured on Twitter, LinkedIn, Instagram, and Facebook.

Contacts

| Foundation date | 2016 |

| Registration address | Techspace Aldgate East, 32-38 Leman Street, London E1 8EW |

| Regulation |

FCA |

| Official site | https://freetrade.io/ |

| Contacts |

Email:

questions@freetrade.io hello@freetrade.io, |

Review of the Personal Cabinet of Freetrade

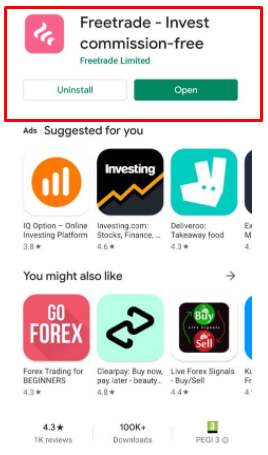

Currently, the broker has only a mobile application, so the opening of a trading account must be done using that platform.

This is a quick guide to creating an account with Freetrade:

On the Freetrade Homepage, go to Google Play or Apple Store.

On Google Play or Apple Store, download the app. It can be set up and used by UK tax residents who have a local bank account.

Select the type of account you want to open:

Fill out the registration form. UK citizens indicate first name, last name, date of birth, address, nationality, email, NI (National Insurance) number. Residents (but not UK citizens) enter the appropriate National Identification Number instead of the NI. Next, you need to confirm your email address and come up with a 4-digit access code. The broker can confirm the identity automatically according to the specified data. If automatic verification fails, the user receives an email with a list of documents that must be submitted for verification. After that, you need to link your UK bank account to your Freetrade account.

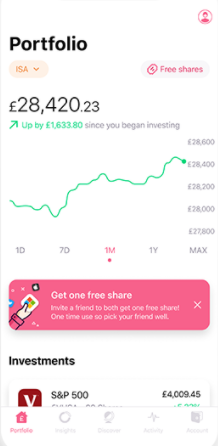

In the Freetrade personal account, a trader can perform the following actions:

1. Replenish open accounts:

2. View available stocks and ETFs, and use the securities search function according to a specific criterion:

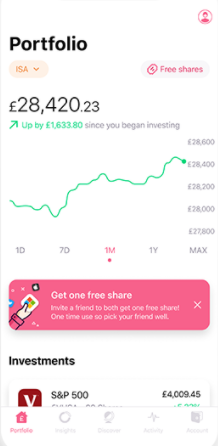

3. Track the movement of funds (growth or decline of investments) through the Gain / Loss menu, which is displayed under the value of the investment portfolio on the Portfolio screen:

1. Replenish open accounts:

2. View available stocks and ETFs, and use the securities search function according to a specific criterion:

3. Track the movement of funds (growth or decline of investments) through the Gain / Loss menu, which is displayed under the value of the investment portfolio on the Portfolio screen:

Also in the Freetrade application, you can:

-

Contact support.

-

Check the balance of your personal funds.

-

Change personal information.

-

Request withdrawals.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Freetrade rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Freetrade you need to go to the broker's profile.

How to leave a review about Freetrade on the Traders Union website?

To leave a review about Freetrade, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Freetrade on a non-Traders Union client?

Anyone can leave feedback about Freetrade on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.