deposit:

- 1000$

Trading platform:

- Proprietary platform

- CommSec (Mobile app)

- Commonwealth Bank of Australia

CommSec (Commonwealth Securities) Review 2024

deposit:

- 1000$

Trading platform:

- Proprietary platform

- CommSec (Mobile app)

- Margin trading available

- The CDIA account allows investors to accumulate interest on the deposit amount if the funds are not used for trading

Summary of CommSec Trading Company

CommSec is a broker with higher-than-average risk and the TU Overall Score of 4.84 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by CommSec clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. CommSec ranks 60 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

The Commonwealth Securities broker provides conditions for novice investors and users with experience in trading. A trader needs to use an active trading strategy as the passive income opportunities on CommSec are minimal.

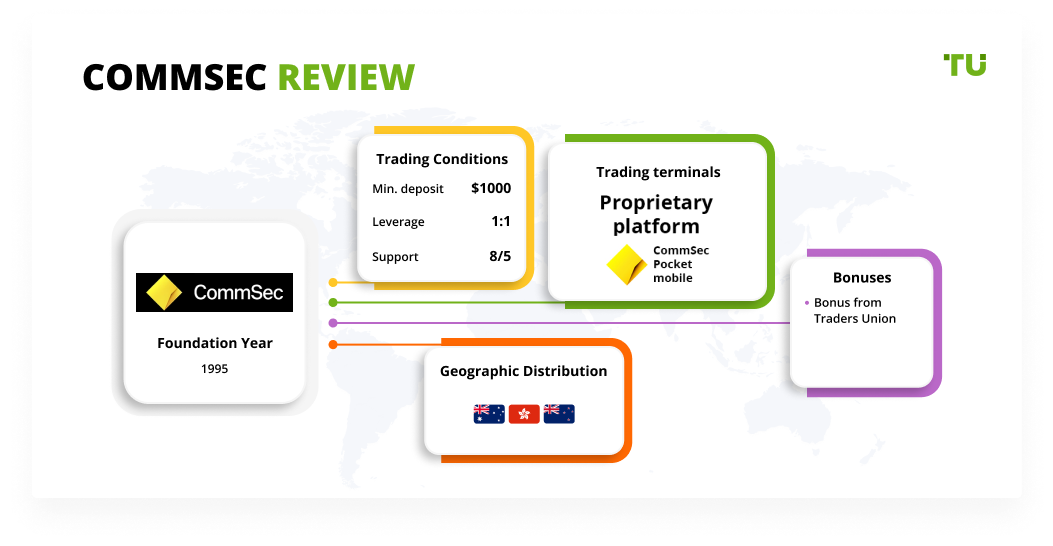

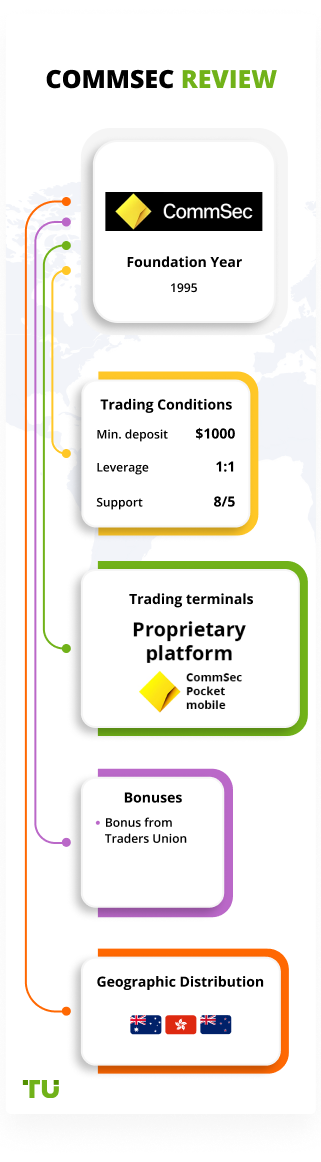

Commonwealth Securities (aka CommSec) is an Australian stockbroker that has been providing financial services since 1995. It is a subsidiary of the Commonwealth Bank of Australia and is registered and regulated in Australia. CommSec provides the ability to trade and invest in stocks, exchange-traded funds, options, securities, and IPOs. The broker uses the clearing and settlement services of ASX Clear Pty Ltd and ASX Settlement Pty Ltd, respectively. Throughout its operations, this broker has won the title of "Best Online Broker for Banking Operations with Functional Capabilities” an amazing fourteen times.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | from 1000$ |

| ⚖️ Leverage: | Margin trading available |

| 💱 Spread: | Fixed |

| 🔧 Instruments: | Stocks, ETFs, options, fixed income securities, IPOs |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with CommSec:

- The company offers accounts with different forms of ownership.

