Note: In fact, Spot Bitcoin ETFs track the price of the token using the same scheme, although the funds themselves trade at different prices. Since Bitcoin ETFs offer you to invest in crypto in the same way, the main factor in choosing them is the expense ratio - the percentage of your investment that the funds charge as a commission.

Best Bitcoin ETFs in 2024

The best Bitcoin ETFs in 2024 are:

-

ARK 21Shares Bitcoin ETF (ARKB) - Cathie Wood collaboration, actively managed

-

VanEck Bitcoin Trust (HODL) - Low expense ratio, high liquidity

-

WisdomTree Bitcoin Trust (BTCW) - Strong performance, direct Bitcoin holding

-

Valkyrie Bitcoin Fund (BRRR) - Secure storage, 0.25% expense ratio

-

Franklin Bitcoin ETF (EZBC) - Low cost, custodian Coinbase Global

-

Grayscale Bitcoin Trust ETF (BTC) - Long-standing trust, large AUM

-

Bitwise Bitcoin ETF Trust (BITB) - Public address, transparent reserves

-

iShares Bitcoin Trust (IBIT) - Passive investment, BlackRock managed

In January 2024, the SEC finally approved spot Bitcoin ETFs in the US, giving investors a new way to gain exposure to the cryptocurrency without the complexities of directly owning Bitcoin. With several options now available, choosing the right ETF involves comparing fees, performance, and other factors. In this guide TU experts will break down the best Bitcoin ETFs currently on the market, analyzing their expense ratios, year-to-date performance, and key differences to help you decide which one best suits your investment strategy.

-

Which Bitcoin ETF was approved?

The Proshares Bitcoin Strategy ETF (BITO) was the first Bitcoin ETF approved by the SEC.

-

Are Bitcoin ETFs safer than Bitcoin?

Bitcoin ETFs offer regulatory oversight and security measures, making them potentially safer than directly owning Bitcoin, which can be subject to theft and cyber-attacks.

-

Should you invest in Bitcoin ETFs?

Investing in Bitcoin ETFs provides a convenient and regulated way to gain exposure to Bitcoin's price movements, making them a viable option for investors seeking cryptocurrency exposure without the complexities of owning and managing digital assets directly.

-

What is a Bitcoin ETF?

A Bitcoin ETF, or exchange-traded fund, is a collection of Bitcoin-related assets offered on traditional exchanges, allowing investors to gain exposure to Bitcoin's price movements without needing to own the cryptocurrency directly.

Best Bitcoin ETFs review

ARK 21Shares Bitcoin ETF (ARKB)

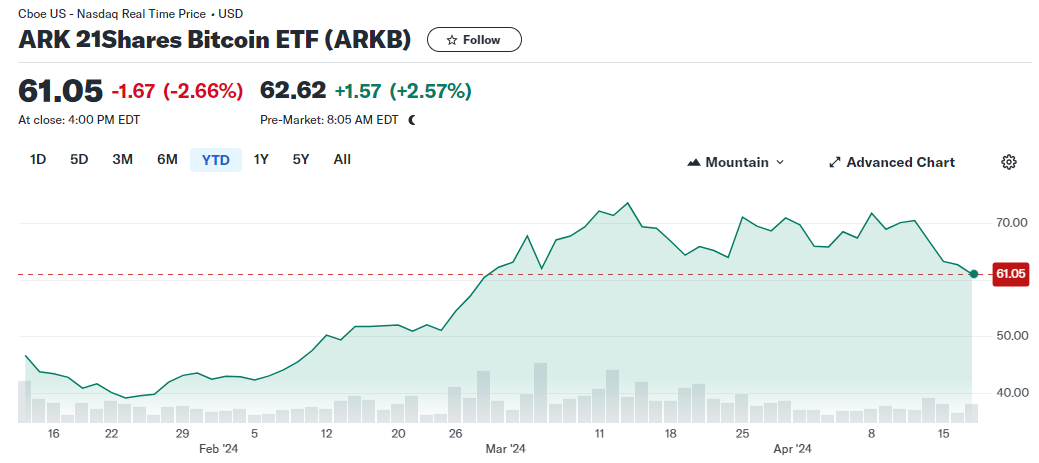

ARK 21Shares Bitcoin ETF (ARKB) is an offering from Cathie Wood's ARK Invest in collaboration with digital assets specialist 21Shares. Known for its actively managed thematic funds like the ARK Innovation ETF (ARKK), ARKB comes with an expense ratio of 0.21%. Initially, the fund had a total fee waiver until it either reached $1 billion in Assets Under Management (AUM) or until July 10, whichever came first. However, it surpassed the AUM milestone and now imposes a modest expense ratio.

