deposit:

- €3,000

Trading platform:

- Mobile application

- LYNX proprietary platform

- LYNX Basic web terminal

- AFM

- DNB

- FSMA

- CNB

- BaFIN

LYNX Review 2024

deposit:

- €3,000

Trading platform:

- Mobile application

- LYNX proprietary platform

- LYNX Basic web terminal

- 1:1

- Trading terms for traders from different countries may vary

Summary of LYNX Trading Company

LYNX is a broker with higher-than-average risk and the TU Overall Score of 4.99 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by LYNX clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. LYNX ranks 55 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

LYNX is a broker for traders and investors who already have experience in trading various assets. The company offers optimal trading terms for active trading and is not designed for passive earnings.

LYNX is a stock and Forex broker providing services worldwide since 2006. The company is registered in the Netherlands. It also has offices all over the world. Each of the branches is regulated by local authorities, in particular by the regulators of Germany, Belgium, the Czech Republic, and the Netherlands. The company also cooperates with BCS Compensation Fund, Kifid (Financial Services Complaints Institute), and DSI, which guarantees the professionalism of LYNX employees. The broker allows for active trading in stocks, options, futures, and other instruments.

| 💰 Account currency: | EUR, multicurrency accounts available |

|---|---|

| 🚀 Minimum deposit: | €3,000 for Individual and Joint accounts, €20,000 for Business account |

| ⚖️ Leverage: | 1:1 |

| 💱 Spread: | $5 for stocks and ETFs; $3 for options; and €0 for Forex |

| 🔧 Instruments: | Stocks, options, futures, ETFs, Forex, commodities, and CFDs |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with LYNX:

- Virtual account to test the trading terms of the broker.

- Proprietary platform with training materials.

- Traders have access to trading with their funds and margin trading.

- There is an affiliate program providing a bonus for participation.

- Trading is available both from a personal computer and from mobile devices.

- The broker offers multi-currency accounts.

- Both stock instruments and Forex assets are available in the company.

👎 Disadvantages of LYNX:

- There are no passive investment programs, save the affiliates program;

- The broker offers only one way to replenish your account.

- Open a bank account with Interactive Brokers to trade.

Evaluation of the most influential parameters of LYNX

Geographic Distribution of LYNX Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of LYNX

The LYNX broker is a stock and Forex broker providing services in 24 countries. The company provides opportunities for active, but not passive, trading. We don’t recommend it for cooperation to novice traders, since the broker has requirements of at least one year of experience in trading and at least two years of experience for trading complex instruments. This information is verified during registration. The minimum deposit is €3,000, and in case a client transfers an account from another company to LYNX or opens a business account, the minimum deposit is €20,000. You can open an account from eight countries and trading terms for accounts from different countries may vary, such as access to various assets and the size of trading fees.

Clients of LYNX have access to a wide range of assets and order execution types. Also, there are educational materials on trading various instruments, up-to-date information on the market situation, and training programs on its portal. The broker's reliability is confirmed by a large number of regulators from different countries, as well as cooperation with a compensation fund, an organization for certification of company employees, and a body for resolving disputes between the broker and its client.

It is not possible to get passive income with LYNX, and the company offers only one way to replenish a trading account - through Interactive Brokers. Therefore, you must open a bank account there before registering.

Dynamics of LYNX’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

LYNX is focused on cooperating with active traders and investors who monitor the market situation and prefer to independently manage their portfolios for profit. For this reason, the broker does not provide passive investment programs or account management services.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

LYNX’s affiliate program:

-

LYNX Friend. You can get a financial bonus for inviting new users to the company. To do this, fill out a short form, indicating your name, surname, and your LYNX trading account number, as well as the referral's name and surname, and his email address. After the referral opens a trading account with LYNX, you both will get a bonus: a loan of €100 for trades.

The number of clients that you can invite to LYNX is not limited, and a financial bonus is awarded for each referral and must be used within three months.

Trading Conditions for LYNX Users

LYNX offers three types of real accounts, and it is also possible to open a virtual account. Traders have access to stocks, futures, options, Forex assets, commodities, IPOs, and ETFs. Not all trading instruments may be available to users from different countries, so before opening an account, check the availability table on the broker's website. The amount of the trading commission also depends on the country listed when opening the account. Trading is carried out on LYNX’s own platform; mobile trading is also available. Clients over 18 years old can open an account here, but it has no accounts for minors. The minimum deposit for an individual or joint account is €3,000, and €20,000 for a business account.

