deposit:

- $10 000

Trading platform:

- Futures Trading Platform

- web and mobile versions

- CQG Q Trader

- CQG Integrated Client

- Sterling Trader Pro

- LS Trader

- Livevol X

- Eze EMS Pro

- Derivix

- Wex

- SILEXX OEMS

- CME Direct

- CTS T4

- Options City (VelA) Metro

- Trading Technologies TT

- Rithmic

- FINRA

- SEC

- SIPC

- NFA

Lightspeed Review 2024

deposit:

- $10 000

Trading platform:

- Futures Trading Platform

- web and mobile versions

- CQG Q Trader

- CQG Integrated Client

- Sterling Trader Pro

- LS Trader

- Livevol X

- Eze EMS Pro

- Derivix

- Wex

- SILEXX OEMS

- CME Direct

- CTS T4

- Options City (VelA) Metro

- Trading Technologies TT

- Rithmic

- Margin trading available: 1:4 during the day and 1:2 at night

- Different accounts may be required to trade different assets

Summary of Lightspeed Trading Company

Lightspeed is a moderate-risk broker with the TU Overall Score of 5.95 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Lightspeed clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. Lightspeed ranks 32 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Lightspeed is a broker aimed at American investors who already have considerable experience in trading in the stock market.

Lightspeed is an American stockbroker for experienced investors. The company is overseen by the US Securities and Exchange Commission (SEC, 0001122636 ), the US Financial Industry Regulatory Authority (FINRA) and NFA (0330872). The SIPC, the Securities Investor Protection Corporation, is responsible for compensating Lightspeed customers in the event the broker files for bankruptcy. Lightspeed specializes in providing investors with access to the stock markets, offering multi-ownership accounts and instant order execution.

| 💰 Account currency: | USD, it is possible to open a trading account in another currency for non-US residents |

|---|---|

| 🚀 Minimum deposit: | $10,000 |

| ⚖️ Leverage: | Margin trading available: 1:4 during the day and 1:2 at night |

| 💱 Spread: | From $2.50 per trade |

| 🔧 Instruments: | Stocks, options, futures |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Lightspeed:

- A wide selection of trading platforms for the different needs of a trader.

- The ability to test the trading conditions of the broker without financial risks, on a virtual account.

- The company offers accounts for trading different assets and with different forms of ownership.

- A Lightspeed customer can earn additional income by participating in the affiliate program.

- Basic training materials for working on the Lightspeed platforms are available on the broker's website

👎 Disadvantages of Lightspeed:

- Expensive minimum deposits.

- Lack of investment programs and other ways to generate passive income.

- The broker charges clients a commission for non-trading operations like holding positions, closing an account, maintaining an account, etc.

Evaluation of the most influential parameters of Lightspeed

Geographic Distribution of Lightspeed Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Lightspeed

Lightspeed is a broker for professional stock market participants. The company has set a high level of minimum deposits that are not comfortable for beginners, but it also offers over 10 trading platforms for investors with different needs. The broker prioritizes independent trading by clients and offers them optimal trading conditions. For the same reasons, investment programs and account management services are not available here.

At the same time, the broker differs from competitors in a higher speed of execution of trades, as well as a low level of commissions in comparison with popular stock brokers. Every client account is protected from a broker's financial collapse: Lightspeed works with the SIPC to guarantee compensation in case of unforeseen circumstances.

Among the drawbacks of the broker, one can single out high minimum deposits, the absence of electronic payment systems for replenishing an account and withdrawing funds. Lightspeed also charges customers for account maintenance, inactivity, transaction cancellation, and other non-trading operations.

Dynamics of Lightspeed’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

Lightspeed is a stockbroker for professional investors. The company is focused on cooperation with clients who prefer to manage their capital on their own and does not offer services for copying trades and automatic trading.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Lightspeed’s affiliate program:

-

Web Partner. The program is suitable for investors who have their own website and financial professionals. Depending on the partner's capabilities, the Lightspeed broker offers the following cooperation options: sending emails to the addresses that are in your database, advertising the broker on its site in exchange for a financial bonus, or providing free referral services. It is also possible to receive funds for attracting new clients to the company.