Since its inception, ARKB has seen significant growth, accumulating around $2.7 billion in AUM, showcasing its prominence among boutique fund providers. It's listed on the CBOE BZX exchange, having decent liquidity since its launch, with a 30-day median bid-ask spread of 0.06% and approximately 3 million shares traded daily.

As of the Year-To-Date (YTD) performance, ARKB has delivered a commendable return of +37.08%. The Net Asset Value (NAV) per unit stands at $62.85.

ARK 21Shares Bitcoin ETF (ARKB)

VanEck Bitcoin Trust (HODL)

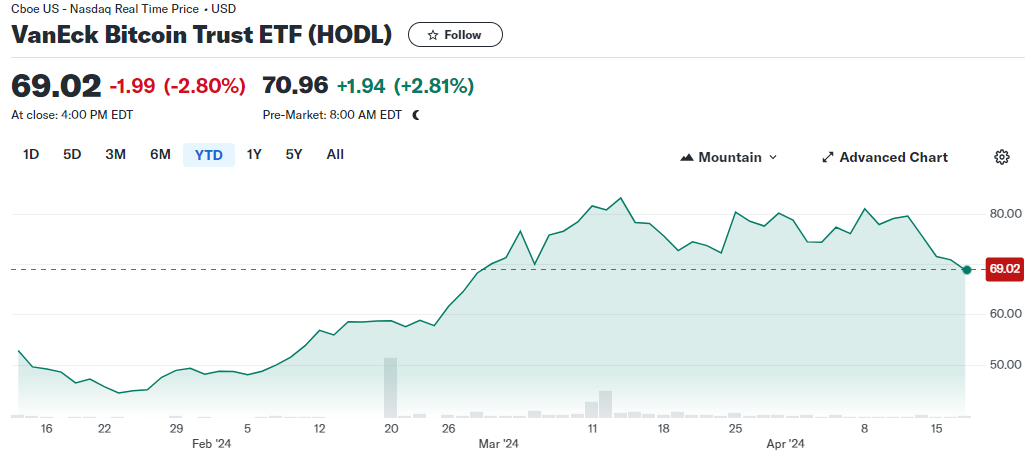

VanEck Bitcoin Trust (HODL) takes its name from the famous cryptocurrency term "HODL," originating from a forum post in 2013. The term represents a commitment to holding onto assets despite market volatility. VanEck's adoption of this term for its Bitcoin ETF symbolizes a nod to the community's ethos.

HODL offers a 0.2% expense ratio waiver on its first $1.5 billion in assets until the end of March 2025, making it an attractive option for investors. Currently, it has accumulated approximately $576 million in Assets Under Management (AUM). VanEck plans to introduce options for this ETF in the future.

As of April 17, 2024, the Net Asset Value (NAV) per unit stands at $69.11. Since its inception, HODL has demonstrated strong performance, with a return of 38.23%.

VanEck Bitcoin Trust (HODL)

WisdomTree Bitcoin Trust (BTCW)

WisdomTree, with a substantial global Assets Under Management (AUM) of approximately $106 billion, holds a significant portion of its assets, around $77 billion, in U.S.-listed funds. Among its popular ETFs are the WisdomTree Floating Rate Treasury Fund (USFR) and the WisdomTree U.S. Quality Dividend Growth Fund (DGRW).

BTCW, WisdomTree's Bitcoin Fund, aims to track the price of bitcoin while considering expenses and liabilities. It achieves this by directly holding bitcoin. The fund calculates its share value daily using an independently derived value based on major bitcoin spot exchanges' executed trade flow.

Since its inception on January 17, BTCW has accumulated roughly $81.17 million in AUM. Year-To-Date (YTD) returns stand at an impressive 54.30%. The Net Asset Value (NAV) per unit is $64.86, with a Gross Expense Ratio of 0.25%.