€3,000

Minimum

deposit

1:1

Leverage

24/7

Support

| 💻 Trading platform: | LYNX proprietary trading platform, LYNX Basic web terminal, a mobile application for iOS and Android |

|---|---|

| 📊 Accounts: | Individual, Joint, Business, and Demo |

| 💰 Account currency: | EUR, multicurrency accounts available |

| 💵 Replenishment / Withdrawal: | Interactive Brokers |

| 🚀 Minimum deposit: | €3,000 for Individual and Joint accounts, €20,000 for Business account |

| ⚖️ Leverage: | 1:1 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 Spread: | $5 for stocks and ETFs; $3 for options; and €0 for Forex |

| 🔧 Instruments: | Stocks, options, futures, ETFs, Forex, commodities, and CFDs |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Trading terms for traders from different countries may vary |

| 🎁 Contests and bonuses: | No |

LYNX Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Individual | From €3 for stock assets, from €0 for Forex | No data |

| Joint | From €3 for stock assets, from €0 for Forex | No data |

| Business | From €3 for stock assets, from €0 for Forex | No data |

Islamic accounts in LYNX are not provided; nor does the broker provide information on swaps. There is no commission for keeping funds in the client's account.

We also compared the commission rates at LYNX with those of its competitors such as Ally and Charles Schwab. You can see the comparative results in the table below.

| Broker | Average commission | Level |

| LYNX | $3 | Low |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Medium |

Detailed Review of LYNX

LYNX is a broker providing financial services in 24 countries. The main task of the company is to provide comfortable terms for active trading and investment in the stock market, Forex, commodity markets, and others. The broker is focused on providing services to users who already have at least one year of experience in trading; and you need at least two years of experience to trade complex instruments. When registering, LYNX asks for this information from a potential client.

LYNX by the numbers:

-

Over 60,000 traders worldwide.

-

Over 60 types of orders available.

-

Access to at least 100 markets.

-

Account maintenance fee is €0.

-

Serves traders from 24 countries.

LYNX is a broker for experienced investors and traders who prefer active trading

The company offers optimal terms for active trading such as access to many markets and trading instruments and auto trading. However, there are no passive income programs at LYNX. The broker allows three types of real accounts: both margin (trading using the broker's funds) and cash (trading exclusively at the trader's funds). LYNX clients can trade futures, stocks, Forex assets, options, ETFs, commodities, and CFDs.

Trading is carried out on the broker's own trading platform, which includes the tools necessary to monitor the market situation, as well as various charts, indicators, and multiple types of order execution. Clients can also trade via a web terminal or install a mobile application and trade using a smartphone — all you need is an internet connection.

Useful LYNX services:

-

LYNX Educational portal. There you will find videos and articles about trading, features on different assets, training programs for brokers, as well as an overview of the market situation and forecast for the day.

-

Information on the stock market. Find here calendars, market hours, central bank interest rates, dividend payout calendar, pre-sales, and post-sales information.

-

Currency converter. This service helps to convert funds from one currency to another at current rates.

-

Service center. Find here the answers to popular questions from traders (FAQs). Answers are classified according to different topics such as account opening, general information, LYNX trading platform, margin and interest rates, account management, and others.

Advantages:

Own educational portal, which contains up-to-date information about trading, market news, asset overview, and much more.

The broker provides clients with a variety of assets: from stocks to commodities and currency pairs.

The company has a demo account where you can check the trading terms of LYNX, your knowledge, or a new trading strategy without financial risk.

The broker offers an affiliate program.

A multi-currency account.

Traders have access to margin trading, and the margin amount is calculated individually, depending on the total value of the portfolio.

The broker is regulated by authorities in several countries, and also it cooperates with independent dispute resolution organizations, a compensation fund, and an employee certification organization.

How to Start Making Profits — Guide for Traders

LYNX offers three types of real accounts with different forms of ownership. Residents from 24 countries can open a trading account.

Types of accounts:

All accounts are presented in two types: cash and margin. Cash requires trading with your funds. Such accounts are available to all users. Margin accounts assume the use of the broker's funds (i.e., a loan) for trading, and only those clients who are 21 years old can open such an account.

The trader can also open a demo account to test the trading terms of the LYNX broker.

Bonuses Paid by the Broker

LYNX broker is focused on traders and investors who prefer active trading to make money. There is no way for getting passive income. The company doesn’t hold contests among users, and there is no accrual of bonuses for trading and non-trading operations. However, high-volume customers can individually apply for a personalized discount.