The referral program allows you to receive additional income without making trades. The reward depends on the manner of cooperation with the broker and the referral's activity.

Trading Conditions for Lightspeed Users

Lightspeed provides a comfortable trading environment for professional investors. The client may choose one of 15 trading platforms and a trading account with the desired form of ownership, which may be: individual, corporate, joint, or retirement. Trading is available both in PC applications, in web versions, and mobile applications. Investors can trade exclusively with their own funds and margin trading. Among the available assets for trading are stocks, options, and futures. The size of the minimum deposit depends on the trading platform that the client chooses for trading and starts from $10,000.

$10 000

Minimum

deposit

1:4

Leverage

8/5

Support

| 💻 Trading platform: | LS Trader, Sterling Trader Pro, Livevol X, Eze EMS (Real Tisk) Pro, futures Platform, Derivix, Wex, SILEXX OEMS, CME Direct, CQG Integrated Client, CQG QTrader, CTS T4, Options City (VelA) Metro, Trading Technologies TT, Rithmic, Web & Mobile |

|---|---|

| 📊 Accounts: | Individual Account, Joint Account, Corporate Account, LLC Account, Partnership Account, Trust Account, Retirement Account, and demo |

| 💰 Account currency: | USD, it is possible to open a trading account in another currency for non-US residents |

| 💵 Replenishment / Withdrawal: | Bank transfers, ACH, Check, ACAT |

| 🚀 Minimum deposit: | $10,000 |

| ⚖️ Leverage: | Margin trading available: 1:4 during the day and 1:2 at night |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0,1 |

| 💱 Spread: | From $2.50 per trade |

| 🔧 Instruments: | Stocks, options, futures |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Different accounts may be required to trade different assets |

| 🎁 Contests and bonuses: | No |

Lightspeed Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Individual Account | From $2.50 per trade | $25 internal bank transfer, $50 external bank transfer, $25 check |

| Joint Account | From $2.50 per trade | $25 internal bank transfer, $50 external bank transfer, $25 check |

| Corporate Account | From $2.50 per trade | $25 internal bank transfer, $50 external bank transfer, $25 check |

| LLC Account | From $2.50 per trade | $25 internal bank transfer, $50 external bank transfer, $25 check |

| Partnership Account | From $2.50 per trade | $25 internal bank transfer, $50 external bank transfer, $25 check |

| Trust Account | From $2.50 per trade | $25 internal bank transfer, $50 external bank transfer, $25 check |

| Retirement Account | From $2.50 per trade | $25 internal bank transfer, $50 external bank transfer, $25 check |

There is no information on swap charges (commission for transferring an order to the next day).

We've also compared Lightspeed’s fees to its competitors. Based on the research, the brokers were assigned low, medium, or high commission levels.

| Broker | Average commission | Level |

| Lightspeed | $2.5 | Low |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Medium |

Detailed Review of Lightspeed

Lightspeed is a stockbroker that allows investors to accumulate capital by trading in stock markets. The company focuses on independent trading and there are no investment programs, the user personally manages his capital, and makes decisions about buying and selling assets.

Lightspeed in figures:

-

15 is the number of trading platforms that are available to clients on the broker's website.

-

$10,000 is the minimum deposit if a trader has chosen the Lightspeed web platform for trading.

-

3 offline offices are located in New York, New Jersey, and Chicago.

-

$250,000 is the maximum amount that can be covered in case of unforeseen circumstances.

Lightspeed is the best broker for professional investors in the US

Lightspeed offers classic trading assets such as futures, stocks, and options. The broker has many platforms, including Lightspeed Trader, where more than 100 order routing directions are available, Sterling Trader Pro, which can be customized for you, and Livevol X with sophisticated risk analytics, etc.

Among the presented trading platforms there are mobile applications, web versions, and full-fledged applications that must be installed on a PC.

Useful services of Lightspeed investment:

-

Reviews. Before starting work with Lightspeed, an investor can read the reviews of the company's clients and, based on this information, decide on cooperation.

-

Active trading blog. This section contains posts of traders about profitable offers in the market, the current situation, and possible events.