WisdomTree Bitcoin Trust (BTCW)

Valkyrie Bitcoin Fund (BRRR)

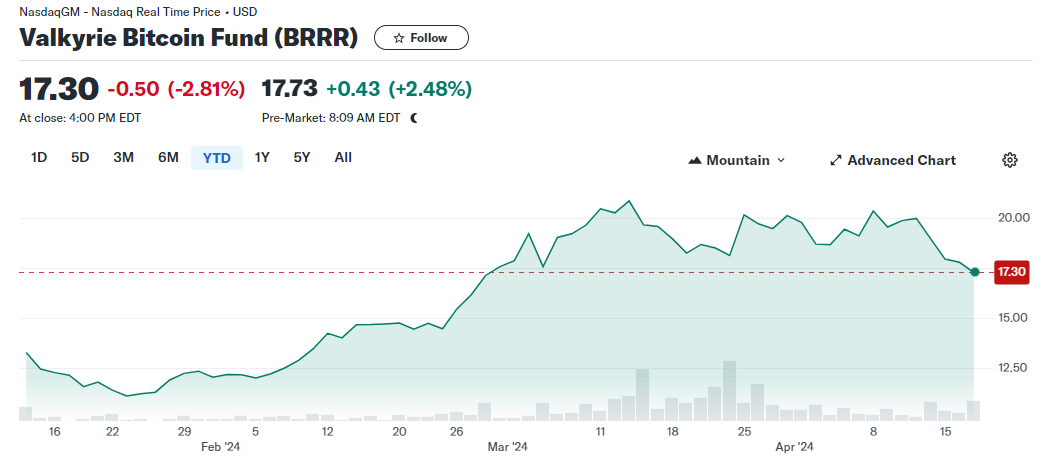

BRRR, a spot Bitcoin ETF, joins the trend of embracing cryptocurrency pop culture in its naming convention, possibly hinting at the sound of money being printed by central banks, a remark often made by Bitcoin enthusiasts.

Sponsored by Valkyrie Digital Assets LLC and CoinShares Co., both dedicated digital assets firms, BRRR's shares trade on Nasdaq. The fund securely stores its underlying Bitcoin in cold storage, with Coinbase Global Inc. (COIN) serving as the custodian.

Investors in BRRR can anticipate a 0.25% expense ratio once the fee waiver expires on April 11. As of the latest data, BRRR has a Net Asset Value (NAV) of $17.30 and has accumulated around $484 million in Assets Under Management (AUM).

Valkyrie Bitcoin Fund (BRRR)

Franklin Bitcoin ETF (EZBC)

Franklin Templeton promotes "simplified access" as a key feature of its spot Bitcoin ETF, emphasizing its convenience and cost-effectiveness, aiming to make entering the crypto market easier for investors. The ETF's name, "EZBC," reflects this ease, sounding like "easy Bitcoin."

EZBC holds over 4,800 Bitcoin in custody with Coinbase Global, audited by PricewaterhouseCoopers (PwC). Its benchmark is the CME CF Bitcoin Reference Rate – New York Variant. The fund imposes a 0.19% expense ratio, with a waiver reducing it to 0% for the first $10 billion in Assets Under Management (AUM) until Aug. 2. Currently, EZBC's net assets stand at around $301.17 million as of April 17, 2024.

With a Net Asset Value (NAV) of $35.40, EZBC has delivered a Year-To-Date (YTD) return of 51.61%.

Franklin Bitcoin ETF (EZBC)

Grayscale Bitcoin Trust (Re-file) (GBTC)

Grayscale's Bitcoin fund traces its origins back to 2013 when it was established as an investment trust. Before 2024, it functioned as a trust, with units traded over the counter, offering indirect exposure to Bitcoin through broker-dealer networks rather than through a centralized exchange. However, in early January 2024, Grayscale's application to the SEC was approved, leading to the conversion of the Bitcoin trust into an ETF, providing investors with more direct access to Bitcoin.

The Grayscale Bitcoin Trust ETF imposes a substantial 1.5% annual fee, equivalent to $15 for every $1,000 invested annually. Although this fee was reduced from 2% in January 2024, it remains higher compared to its newer ETF counterparts. Consequently, the fund experienced significant outflows of investor funds following the approval and commencement of trading of the new ETFs.