Investment Education Online

The LYNX broker provides services for traders who already have experience in trading in the stock and foreign exchange markets. Also, LYNX provides access to its proprietary platform with training materials and tools that will be useful to traders while trading.

To test the knowledge gained or test a new trading strategy, you can open a demo account and trade without financial risk and profit, to get a safe experience.

Security (Protection for Investors)

LYNX is represented in several countries and its activities are regulated in each of such countries. So, in the Netherlands, the regulators are the Netherlands Financial Markets Authority (AFM) and the Netherlands Bank (DNB); in Belgium its the Financial Services and Markets Authority (FSMA); in the Czech Republic its the Czech National Bank (CNB); and in Germany its the Federal Financial Supervision Authority of Germany (BaFIN, 120442).

Branches of LYNX located in Belgium, Germany, and the Czech Republic are also under the supervision of local regulatory authorities. Order execution and account administration are handled through Interactive Brokers Ireland Limited (IBIE), the world's leading broker in terms of trades. Concurrently, IBIE is a subsidiary of IBKR, which is registered with the SEC.

LYNX also cooperates with the Dutch Investor Compensation Scheme (BCS), which provides financial payments of €20,000 in case a broker cannot fulfill its obligations to clients due to bankruptcy or fraud. The assets and funds of clients of LYNX are stored in IBIE, which also guarantees its security. Confidentiality is ensured by two-factor authentication and account access settings. You can download the mobile app and set a fingerprint as a password. The transfer of funds or assets shall be carried out only after a thorough security verification, including using unique codes.

Disputes between a broker and a client shall be resolved by Kifid (Financial Services Complaints Institute), and the activities of the employees of LYNX are monitored by DSI, an independent body certifying employees for expertise, competence, and business ethics. Employees who are not certified will be fined and held liable under DSI laws.

👍 Advantages

- This broker is regulated by authorities from four countries

- LYNX cooperates with a compensation organization

- An independent body handles the disputes between a broker and a trader

- Broker’s employees are periodically certified

- The broker provides reliable protection of clients' personal information

👎 Disadvantages

- Client funds are not stored in segregated accounts

Withdrawal Options and Fees

-

A trader must use an Interactive Brokers bank account to replenish his account. To deposit funds, open a LYNX trading account and apply to replenish your account in your personal account. After that, the broker will send you step-by-step instructions on how to make a deposit.

-

LYNX doesn’t provide accurate data on the funds’ crediting period. The company also doesn’t indicate the period for withdrawing funds to the client's personal account.

-

There is no information on the commission fee for depositing or withdrawing funds on the broker's website.

Customer Support Service

You can always contact LYNX support if you have any problems in the process of opening an account, trading, making transactions, and other actions. Support is online twelve hours per day, five days a week.

👍 Advantages

- The broker offers a “remote help” service.

- There are FAQs sections in the service center on such issues as account replenishment, trading process, personal account settings, and others.

👎 Disadvantages

- Support is closed on weekends

- No callback function

This broker provides the following communication channels for its clients:

-

international phone call;

-

fax;

-

email.

-

visit an offline office.

The broker's representatives are also on social networks: Facebook, Twitter, LinkedIn, and YouTube. Online chat is available during registration.

Contacts

| Foundation date | 2006 |

| Registration address | LYNX Nederland Herengracht 527 1017 BV AMSTERDAM |

| Regulation |

AFM, DNB, FSMA, CNB, BaFIN |

| Official site | https://www.lynxbroker.com/ |

| Contacts |

Email:

info@lynxbroker.com,

|

Review of the Personal Cabinet of LYNX

Open an account with this company and take advantage of the offers by the LYNX broker and start trading various assets. Follow the instructions below.

Follow the official page of the LYNX broker. If you already have an account with the company, click on the "Login" button to authorize it, and to open a new account, click on the "Open an Account" button.