-

News. Section with news about the broker's work, its innovations, expanding opportunities, new offices, etc.

-

Trading reports. The user can learn statistics on his trade: find out the total amount of profit, loss, the amount spent on commissions and data on all his operations.

Advantages:

The broker offers a variety of trading platforms for different investor needs.

With a free demo account, the user can check Lightspeed’s trading conditions and try out new trading strategies without the risk of losing capital.

Lightspeed's regulation allows its clients to be provided with reliable protection and financial compensation in the event of bankruptcy.

The broker allows you to open accounts with different forms of ownership.

Clients can trade using margin funds.

High speed executions.

How to Start Making Profits — Guide for Traders

The Lightspeed stockbroker offers clients two main types of accounts: the first one allows you to trade stocks and options, the second one allows you to trade futures. Each of the accounts has a different form of ownership.

Account types:

Lightspeed allows clients to test their trading conditions on a demo account that is available for 10 business days (Monday through Friday during market hours).

Bonuses Paid by the Broker

Lightspeed positions itself as a broker for professional market participants and provides its clients with access to a wide variety of assets and trading platforms. The accrual of financial bonuses for opening an account, trading, and non-trading operations is not provided.

Investment Education Online

The Lightspeed broker offers a small number of educational materials for traders. In particular, a video on setting up the Lightspeed trading platform and information on the current market situation.

You can test new trading strategies and acquired knowledge on a virtual account, which excludes the possibility of losing capital.

Security (Protection for Investors)

Lightspeed is regulated by FINRA (the US financial industry regulator) and the SEC (US Securities and Exchange Commission). Regulators ensure that the broker fulfills its obligations to them and the broker’s clients.

The broker is also a partner of SIPC (Securities Investor Protection Corporation). The organization guarantees Lightspeed clients up to $250,000 in capital protection and provides compensation in the event of a broker's bankruptcy.

👍 Advantages

- Two-factor authentication protects the client's account from hacking

- The broker is regulated by two independent bodies

- Investors can receive compensation of up to $250,000

👎 Disadvantages

- Client funds are not kept in segregated accounts that are unavailable to the broker

Withdrawal Options and Fees

-

The Lightspeed broker offers several methods for depositing and withdrawing funds: domestic and international bank transfer, day or night check, ACH and ACAT (automatic transfer of a client's account from one company to another).

-

The broker does not provide information on how fast funds are transferred to the trader when depositing or withdrawing funds to a personal account.

-

The amount of the commission depends on the transfer method and trading instruments used. Securities trading fees: incoming ACAT - free, outgoing ACAT - $95. ACH transfers are free, and there is a $30 fee for withdrawals or refunds. Internal transfer commission is $20, while external is $50. The charge for domestic night checks is $30; for international night checks is $50. The broker also charges a commission for currency conversions: if the deposit amount is up to $1,000, the fee will be $10; for an amount over $1,000, the fee is $50.

Customer Support Service

If any problems or questions arise regarding Lightspeed trading, etc., the user can contact the broker's support team.

👍 Advantages

- The broker offers a domestic and international number for contacting support

- Ability to resolve issues offline

- A FAQs section with answers to frequently asked questions is available

👎 Disadvantages

- There is no online chat on the broker's website

- No callback function

Available communication channels with customer support specialists include :

-

a call to a listed phone number;

-

letter to email;

-

feedback form on the site;

-

offline offices in New York, New Jersey, and Chicago.

Broker representatives can also be found on social networks and messengers like YouTube, Facebook, Twitter, and LinkedIn.