As of the latest data, the Year-To-Date (YTD) return stands at 61.41%. The Net Asset Value (NAV) is $54.31, with Assets Under Management (AUM) totaling $23.75 billion.

Grayscale Bitcoin Trust (Re-file) (GBTC)

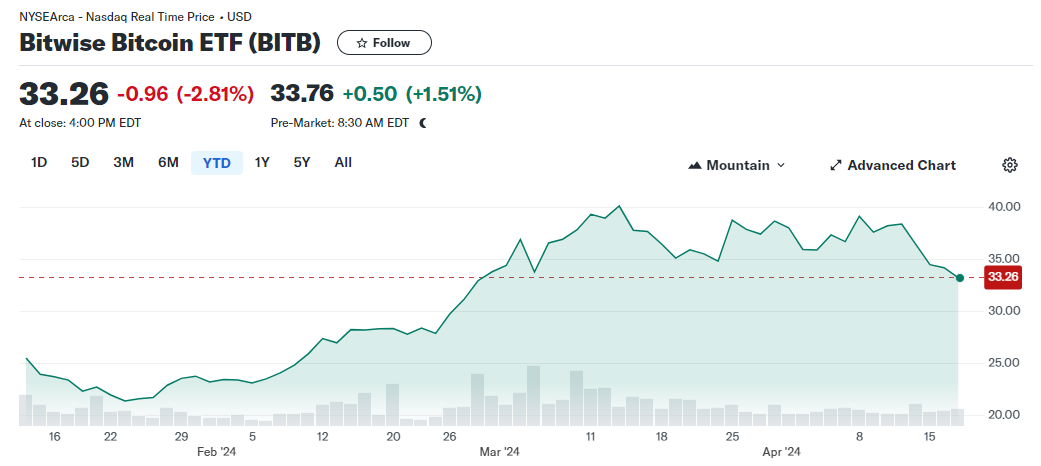

Bitwise Bitcoin ETF Trust (BITB)

BITB gathered attention in January by opting to disclose the public Bitcoin address of its holdings, ensuring a high level of transparency regarding the ETF's reserves. This move allows potential investors to verify the ETF's holdings and even contribute Bitcoin if they desire. Investors seeking the expertise of a specialized digital asset manager over a larger fund provider like BlackRock might find BITB appealing. Managed by Bitwise, a company exclusively focused on cryptocurrency, this ETF has amassed approximately $2.1 billion in Assets Under Management (AUM).

The ETF imposes a modest expense ratio of 0.2%. As of the latest data, the Net Asset Value (NAV) stands at $33.26, with a Year-To-Date (YTD) return of 54.31%.

Bitwise Bitcoin ETF Trust (BITB)

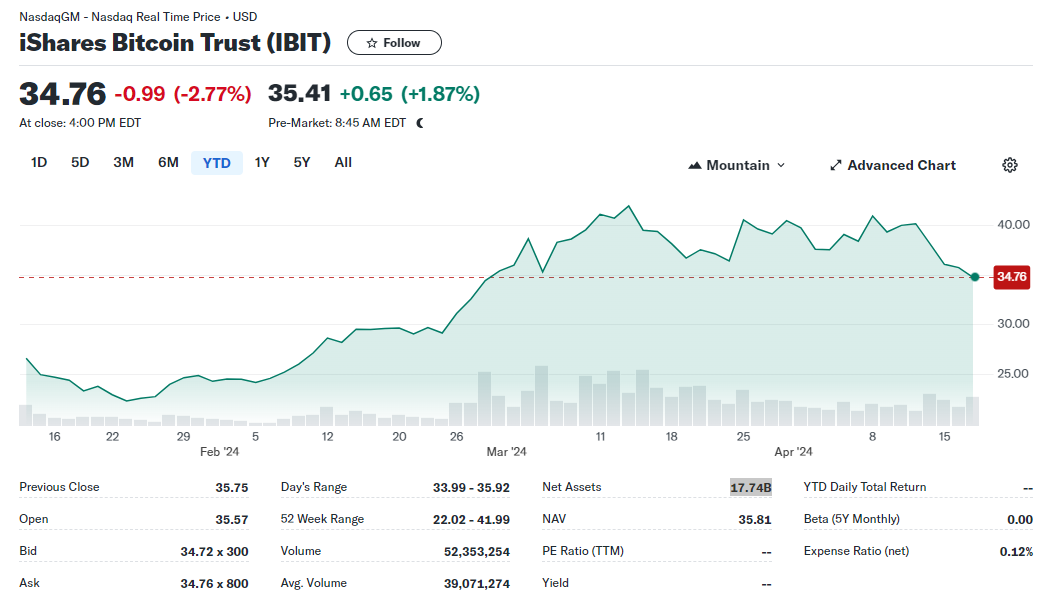

iShares Bitcoin Trust (IBIT)