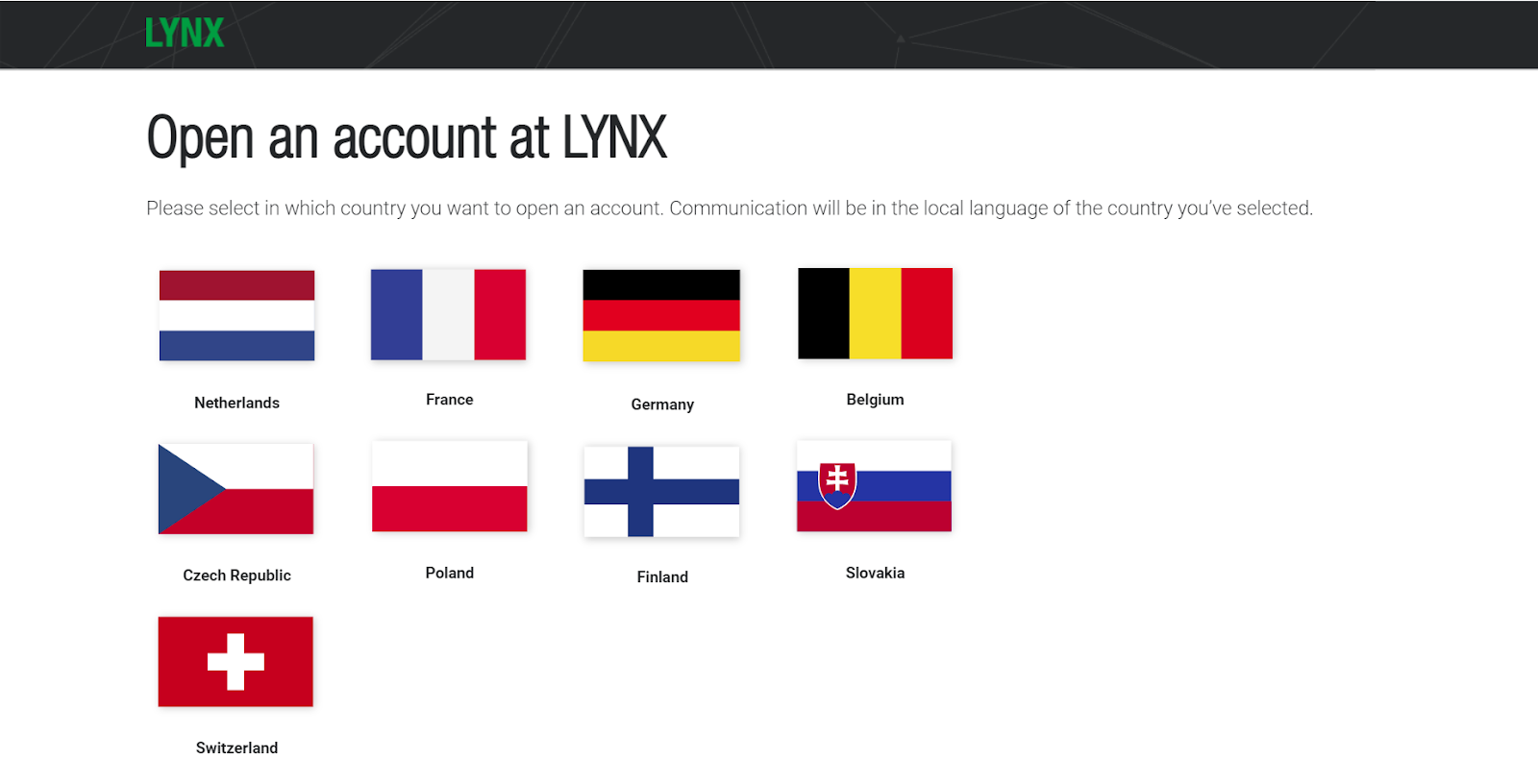

Select your country to open an account. Please note that your choice will affect the interface language and trading commissions.

Check out the broker’s requirements for potential clients. Requirements for traders from different countries may vary.