- Communication with the support service is convenient for its clients.

- There is no account maintenance fee.

- CommSec offers a variety of assets to create a diversified portfolio.

- Traders can trade both with their own funds and with margins.

- The broker offers clients two mobile applications: CommSec - for full-fledged trading, and CommSec Pocket, which has limited functionality and is aimed at novice investors.

- Customers participating in the CommSec One program receive trade benefits.

👎 Disadvantages of CommSec:

- There is no possibility to check the broker's trading conditions on a demo account.

- There are no passive income programs or services at CommSec.

- The broker's website contains incomplete data on trading conditions.

Evaluation of the most influential parameters of CommSec

Geographic Distribution of CommSec Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of CommSec

Commonwealth Securities is an Australian stockbroker that has provided financial services for over 20 years. The company's trading conditions are suitable for both professional investors and beginners. In particular, the broker provides a simplified mobile application for newcomers to trade in stocks. It offers a limited set of tools from different industries. However, there is also a fully functional mobile trading app.

The trading conditions at CommSec provide an opportunity to receive income by actively making trades. Programs for passive investing, copying trades, and bonus offers are not provided. CommSec’s clients can trade both with their own funds and with margin, regardless of the type of account. Trading assets are also available to all investors. Traders can receive additional benefits by participating in the CommSec One Program.

The broker provides access to 25 international markets, but to open a trading account with CommSec, the client must be a resident of Australia. A negative is the broker's website provides incomplete information on trading conditions.

Dynamics of CommSec’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

This stockbroker aims to work with traders who prefer active asset trading. The company does not provide programs and services for generating passive income. However, an investor can open a CDIA trading account, which allows them to make deals with benefits, as well as receive interest if the investor is not actively trading.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

CommSec’s affiliate program:

-

CommSec One. Traders who become members of this program receive exclusive benefits from the broker such as personalized support, access to events and webinars tutored by experts from different industries, and free access to the CommSecIRESS Viewpoint. Also, traders get privileges when investing in IPOs.

To become a member of the CommSec One program, the user must meet one of the broker's requirements such as have $100,000 or more in the account, as well as the balance in the margin account; own over $2.5 million; and the annual brokerage costs must exceed $3,000. A CommSec registered trader can also become a CommSec One member upon meeting all these conditions.

Trading Conditions for CommSec Users

Commonwealth Securities is a broker for traders and investors from Australia. Its trading conditions are suitable for both beginners and more experienced market participants. Clients have access to four types of accounts with different forms of ownership, as well as margin and cash accounts. CommSec offers stocks, options, fixed income securities, and exchange-traded funds as instruments. The broker is focused on providing services for active investors only, therefore there are no programs for generating passive income at CommSec. The bonus program and the standard referral program (reward for attracting new customers) are nonexistent here; however, it is possible to receive a percentage of the deposit if the client has opened a CDIA account and does not make trades. Trading is carried out both through the broker's own terminal and from mobile devices through the application.

1000$

Minimum

deposit

1:1

Leverage

8/5

Support

| 💻 Trading platform: | Proprietary trading platform, CommSec and CommSec Pocket mobile apps for iOS and Android |

|---|---|

| 📊 Accounts: | Individual, Joint, Company, Trust |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Bank cards, MasterCard, online banking, wire transfers |

| 🚀 Minimum deposit: | from 1000$ |

| ⚖️ Leverage: | Margin trading available |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 Spread: | Fixed |

| 🔧 Instruments: | Stocks, ETFs, options, fixed income securities, IPOs |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No |

| ⭐ Trading features: | The CDIA account allows investors to accumulate interest on the deposit amount if the funds are not used for trading |

| 🎁 Contests and bonuses: | No |

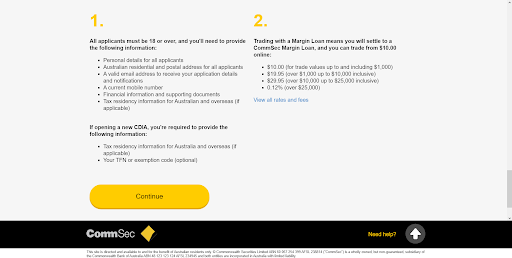

CommSec Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Individual | From $10 | Not available for CDIA accounts and CDIA SMSF option accounts |

| Joint | From $10 | Not available for CDIA accounts and CDIA SMSF option accounts |

| Corporate | From $10 | Not available for CDIA accounts and CDIA SMSF option accounts |

| Trust | From $10 | Not available for CDIA accounts and CDIA SMSF option accounts |

There is a commission for closing a trading account, it is calculated individually for each client.