The iShares Bitcoin Trust, offered by investment giant BlackRock, is one of the first Bitcoin spot price ETFs approved by the SEC. Managed by iShares, a trusted ETF provider with a long history, the Bitcoin Trust employs a passive investment strategy. Coinbase Custody, a service provided by Coinbase, holds the Bitcoin comprising the ETF's portfolio.

Investors may find IBIT appealing due to its affordability, with a management fee initially set at 0.25%, but it had initially reduced to 0.12% if assets under management do not exceed $5 billion within the first 12 months from inception (which occurred on Jan. 5, 2024). Currently, IBIT has a Net Asset Value (NAV) of $34.79 and has accumulated $17.74 billion in Assets Under Management (AUM).

iShares Bitcoin Trust (IBIT)

Comparing the Best Bitcoin ETFs: key metrics and features

| ETF Name | Cost (Expense ratio) | Price per Share | Assets Under Management (Millions) | Investment strategy | Launch date |

|---|---|---|---|---|---|

|

ARK 21Shares Bitcoin ETF (ARKB) |

0.21% |

$62.85 |

$2.7 billion |

Spot Bitcoin |

Jan 09, 2024 |

|

VanEck Bitcoin Trust (HODL) |

0.20% |

$69.11 |

$576 million |

Spot Bitcoin |

Jan 04, 2024 |

|

WisdomTree Bitcoin Trust (BTCW) |

0.25%. |

$64.86 |

$81.17 million |

Spot Bitcoin |

Jan 11, 2024 |

|

Valkyrie Bitcoin Fund (BRRR) |

0.25% |

$17.30 |

$484 million |

Spot Bitcoin |

Jan 10, 2024 |

|

Franklin Bitcoin ETF (EZBC) |

0.19% |

$35.40 |

$301.17 million |

Spot Bitcoin |

Jan 11, 2024 |

|

Grayscale Bitcoin Trust (Re-file) (GBTC) |

1.5% |

$54.31 |

$23.75 billion |

Spot Bitcoin |

Jan 11, 2024 |

|

Bitwise Bitcoin ETF TrustBITB |

0.20% |

$33.26 |

$2.1 billion |

Spot Bitcoin |

Jan 11, 2024 |

|

iShares Bitcoin TrustIBIT |

0.25% |

$34.79 |

$17.74 billion |

Spot Bitcoin |

Jan 11, 2024 |

What is a Bitcoin ETF?

A Bitcoin ETF, or exchange-traded fund, is a collection of Bitcoin-related assets available on traditional exchanges through brokerages. These ETFs aim to provide exposure to cryptocurrencies for retail and other investors without requiring direct ownership of the assets.

Essentially, a Bitcoin futures ETF holds Bitcoin futures contracts and offers shares of the fund to investors for trading on mainstream exchanges. These ETFs are created by acquiring futures contracts from entities like the CME Group, bundling them into a fund, and then selling shares to investors. The management of futures contracts within the fund occurs while shares are actively traded on traditional exchanges, enabling investors to gain exposure without engaging directly in cryptocurrency exchanges.

The first Bitcoin-linked ETF, the Proshares Bitcoin Strategy ETF (BITO), was approved by the SEC in October 2021, listing on the New York Stock Exchange. Unlike spot ETFs, which hold Bitcoin directly, BITO primarily utilizes futures contracts.

Initially, the SEC rejected proposals for Bitcoin ETFs involving direct Bitcoin ownership by companies until 2024. However, following a court order in August 2023, the SEC reconsidered, leading to the approval of 11 Bitcoin spot ETFs on January 10, 2024. These spot ETFs, unlike BITO, hold Bitcoin directly and began trading in January 2024.