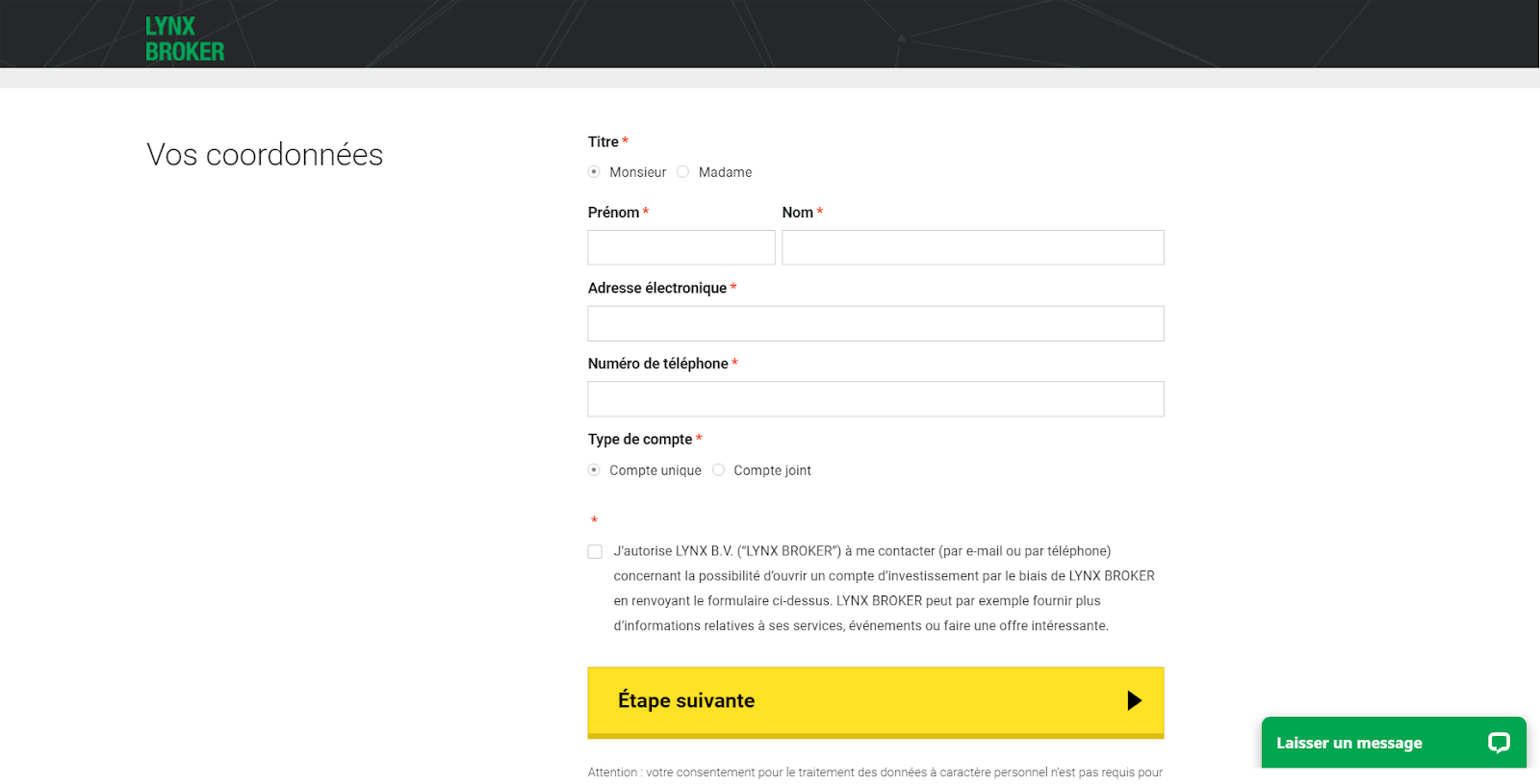

Fill out the form with basic personal data: indicate gender, first name, last name, telephone number, email address, and the desired type of account (individual or joint).