We also compared the trading commission figures of Commonwealth Securities with those of other stockbrokers like Ally and Charles Schwab. As a result of the comparison, each broker was assigned a high, medium, or low commission level. You can see the comparative results in the table below.

| Broker | Average commission | Level |

| CommSec | $10 | Medium |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Low |

Detailed Review of CommSec

Commonwealth Securities aims to cooperate with active traders and investors from Australia, regardless of whether they have experience in trading. The company offers several types of accounts, including personal, joint, trust, and corporate. Traders can trade both using their own funds and using the broker’s capital (margin). There are no accounts for minors. The broker's trading conditions are intended for clients with an active strategy, therefore, there are no trade copy services and other programs for obtaining passive income at CommSec. The affiliate program is extraordinary: a user who meets the requirements of the broker can become its participant. At the same time, the trader does not need to attract new clients to the company, the program is for obtaining privileges in trading. There are no direct bonus programs or contests, except for the Traders Union rebate service.

CommSec by the numbers:

-

The broker has been providing financial services since 1995.

-

$0 is the size of the commission for servicing the trading account.

-

The broker has a choice of 4 types of trading accounts.

-

The broker provides access to 25 international markets.

-

For novice investors, CommSec has 5 in-depth video tutorials on how to get started.

CommSec is a broker for both beginners and experienced investors who have an active trading strategy

Users who open a trading account with CommSec have access to the following assets: stocks, options, ETFs, fixed income securities, and IPOs. The broker provides clients with access to Australian assets and 25 international markets. This allows investors to make their portfolios as efficient and diversified as possible. The broker's clients can take advantage of expert investment advice, free trading ideas that each client receives daily. Commonwealth Securities also offers advanced market research tools and domestic and foreign market reviews.

You can trade on CommSec through the broker's own trading platform, which has a wide range of functions. Traders can make trades from mobile devices through the CommSec app. Beginners are recommended to use the CommSec Pocket application because it has limited functionality but allows you to quickly master the basics of investing.

Useful services of the CommSec stockbroker:

-

Market News. This section contains information about the current market situation, as well as forecasts for the week. It also has an economic calendar and other tools that allow traders to adjust their trading strategy in accordance with the state of the market.

-

Support. This is where CommSec customers can turn to qualified professionals for help if they have problems while trading or conducting financial transactions.

-

CommSec Learn. This is a section where users will find short and structured video tutorials on five topics related to investing.

-

CommSec Pocket. The simplified mobile application is intended for novice investors and limits access to a reduced number of instruments. It also allows you to start investing from $50.

-

FAQs. This section contains answers to the questions that traders ask most often. Answers include information on placing trades, commissions, account management, margin lending, and other topics.

Advantages:

The broker's trading conditions are intended for investors with different levels of professionalism, including beginners.

CommSec's proprietary trading platform has advanced functionality.

The broker offers various types of orders to help build a portfolio according to the needs of the investor.

A wide range of instruments allows you to diversify your portfolio.

How to Start Making Profits — Guide for Traders

Commonwealth Securities is an Australian broker that provides financial services exclusively to Australian residents. For trading, users can choose one of four types of accounts with different forms of ownership.

Each of the accounts is presented in two types: cash, which is for trading using your own funds; and margin, which is for using the broker’s assets during trading.

The CommSec broker does not provide a demo account to test its trading conditions.

Bonuses Paid by the Broker

Commonwealth Securities does not provide bonuses for making trades, deposits, or other transactions. The trader's account is credited with interest only if he has opened a CDIA account and does not use the deposit for investment.

Investment Education Online

The Commonwealth Securities broker aims to cooperate with users with different professional backgrounds, including beginners. Therefore, the site contains a section with training materials that will help you understand investing and keep abreast of trends in the investment market.

The Basics of Investing,

Defining Investment Goals, Developing Your Own Strategy,

Research and Trading,

Analyzing Personal Progress.

Commonwealth Securities does not have a virtual account where you can safely check the knowledge you gained from the tutorials.

Security (Protection for Investors)

Commonwealth Securities is a subsidiary of Commonwealth Bank of Australia. The broker is an official member of the ASX and Chi-X Australia markets, which guarantees a high level of asset liquidity.

Clearing services to the broker CommSec are provided by ASX Clear Pty Ltd, and ASX Settlement Pty Ltd. They are responsible for transactions and settlements. Commonwealth Securities is a member of these organizations.