Should you invest in Bitcoin ETFs?

👍 Pros

• Simplified access to Bitcoin

Investing in Bitcoin ETFs allows investors to participate in Bitcoin's price movements without the need to directly purchase the cryptocurrency, eliminating the complexities associated with crypto wallets and exchanges.

• Regulatory and security benefits

Bitcoin ETFs, particularly those approved by regulatory bodies like the U.S. Securities and Exchange Commission (SEC), offer regulatory compliance and enhanced security measures, reducing concerns about regulatory risks, wallet security, or cyber-attacks.

• Market integration and liquidity

Bitcoin ETFs trade on traditional stock exchanges, providing liquidity and a familiar trading environment for investors. They also facilitate institutional participation, integrating Bitcoin into mainstream financial markets, potentially leading to increased market liquidity and stability.

• Diversification and tax benefits

Investing in Bitcoin ETFs allows for portfolio diversification. Some ETFs offer exposure not only to Bitcoin futures but also to stocks, providing balanced investment options. Additionally, certain SEC-regulated Bitcoin ETFs may offer tax efficiency, providing additional financial advantages.

👎 Cons

• Control and ownership

Investors in Bitcoin ETFs do not own actual Bitcoin, contradicting the decentralized nature of cryptocurrencies.

• Cost implications

TU expert Igor Krasulya has noted that Bitcoin ETFs come with management fees and operational costs, which can impact net returns over the long term.

• Market hours limitation

Unlike the cryptocurrency market, which operates 24/7, Bitcoin ETFs are subject to the operational hours of stock exchanges, potentially resulting in missed opportunities due to round-the-clock price fluctuations of Bitcoin.

• Tracking errors

While Bitcoin ETFs aim to replicate Bitcoin's price movements, tracking errors may occur, leading to differences between the ETF's performance and the actual market performance of Bitcoin.

Top 3 Brokers to Buy ETFs Online

How to buy bitcoin ETFs?

To purchase Bitcoin ETFs, follow these simple steps:

Open a brokerage account

Begin by selecting a brokerage firm that offers Bitcoin ETFs and open an online brokerage account with them.

Fund the account

Transfer funds into your brokerage account from another brokerage platform or a regular bank account. Ensure that you have sufficient funds to cover the cost of your desired ETF shares, as well as any additional fees or commissions.

Research available Bitcoin ETFs

Explore the variety of Bitcoin ETFs available, considering factors such as fees and your investment objectives.

Place an order

Once you've chosen the Bitcoin ETF(s) you wish to invest in, place a buy order for the desired number of shares. You can choose between a market order, which executes immediately at the current market price, or a limit order, which allows you to specify the maximum price you're willing to pay.

Monitor your investments regularly

Keep track of your investments by monitoring their performance regularly. Stay updated on Bitcoin's price movements and related news, as these factors can influence the volatility of your Bitcoin ETF investment.

Expert opinion

As an expert in the field of cryptocurrency investments, I would recommend novice traders to cautiously consider Bitcoin ETFs as a potential entry point into the world of digital assets. While Bitcoin ETFs offer simplified access and regulatory benefits, it's crucial to understand that they introduce a layer of complexity and cost that may not align with the core principles of decentralization and ownership associated with cryptocurrencies. Novice traders should also be aware of the potential impact of market sentiment, regulatory changes, and macroeconomic factors on Bitcoin ETF prices, as these can significantly influence investment outcomes. It's advisable for beginners to start with a small allocation, conduct thorough research, and continuously educate themselves on the evolving landscape of Bitcoin and ETF investments to make informed decisions in this crypto market.

Conclusion

In conclusion, investing in Bitcoin ETFs offers a simplified and regulated way to gain exposure to the cryptocurrency market. From the iShares Bitcoin Trust (IBIT) to the Grayscale Bitcoin Trust ETF, there are various options available to suit different investment preferences and goals. By opening a brokerage account, funding it, researching available ETFs, placing orders, and monitoring investments regularly, novice traders can navigate the process of buying Bitcoin ETFs effectively. Despite some limitations like management fees and market hours, the benefits of regulatory oversight, ease of access, and potential for diversification make Bitcoin ETFs an attractive option for those looking to enter the world of cryptocurrencies.

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).