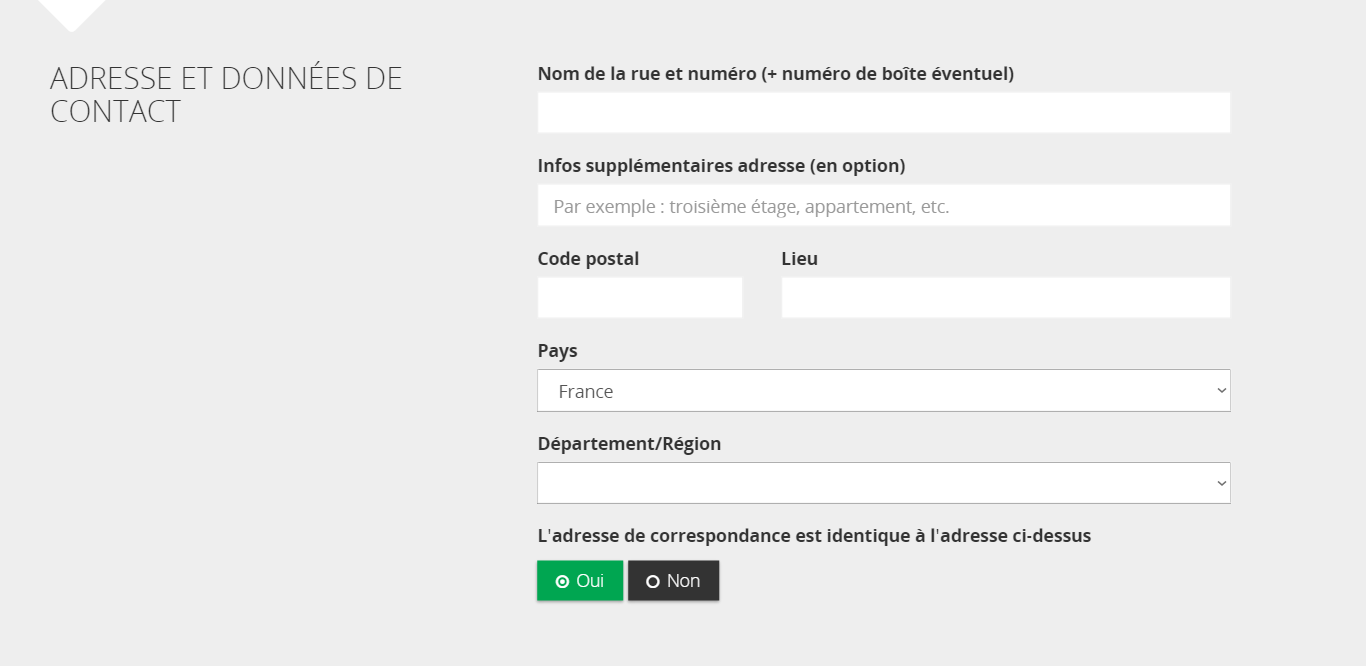

Provide information about your place of residence: country, city, region, as well as postal code.

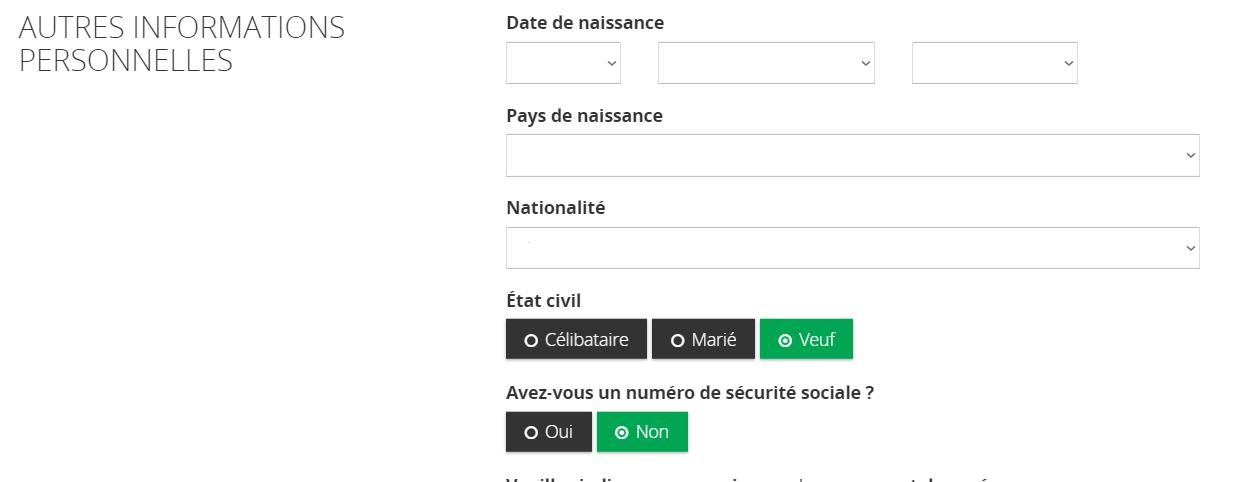

Provide extra personal information: date of birth, tax residence, nationality, as well as marital status, and social security number.

The next step is to ensure that your account is secure. To do this, provide answers to three questions that will be used for two-factor authentication. One of the questions is the same for all users, the remaining two questions can be selected at your discretion.

Include information about your tax residence, your profession, and extra information: whether you or your family members are the owners of investment companies or shares of companies listed on the stock exchange.