👍 Advantages

- Broker cooperates with Australian stock markets

- Financial operations are supervised by ASX Settlement Pty Ltd

👎 Disadvantages

- There is no data on the regulation of the broker's activities

- Client funds are not held in segregated accounts

- Account security information missing on CommSec

Withdrawal Options and Fees

-

To replenish a trading account, CommSec customers can use MasterCard, online banking, and electronic transfers. It is preferable to conduct transactions through a CDIA account.

-

The broker does not provide information on how quickly funds will be credited to a trading account when replenishing a deposit or when withdrawing funds from a personal account.

-

There is no commission for transactions made through a CDIA account. Traders can conduct transactions without restrictions. There are no data on fees for transactions made in any other way.

Customer Support Service

To resolve questions and problems that traders have at different stages of working with a broker, CommSec provides a support service. You can contact it during the working week from 8:00 to 19:00, Sydney time zone.

👍 Advantages

- Commonwealth Securities offers several ways to contact company employees

- Assistance is provided by qualified specialists

👎 Disadvantages

- Customer support is not 24/7

- Support is closed on weekends

- Answers to online forms are received within two business days

This broker provides the following communication channels for its clients:

-

fill out an online form on the broker's website;

-

call one of the numbers provided in the "Contact" section which lists the numbers for Australian residents, residents of other countries, and speakers of Mandarin and Catalan dialects;

-

fax;

-

write a classic letter to the mailing address of the broker.

There is no live chat on the CommSec website. The broker is also featured on social networks such as Twitter and YouTube. You can contact it directly via those networks.

Contacts

| Foundation date | 1995 |

| Registration address | Commonwealth Securities Locked Bag 22 Australia Square NSW 1215 |

| Regulation |

Commonwealth Bank of Australia |

| Official site | https://www.commsec.com.au/ |

| Contacts |

Email:

pocket@commsec.com.au,

Phone: +61 2 9115 1417 |

Review of the Personal Cabinet of CommSec

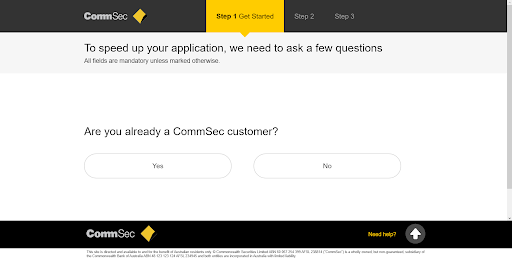

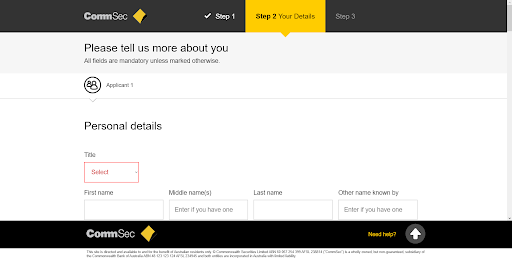

You can start trading with the Commonwealth Securities broker only after opening a real account with the broker. Here are the step-by-step instructions:

Also in the personal account of the broker you can:

Visit the official website of the CommSec broker. On the main page, at the bottom of the screen, there is an "Open an account" button. Click on it to register a new trading account.

Select whether the statement that you are a client of a broker is true. Indicate if you have a NetBank customer number. Select the type of trade: cash or margin, as well as the desired type of account.

Check out the requirements that the broker makes for potential clients.

Fill in the fields with personal data: name, surname, date of birth, etc.

Enter your residential address.

Write your email address and phone number where the broker can contact you.

Indicate the field of your work.

Provide information about the second account holder if you open a Joint, Trust, or Trading account or provide additional information when opening a Corporate account.

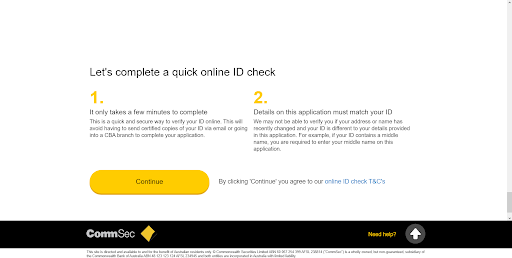

Verify your identity to open an account.

For verification, enter the data specified in one of the proposed documents: driver's license, Australian medical card, or passport.

Make financial transactions between accounts.

Review the history of transactions and money transfers.

Open new trading accounts.

Participate in programs for the broker's clients.

Contact support.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the CommSec rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about CommSec you need to go to the broker's profile.

How to leave a review about CommSec on the Traders Union website?

To leave a review about CommSec, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about CommSec on a non-Traders Union client?

Anyone can leave feedback about CommSec on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.