Contacts

| Foundation date | 2001 |

| Registration address | 1001 Avenue of the Americas, 16th Floor New York, NY 10018 |

| Regulation |

FINRA, SEC, SIPC, NFA |

| Official site | https://www.lightspeed.com/ |

| Contacts |

Phone:

1.888.577.3123

|

Review of the Personal Cabinet of Lightspeed

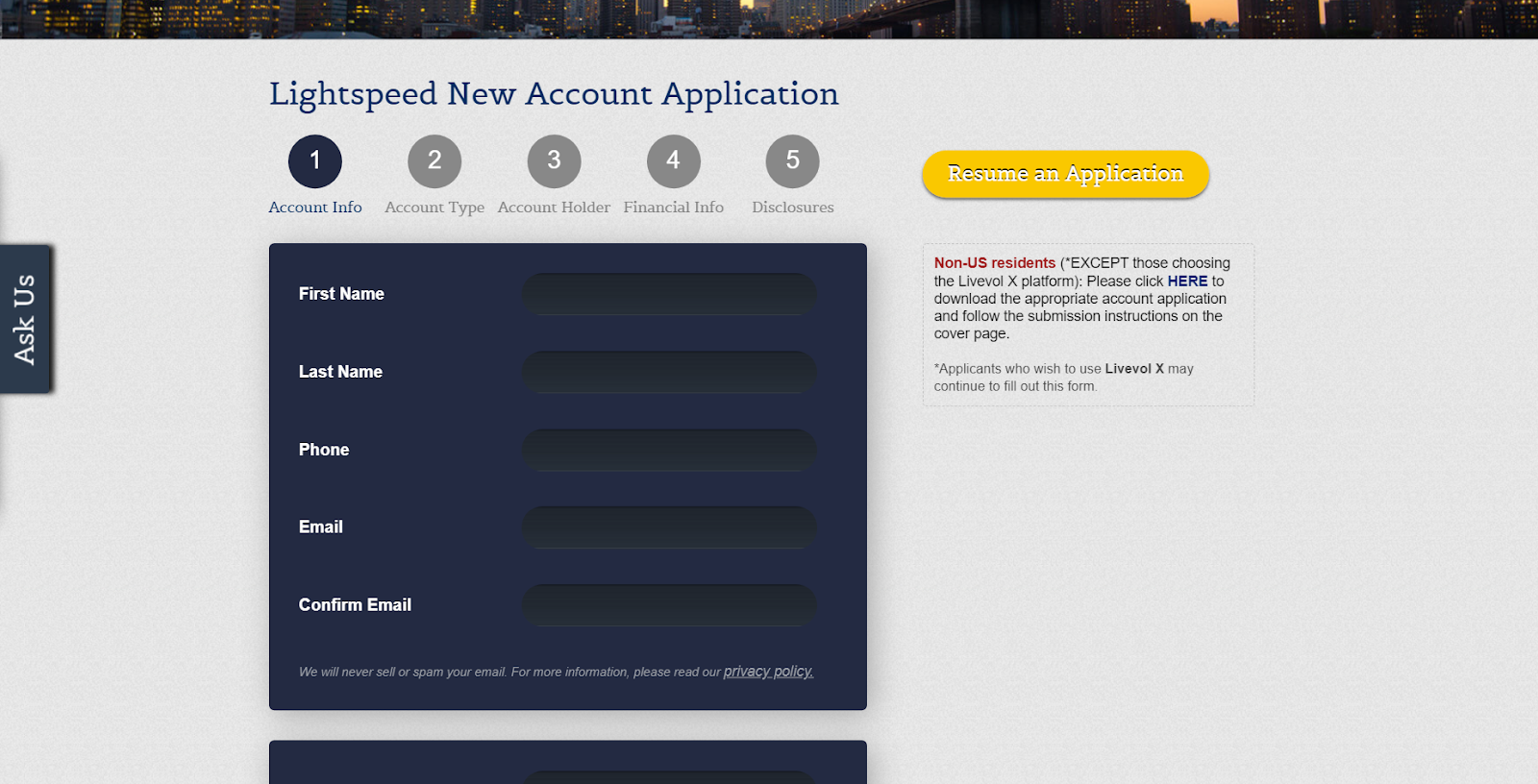

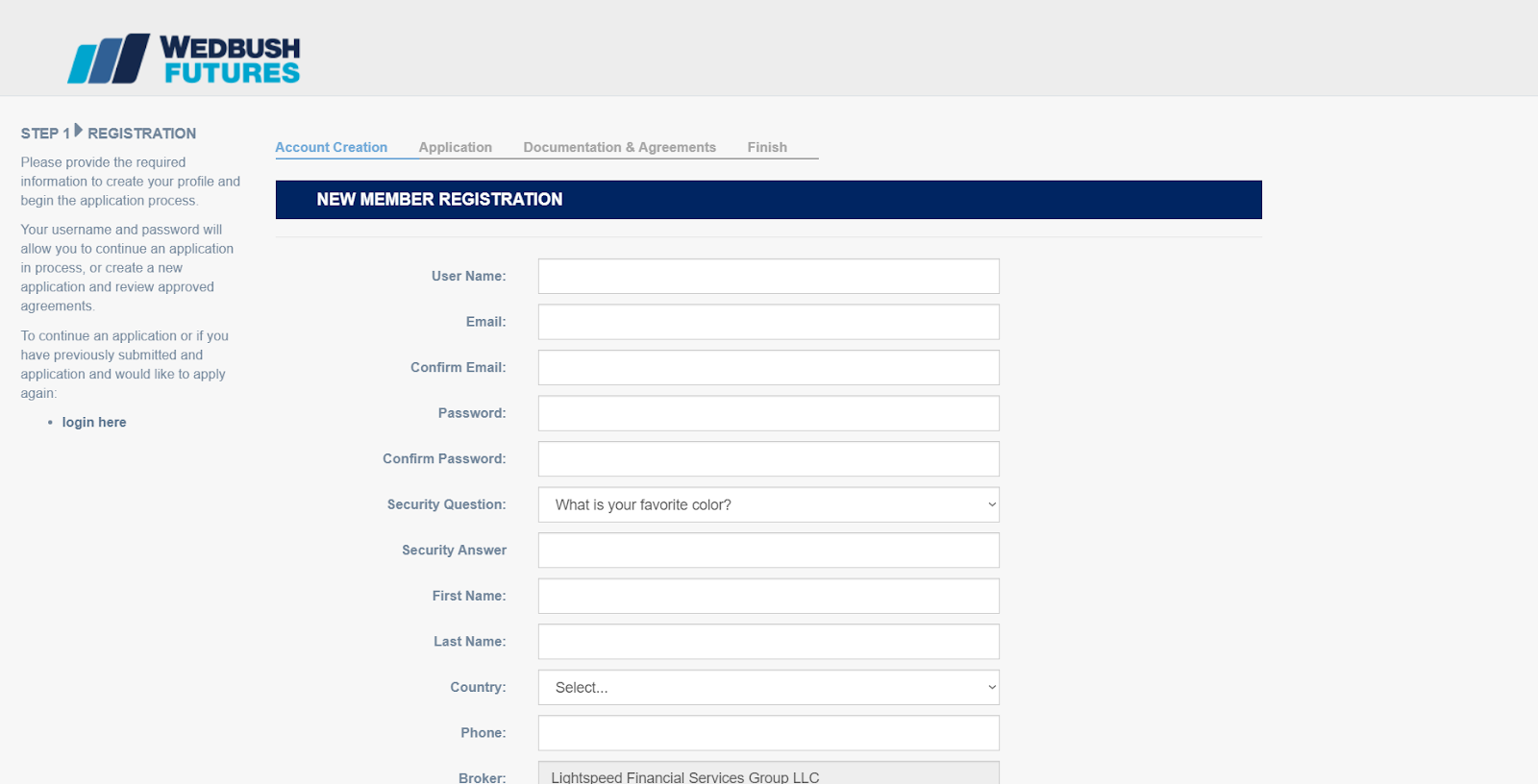

To start trading with Lightspeed, you need to become a client of the company. We suggest that you learn these brief instructions for opening a trading account:

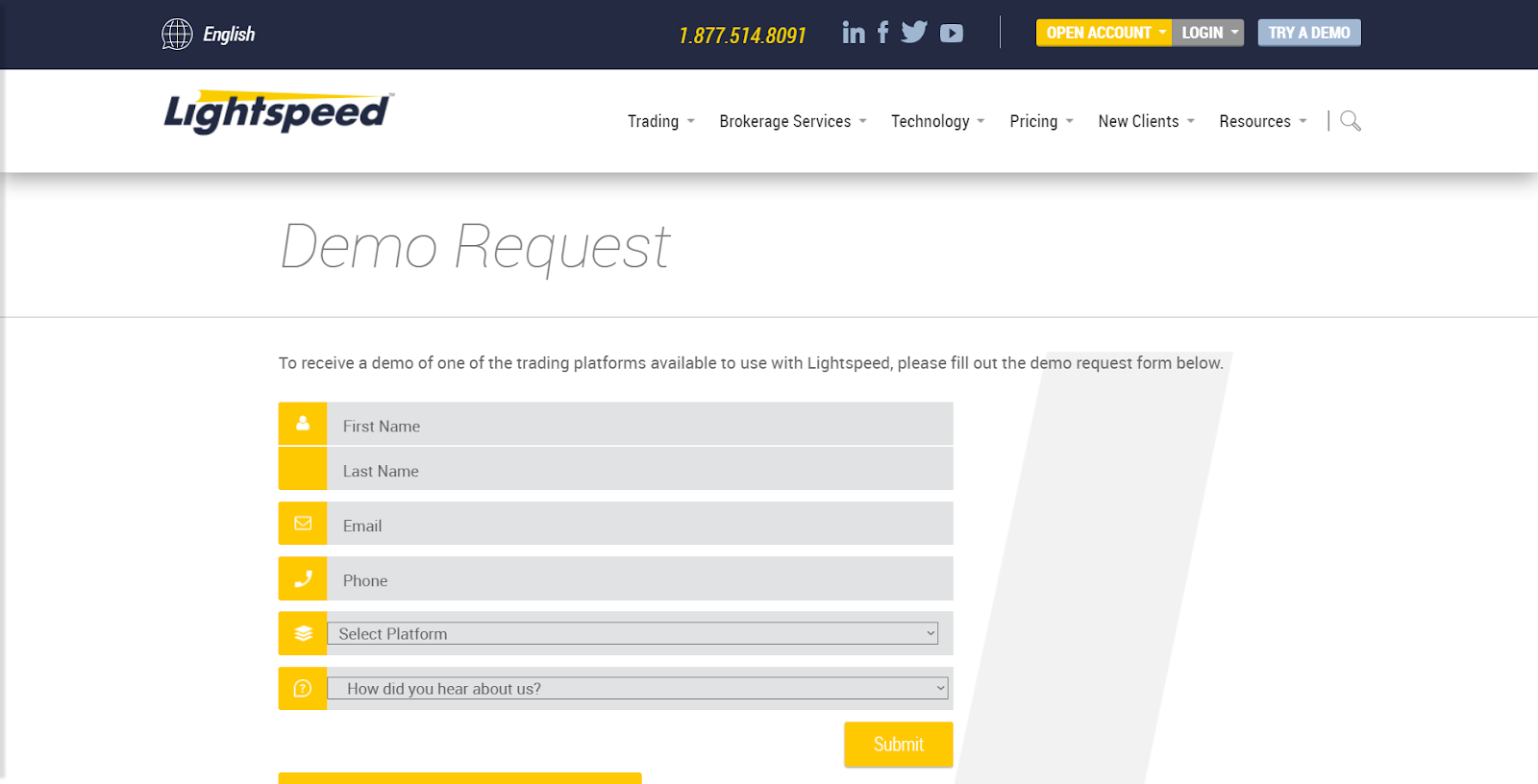

Visit the official Lightspeed website. To create a new account, click on the "Open Account" button in the upper right corner and select a specification: stocks and options trading, futures trading. You can also open a demo account by clicking on the "Try a Demo" button.

To open an account for trading stocks and options, fill out a special form with your personal data (last name, first name, phone number, mail, etc.), then specify your account settings and financial information.

To open a futures account, a trader needs to fill out a special application and send it to the broker for consideration.

To open a demo account, click on the "Try a Demo" button and fill out a short form. A letter with a username and password for entering the demo account will be sent to the email that you specified during registration.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Lightspeed rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Lightspeed you need to go to the broker's profile.

How to leave a review about Lightspeed on the Traders Union website?

To leave a review about Lightspeed, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Lightspeed on a non-Traders Union client?

Anyone can leave feedback about Lightspeed on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.