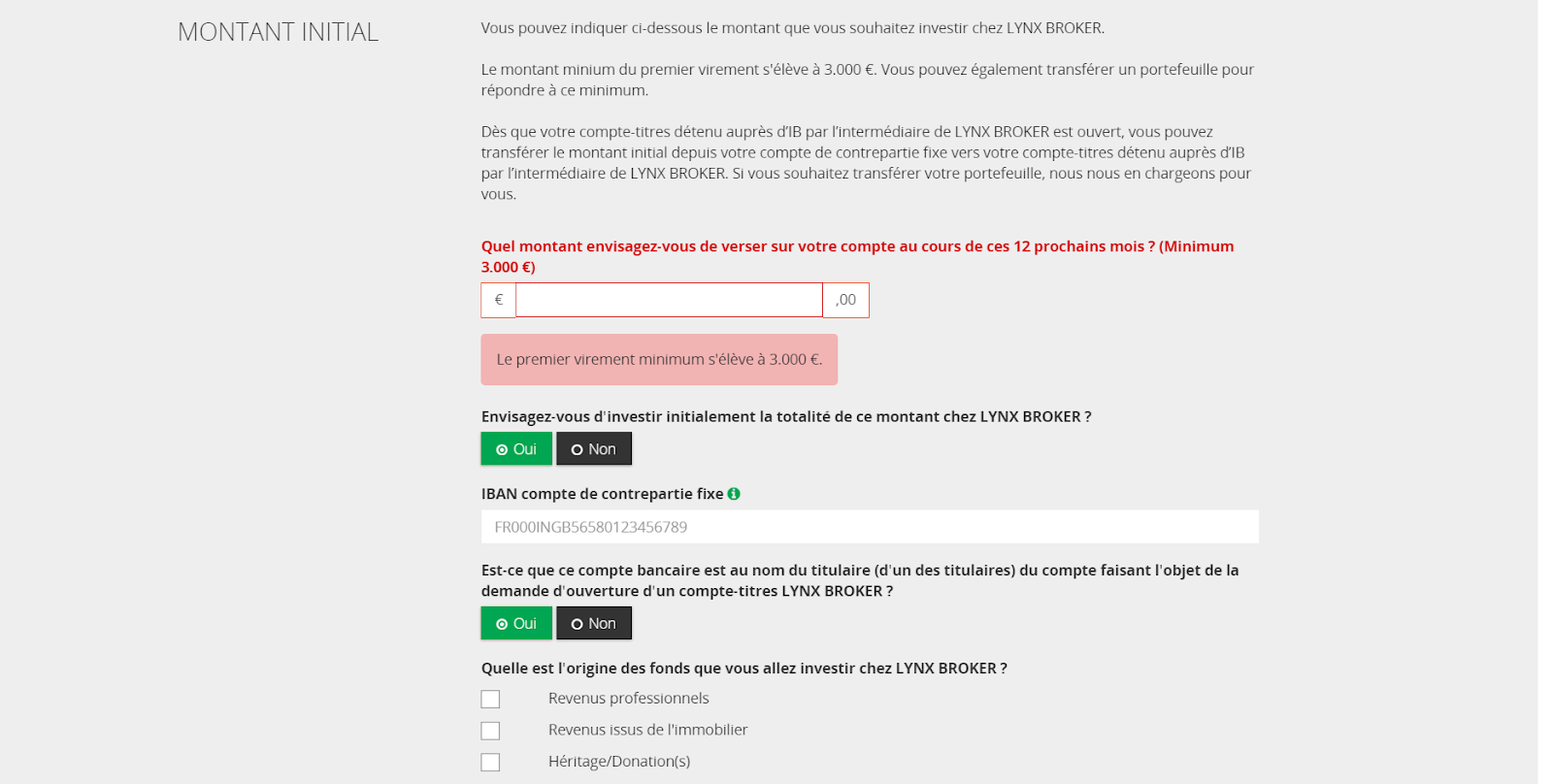

Indicate the minimum amount you are willing to invest in LYNX and the source of income that you will use to fund your account. Also indicate the IBAN — your personal bank account, to use for depositing your trading account. A bank account shall be opened on your behalf.

Indicate your experience in trading futures, stocks, options, and other assets. Please note that trading with LYNX requires at least two years of experience trading leveraged options, futures, and instruments. One year of experience is sufficient for other assets.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the LYNX rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about LYNX you need to go to the broker's profile.

How to leave a review about LYNX on the Traders Union website?

To leave a review about LYNX, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about LYNX on a non-Traders Union client?

Anyone can leave feedback about LYNX on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.